On October 2, 2019, Charles Schwab announced that it would no longer charge any trading fees. I remember my father using Charles Schwab in the 1990s and being charged $50 a trade. This article will discuss how online brokerages make money charging zero trading fees.

Immediately after the announcement, Charles Schwab stock dropped about 9%, while firms like TD Ameritrade and E-Trade dropped by even greater percentages. Clearly, investors in these names were not happy that these companies would be losing a significant portion of their revenue.

But when fees are cut, consumers generally win, if the firms can stay in business. Thus, the question is how will online brokerages make up for this lost revenue? Another question is what should investors on the platform do?

How Online Brokerages Make Money Charging Zero Trading Fees

After Charles Schwab announced its trading fee elimination, TD Ameritrade, the first online brokerage I opened in 1995, followed suit the next day. E*Trade has also eliminated trading fees.

So how are online brokerages going to make money or at least make up for their lost revenue? It may surprise you to know that Charles Schwab has been generating the majority of its revenues (57% in 2018) by acting as a bank.

In other words, Charles Schwab pays you a lower interest rate on your cash deposits with the firm, and earns a higher interest lending or investing the money elsewhere.

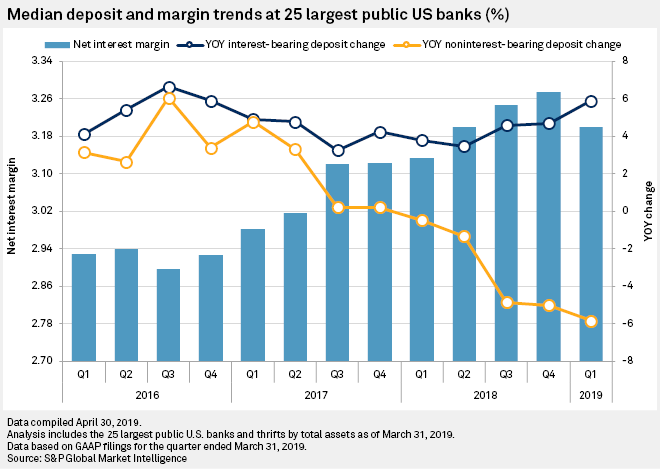

For example, Charles Schwab could pay you a 0.1% interest rate on your cash and buy a 10-year treasury bond paying 1.5%. This is their Net Interest Margin (NIM) business.

By cutting its trading fees to $0, Charles Schwab is hoping to attract more customers and their idle cash onto its platform.

In TD Ameritrade's case, it is slightly different because it doesn't own a bank. It has affiliate partnerships with banks such as TD Bank to hold customers’ cash on deposit. The bank partner then pays a portion of its net interest margin to TD Ameritrade. Therefore, the net interest margin business profitability is lower.

Further, less than 30% of TD Ameritrade's revenue comes from its net interest margin business. In order to stay competitive, TD Ameritrade had no choice but to also cut its trading commissions to zero, even though commissions accounted for a greater percentage of revenue.

Hence the greater percentage fall in its share price. TD Ameritrade's #1 mission has to be to boost its net interest margin business to be its main revenue generator. Thus, I suspect it will be advertising higher cash interest rates in the future.

Besides trying to earn more net interest margin business off customers, online brokerages are hoping to generate more margin trading and options trading business. New customers might even join their money management business that invests money in mutual funds with higher fees than index funds and ETFs. For example, Schwab has an Intelligent Portfolio Premium business that costs a fixed amount to join and has a monthly fee.

What Online Investors Should Do

Free trading is great. But just as getting fries for free sounds great, if you subsequently also buy a Big Mac, a 16 oz Coke, and baked apple pie, you've probably spent too much on an unhealthy meal.

To take full advantage of free online trading, here's what I think investors should do:

1) Review your historical trades.

We know from the data that individual investors are the worst performers. Therefore, instead of immediately increasing your trading frequency because you can for free, review your last several years of trades and see whether you made good decisions or not. Be honest with your results.

Use the $0 trading fees to make incremental adjustments to your portfolio to match your desired risk exposure. In the past, maybe you held back on adjusting your equity exposure from 72% to 70% because it wasn't worth paying $4.95 – $6.95 per trade. Now, commission fees are no longer a reason not to do so.

2) Do not engage in margin trading.

Margin trading is how you can lose all your money in a downturn. Margin trading not only exposes you to total loss, but it also costs an interest fee to trade on margin. Please don't leverage up at this point in the cycle. The S&P 500 and the NASDAQ are at all-time highs. Valuations are expensive. I'd much rather invest in lagging rental properties instead.

3) Do not engage in options trading.

The average investor has no business doing any sort of options trading. If you must dabble, then look to use options to hedge by selling covered calls or buying puts. Even then, I don't recommend options trading unless you have plenty of time and interest.

See: Personal Lessons Learned From The 2008 – 2009 Financial Crisis

4) Keep cash to a minimum in the brokerage.

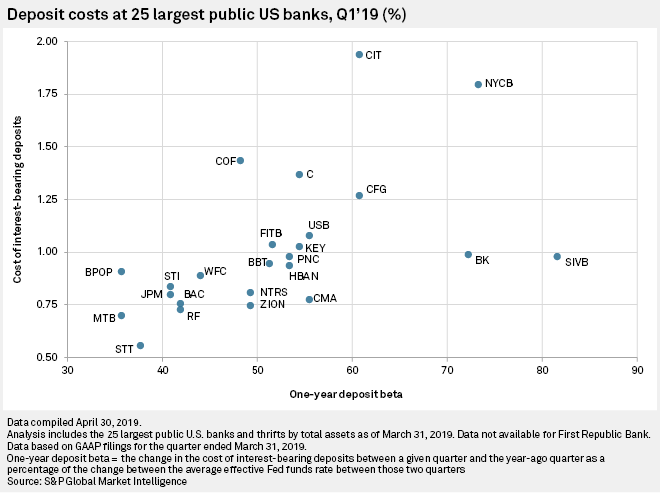

The money in your online brokerage account should be 95% – 100% invested in stocks or bonds or other investments. The vast majority of your cash should be invested in an online bank with a much higher interest rate or in a special cash fund with your online broker that pays a higher interest. The chart below shows how CIT Bank has the highest cost of interest-bearing deposits. Savers should take advantage.

Alternatively, your favorite digital wealth advisors such as Personal Capital and Betterment have created new high yield cash products to attract more users and provide more value and synergies as well. But their savings rate will change depending on the conditions.

5) Question the fees of their mutual funds.

If you elect to use a digital wealth advisor platform on an online brokerage account, then you should ask them to generate a sample mock portfolio based on your investment goals and risk tolerance.

Then you should analyze the funds they are putting you into by analyzing the composition, the historical returns, and the fees. If the portfolio isn't made up of index funds and ETFs, then the funds will most certainly be more expensive.

Related: How To Analyze Your 401(k) For Excessive Fees

6) Set up a punt portfolio or a teaching portfolio.

For those of you who have the time and the means, you can now set up a punt portfolio to see if you can actively beat the market. Given there are no fees, your punt portfolio can be as small as $1,000. If you've always wanted to be a daytrader, here's your chance to get it out of your system.

I personally have roughly 25% of my public investment portfolio in active funds and individual stocks. I invest in big tech names and other names that I think will outperform.

You can also set up a teaching portfolio for your children or your friends to show them how to buy and sell securities, highlight how difficult it is to time the market, and more.

Because my dad explained to me the stock ticker section of the newspaper in high school, I became interested in a career in finance. My career in finance ended up being quite lucrative, and without it, Financial Samurai would not exist. Therefore, you never know how far a little education will go with your children.

If you have children, I highly encourage you to put them to work and open up an Roth IRA. It's great to contribute to a Roth IRA with earned income at a low or zero percent tax rate.

Within 20 years, they could become millionaires if you combine the Roth IRA with a custodial trading account and a 529 plan.

Make Sure You Eat For Free

Please stay disciplined when it comes to building your after-tax investment portfolio for passive income. Your taxable investment portfolio is what will generate passive income. And passive income is what is necessary to retire early or live a life of freedom.

Take advantage of $0 trading fees by making minor asset allocation adjustments to your portfolio. But remember, the more often you trade, the higher the likelihood of worse returns. Day trading is just not worth it due to the taxes, time, and unlikelihood you will make any money.

A lot of people have gotten burned trading meme stocks over the years. So please be careful and focus on long-term investing and having a proper asset allocation.

Finally, don't forget about the tax consequences of trading. If you hold a security for under 12 months, you will pay short-term capital gains tax. Short-term capital gains tax is equal to your federal marginal income tax rate. The more you trade, the more trade reconciliation you'll have to do come tax time as well.

Enjoy the race to zero fees. Now if only the real estate industry would hurry up and cut its commission fees to zero. That would be a cataclysmically positive event for the economy!

Wealth Management Recommendation

Sign up for Personal Capital, the web’s #1 free wealth management tool to get a better handle on your finances. In addition to better money oversight, run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator. It pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. Definitely run your numbers to see how you’re doing.

I’ve been using Personal Capital since 2012 and have seen my net worth skyrocket since. Optimize your finances wisely.

Note: Congratulations to Robinhood for going public. Although Robinhood has really screwed over a lot of its platform investors in the past by shutting down trading on its site, at least its founders and employees are now rich!

How online brokerages make money is a Financial Samurai original post. Join 100,000 others and sign up for the free Financial Samurai newsletter here.

How do I not keep cash sitting in a brokerage account if the market is high and I’ve sold things to take profits? If the cash is in some type of IRA (not Roth) then it would count as income if I withdraw it to get higher rates with online banks.

Best to keep it in you brokerage account as it still pays something. Further, when aother investment opportunity aises, you need the cash to invest. But in general, your brokerage account should be 90%+ invested.

It’s the profit on the bid/ask spread.

Schwab and others make a big chunk of their revenue from managing money for institutions and individuals at an average of 1% of the asset value. That wasn’t mentioned in your story. Also, they can widen the spread between buys and sells and pocket the difference as revenue on stock trades.

No offense but cash interest is not how they make the majority of their money from no commissions trades. Look at the Schwab 10K page 28 and it’ll show how much money they make off market executions. For example I put in a trade for a Buy Limit at 23$. I might get 23$ but Schwab could execute at the market at 22.75$. I’d never know. This doesn’t seem like a lot but for larger equity orders it’s well worth the low single digit commission paid for better pricing most the time isn’t it? For smaller investors it makes sense but for bigger players be aware of this.

Interesting fact. How does one trade at the actual market? Or is this impossible for the average small investor -who also doesn’t day trade- through online zero fee trade companies? Or does this happen because these individual trades are bundled into larger blocks?

One unintended consequence for Charles is the reduced incentive to use their already zero commission ETFs. Why use SCHB if you can now buy VTSAX for free?

True. Has there been a study of the performance difference between the two?

Does this kill index mutual funds? To dollar cost average, I like to move money into index funds in small, periodic amounts on a recurring basis but to do that into ETFs was cost-prohibitive because of the trading fees, so I used index funds at Vanguard. The trade-off was paying a slightly higher management fee than the comparable ETFs.

Now that we have commission-free trading, it seems it would make more sense to make these same small, periodic investments into the index ETFs to take advantage of the lower expenses. For larger one-off investments I used ETFs anyway to get the lower fees, now I may use them for everything.

For a newbie in re: ETFs. Please explain further —thanks. (Btw… I have seen that merrill offers zero fee stock and etf trades.)

I wonder if we’ll see consolidation in the coming years. The profit margin is shrinking for brokerages. Do they really make much from margin lending? It seems like they lost a big chunk of income from cutting fees to $0.

It seems like all the no fee startups go out of business after a while. Can these bigger brokerages survive no fees?

Brokerage services for the most part are a commodity. The existing clients try desperately to differentiate via services like financial planning, market research.

I do think that bigger brokerages will be able to cross sell in other channels. For instance, we see services like Betterment provide their own proprietary asset management platform

I’m half temped to move my money to Charles Schwab. They’re offering $2500 if you move 1 million into a brokerage account. I’m close to moving it over.

Oh yeah? Thanks for the heads up! Does it say how long you have to keep the portfolio therefore? I hope they won’t force you to hold too much cash.

I just transferred $1 million to Wells Fargo to get my mortgage refinance. Maybe I’ll transfer it again to Charles Schwab to get that free $2500! Boy needs some new shoes

TD offer is better. Need to keep money there for a year

http://www.tdameritrade.com/gametime

I think they just merged with Charles Schwab.

Regarding real estate commissions, what do you think about using Redfin for their rebates? I do most of my own legwork in terms of finding rental properties to purchase. I just hire Redfin to handle paperwork for the buying/selling. I don’t feel like maintaining a real estate license with all of the fees and continuing education. I only buy about 1 or 2 properties per year.

Redfin is great. I’ve used them twice.

$2,500 for a pair of shoes? I didn’t think San Francisco was THAT expensive.

Sincerely,

ARB–Angry Retail Banker

I am a member at E-Trade and they just announced they are going to $0 trades yesterday and will be effective on October 7th. I am really happy there.

I switched to Merrill edge last June. So I’ve had free trades for over a year I buy more often I’m not generally a trader but I’ve been selling some stuff I bought before I knew what I was doing. I have found I tend to buy more in smaller amounts generally than I would if I was paying a fee. It has worked for me. It might not work for everyone.

MerrillEdge is good, but the fees! They have a fee for everything, it seems. My mom left me her portfolio with Merrill, and they’ve cost me thousands already. $125 account management fee – yearly, whether you do anything with your account or not. $650 on a $10,000 trade. Fees on a sliding scale, from the hundreds into the thousands of dollars. Did Merrill start charging fees recently?

Interesting read on how brokerage firms are changing their business models. If you don’t adapt, you will soon be out of business. I agree with your line of thinking, that free trades don’t matter. Trading is a losing game both in “not being able to time” the market and in tax friction. I personally use Vanguard for my long term money. I do it for two reasons, one it’s low fees. Second, they are less likely to “get you” on some hidden cost. Sure, some brokerage firms have great loss leaders and tempting “free” services, but what about that extra 5-20 bps fee in the money market fun where you store your cash? It’s this little items that are overlooked that add up in extra expenses. The founder of Vanguard, may he rest in peace, was worth 80-100 million (with a lot of book deals). The founding family of other large brokerage houses are worth more than 20-30 billion! Who do you think is making a profit from you?

You make excellent points — all of them — and re: Vanguard that’s exactly why I have my several millions in assets primarily there. I trust Vanguard to put the client’s interests first.

I was surprised to hear the news about Schwab going to 0 fees and then even more surprised how fast TD Ameritrade went for the same thing the very next day. They must have had their tech teams scrambling to get that setup so fast.

It’s nice to be able to trade for free. I’ve been trading within a list of ETFs at my brokerage that have 0 trading fees for a while now. It definitely has encouraged me to trade more often. I remember in the past how I would often hesitate to pull the trigger on a trade just because of the fee and I also made bigger bets as a result. Since I’ve had 0 trading fees, I place more trades more often in smaller amounts to leg into positions.

Lots of fascinating insights in this post. Thanks for sharing so much info and insights!

I agree that payment for order flow is a likely source of income for zero commission brokers. The question is whether the customer is worse off for receiving a less efficient price vs. paying zero commission. Buy and hold investors are probably better off with the zero commissions.

With interest rates falling, Schwab’s banking interest revenues will be squeezed.

I am suspicious of Robin Hood. Their payment for order flow revenues are 10 times what TD Ameritrade, Schwab or E-Trade make on a normalized basis.

So where do you look to find out how much your broker or financial advisor is being paid for order flow?

The money in a “brokerage” is not in trading commissions but assets under management. This insight is what led the “discount brokers” to completely demolish the old commission-based stock broker model over the past 30+ years.

Not saying this is bad at all. It is almost definitely a good thing for the small investor. Overall Schwab’s total revenue on its AUM is $10B/$3.4T or 0.3%.

I’ve had TD Ameritrade (Scottrade) for decades. I’m glad there are no fees anymore. :-)

I’ll just continue to buy (DCA) periodically/monthly and reinvest dividends. I don’t sell very often at all, especially for the reasons you mentioned.

Although I also opened up an account with Robinhood too a few years back since they were one of the first to offer free trades.

Actually sophisticated investors can use margin to increase returns with a bit more risk. I have 100% in index funds but add a little leverage to increase returns. This is possible because margin rates have been very low for a long time. I pay 3.2% at IB. As long as you keep margin percent moderate, margin call risk is tiny and in the long term you come out way ahead

It’s nice to be sophisticated! How did you margin investing work out in 2008-2009?

Just fine. IB uses an algorithm to determine what your equity percentage needs to be based on the volatility of your portfolio. With an indexed portfolio, it is extremely low, about 15% for me. So if you leverage up 30%, even if the market drops 50%, you would not face a margin call. For example if you have $1m invested and margin $300k, you equity percentage is 1m/1.3 or about 77%. If the market drops 50%, your equity goes to 350/650, or 54%, which is still way above the minimum of 15%. The market would have to drop by over 72% before you would face the risk of a margin call. Yes, this approach introduces more volatility, but in the long run it will increase your wealth as long as margin rates stay below the long term average stock market appreciation. As long as I’ve been invested, that has been the case with Interactive brokers. Other brokers may have higher margin rates so you need to shop around.

No trade commission is a good thing. It will encourage day time traders to increase their activities.

The activities will translate to acceleration that will move the market up in long term.

If you are a buy and hold investors, you will reap the reward for going long!

Any company that goes public needs to get the public attention – day time traders is a sizable group on par with gamblers in the casino industries – they are the critical mass that will market the company.

By law of self-preservation, the company will act appropriately to all these activities and move its price and bottom line up (market capitalization).

We, as long term investors should encourage this critical mass to trade more. Ninety 97 – 99 will lose to the house. The casino, the house, the market will always win and we will get a small crumb from the market if we go long.

How about leaving your money in Vanguard Money Market Fund. Their yield is higher compared to others.

Should be a good thing. The thing is, most online brokerage investors just keep their cash idle. You need to buy a money market fund to get the higher rate, otherwise, you will get like 0.1%. For Fidelity, for example, I have money in SPAXX, the Fidelity Government Money Market fund. 7-day yield is about 1.65% as it’s come off its highs.

You need to either call and ask or figure it out on your own and buy a particular money market fund.

Hi Sam, are you aware that there are additional money market funds available at Fidelity with higher initial investments (100k, 1M, 10M) that provide incrementally higher yields? There is also the choice of money markets that are treasury only, govt, muni, state specific muni, tax exempt, etc depending on your circumstances.

Bottom line – I’m guessing at your cash level, tax bracket, and location you can do a lot better than the yield on SPAXX with both taxable and/or TEY options.

Cool. Let me know what they are. I have very very minimal amount of cash in my investment accounts.

I currently have Wealthfront accounts (rolleover IRA, SEP IRA, individual investment account). I’m not sure if I should transfer to Schwab to take advantage lower fees? I don’t actively trade, but maybe that’s something I should start doing? How does the Wealthfront 0.25% management fee compare to Charles Schwab?

Not sure if it’s worth the hassle to transfer at all, especially since you aren’t an active trader.

From what I gather on the Schwab Intelligent Portfolio product

$300 1st 3 mos + $30/mo + ETF fees=$570/yr

Portion of funds in FDIC Schwab Bank (<0.1% APY)

$25K minimum

Brokerages also can get paid for order flow too.

I wouldn’t blanket ban Options Trading either. While yes you need to put some effort into it to learn it the average inverstor can do it. Any Tastytraders out there? Excellent way to learn and no cost.

One other way online brokerages make money is through selling their order flow to firms. This is how Robinhood makes a lot of their money, and results in slightly poorer execution prices for the customers.

There is no free lunch :)

This started with Interactive Brokers offering “IBKR Lite” with no fees. Instead they will get payment for order flow and you won’t get the best prices, same story as Robin Hood. They will continue to offer “IBKR Pro”, which charges fees and tries to get the best prices. IBKR pay fairly high interest on deposits above a minimum level.