You might be afraid of an adjustable rate mortgage increase once the introductory fixed rate period is over. However, there is always an adjustable rate mortgage increase cap that prevents the borrower from paying too much. with the ARM interest rate cap, ARM holders can better plan for their future.

Let me explain how much an adjustable rate mortgage (ARM) can increase using my own 5/1 ARM example. In my strong opinion, taking out an ARM over a 30-year fixed rate mortgage is the best way to go to save money.

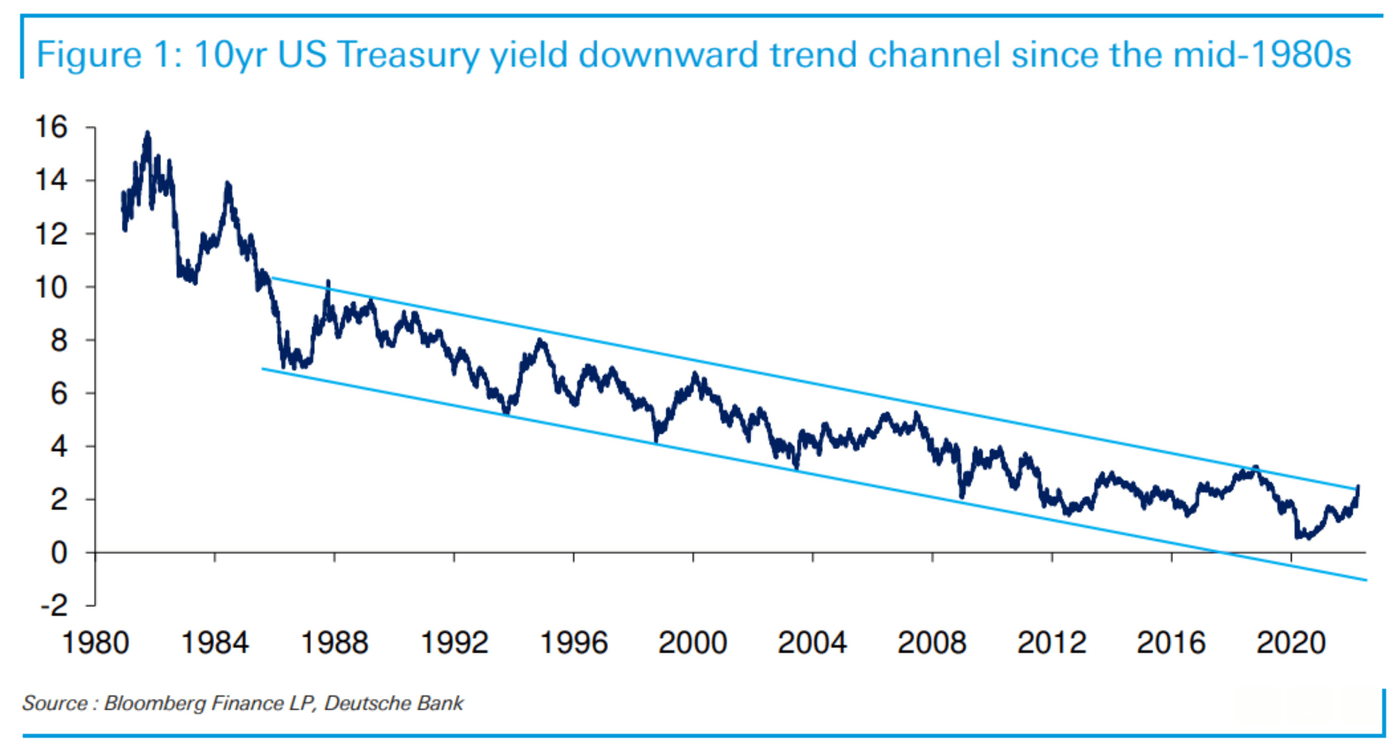

Interest rates and mortgage rates have been coming down since the 1980s. Sure, there will be temporary bouts of elevated inflation for a year or two. But due to efficiency, technology, and a more intertwined world, interest rates will likely stay low for the rest of our lives. Paying a higher mortgage rate than you need is a suboptimal decision.

Adjustable Rate Mortgage Increase Cap

We bought a San Francisco single family fixer in 1H2014 for $1,250,000. We were tired of living in the north end of San Francisco for the past 9.5 years and wanted a change of scenery.

Originally, we had planned to relocate to Hawaii, but when we found our current house with ocean views, we though this would be a good compromise.

We put down 20% and took out a $992,000 5/1 ARM. Originally, I was going to put down 32%, because I had about $430,000 come due from a 4.1% 5-year CD. But with a mortgage rate of only 2.5%, I felt it was worth borrowing more and investing the difference.

The 2.5% 5/1 ARM was based on the one year LIBOR rate + a 2.25% margin – 0.25% discount for being an excellent customer. Back in 2014, the one year LIBOR rate was at only 0.5%, hence my 2.5% rate.

LIBOR As An Index For An ARM

The London Interbank Offered Rate (LIBOR) is the average interest rate at which leading banks borrow funds from other banks in the London market.

LIBOR is the most widely used global “benchmark” or reference rate for short-term interest rates. Check out the historical one-year LIBOR chart below.

As you can tell from the one-year LIBOR chart, I bottom-ticked my mortgage rate in 2014. Some of you might be thinking that instead of getting a 5/1 ARM, I should have gotten a 30-year fixed rate instead.

But given my strong belief that we will be in a permanently low interest rate environment for the rest of our lives, I felt that paying 0.85% – 1.25% more for a 30-year fixed rate was a waste of money. So my actions followed my brain.

Besides, the average homeownership duration in America is only around eight years. At most, one may consider taking out a 10/1 ARM to match durations.

Matching ARM With Ownership Duration

As I planned to either sell my home within 10 years in order to buy a nicer home in Hawaii or pay off the mortgage during this time frame, to me, taking out a 5/1 ARM was worth the “risk.”

At one point during my 5-year introductory fixed rate term, LIBOR rose to about 3%. Based on a net 2% margin, this would mean my ARM could potentially reset to 5.25%.

If I end up paying 5% for the next five years, my average mortgage rate over a 10 year period would be 5% + 2.5% = 7.5% / 2 = 3.75%. 3.75% is pretty much in-line with the rate I would have gotten if I just locked in a 30-year fixed rate mortgage back in 2014.

However, with the money saved from not paying a 30-year fixed mortgage and the $100,000+ less in downpayment, I ended up investing the difference and earned a ~12% return on average from 2014 – 2022 because the stock market went up.

The percentage of loans that are adjustable loans is still under 5%. This is unfortunate because this means 95% of American mortgage borrowers are paying a higher interest rate than they should.

Terms Of My ARM Increase

But surprise! I didn't end up paying an estimated 5% mortgage rate in 2019. Instead, based on my adjustable rate mortgage increase cap, I received a letter saying that I'll be paying at most 4.5%. Have a look at the portion of the letter below.

The reason why my rate only goes up from 2.5% to 4.5% is that under the terms of my mortgage, my ARM can only reset by at most 2% after the initial 5-year fixed rate of 2.5% is up.

This maximum reset amount is pretty standard among ARM loans. But this reset amount is something you must have your bank point out in the document.

Maximum Mortgage Interest Rate For ARMs

The other thing to note is that ARM loans generally have a maximum mortgage interest rate they can charge for the life of your loan. In my case, that maximum is 7.5%, but we're never going to get there in my opinion.

Unfortunately, after one full year at 4.5%, my bank can raise my ARM by another 2%, bringing my mortgage rate up to 6.5% for year seven.

However, I doubt rates will keep on surging higher as the global economy slows. Instead, by the time my ARM reset occurs again in 7/1/2020, we might very well be in a recession with one year LIBOR rates moving back down.

What ended up happening was that before my five-year term ran out, I refinanced my 5/1 ARM into a 7/1 ARM at 2.625% with no fees in 2019. It was a difficult refinance, but one that I am so happy I did.

In 2020, I ended up buying a new primary residence and renting out my old house. Thankfully I refinanced my mortgage in 2019 because if I had waited until after I rented out my property, the mortgage rate would be at least 0.5% higher for rental properties. Always refinance before renting out your property to get the best rate.

Paying Down Principal Will Lower Payments Once An ARM Resets

You can see from the letter that despite my mortgage rate increasing from 2.5% to 4.5%, an 80% increase, my monthly payment was only expected to increase from $3,919.60 to $4,079.33, a mere 4% rise.

The reason for the slight increase in monthly mortgage payment is because we've paid down 32% of our loan in 4.5 years ($992,000 down to $734,000).

Paying down over $250,000 in our mortgage was partly due to normal monthly principal payments coupled with random extra principal pay downs. Although the 2.5% interest rate is low, paying down mortgage debt has always been part of my long term investment strategy.

Have A Disciplined Approach To Paying Down ARM Principal And Investing

Following my FS-DAIR strategy, I would regularly try and use 25% of my free cash flow to pay down debt and use the other 75% to invest. Again, I'm just taking action based on my own advice.

I kept on paying down principal randomly until the 10-year yield breached 2.5% in December 2017. Once the 10-year yield was higher than 2.5%, I stopped because I was now getting an interest-free mortgage since I could simply invest the amount of my mortgage in a 10-year bond yield to cover all my payments.

If I had taken out a 30-year fixed mortgage for 3.625%, I wouldn't have been able to experience interest-free living.

Your mileage will vary in terms of how much principal you actually paid down during the initial fixed rate period of your ARM. However, even if you didn't pay down any extra principal during a five year period, you will have still paid down ~10% of your principal balance, depending on your interest rate.

Appreciation In Your Home's Value

Even if you've got to pay a higher mortgage rate when your ARM resets, you may be pleased to discover that your home has appreciated in value during the fixed rate period. The higher interst rates go, it likely means there's higher inflation due to higher demand.

In my example, the San Francisco median home price increased from $1,100,000 in 2014 to ~$1,800,000 in 2024, or a 64% increase.

A $550,000 median principal increase more than makes up for a measly $159.63 monthly increase in mortgage payment, roughly half of which is going to pay down principal anyway.

Again, your home's appreciation amount will vary. Unless you timed your home purchase completely wrong, such as buying in 4Q2006 – 4Q2008, you'll likely come out OK.

Even if you did purchase at the most recent peak, normal downturns usually last no more than 3-5 years with 10% – 20% corrections.

Partly due to the appreciation of your property during the fixed-rate period of your ARM, there's no rush to pay down extra principal before your ARM resets. The property appreciation will more than outweigh a potential interest rate increase. And the thing is, there's a decent chance your ARM may reset to the same rate or lower.

Make A ARM Mortgage Pay Down Plan

When I got the letter stating my adjustable rate mortgage increase, I had a year before my mortgage rate was to increase from 2.5% to 4.5%. As a result, I came up with a mortgage pay down play during the remaining months. So should you once your adjustable rate mortgage is set to increase.

Bottom line, don't be afraid of an adjustable rate mortgage increase. Rates likely won't increase or increase by much. If mortgage rates do, you can always pay down principal or refinance to another reasonable rate.

Summary Of What Happens When An ARM Resets

1) Match the duration of your mortgage's fixed duration with the estimated ownership duration or the length of time you estimate it will take to pay off the mortgage.

2) Paying for a 30-year fixed rate mortgage might provide you more peace of mind, but you're likely overpaying for that peace of mind.

3) Read the terms of your ARM loan carefully and figure out what is the maximum interest rate increase during the first reset and what is the lifetime interest rate cap.

4) Try to make extra payments during your ARM's fixed rate period to relieve potential interest rate pressure during the reset.

5) Don't borrow more than you can comfortably afford = no greater than a 80% loan-to-value ratio with a 10% cash buffer after a 20% downpayment. Being overly leveraged is what consistently destroys people's finances.

Real Estate Investing Recommendations

If you’re looking to buy property as an investment or reinvest your house sale proceeds, take a look at Fundrise, my favorite private real estate platform today. Financial Samurai is a six-figure investor in Fundrise funds because I believe in their philosophy of investing in the Sunbelt region, where valuations are lower and yields are higher.

Fundrise allows you to invest in a diversified portfolio of mid-market commercial real estate deals across the country that were once only available to institutions or super high net worth individuals. Fundrise focuses on single-family and multi-family properties in lower cost areas of the country. Thanks to technology, there is a demographic shift towards lower-cost areas.

Instead of taking a large concentrated bet in a single property, you can diversify across multiple properties with as little as a $10 investment each. In the past, accessing high-quality commercial real estate would require $100,000+ or more.

Shop Around For A Better Mortgage Rate

Check the latest mortgage rates online for free at Credible. You'll get real quotes from pre-vetted, qualified lenders in under three minutes. Credible is the easiest way to compare rates and lenders all in one place. As mortgage rates come down, it's worth shopping around for a lower mortgage rate.

In order to make more money, mortgage brokers and banks LOVE to scare the heck out of inexperienced homebuyers by saying their payments will surge higher once an ARM resets.

They don't show them a 40-year historical chart of declining interest rates. By scaring their customers, they have a higher chance of locking them into 30-year fixed rate mortgages for fatter margins. Don't be fooled. Mortgage rates have been trending down for decades.

What Happens When An Adjustable Rate Mortgage Resets And Increases is a FS original post.

In other words, the curve is flat. And in some places, it’s inverted. This is good news if you’re on the receiving end of the equation, but not great as a fixed rate payer.

Trying to determine what the best approach is today…here are some details.

Looking for a home around $500k, and will have 200k available as a down payment. Want to focus on getting as low a monthly payment as possible, but also am wary of the 30 year mortgage given all of the above mentioned points.

However, whatever house we buy, we do expect to live in for at least 15-20 years, as we will have two young children.

Have a buffer of investments of about 475k, and have 75k earmarked for college.

Wife currently works, but wants to explore not working or potentially going part time for the next 3-6 years.

Live in Midwestern city, make an ok salary for here but certainly not anything impressive for most people on this site I’d imagine (about 80k).

The best 30 year rate I see today is about 4.3%, and the best 7 year ARM is about 4.15% from what I see.

Am I crazy, or did the spread between the 30 year and ARM rates just get much smaller, thus making the ARM mortgage options less attractive?

You are not crazy. The spreads have narrowed as the Fed has been raising rates (shortest end). Therefore, we should be saving more aggressively in money market accounts and short-term treasuries (3-6 months). For example, CIT Bank is pay 2.45% for their money market account, which was unheard of just two years ago.

So yes, if you are a borrower, it’s making more sense to borrow over a longer duration of time. However, it’s still best to match fixed duration to the length of ownership or how quickly you plan to pay off the mortgage.

I’m seeing the ARM loans at 4.25% and above currently. As many of you have done, I did a refinance to an ARM at around 3.25% a couple years ago that will end in 5 years. I assume we are all in the same camp that rates will continue the down trend and just hold the ARM until the end.

The media portrays a scary picture of higher and higher interest rates…

You are very wise to keep a good chuck of cash handy for your Hawaii house ambitions. I can tell you from experience that having a larger down payment (or ability to pay cash with plans to refinance into a proper mortgage at a later date) is extremely important to your negotiating position. This is especially true if it’s a hot property with several people interested in it. Sellers usually go for the highest priced offer, but not always. Sometimes sellers will go with the buyer who looks like the best bet to be able to close on the house in the time specified, even if there are higher priced offers to consider.

On a related note, I’d definitely make friends with a few real estate agents in the market(s) where you’re looking in Hawaii. A good agent will be able to alert you to deals that aren’t on the public market (aka MLS) yet, which is a wonderful situation when it works out. I know some good agents in various places in Hawaii, so please hit me up if you need some suggestions!

I’m clearly not as educated as most folks commenting on this blog but have a pretty basic question on refinancing from a 30 yr to a 7/1 ARM.

Background

I bought my home in Q1 2018 for $780,000 and owe $660,000 paying 4.75% (horrible time to buy but home of my dreams so don’t care). It was a new build so my property taxes went from $1200 to $6,800/yr, my bank increased my monthly payment by $1000/mo (delta from prior year plus reserves for next year)! I’m motivated to reduce my monthly fees now, long term game plan is to do what you’re doing, pay a substantial amount down on my principal before the 7 year lock is up. Goal is to start a family and stay in this house until they graduate high school. I have a long-time girlfriend/roommate that I plan on marrying and this is our home. I’ve always done 30 year fixed and your insights have helped me shift that paradigm.

Now my question: I can get a 3.375% Interest Rate, 4.47% APR 7/1 ARM through Ally Bank. I have read many definitions on APR but I still struggle to grasp the concept. The difference between the IR and the APR? How much do I have to pay attention to APR?

I have a 2.875% on a 30 year. Whether an ARM makes sense depends on the spread and your expectation of rates. I could have save a little bit on a 15 year or 10 year but locking in for 30 years was a no brainer.

In 2012-2014 it seems like a bad deal given rates have gone up and you got to itemize. In 2019 the equation is different if nothing else because of taxes.

I certainly would not make the statement that rates will remain low within our lifetimes.

Either way, most folks can’t dump $250K into an ARM to lessen the impact of a rate increase. I mean going ARM isn’t a bad strategy but has more downsides than upsides when the rate was so low to begin with. I only paid .375% more than you.

Spending more than you need is spending more than you need.

I have a 5/1 ARM at only 2.375%.

Most financially savvy people have the financial means to pay down debt.

Went from a 10/1 interest only in 2006 to afford a significant upgrade (and knowing income would improve)…to a 30 year fixed refinance in 2008…to a no cost 15 year fixed refi in 2011 @ 3.375%… to a no cost 10 year fixed refi in 2015 @ 2.75%. Now, seven years left at 2.75% fixed. I want to think I made the right call with the combo of fixed + reduction in years even though, in hindsight, that initial 10/1 interest only was probably not necessary.

Excellent. You are beating the system. Like it.

Hi Sam,

My husband and I just bought a house in Hawaii. We were originally going for the 30-year conventional, but switched to an ARM after reading about them on your site.

We don’t plan to live here forever, but will be keeping it as a rental after we (hopefully) find our dream house. We got our foot into the dream neighborhood, but where I really want to be is basically across the street from where we currently live (are you familiar with Keolu Drive? I definitely have my eye on the Kaelepulu side of it).

Definitely bummed that we had to pay additional fees and mad that our realtor tried to tell us to stick to the 30-year mortgage (for his benefit), but glad to have come across your site and are saving at least $45,000 in the long run.

What areas are you looking in Hawaii?

We’re looking at Waialae and Kahala area. We love the quiet beaches there, the club, and the proximity to Kaimuki.

I’m not aware of Keolu Drive. What neighborhood is that and how much does a 4/3 house on a 10,000 sqft lot cost there?

Mr. Money Mustache got divorced and had to buy a house. I hope he read this post

Here is timeline of my loan on my primary home. I have refinanced twice to get better rate and currently paying 2.625 on 15 year fixed. There were no way anyone could have predicted how the rates will play up in next 6 months when I was financing it.

3.375 5/1 ARM July 2014 (Zero Closing Cost on principal 295K loan)

3.625 30 Year fixed refinanced in Jan 2015 18 MONTHS – 2015 (Zero Closing Cost on principal $290K)

2.625 15 year fixed refinanced in Aug 2016 ( $450 for appraisal and principal $250K)

Sam- great article. I have a 10/1 IO Arm with 7 years left at 4%. We just sold our free and clear rental property in San Diego. I’m going through the same debate right now with the SALT caps. We have 400k worth of cash that I just moved from AMEX Savings to CIT (thanks to you). With our mortgage being an I/O, we could save $1330 a month on interest if I throw that cash at the mortgage. (Balance of 560, house worth 850).

Considering paying it down, and opening a large HELOC in case buying opportunities return in the next few years. Question is, better off keeping the cash, or paying it down? Ran the numbers every way possible and over a 5 year period looks like a net 45k in interest savings if we do not end up re-investing that cash in something.

I refinanced to a 7 year ARM for 3.25% a couple years ago. The ARM does make me nervous and if rates drop back in the next few years, I may switch up to a fixed rate. I moved almost 10 years ago and plan to live here for a long time.

Love ARMs – a great tool that much better matches duration that you need. Much better ARM opportunities a couples years back vs now where the curve is much flatter.

One thing to note, for borrowers that are close to the banks max income to payment ratios, the ARM might be harder to qualify for than the fixed as you need to be able to afford a higher rate.

Also I know the average rate calculation was done for simplicity. But in reality your savings are even higher. Your principal post the reset is lower than initially (even without additional principal payments). So you are paying a lower rate on a higher balance and a higher rate on a lower balance.

Lots of math- but a good way to see the value of the ARM is to compare it by payments. If the 30yr fixed is X bps higher than the ARM, the additional payment is Y. If you prepaid that additional premium, and see where your loan balance is at the first reset. Then calc your max payment based on that 2% step up and see how many payments you have left – you will payoff earlier than the original 30yrs due to prepayments. Then compare that max payment to the payment you need to make on the 30yr fixed to pay it off at the same time. Generally, if you can qualify for the ARM, you will come out ahead with the ARM over the 30yr fixed but harder to do today with a very flat curve. I like a 15yr fixed if you can afford the higher payments.

Does the loss of SALT deductibility play a role in your mortgage plans?

Absolutely. Based on the $10K SALT cap… and a 4.5% impending mortgage rate, I should pay down the mortgage by around $500K – $600K come reset time.

But I may just take the standardized deduction of $12K. Less mortgage debt is better at the end of the day.

Sam,

Didn’t the standard deduction double to 24,000 for married couples. Thought I had read that somewhere?

Yes, I was talking about per person.

Thanks Sam. Got nervous for second there.

The standard deduction is $24,400 for married couples filing jointly in 2019.

Guessing!, you may have over $75,000 (?) in SALT and maybe another $10,000 (?) in other deductions. At that level, you would lose about $60,000 in deductions. Your income tax rate will come down so you may be about even with 2018 (?) if you leave things alone, but not as good as someone who did not rely on SALT to reduce taxes, maybe to the tune of $12,000 – $15,000 (???).

Thank You Bob. Appreciate the information.

It’s a wild guess. I was trying to see if STS ($am the $amurai) thinks it is close.

That’s nice your bank will only reset your rate by at most 2% after the initial 5-year fixed rate is done. What an insightful 30-year mortgage interest rate chart too! It’s crazy to see how high rates were back in the early 80s, wow. What a huge difference to today!

Reading all of your posts I feel very foolish. I purchased my home in 1999 first home 30 year fixed 6.5%. Knowing myself not planning on ever moving 20 years this March. Paid extra toward principle got down to owing $68k thats when I made one of the biggest mistakes of my life I refinanced and wound up on roller coaster ride with ARM trying to keep my house from 2005 through 2009 with a well known western name company rates wnt up to almost 12%. I battled for years sending every dime I had to them. I then contacted local states attorney never got addition funds applied to the mortgage did finally get lower interest rates after modification. Lost my job 2011 thank God for grown children they helped me out when I used up all my savings in 2014 had no income couldn’t work because of health issues. Frustrated because kids were taking care of me I took early pension and lost alot of it. In 2016 my kids hired a lawyer for me helped get another modification because my payments and amount owed had sky rocketed and my monthly income was only $1700. The attorney found I supposedly owed almost $95k interest rate was 5.5%. After the modification $16k was forgiven my payments dropped to $435 with 2.5 interest for 5 years. I had a house fire in 2017 while out of the house waiting for repairs to be completed my kids wanted to pay off remaining amount I asked mortgage company for pay off hoping they would give me a break because of the fire they actually quoted me more than what was owed. Insurance went up because of fire so mortgage went up by $250. I don’t want my kids to have spend that kind of money when they have families and mortgages themselves. I don’t know what to do.

Hi there, can you explain how your mortgage interest rate went up to 12%? That doesn’t sound right because interest rates started declining further during the financial crisis. Did you get a negative amortization loan?

Hope things get better for you.

Sam can you comment on how to view the trade off between maximizing mortgage interest write off vs the pay down logic in ur post. Seems like that is one other factor to consider.

The $10,000 SALT cap is something all homeowners should factor in now for 2019.

In 2016 I refinanced into my cherished 10 year 2.45% fixed rate loan. I had been paying extra on my mortgage and decided that I should be compensated for it; I have not since paid any extra as this long term rate approximates what the current market will pay for liquid funds. I guess there is some opportunity cost with the increased payment each month but because the rate was so low and I had reduced the principal through paying down my first mortgage it was only $300/month more. I think this is an overlooked product which combines low rates of an ARM with the certainty of a fixed rate, but as most buyers probably look to buy as much house as they can afford amortizing the principal over 10 years is probably not realistic most of the time.

Very interesting.

Can you explain the logic of waiting for month 61 before you throw in the extra principal?

Opportunity cost and other investments that may pay more than 2.5%.

The 10-year bond yield, for example, is back to 2.7%. That’s a risk free return. The 1-year bond yield is at 2.6%.

Thank you for posting this because it’s very much on my mind. when I lived in Florida and before that I lived in the house for six and two years and so I was glad I used ARM loans. I bought my current house in 2016 at 3% for the 5/1 loan. I have been fretting when that goes up off and wishing that I had gone with the 3 7/8% for 30 years that I had the option for. I feel better with what you said but it’s a little hard to pay it down with the market being down right now and the stocks that I put some of the free cash in down. But I appreciate this post as I feel a lot better with not going with a 30 year mortgage

and I still have two years left before it goes up and who knows if I might get a new job and move away.

Interesting, we have had a fixed rate for 20 years and there months at an unheard of rate 6.75%. I have come across since rates at 2.75: from the last 3 years to currently 4.7 and had been trying to get my co title owner, husband, on board to understand, see the big picture of the money wasting making our home payment total amount more than tripled. I miss the banking earnings at these higher rates which we will never see again. Yet paying these rates on a big ticket item such as mortgage is maddening. You can take the horse to the water, but you cant make it drink it.

Suggestions, I know the Harp program is gone, it had benefits and no appraisal required.

How to make see-suggestions, figures/calculations/options/to see the loss and gains

Thanks for the post; great stuff for me to consider.

I am closing on a first position $400k HELOC. First draw of $350k will be fixed at 2.865% for 12 months. Will use the funds to substantially expand a property I purchased in Q218 into a mini family compound with 3+ live/work residences (vs. the current single residence). Will keep the funds in my high yield savings account (currently 2.10%) until needed. Suspect permitting will take ~6 months, but I will get as far as I can in 2019 with the HELOC funds.

Plan was to re-finance to a 30-year fixed at the close of 2019, since I plan to hold and own this property for 50+ years (I am mid-30s). Have multiple close relatives with various medical issues that may mean I need to support/subsidize them, and this was the best way I could see to do that. Otherwise, my property will be a terrific little rental (very flexible usage since my zoning is mixed use/commercial) only 45 minutes from downtown Seattle, no car needed.

Now I will do more research into ARMs…

FYI, CIT Bank has an online money market rate of 2.45% right now. Not sure how long it will last, but that’s much better than 2.1%.

Be careful leveraging too aggressively right now, especially around Seattle. Volume is way up and prices are down. Not sure how long the softness will last, but I expect all year at least.

Is it just me, or are you letting some other folks author today? This piece has a different tone, as do the comments. Who’s at the keyboard? Ms. Sam?

Yes, I am an AI program named Winston. How may I help you Mike?

What are some of the passages that gave me away so I can improve on my algorithmic writing?

The last time you commented was on 8/08/2018. Where have you been?

Well you mentioned hiring some help recently, and that the writers would have to be a perfect fit. I agree! I’m sure you’ll find a good balance/fit for the site.

I visit weekly and read almost everything, except for most of the comments, have been for over 5 years. Sometimes there is some substance in a few comments, not really worth digging through; most of the meat is in your writing and deeper logic explanations.

I don’t understand the view that rates have gone down for 30+ years and will continue to be low for our lifetimes. They can’t go down forever. They spiked up in ’68, ’73, ’78, etc. They’ve spiked in other countries.

Rates go up and down. My “historically low’ 3.375% 30-year fixed is a bet that either inflation or rates will take off sometime in the next 28 years. Won’t there be upward pressure on the US10Y eventually as US debt-to-GDP keeps creeping up, now past 105+%? Won’t there be inflation pressure if in the next recession we drop rates back down to 0%, run out of room, and have to expand the money supply?

Maybe I’ve been reading too much “Lords of Fianance”, but I feel like there’s huge upside to the chance of paying off my mortgage in inflated dollars or pocketing the difference of investment at high rates… and if I’m wrong, the downside is like 100-125 bp. OK at 6%, I’d just ARM and aggressively pay off but not at 3.375%

Your point about personal circumstance is very true. I’m thinking forever term, because after moving once a year in my 20s, I’m going to die in this house 100 years from now!

You have all the right to spend 30 years paying down your mortgage. Inflation will definitely help inflate away the cost.

Because I’m focused on reaching financial independence sooner, I’ve always had the goal of paying down mortgage debt sooner as well.

I’ve been so focused on optimizing my finances to reach Financial independence, but sometimes, I forget that it’s OK to waste some money sometimes, especially once you’ve already reached your goals.

This is why I am kind of reluctant to do a refinance. I don’t want to go through the experience nor do I want to pay fees. I’ll just more aggressively pay down debt now that I have an incentive.

Definitely do what’s best for you!

I comment specifically because I am muddled in my own mind about how to quantify this decision of ARM vs. fixed, pay off now vs later. I feel like I’m making the rational choice, but am definitely open to people pointing out how I’m wasting money…

I hate having any debt, and I feel like once a quarter I revisit whether I should be paying this thing down but then convince myself to hold off.

Your rate is not very high. I wouldn’t worry about it too much. I have never regretted paying off debt though, no matter how low the interest-rate.

Oh Sam, I think you’re the only person on Earth excited by a 2% increase in mortgage payments ;)

After reading your blog posts about mortgages, I was originally going to do a 7/1 ARM when I bought my home in, of all times, Q1 2018 (the worst time to buy, as per your article). I ended up deciding against when I saw that the difference in payment would literally be only a few dollars amount (I don’t remember exactly, but it was a comically small amount like $8 or something). Meanwhile, an ARM with your average 2/2/5 adjustment values would have risked pushing me into the 8% territory if rates continued to rise. I figured that simplicity would be best for me and went with the 30 fixed and decided to just pay extra each month. I think I’ve paid off over 10% of the principal in my first year.

It helps that my purchase price was only $120,000, and in a HCOL city as well. People usually think I’m leaving off an extra zero until I tell them it’s a 1 bedroom coop with an $800 HOA.

STILL cheaper than renting! :)

Regarding one thing you’ve mentioned:

“In order to make more money, mortgage brokers and banks LOVE to scare the heck out of inexperienced homebuyers by saying their payments will surge higher once an ARM resets.”

I’m sure part of it is that, but I think part of it is also for compliance/liability issues. In today’s lawsuit-happy society, I imagine lenders are nervous about being sued by borrowers angry that their rates went up. Having worked in retail banking, I can’t tell you how many times customers threatened legal action because of chronic overdraft or maintenance fees on poorly managed accounts. You can bet a local politician and a self-serving lawyer would stand behind these people in a class action lawsuit if there was ever a situation today with low-middle income people paying 5% or more on mortgages that were under 3% a year or two ago.

Sincerely,

ARB–Angry Retail Banker

Good point on compliance.

Jury is still out on whether 1Q2018 was a terrible time to buy. Prices have definitely softened, but if they only go down by 5% or 10%, that’s not a big deal.