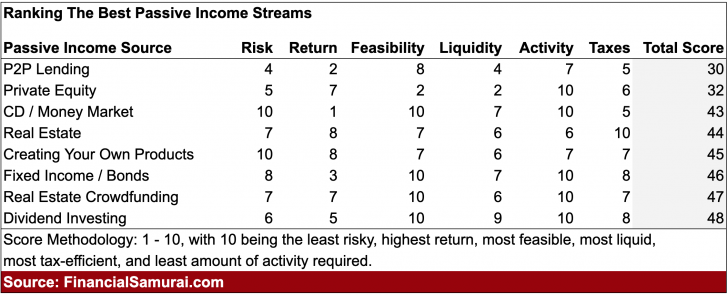

Are you asking yourself: should I invest in P2P lending? My short answer is no. I do not recommend investing in P2P lending because returns are lower, risk is higher, and I'm not sure platforms like Prosper will be around. P2P lending ranks last in my best investment rankings chart.

If you are still interested in P2P lending, here is a review I did years ago and how my investment performance went.

Should I Invest In P2P Lending?

At long last, Lending Club went public recently with an estimated $5 billion market cap. It's the first really big new generation fintech IPO, and boy is it going to make a lot of people a lot of money. To give you some perspective, at a $5 billion market cap, Lending Club is ~$1.3 billion larger than Yelp! I've been following both Lending Club and Prosper since their inception as their offices were right next to mine in downtown San Francisco.

In 2013, I finally decided to invest some money into P2P lending with Prosper to see what the fuss was all about. I had a friend working at Prosper at the time who helped teach me about the market place and the company over several lunches. I've written a post on tips for P2P borrowers from a lender's perspective, a post highlighting the P2P lending returns by borrower rating and credit score, and how P2P lending can even get a little addictive due to the ability to pick and choose who gets to borrow your money.

I was relatively gung ho about allocating several hundred thousand dollars to P2P lending, but I didn't because I still wanted to do more research given I expected rates to stay low and the stock market to outperform as a result. I also ended up buying another house, so I only invested several thousand in P2P lending as a result, and basically ignored the account for much of the year until now.

MY EXPERIENCE WITH PROSPER ALMOST TWO YEARS IN

Here’s a snapshot of my current performance:

A 7.43% overall return isn't too shabby for 2014 given the stock market has returned about ~9% over the same period. I'm a very conservative investor with P2P lending since it's only been about two years of actual investing. As a result, I pretty much invested in A and AA Prosper Rating borrowers along with several B Ratings to get some juice.

My P2P lending portfolio: Five AA notes up front, two A notes two months later, and then four more (2 AA, 1 A, 1 B) after six months. Most recently, I added an additional four notes (1 AA, 1 A, 2 B). You can see several of the loans have already been paid in full. Prosper and Lending Club recommend investing in more than 100 notes for diversification purposes, but I only have several thousand bucks currently invested in high rating notes. If I had $50,000+ invested, I'd definitely be much more diversified.

There are three guiding principles to my P2P lending philosophy. The first is that I don't lend to people who have a history of more than two delinquent payments. I understand everybody runs into hardships and needs money sometimes. But if you've got three delinquencies, you're out. There's clearly something wrong with your financial situation or your ability to honor a contract. The second lending philosophy is to not lend money to people who want to buy stupid stuff they don't need. You know, like a sail boat or a $50,000 wedding. Finally, I'm primarily only lending money to people who are using P2P to consolidate their loans.

Credit card debt is especially prevalent for P2P borrowers. And we all know credit card interest rates are at a usurious 12%-29% for the most part. If a P2P borrower is taking action to consolidate his or her credit card debt into a loan at under 12%, I'm all for helping this person as much as possible if s/he doesn't have a long history of delinquencies. I think it is absolutely absurd that credit card companies can get away with charging 10X the risk free rate. It feels good to help borrowers save money. The average credit card debt per household is around $15,000 per the Federal Reserve.

I’ll be depositing more cash into my account in about two weeks, and I will be diversifying into a broader range of notes. Currently I’m highly weighted in AA and A rated notes, so I want to add a few more B rated notes, and maybe a couple C rated notes for the first time. But I know that I'm going to be severely disappointed one day when a borrower decides to no longer pay.

TIPS FOR INVESTING WITH PROSPER

Any type of investing is a learning process, and I’m happy that I have a much better understanding of how P2P lending works now that I’ve actually done it for a couple years. Here are some tips from my experience investing with Prosper.

1) Check if you’re eligible first. Your eligibility to be an investor depends on your state of residence, and sometimes your income too. Not all states are created equal. Further details below.

2) Ease your way into it. If you’re a cautious, low risk investor like me, and aren’t sure if P2P lending is right for you, start off with AA and A rated notes to get comfortable with the process. You’ll still make great returns and can diversify into lower rated notes over time.

3) Don’t overlook your notification settings. I made the mistake of having too many email notification settings turned off, so I didn’t realize when notes I’d invested in expired or were paid off in full. So, I had cash just sitting in my account for months that I should have immediately redeployed.

4) Setup recurring transfers to fund your account. I didn’t realize until recently that Prosper has a feature that lets you automatically deposit funds into your account on a recurring basis. If you have the cash flow, automating is a great way to go.

5) Watch for and utilize monthly payments. Once you invest in notes that become fully funded and active, borrowers will start making scheduled payments every month that will be deposited into your account. You can then use that cash to invest in more notes or withdraw if needed.

ELIGIBILITY REQUIREMENTS TO INVEST WITH PROSPER

There are certain requirements you have to meet in order to be eligible to be a lender with Prosper.

- First, you need to be 18 years or older with a valid social security number. Institutional investors can also open accounts with a valid tax ID.

- Second, you need to have a checking or savings account.

- Third, you have to reside in an eligible state.

- And fourth, you may have to meet certain financial suitability requirements based on your state, indicated by asterisks in the table.

Prosper Borrowers however, are eligible to apply in every state except for Iowa, Maine, and North Dakota.

Financial Suitability Requirements

* Alaska, Idaho, Missouri, Nevada, New Hampshire, Virginia, Washington: Minimum AGI of $70,000 plus a minimum net worth of $70,000, OR minimum net worth of $250,000. Net worth excludes home, home furnishings, and automobiles. Lenders also can’t purchase Notes greater than 10% of their net worth.

** California: If you buy $2500 or less of Notes, your investment can’t exceed 10% of your net worth. If you go over $2500 in Notes, the previous applies plus a minimum gross income of $85,000 on your last tax return and for the current year, OR a minimum net worth of $200,000 and total investments can’t exceed 10%.

*** Maine: The Main Office of Securities recommends total investments do not exceed 10% of your liquid net worth (cash, cash equivalents, readily marketable securities)

Lenders and his/her spouse are considered to be a single person for these rules.

If you’re an individual, the minimum you can invest is $25, and the maximum aggregate investment (after meeting the above requirements) you can have is $5 million. There’s also a 1.0% annual loan servicing fee charged to all investors based on the outstanding principal balance of the borrower loan.

MY GOALS INVESTING IN PEER TO PEER LENDING

I plan on doubling my account size with my next deposit this month and consistently contributing to my account every month for the next year. I also plan to diversify my exposure into more B notes, and a few C notes for the first time in order to increase returns by 1% or 2%. No matter how much financial pundits cackle, I still don't believe interest rates will be going up any time soon. As a result, the demand for yield will remain and earning 7-8% a year with a practically set it and forget it P2P lending portfolio is a very attractive proposition.

Right now I only have 12 notes that are active (three were already paid off well in advance of the loan maturity date). I plan to increase the number of notes to 20 with my latest tranche of money, and eventually up to the 100+ note recommendation for maximum diversification. I've built up a very sizable structured notes portfolio since 2012 by being disciplined in contributing, and I plan to do the same thing with my P2P lending portfolio in 2016-2017. My bogie return is 2-3X the 10-year yield. That means 4.4%-6.5% based on the existing 10-year yield. P2P lending hits the sweet spot.

2H2018: Prosper sent a message to investors saying they overstated returns over the past several quarters. This is unacceptable because now investors can't fully trust Prosper. I'd invest with LendingClub instead. They've had their ups and downs, but at least they are a publicly listed company under immense scrutiny from thousands of investors and the SEC. Trust is everything! I'm decided to wind down my Prosper positions.

Better P2P Investment Alternatives

Ifyou want to invest in P2P lending, you should really focus on investing in dividend value stocks, rental properties, and real estate crowdfunding as we recovery from the pandemic. The risk-adjusted returns are much better in my opinion.

Real estate is my favorite way to achieving financial freedom because it is a tangible asset that is less volatile, provides utility, and generates income.

Take a look at my two favorite real estate crowdfunding platforms that are free to sign up and explore:

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends.

I've personally invested $810,000 in real estate crowdfunding across 18 projects to take advantage of lower valuations in the heartland of America. My real estate investments account for roughly 50% of my current passive income of ~$300,000.

Manage Your Finances In One Place

One of the best way to become financially independent and protect yourself is to get a handle on your finances by signing up with Personal Capital. They are a free online platform which aggregates all your financial accounts in one place so you can see where you can optimize your money.

Before Personal Capital, I had to log into eight different systems to track 25+ difference accounts (brokerage, multiple banks, 401K, etc) to manage my finances on an Excel spreadsheet. Now, I can just log into Personal Capital to see how all my accounts are doing, including my net worth. I can also see how much I’m spending and saving every month through their cash flow tool.

A great feature is their Portfolio Fee Analyzer, which runs your investment portfolio(s) through its software in a click of a button to see what you are paying. I found out I was paying $1,700 a year in portfolio fees I had no idea I was hemorrhaging! There is no better financial tool online that has helped me more to achieve financial freedom. It only takes a minute to sign up.

Finally, they have an amazing Retirement Planning Calculator that pulls in your real data and runs a Monte Carlo simulation to give you deep insights into your financial future. Personal Capital is free, and less than one minute to sign up. It's one of the most valuable tools I've found to help achieve financial freedom.

It doesn’t take much brains to see that one default on a loan can but you in the red. Prosper has not traditionally done a good job of rating or vetting borrowers and if you get stung making one of these loans, all of your interest and some of your principal will be gone.

I’m totally confused by these financial suitability requirements – there are actual laws that prevent a private citizen from investing their own money in whatever they want if they don’t make enough money?? What is the reasoning behind this and how is it fair? How is a lower-income person ever supposed to get ahead if they’re prevented from investing their money? It almost sounds like a scheme to see that the “poor” remain poor.

Did anyone else see this? I’m furious:

https://www.bloomberg.com/news/articles/2017-05-04/online-lender-prosper-says-system-error-overstated-loan-returns

I logged in to Prosper today and saw this note. I don’t remember exactly what my stated returns were previously, but Annualized Net Returns and Seasoned Annual Net Returns are now at 5.25% and 3.87%, respectively. Previously, I remember I’d log in and feel quite pleased that the returns were in line with or beating S&P 500. Seems to have dropped at least 2 points, christ.

Damn, just logged onto my Prosper account. NOT good! Feels like we totally got screwed! WTF. Thanks for highlighting this. I’ve written a response: Prosper Just Screwed Over Investors

Sam – Nice job on the blog. I am interested in this peer-to-peer alternative investment strategy. I live in Ohio and can not be participate given the prohibitive laws in the state. Are you aware of another way to invest on these platforms? Could I potentially set up an LLC based in Virginia for example to get around these laws? Thanks.

Hi Eric,

You should try real estate crowdfunding with Fundrise instead. I’ve become much, MUCH more enthusiastic about real estate sourcing now that it’s opened up because 1) there’s a real asset behind the loan or equity investment, and 2) the returns so far have been higher.

I think you can easily sign up and explore in Ohio.

My plan is to invest more surgically in the heartland of America now that Trump is president for 2017 and beyond. Coastal city real estate prices are cooling.

Sam

Sam, what do you suggest as a minimum or maximum that p2p or any crowdfunding should be apart of ones allocation? currently p2p stands to be about 5% of my net worth.

I am now into my 3rd year of investing in p2p via lendingclub and prosper. I suggest to use both and both platforms have their pros and cons but still more or less the same. Each do use different verbiage to list loans and what they rated as. But you do get used too it. This year I have setup my accounts to be fully automated because I grew tired of individually selecting notes my self. So far so good. Keep in mind this is not a very liquid investment, it is unlike the stock market were you can instantly sell a position and have the cash cleared to your account within 3 days or faster.

How can one living in Pennsylvania invest in P2P. Looks like it’s off limits to this quaker stake.

[…] Related Post: Should I invest in P2P lending? Prosper performance review […]

[…] of the reasons why I waited so long to start P2P lending is because I just can’t stand people who don’t pay their debts. Be a Lanister and […]

[…] P2P Lending Prosper Performance Review […]

[…] are over-regulated, too slow, and not innovative enough. This is why you’re seeing a rise in P2P lending, crowd funding, and social lending […]

[…] come to mind are AngelList, RealCrowd, Prosper Lending, and Lending Club. Each of these companies are democratizing other asset classes (venture, real […]

Sam…

Thanks for your review of P2P investing with Prosper. I have become a big fan of P2P.

I started with a small amount last September 2013 (a few thousand to get my feet wet and test the waters.) Prosper more than passed my tests, so I slowly added $10,000 in 2014 and a year later, with various additions, I am up to $15,000. I made $1520 in interest last year amounting to a 11+% return based on over 500 loans (at mostly $25 each and few at $50). The big surprise was that I only had five defaults using A,B,C and a few D loans. I am very happy indeed.

I use my own set of filters with automatic settings that yield about 1-4 possible loans each day. Generally, I spend about 10-20 minutes a day around 9AM and 5PM when I have the internet available. I use P2P for diversification against my rather erratic investments in my more speculative portfolio of high yielding MLPs (oil/gas), BDPs (Business Development Corps), and REITS which also yield about 11%.

These more unpredictable and speculative stocks come with a great deal of noise and drama, with the world coming to an end one month, and then rising towards the heavens the next (as featured in the story of oil this past month.) In contrast, P2P is so smooth, dependable, and predictable …almost boring. Just money pouring forth every few days into my account. No screaming, no posturing, no bravado. Just a steady flow that will move up to $20,000 at the end of 2015. If only I was age 30 the compounding effect would be incredible!

Prosper, IMHO, has yielded to the corporate set as a means of providing stability to the company in this very young market. It seems the corporations and big money interests siphon off the highest quality most secure loans while the few remaining glide towards the individual investor. In the beginning it was easy to find quality loans at 15% or higher. Now, those are rare and I’ve had to expand my range to 12-16% loans. I am not complaining, just pointing out that it takes patience and time to build up a decent portfolio of loans to provide enough interest for passive income in retirement. Overall, I expect a return of about 10% in the next few years. A far cry from my savings account return of 0.85%. I recommend P2P investing as a means of providing diversification to an investment portfolio.

Comments like David Michael’s make me highly skeptical of P2P.

Spending 10 minutes a day to snatch up a few loans is 60 hours a year (if we were honest and counted brainspace and login/distraction time, it would be more like 120 hours, but whatevs). Let’s say 11% is your return. Back out a 6% return from an zero effort S&P index fund and then factor your hourly rate (let’s $40/hr). To break even you have to make $2400 which is 5% of $48k.

Are you telling me it takes only 10 minutes a day to manage $48k in P2P loans?

Or you can set your filters specifically to only show you the top loans per day and have that automatically invest. What you and I consider as top loans, however, is debatable.

Propser seems to have changed in the last year. I was doing good, then all of a sudden kept getting hit with more charge offs than interest. Have lost money for five straight months. I have over 500 notes and around 10K invested. Email Prosper multiple times asking them what is going on and they will not answer. The funny think is I haven’t made money in months, but the investing page says I’m making over 9%.

Very interesting feedback! I hope it’s just a streak of bad luck. I haven’t experienced this yet. Can you e-mail support and ask if something is up?

I am having the same experience. I have been investing with them since 2013 and in the last 6 months I’ve seen a number of delinquencies ranging from A to C notes, to the point where I have negative returns (though Prosper is still showing 8% return on my balance sheet).

Also browsing through the new listings it seems that even people who get A rated have high debt to income ratio that is making me less likely to lend to them (I don’t to automatic lending). Anyone else seeing similar results?

I believe the rate you see vs what you are getting in interest payments in the short term don’t match up. Because the rate they say you are getting is forward looking assuming from that point on all notes will be paid on time and all interest/principle will be back going forward. As notes are delinquent and charged off, that is when an adjustment to the rate you are getting will get an adjustment.

I had NO idea I couldn’t invest at all because I live in AZ! What the crap is that?! How crummy! I actually really wanted to invest in P2P because I’ve heard a lot about it and it seems worthy to me. Now I’m a really mad! I already hated AZ… now I hate it even more… grr!

Sweet write up though. I just have to find a state that doesn’t have ridiculous, unnecessary, freedom-crushing rules.

Melissa,

I had another reply that is apparently still being reviewed, (or failed, as it included external links) but one benefit of LC going public is that they will become available in all 50 states. This is known as a “blue sky” rule, and a direct effect of being a publicly-listed company.

It is also an interesting aspect for investors in the company–they have an immediate boost in their addressable market. Putting that into context, maybe the 50% boost isn’t out of order.

Whoops, missed this post when you first published it last week.

You’re lack of diversification scares me Sam! I understand you are going after prime borrowers, but such concentrated risk! Given you’ve been doing this for a while now, you’d think your comfort with the process would allow you to expand further than you have. After investing in P2P lending for soon to be six years, my expectations are pretty set, and I’ve gotten things automated to the point where I check balances once every other week and make sure nothing has broken. With Prosper specifically, I invest in C, D, and E loans. The bulk of my loans are C loans and my criteria focuses on high income earners with two-years or greater of employment, and no public records. I only invest in three-year notes in Prosper.

What can I say. I like to live dangerously. :) I don’t have much invested. If I had more than $10,000, I’d probably have 50 loans, and ultimately get up to 100+ with $25,000.

How has the C,D, and E loans done for you? What do you think the default/non payment rate is at those levels?

thx

When looking at my detailed returns, my default rates will end up around 5-6% or so. With an average yield (although it is declining as underwriting changes) of about 19.7%, I’m currently earning not quite 14% on my notes from 2013, which after factoring in the 1% service charge, gives me a default rate of approximately 5%. Yes, losing principle isn’t ideal at any point, expecting to maintain a 0% default rate long-term would be quite the feat. I’ve excluded any notes invested in during 2014 as they haven’t aged enough to make a reasonable comparison.

My target return is in the 10-12% range, so seeing “seasoned” returns of 13.75% leaves me some additional room for defaults as the notes continue to mature and turn over. While every person’s risk tolerance is different, the one, more universal idea is that some level of diversification is needed. You mention living dangerously, yet haven’t put much at risk in P2P! You should give it a bigger shot.

My ROI is 7.8%. That’s not bad, but now I think it’s too risky. There will be a bunch of defaults if the economy heads south. The risk seems too high for me. It’s also hard to get new loans these days. I don’t have time to log on at 9am and I only get a few loans per month with my auto screening.

I guess my screen isn’t that good since I see that some readers get double digit ROI.

I have P2P and will be moving to NC in June 2014. What happens then? I am not able to invest anymore??? Wondering why some states are excluded in their business plan?

G,

It’s not really about their business plan. It is also a matter of State Law, and whether the model can comply with each state’s statutes.

Here is a somewhat dated article (2011) that discusses the problem:

Here is a more recent article, from last year:

https://www.lendingmemo.com/lending-club-and-prosper-states/

The second article had an interesting paragraph:

“When I sat down with Lending Club’s COO in May (read the interview), Scott Sanborn described how Lending Club has a goal to become a public company sometime in 2014. When this does happen and Lending Club has an IPO (TechCrunch), the so-called blue sky exemption will happen, and all the states should open to the public for investors.”

Since that IPO did just happen, then perhaps there will be news on this front in the near future. I did check their website today, and the approved State list still exists.

One additional thought that occurs to me: If they get instant access to a bigger market, then that could justify a big IPO jump. It was not a hidden factor, and I have not looked at the current P/E or other ratios. But it certainly is more impactful to the actual business than most IPO’s.

So, I’ve been following an alternate strategy that has, for the time, worked extremely well for me. I’ve been investing in P2P with Lending Club for a little over two years now. Instead of working off of credit reports, scores, and other habits gleaned from self provided information and the credit bureaus, I have decided to utilize my everyday job skills as a syndicator to purchase aged notes on FolioFN.

In particular, I purchase notes that meet the following qualifications:

1. They must have half the original term left or less

2. They must never have been late on a payment on the note. Not even a few days late.

3. The note must have a yield to maturity of at least 12.00%

4. The note must be below $15.00 to purchase

So far, this strategy has panned out well for me. A lot of people want to see more liquidity in their notes and frequently sell either because they do not have the stomach for the timeline or they just need the cash. I’ve been able to achieve 13.94% return on the notes so far, without any delinquencies.

It’s definitely an alternate strategy and definitely has some inherent risks. But overall, a lot of people out there honor their contracts and pay their debts. You just have to find the right ones.

Do you find return opportunities are decreasing w/ more investors in the space now? 10.8% is great. I not Lending Club recently changed their bands, basically offering lower returns for their same perceived risk level. (and in turn lower interest rates for borrowers)

I’m a huge fan of P2P. In Prosper, I have about 800+ loans but I was very bullish and bought whole loans when it met my criteria. I started in 2009. My return for “seasoned loans” is 13.52%. Early this year I switched over to Lending Club and haven’t looked back.

I like both platforms but I Lending Club has a larger selection of loans and makes it easier to diversify large sums of money quickly.

In Lending Club, I have 5800+ loans. I definitely diversified here and did not ever buy whole loans. I did not start investing heavily until early this year, so the returns are still due to change. My return is 14.5% as of now. We will see years down the road.

They are all in taxable accounts because I plan to use this passive income to replace my active income and retire one day like Sam!

I have been using LendingClub for almost 2 years now. I am very happy with the returns. I am in the ball park of 9%, I was closer to 14% at first. I had a good chunk of loans in C,D,E,F. My criteria is very strict when it comes to the higher risk loans, therefore I tend not to find what I am looking for, but I am always constantly checking and checking, they eventually appear during the week. But funny thing is those folks in the higher risk category tended to pay off the loans well before they were fully due. I have had 2 loans go into default, my account size is about 600 loans total, I invest the minimum 25 dollars each always. I don’t know if you have done deeper research in defaults. There are a few websites like Lendacademy that has posted some very interesting data, basically it showed the risk vs reward from an A loan or D,E,F loan. The D,E,F loans did not default as much as one would think compared to the A loans based on historical data from places like LC and Prosper, there are quite a few good forums and blogs that have a lot more information out there. I reinvest all earnings as they come in and every few months or so, I may throw in a few hundred extra. Currently P2P lending only represents about 3% of my net worth. I may raise it to about 5% the more confident I get. And I would like to see my overall results at around my 3 year mark when most my loans that were bought first should be fully paid off by then. I am not sure how prosper does it, but on lendingClub there is two options for notes… there are plenty of 36 month ones which mostly range from the A to D area, the more higher risk ones tend to be 60 month loans, some higher risk ones you can maybe find at 36 months but those seem to be rare or might not meet your criteria. I try to keep ration at about 80% for 36 month loans and 20% for the 60 month loans. I haven’t really been able to find data to see if 3 years or 5 years makes big difference in terms of added risk to default or not.

As a LendingClub lender, we were offered pre IPO shares using the Direct Share Program that Lendingclub set up prior to launch of its IPO. The max requested shares was 350 which I requested, but received 250 only. I believe in this market and I believe there will be room for more growth and other players will get involved in this area. I have never had the chance to buy shares at the IPO price, and since I like this company and what it is about. I decided to get some shares although 250 shares at 15 dollars each will not make or break me, it is less than 1% of my net worth. I try to keep individual stocks to less than 15% – 20%(I am trying to get this down to 10%) of my overall portfolio and the rest goes into index funds like clock work.

Another strategy that I use to minimize losses is selling loans on the secondary market. If a loan goes in to grace period, a loan is paid but was not paid on time. I immediately put it up for sale on FolioFN which LendingClub uses to allow you to sell your loans and allows other LendingClub members to buy up secondary loans.. I usually price them for the remaining balance, some times a bit less or even a bit higher if there is still quite a few payments to be made. Most of the time they get sold quickly if they are priced well and fairly. I have had to do this several times as I do not give a chance to borrowers who are late or in grace period, its worked out quite well. This process is rather quick, a few clicks and they are up for sale.

I have not tried to use the automatic re investment thing LC has. Since my account is rather small, it is not so time consuming to use my filters and glance a few loans and pick them and be done. I imagine guys with huge accounts that are getting 1000s or more in payments per month then it could be useful to automate the process of choosing loans.

I received 250 shares at the IPO price as well. Now the question is do I flip them or hold them?

Up 56% on one day is amazing. Sounds like it’s prudent to lock in some profits. But who knows. Sell half, and let the other half ride?

I ended up selling all to lock in some profits (64%, yes!). I wonder how many new millionaires the IPO created.

At least several hundred right here in the SF Bay Area, who I presume will look to deploy the profits by buying real assets like property after the lockup period is over.

Money raining from the skies here in SF!

That’s a lot of loans out there Jeremy. Nice work! 10.8% is sweet, and I’ll be curious to see how your D and E loans do.

I’m pleasantly surprised by how little work one has to do too. Given I’ve got way less loans, I like to spend time picking and choosing. I think the most I’ll ever have is 100. The auto feature is pretty sweet though for larger investors.

Any idea whether residents of states like Texas can invest in P2P via secondary market transactions? I’m interested, so it’s frustrating that my local government tells me that I “don’t have the right” to invest in P2P

It’s interesting that some states do not allow their residents to invest. Fortunately I live in California so I can, and the requirements are reasonable. I don’t think I’d invest more than 10% of my net worth anyway. I find P2P more interesting than stock investing personally, and Prosper is also in my back yard which is cool. It’s nice to know there are ways for people to consolidate their credit card debt too.

Do you know if people can consolidate student loan debt using a peer to peer source? My friend has over 50K in student loan debt some goverment and some private. Could she use a peer to peer source to lower her interest payment and consolidate?

The most you can borrow is 35,00, and the loan duration is is either 3 years or 5. If you consolidate, you will may have a much shorter pay back period, which would increase the monthly payments. P2P lending is basically a personal loan and you can use the money for pretty much anything.

You can consolidate anything on LC or Prosper but may run into into maximums in the amount they will lend. Check out Sofi for student loans, but if your rates are decent they may not do better.

RE: Samurai’s Question getting about 8% gross so far, including write offs not taking into account current delinquencies. Investing for a bit of a year on Lending Club.

Strategy – consolidations only, watch that the amount borrowed isn’t too high vs. their income or doesn’t pass a smell test. I never invest where N/A for their job either. I avoid high inquiries in general and any past delinquencies of bankruptcies. I also avoid the secondary note market, activity their seems fishy to me, bought loans that looked good but seller knew they would be paid off somehow, lowering my return.

I think in general it’s interesting but maybe more trouble than it’s worth to be an active investor. I think for small marginal gains by investing actively it may be smarter to go passive and just auto invest w/ them. So far just doing it for fun.