When I first started writing about FIRE (Financial Independence Retire Early) in 2009, my main goal was to first survive the Global Financial Crisis. If I did, then I would find some way to permanently change my life for good.

Back then, the FIRE movement was a bear market phenomenon. Plenty of people were getting laid off from their jobs. Partially due to pride, some of these folks said they retired early. Others said they were digital nomads.

Whatever they called themselves, many proceeded to try and make money online in order to supplant lost wages. I was impressed with the human's spirit to adapt, even if some of their stories felt a little disingenuous.

I took notes as I planned my own escape from the corporate grind while chronicling my journey on Financial Samurai. Mainly due to luck, I survived seven rounds of layoffs.

The Journey To FIRE

In December 2010, I published the now classic post, The Dark Side Of Early Retirement. My goal was to highlight all the potential negatives of early retirement to make sure I and others weren't missing anything. Leaving a well-paying job with great benefits in my 30s seemed reckless.

If you go through the comments, you'll notice a lot of unhappy people who disagreed with the negatives I highlighted. However, I was 33 at the time and really itching to get out of the 7-to-7 work grind.

Sometimes speaking the truth hurts the most. But I needed to know the truth before making such a drastic change with my life.

It took another 1.5 years before I finally retired from finance in the spring of 2012. I was afraid of the unknown. Therefore, I devised a plan in October 2011 to engineer my layoff with a severance package. It worked, thank goodness.

My FIRE Confessionals

As the economy continued to recover after 2012, some folks who said they had retired decided to go back to work.

By 2014, I no longer told anybody I was retired. Not only did I feel stupid saying so in my mid-30s, but it was also no longer true.

I was spending about 20 hours a week writing on Financial Samurai. Further, I wanted to explore the startup world given I lived in San Francisco. Therefore, I decided to consult part-time for Personal Capital from 2014-2015. I also picked up a couple more consulting gigs with two other startups (series Seed, B).

Finally, working at a startup could be crossed off my bucket list. I was living in San Francisco since 2001 and wanted to be able to tell my children someday that I participated in the startup boom.

Throughout my FIRE journey, I've tried to be as candid as possible. Instead of always telling you how great things are, I wrote posts like The Negatives Of Early Retirement Nobody Likes Talking About.

My goal has always been to share with you the good and the bad so you can make a more informed decision. There have definitely been many times when I questioned giving up my finance career so soon.

Having Someone To FIRE With Is Better

After my wife retired in 2015, I decided to stop all consulting gigs and just write on Financial Samurai. We decided to travel the world aggressively before having our first child in 2017.

From 2015 – 2017, we had a lovely two years of early retirement bliss. Even though it's financially more prudent to always have one spouse work a day job for income and benefits, life is better if both partners don't have to work.

Here's a plan to help both spouses retire early in case you're feeling bad for your working spouse. The post is also for couples who are too afraid to quit the money.

Hard To Overcome The Male Ego

Although I tried to stay retired, I could not after our son was born in 2017. Being a full-time parent for the first two years of a child's life is the absolute hardest job in the world. To say that I was retired while working harder than ever being a dad made no sense.

Therefore, I proudly identified myself as a full-time father and a high school tennis coach instead of an early retiree. Unfortunately, I couldn't convince male peers to identify as full-time fathers to take our fatherhood jobs more seriously. Instead, there was an overwhelming desire to identify as retired or FIRE.

Perhaps it's our fragile male egos? I have yet to hear a stay-at-home mother say she is an early retiree while her husband or partner works. So interesting!

Tried To Go Back To Work

Then in 2019, something miraculous happened. As geriatric parents, we had our daughter as mentioned in, Why I Failed At Early Retirement: A Love Story. Now the pressure was really on to provide.

Once we had kids, I wanted to make more money. It's like we are genetically wired to earn more and stay in shape to help ensure the survival of our species.

Suddenly, $200,000 a year in passive income didn't feel like enough. Gobbling endless amounts of my favorite key lime pie also was no longer appropriate.

I felt like we needed more after modeling out the future costs for our children. Too bad education and healthcare costs are so expensive.

I tried to convince my wife to go back to full-time work, 12 months after having our second. But I failed. She was happily busy taking care of our kids and helping me with Financial Samurai part-time.

I considered getting a day job again in 2020. But then the pandemic hit and I was stuck at home.

Therefore, the logical thing to do was to spend more time making more money from home. I was determined not to let the pandemic defeat us. When your back is against the wall, you find a way!

In retrospect, if there's ever a time to have a child, it's right before a global pandemic. Both parents get to go to the hospital and witness the miracle of childbirth. Then both parents get to stay at home and raise their child during their most crucial development phase.

We weren't planning on traveling for a couple years after our daughter was born anyway.

Back In Wind Down Mode

From a financial standpoint, the pandemic has ironically been good for investors.

After building enough capital to generate our passive income target for over a year, I'm in wind down mode again. Sometime during the Biden Presidency, I want to get back to early retirement life. Having our son attend preschool this fall will free up 30+ hours a week.

With a growing government safety net and higher taxes, the best time to retire could be right now. Investors have already had a surprisingly great run. Therefore, why not take things down a notch and enjoy life more?

To plan ahead, I've published new versions of my Dark Side To Early Retirement post to make sure I don't miss anything again. These early retirement preparation posts include:

Not Afraid Of Retiring A Second Time

This time around, I'm not nervous about retiring because I've got experience.

I don't have any uncertainty about what to do next. All I want to do is raise my kids, go on more dates with my wife, play sports, and write online. It's a simple life, but one that I enjoy.

Pivoting from working 30-40 hours a week on Financial Samurai to writing 10-20 hours a week is easy compared to going from a job to no job. Further, I am not switching careers either.

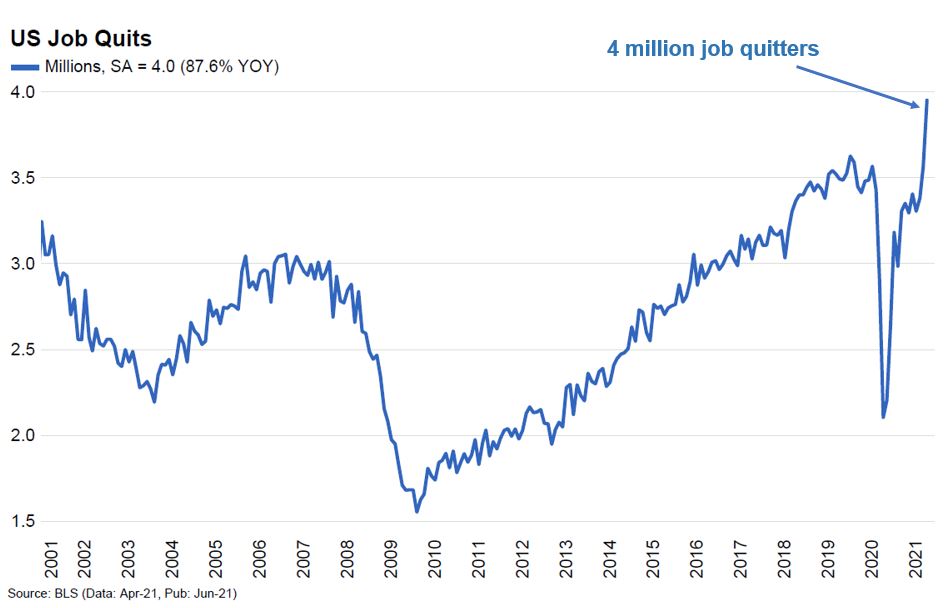

It seems to me the FIRE movement has now turned into a bull market phenomenon. With investors so much richer today than ever before, employees are leaving their jobs at the greatest rate ever.

I'd like to think that if I had kept working until this year, I would have no problems trying to engineer my layoff either. There's no point in having money if you can't use some of it to buy more freedom.

However, I might be delusional in my confidence now that I have two young kids. Therefore, to help those of you who are thinking of retiring early, let me share more FIRE confessionals from several readers.

If you have a FIRE confessional, I'd love for you to let us know in the comments section below.

FIRE Confessionals: A Bull Market Phenomenon

The definition of FIRE is when your investments generate enough income to cover your desired living expenses.

We can make ourselves feel better about our progress by coming up with new FIRE definitions like Coast FIRE. However, true FI lies in the numbers

Below are some perspectives from people either trying to FIRE or who have already FIREd.

1) FIREd at 32 with ~$500,000 Net Worth (Female)

In 2016 at the age of 32, I left work after building a net worth of around $500,000 and no debt. I was single and fed up with the system. So I decided to go the Lean FIRE route. Today, my net worth is around $650,000.

Back then, I figured I could live simply off $20,000 – $25,000 a year. I did for a couple of years, but then I started resenting my budget. It's fun to live frugally for a bit. But as you get older, you naturally want to enjoy nicer things.

I spent 10 years after college saving and investing over 50% of my income every year. Now I wish I had lived it up more in my 20s. I currently spend about $35,000 a year and feel happier.

Two years after work, I also started asking myself whether this was all there was to life. Even though I disliked my job, it gave me something to do. And my boss was actually pretty nice too.

Before I left, my boss said he wanted to promote me to senior manager with a healthy $15,000 raise. He was a good guy who looked out for me. But it felt strange to be so appreciated. It felt so strange that I ran away.

My father left my mother when I was just three years old. She had three boyfriends when I was growing up and I hated all of them. As a result of feeling abandoned as a kid, I'm also afraid of marrying my partner.

What if we get married and he leaves me like my father left my mother? I would rather not go through that pain. But at 37, many of my girlfriends now have kids. They seem happy.

If I didn't always look at people with great suspicion, I probably would have kept working until at least 40.

FIRE isn’t a magical potion for happiness.

2) FIREd at 40 with ~$1.9 Million Net Worth (Male)

I was actually laid off at my finance job in 2018. Luckily, I received a fairly generous severance package that covered a year's worth of living expenses.

I aggressively looked for work for 14 months, but couldn't find anything. Was it age discrimination against people over 40? Or was it my personality or lack of skills? I wasn't sure. I hadn't interviewed in a long time.

What I did know was that my ego was squashed. My wife was a stay-at-home mother to our three year old. Losing my job felt like I had failed as a father.

Instead of staying in San Francisco, a year after I had lost my job, we decided to sell our house and move to Bend, Oregon, where property is much cheaper.

Luckily, we got a good price for our SF place that we bought in 2011. We cleared about $300,000 after taxes and fees. Unfortunately, we didn’t buy a place in Bend before the pandemic pushed prices even higher.

Although we had a net worth of almost $2 million when I was laid off, I didn't FIRE by choice. I wanted to keep working until I was 50 and amass a net worth of $5 million to take care of my family.

With $5 million, I could withdraw $150,000 a year easily, retire early, and live comfortably while renting.

I also wanted to get to a $5 million net worth because we also wanted to have another child. I realize plenty of people have multiple children with much less wealth. However, this was just my Fat FIRE mindset at the time, which took time to adjust to.

By the time I got over the trauma of losing my job, two years had passed. And by this time, my wife was also in her 40s. We tried for two years, but could not conceive.

We even paid $43,000 out of pocket for several IVF trials to no luck. This cost was another kick in the shins because my old company would have paid for two IVF cycles.

Today, I've learned to accept our situation and embrace the FIRE movement. Although life didn't work out as planned, we still have enough wealth thanks to a bull market.

And don't call the Internet Retirement Police on me, but I've got a new job lined up that allows me to work remotely! I continue to tell everyone I'm FIRE though because it makes me feel like I belong to a community.

Since moving to Bend, I haven't been able to find a group of people to hang out with. Be careful moving to a new place just to save money. It's the relationships you have that make a place special.

3) FIREd at 35 with ~$1 Million Net Worth (A Couple)

At the end of 2019, my wife and I decided to quit our respective jobs and travel the world. We were in Tulum, Mexico in February 2020 when news of COVID-19 intensified.

Instead of continuing down to South America, we decided to cut our 3-month adventure short and head back to Chicago. Chicago is the best city to live in during the summer. However, it's a tough city to live in during the winter.

Unfortunately, we ended up staying in Chicago for the next 12 months in our one-bedroom condo thanks to COVID. Living in a house with a yard and a pool would have been nice. But we were looking to simplify. Further, we had thought the pandemic would have calmed down by July 2020.

In retrospect, we should have stayed at our jobs during the entire pandemic. If we had, we would have made a combined $240,000 in income in 2020. After taxes, we would have saved about $120,000 of it. Not only that, our company's stock went up 35%, which would have meant another ~$100,000 in gains.

The other financial move we made was liquidate about $90,000 in stocks in early 2020 to help pay for our trip and also be more conservative. We never got back in. Our net worth composition consists of $400,000 stocks, $150,000 bonds, $300,000 real estate, and $150,000 in cash.

I know we shouldn't be complaining. But our timing was off. COVID really screwed with our FIRE plans.

Due to the growing covid variant, we're a little worried we're going to repeat the last 15 months. But we've decided to no longer put our lives on hold. We plan to rent a camper and see some of our great national parks.

Share A FIRE Confessional

I hope you enjoyed these latest FIRE confessionals. You can subscribe to my free newsletter and respond with your FIRE confessional the next time I send out an e-mail. Or, you can share your confessional in the comments section below.

One of the things I've noticed on my financial independence journey is that things often don't go according to plan. As a result, we need to be flexible with the way we approach financial planning.

We should also be more accepting of other people's journeys. For example, I received a lot of flak about how much is enough to live a middle-class lifestyle with kids in a big city.

I've also been bonked over the head on Twitter because I identified as a high school tennis teacher instead of as a blogger with passive income. I'm now a retired high school tennis teacher and dedicated stay-at-home father + writer.

Let's let people live their lives how they see fit. Things are always changing, which is really the fun of it!

Related FIRE posts:

FIRE Confessional Part I: Surviving A Bear Market

Common Blindspots On The Road To Financial Independence

Overcoming Money Trauma: Why I Retired Early With $600,000

My Secret To Retiring Early With A Family And Two Kids

I'm Unwilling To Change The Rules Of FIRE To Win The Game

Readers, how is your FIRE journey coming along? Any FIRE confessionals you'd like to share? If I get enough feedback, I will publish a FIRE confessionals part III. What are some funny things you've noticed about the FIRE movement as it has become more popular?

Subscribe to Financial Samurai For More FIRE Confessionals

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Please share, rate, and review!

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

I am technically in FIRE finally.

I bootstrapped and founded my own companies starting at 17 and became a liquid millionaire at 20. I owned 50% of the company at the time and we killed it the first 5 years or so – it was an easy million bucks a year minimum in net income. Then the hard times hit and I doubled down, nearly lost all our biz capital, pivoted successfully at the 11th hour, and rapidly hit an even greater level of success for some years again. All the while, I did save up quite a bit of the distributions so I was able to really invest about $7M of company cash flows into tons of R&D. Those years, it was just a race against venture backed companies. Once COVID hit, we hit some snags even as a tech company – mainly being bootstrapped and hit hard by a non covid related event a few months pre pandemic. I nearly lost the company and it was a scary moment – I fully rebuilt the company and team and out new CEO scaled us back up towards 30 people along with 257% revenue growth since 2021 started. Yes, I replaced myself as CEO finally (who is really awesome). Now, I am the chairman of the company, I own most of the company and will not lose majority even with dilution, and I only work on the company about 5-10 hours a week. I think my company has finally hit the stage of critical mass (high margins, a unique platform in our niche industry that can’t be replicated without at least 20M in R&D nowadays, a formula for scaling by building vertically the whole time) and if so, we may sell for the right price. I’ve turned down all previous offers, thankfully.

It’s been a freaking ride, and I have lived a very luxurious life. I try to cap lifestyle inflation so I am always saving lots but it was flipped upside down for 2 years during pivot where I really constrained my spending. My liquid net worth is $3.5M (keeping in mind, this is almost all after tax and after I spent nearly 3M enjoying life in my 2020s and took care of my family) at 31. Based on modeling, my total net worth is north of 10M and closer to 20M if we hit our target sale price by 2023. Obviously, lots of risk to that. So, my current savings rate also helps me achieve 5M liquid by end of 2023.

I’m enjoying all my time off. At the same time, I’m implementing habits and routines for greater success in my next venture. I plan to try and swing really big once I feel good and ready. In the meantime, I’ve basically been managing my portfolio and studying blockchain. I’ll be stoked to have 10M liquid, but just for the freedom to swing even bigger next time.

This is the best LARP I’ve ever read.

Ha – I’ll take things that never happened for $1,000…

Why don’t you believe this is possible? Since early 2020 a lot of investors and business owners have gotten extraordinarily wealthy. The NASDAQ alone was up 43% in 2020, with many individual companies rising much more.

Check out: $10 Million: The Ideal Net Worth For Retirement

Huh? It def happened lol. This quite frankly isn’t even too impressive in my circle – I have friends and acquaintances that have done incredibly well for themselves. I may finally join their ranks when the liquid net worth exceeds 10M and non liquid 30+.

I think the most significant thing FIRE could do for itself is to drop the RE from FIRE and leave FI, as once you reach early retirement, you soon realize that you are just chasing new passions. Throughout your lifespan, if you start in your 30s, you could quickly go through ebbs and flows of retiring and working more than just a couple of times. But that is the beauty of FI; you are no longer tied to a job for the money. Instead, you can chase your passion. Whenever your focus drifts, you have the power to tune out and start something new, whether that be traveling, raising kids, or chasing a unique job opportunity that is too fun to pass up.

I have been following Financial Samurai for 10 years and loved every bit of your journey Sam. You have inspired my families FIRE journey and I hope to one day share stories with you over a beer. I graduated college in 2009 with a negative net worth and $80k in student loan debt. Here are my vitals:

-34 year old married male

-2 kids under 3 years old

-Net worth ~$10M

-$1M retirement portfolio

-$1M Marketable Securities/cash

-$8M Real Estate

-Not included $2M Southern California primary residence and $1M mortgage

-Combined income is ~$1M annual income mostly from our assets but my wife is a CFO for a small company

I retired from my job in real estate private equity in October 2020 after I spent years building a real estate apartment portfolio on the side. All of my deferred compensation dried up since our company specialized in buying office buildings which, due to the pandemic, was one of the hardest hit property types in commercial real estate. I work 25-30 hours a week maintaining our assets which is perfect for me as I have time to golf, surf, learn spanish, spend time with my kids and wife and such. It’s difficult to travel due to the age of our kids so my wife and I don’t mind our schedules today but see our work schedules decreasing or my wife retiring as our kids get older so we can travel more.

I am grateful for aggressively investing in cash flowing real estate to the point where I started a company and didn’t even realize it. I have helped my friends and family make money along the way and join me in my FIRE journey. I realize I am lucky to have benefited from the low interest rate environment and run up in real estate prices since 2013. My wife and I are super savers so as our income increases our expenses never really changed. One of my greatest accomplishments in life is housing over 100 US Veterans that were previously homeless. We have an abundance mentality on life and try to share that with others whenever appropriate.

My FIRE journey has evolved from completely retiring to gaining more control of my time!

I love this post and finding this site ~3 months ago. I’m incredibly nervous regarding “leaving” the tried and true path, though to be fair I’ve been running a small startup for the last two years after leaving a job at a large management consulting firm, so probably half way there :). The corporate ladder definitely felt empty, but also safe and with a built in community of people I liked working with.

Basic vitals:

– 34, M, DINK (but first kid on the way!)

– $1.1M net worth, primarily between stocks / REITs (55%), 401K (20%) and cash (5%), net on housing (20%).

– If I including the latest implied valuation on equity for our private company, it’s closer to $4-5M, but that is in no way liquid.

– Soft FIRE target (move to adjunct, part-time consulting) at ~$3.5M in total with $100K+ of passive income (targeting 45).

To be honest, the last year has been a wild ride. We went from ~$750K net worth in March 2020 to $500K in May to $1.1M today in about 15 months, largely due to the sizable stock allocation and my wife’s public company equity. To be honest, we probably could walk away now in a soft-FIRE, but I do like nicer things and have no idea how I’d find fulfillment on the other side of this. Would be curious how people identify the ideal time to step off the gas?

Not sure when I would feel comfortable with FIRE. My Father FIREd at 53, so perhaps that should be my marker. Get done before Dad was. My mom FIREd at 62 if you can still call that Early. I’m definitely stacking chips to make that decision though probably another 10 years or so before I would really think about it. Currently sitting on $3.5M. Right now the money for my family is coming pretty easy (knock on wood): high salaries, stocks, RE, and some private investments, one of which net over $1M in the last year alone. There is potential it could go another $10-20M in the next 3-5 years as well. Even still I think I still have some career goals left to hit before I would hang it up and pull the trigger. Perhaps hitting the lottery might change that.

One thing for sure is while I don’t want to speed up time for my kids, I see expenses coming down in the near future. Daycare has been north of $45k/yr, so getting that back will be nice in another couple years. If they stay public school all the way through Highschool that’s like a near $600k pick up. Of course most of that will just be going into the 529’s anyway.

Anyway, good luck to all who have FIRED, and to all those still on the way. Make a plan, and execute is really all you can do.

well I’m far from FIRE yet so I guess I can’t relate to these problems but I certainly do appreciate reading posts like these so I can be aware and more prepared for it.. when I took my extensive leave after winning the covid lottery, I was surprised to see that I missed work lol and even now with how my plan is set up I still plan to work in some capacity even after I have reached FIRE… also it was cool to see a fellow reader FIREd with $500k so I guess it really depends on your lifestyle eh? I mean if you’d make it work why not!

I am grateful to not have FIRED yet, but also grateful to this and a few other blogs that have helped me achieve a pretty high degree of financial security. I’m a little on the anxious side, and knowing I have an active and passive income stream for me and my family even if I lose my job, the market crashes or my marriage fails gives me some peace.

On the other hand, I am so glad to still have my job, as it turns out raising kids can be very expensive (if you want it to be). My older kid found a sport that he absolutely loves and excels at, and I don’t think I even want to share on here how much it costs between team dues, equipment, regular private lessons, summer camps and travel to tournaments.

He works so hard, and I consider it my privilege to be able to support him, which I wouldn’t have been able to do if I had FIRED. I assume for now that my younger child will have a similar path.

Also, I plan to fully fund both kids undergraduate degree wherever they choose, and I’m happy to work a little longer to accomplish that goal, as I consider it a great privilege to be able to provide that for them.

Age: late thirties

Net worth: ~ $2m (not including home equity, 529 plans or my spouse’s separate accounts or equity in his firm)

Annual passive income: ~ $70K (from real estate)

You sound like a great parent! I love the saying, “Have children and the money will come.”

We parents will do anything for our children. They provide us more meaning to earn.

Not sure your annual expenses, but once your annual passive income can covered your normal expenses after-tax for more than one year, you’re going to feel a tremendous amount of relief.]

Related post: Overcoming The One More Year Syndrome To Do Something New

This blog has given me the confidence to actually keep at the job market for a few more years, and not have FOMO for not retiring sooner.

Age: 36

Net worth: $300,000 all in real estate

Annual passive income: $80K

The trick is to not get burnt out, which can actually be tough. I am always glad to know though, that if I need to (mentally, emotionally) I could quit and just be done with it.

Hi Amanda, I’m glad! And nice job building an $80K passive income source on a net worth of $300K! That is pretty huge. For reference, my passive income was also $80K when I was 34… but it was off about $2 million in invested capital (ex primary residence).

Burn out really is tough, which is why I’ve decided to take things easier this summer. Got to love knowing you can walk away if you want to!

Retired at 55, woman in finance, with $750K,!off to live in some other countries, returned to USA, Re-settled on coast of So Calif. BUT I didn’t keep some real estate. Have bought and sold, but didn’t keep! I’ve learned that real estate can have a looong cycle.

So here I am, 80 and renting, with rents going up. Impossible to buy now. I have a big IRA, personal money and Soc Security so it is livable. Would be easier if I’d kept a place!

The strong stock market has helped me, but the strong real estate market has

given me a concern that may bug me for the rest of my life.

Hi Gayle – 25 years later, how has your $750K done? Hopefully well!

Thanks for sharing your lament on selling all your properties and renting. It buttresses my belief that we should all have at least one paid off residence for the rest of our lives.

But it sure seems like you are dong great and have had a wonderful early retirement life!

I’ve learned that doing nothing but leisure activities is a sure way to be unhappy. I started an Internet business after college over 15 years ago. It gave me the freedom to travel anywhere and to have a completely flexible schedule. I lived in many different countries. It was a time to broaden my horizons but it was not a long term plan. Eventually the travel and leisurely life felt empty.

Everybody is different, but I became much happier when I created a schedule with meaningful activities and invested in meeting and helping my local community. It involved commitment and responsibility. Instead of peacing out, I sought out meaning.

I think most people feel overworked. Their little vacation time feels like paradise because of their hectic work schedules. I think the key for young people is not retirement, but finding a way to modify their jobs to offer purpose. Maybe a few more vacation days too.

“I created a schedule with meaningful activities and invested in meeting and helping my local community”

“I think the key for young people is not retirement, but finding a way to modify their jobs to offer purpose.”

Agree with both points. Once you lose purpose, life takes a hit down. We need meaning to what we do!

The first example in this post is a little sad, mainly due to her upbringing that affected the way she views people. It’s a reminder to all parents to spend more time with our children and support them.

I’ve been following you for years and put into action a lot of what I learned.

My stats:

-59 year old female (divorced)

-1 grown daughter

-$2.5k monthly mortgage, no other debt

-$4 million net worth ($1.3 in real estate, rest in stocks)

Here’s my story. My new boss eliminated my position after 30 plus years of working at the same hospital. I was a nurse manager. As Mike Tyson would say, “Everyone has a plan until he gets punched in the face.” Instead of taking a different position, I retired at age 57. It’s great to have Forget You Money! Also, I negotiated a hefty severance (thanks to you). Two months after retiring, covid hit. It was gut wrenching to see my portfolio drop 35% that soon after retiring. I didn’t sell and stayed the course. I retired with $3.8 in net worth, which has been steadily growing. I am living on savings until age 59 1/2 then will take $100k/ year in passive income. It’s hard to find someone to hike and travel with since they’re all working. Still, I have no intention of returning to work and absolutely love the freedom of doing whatever I want.

Thanks for letting me share my story and keep doing what you’re doing!! All the best.

Nice job holding on! And thanks for sharing your story.

You negotiating a hefty severance package is music to my ears! Hooray!

Loved the FIRE confessionals. Every time I read them, I think they are crazy. FIRE at low net worths in their 30’s, living on small budgets, no kids seems to me very unfulfilling. Now FIRE with $5 M that works for me. The most ardent FIREs seem to be really young, somewhat low net worths, no kids, tight budget…… So much in a hurry to say they are retired and dont work for the man that the may not be living their best life. You, Sam, are in a much different situation than most FIRE (good for you and your family). Money buys time, and financial independence to experience ife.

“The most ardent FIREs seem to be really young, somewhat low net worths, no kids, tight budget…… So much in a hurry to say they are retired and dont work for the man that the may not be living their best life. ”

There’s a lot of FOMO in the FIRE community. If you spend lots of time on social media, in forums, etc. that FOMO will increase.

And if you don’t have enough real world connections, you logically end up finding your tribe online.

I actually would like to write more about FIRE and share stories. But I’ve found that once I had enough passive income, I wanted to write about everything else that happens in life.

Coast FIRE is a pretty hilarious concept as it pretty much describes any normal working person who saves and invests.

It’s definitely a good idea to give hope for those who are so far away from true FIRE to keep on going.

But I also question the self-esteem and wisdom by people who say they are Coast FIRE.

Personally, I’m going to happily work while the good times are good. Have a $3.5 million portfolio that is generating about $100K in passive income.

Self-esteem is definitely something to be aware of in FIRE and everything. The more self-confident you are, the less of a need there is to announce to the world you are FIRE or create new FIRE categories. You just are and go about your business.

I remember the first year I left work from 2012-2013, I was unsure about what I had done. So I told people I had retired early. But as the economy recovered and my wealth grew, there was no need to talk about early retirement anymore. I became confident in my purpose.

$100K passive income is great!

First off, I’ve been following this blog for several years. Thank you, Sam for the enjoyment and for sharing your knowledge. Here are my vitals:

-50 year old male (widowed 11 years ago)

-2 kids in high school (public, same as me)

-No mortgage on house, no car loans

-2 529’s ~$650k. They also have Roth IRAs ~$20k ea.

-Taxable ~3.5m

-Non-taxable ~$3m

-Budgeting $15k/mo gross withdraw from taxable until 65. Not sure I’ll spend that though.

I’m totally burnt out in my career. It pays well so I feel like I want to ride the wave until they tell me to go home. Walking away on my own is proving harder than I thought when I used to dream about it. Once I leave I’m not getting back into this space and will not be able to come close to replacing my income in other work so that element of self worth will be over.

I know the numbers look good and I’m grateful for that. My real issue is getting over the mental aspect of actually walking away and not knowing what to do with myself afterwards. I was motivated by the chase but now have cold feet.

Loving the kids Roth IRAs and taxable account! Thanks for sharing your vitals and your thoughts about life after work.

The “one more year syndrome“ is really something many people struggle with.

It will be interesting how you feel after your kids leave the house. It frees up more time. But then, work fills up a lot of time as well.

I would try asking for a sabbatical! Baby steps as you remove your self away from work.

With no debt, I would really start living it up more with your finances. I got involved with a foster care organization before the pandemic, and that gave me a lot of purpose.

A lot of people in the world could use some help. Maybe there’s some organization locally that could use some help as well.

Thanks for sharing your story Sam! What I’ve always liked about your blog is your honesty and openness to discuss both the good and the bad. There aren’t a lot of blogs that do that. I hope you get to enjoy a more balanced day-to-day. Summer is a great time to take it down a notch!

Btw that’s one crazy job quits chart. What a spike!

Maybe FIRE isn’t for everyone, but I cycle with a few guys in SoCal that are retired. They both retired before 50 and fill their days with surfing, martial arts, & other outdoorsy activities. They both are in amazing shape and have great personalities. When I look at retirement I see myself doing a lot of things like this, but I also see the possibility that you might get bored if you don’t build some sort of routine. When it comes down to it people want purpose and if they don’t it leads to problems.

I agree. And having cycling buddies is a great part of retirement life. It’s really necessary to have that physical connection and exercise pared up with mental enrichment too.

Some people, like the second FIRE confessional have been unable to find a good in-person support group, especially during the pandemic. So they have found a community on line instead. But I argue that off-line connections are way more powerful.

Just want to say that I love your emails and I try to read them all. Thank you for writing Also, we’ve had a lot of parallel paths and are around the same age— I also worked at McDonald’s ($4.25/hr) and Goldman Sachs. I “retired” early from Wall Street – experienced many of the negatives you’ve discussed about retiring early – and after a while decided I wanted to work again and am now in the Foreign Service for fun. And I went to both private and public schools. Also, I just had a “geriatric” pregnancy during the pandemic. I’m lucky – it was a natural conception. My daughter is now 3 months old.

All the best,

J

Perhaps we are siblings from another mother! Congrats on the little one!

The McDonald’s experience was one of the worst and best work experiences ever. So good to work a service minimum wage job so you know what’s out there and can appreciate other jobs more.

Yup, worked in K-Mart’s appliance department for over a year when I was in college. Made one nickel more than minimum wage, plus commissions on televisions and refrigerators and such.

My failing grades disappeared and I was on dean’s list every semester, despite 30 and 40 hour work weeks as a part-timer.

My coworkers were good people, salt-of-the-earth people, and they seemed pretty content with life. But I learned in every fiber of my being that I never wanted to work retail ever again, and I never did.

I understand a lot of folks were really shocked a couple of years after I left, just prior to my college graduation, when the men in black came in and interviewed everyone for my security clearance background investigation. I learned this when I was briefly back in town and went there for some batteries, discovering I was a local celebrity, even in absentia.

As I said, I’ve never worked retail again, but having done so helps keep me grounded.

I used to work at K-Mart way back. Let me guess you were making $3.40 hr? :)

I’m failing at FIRE for now. I blew past my net worth target last year and kept working because I didn’t think I’d have anything better to do with lockdowns going on, and the related financial uncertainty.

So now I’m stuck in one more year territory for the foreseeable future, maybe until there’s a nice market crash and my net worth is still above target. I’ll probably try to float the idea of shifting to part time work the next time I have a yearly review with the manager… that might be the way to ease into it.

Doesn’t sound like you failed at all. Making the logical move to work during the pandemic when everything was/is shut down makes a lot of sense.

One of the worst time to retire is during a pandemic.

Are you hating your job? How old are you?

I ended up on here because I put F*CK THE IRS into the google search engine. Yours was the first site to be available after many reddit fumings.

Having read a couple of your posts I have come to a certain realization. It was one I have always had and I am aware of all too keenly as I try and apply for loans or maintain work that is just slightly above poverty wages.

We are not the same people. I salute you for all of the undoubtedly well thought out paths you took in your life. Although when we are all teens in high school its hard to really understand what is in store for us when we graduate. Makes it even tougher if you come from a dysfunctional upbringing. I am of that stock. 40 and looking for work to try and slug through the rest of what this life will no doubt throw at me. Now that I am here you can trust and believe I wouldve made better decisions when I was younger. I guess the world needs people like . we are many. Id wish you luck in the future but it seems you habe it all planned out to which fabric you want in your coffin or what urn youd prefer your ashes to languish in. If ashes do indeed posses the knowledge of self that would be needed to actually languish. I will no doubt end up arriving at my final place of rest in a skidding stop with a bottle of whiskey in one hand, an empty gun in the other with a head full of precious regrets yelling YEEEOW, WHAT A WILD RIDE! Just remember that a funeral shroud is bereft of any pockets. You seem like good people and you habe a knack for the written word ao I will continue my subscription to your financial website even though if I had two coins to rub together Id save them to keep me warm on the cold nights with their friction.

Lost in Transaction

Welcome to Financial Samurai! And what an interesting search phrase to lead you to my site! I do have several IRS related posts. But I’ve never used that language. Fascinating.

I am definitely a meticulous planner because I’ve made so many mistakes in the past. So I try to learn from them and try to come up with a pre-modem just in case there are twists and turns. And there always are.

But it’s exactly because I only know what I know, and not enough, that I write so I can learn from other people’s experiences.

I do believe there are optimal and sub optimal choices we can make. Therefore, if we can make many more optimal choices, things will likely turn out a little better.

Best of luck to you and welcome again!

At 40, I was newly divorced, my ex had done the classic spend everything and run up all the cards and left me over 80k of the bills, then refused to pay any of what the court assigned her, and forced our house into foreclosure. Plus, I was saddled with humongous legal expenses for both sides, along with ten more years of child support.

Once I started to get a handle on all this I kept on living a bit below my means. Then I had a little luck with real estate and quite a bit more with investing (but I studied investing a couple of hours a day for six months or more–everything you want to know is available on the internet somewhere, for free–so maybe it wasn’t luck). I also trained myself to be a computer programmer and a database designer.

One of the things I eventually wound up programming was a system to allow a major insurance company to track and report on hundreds of mutual funds it was interested in. Synchronicity?

A few years after this I became a single parent, but had to keep paying the child support to keep my ex from going back to court to enforce physical custody.

When I was fifty the child support ended and I had nearly a million in assets (stocks, retirement funds, and real estate). I remarried, to an incredible woman who, in addition to being able to put with me, turned out to have very similar funds and made about what I did, then.

Ten years later we were multi-millionaires (with hopes of hitting double digits before we have to start taking RMDs). No inheritances yet (maybe someday), we are just a couple of years from full retirement, and I never had a job that paid over 100k per year until the last three or four of that.

While in retirement, we intend to spend at least six months of every year traveling, and for as many years as we are physically capable (pandemics permitting).

What I am saying is, things can get very, very bleak at 40. And then you can make them way better, although I will not tell you it is easy.

I experienced involuntary retirement 8 years before I planned and right in the middle of my lifetime peak earnings. Fortunately, personal disability policies replaced 30% of my income, tax free and premium-free. I became involved in 3 small business ventures; I closed two of them when the pandemic made the business models untenable, the 3rd sailed right through the hard times with nary a hiccup, generates an additional 40-60k to us yearly as 30% owners and part-time workers. Our side-gig became our only gig, so to speak. I have retired business debt, overhauled our expense budget very substantially, we very conveniently curtailed lifestyle expenses with the arrival of the pandemic. The only challenge has been to fill my time with things other than Netflix binges and other idle pursuits. I’m actually attempting to return to my professional life on about a 0.5FTE basis because I enjoy it, it offers access to a robust professional peer group and will allow me to more easily maintain contact with a lot of pre-pandemic friends. My hope is to work just enough to satisfy my interest and keep my mind occupied, maintain core benefits and then start more adventures; hobby businesses, eventual travel as restrictions ease up. We access a bit of retirement income via the 72-t tax program to cover insurance premiums, will probably increase that a bit over the next 5-7 years as the IRAs continue to appreciate and turn on social security benefits a bit later than usual. I built about 200k in Roth assets that act as our emergency fund and occasional discretionary purchase such as replacing an aging vehicle. When we fully access retirement assets, we’ll have plenty of discretionary income; our wants and needs are pretty simple, not much lifestyle creep there. We will generate passive income through rental of a couple of dwelling units that are currently used for vacation and by our teenage son for get-away-from-parents space until he’s permanently independent. That all adds up to several sources of mostly passive income, although I didn’t deliberately plan it that way when I first acquired/built the assets. I’m an accidental or incidental FIRE practitioner, even though I fully intended to die with my boots on before life handed me a different agenda about 4 years ago.

Awesome! Thanks for sharing your FIRE confessional.

Your story shows us that we often adapt when life throws us off monkey wrench.

As a parent now, one of the main things I think about is problem-solving and overcoming adversity for my children. I’ve got to be careful not to hover or do too much.

I’m glad things are going well for you!

There’s one blogger who also moved away from San Francisco and went to Washington due to affordability. But he got not one, but two jobs but tells people he is retired. It’s kind of funny.

Not sure why he doesn’t recognize the disconnect. It seems like many FIRE bloggers don’t have enough passive income and are just anxiously trying to make money in different ways.