I'm always searching for reasons why things are the way they are. It's also fun to connect the dots and come up with an investment thesis to make a lot of money. What I've recently discovered is that because the minimum qualifying income required to purchase a house is so low, there is still a lot of upside to housing prices.

For years now, I've made the case that Americans earn more and are wealthier than we all like to think. And finally, after three years of waiting, the U.S. Census Bureau came out in 2020 with 2019 data saying the real median household income has reached $68,703.

$68,703 is a healthy middle-class income. The question now is: Is $68,703 a high enough household income to afford a median-priced home?

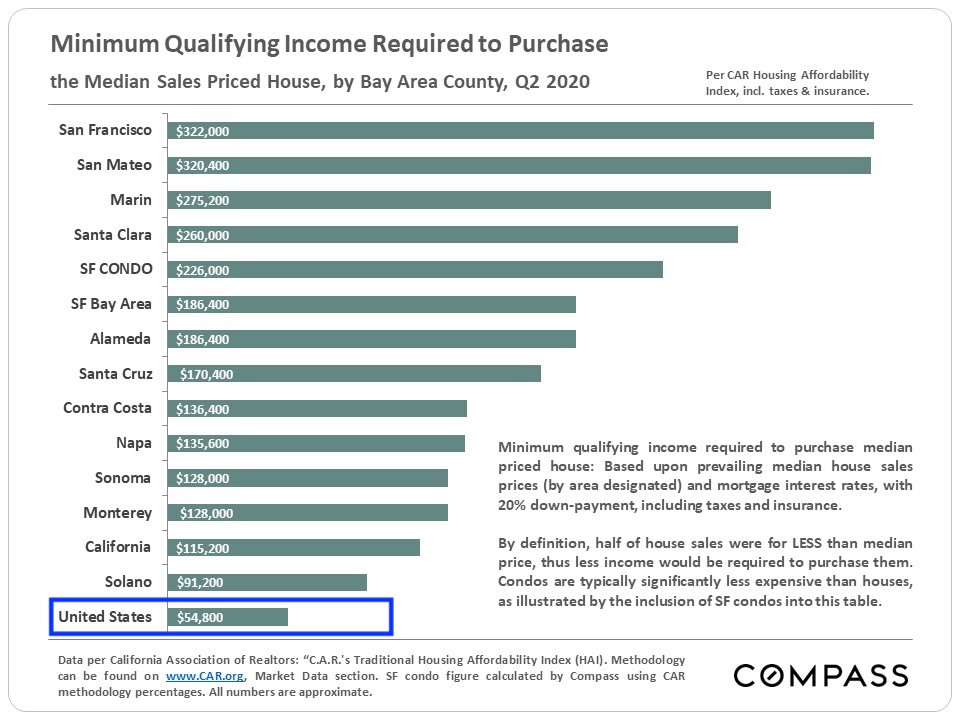

Let's look at data from the California Association of Realtors (CAR) on the required minimum household income to afford a home.

Minimum Qualifying Income Required To Purchase A House

You'll see below that for the United States as a whole, the minimum qualifying income required to purchase a home is only $54,800! No wonder why the single-family rental market is so strong!

If what CAR reports is accurate, then the median household, which earns close to $69,000 annually, has a healthy $14,000 income buffer to purchase a home. Put in a different way, the median U.S. household can afford monthly mortgage payments which are 25.5% higher than the mortgages of a median-priced home.

The CAR Traditional Housing Affordability Index is explained here. The calculation assumes a median price home, a 20% down payment, the national average effective mortgage interest rate on all fixed and adjustable-rate mortgages, and Principal, Interest, Taxes, and Insurance (PITI) of no more than 30% of a household's gross income.

Many homebuyers put less down than 20% and spend more than 30% of their household gross income on PITI. Therefore, I say the CAR's definition of housing affordability is pretty accurate.

Up To 25% Further Upside In U.S. Home Prices

If mortgage rates and the median U.S. household income stays the same over the next several years, then theoretically, U.S. home prices have roughly 25% further upside.

If the price for a median-priced home in the U.S. is currently $291,300, then in several years, the potential price for a median-priced home in the U.S. might be $364,125.

Of course, every housing market is different. 18-hour cities are likely going to appreciate faster than 24-hour cities in the short-term. Therefore, you may want to diversify your real estate investments accordingly.

However, long term, I still am bullish on 24-hour cities due to continued strong job opportunities, network effects, and more.

I believe mortgage rates are going to stay low for at least the next decade. Further, I believe the median household income will stay buoyant. It's hard to see real U.S. median household income collapsing by $14,000 to $54,800 in several years. Even if it does, mortgage rates will likely be even lower to support housing affordability.

Therefore, there's still plenty of upside in the U.S. housing market. By 2026, the U.S. median home price could easily be 20%-25% higher. The biggest tailwind is that the millennial generation is in its family formation years.

If you haven't done so yet, please refinance your mortgage and take advantage of record-low rates. Check out Credible, my favorite online lending place where you can get no-obligation quotes from competing lenders in minutes. Mortgage rates are finally ticking up, so please refinance before they go higher.

Surviving In An Expensive City

Now that I've made a bullish case for the U.S. median home price, let me focus the attention on how to survive in San Francisco with two children and two stay at home parents.

To track middle-class expenses, I pay attention to the minimum qualifying income required to purchase a home and the cost of healthcare. I also keep track of private school tuition, which is more an upper-class decision.

A middle-class lifestyle is all we can reasonably ask for. However, thanks to inflation, tremendous competition, and a dramatic decline in interest rates, it's getting harder to achieve a middle-class lifestyle status or stay in the middle class.

In 2018, when I wrote, Why Households Need To Earn $300,000 To Live A Middle–Class Lifestyle In An Expensive City, the post received plenty of backlashes. The general consensus was that needing $300,000 to raise a family was way too much, despite the cost of living saying otherwise.

To be clear, the post was in response to the California Association Of Realtor's (CAR) calculations, not mine. Now we know the income level today is closer to $322,000, which is 7.3% higher. See the latest figures below.

Cross-Checking The Minimum Qualifying Income

$322,000 sounds like a big minimum income. However, if you follow my 30/30/3 home-buying rule, $322,000 is actually not big enough! This is because the median home price in San Francisco is about $1,600,000. Therefore, a household would need to earn a median income closer to $533,334.

But I've also said that for households living in an expensive area can stretch to 5X their household income. This is mainly due to a dramatic decline in mortgage rates. Therefore, $322,000 X 5 = $1,610,000, which is spot on with the median home price in San Francisco.

Thankfully, six-figure incomes are a dime a dozen in places like the Bay Area. The average starting compensation package for college graduates joining big tech is over $100,000. The greater difficulty may be coming up with a 20% down payment plus a 10% cash or liquid securities buffer.

A $1,288,000 mortgage after putting 20% down at a 3% mortgage rate is only $5,430 a month. $5,430 is an affordable 20% of a $26,833 monthly gross household income ($322,000 annual).

Now let's move on to healthcare costs.

Healthcare Costs Are Surging

If a household is self-employed or unemployed, the household will have to bear the entire cost of its family's healthcare insurance premiums. Based on my research for Gold and Platinum plans, the annual cost for a family of four will be between $27,000 – $30,000 for 2021+.

Hopefully, at least one spouse works and gets subsidized healthcare. That said, it's much harder for one spouse to earn the required minimum of $322,000 by him or herself.

Take a look at the details of these two real healthcare insurance family plans we are considering. Does $2,532/month for healthcare sound reasonable to you?

A Struggle For Retirees With Debt

Mortgage debt is the reason why a $322,000 a year minimum household income is needed to live a middle-class lifestyle in an expensive city. The minimum qualifying income to buy a nice home is too low.

If you are able to pay cash for your home or pay off your home, a $322,000 a year household income becomes unnecessary. One can simply take the $5,430/month ($65,150/year) mortgage payment on a median-priced home after putting down 20% and subtract it from $322,000 to get a new minimum required income of $256,850 ($21,404 a month).

But even the need to earn $21,404 a month seems to be unnecessary with a mortgage. Let's say you have two kids attending private school for $10,000/month total. You're left with $11,404 a month for food, clothing, maintenance, taxes, travel, and transportation.

$256,850 a year in household income for a household without debt should be more than enough. My family of four comfortably live on less than that a year.

The Temptation To Cheat On Passive Income

As the cost of living goes up, there is a growing temptation by retirees or people seeking to retire to cheat on what is considered passive income.

Instead of just including income from investments as the only source of passive income, some people have started including active income from their online business, consulting income, food delivery income, and more as sources of passive income.

Cheating might temporarily make you feel better about quitting a high paying job. But deep down you will feel bad knowing that you haven't really achieved financial independence.

A better solution is to just own up to the fact that you are not financially independent. This way, you are mentally free to actively try and make more income. In a permanently low-interest-rate environment, we must adapt.

Keep On Planning A Couple Years Ahead

After readers started saying I was an early retirement failure for wanting to go back to work in 2018 to prepare for a potential downturn, I decided to accept the criticism and hang a lantern on my failure. As soon as I fully embraced failure, I started making a lot more money.

I'm very grateful for the constant criticism in order to improve my finances and our family's lifestyle. So please keep it coming!

By thinking a couple of years ahead before our daughter was born, we were able to better prepare financially for her added cost. We were also able to invest in some stocks that have done really well since 2018.

Finally, we were able to buy a larger single-family home with cash in anticipation of needing more space. Buying a house after the baby arrives is like shopping for groceries while starving.

The cost to live a middle-class lifestyle will likely keep going higher thanks to inflation and market forces. But that's what our investments are for! To not only keep up with inflation, but beat it soundly year in and year out.

Personally, I enjoy the challenge of trying to stay financially ahead in one of the most expensive cities in America. If we move to Honolulu in Fall 2022, the cost of living there will feel comparatively inexpensive. Let's just hope our son gets in somewhere.

It is awesome to be able to take out cheap debt to increase our standard of living. It is also equally awesome to pay down that debt and become debt-free. When the time comes for you get off the income treadmill, plan on being debt-free.

Without debt, life really does get much easier.

Real Estate Investment Alternatives

Given I believe there is potentially 25% upside to the U.S. median home price, investing in real estate is a core part of my wealth-building strategy. One way to invest in real estate across the country is through real estate crowdfunding.

If you don't have the downpayment to buy a property, don't want to deal with the hassle of managing real estate, or don't want to tie up your liquidity in physical real estate, take a look at Fundrise. Fundrise offers customized real estate funds for diversification and diversified real estate exposure.

If you are an accredited investor and like to invest in specific commercial real estate opportunities, check out CrowdStreet. CrowdStreet is focused on real estate deals in 18-hour cities where valuations are lower, cap rates are higher, and growth may be stronger as well due to strong demographic shifts.

Both platforms are free to sign up and explore. As part of my real estate diversification strategy away from San Francisco real estate, I've invested $810,000 in 18 different real estate crowdfunding deals across the country.

Readers, are you bullish on housing given the minimum qualifying income to buy a home is so low? If so, how much more price upside do you see, and in what time frame?

Glad to read an optimistic take on SF real estate! I would love to be in the market for a rental property but for now am just funneling everything into index funds. Definitely keeping an eye on things though. The Bay Area has its issues, but they have been so overblown at the national level that I think it will remain a hidden gem to much of the country for the foreseeable future.

I just paid off my Bay Area home! I’m a native and obviously bullish on California long term, but I’m sure you’re aware of the headwinds:

* Remote work going to places like Texas, etc.

* Worst roads in the nation

* Highest energy prices

* Highest taxes

* Hardcore SJW politics taking over public/private sectors

* Re-shoring that portends a slowdown in Asia trade

* Chronic homelessness

* etc…

Sure, we have great weather, ZIRP and the “A” players in high value add industries aren’t gonna leave Los Gatos for Des Moines. Sure. But…man, on top of all the other headwinds nationally and internationally, can nothing pierce your optimism bubble? Just a bit?

Right? Let’s not also forget the following:

“The California Public Employees Retirement System has scarcely two-thirds of the money it needs to pay benefits that state and local governments have promised their workers.”

“Moreover, CalPERS’ official estimate that it is 70.8% funded is based on an assumption of future investment earnings averaging 7% a year, which probably is at least one or two percentage points too high. In the 2019-20 fiscal year that ended June 30, CalPERS posted a 4.7% return and over the last 20 years it has averaged 5.5% by its own calculation.”

“There are three ways to resolve the debt dilemma: Earn higher returns, require government employers and employees to pay more, or reduce future benefits. CalPERS is pursuing the first two but a recent state Supreme Court ruling makes the third virtually impossible.“

Before moving to DC area, I lived in London, Beijing and Delhi, all major capital and metropolitan cities in Europe and Asia. Compare to them, the US capital is the cheapest and easiest to buy, also the most spacious. I’m sure many people come from other countries would feel the same. So the rational respond is to buy as much as possible before the US catch up with the unaffordability in the rest of the world, which I hope not to happen!

Yes, as soon as people live overseas in other international cities, they’ll realize how relatively cheap real estate is in every city in America by comparison. Even S.F. and NYC.

It’s one reason why foreigners have bought up a lot of real estate in America so far.

Americans enjoy the highest disposable income in the world with a very affordable housing price. It is a god blessed country on has to say! Sadly many people are used to it and stop appreciating.

Indeed. I appreciate it so much after living aboard for 13 years and going all throughout Asia for 13 years for work.

“The median home price in San Francisco is about $1,600,000.”

You have to wonder how this can be sustained with the declining quality of life in Cali. It’s such a mess! Taxes keep going up, while the summers are spent breathing hazardous air from fires burning everywhere, and rolling blackouts. 150 million cut from LAPD, homeless (tent cities) everywhere, and now they want reparations even though it entered as a free state! Classic! Hopefully the hordes that are leaving learn from their past voting mistakes in the new places they take up residence.

“Elon Musk, Joe Rogan and Ben Shapiro, to name just a few, are leaving California to escape incompetent governance. The “response” from Sacramento? Wealth and massive income tax increases on job creators (AKA “the wealthy”). Should I align with 3 smart guys, or Sacramento? Hmmm.” – Billionaire bond fund manager Jeffrey Gundlach

Legislators last month proposed a 0.4% wealth tax on anyone who has a net worth of $30 million or more. The tax would also apply to former residents for 10 years!

An additional proposal would raise the state’s top income tax rate to 16.8%, up from 13.3%.

The potential tax changes are being considered after Gov. Gavin Newsom said in May the state faces a $54 billion budget deficit due almost entirely to shutting the state down. The actual virus is not the states biggest problem by a mile!

High taxes are only part of the equation for Californians who are considering moving out of state. They are also dealing with high living costs and a wave of civil unrest. I wouldn’t willfully choose to live in San Fran if the median home price was less than the national average!

True, things are currently difficult due to the pandemic. Do you know which cities and states have not been hit or have barely been hit by the pandemic? If so, please list them and I will put them on my radar for real estate deals.

Didn’t some city in TN raise property tax rate by 32%?

I think what folks don’t understand is that income is high in SF. College graduates have $150K annual comp packages. By the time they are 30 and looking, their comp is at over $300K and they have a partner who makes a similar amount.

Which city do you live in? Id love to do a comparison analysis and maybe buy some real estate there if it is so great. Thanks!

Notice I didn’t say anything about my city being “so great.” I share in your misery in Cali Sam, but I’m not going to bury my head in the sand about what a joke it’s becoming. Unlike you, I have lived in Cali all my life and I am very familiar with the rapid decline of a once awesome state. Of course, I’m not struggling like a typical San Fran resident living in an old/tiny home on a zero lot for 1.6 mil.

I will one up you and give you an entire country. Sweden may have already reached herd immunity because they never bought into the politicized draconian lockdowns that were only supposed to flatten the curve. Did everybody forget the original intentions of the lockdowns? We were told that we didn’t want to overwhelm hospitals. Lockdowns were not originally meant to do anything besides flatten the curve. Instead, they have destroyed local economies and Cali now has 11.4% unemployment to show for it. It’s basically a 54 billion dollar my bad. Let’s just raise taxes again to cover it. I mean, we already pay twice as much for gasoline as the rest of the country. Let’s see, where else can we increase taxes to cover the mismanagement? Are you really comparing TN and Cali taxes? You don’t think a plan to raise property taxes in Cali is inevitable? It’s already being proposed with businesses to expose everyone to the idea (prop 15). Is it not? Gotta keep finding new ways to tax Californian’s to death. TN can increase another 32% and still pale in comparison to the total tax burden, cost of living, and lack of return on investment on the ridiculous taxes paid. It’s obviously becoming more than residents can take. Do we have the best education and least amount of crime to show for the highest taxes? Why not?

It’s just such a pathetic look when the governor is at his presser yesterday begging people to stop leaving. I mean, every day some wing ding new idea is proposed and then he wonders why tax payers can’t take it any linger. Don’t even ask me to start listing all the recent proposals for the rest of the country to laugh at. We are getting mocked enough!

The thing is, I’m not miserable. I’m not sure where you got that idea. Can you elaborate? What are some of the things that are happening in your life to make you so negative? And where do you plan to move to? Do you plan to move to Sweden? If so, I think that would be great.

One of the best strategies is to retire In a more socialist country like Sweden, or Canada, Australia where the healthcare benefits are better.

Nowhere did I say you are miserable Sam! Quite the opposite, your life seems pretty awesome! Obviously many desire to live in cities like San Fran, Portland, Seattle, and NYC.

I’m not negative at all. I’m a very happy person. Do we not have the right to question governance? Notice I’m pretty much just stating facts. Please don’t cancel me.

Not planning to move to Sweden. You just asked for an example of a place that may not have been impacted by politicized lockdowns. I love America, unlike the politicians that paint it as a racist hellscape. Plus, why endure the cost of moving to a socialist country when the Harris/Biden administration want to bring socialism to us?

Feel free to answer some of my questions as well, versus just being the one to ask the questions. I believe that I have taken the time to answer most of yours.

Ok cool. I was worried there for a moment and it’s good to get feedback.

I’m prepared for higher taxes and will make adjustments accordingly. Bc of my lower income now, higher taxes are no longer as big of an expense.

Most of my income is tax-efficient passive income.

Well, that’s good that higher taxes are no longer as big of a deal for you. I wonder what percentage of Cali’s 40 million population can relate? I didn’t mean to ask an additional question, but it would be nice to get your thoughts on some of the other questions already presented:

1)Where/how else can Cali increase taxes to cover the mismanagement?

2) Are you really comparing TN and Cali taxes?

3) You don’t think a plan to raise property taxes in Cali is inevitable? It’s already being proposed with businesses to expose everyone to the idea (prop 15). Is it not?

4) Do we at least have the best education and least amount of crime to show for the highest taxes? If not, why do you think? Should LAPD have cut 150 million dollars from the budget? Did taxes need to be raised even higher to prevent it? Are tax payers getting the best bang for their buck in terms of law enforcement for paying the highest taxes?

5) I’m not negative at all. I’m a very happy person. That said, do we not have the right to question governance? After all, they are employed by the people, right?

6) Why endure the cost of moving to a socialist country to retire when the Harris/Biden administration want to bring socialism to us?

I think the majority of the population can relate bc the middle class won’t be facing higher taxes under either president if we can believe them.

The greatest thing is taking action if you’re not happy. And I’m glad that’s what every rational person does. Let’s do this!

What do these grads do in Cali for $300K a year that a smart, decent, and common sense minded Indiana University grad can’t do the same job for $150K??

Your list sound like an awful lot of republican talking points. That 16.8% rate only effects individuals making over $5 million a year. (Small businesses aren’t paying that rate if they are smart with their taxes). It’s basically athletes, actors and CEOs… Who can just go in and negotiate a 3-5% higher salary to off set said costs. Do you really think they don’t have agents looking at the higher taxes and negotiating a higher pay for them to offset those higher taxes? They also aren’t leaving CA… because they need to be in stadiums or at studios every morning on set working.

I live in Los Angeles.. haven’t had a single loss of electricity all summer, the air quality issues have been bad the past few years, but I remember mudslides being more of a problem in early 2000s. And civil unrest has been a thing of the past since the springtime.

I don’t think Elon is really leaving CA.. and I wouldn’t lump Rogan and Shapiro in with Musk as brilliant minds.

I would guess you don’t make $30 million a year… you are honestly arguing for .001% of the population who won’t even really feel any lifestyle changes due to these taxes.

It’s not about small business. It’s about the wealthy that create jobs. 13.3% is bad enough for the rest of us, is it not? What do Californians get in return for the highest taxes? Best education, lowest crime, best air quality, uninterrupted power, lowest homeless population? Cali must be at the top in all of those areas to justify the highest taxes, right?

You are fortunate that your pocket hasn’t experienced a blackout yet. I live in Cali too. Fires and horrible air quality in the summer burning months has now been going on for over 10 years! It’s now a normal part of summer.

Musk, Shapiro, Rogan comments were a billionaire’s quotes who is also leaving, not mine. Are you delusional enough to think people aren’t leaving because pro athletes can’t? Is that why the governor was begging people to stay at his presser yesterday?

“And civil unrest has been a thing of the past since the springtime.”

Well, we did just have two officers shot ambushed for no reason in Compton. Is September still considered springtime? Hmm…

In your healthcare plan examples: are the numbers in red the monthly premiums?

It’s a seller’s market in the college town that I live in; population of roughly 140,000. In combination with the low interest rates, I would think that the banks can be picky in who they give mortgages to. My sister and her husband bought a home in Orlando, FL, this past April and underwriting was very thorough even though they have a six figure income and enough liquid savings to cover two mortgages for two years. While the minimum qualifying income is low, it seems that getting the property to appraise at the proper value and credit history would be the things that would keep a mortgage from being approved.

However, I have been keeping an eye on some properties that are median priced and sellers had reduced their prices beginning in August.

I’m glad to see the minimum qualifying income is lower than the median household income. And it’s nice to see the median household income has risen. When I did a refinance earlier this year the underwriting process was still very lengthy with a lot of documentation required. Although it’s an uncertain time in the economy, the drop in rates has made home buying more affordable.

Income tax is a killer, and debt forces you to earn more and pay a higher income tax rate. In an extreme case, you could be paying the gov’t 37% on that 0% credit card. Something I realized the other day is that, without my mortgage payment, I wouldn’t have to earn and be taxed on the top $20k of my income. My family and I could live quite happily on $2k/month income. If FIRE is your goal, all debt has to go.

The data makes San Francisco seem like a terribly overpriced place to live. The median income is only $96K in San Francisco vs $68K for the US as a whole. But the median US house is only $286K while you say it’s $1.6 million in SF. Five times the housing costs but only 40% more income. I don’t see how that kind of ratio can continue indefinitely. With remote work growing in acceptance I could see a huge housing collapse coming as people flee the city to have more affordable lives. I think the same could happen to New York, Vancouver and other pricey places. The difference in median pay doesn’t begin to cover the extra costs.

It’s more of an equality issue, since most rent in SF, but most own in America. The median income for the median homebuyer is much, much higher than $96K. Closer to $300,000 – $500,000 for this late 20s, early 30-year-olds. Further, there is more than one generation of income that often is coming to assist e.g. Bank of Mom and Dad. If you think the ratio is out of wack in SF, it’s even more in Vancouver.

I bet you can’t name two major companies in Vancouver who pay the wages many of these big tech companies do in SF. $150,000 total comp packages for 22-year old college graduates. Think how much they’ll earn when they want to form a family. For example, one of my tenants pays $4,200/month in rent but earns $300K.

There is much more money out there than we know and realize, partly thanks to generational wealth. Here’s a home that just sold for $455,000 over asking in SF. A regular old house.

It is ironic though that the more people who leave SF, the more I want to stay and the more I would pay for real estate. Therefore, it’s a win-win. But Im always an optimist, which is a blind spot.

Remind me where you live? We can compare!

Related: A Big Opportunity In Big City Living

Sam, what you mentioned for sure exist, but these examples are outliers not the rule.

No matter how well the deep pocketed Google or Facebook pay their employees or the mass generational wealth transfer, the number of people they employ and the people who inherent substantial wealth to make a difference is a drop in the bucket compared to the total population with healthy income needed to support the cost of living in cities like SF for everyone.

The balance of the system needs to be restored, somehow. My prediction is, it is going to get ugly for the big cities, either in a volatile steep drop way or slow downward spiral until things reach a better equilibrium.

Sure, only time will tell. Where do you live and own and how is that market going?

I live in a state where the economy is currently a healthy blend of traditional and new industries, with good representations of both small businesses and large corporations. So I am somewhat happy with where things are for people and obviously there is always room for improvements. The local market is faring ok and trending upward in my opinion.

Cool. What city and state? No need to be mysterious about it. You’re safe.

Hi Steve, I’m 32 and a product manager at Google. I will pull in between $600,000-$700,000 this year, depending on stock price. My wife makes $200,000, and we are going to buy a $2.5 million house as we have kids.

We wouldn’t have been able to make this money if we weren’t in SF

Hi Joe,

Good for you. You exactly prove my point. While you and your wife combined make close 1 mil/yr, you also only need 1 roof over your family’s heads. You aren’t out spending like 10 families each make 100k/yr as you can only consume so much. The number of peole making income like you and your wife will not be able sustain SF in its current state of operation.

J, I literally have thousands of colleagues who make multiple six figures a year at Google.

Then I have friends who work at Apple, Facebook, and other companies making multiple six figures as well.

It is a very common individual income. We’re also investing in stocks and out of real estate as well.

Don’t forget the tens of thousands of people with big windfalls from IPOs over the past and next 3 years.

Heck, I even got a random windfall after a private company investment got bought. I hadn’t consulted there for 5 years.

Well, thousands of high earners cannot support millions of middle class. There are close to 40 million people in California. Other people with lower paying jobs need to live too.

J., I kind of see the point you are trying to make, but you also need to acknowledge the chart that FS is point out… The trend is up. Sure, there are mega millionaires tipping the scale, but even near the bottom life is trending up.

Also, note the focus was on home purchase. Plenty of opportunity to rent (for a place to live) if they can’t afford the purchase.

Last, with multiple comments, you have yet to reveal the secret state and city in which you reside. Where is this utopia? The rest of the readers want to know.

The kind of places similar to where I reside is littered all over US. I think the dramatic uptick in California license plates everywhere (ie. many small cities/towns doing similarly well across the country) I go proves my point. And no, I think these towns don’t need more influx of people driving up their affordability.

It’s more appropriate to compare San Francisco to other major hub cities in the world, rather than the average town in the States. Consider Hong Kong, which is a major financial and international business hub, with limited land like SF. A 450 sq ft studio goes for $1.5 million US there.

If you use that benchmark as a ceiling, then San Francisco has a long ways to go, and I believe we’ll continue to be THE international tech hub for decades to come (even as certain roles go remote with new WFH plans). Consider also that in HK, they build skyscrapers that people live in. In SF, there are 5-6 story caps on how high developers can build in most neighborhoods. That restricts supply. Prices go up, as long as people still find SF a desirable place to live (and I, like Sam, feel bullish on SF life coming back quickly).

Background: I live in SF now, but previously in smaller cities and towns throughout the South and East Coast (Lexington, KY; Jacksonville, FL; Cherry Hill, NJ; San Antonio, TX). I’ve seen more America than the average American.

Without a doubt, if I didn’t have family in SF, I may not have moved here. It’s so expensive, but the tech income I get covers the $2.3 million family home I just bought in Bernal Heights.