The average household income in America is roughly $76,000 in 2024. In 2020, the average household income in America was $62,000 according to the U.S. Census Bureau. In 2021, the average household income was roughly $68,000.

It is clear that household income is finally growing thanks to inflation. With so much government stimulus to help save the economy from the pandemic, wage inflation and housing inflation should continue to grow.

Let's take a look at the two main government sources of reporting such income and drill into the details of income statistics by age, percentile, sex. We'll also look at median net worth amounts as well.

My goal is for every Financial Samurai reader to earn well above the average and median household income figures in order to achieve financial independence sooner, rather than later.

You can only save so much. It's much better to boost your income as high as possible.

Average And Median Household Income Sources

1) The Social Security Administration (SSA). Everyone who earns a W-2 paycheck will make payments to Social Security and Medicare. As a result, they collect all the wage statistics.

2) The U.S. Census Bureau. The U.S. Census Bureau regularly conducts surveys such as the Consumer Finance Survey, Current Population Survey, and Annual Social and Economic Supplements Survey. The only problem with these surveys is that they don't do them annually. The surveys are more on a bi-annual or tri-annual basis.

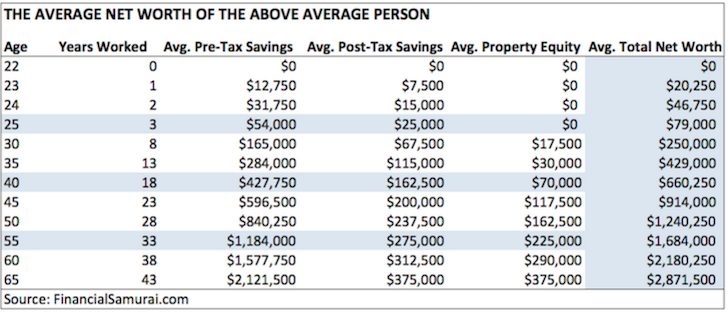

The U.S. Census Bureau has helped me build the net worth guide: The Average Net Worth For The Above Average Person. My net worth guide is to help people looking to achieve financial independence sooner, rather than later.

It's always much better to end up with a little too much money than a little too little. When you're older you don't want to have to go back to work in case of a shortfall.

Wage Income Versus Investment Income

Although we are talking about wage income (W2) that one earns from a day job, I want to highlight that wage income is not the most efficient type of income. The reason is, wage income is subject to the highest marginal tax rates.

Investment income is superior because it is passive AND subject to much lower tax rates. If you can hold onto your investments for greater than one year, you are subject to lower long-term capital gains tax rates.

See the difference in short-term and long-term capital gains tax rates below. The short-term capital gains tax rate is equivalent to the various wage income taxes.

The Average Household Income

According to the Social Security Administration (SSA), the average wage in 2019 was $48,251.57.

In a two-income earning household, the average household income is higher than $48,251.57, but unlikely to be twice as high. The reason why the average two-income earning household isn't ~$96,500 is due to the desire to have and raise children.

In most households, one parent often stays at home to raise children or reducing his or her hours.

The likely two-income earning average household income is likely closer to $72,000 – $80,000.

The Median Household Income

According to the U.S. Census, the median household income is roughly $74,000. The mean household income was roughly $80,000 as of 2019.

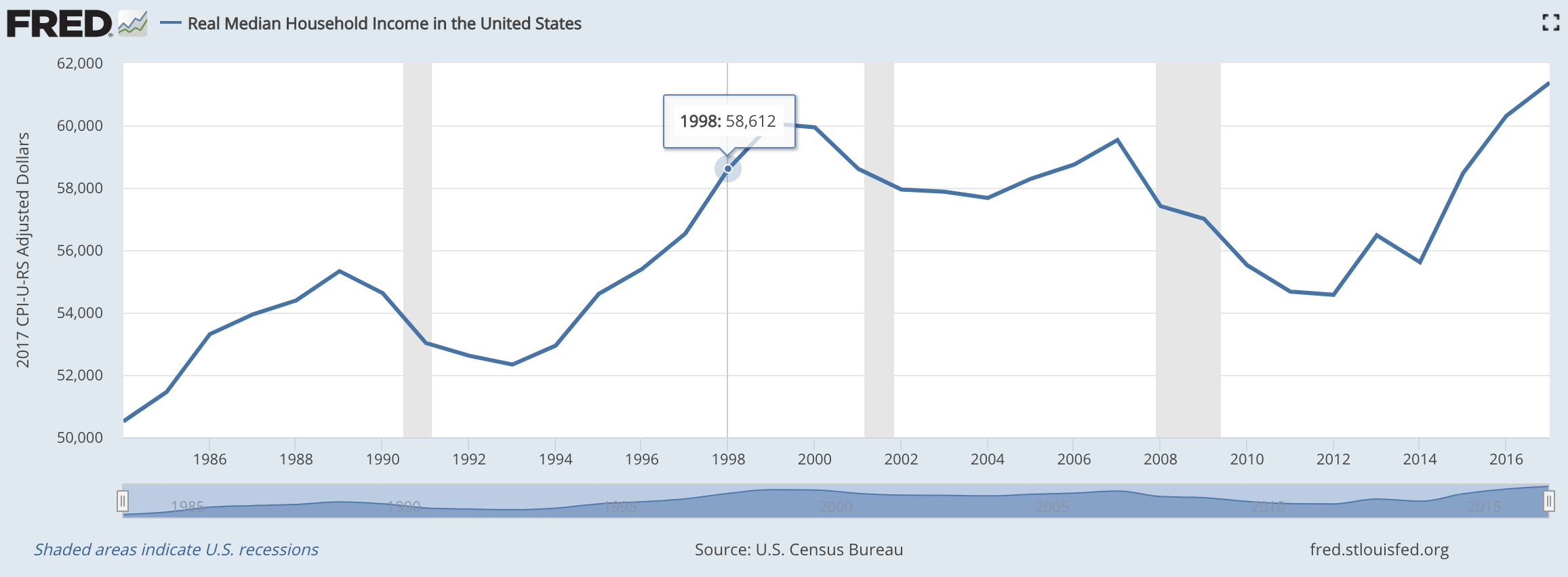

As you can see from the chart below, according to the U.S. Census Bureau, the median household income in America finally broke out of its 1999 high of $60,000, in 2017.

From 1999 – 2017, the median household income in America essentially went nowhere.

Below is the chart of the median income by age.

| Age of Householder | Median Income |

|---|---|

| Under 65: | $69,628 |

| 15 – 24 | $40,093 |

| 25 – 34: | $62,294 |

| 35 – 44: | $78,368 |

| 45 – 54: | $80,671 |

| 55 – 64: | $68,567 |

| 65+: | $41,125 |

For those of you looking to retire early, please note that retiring between 35 – 54 means foregoing your peak earnings years.

I retired at 34 in 2012 and forewent between $1.25 – $3 million of income between 2012 – 2019. That's a huge amount of money to miss out on.

Retiring too early was one of my main regrets. I should have kept working until 40 to take advantage of peak earning years and all the benefits that went with work.

But at least I gained a lot of time, was able to raise my son full-time, and build Financial Samurai into one of the top personal finance websites today.

| Income Range | Percent Distribution |

|---|---|

| Under $15,000 | 10.7% |

| $15,000 – $24,999 | 9.6% |

| $25,000 – $34,999 | 9.2% |

| $35,000 – $49,999 | 12.3% |

| $50,000 – $74,999 | 16.5% |

| $75,000 – $99,999 | 12.5% |

| $100,000 – $149,999 | 14.5% |

| $150,000 – $199,999 | 7.0% |

| $200,000+ | 7.7% |

Median Salary By Sex

Another area of interest is the median income by sex. There's a lot of discussion about the gender wage gap that has narrowed over time. But it's still not enough.

The blue bar indicates the median male salary and the red bar indicates the median female salary. Starting at the 25-34 age range, the salary gap widens and continues to widen for the remaining age ranges.

One can postulate that the reasoning for the widening income gap is due to mothers taking time away from work to raise children starting in the 25-34 age range. Once a person is out of the work force for a number of years, it's harder to catch up in salary and title.

Another potential reason for the wage gap involves the differences in occupations preferred by men and women. For example, most teachers are women. Most investment bankers are men and so forth.

The Top 1% Income By Age

In order to be in the top 1% income earner in America, you need to make at least $650,000 according to the IRS as of 2024.

Based on the Internal Revenue Service’s 2010-2017 database below, here’s how much the top Americans make:

Top 1%: $380,354 – For 2021, a top 1% income is over $470,000 a year. Again, inflation! You can add 15% – 20% to all figures below.

Top 5%: $159,619

Top 10%: $113,799

Top 25%: $67,280

Top 50%: >$33,048

Making $470,000+ a year is a lot of money, especially if you live in the South or the Midwest. But $470,000 isn't exactly living it up if you live in an expensive city like NYC or San Francisco with kids.

I argue that a household earning $300,000 a year is living a pretty middle class lifestyle. I define “middle class” as being able to own a median priced home, save for your children's college education, save for retirement by 65, and take reasonable vacations.

The Middle 50% Income Earners

To be in the top half (50%) of all earners you need to earn more than $33,000 a year. The number of people earning less than $33,000 accounts for 48.06% of the population. This is the average household income.

If you live in San Francisco, the government says that a family of four who earns less than $101,000 a year is considered low income.

In other words, where you live matters. It's too bad the federal tax rates don't take into consideration high cost of living areas of the country. It is up to us to move to lower cost areas of the country if we want to make our dollar go farther.

This demographic shift away from expensive coastal cities and towards the heartland of America is why many people are aggressively investing in real estate crowdfunding. Valuations are lower and net rental yields are higher. Thanks to technology, nobody needs to live and work in an expensive city any more.

Big companies like Google are spending billions to expand inland as well. My favorite real estate crowdfunding platform is Fundrise. They have the best vetted and most innovative offerings today.

Disclaimer: I invested $810,000 in real estate crowdfunding in 18 different projects to diversify away from San Francisco after I sold my SF rental property for $2.74 million in 2017. The average household income will grow with more investments in appreciating assets like real estate.

Federal Poverty Income Limits

Once you start getting below the middle 50% income threshold of ~$33,000, life starts getting more difficult in America.

The Federal government has come up with the Federal Poverty Limit (FPL) guideline to decide who gets subsidized healthcare and other financial assistance to make it in our great land today.

The chart below shows that 100% of FPL equals the poverty threshold by household size. A household can earn subsidized healthcare and other benefits if they earn up to 400% of FPL. The average household income generally is the cutoff point for subsidies.

Earning 300% to 400% of FPL isn't so bad if you live in a lower cost area of the country. But anything short of 400% of FPL will be difficult in the expensive coastal cities.

For this reason, I'm bullish on the heartland of America real estate. People are rational and will move to improve their lifestyles.

The Ultra Wealthy

Although earning a top 1% income of $650,000+ sounds great, real wealth is defined by net worth. After all, it's not how much you earn, it's how much you keep.

Below is a chart highlight the median net worth for the top 1 percent, top 80th – 99th percentile, and the Middle Class. The average household income should be considered the 50th percentile.

- Net Worth Of The Middle Class: $87,000

- Net Worth Of The 80th-99th Percentile: $746,950

- Net Worth Of The Top 1 Percent: $13 million

In other words, the top one percent have really pulled far ahead in wealth over the past 24 years. The median net worth of the top 1 percent is about 120X higher than the median net worth of the middle class.

The reason for these gains have to do with consistently saving and investing their income into risk assets like stocks, real estate, bonds, private equity, and so forth.

While the average American only saves ~6% of his or her savings and doesn't invest, the financially focused American saves at least 20% of their after-tax income and religiously invests for the long term. Based on a huge increase in the U.S. personal savings rate to 32% during the height of the pandemic, Americans can save if we want to!

Everybody's goal should be to accumulate a top 1 percent net worth because the estate tax limit is currently $11.4 million. In other words, you can amass up to $11.4 million and pass it to your heirs or give the money away to charities before the government taxes you ~40%.

Strategies For Increasing Income And Net Worth

I hope every single reader on Financial Samurai increases their incomes and their net worths above the median levels over time. I’d like to reiterate some moves one can do to make these two things happen.

1) Move to a more economically robust area of the country.

It took our settlers 3-6 months to cross the entire continent. Now we can make the same trip in four days by bus. Take some risks and go to where the action is. Yes, I understand it’s frightening, but we live in America where rules and laws are pretty uniform.

I suggest geoarbitraging first in your city, then move to a different state, and then consider moving internationally to a place like Thailand or Malaysia. You don’t have to go straight to a foreign country to save on costs.

I’m taking advantage of this logical migration shift away from expensive coastal cities by aggressively buying midwest and southern real estate through real estate crowdfunding.

Take a look at CrowdStreet, one of the best real estate crowdfunding platforms today. They focus on real estate opportunities in 18-hour cities where valuations are cheaper and cap rates are higher.

I've invested $954,000 in real estate crowdfunding to diversify and earn income 100% passively.

2) Work longer hours.

A 40 hour workweek is arbitrary given there are 168 hours in a week. If you want to make more money, the easiest thing you can do is work more hours. Hard work requires no skill. Work 50 hours, and watch your income grow by 25% more than the 40 hour worker.

Work 60 hours a week and watch your income grow by 50% or more due to over time. There’s no reason why you can’t find another hourly wage job.

It’s silly to complain why you don’t feel like you’re getting ahead if you are working less than 40 hours a week. Go to France, Greece, Spain, or Portugal if you want to kick back. This is America, where getting your butt kicked every week is a rite of passage.

3) Leverage the internet.

Growing wealth is about finding leverage. The internet is one of the greatest leverage tools available to us all. It cost me $1,200 to start Financial Samurai in 2009. Today, you can start your own website for under $50 in less than an hour. Plenty of people have gotten rich off the internet.

Instead of making Facebook or Google rich, it's best to get rich yourself. Here's my step-by-step tutorial on how to start your own website.

4) Believe that you deserve to be rich.

Making lots of money starts with the proper money mindset. The Lyft COO made $32 million in 2018 for one year's worth of work then got fired. Surely, you and I could do just as good of a job tanking the company for millions less.

Even a train janitor makes $271,000 a year here in the SF Bay Area. Abolish welfare mentality! There’s more money out there for everyone.

5) Building passive income streams.

Instead of relying on just one income source, as most Americans do, it’s important to build as many side engines of income as possible. If one engine goes down, another engine keeps your ship afloat.

Goodness forbid you lose your job. The wealthiest people in this country have at least five different passive income sources. Here are the best passive income investments to consider by rank.

6) Save until it hurts each month.

If the amount of money you're saving doesn't hurt, you're not saving enough. Too many Americans just wing it when it comes to saving money. Then they wake up 10 years from now wondering where all their money went. Don't be like most Americans. There is no rewind button in life.

7) Diligently track your income and wealth.

The more you stay on top of your finances, the easier it is to optimize and grow your wealth. I recommend using a free financial app like Empower Personal Capital to track your cash flow, x-ray your investment portfolios for excessive fees, and plan for your retirement.

I've been using Empower since 2012 and have seen my net worth skyrocket during this time.

Remember, nobody cares more about your money than you. Work hard. Save aggressively. Invest wisely.

The average household income in America should continue to grow, at least at the rate of inflation. Your goal is to grow your household income faster than the average to get rich.

For more nuanced personal finance content, join 100,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. Everything is written based off firsthand experience.