If you're looking for a car buying rule, let me introduce you to the 1/10th rule for car buying. The 1/10th rule will help you spend responsibly, reduce your car ownership stress, and boost your net worth over time. It is the #1 car buying rule today.

If you buy an overpriced car, it is guaranteed to depreciate. If you buy an affordable car based on my 1/10th car-buying rule, on the other hand, then you can invest more cash flow into stocks, real estate, and other investments.

Over time, these investments have the potential to appreciate in value, thereby buying you the most valuable asset of all: time! Having the time and freedom to do what you want is priceless.

The 1/10th rule for car buying is the most followed and most popular car buying rule today. For those of you who want to achieve financial independence soon (FIRE), the 1/10th rule will help you get there.

Americans Spend Way Too Much Money On A Car For Their Financial Health

Back in 2009, I watched in horror as a total of 690,000 new vehicles averaging $24,000 each were sold under the Cash For Clunkers program.

The government's $4,000 rebate for trading in your car ended up hurting hundred of thousands of people's finances instead. With a median household income of only around $50,221 at the time, spending $24,000 on a new car was clearly too much.

Instead of buying a $24,000 car in 2009, you could have invested the $24,000 in the S&P 500. If you did, you would now have over $150,000 today. That's quite an opportunity cost for buying a new car!

Buying too much car is one of the easiest and biggest financial mistakes someone can make. Besides the purchase price of a car, you've got to also pay car insurance, maintenance, parking tickets, and traffic tickets.

When you add everything up, I'm pretty sure you'll be shocked at how much it really costs to own a car and hurl. After more than 10 years, the 1/10th rule for car buying has become the standard car buying rule for financial freedom seekers everywhere.

The Car Buying Rule To Follow: The 1/10th Rule

The #1 car buying rule to follow is my 1/10th Rule for car buying. The rule states that you should spend no more than 1/10th your gross annual income on the purchase price of a car. The car can be new or old. It doesn't matter so long as the car costs 10% of your annual gross income or less.

If you make the median per capita income of ~$42,000 a year, limit your vehicle purchase price to $4,200. If your family earns the median household income of $75,000 a year, then limit your car purchase price to $7,500. Absolutely do not go and spend $49,388, the absurdly high average new car price today!

If you absolutely want to buy a car that costs $49,388, then shoot to make at least $493,880 a year in household income. $493,880 is about the top 1% income threshold today.

You might scoff at the necessity to make such a high amount. However, it takes at least $300,000 a year to live a middle class lifestyle with a family today. Inflation has really made making more money necessary just to run in place.

The last thing you want to do is waste money on a car you don't need.

Minimize Your Financial Stress With A Cheaper Car

If you actually want to save for college, save for retirement, take care of your parents, buy a home, and not stress out about money when you're old, please keep your car purchase to at most 10% of your annual gross income.

Once you buy a car following my 1/10th rule, own your car for at least five years. Better yet, shoot to own it fo 10 years. Don't go selling your car every 2-3 years like most Americans do. If you do, you don't experience the full value of the car. Further, you end up paying wasteful sales taxes each time you buy a new or new used car.

Buying a car you cannot afford is the #1 way to financial mediocrity. One of the biggest benefits of buying a used car is more mental relief. And when you have less stress in your life, you will enjoy it better.

Since Financial Samurai was founded in 2009, my goal is to help readers achieve financial freedom sooner, rather than later. Ideally, I'd like every reader to achieve an above average net worth for their age.

Financial independence is worth it. A car you cannot comfortably afford is a great headwind.

Why You Shouldn't Spend More Than 10% Gross On A Car

If you want to achieve financial freedom, let's go through specific reasons why you should follow my 1/10th rule for car buying.

1) Maintenance costs

The more you drive, the more you will pay to maintain your vehicle. With thousands of parts per car, something will inevitably break or need upgrading. After 10 years of car ownership, everything from your battery to your vacuum pump will need changing.

Not only do you have to pay for maintenance costs, you've also got to pay for insurance, parking tickets, and traffic tickets. Further, the thrill of owning a new or new used car lasts for only several months. However, the pain of paying the same car payment lasts for years.

You might think getting an extended warranty will save you lots of money. But extended warranties are offered because they are more profitable for the issuer, not the car owner. Otherwise, a business wouldn't offer them.

Below is data from Consumer Reports highlighting the cheapest to most expensive car brands to maintain long term. As you can see, the cost to repair and maintain cars goes up over time. Therefore, you need to carefully budget in long-term maintenance and repair costs with each car you buy. The cost of buying a car certainly isn't just the initial purchase price!

2) Opportunity cost

When you buy a car you lose the opportunity of investing your money in assets that will likely grow and pay you dividends in the future. Everybody knows to save early and often to allow for the effects of compounding. Buying too much car is like negative compounding!

Imagine how much money you would have accumulated if you invested $300-$500 a month in the stock market since 2009 instead of paying for a car? You'd have hundreds of thousands of dollars.

You can dollar-cost average and buy a S&P 500 ETF every month instead of spending money on a car payment. Even better, you could invest just $10 a month in Fundrise, my favorite private real estate investment platform to build more wealth.

Fundrise invests in residential and industrial real estate in the Sunbelt, where valuations are lower and yields are higher. Personally, I've invested $954,000 in a couple private real estate to take advantage of the demographic long-term trend towards lower cost areas of the country. Investing in long-term trends is one of the best ways to build wealth.

3) More Stress

When you pay more than 1/10th your income for a car, you will become more stressed. You'll feel stressed whenever you get a door ding after parking your car at the local grocery store. You'll get stressed whenever you incur wheel rash after parallel parking too close to the curb.

Sometimes when you're driving in traffic, you'll feel more on edge because you don't want anybody damaging your car. If you are within 1/10th of your income, you drive and park stress free. You stop caring about door dings, bumper scrapes, even break ins. Stress kills folks.

In fact, the biggest benefit of driving a cheap old car is less stress. With less stress, your mental health will improve!

Now that my car is nine years old, I don’t care if it gets scratched, or Ding. The other day, I opened my trunk, edit, scraped along a rusty fence. No problem! The older, my car gets, the more I love it. I recommend owning cars for 10 years or more. Then change for better safety features.

4) Makes you want more

The nicer your car, the more you want to spend on other things. You start thinking stupid thoughts like: I've got to buy a matching chronometer watch, driving shoes, and outfit. You start paying $20 for valet because you want people to see you come out of your car instead of park for free.

If you think about it, only the rich or fools buy new cars today. With the average new car price at roughly $50,000, a middle-class household should buy used instead.

5) An expensive car can make you feel stupid

Deep down, you know that if you can't pay cash for your car, you can't afford the car. Each payment you make is a reminder how foolish you are with your money. Why would you want to be reminded every single month of being dumb? The thrill of owning a nice car fades after about six months. But the payment stays the same for years.

Depreciation is intense with new luxury cars especially. I would avoid them at all cost. Instead of buying a $115,000 Range Rover Sport, buy a Toyota Highlander for 1/4th the price instead. Be responsible with your money if you are still on the path to financial freedom.

If You've Already Bought Too Much Car

Look, everybody makes dumb financial moves all the time. The important thing is to recognize your mistake, stop, and fix it! Here are some things you can do if you've bought too much car already.

1) Own your car until it becomes worth 10% of your income or less.

This is the simplest solution if you've spent too much. Drive your car for as long as possible until the market value is worth less than 10% of your gross annual income.

Ideally, you want to get your House-To-Car Ratio up to at least 50 if you want to achieve financial freedom sooner. In other words, the house you own should be worth at least 50 times the value of your car. If you own a car and don't own your primary residence, then you are going to fall farther behind the general public with each passing year.

2) Bite the bullet and sell your car.

If you've spent anything more than 1/5th your gross annual income on a car, I'd sell it. It's making you poor. Even if you have to take a little bit of a hit, I think it's worth getting rid of your vehicle. Don't trade it into the dealer because you'll get railroaded. Instead, try negotiating via Craigslist.

If you have an expensive car lease, here are ways to get out of your car lease. Unfortunately, you will likely be “upside down” on your car lease where you have to pay money to get out of it. Hence, if you can afford the payments, I'd fulfill the lease agreement and swear never to lease another car again.

3) Punish yourself.

Like Silas does in The Da Vinci Code, whip yourself into submission! OK, maybe don't go to that extreme. However, if you don't punish yourself, then you will repeat your mistake and feel fine with what you have now.

For the life of your car loan, take away a food you love to eat such as chocolate. If you are a coffee addict, swear never to drink that stuff again! Save more of your income after taxes. Feel the squeeze so that you realize how ridiculous your car spending is.

If the amount of money you're saving each month doesn't hurt, you're not saving enough!

Recommended Cars By Income (Tastes May Differ)

The beauty of the 1/10th rule for car buying is that it is tethered to your income. If you want a nicer car, you must make more income! Here are some suggested cars you can buy based on my 1/10th rule.

Cars built in the 1990s and beyond are so much more reliable than those built prior. If you are serious about improving your finances, consider buying a car with less options. The less electronics, the less electrical gremlins too. The more you have loaded in your car, the more maintenance headaches you will have in the future.

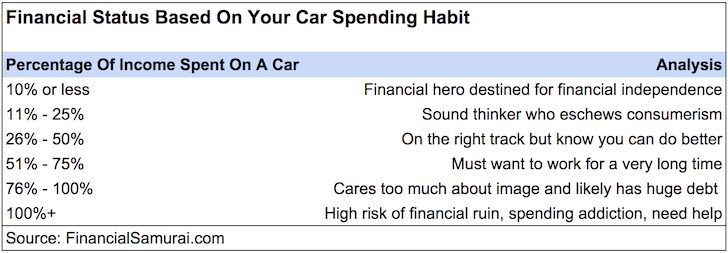

Below is the chart highlighting you financial status based on your car spending as a percentage of household income. The closer you follow my 1/10th rule for car buying, the closer you will get to financial independence.

Please note that there is NO SHAME in owning a car that's worth less than $10,000. I bought a second-hand Land Rover Discovery II for $8,000. Then I drove it for 10 years until it was worth less than $2,000.

The car was great and loads of fun. With the money saved from not buying a more expensive car, I diligently invested the money. A decade later, the money grew by over 160%. But it is important to pay attention to safety.

In fact, the best time to own the nicest car you can afford is when you have kids. This way, you amortize the cost of the car across more heartbeats. Further, you have more valuable cargo which means a safer car is even more important.

But once you've found a safe enough car, put your ego aside so you can have true wealth. All the freedom in the world. Your goal should be to generate enough passive income as possible so you don't have to work. Be a time millionaire or billionaire! Freedom is the true value of wealth.

The Choice For Great Wealth Is Yours

Treat the 1/10th rule of car buying like a game. You will be surprised to find how many different type of cars you can buy with 1/10th your income if you make over $25,000 a year.

If you want a $30,000 car, get motivated by the 1/10th rule to figure out a way to make $300,000 a year. One way is to start a side hustle to generate more income on the side. We're all spending way more time at home now. Might as well try to make some side income online.

If you can't get motivated, then fine. Just don't think you can afford much more. Think about your future and the future of your family. A car is simply there to take you reliably from point A to point B.

If you're thinking about prestige and impressing others, don't be silly. Owning a nice property is way more impressive because at least you can potentially make some money from the asset!

The Worst Combo For Your Finances

One of the worst financial combos is owning a car that you purchased for much more than 1/10th your gross income and renting. You now have two of your largest expenses sucking money away from you every single month.

Think about all the wealthy people you know or the millionaires next door. Chances are high the majority of them own their homes and drive used cars. Their cars likely don't come close to 50% of their gross income.

If you want to achieve financial independence, follow my 1/10th car buying rule. Letting material things stress you out is no way to live.

If you want to detonate your finances and end up working longer than you want for the sake of a nicer ride, then go ahead and spend more than you can comfortably afford. After all, we've only got one life to live.

Buy Real Estate Instead Of An Expensive Car

Keep your car expenses to a minimum and follow my 1/10th rule for car buying. If you do, you will increase your chances of achieving financial freedom given a car is almost guaranteed to lose value over time. Instead of buying a fancy new car, use the money to invest in real estate instead.

To invest in real estate without all the hassle and unexpected costs, check out Fundrise. Founded in 2012, Fundrise offers funds that mainly invest in residential and industrial properties in the Sunbelt, where valuations are lower and yields are higher. The firm manages over $3 billion in assets for nearly 400,000 investors looking to diversify and earn more passive income. The minimum investment amount is only $10.

Another great private real estate investing platform is Crowdstreet. Crowdstreet offers accredited investors individual deals run by sponsors that have been pre-vetted for strong track records. Many of their deals are in 18-hour cities where there is potentially greater upside due to higher growth rates. You can build your own select real estate portfolio with Fundrise.

I've personally invested $954,000 in private real estate since 2016 to diversify my holdings, take advantage of demographic shifts toward lower-cost areas of the country, and earn more passive income. We're in a multi-decade trend of relocating to the Sunbelt region thanks to technology.

Both platforms are sponsors of Financial Samurai and Financial Samurai is an investor in Fundrise funds.

The 1/10th Rule For Car Buying is a Financial Samurai original post. I came up with the rule in 2009. If you want to build more wealth, join 65,000+ others and sign up for my free weekly newsletter.

Do the rules change at all once you retire or should a car still be a tenth of 4% of liquid, invested assets? (e.g., if you have 4mm in assets, only get a car that’s 16k) I would think some other rules might come into play especially if you no longer have a mortgage.

Good question. Once you retire or have reached financial independence, your income usually declines but it is made up for by your assets. You can relax the rule. Instead of a car being 1/10th of income, you can lower it to 1/5th. It’s really up to you and your liquidity situation and goals.

Given you don’t want to die with too much, it’s worth spending up if you think that you will. Be intentional with decumulation spending as much as you were with accumulation before retirement. It’s harder than it seems!

Personally, I told myself I would buy a new car in 2025 once my Range Rover Sport turns 10. But now that I’m here, I’m finding it hard to do!

Since you’ve read this post and have thought about this question, I think whatever you decide will be fine. Best to you.

Good question. Once you retire or have reached financial independence, your income usually declines but it is made up for by your assets. You can relax the rule. Instead of a car being 1/10th of income, you can lower it to 1/5th. It’s really up to you and your liquidity situation and goals.

Given you don’t want to die with too much, it’s worth spending up if you think that you will. Be intentional with decumulation spending as much as you were with accumulation before retirement. It’s harder than it seems!

Personally, I told myself I would buy a new car in 2025 once my Range Rover Sport turns 10. But now that I’m here, I’m finding it hard to do!

Since you’ve read this post and have thought about this question, I think whatever you decide will be fine. Best to you.

Hey Financial Samurai, you’ve really hit the nail on the head here despite what all the negative comments are saying, so thank you! In 2017 I bought a 7 year old Ford Focus for $3100, and that is what made sense to me because I had just graduated high school and was making about $31,000 as a machinist. I make a lot more now, but I absolutely refuse to pay the inflated prices we are seeing for new and used cars, so I’ll probably keep driving it! It’s safe enough! I keep up on the maintenance, and it’s got plenty of good safety features.

Good work Phil! Keep saving and investing your money. The compounding really starts to take off after about 10 years.

I can’t pay these inflated used and new car prices either. They are nuts!

I think you’ll enjoy this latest car post of mine: https://www.financialsamurai.com/driving-a-28-year-old-beater-made-me-love-my-car-again/

Sam,

If this is supposed to apply at a household level as well (i.e. using household income, and applying to more than one car) this is seriously aggressive!

It’s supposed to be!

Indeed. To reach financial freedom sooner, one must be more aggressive than the typical person. You don’t have to follow the 1/10th rule exactly. You could also drive your car long enough where it’s worth only 10% of your gross household income as well.

I’m just trying to help people consider the costliness of buying and owning a car. Too many people buy way too expensive of a car for their own good. But, at the end of the day, people are free to spend their money as they wish!

Personally, I like to use the 1/10th rule as motivation to earn more if I want a particular car.

Here’s another ratio to consider: https://www.financialsamurai.com/house-to-car-ratio-for-financial-freedom/

Do you want to live a life worth living? A life of safety so you can even get to the golden years sound? A life where you’re not strapped and constantly thinking about money and savings? I consider these small stresses no matter how much one gets used to them.

The 10% income rule is simply absurd. It conflicts with your ultimate goal of early retirement which is to be at ease from STRESS of work and BETTER quality of life. If you had to tighten the belt this much just to stop early, I question your ceiling and lack of ambition. Do people value not working this much to live with $6k car that may not even have safe side curtain or knee airbags? Am I wrong to see this as a sign of laziness or lack of ambition?

You hear YOLO lots, but whatever little wisdom there is, is important. I took an advice early when I was younger to put your energy/efforts you use to save money towards finding ways to make NEW money. You can’t save your way to true riches. Be ambitious while you’re young. Stay driven after you peak.

I feel that through this website you have stayed driven and pursuing your ambition because your site is very successful. But your 10% rule just to aid towards early Kirkland retirement is diverging from your life story, preach ambition, preach responsible spending not unrealistic spending. Then again maybe you’re chasing shock value click bait, which you have succeeded with me lol

If you want a nicer car, my 1/10 rule for car buying encourages you to make more money before buying that car. It’s a break from people buying things they want without being able to comfortably afford it yet.

I’m glad to have succeeded with you. If you want a nicer car, my 110 rule for car buying encourages you to make more money before buying that car. It’s a break from people buying things they want without being able to comfortably afford it yet.

Are you talking about buying a car with cash, or borrowing money and having to make payments on it?

For anyone making payments on a car loan, I agree that it makes sense to consider their income when setting a limit.

But for anyone who buys a car with cash, I would say the cap is whatever amount of cash the person has saved up, that they are willing to spend on the car. If they want to have a nicer car instead of this year’s vacation, or the whole family deliberately spent less on Christmas presents so they could have more money to spend on the better car, those seem like perfectly valid tradeoffs to me.

I’m talking about paying cash, Leasing, or borrowing. My 1/10 Rule for car buying encompasses all forms of ways to buy a car.

You could’ve saved up enough to pay cash, but if that leaves you with a liquidity shortage, or the car is way more expensive than what your income can afford, then that could be a problem. Because don’t forget, there are maintenance, expenses, taxes, tickets, and accidents to pay for as well.

I agree with your logic although I also agree with many of the comments regarding how difficult this may be.

So long as the consumer buys on impulse and desires a shiny new vehicle every few years, the Automobile industry will continue to charge ridiculous prices while providing justification for the expense. In reality much of it is all about ever increasing quaterly profits.

I exceeded the 10% rule purchasing my first ‘new’ truck. Or did I? I recieved the same trade in price on my older truck as I had paid for it 5 years earlier. Had a large enough down payment to limit my loan amount so that it could be paid in 4 years vs 5 thus saving many dollars in interest. In the end the truck cost 27,000$. I ran it for 24 years and performed all service myself. Doing the math that’s about $1100 per year. 20 years of that was no payments other than gasoline, tires, oil, typical maintenance items. My gross income was greater than 11k per year.

My other vehicle is a 2005 Corolla, purchased with 1000 miles on it for 16k. Another $1100 per year auto. Still kicking and hope to get another 10 years.

Looking at things that way I have spent way less than 10% of my gross annual income (assuming 80,000k).

Does that math work?

Used cars are selling for more than they were new now. The market is crazy. And so are you apparently if this is your advice. Maybe go back to the 2000s or something where this might’ve not seemed so unrealistic.

Used car prices are now about $3K less than the 2022 peak; down 12%. It is still above 2021’s nadir.

The Manheim index had prices going from 150 (2020) to 260 (end 2021) and now down to 199. The graph looks like it should be about 175 now, so we are about 14% high.

The other thing to note is that wages have increases about 22% over the same period.

So adjusting for car price fluctuation over Covid, an 11.4% valuation would get the same car as the 10% from earlier.

And the average person should be able to afford that with their 22% wage increase.

For example a person previously on $50K, would be advised to purchase a $5K car.

Now that car would be $5,700. But that person would be earning $61K, so could easily afford it. In fact they can get a slightly better car.

Once you get over your ego, you can see that buying TWO $4k crapbox 20-year old Corollas every year would cost you less than buying a new Camry at $37,000 / 7% / 60 months. That’s assuming you just throw the first one away without selling for salvage and buy the second one, and also doesn’t even account for the differential in insurance costs (full coverage and gap insurance would be required for the brand new car).

And that’s just a Camry. It’s more than $10,000 LESS than the average new car cost in the US ($47,244 in 2024).

This concept was interesting until I did the math. It makes no sense at all based on the actual cost of cars today. Not to mention the cost of repairs, associated hassle, and loss of time getting repairs done. It is also theory and makes zero sense in practical terms.

What does your math say? Feel free to share it and some examples.

The solution isn’t to spend more on a car. It’s to spend less.

Make sure your House-To-Car Ratio is as high as possible if you want to achieve financial freedom earlier.

Pardon me if I may come across rather bluntly, but you are absolutely deluded… And I’m saying this after double checking whether there might have been a mistake and you are relating about how things were 5 or 10 years ago – yet it says clearly this was written 02/01/2024!!! Have you actually checked car prices in the past few years before saying one should only pay 10% of one’s yearly salary for car acquisition? I suppose you will also say people shouldn’t spend more than 25% of their income on housing? It begs the question: IN WHAT WORLD ARE YOU LIVING?

I am a pensioner on $20,000 (Canadian) a year and $2,000 cars are simply impossible to find. I just got offered a 2005 Camry for $6,000… My present car is a 2004 at the end of its rope (250,000 km in the rust belt is an achievement by itself) and I should spend 30% of my yearly income on a car that may perhaps last another 5 years, if I’m lucky?

I’m sorry, but advice like yours reeks of the famous “let them eat cake” remark attributed to Marie Antoinette of France before the French Revolution when people with money were like they are today, totally disconnected from the reality of the majority.

No worries. I’ve heard much harsher language before. If you are a pensioner, hopefully you have amassed a large enough net worth over the past 30 or 40+ years working to retire comfortably.

If that is the case, then you can follow my net worth rule for car buying, which used assets as a barometer.

Not everybody is as privileged to have invested and lived through the greatest bull market in history, while having a pension. Something like 14% or less of American workers are eligible for a pension.

For reference, this is the #1 car buying rule for financial freedom seekers. I introduced this rule over 10 years ago (this site started in 2009), and it has been followed by over 10 million people. I update this post every year.

For those of us that make more average incomes you have to almost completely throw out this 10% rule of you want a good car in today’s environment.

I make $66,000 a year and I’m probably going to buy a used 2022 Toyota Prius for around $23,000. Right now I own a 2007 Chevy Impala with 122,000 miles on it that’s burns oil. I live in a Rural area of the Midwest with no public transportation whatsoever, so I drive about 18,000 miles a year. Many of my coworkers drive 25-30,000 miles a year.

I was planning on keeping my Chevy impala forever. Drive your car into the ground baby! Until my mechanic got my car underneath a lift and stabbed a screwdriver straight through a rusted out structural portion of the frame. My vehicles frame could snap on the highway at any time. He told me not to take it out for any interstate driving and he is right.

Now if I follow this rule above, I’ll have to spend $6,600 on a car. You know what kind of car I can get for $6,600? Basically exactly the same car I have now (minus a bit of rust). So now I’m back to owning another late 2000s car with over 100K miles on it and probably the same engine and transmission issues my current car has. I might as well buy something newer and treat it better this time around.

But Why a Toyota Prius? Because they consistently get 50MPG on both the highway and city driving. Why do you think whenever you go to an airport all the Ubers and taxi cabs are Priuses? Because they have the lowest total cost of ownership over their lifetime. The 2022 Prius uses a single speed planetary gear style transmission, dual port injected 4-cylinder Atkinsons cycle engine, and has no drive belt or alternator that can fail. The head gasket issues and EGR clogging problems have been solved in the 4th Gen Priuses. The toyota Prius also has a bunch of plastic panels on the bottom to protect the hybrid system, but has the added side effect of protecting the undercarriage from corrosion.

I plan to drive this car into the ground as well, and I think this is the only sensible additude to have if you plan on buying a new car. If you plan to buy a newer car, plan ahead that you will own this car for the next 10+ years and purchase accordingly. This time I’ll use cosmoline on some areas known to rust.

Excellent feedback and analysis. In your situation, a reliable car is vital given you drive so much. Hence, relaxing the 1/10th rule makes sense.

I still wouldn’t pay 1/3rd of my income on a car, but that’s just be.

I’m a big fan of driving a car for 10+ years. My car is a 2015, so it will complete 9 years come July 2024. But it only has 51,000 miles.

Enjoy the Prius!

I think your car spending is reasonable as long as you can pay cash for it. You obviously need a reliable car you could drive for the next 8-10 years. For example, Dave Ramsey recommends not to spend more than 50% on annual income on ALL vehicles owned by a household. You are well within this range. The sad truth is that majority of Americans buy cars they can’t afford and that is why 85% of them are bought on credit or leased. Sam’s 10% rule I think is mostly for people with high incomes who pursue the FIRE dream. I personally try not to spend on a car more than my monthly income, which is easy to do if you make $40-50K a month, and pay cash unless I get 0% financing for 36 months. Congrats on you car choice.

The answer to everyone’s doubts/concerns below is a used Lexus ES350 or RX350. I bought my 2011 RX350 in 2015 for $20k cash and my 2014 ES350 this year for $17k cash. RX350 has been flawless and and has 138k miles on it now. The ES350 is flawless (same drivetrain as RX350) and has 66k miles. I make 160k per year and keep my cars till the tires fall off. Both cars will EASILY reach 250k miles (probably 7-8 years for RX350 and 10 years for ES350). A Lexus or Honda product will last the duration and have small maintenance bills. TBH, I would not have to think twice about buying a 2007 ES/RX350 for $5-10k as they are solid cars. I think this post is brilliant and should be followed.

Greetings,

In 2015 my wife and I bought a new Scion xB, 2015 model year, for $18,840. Our previous car had died and I really needed another one for commuting to work. True, we didn’t need a new car, but the price was acceptable considering it’s a reliable Toyota product. Our combined annual income at the time was $203,000. I still drive the same car today. It’s in very good condition, fun to drive, and we never regretted the purchase. And it has never had a mechanical failure. This 10 percent rule can be done successfully. Don’t waste your money on cars. Thank you for the good advice on this web site.

While I understand and can fundamentally agree with the principals behind this rule, it’s laughable how out of touch this is to the reality of most. I’m sure it’s easy to preach one size fits all financial advice when your individual gross income VASTLY exceeds that of whole households across society.

Why is me buying a $8,000 car when my income was over $80,000 out of touch with reality? The second hand car I bought served me well for over 10 years. Then I followed my 1/10th rule for car buying again and bought a $20,000 Honda Fit and traded in my old car for $1,500.

Just because your reality is different from another person’s reality doesn’t make another person’s reality laughable. What’s laughable is the median household of only $75,000 in America buying an average priced car of $49,500. That’s a surefire way to never achieving financial independence.

Being able to invest and watch the money compound over time for more freedom is way more valuable than buying an overpriced car that is guaranteed to depreciate in value. But, to each their own!

I bought a brand new Mazda 3 about 12 years ago that I still drive. I was probably at about 20% car price / income at the time, but I had saved quite a bit of money the previous 2 years not having a car at all. Now with the car value falling and my higher income I’m under 5% in car value / income even with today’s inflated used car prices. A car has generally been more a convenience and luxury for me since I do live in an area with good public transportation.

With current car prices, is the 1/10th salary rule a pipe dream? I think it’s impossible currently and possibly moving forward.

I just sold my 10 year old Hyundai Economy car for $10k to Carvana. It needed atkeast $2500 in maintenance. New tires, brakes, suspension… but had pretty low mileage at 55k miles. Carvana will probably turn around and sell it for $15k. I bought it NEW for $16k in 2013.

1/10th rule for someone making $50k a year is a $5k car. I would fear for my life driving a $5k car in this market.

$2500 is a lot less than a new car

If you’re earning minimum wage you probably shouldn’t even have a car. You’re sore doing more on gas, insurance, parking and repairs than you can afford. Take the bus. Ride a bike. Walk. Fiscally speaking you probably should not own a car unless your household net is more than $80k, and even then you’re throwing away more money than you can really afford.

I agree that as income goes higher the ratio would change. Probably every $50k mark ratio lowers. Nobody is making $200k and then buying a camry. Also to ppl complaining about used cars Toyota is King and Honda is probably second. It’s funny how ppl will buy an American car (ford, Lincoln) complete crap and then blame it on that it’s used.

My Goal is:

making under 50k > buy no car or motorcycle

100k > used Toyota Camry, 10 years old

200k > used Luxury 5-10 years old (Mercedes’ Lexus etc)

300k > buy any car I want: S class or Tesla P100 or rotate every year

I’m making over $250 and still drive a Rav 4 hybrid. Maybe I should scale up for more comfort, but with current economy, it seems foolhardy.

I wonder how this formula translates to EV, with the price premium associated with them (20-30% cost of equivalent class of cars). I guess 1.30/10 of salary, or do we all need to go down a class? We need to take into account the long-term fuel savings and maintenance costs. I hope this article gets updated.

I’d assume you mean 1/10 of your net sal not gross? Well that only leaves me with very high mileage car that would be more in my machanic’s garage then in mine. The cost of used cars have skyrocked due to high demand and inflation with your paycheck not keeping up.

I had an old car for years but I had to junk it because they don’t stock the parts anymore; the fuel pump went (it was replaced six months before) the car would have kept going if I could find another one but that model car was long gone to the crusher in all the junk yards.

So far I’m lucky that I can walk or bike to work but that’s gonna change too since my rent is going to skyrocket which will force me to move farther away from my job. So now I have to look for a car that is dependable/low miles/cheap to insure/good on gas for around 3,500 or less?? Not in this lifetime!

Gross. Sorry if I was not clear in the post. But I will make it more clear now.

For three years, my car was probably worth between $2000-$4000 until I finally traded it in for $1,500. It worked fine.

As I made more money, I bought a nicer car. It’s a good motivator!

does this include insurance or just the purchase price? As a new driver, my insurance premium is worth more than the cars I am looking at.

Definition of lifestyle creep

Indeed. And if done well, it’s great because it feels so good to spend more money as you get wealthier. Otherwise, we end up dying with too much. And that would be a waste.

wow just ignored my question. Great ethics you have. You have all this money but no manners

Curious. Do you think I owe you anything? If so, the entitlement mentality you have might really hurt you over the long term since you’re not paying anything and consuming this post for free. There are over 1,200 comments on this post. It’s hard to keep track of everything.

Please work on your emotional intelligence (EQ) if you want to grow your wealth, build better relationships, and live an easier life.

“does this include insurance or just the purchase price? As a new driver, my insurance premium is worth more than the cars I am looking at.”

To answer your question, just the purchase price.

At some point this rule stops making sense right? Like if you have a household income of $300k you can afford a $50k car easier than someone who makes $60k a year and buys a $6,000 car.

As you make more money your cost of living doesn’t go up unless you decide it should, but a loaf of bread costs the same regardless of your income.

Great article. My partner and I are a one-car household. We own a car that we purchased for less than 5% of our gross annual income. Pretty good, right?

However, I am starting to look at the total cost of ownership more closely. We’ve been considering getting an EV for some time now. With the higher price of gasoline and extra maintenance costs for ICE vehicles, we would actually save money on an annual basis by trading in our car for an EV that is more expensive on paper (paying cash for the balance, of course).

Hi Jesse – You might enjoy this post on the getting an electrical vehicle might finally be worth it.

Thanks for the link! The only thing holding is back is the recent spike in price of used EVs. Of course, if that gets much worse it will make ICE vehicles look good again.Had we bought a Nissan Leaf a few years ago I’d be sitting pretty right now.

My disability insurance payment is about $2300 per month. I had paid my home off early and inherited around $120k. I want to rent for a year to improve my credit score so I can buy a modest home costing around $150k. I was planning on spending $20k on a car that I intend to keep 10+ years but after reading these articles, I’m second guessing if I should limit the car purchase to under $5k. I have no problem driving a beater; 20 years ago when my terminal illness made it impossible for me to work and make the money I was used to earning I learned really fast that when that hood gets popped open, some cars still say “Toyota”. I then let my high dollar, high payment car go and spent $250 on an older car that lasted 2 years. I haven’t had bought a car via financing since that time. Just wondering what my best strategy would be right now.

Sounds like you need a really reliable car. 10% of $2,300 a month is $230. I would just pay $20,000 cash for Toyota Corolla for something really reliable with the hundred $20,000 inheritance. Keep it simple and minimize car stress.

Hi Sam.

I’m Brazilian. How can I apply and follow this rule living in my country, with a different currency?

Same concept. Spend no more than 10% of your annual gross income on a car, even if it’s in Brazilian real. This may make things even tougher to buy the car you want. But again, a car is a depreciating asset. So you want to allocate the least amount of capital possible to a depreciating asset.

Old used Camry?

One must really love money and hate oneself to do this

Birthing wrong with a used Camry for folks making under $150,000 a year. My dad used to have a 7-year-old one when I was in high school. It ran great. He retired at a regular age and is comfortable.

My wife and I tried this rule. In 2018 we picked up a 2010 Subaru Legacy for $7500 (cash), we were making around $120k at the time. Later on in 2018, we picked up a 2009 Ford Expedition EL for $5000 (cash). Our income has nearly doubled since then. We did the FS and DR approach all in one. It worked well for us to build up savings, but it was a pain in the backside.

The Expedition turned into a headache, leading to us being stranded several times. We learned that the seller disabled the engine light when we bought it, then later found out (assuming) the mileage was rolled back… A LOT. Yes, we did a Carfax on it prior to buying it but the mileage was most likely rolled back 5 years prior. We ended up putting about $8,000 in the car over the 3 years we owned it, not including oil changes. $13,000 in over 3 years, $1,500 back to us on trade-in.

The Subaru did us well for the most part, we ended up having a transmission issue that was going to cost us $6500 to replace, and we had put about $2500 into the car over the 3 years we owned it. It would have been $9,000 repairs over 3 years PLUS the $7500 we bought for it, so we declined and traded it in. We received $3,000 for the trade in for parts, it would have been $5,000 if we replaced the transmission. If we replaced it, that’s $19,000 spent over 3 years on a car that gave us 35,000 miles – it could have gone more had we replaced the transmission but that cost effectiveness just wasn’t there.

We bit the bullet and bought brand new cars.. 2 of them.. we told ourselves we were NEVER going to buy a brand new car. Our financial situation is/was in a good spot; we didn’t follow the 1/10th rule but both cars will be paid off within 36 months. The comparative cars we were looking at were $30-$40k with 100k+ miles, or we spend $40k on a brand new one.

We have 3 kids and live in rain/snow, so we wanted AWD and space. We had PTSD (jokingly) with buying the Expedition and didn’t want to take another chance – too many DIY people out there that don’t know what their doing to their cars. The car loans are sub 2.5% as well. We bought the two new cars thinking that if they last long enough, two of our kids will have them around the 10 year marks.

We paid a “premium” for space, updated safety, reliability and longevity. Even if we have some repairs that are a few grand every 5 years, and we put 200k on the cars before the kids get them, we KNOW the history of the car and we won’t have any surprises.

All that being said… I do like the 1/10th rule and understand it greatly, especially when you’re looking at sling-shotting yourself into a better financial situation. We are also fortunate enough to continue investing/saving/paying off debt with the car payments that will soon be gone.

Cheers.

Much cheaper to buy brand new cars in a long run.

I don’t know who came up with the 1/10th rule, but it was clearly someone who knows nothing about cars. Cheap cars are unreliable money pits, and your story illustrates that. I’d rather spend more for peace of mind.

But I don’t have financial security. At least I have a nice car!

Very interesting article and very informative to many (but not all) people. That being said, not everyone is in the upper 10% wage earners and can waste their hard earned money on such toys costing the majority or more of their income. Those folks that drive BMW’s & Mercedes…all the power to you if you can afford it. But not everyone lives in California, metro-NYC or similar area and has that much disposable income.

The key (as I am in my mid-60’s) after living all over the USA and parts of the world is DON’T LIVE BEYOND YOUR MEANS. Sure, everyone wants to live on the beach with palm trees and great weather year round. I know, I did it from Southern California to the Castles of Edinburgh and everywhere in between. Now I live in the country far from the big cities and related stress due primarily to financial uncertainty. Why uncertainty? Because NOTHING is guaranteed in life except taxes and death. Not your job, income level, health, stock market, vehicle, spouse, home/apartment or anything else. A simple accident or mishap can alter a persons entire life. With all the insanity in today’s “Covid Culture”, things have gone “Bat-S*IT Crazy”.

That being said, after reading many of the comments in this thread, it is interesting to say the least, hearing from both sides of the financial spectrum. What works for someone living in upscale San Francisco is not going to work for someone living in rural Columbus, Mississippi and vice versa.

Personal opinion, if anyone is living paycheck-to-paycheck and spending $60K on a new truck is either trying to impress the girls or over-the-top with testosterone injections. The older guy’s reading this know exactly what I’m talking about…we all have done it to some point. I have seen young people go without eating, live in a dump and work numerous part-time jobs just to make the monthly truck payment on the $60K PU. Insane.

I have always bought high-mileage dependable vehicles. Yes HIGH MILEAGE and if you park them side by side to a new car, you can’t tell the difference. I have read in this thread that a cheaper vehicle will cost $3000+/year in auto maintenance. Yes, if you buy garbage…evidently the guy who wrote that has no idea on how or what type of used vehicle to buy. Remember, in the 1970’s and earlier (specifically up north) cars that made it to 50,000 miles were considered unheard of. The body would rot before the engine failed. No so much today. I’ve seen vehicles past 400,000 miles on the road! You need to have an experienced individual go to the seller and inspect for anything major. The transmission and engine are the biggies. There is no reason you can not have a decent car for around $2500 if you do your homework.

Think about payments. Unless you pay cash (most do not), you can double the amount of the loan if you take it to full term. A $15,000 loan will be like $30,000 when all paid off. Then the REQUIRED FULL-COVERAGE INSURANCE until the loan is paid off in full. If you live in a big city, that is BIG BUCK INSURANCE. Yes, you might save on gas mileage over time and repairs, but, will you be paying $400+/month in auto repairs? I don’t think so.

Bottom line, do what is best for you and your situation as no 2 people have the same variables. What works for me may not work for you. Personally, I don’t have a “Status Class” vehicle to drive around trying to impress others as is unfortunately so common. I’m happy with my 10-year old Jeep Grand Cherokee that is paid off in full ($3000 at the time) that has no body damage, has over 200,000 miles on it, spent only around $300 over the past 2 years in maintenance parts (I repair my own vehicle) and was worth around $40,000+ when it was new. I’ll drive it until it drops. If I bought it new and took out a loan, I would have been a slave to the bank and insurance company for 5+ years. Less stress my way!

PS – Don’t get credit cards unless you pay it off 100% each month either. The 20% interest will eat your soul if left to pay out over time!

I do somewhat agree with the objective and reasoning of the goal, with one caveat. The rule is certainly achievable IF you can perform some car repairs yourself.

I make about average household income, and I own a 2001 Honda Civic and 1991 Toyota. By that metric, I am meeting the 1/10 rule. But for these cars have repaired them myself. The timing belts, faulty camshaft sensor, replacing brake pads. If you can do the work yourself, buying a Civic, Corolla or Camry, you can reliably get by paying very little for a functioning car.

Also, I don’t stress things like dings in parking lots, thieves targeting my cars, or any other damaging element.

I will say I agree with the author’s sentiment, but I do not think it is a make or break law. If someone does 1/5 instead, but sacrifices other areas, they can still accumulate respectable wealth. But the author already made a table for that anyways.