As the economy goes down the tubes thanks to a Fed-induced recession, anger against anybody who is perceived to have more wealth or success will go up. As a result, it's important to practice Stealth Wealth to stay safe and happy.

I know anger has increased since the bear market began because I run a personal finance website with over 2,500 articles. Lately, there have been a lot more insulting and testy comments on new and old articles, which I won't share.

There's a natural tendency for some people to shout on the internet and blame strangers for their financial losses or problems. Blaming others is easier to do than blaming yourself. It may also be gratifying to call people “out of touch” or “elitist” to feel more self-righteous.

As a result, is there any wonder why some rich people want to signal that they're middle class to the public? Nobody likes to be a part of a minority that gets constantly pelted with insults.

In this post, let's do a case study on how one person tried to signal being average but didn't quite succeed. The post is not meant to denigrate the person, but to help us learn how we can be better Stealth Wealth practitioners.

It takes courage to put yourself out there for public consumption, so I applaud her efforts. When you're still aggressively building wealth and growing credibility, finding the right balance between stealth and status is hard.

A Stealth Wealth Case Study On Poor Signaling

To set the mood, there was a lot of panic during the Silicon Valley Bank bank run. A lot of lives and businesses were at risk of going under. Many people had an interest in having SVB's deposits above the FDIC limit guaranteed, including myself.

The below tweet exemplifies what was at stake if depositors at Silicon Valley Bank were not made whole by the Federal Government. In a whopping 23-tweet thread, the author argues saving SVB was not about saving the top 1%, but the common person throughout America.

Let's just review the first tweet out of twenty-three.

At first glance, this is an excellent tweet highlighting how Silicon Valley Bank wasn't just a bank for techies, entrepreneurs, and VCs in the Bay Area. How could it be?

Lindsey is an Ohio mother of four. Not only does Lindsey do double duty as a mother and startup founder, but she also drives a Honda minivan. In addition, her husband works in manufacturing.

She appears to be a “salt of the Earth” type person who is as far away from being a part of the elite class as possible.

The innuendos from her tweet are:

- Ohio has more down-to-Earth people than people who live in California

- A Honda Odyssey is a middle-class car that's driven by regular people compared to those who drive Tesla Xs

- Manufacturing is nobler than investing money and coding

- Being a mother, especially a mother of four, may be superior to those who have no children or fewer children

The strategy of painting yourself and the things you own in a more regular light is good Stealth Wealth practice. You just can't go too far, otherwise, people will feel slighted. The implication about being superior given she's a parent can also be offensive to those who can't have children or don't want children.

To make Lindsey's signaling she is middle-class great, she should have hidden her bio and what her company does. But to obfuscate her bio and her company would then defeat one of the purposes of Twitter: to grow your profile or business.

How Her Stealth Wealth Backfired

To gain status, many of us need to signal to society we have status. This way, we can hopefully build upon our status and become even more successful.

Hence, let's take a look at Lindsey's Twitter bio:

Founder/CEO @Strongsuit_co eradicating the mental load so we can all win @ work and @ home; Dreamer, builder, adventurer, feminist, mom of 4; frmr @McKinsey.

Stealth Wealth Mistake #1: Listing A Prestigious Organization In Bio

Based on Lindsey's bio, she is a superwoman who can do it all. Not only is giving birth and raising four children a difficult feat, but so is getting a job at McKinsey Consulting.

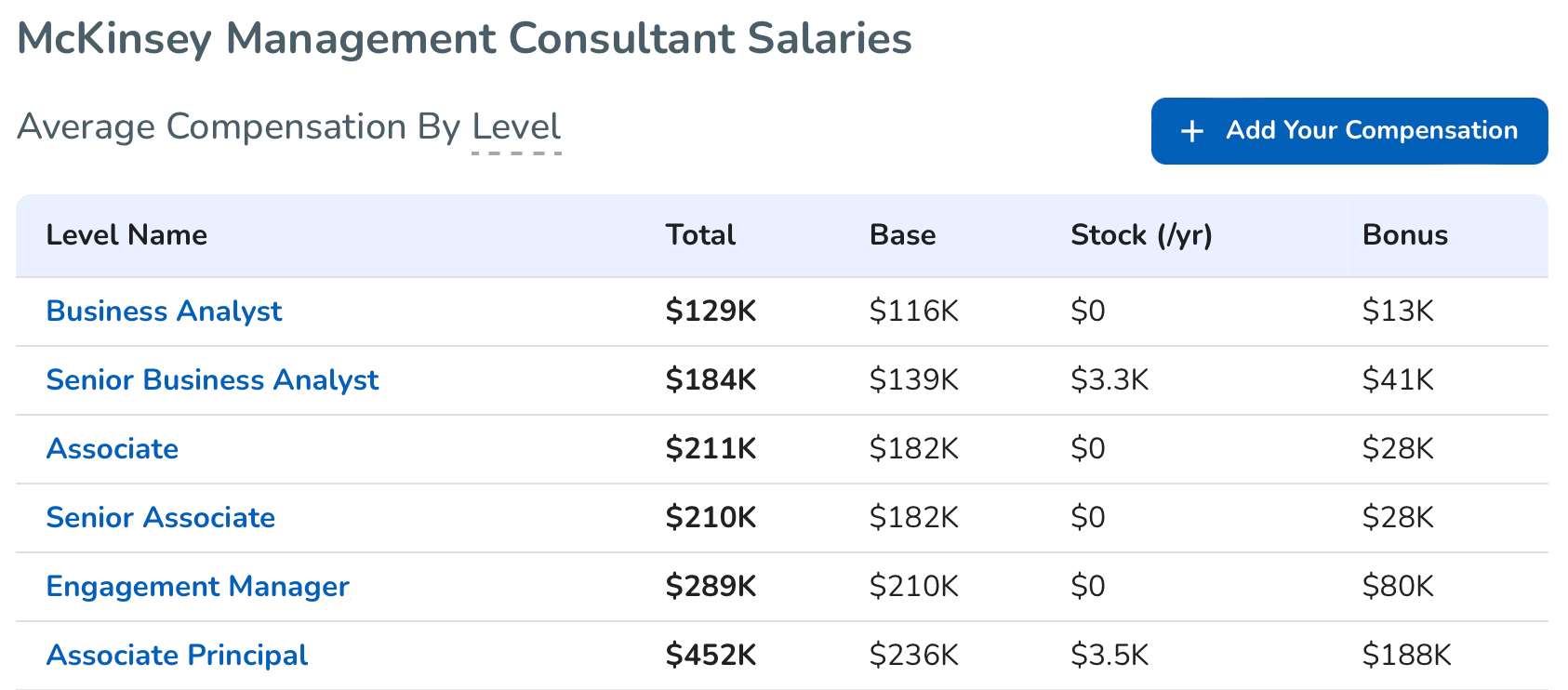

McKinsey is a strategic consulting shop that pays some of the highest salaries post-college. It also has an acceptance rate of about 1%.

With an average compensation of $129,000 a year out of college and $452,000 ten plus years out of college, you can earn a top one percent income for your age group. As a result, listing McKinsey in your bio is not practicing Stealth Wealth, especially if you claim to have ten years of strategy consulting experience.

Listing McKinsey in your bio is a status play. Hence, to be a good Stealth Wealth practitioner, you need to scrub your bio of status markers if you are going to successfully argue yourself as a “commoner.”

Stealth Wealth Mistake #2: Founder Of A Business For Wealthy People

After checking out StrongSuit, it seems like their services provide executive assistants to busy families. A StrongSuit assistant can help you sign your kid up for soccer, remind you when is teacher appreciation day, and when to book a vacation.

Essentially, StrongSuit helps reduce the mental load all parents experience by doing some of these daily family tasks. As a parent to a couple of young kids, I get it. Although I'd never pay someone to remind me to take my daughter to swim class. It's one of the events I look forward to the most each week!

Paying $500 a month for a family assistant is a luxury that perhaps only the mass affluent or rich can afford. As a result, Lindsey's plea for help does not support her argument of bailing out the common person.

Check out the video yourself.

Stealth Wealth Mistake #3: Saying You're A Private School Alumni

Her final stealth wealth mistake is highlighting being a graduate of DePauw University and Duke University in her company bio. Although it is perfectly normal to list your education to build credibility for your business, it runs contrary when trying to be Stealth Wealth.

You've got to be consistent with your signaling to make a more powerful argument.

Expensive Undergraduate Degree

The annual tuition at DePauw University is $56,030. The university estimates the average annual cost to attend the university is $71,920. This is an amount very few middle-class families can afford, even if most don't pay full sticker.

What's more, DePauw University has an acceptance rate of about 65%, which makes attending the school an even greater luxury. Only the rich or those with generous grants would be willing to pay $56,030 in tuition alone to go to a school ranked #45 on U.S. News & World Report's National Liberal Arts Colleges (not the main list). After all, you can pay the same to go to any Ivy League university.

One of the reasons why I attended The College of William & Mary was because I could afford in-state tuition. In the event I couldn't find a job that required a college degree, I could pay back my parents with a minimum-wage job at McDonald's.

My parents were government workers, so I had a good idea of what they made. It didn't feel right to attend a private university, unless, maybe the university was ranked in the top 10.

But I didn't even apply to the top private universities because I simply wasn't smart enough. Applying felt like I'd be throwing away application fee money. When you come from a middle-class household, application fees can act as a barrier to even try.

An Even More Expensive Graduate Degree

Duke University is a top 20 MBA program that costs $75,000 a year in tuition. Duke estimates its MBA students will need to spend $106,962 a year to attend Fuqua for two years. Its acceptance rate is about 24%.

Forgoing two years of income and paying six-figures a year to get an MBA is a steep price to pay. But luckily, Linsey was making multiple six-figures at McKinsey to be able to afford the tuition.

Remember, the average income for an Engagement Manager is $289,000 and $452,000 for an Associate Principal. And in her tweet thread, Lindsey said she made the same as her husband.

It was smart not to mention her husband also makes multiple six-figures a year. But the average person can deduce that means they once had a household income of over $500,000 a year in Ohio. That's like making over $1 million if they lived in New York City or San Francisco.

I also have an MBA, but from UC Berkeley. However, I didn't go the full-time route because I couldn't afford to give up two years of my career and pay ~$28,000 a year in tuition.

Instead, I went the part-time route and my employer paid for 80% of my tuition. I could have asked for the remaining 20% reimbursement, but we were in the middle of multiple rounds of layoffs. My cost-benefit analysis concluded it was more important to keep my seat.

Carefully Signal The Image You Want

Showcase your pedigree if you're trying to build a company, sell a product, or sell yourself. Be proud of the places you've worked and the schools you've attended. You've earned the right to tell the world about your background.

However, if you're going to argue you're a regular middle-class person who needs to be saved, then you may want to scrub your biography of status and wealth markers. If you don't, you may receive a lot of backlash.

Personally, I think what Lindsey is doing is incredible. I salute all entrepreneurs and working parents.

Taking a leap of faith is not easy as it requires tremendous courage and planning to leave a well-paying job behind. Then for her to also take care of four children is incomprehensible to me as a tired dad of only two young children.

It's clear Lindsey is trying to solve a problem that only grew bigger during the pandemic.

The Right Balance Of Stealth Wealth And Status

Finding the right balance of stealth wealth and status is always going to be tricky.

My recommendation is to be flexible in your signaling. If you need credibility, then highlight your status markers. If you want peace, hide them.

From 2012 to 2019, I was happy being a nobody. I just did my own thing. Instead of fame, all I wanted was to conservatively grow my wealth to stay free.

However, once we got rejected by six-out-of-seven preschools between 2017 – 2019, I realized I needed more status for my kids. On each application I put down I was a HS tennis coach. In contrast, my friend got into all four of the preschools they applied to, even though two have a “lottery system” for the sake of equity.

Then when I published my personal finance book, Buy This, Not That in 2022, I needed to highlight my achievements in order to get interviewed on podcasts and TV. For three months, the book marketing felt unnatural. But it got me out of my comfort zone and reaffirmed my desire to stay low key.

Now I'm happy being a nobody again as I focus on family, sports, and writing my next book. My kids have gotten into good schools and there's nothing I need to sell to survive. Perfect!

I still need to share certain financial figures to be a credible personal finance writer. However, as time passes, I've become less inclined to share as much. My figures don't matter. Yours do if you're still on your path to financial freedom.

Related posts:

A Stealth Wealth Solution For Real Estate Investors With Kids

Are You Smart Enough To Act Dumb Enough To Get Ahead?

The Stealth Wealth Compendium Of Useful Phrases To Deflect Attention

Finance Is The Language Of The Elite Only If You Don't Learn It

Reader Questions

What are some Stealth Wealth signaling mistakes you see? What's the best strategy to come across as credible, but not seem boastful? How have you been able to hide your wealth or intelligence to keep more haters at bay?

Invest In Private Real Estate

Check out Fundrise, my favorite private real estate investment platform. You can invest in private real estate funds that specialize in single-family and multi-family homes in the Sunbelt region. Thanks to technology and work from home, the demographic shift toward lower-cost areas is here to stay.

I've personally invested $954,000 in private real estate funds and deals since 2016. My goal is to earn more passive income and diversify my expensive San Francisco real estate holdings.

Invest In Private Growth Companies

Instead of building a business, consider investing in a private growth companies instead. Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment.

Check out the Innovation Fund, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 35% of the Innovation Fund is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI!

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum. You can see what the Innovation Fund is holding before deciding to invest and how much. Traditional venture capital funds require capital commitment first and then hope the general partners will find great investments.

Join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

Too funny— the VERY first thing I noted was “McKinsey”. :D :D :D

And, yeah, I did find her marketing video… well…. a bit nauseating. But you’re right, Sam, she hit her market.

Thanks for the laugh!

The labels “privilege” and “signaling” have become tools of judgement in my opinion (just an opinion). Part of the problem with social media is that a poster’s thoughts may seem clear and reasonable in the instant they craft the post(s), but like fashion may look dated in the near future or may have an unintended reception by readers. People have often worn their associations and identifications on their sleeve, their car bumper, lawn sign, etc. – those ways of signaling have been around for a very long time. I remember being yelled at by a pick up truck driver years ago who didn’t like my Japanese car or my Chesapeake Bay license plate – or both. I can’t remember exactly what he called me before he sped past me, but my friend and I burst out laughing. If someone is using social media to market themselves, I suppose signaling is part of the process. Who reads (or writes) a 23-tweet thread, anyhow? Unless it’s a great story that ends up becoming a Netflix drama (yes, that was quite something) or a very informative discussion with good data and analysis from a true expert. There’s also the issue of our self concept vs how others see us. That Venn Diagram can lead to all sorts of miscommunication – if you post from the outer area of your self concept circle, and someone reads it from the outer area of theirs, well…but if someone spends a lot of time trying to communicate from inside the area where both circles intersect, the communications may become superficial and inauthentic (because they’re spending too much time focusing on how they might be interpreted).

Driving my LExus LC500 around is probably a bad idea.

I agree with much of this article. I would quibble only with these two points:

* “Manufacturing is nobler than investing money and coding”

* “Being a mother, especially a mother of four, may be superior to those who have no children or fewer children”

I interpreted the point about her husband working in manufacturing as a way of saying that her husband has a regular job in an industry that employs many average, middle class people. He’s doesn’t work in a job that has a reputation for putting you into a more elite class, like doctor, lawyer, investment banker, etc.

I interpreted the point about being a mother of four children as showing that she has her own set of significant expenses, and that her lifestyle is more likely to involve driving kids to school and to basketball practice than jetting off to Europe or a tropical island for an extended vacation. Maybe you would see that as her claiming superiority. I see it as her claiming normalcy.

But those are just my interpretations — just my way of putting in my two cents.

Yes, both points are claiming “normalcy” with normalcy being the preferred status in this situation.

However, having 4 children is actually normal compared to the median number of kids a family has in America (2). In fact, continue signaling of for children as a sign of wealth given the cost of raising children.

Also, the husband working in manufacturing is a misdirect. Making $250,000+ in manufacturing isn’t what one might think the job is.

Sam – I resonated with your comment that for some people (like us), attending a public college/university was a no-brainer. As a Virginia resident in a middle-class family, going to William & Mary or University of Virginia was the highest target set out for me. (Like you, I ended up at W&M. And then luckily got accepted to UVA law school.)

As for stealth wealth: it certainly makes sense to disguise your wealth if you’re looking for government handouts – or you’re being sued (e.g., Alex Jones and the Sandy Hook lawsuits). But the opposite – exaggerating your wealth – seems much more common these days. For instance, if you’re trying to promote yourself as an investment guru, you won’t highlight that you’re driving a used Honda. More likely you’ll have a profile picture of you next to a Lamborghini – even if you just borrowed it.

Funny you mention Honda… a guy I know and chatted with last week after tennis drives a Honda.. and he’s worth $3 billion! But this is like counter-signaling, and he’s already well known and older. No need to show any status or wealth b/c everybody already knows.

How one person tried to signal being average but didn’t quite succeed…

I have a slightly different take. I think she reads websites like this and learns that $3m is the new $1m, and you need at least $3m now to retire at 65. Who knows how much you need to retire at 50? She is reading 5M, 10M….The financial media has really put the fear of God in folks…whether exaggerating or not we won’t know – housing, medical costs, etc…. So if $3m is the new minimum to retire at 65, then I and others have to conclude that that is a “middle-class” amount.

OK, so lets say she and hubby are making a 500k combined income. After taxes lets say $350k. As your articles suggest, a family of 4, in their stage of daycare and saving for college likely spending $250k a year. That leaves $100k to save.

So say she is diligently saving for the past 10 years, giving up lavish vacations and cars, and has built up a 1.5 mill (with capital gains) of assets.

Now, let’s remember that we are only provided one place to put our money (liquid) that we are told is “safe” – the banking system. Now she wakes up one morning and she is told “sorry, 1.25million of your savings is gone, you only have 250k left.”

Is that still more than the poorest of the poor in our ghettos could ever dream of? Well. of course. But they aren’t reading these articles or caring about stealth wealth either.

Those finances I suggest for her are not “elitist”, but closer and closer to middle class.

What she is doing is simply expressing a FEAR, which is justified if true, that if banking system is not safe, what are we supposed to do with our money and savings? That FEAR applies to really anyone who has accumulated over 250k in savings. The person who has accumulated “only” 350k and is 60 years old still doesn’t want, or can afford to lose, to lose 100k. And yes they can open different accounts. But not everyone lives their lives with that awareness. IF you can put your personal money in a bank and it just goes into thin air, that is like a sacred trust that has been broken. I don’t think she really cares about her “averageness”, she is just scared.

And that is why Bitcoin has gone from 20k to 28k this past week, LOLLL

I like the take. I don’t think one needs $3 million to retire today or within the next ten years. But I do believe $3 million today equals the $1 million from the 1980s and 1990s due to inflation. We’re talking about living the millionaire lifestyle.

If her household was making $350K AFTER taxes, I sure as hope they are saving more than $100K a year living in Ohio. And I’m sure they probably did.

YEs, the fear of instantly losing $1.25 million in the bank would be terrifying. But most of that would be diversified, $500K would be FDIC insured, and money market funds owning Treasury bonds would be secure.

But yes, a personal finance site like FS that challenges you to save and earn more may create financial anxiety. Or it might share what’s possible and provide motivation.

I could be my monetizing my talents so much more or just helping my friends and family become wealthier if I put myself out there. I dish out my financial advice to my small network, but who wants to listen to someone who’s driven the same car for 30 years, lives in the same house for 20 years and owns a few apartments but probably lives off his wife’s income? My life looks the same but my NW which I keep private has increased tremendously over the last 10 years.

In short, I agree if you want to influence other people whether it be for selfless or selfish reasons, you need signal your accomplishments. Thank you Financial Samurai for “putting yourself out there.”

BTW what happened to the option that allows one to be emailed if someone responds to comments?

Hi David – I got to upgrade my comment system. It used to have these features, but has disappeared. But if I upgrade the comment system, I’m afraid I might lose the comments or break something.

In my opinion, in order to practice TRUE stealth wealth; you need to be both independent and free. If you need a job or you need a loan, then you have to display what makes you worthy of a job or a loan. Once you display your worthiness, the world will see you and the haters will come for you. If you don’t need a job or a loan, then you can go off the grid. If you can afford to go off the grid, then you can become a master stealth wealth artist.

The second option is to acquire a stealth job (ex – online job) or acquire stealth loans. This lady is clearly taking her loan request (or in this case, her bank bail out request) to the public. Bad idea.

Yes, much easier to be stealth if you are independent and free and don’t rely on anybody or anything.

I thought I was independent or free until my boy got rejected from 6 out of 7 preschools. Then I knew I took things too far or that I’m never really free…

She got a lot of “free” advertising at the expense of her common man credibility—because as you and others have suggested, she isn’t common. But that’s ok. She’s trying to reach an uncommon demographic with a type of signal that will resonate with that demographic. Did she hit her mark? She’s probably not that far off. It’s just that when you signal like that to the whole world you tell everyone how out of touch you are. And for that people will drag you. There’s likely a an extra helping of misogyny at play here too.

For marketing, she hit her mark! And should bring more awareness and business for her. Sustaining a startup isn’t easy.

Hi,

Low profile is the way as per my perspective.

WTK

This is the way.

This is the way.

She shouldnt be worried about banks tanking. If i was in her place i would be much more worried about the new AI technologies

Good point about AI doing the executive assistants role. Guess AI will disrupt many industries, including mine.

Perhaps, she was comparing her situation to the Zuckerberg’s and Gates of the world, while attempting to be seen as salt-of-the-earth.

Maybe. We all fail if we compare ourselves to them.

I’m curious who’s raising her kids.

I assume school, spouse, family members and maybe her executive assistant assistant.

Hard to spend lots of time with kids juggling so much.

The desire to have it all is stressful!

Never heard of Depauw. Thought it was DePaul. $55,000+ for a private university few have ever heard of is indeed a privilege. Hopefully she got a scholarship. But might be hard as a white woman who is overrrepresented in universities today.

As a household that makes about $270,000, I can absolutely tell you we won’t be paying $55,000+ a year to go to Depauw.

State school all the way, like Indians University.

Never heard of Depauw either before this month. Definitely got to have heard about the school before spending any money. But I’m sure many in Indiana have heard of the school.

The first rule of stealth is to not give any signals at all. So it would be better to delete all social media. Be a nobody.

But there’s a balance if you desire to grow your profile or company. Hence, stealth wealth is easier to conduct AFTER you have achieved a level of wealth and/or status you are comfortable with.

I empathize with Lindey’s situation bc as a fellow parent and entrepreneur there really was a risk of losing it all that weekend. I’m sure she will improve on her signaling going forward.

It takes practice to find the right balance.

I used to agree with this and I’m not on social media. But now as the Chair of a non profit, I see that having a social media presence is practically necessary. I’ve also noticed that not being on Facebook has been a hinderance in staying in the loop with other preschool parents and neighbourhood coalitions/ events. The price of hiding is going up.

Yes, social media is like a must-have resume now for growth, marketing, job search, and business acquisition. Just have to figure out the best way to curate.

Reading this and agreeing from FIRE in semi-upscale South America. Local $1 beer, sitting outside on a 72F day. Working on my low profile.

Low key & stealth by default..

Fellow real estate investor & I went through the checkout at Home Depot. After paying we stood by waiting for their ‘loading help’. I overheard the cashier tell her fellow training associate that by the way we were dressed she expected the credit card to be denied.

My fellow investor owns 28+ properties, comfortably retired at 50 on his rental income, I was 45 (1998). He pays me $4500/month just on the notes I hold on several rental properties I sold him. I also hold the notes on the investment properties his three kids own.

The wife & I have a large portfolio of properties (all free & clear) but I guess you’d never know it, & I’ve often been called a slumlord by Lib friends.

Neither my investor friend nor I have social media & in 40years I have never had a business card. But we rarely have a vacancy & most are filled by word of mouth & not one tenant skipped a rental payment during Covid. When showing apartments to prospective tenants I’m often assumed to be the maintenance guy.

Life is good !!!

Those McKinsey comps are WAY off, much too low. I place McK folks into industry roles and can speak to what they make.

Don’t be shy. Feel free to share what they make at different levels and ages.

Here is for BCG (analogous) before bonuses.

A1: $110K

A2: $115K

SA/A3: $145K

C1: $190K

C2: $195K

PL1: $225.4K

PL2: $232.2K

Pr1/AD1: $252.9

Pr2/AD2: $260.5K

Pt1/AD3: $268.4

Pt2:/AD4: $276.5K

Not bad! But bonuses are a good portion of total comp. What are the ranges you see now if different from Levels.fyi.

Is it cognitive dissonance where people truly are not aware about their privilege?

Maybe we live in a overly hyper competitive world where even if you make a top 1% income, raise millions for your start up, go to an elite business school, and are a CEO, he just can’t see how well off you are because you’re competing with other people who have even more.

So there is this never ending comparison cycle that leads to always feeling like you are never good enough.

Yes. Hypercompetition is it, especially if you give up the comforts of a good paycheck after going to expensive private universities. There is even more pressure to succeed.

Part of the reason why I love Hawaii is because so many more people are much more chill there. There is way less of a hustle, culture and more of a live life to the fullest culture.

Yes, this woman, and many like her, really have no well off they are compared to the average person. I even had to explain this to a younger guy I mentor that makes ~95k/yr in the midwest at 30 y/o that is always struggling with money. I told him he makes $25k/more than the average family of 4 does. He doesn’t see himself as upper middle class but he absolutely is at that income level and location as a single dude. This lady is like taking that to the next level.

I do think in this situation the optics are horrible. If this was a bank in the southeast or midwest, it would likely have not bailed out depositors. Deposits at SVB would likely have ultimately paid out 80-90% + the $250k base. Any company that couldn’t handle that likely shouldn’t be in business. Hopefully this will teach folks its helpful to diversify your banks!

All banks are equal. Some banks are more equal than others.

There is a saying that goes something like “you are as likely to get a man to admit he is rich as asleep.” By and large, if people are talking about money, they are lying. Whether they are downplaying it or overplaying it, you can take it to a solvent bank that they are not being forthright.

I took my picture off the other day. Empathy is realizing that we are all unique. You have to do best for you, whatever that is. I did see a video- what is in a name. Unfortunately, some people make unfair judgements based on a name. I was astounded at how many actors, actresses changed their name. Best to keep a low profile. It is tough sometimes, but the more insecure someone is, the more they tend to brag, unfortunately.

As a writer, it is nice to write freely without preconceived notions by readers. Let the quality of words do the talking.

Oh my. She had no idea what was coming for her. I can empathize with her situation in some ways. She certainly achieved a lot in her career and with her business. And to suddenly have so much jeopardized overnight with SVB would be beyond soul crushing.

But I couldn’t help but chuckle to myself when I watched the business pitch. It’s certainly a very niche demographic they’re targeting. But they were doing something right to get to where they were.

Anyway, this is a great reminder of how much courage it takes to be a creator and an entrepreneur. And that in times like these, those that loathe other people’s success and those with more privilege, especially if they are hurting themselves, will try and tear others down any chance they get.