Are you about to payoff your mortgage? Congratulations! There are some important mortgage payoff fees, documents, and procedures to know. Unfortunately, you don't just send your final payment and that's it. You’ve got to go through some hoops.

In 2015, I finally paid off the mortgage of the very first property I bought in 2003. It felt wonderful for about a year. Then life went on as usual. Even though the stock market and real estate market has ripped higher since, I don't regret paying off my mortgage. It feels great to have less debt or no debt.

Here's some more background about my condo and the mortgage payoff fees and procedures. You'd think once you sent your final payment you'd be done with everything. But like many things in life, paying off a mortgage isn't that simple. There were some surprises.

Finally Paying Off My Mortgage

“Work a lifetime to pay off a house. You finally own it, and there's nobody to live in it.” – Death Of A Salesman

After twelve years of methodically refinancing my property whenever rates dipped, and consistently paying down principal every month, I finally own my two bedroom condo in Pacific Heights, San Francisco free and clear!

The condo originally cost $580,000, which I thought was relatively good value for a 2/2 with parking and a park view in 2003. I had relocated from Manhattan two years earlier where all park view condos cost a bloody fortune. Go watch Millionaire Dollar Listing New York to see for yourself. My condo is nothing fancy, but it has everything one needs to live a comfortable life in my favorite city in America.

According to Zillow, USAA, and a one bedroom sale in the same building last month, the value of the condo could be worth double its purchase price with a little bit of updating. Whatever the real value is, I don't plan on ever selling because it is an income generating engine. Real estate is “forced savings” at its finest.

The Mortgage Payoff Process

Whenever I was feeling liquid, I'd mosey down to the local Citibank branch to pay down some extra principal – $500 here, $10,000 there, it adds up. When paying down a mortgage off cycle, it's important to instruct the teller to pay down “principal only,” otherwise, they may use your money to pay down your upcoming principal and interest payment.

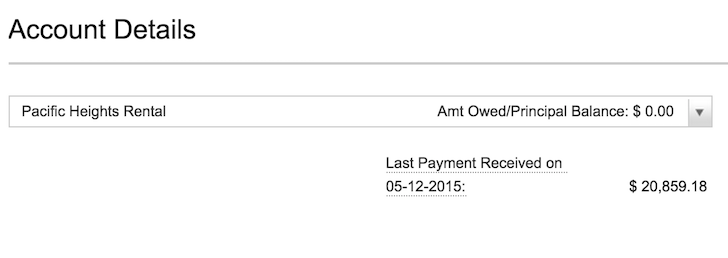

With $20,742 left in principal left after aggressively paying down the mortgage over the past six months, I decided to just pay the rest of the balance off at my local branch. When I got there, they said paying off my mortgage with them would not be possible. Instead, here's what I had to do.

Mortgage Payoff Procedures To Follow

1) Call the mortgage department and request an official principal payoff letter. The principal payoff letter will calculate exactly how much in principal and interest you owe. Any overage payments will be refunded at a later date.

2) Once you receive the principal payoff letter, write the check for the exact amount and in the memo, write: “Payoff” and the mortgage account number. Send in the letter and follow up a week later.

3) Cancel any automatic payments in the meantime. The principal payoff letter will have an exact amount to account for everything. Remember, a mortgage is paid in arrears i.e. the mortgage payment for June is paid on July 1 etc.

4) Get the paper Deed in the mail. If you don't get it within a month after paying off the mortgage in full, definitely call to see what's going on.

5) Confirm that the liens are removed with the title company and the bank. You can do so by requesting a “Reconveyance Letter” from the mortgage holder. You must request it; the mortgage holder doesn’t send it automatically. It will confirm that there are no liens existing, and that the title has been “reconveyed” to you, the owner. This letter will save time and money when going through future credit/title searches, as it shows the lender/buyer owns it with no complications.

6) Notify your insurance company and local county tax office to change the bills directly to you if you've been paying for both through your mortgage company.

Mortgage Payoff Fees To Know About

Given this is the first time I've ever fully paid off a mortgage, I was surprised to see so many extra fees beyond my principal and interest owed. Take a look at my payoff amount calculation in my mortgage payoff letter. Notice all the mortgage payoff fees.

Although my principal balance was $20,742.07, Citibank charged me interest through 5/16/15 because 5/16/15 is the grace period I get to pay my April mortgage until a late charge is due. Given I'm sending my final mortgage payment amount in before 5/16/15, I should get some interest credit back.

Here are the definitions of the various mortgage payoff fees.

Recording Fee: The fee charged by a government agency for registering or recording a real estate purchase or sale, so that it becomes a matter of public record. Recording fees are generally charged by the county, since it maintains records of all property purchases and sales. This fee varies from county to county.

Reconveyance Fee: This fee is charged by title companies or attorneys in some states and covers the cost of removing your current lender’s lien from your property title when you refinance. For comparison purposes, a reconveyance fee is considered to be a third party fee and may be included in the title insurance fee by some lenders.

Payoff Statement Fee: What the hell is this? Seems like just another pesky fee banks are sneaking in to try and make money off their customers. I'm sure the banks are figuring what's the big deal making an extra $30 if the entire mortgage is getting paid off. Here's our chance to make more money off our excited customers!

Once you've sent your final check in the mail or via wire (there's another fee!), all you can do is sit back and wait for the bank to notify you that your mortgage has been paid in full.

It's more than likely you'll get a little money back from the extra interest you paid. The payoff statement will always have you paying a bit more to ensure a complete payoff.

The bank should also send you a reconveyance letter, which says the title name has been changed from the bank to you.

You Won't Regret Paying Off Your Mortgage

Yes, you could make more money investing instead of paying off the mortgage. But there is this priceless feeling about paying off your mortgage that feels great. By the time you retire or no longer can or want to work, you should pay off all your mortgages.

I paid off another mortgage in 2022, and I realized there is a triple benefit to paying off a mortgage I didn't full appreciate. The bear market makes having less debt so much more valuable.

My original goal was to pay off the remaining ~$91,000 mortgage balance by the end of the year. However when you can see the finish line, all you want to do is run as fast as you can and pay the darn thing off.

It feels great to no longer have a mortgage on a property bought when I just turned 26 in 2003. In early 2014, the mortgage was actually around $250,000, but I decided to conduct mortgage arbitrage.

I borrowed ~$150,000 more for my new home purchased in June 2014 at a 2.5% rate to get as close to $1,000,000 in mortgage debt as possible. I then utilized the $150,000 in cash that would have gone towards a bigger downpayment to pay down my then $250,000 mortgage at 3.375% condo loan instead.

Higher Return Elsewhere?

A lot of people recommend never paying off your mortgage, especially your primary mortgage. The idea is that you can make more money investing in the stock market or other investments.

Until I took out a 4th mortgage, I generally have agreed with this principal. However, four mortgages felt like one too many. Every year I want to make one big financial move.

With valuations in the stock market and private equity market feeling stretched at the time, paying off debt felt right.

Paying Off $100,000 In Mortgage Debt In A Year

Let me share how I paid off $100,000 in mortgage debt in one year.

1) Wrote Out My Goals

Wrote a post on September 8, 2014 entitled, Why I'm Paying Down My Mortgage Early And Why You Should Too. By putting my goal out there for the public to see, I was galvanized to succeed. Failing in public is embarrassing, so I try my best not to.

Many of the posts I write on Financial Samurai are written in order to provide motivation because I have a tendency to relax. Make your financial goals public to improve your chances of success!

2) Decided to work harder.

During Christmas week of 2014, I spent time looking for another consulting client and found one for January. From December 2014 – April 2015, I billed 61 hours a week between three clients compared to billing 25-41 hours a week from November 2013 – December 2014 between two clients.

I knew I could work 60+ hours a week because that's what I did for 13 years in my finance career. For three months, I felt very rich for my age because there was also business and passive income flowing in. There's no substitute for hard work.

3) Used 100% of all consulting income to pay down the mortgage.

Every time I deposited a consulting pay check, I immediately asked the teller to transfer the same deposit amount to pay off principal. It felt fantastic having a focused purpose for the consulting income. My primary goal for consulting was to develop my online marketing acumen and experience the startup world so I could write about it.

Money was a bonus, but during that three month period, money became a great motivator to keep on working. In fact, I told myself that I wouldn't stop consulting this year until I paid off my mortgage!

4) Used 100% of my surprise deferred equity compensation towards principal.

Although tempted to use the $11,381 to go on a bender with friends to Vegas, I decided to be responsible. Put surprise windfalls to good use. Your future self will thank you.

5) Used 100% of all operating profits (rent – operating expenses) from the rental property to pay down its own mortgage.

Viewing each rental property as its own business unit helps optimize profitability. Co-mingling funds blurs operational efficiency by making owners overestimate returns.

Now that the mortgage is paid off, I plan on aggressively raising cash for the rest of the year. Perhaps if the economy continues to improve, I'll then focus on slaying my vacation property mortgage next!

Mortgage payoff fees are sadly party of paying off your mortgage. But now that you know what the mortgage payoff fees are, you won't be surprised when you finally do.

There is just one downside to paying off your mortgage though. And that is you might lose some motivation to grind hard and build more wealth. Because once your living expenses are paid for, life is pretty easy! And when life is easier, you simply don't try as hard.

Wealth Building Recommendations

1) Shop around for the latest mortgage rate. Check the latest mortgage rates online. You'll get real quotes from pre-vetted, qualified lenders in under three minutes. The more free mortgage rate quotes you can get, the better.

2) Invest in heartland real estate. Take a look at Fundrise, one of the largest real estate crowdsourcing companies today. You don't need a big down payment or need to deal with tenants with Fundrise. You also free up a lot more liquidity.

Real estate is a key component of a diversified portfolio. Fundrise invests mainly in single-family and multi-family rentals in the Sunbelt, where valuations are cheaper and yields are much higher.

I personally have invested $810,000 in the heartland of America. Sign up and take a look at all the eREITs Fundrise has to offer. It's free to look.

Mortgage Payoff Procedures To Know is a Financial Samurai original post. With negative real mortgage rates, you shouldn’t be in a rush to pay off your mortgage. High inflation is making your mortgage cheaper.

We found when paying off a mortgage that there was no provision in our loan agreements for the bank to charge us recording or re-conveyance letter fees. So, the bank just tried to inflate the final, payoff interest amount to include those fees, while concealing it under the heading “interest”. It was obvious because the amount of “interest” they wanted to charge for the partial payoff month was significantly greater than the interest the bank charged for the last full month. We just sent them a check for the remaining principal and enough to cover the interest for the partial payoff month. After a little grousing, the bank accepted it and took care of the re-conveyance recording, etc, without any additional charges.

Sam’s comments applies to all types of real estate. Currently trying to get rid of a timeshare and fortunately, I saved the last few statements but did not get a release letter. Getting around the issue but closing got delayed until I could convince everyone it was free and clear. What a pain. Follow the procedures and you will potentially save yourself a lot of grief.

oh wow. I wouldn’t have had any idea about so many things on your list. Congrats on paying off that mortgage, impressive! I’m trying to pay down extra principle each month on my primary residence, but I still have a long ways to go. Will come back to this post when I get close to a zero balance!

I have suffered a total loss on my doublewide mobile home in Hurricane Michael. The insurance issued the total amount of coverage available. I was told by someone that if it’s a total loss, the insurance has to pay off the balance, like a vehicle that’s been totaled is replaced by the insurance. I can’t find anything online that states this. There are no loss of use or replacement clauses in the policy. I was a first time homebuyer and just stayed with the insurance that was with the land home package. No one explained anything different to me. I am now 29,000 in the hole, with a damaged, but intact home. I feel like I have to move to make the money to pay off the balance and get a home built. What is your suggestion?

I know this thread is old, but does anyone know what a Loan Tie-In Fee is for??? Closing on a home soon and haven’t been able to get a clear answer from anyone. Thanks!

Do banks ever forgo or write off the early layoff fee.

We are getting a new Home equity loan with our credit union and paying off the one at the bank early. There is an early payoff fee, I HATE TO PAY. A silly payment I think for giving them their money back early after paying two years of interest to them….?

Hi, Sam. I envy you and others with whom you correspond, having achieved such remarkable success so early in life. I am not in yours nor in anyone else’s league who post in your comments–my loss or lack of acumen. I am turning 67 this year, a single mom of two adopted developmentally delayed girls both living at home. 2 mortgages (1 HELOC). Still working same position (plus 1 pt job that produces just a little more income, very small). Must work until I am 70, a teacher. I adopted the girls late in life. Debt to income ratio is up there so there is little room for pay down of anything as all resources are being used. Payoff on HELOC, if payments continue as is, will happen when I turn 87. If things remain as is (which they won’t, since I have a 30 yr arm, my 1st mortgage payoff will happen when I am 85 (1st mortgage was sold 3 times; 2nd mortgage sold twice; both total around $287). I want the girls to stay in their home, free and clear. I owe them that. Very worried. HELOC was used to bring one of the girls home after numerous failed attempts (and $$$ loss). Benefit cost will increase a lot post retirement and term life will continue at only $25K regardless of current payoff amount, per school system. Trying to calculate how little I can live on with SS and retirement to cover medical for the girls and continue insurance. The girls may be able to work if given proper training but won’t return enough income to pay a mortgage. One girl is now 21; the other is 15. Neither were adopted as infants but rather much later in life. Regrettably, I am not financially savvy but my girls have never wanted for anything of substance. I made sure of that. The first half of my life was spent on my school kids, now it’s my own children who need me. I need a good financial adviser near zip 20707. Can you recommend? County benefits office referred me to an outside source for a starting place to look.

Hi Dee,

Awesome you adopted your girls! Was it an easy or hard process to get through?

I don’t know anybody in your zip, but I do offer personal finance consulting for the past several years if you want to click the link.

Thanks

It has been the most difficult thing I have ever done. You have visited many countries so you know the conditions in Russia and Ukraine, however, I would not change a thing. I can survive being broke as long as i have love.

Great attitude!

Just wanted to say thanks for sharing this info. I’m planning to pay my mortgage off in a couple of months. I had heard that there were some extra fees that would be due at payoff time, but it was hard to find any specifics on how much they would be. I could ask my lender, but of course they charge me a fee to tell me the payoff amount, so I only want to ask that question once.

No problem!Glad this article helped. Congrats on paying off your mortgage!

[…] The second action was finally paying off my condo rental property mortgage (Rental Property 2). The monthly PMI mortgage was $1,308, $200 of which was principal. I also […]

Congratulations on paying off the home loan! It sucks about the extra fees, but I agree that people excited to pay off their loan probably just want to get it done.

Just curious – do you always send mortgage payments as cheques? If so, why not send it electronically?

Hi Ben, I tried to just do a bank transfer/account transfer, and they wouldn’t let me. I need the exact mortgage payoff letter to then send a check. I could do a wire after getting the letter, but that would mean more fees.

Hi Sam – Congrats on the payoff, I know the feeling! Although my story is a little different. I purchased my first condo in India when I was 27 (I live in the US), paid off the mortgage 9 years later last year. Most people that I know in India purchase homes with the intention of either occupying it themselves or with capital appreciation in mind. Among my friends, rarely has anyone bought a home with rental income in mind. The main reasons being the high interest rate environment (high inflation) of ~10% for 20-yr adjustable rate mortgages; And rental income is usually a fraction of your mortgage payment, a third or even a fourth. Most of my friends do end up renting their homes, but condo fees, maintenance, repairs, and property taxes mostly eat up the rental income. But the bright spot is capital appreciation – my condo is 3x my purchase price in 10 years. And the 2nd condo I purchased 3 years ago in a suburb of Mumbai – and on track to payoff latest by 2018 – is 1.5x, both handily beating the high rate of inflation. Having one less piece of debt frees up my cash for investing in other areas. And I have found the disciplined approach to paying down balances to be very satisfying!

Congrats! With the India market up massive last year, Indian real estate must also be on fire! Will you ever return you think for good?

I enjoyed my time at Colaba (sp) area in Mumbai.

I think we would. But as you grow older, more variables get into that decision, and what you once thought was a simple “pack up n go” becomes a lot more complicated :) .. But going back is never off the table for my family, we keep that option open.

Yes, Colaba is nice, history+modern n all!

Hey Sam – great post. I love these ones giving a nice chart which at least shows a solid figure of where we can aim for at our respective ages. I’m from Australia but the numbers have a lot of relevance.

One thing I’ve struggled with in the past is financial goal setting. I’ve tried to set goals and at times they read really specific but I just don’t seem to stick to them. Have you thought about doing a post on that process?

I guess I’m curious to see how people such as yourself complete the whole process. Do you set the goals and review monthly? Do you include a plan for how to get there? Is it something you spend a lot of time doing?

Howdy mate,

These posts should give you various barometers for income and wealth goals, depending on what you want to choose. Stretch goals are good, b/c they’ll allow us to go farther than if we had easily attainable goals.

Median Income By Age

Average Net Worth For The Above Average Person

Average Net Worth For The Upper Middle Class

The Top 1% Net Worth Amounts By Age

I set ANNUAL goals. Monthly financial goals are too cumbersome. I do track my net worth online once a month as well.

I find writing posts a great way to keep track of things.

Well played FS. We’re up to four houses, 3 rentals and 1 primary. Always enjoy when you wax on Real Estate. Our plan is to sell the primary and two rentals over the next three years, pay off one of the rentals, move into it in AK, and eventually buy land and build a retirement home. As always, enjoy following your adventure to 200K passive income. Looking forward to my own retirement in 1.5 to 3.5 yrs.

Sounds like a plan Chris! Let’s hope the property market stays buoyant long enough for us to cash in. Although, I really plan to never sell unless it becomes a huge PIMA or my online business doubles.

A passive income post will be published by July!

“Reinvest” that $63 in a nice bottle of bubbly to celebrate! Congrats!

Will do! Cheers

This is a timely post for my personal finances, especially when you layer in two other recent FS posts (FS-DAIR and adding square feet to your home). I’d love any feedback from Sam and the community on my situation.

Context

Net worth 625k

35 yrs old, married, 2 kids (may have a third)

Gross income 265k, will prob rise 4%/yr with bigger raises every few yrs for promotions

House valued about 750k

560k mortgage at 2.875, 65k mortgage at 4.625

Annual savings – 36k 401ks, 11k Roth, 4k 529s, 15k company match, 20k debt paid down/yr (with minimum payments)

11k in student loans ($200/Mon)

Have about $2k monthly cushion in our budget and $45k in cash – trying to decide whether to do addition on house, pay down debt, save more for college, save more in taxable account

My goals:

– expand home by at least 400 sf and add screen porch

– hit $1m net worth in next 3 yrs

– be in a position to semi-retire in 15 yrs (work part time, start a business, etc)

– save enough for in state college for kids (estimating 250k per kid)

This article is so timely because I literally had my go to contractor over yesterday to run estimates on three significant projects:

1) 500 sf addition plus master bath reno and new screen porch – 70k

2) finish 1200 sf basement – 50k

3) landscaping including new driveway – 20k

Before he came, I was planning on paying off student loans and tackling our second mortgage. But now I’m excited about these projects. I think the addition would raise our house value to 875-900k, and adding the basement would make it at least 1m. My neighborhood is hot!

Hmmm…maybe I should tackle all three (saving over next year and borrowing from 401k or HELOC). Or just pay down debt and wait as long as possible on additions. Or mix the investments – some towards home, some to debt, some to increased 529, some to taxable account.

Right now, my instinct is to tackle the addition over next year, because we will get a lot of satisfaction out of the additional sf and porch. Then move to using the FS-DAIR rule for our monthly cushion.

I’d love any other perspectives on this!

Curious how you plan to spend $140,000 with currently $45,000 in cash on hand and $2K monthly cash accumulation? Maybe do it over 3 years?

I like this option: 1) 500 sf addition plus master bath reno and new screen porch – 70k

But, where do you get the missing $20-$25K and sleep well at night with the buffer?

Right now, every is rosy. But things might go south at some point with the next 3 years. We never know.

Doing the renos NOW at age 35 is better than later with the 3rd kid and when you’re older and starting to get tired of all this stuff.

What city are you in?

ca,

It sounds like you are in great financial shape. I’m no CFP or RIA, but this is what I would do:

1. I wouldn’t worry about the debts – they are pretty low interest and give you a tax deduction, which makes them even cheaper.

2. Put on the addition so you and your family can enjoy.

3. Since it looks like you are already maxing out all retirement accounts, I would dump more money in taxables to give you more flexibility when you semi-retire (you won’t be able to draw from IRAs and 401(k)s until 65ish without penalties).

4. Since you have young kids, I would also pour more into 529s to give it time to grow, making the tax savings greater when you take it out.

5. Get a second opinion from a fee-based professional

6. Visit my blog! :)

Good Luck!

Congratulations on your determination to pay off your morgage. I am a little confused, you indicated you are 26 and with 13 years experience in financing. You must be a prodigy child. Even though you need to be at leat 18 to sign contracts. Just wondering.

Hi John, I bought the property a couple days after I turned 26. I’m 38 this year, and started investing online w/ Charles Schwab when I was around 18. Sorry for the confusion.

I wrote,

“The condo originally cost $580,000, which I thought was relatively good value for a 2/2 with parking and a park view in 2003.”

To help clarify:

I’ve added in “IN 2003” again to this line “It feels great to no longer have a mortgage on a property bought when I just turned 26 in 2003.”

Hope this addition, this comment, and a reminder in the later part of the post can help avoid further confusion.

He isn’t 26. He was 26 when he bought the home.

You got off lightly. In south Africa you’re not allowed to closer a mortgage account on your own, you need a attorney to do that for you. For the privilege I spent around $350 on a loan of only $50k. Try explain that one to me!

Sam,

Congrats!

We paid off our mortgage in 2002 and we recall the following.

Your lender should send you a mortgage satisfaction letter. Put it in a safe place. They should also publicly record in your county land records clearing the lien. In our state, we are able to verify online that our mortgage was satified for our property.

If your mortgage includes the home insurance then you need to notify your insurance company that you paid off the mortgage and to send the bill to you.

If your your mortgage includes the real estate tax then you need to call your local county tax authority to send the tax bill to you.

Thanks AJ. That’s a long time ago! Nice work. What did you end up doing with all the extra cash flow?

I’m sitting tight, and should get everything by the time I return from my trip in mid-June. If not, I’ll give em a ring.

I’ve added your suggestions to the post. Cheers

Sam,

First, I want to thank you for your site. Via RB40’s site, we found a link to your site. I have been a reader for about a year and I find your posts extremely informative. We are blown away by your many sources and amount of passive income to make you FI. I shared your site with friends and co-workers.

“What did you end up doing with all the extra cash flow?”

After the mortgage was paid in 2002, my wife reminded me that we went on a spending spree for two years. We were young and stupid. Did some local traveling, wife brought clothes, toys for me and dust collectors for the house. We started to track our NW and noticed that we spent a lot of money so we buckled down again. Since we are financially conservative, our savings were only in CDs. It was nice when they were around 4-5%. We do not invest in the stock market. We never traded in our starter home for a bigger house. Our 401Ks are in fixed dollar usually around 5%. Since, I don’t want to deal with tenants, we did not buy a rental property. We want to keep it simple. Simplify your life was what we try to live by.

In 2009, we went to Hawaii and it was a life changing experience. We were happy in Oahu. We realized that we were happy with just the clothes on our backs. Our pipe dream was to retire in Hawaii. Renting a place in Hawaii will be good enough provided if we can afford it.

When we returned home, we created another spreadsheet to track all expenses. We cut all not crucial expenses. We basically stopped consuming saving 14K-16K. We started to buy 5% muni bonds and two years ago we reached FI. The tax free passive income covers all expenses and future medical insurance of 20K should we become unemployed. Including our passive income, our saving rate is 86%. We have 6 years of living expenses in regular savings and will be 8 times if we make it to Dec. We are fortunate to have combined pensions of 68K at 55 should we both get eliminated this year. Our company is outsourcing so we are waiting to get elminated.

Also, thanks to your recent NW post which allow us to see how we are doing.

I find this site entertaining and have read every post. This is my first time commenting in a while because the idea of owning a home “Free and clear” is a bit of a pet peeve of mine.

You don’t own your home “free & clear” because if you stop paying your property taxes, you will lose your home. In a perfect world, we would all own our homes “free & clear.” But this is not possible. Unless you have an allodial title to your property (which is practically nonexistent in the US), you don’t really own your home, even if you don’t have a mortgage since you have to pay property taxes. Semantics & legal verbiage aside, do you truly own something if another entity will take that something away from you unless you pay an annual tax?

I believe the concept of mortgage freedom does not exist and is a false sense of security and ownership. I know this is an unconventional way to think about home ownership which is why I felt compelled to comment on here for the first time in a while. I’d be curious what other people think.

To me, ownership is something that you own outright, and you are indebted to nobody in order to maintain ownership of that something. So when you have a home, you are indebted. Call it a mortgage payment, call it taxes, but you owe money and if you don’t pay you lose your property. I don’t consider that ownership but maybe I’m missing something. People have said to me, “Well, what about your car? You need to pay insurance, and have it registered, and in some states emission inspections.” But the difference between a car & a house is that a car can sit inert in your driveway, unregistered and without insurance. Sure, it can’t legally be driven but you still own it, could sell it, get it registered, inspected, etc. Most importantly, it won’t be confiscated. The same cannot be said for a home. So it’s not just semantics. This is a key difference.

Other “well-followed” personal finance bloggers have said to me “That’s like saying, “You can never really own your home because you still have to buy food. If you stop buying food, you’ll die and dead people lose all their property. So really, in the face of the fact that humans require nutritional sustenance, home ownership is an illusion.”” (Yes, a well-respected blogger actually wrote that!) Of course the educated and above average net worth readers of this blog I’m sure know that dead people (at least in the US) do not lose their property when they die! If they did, I (and many others) would be out of business. Very wealthy people whose wealth will outlive them spend a lot of time and a lot of money planning with lawyers, accountants, and financial advisors to figure out where they want their property to go when they die. So if you own something, you own it even if you stop buying food and die because it is part of your estate. So I’m going to stick to my guns and say you don’t really own your home. If you were to pass and leave your child a t-shirt, that t-shirt is your childs’. If you were to leave your child your house, the house is your child’s so long as he “rents” it from the city/state (i.e. property taxes).

If you think you own your home because, hey, it’s all semantics anyways, and we don’t really own anything because you could stop eating or not get a driver’s license…then fine. Just my 2 cents.

I enjoy reading your perspective! Do you mind sharing what other pet peeves you have? My pet peeve is someone being late, as that affects me. If a pet peeve of yours is me paying off my mortgage, them I’ve very excited to know what else bothers you!

Can you provide some back ground on yourself e.g. renter, owner, age, occupation, etc?

Everything in this world is impermanent. I like to listen to the 4 Noble Truths and 8 Fold Path.

You paying off your mortgage doesn’t bother me, just the term “free and clear” as I believe that is an inaccurate term.

I am fortunate enough to neither rent nor own and I will soon be 30 years old. As for occupation, I help oversee the investment affairs for a small group of families.

As for other pet peeves, people looking at their phones during a meal or meeting. And people who aren’t good listeners or interrupt others that are talking. Also, people who are incapable of ever being wrong. I’ll let you know if I think of some more. Glad to know you are interested!

Joe, I think you’re missing the point of the article by nit picking definitions of words.

Joe, can you elaborate on how you neither rent nor own? Who pays for your living situation?

Congrats on paying off your mortgage! Its certainly something I’ve never done (mostly because I am just 26). I’m definitely in the “keep your mortgage” camp. I have a 30 year loan at 4% that I’m in no rush to pay off, though I definitely can understand the emotional relief by seeing that balance drop to 0. I keep telling myself just what you described – that I’m earning more than the cost of my loan in investments and elsewhere, while maintaining liquidity. Does it not bother you that you have $250,000 locked up in a 3.4% rate? That’s like having an annuity that is barely beating inflation.

It doesn’t bother me at all. I’m very happy to have paid off this property. If all I had was this property and $250,000, I wouldn’t pay it off until maybe 15 years from now. But the property is one of several, and real estate is under 40% of my net worth, and more like 20%, depending on how I value my online business.

Inflation is at about 1.5%-1.8%. Paying off 3.4% debt is one thing. The property is still an asset that can appreciate in a bull market.

What percentage does your property account for your net worth and what is your net worth now?

I see your point. It sounds like you’re playing more conservative with this property whereas you can be more aggressive elsewhere with other investments. I only have one property, and its a big part of my net worth, so I would much rather pay the 4% interest in exchange for long term investing at 8 or 9%.

I can’t help but think that you could now leverage that property into others.

It’s the never ending cycle of more, more, more. I found my enough about 5 years ago, yet I bought another place last year, and have kept on building my online business. I need to stop, so now I’m in cash accumulation and debt payoff mode.

Fair enough. I have some friends in their late forties that are completely illiquid because they buy every property they can find. They had to ask a tenant that they knew was good for it to pay up front so they could cover the last 5k on their most recent down payment. Seems a little extreme.

Wow! Aggressive.

What happens to them during a downturn or if they lose their jobs for an extended period of time?

Same thing that happened to them (or a different set of them) in 2007-2010. They lose their properties, cash, (what cash?), and credit. Happens every cycle, though admittedly, more last time around.

I don’t know, I know they’ve had to borrow money from family for rehabs. She just quit her job and he’s thinking about leaving his company (in which he’s part owner) to start up something else. It makes me nervous just to think about. They have no fear. Of course, she has a doctorate and he’s an MBA ex-F18 pilot, so I guess they’ll always have opportunities. When he started his current company he told his wife if it didn’t work he’d mow lawns. Two years later he sold 60% to PE.

If your balance is 20.7k, why not just send them 20.5k for second to last payment? The last bill will come to ~$200 which you just pay regularly and avoid $30 payoff statement and wire fees (Yes, the interest on carrying $200 for extra month is only 66cents).

Because it doesn’t work that way. And if I pay $20.5K, then I’ve got to wait another month to pay it off. Why make things more complicated?

Is this how you paid off your mortgage? I don’t understand the benefit of paying the mortgage several hundred short. Please explain. Thx

To avoid $30 payoff statement fee, which is triggered when you are requesting a payoff amount. If you force your last payment to be less than your monthly payment, then the last due amount is de-facto payoff amount. You just got it w/o officially requesting it. Sure, you have to wait extra month, but so what -> You do save $30. (at the expense of $0.66 of interest charged on remaining $200).

Other fees you cannot avoid.

Also, what do you mean “It does not work that way”? What particular part of my proposal does not work?

Have you done this from experience? I’ve asked them.

Yes, we have done it. By paying almost everything, you effectively move to last month of your loan. Your last bill is de-facto payoff amount. It worked for us. Only $30 in the grand theme of things, but why not..

Got it. I’ll let Citibank know, even though they said the fee is always going to be the fee. And congrats for paying off your mortgage!

FYI I just did this on my Loan at Mr Cooper, Payed off everything but $150 via their online payment system. They Still charged me the $30 Payoff Statement Fee! When I called I was told it was automatic. They closed out the loan and used my escrow to finish paying the remaining balance. I feel cheated because I never agreed to this fee nor did I even request a payoff.

Well did not work for you. In grand theme of things 30bucks is a nothing. Just pretend you spent it on a couple of beers at the bar

Hi,

I listened to a personal finance audiobook recently. The author warned about not paying off mortgages early. He said many wealthy people keep their mortgage, only pay the regular amount due, and invest all excess income CONSISTENTLY in mutual funds, ETFs, etc. His logic was that paying it off early is almost like a sunk cost and the dollars are burning into the walls of your home (or something like that, lol) doing nothing for your money.

What are your thoughts about this logic?

It’s a general thought process. Here’s what I wrote in my post,

“A lot of people recommend never paying off your mortgage, especially your primary mortgage, because you can make more money investing in the stock market or other investments. Until I took out a 4th mortgage last year, I generally have agreed with this principal. However, four mortgages felt like one too many. Every year I want to make one big financial move. With valuations in the stock market and private equity market feeling stretched, paying off debt felt right.

By paying off my mortgage, I’m locking in a guaranteed 3.375% return while improving my loan profile if I were to ever refinance my primary residence again. I got rejected from my latest mortgage refinance due to too much debt. Mortgage underwriters have funny math. By completely wiping out my $1,308/month mortgage payment, my cash flow in their eyes increases closer to $2,000/month.”

If I only had one or two mortgages, I’d probably just keep them on an unaccelerated schedule. But b/c i had 4, it felt like one too many, especially after my mortgage refi was done.

You just don’t want to be HOUSE RICH, CASH POOR. Although the condo is valued at about $1.1 million, it is a minority portion of my wealth b/c I have four other properties, private equity investments, public equity investments, and an online business.

I would say if the one property you are considering paying off is worth more than 50% of your net worth, DON’T pay it off.

See: Financial Samurai 2015 Passive Income Update

Congrats on the mortgage paid off.

Just a side note, if you do decide to open a line of credit, you need to refinance first before open a line of credit. They will make you close it before you can refinance! Banks … are funny that way.

Thanks.

Don’t understand about the HELOC. What is there to refinance first I’d there is no loan? You mean go through an underwriting process to determine the HELOC?

You had mentioned you want to refi on another property. If you going to refinance this property, then don’t open a line of credit (against the paid off house). The bank will make you close the line of credit even though you carry $0 balance. Another rediculous rule that doesn’t make much sense.

Got it. I definitely don’t plan to take a line of credit on my paid off condo after paying it off.

I’m putting this one in the books and plan to accumulate capital in other ways now.

Congrads! I have four mortgages and a paid off home so I can relate to you so much! I have a 10 year plan to get rid of the 4 mortgages. I wanted to go full speed ahead to pay them off but I am following your advice and creating multiple streams of passive income. My real estate income is nice but I am starting to invest in dividend paying stock too. My plan is to retire in 10 years or less with paid off rental properties and a nice dividend cash flow. I’ll be 41. My only regret is I didn’t find financial blogs earlier!

I’m sure if you focus on retiring in 10 years, you’ll be able to get very far. It’s really a balance on debt, equity, and cash flow. The balance ebbs and flows.

Just be careful not to go over the cliff with the amount of debt, just in case there’s another downturn. Good luck!