We've all heard of men buying midlife crisis cars to feel more alive (or make up for shortcomings). But what about buying a midlife crisis house? Have you ever thought of such an interesting phenomenon?

Let's say you're living in a perfectly fine house that fits all your needs. It has the best layout with the right number of bedrooms, right number of bathrooms, an office, and a couple of decks overlooking the ocean. What more could you ask for right?

It turns out, when you're experiencing a midlife crisis, being content with what you have can sometimes get thrown out the window!

Boost your wealth through private real estate: Invest in real estate without the burden of a mortgage, tenants, or maintenance with Fundrise. With almost $3 billion in assets under management and 350,000+ investors, Fundrise specializes in residential and industrial real estate. I’ve personally invested $300,000 with Fundrise to generate more passive income. The investment minimum is only $10, so it's easy for everybody to dollar-cost average in and build exposure.

A Midlife Crisis Can Relate To Many Things

Now that I'm firmly middle-aged, I'm trying to be aware of anything I'm doing that's out of whack. If we're doing something due to a midlife crisis, we may be trying to compensate for our lack of self-esteem or lack of satisfaction in some part of our life.

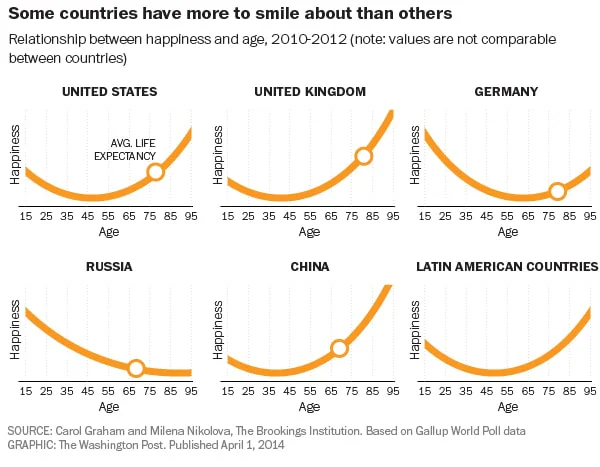

Since 40, I've been building a mid-life crisis fund to potentially deal with a dip in satisfaction in the future. Plenty of surveys have showed life satisfaction troughs in one's 40s and early 50s, then recovers.

Here are some things I've thought about recently.

Potential midlife crisis examples:

- Am I eating less and exercising more because I want to look sexy for the ladies on the pickleball court? Or am I doing so because I want to feel better and increase my chances of living a longer and healthier life? The reasons may be both. However, if I'm not going through a midlife crisis, the predominant reason should be the latter, especially for my family.

- Am I recording more podcasts to gain more recognition because I don't feel like I've done enough in my life? Or am I recording more simply because I enjoy a new challenge and want to develop an archive of recordings for my kids? If the desire for recognition is more than 50% of the reason, that's different from being the nobody I'm used to.

- Am I buying a new house that I don't need to look more important to other parents and friends given I don't have a job or much status? Or am I buying a new house because I think it will provide for a better lifestyle for my family? If the main reason is the former, then I may be going through a midlife crisis.

Why We Desire A Midlife Crisis House

Some people are creatures of habit. No matter how much money they have, they aren't willing to move.

Perhaps the most famous example is Warren Buffett still living in the house he bought in 1958 in Omaha, Nebraska. Back then, he paid $31,500, the equivalent of around $350,000 in today's dollars after inflation.

Sure, the house is 6,570 square feet, considered mansion-sized by some. But it costs nothing compared with his $100+ billion net worth.

Here are some reasons why some of us buy unneeded houses in our 40s and 50s.

1) A fancy car just won't do it anymore

If we have the ability to buy a midlife crisis house, then we most certainly can afford to buy a midlife crisis car already. We've either already purchased our dream car or we just aren't that into cars.

The irony is, buying a midlife crisis car might ultimately save you a lot more money. Because if you can satisfy the hole you feel inside with a fancy new car, you won't have to buy an unneeded nicer home.

My aging car

I bought my Range Rover Sport in December 2016, mainly in preparation for the birth of our son in April 2017. We had been driving a Honda Fit on a three-year lease that was coming due and we wanted a larger, safer car for our family. However, if I was going to buy a new used car, I wanted one that I loved.

The Range Rover has been one of my favorite cars since middle school. Since starting work, I've purchased almost every car I've ever dreamt of owning since I was a kid: MB G500, BMW 635CSi, BMW M3, LR Discovery II. It's been a fun ride!

Given it's been nine years since I bought my existing Range Rover, its novelty has worn off. Hence, it's doing nothing to offset the itch to buy a midlife crisis house. But I still love Moose II all the same.

Besides, new luxury car prices are outrageously high. I went to the Range Rover dealer to see how much a new version of mine car would cost, and the asking price was $110,000 pre tax! Forget about tit.

2) Keeping up with the Joneses or surpassing the Jones with a nicer house

If you have a day job, you'll witness your coworkers getting paid and promoted. As they get promoted, they'll buy nicer homes and other luxurious things. You'll naturally want to keep pace with their success, given you may feel less successful if you don't.

If you aren't already surrounded by highly motivated people at work, you may be as a parent during school functions and playdates. As a result, you will also end up comparing your things to the things owned by other parents.

Before meeting anybody, you could have been perfectly happy with your house. However, after meeting other people of your similar age and status with nicer homes, you might begin to question everything!

You might wonder how the heck can these people can afford their house, their car, and the other nice things? The answer is sometimes a lot of debt, which as a FIRE person, you use a lot less than average. Then you might start thinking why someone less deserving have nicer things than you.

Mixing back in with working society

One of the good things about leaving work in 2012 is no longer being surrounded by type-A, ultra-competitive folks who constantly buy nice things. Not hearing about their purchases helped stop me from craving nicer things.

However, once my son started school in 2020, I was injected back into society. I started getting to know other parents who went on cool vacations, drove expensive cars, and bought new houses. As a writer, it was fascinating to observe the “peacocking” that sometimes went on at playdates.

After a parent hosted a party at his modest house one day, I asked myself whether I was proud enough to host poker night at my house in the future. In addition, I wondered whether I should buy a nicer house to impress other parents! Before plugging back into the Matrix, I never thought about these things.

3) The realization that you may die with too much money

One of the best ways to decumulate wealth is to buy an expensive house. Your maintenance and property taxes will shoot up. So will your house payments if you take out a mortgage. But at least you'll get to enjoy your wealth, unlike with stocks.

As a personal finance enthusiast, you will most likely get richer than the average person because you're saving and investing more than the average person. Given the power of consistency and compounding, there's a good chance that a majority of us will die with a lot of money left over.

As a result, one solution is to look for sweet new houses. If you have kids, the best time to own the nicest house you can afford is when you have the most number of heartbeats at home.

A greater focus on decumulation

The investment gains of 2020 and 2021 were unexpected. As a result, I've accumulated an “overage” of wealth based on my pro-forma net worth calculations by age. The same goes for 2024, when the S&P 500 rose by 23% after a similar gain in 2023.

Given I committed to decumulation starting at age 45 in 2022, I need to proactively spend more money to get back to my baseline financial projections upon death. The 2022 bear market helped. However, the 2023 and 2024 bull markets have “hurt.”

I could buy a new car but I've committed to driving my car for at least 10 years until December 2026. Spending more money on food was an interesting experiment for three months. But there's only so much we can eat. I was sick of most finer foods after three months.

In addition, given I'm enthusiastic about sending my kids to community college, I will have excess savings if they go given we super-funded two 529 plans. Therefore, all that's really left is buying a midlife crisis house.

4) The desire to feel protected with a nicer home

After the pandemic, many of our expectations about safety and independence were shattered. As a result, it was natural for people to want to gain more control of their lives by buying bigger homes. Given we are Kings and Queens of our homes, the larger the home, the more control we regain.

At the extreme, if we buy a home with land as big as the city we live in, our life would revert back to normal. We could essentially do anything we want since we owned everything.

When we lose control, we naturally want to take back control through ownership. A midlife crisis home gives us greater control and protection from unknown dangers.

Bigger house for growing kids

After realizing my home remodel would take way longer than expected in 2020, I decided to buy an already completed, fully remodeled home. Funny enough, our new home is about the same size as our now-remodeled old home. But I wasn't willing to live in a construction zone for another 2+ years with a baby and toddler.

Life is pretty much back to pre-pandemic normal. But the sense of wanting to feel safe, especially with kids, has not gone away. As a result, I'm looking for homes in even safer neighborhoods with lower levels of traffic. A hidden neighborhood in the hills would be ideal!

Wanting Nothing Is Also Good Thing

As the recently deceased Sinead O'Connor once said, “I do not want what I haven't got.”

It's wonderful to be content with all that we have. At the same time, it also feels wasteful to hoard wealth beyond what we need. This is the conundrum many FIRE enthusiasts face.

Minimalism and early retirement go hand in hand. But if you do money too well, you will end up with too much of it. How ironic. And what a darn shame.

Instead of buying a midlife crisis house, maybe it would be better to take a trip of a lifetime instead. Or maybe getting a puppy will help solve the loneliness inside.

There are plenty of cheaper ways to solve self-esteem issues, including going to therapy every week. Heck, if you're dissatisfied with life you might even be able to make more money by finding a new job or go back to work if you're retired.

Personally, I highly value living in a nice home. I spend so much time at home writing, podcasting, and taking care of my family, that spending money on a home feels like great value. And the fact that a home could also potentially go up in value makes it an ideal asset.

You might think you're going through a midlife crisis by buying a nicer home you don't need. However, if you're in tune with your emotions, you might be acting perfectly rational after all.

Bought My Mid-Life Crisis Home

I ended up buying my mid-life crisis home in 2023, a home I salivated over a few years prior when it came back on for a lower price. At that time, my stocks had rebounded and I enjoyed my previous home for one more year. As a result, I figured it was now or never.

Buying a home I didn't need cost me in upside stock market gains since I sold stocks to pay cash for the house. However, I have truly enjoyed living in my new mid-life crisis house.

Having a gated front yard provides me mental relief from the kids running onto the street and getting run over. Living on a hill reduces the number of crimes. It feels good to feel safe. In fact, feeling safe might be priceless. I found the almost-perfect house to raise a family with a large lot and views.

Invest In Real Estate More Passively

If you're looking to invest in real estate passively, check out Fundrise. Fundrise manages about $3 billion for over 350,000 investors. It predominantly invests in residential and industrial properties in the Sunbelt, where valuations are lower and yields are higher.

Financial Samurai is a six-figure investor in Fundrise funds because I believe in the long-term demographic shift to lower-cost areas of the country. Fundrise is also a sponsor of Financial Samurai. Our real estate investment philosophies are aligned.

The Midlife Crisis House is a Financial Samurai original post. Financial Samurai began in 2009 and is the #1 personal finance site today. Join 60,000 others and sign up for my free weekly newsletter here.

Very good article and spot on. I have seen couple near retirement that buy way too big or too expensive and in less than 5 years selling their dream home. They might loose a job, did not calculate retirement needs or health issues. They do all right on the sale but it is emotionally draining. Maybe a few ratios or analysis that you do so well to add to this article

Oh no! I’m looking up properties in Italy… is this what I am experiencing?

I think for our family, having a kid has made us clear on our priorities, and realize that someday is now. We want to provide him a certain life, including decompressing from North America in Europe every year.

Probably! But looking is one thing, living the dream is another. Best of luck!

Well, might not be a mid-life thing exactly, but there is a strong tendency to retire and then build or buy the “forever house.” A grand place for the patriarch and matriarch to receive their expanding families for frequent visits and get togethers. To have storage for all their stuff. To have extra garages for fun cars and/or golf carts. Entire rooms dedicated to some hobby or another. A living room, a great room, a family room, a game room, a sun room, a massive kitchen with two sinks and two oven, maybe two dishwashers, and a double-wide fridge. A master bedroom suite on the main floor with a spa bath and his-and-her walk-in closets. A whole handful of guest rooms.

Also, they want a view, or a dock, or even a considerable parcel of land with it. They might also want a neighborhood that only allows older people, and perhaps has a clubhouse and other amenities. And they want it in a place where there might not be that many jobs other than being a retiree (or cleaning up after them).

Heck, I want that. My wife keeps having to talk me down. But it would be almost impossible for her to do that if I didn’t have an idea of what comes next.

That’s at, say, 65. In their seventies they have trouble pulling the trash up and down the driveway. Early on they discover that yard maintenance outfits have a disturbing tendency to move out of the home care business once they have enough business customers. So the search goes on for the next one. Meanwhile, they need more and more help around the house. They reach the age at which neither one of them is willing to vacuum, dust, or wax, let alone clean toilets, wash windows, change air filters, and so on. It’s a lot. And the kids start to notice that the corners of the house tend to have lots of cobwebs, something that never would have ever been allowed, because the parents can’t see them anymore and cleaning staff, no matter how well paid, just aren’t that invested.

By the time they get to early 80s they need to downsize. Not for financial reasons, perhaps, but just because it’s beyond them, even with lots of services.

And, bad news, the only serious market for these things is the folks fifteen years younger that are starting to retire (an awful lot of them are nowhere near the job markets). But the baby boomers don’t last forever and the next generation won’t be as large, won’t be able to buy all of the old retirement estates (let alone all the new ones that developers will try to push), and may actually prefer a different thing altogether, like just keeping the old place and getting a couple of smaller homes that they migrate to in different seasons, or for a chance of venues, or whatever. I’m somewhat tempted that way, also.

Buy it soon!!!! The older your kids get, the more space you need!!!! So you might as well enjoy the extra space for as long as possible. You might not necessarily be having a midlife crisis house. You might instinctively know that you need more space as your kids grow, and especially through high school. They will need space to have their friends over, do stuff, and also show the other kids that they are their equals but better because you taught them not to be entitled. By the way your kids will need a lot of money, both son and daughter, to keep up with the Joneses in school. Figure on a 20K per year clothing budget per child, regardless of gender. Or maybe a lot more I might be vastly underestimating lol. There is nothing more charming than a wealthy, well dressed, compassionate, kind to everyone regardless of their social status, courteous child.

Do vacation home count as a mid life crisis?

I think so! Because nobody needs a vacation house.

We all have a guidance system and it called our emotions. When you are on the right path you will feel happy. If you are not happy you are on the wrong path. In a song by Van Morrison “ when will I ever learn, God gives me everything I need and more, when will I ever learn.” Figure out what you want and let the Law of Attraction work for you.

I have read your newsletter consistently over the years. Maybe I missed it but I don’t recall you mentioning preferred stocks. Please share your thoughts on this type of inversment.

The wife has managed to collect a set of friends who ALL have purchased their dream multimillion dollar homes (I don’t want to quote the exact figures partially because I don’t know how the FS audience would respond and partially in denial) within the past five years. I’m getting the pressure now, and it doesn’t help that I’m taking a less conventional route of startups / entrepreneurship, which makes her anxious, not least because I haven’t had any Big Hit yet. And finally disposition-wise I’m more beach bungalow and she’s more private mansion. How do we get through it??

Quote some figures! The audience will be fine.

You have to run the numbers with her. It would be unwise to put yourself under financial stress before a big exit or windfall.

Show her the 30/30/3 rule. And since all her friends have mansions, you guys can just go over and visit and enjoy!

In 1971 Buffet bought a California beach home

(https://toptenrealestatedeals.com/weekly-ten-best-home-deals/home/a-beach-deal-from-warren-buffett) so possibly he was going through a mid life crisis as well!

If you want something “easy” I definitely would not recommend a puppy ;) They are a lot of work and it takes a great deal of patience to train one. Perks are they’re super cute and fun companions of course though. But definitely not something I consider easy.

Decumulation is quite an interesting journey and a fortunate situation to be in. I enjoyed your post on decumulating with food. As for houses, I know someone who spent multiple six figures over ask on a house in their 40s. I was surprised at the numbers, but perhaps that was her way to grab what she felt was an ideal midlife crisis house so no one else could. She’s very happy since and was able to afford it, which is nice. Fascinating stories. In any case, I think we should all enjoy each day to the fullest in whatever way we see fit. There’s no time like the present!

It’s not just a bigger, more expensive house that can signal a mid-life crisis, but buying more anything (including investment real estate) instead of just not spending.

I find myself in that conundrum after getting to a manageable portfolio of 10 units, but still looking — “just in case”. Why keep looking?

Because there might be a good deal out there. Because more is better in a consumption society. The US also has a serious case of hustle culture so that encourages accumulation v staying put.

I agree that minimalism is a better pairing with early retirement, but it’s hard when one likes to shop — and in my case, that means investment real estate!

The irony is, the less you spend, the more the cash burns a hole in your pocket. So to not spend by investing feels increasingly uncomfortable.

You get this feeling? Bc we’re all facing a clock of death. Just feels so bad to die with excess.

For those whose financial and material accumulation has grown over the years I suggest that rather than buying “up” with their home, cars, and other possessions that they consider becoming involved in various non profits that hold meaning to them and then support those causes generously through personal philanthropy. Making an investment of one’s time and money in the lives of others in a way that improves their quality of life will provide a return that can’t be measured, will fill your soul with goodness, and make the reason for “up-ing” physical possessions seem shallow and temporal. “It is more blessed to give than receive.”

Agree. But it may not be enough as people certainly do both.

Mentoring, teaching, writing online for free, answering people’s questions, volunteering, all those things are good for the soul and for society.

What are some things you’re doing? Ever had a midlife crisis yourself?

Sam – I’m involved with the state (local) offices of two national environmental organizations and financially contribute to those causes in addition to a few other NPO’s that my wife and I support. In retirement I have volunteered my time to mentor young people in my career field through a local chapter of a national professional society. I did have a mid life crisis but one with positive outcomes: lost weight, got in shape, returned to actively playing tennis and made significant dietary changes. Thanks, Sam, for responding and for all you do to educate and inspire your army of followers – your advice is sound and filled with a sense of caring to help families achieve financial goals.

Sure, go for it. My son would say “You do you.” Heh.

Mrs. RB40 seems to have similar feelings about the house as you. She has been complaining that our house is too small. I don’t want to move, though. It’s a pain.

In a couple of years, I plan to ask our tenant to move out so we can use both units in our duplex. That’s an awesome way to get more living space for a few years. Meanwhile, I sent my dad some money to build a beach house in Thailand. I guess that’s my midlife crisis house. We’ll have a comfortable place to stay when we visit next time.

Both sides of duplex. Bad move. Cmon now. How about you move and rent both sides. Win win

So far, the feedback has been that women seem to care more about living in a nicer home than men. I think owning both sides of the duplex makes sense, but sounds like your side can be easily rented out.

I love living in a nicer home. More people in the family, the smaller the house grows. I need peace and quiet as a writer.