I love index funds and ETFs for their low-cost nature and simplicity of ownership. However, if you want to build generational wealth before traditional retirement age, consider looking beyond just index funds and index ETFs.

Since starting Financial Samurai in 2009, I’ve written extensively about investment strategies, financial independence, and retiring earlier to do what you want.

Based on years of reader surveys and conversations, it's clear this community is one of the wealthiest on the web. A significant portion of you have already surpassed the $1 million net worth mark, while many more are closing in. In comparison, the median household net worth in America is only about $200,000.

With this in mind, it’s time to acknowledge a simple truth: the richest people in the world don’t rely mainly on index funds and ETFs to build their fortunes. Instead, many use index funds primarily to preserve their wealth, not create it.

Why Index Funds Alone Aren’t Enough

Most of us love index funds for their simplicity, low fees, and historical returns. But if your goal is to achieve financial freedom before the traditional retirement age, or to reach a top 1% net worth, index funds alone probably won’t get you there before age 60.

To get rich sooner, you need either:

- A massive amount of income to consistently invest large sums into index funds, or

- To take more calculated risks in other asset classes

Simply put, index fund investing is best for capital preservation and slower, steadier growth with moderate risk. A potential 10% annual return is fantastic. But at that rate, your investment only doubles every 7.2 years. Hey, I'll take it, and so would many of you. However, it's simply not good enough for the richest people.

Your life is finite. Most of us only start working full time and investing after age 18. Forty years might sound like a long time to build wealth, but trust me—it flies by. I'm 48 now, and I graduated college in 1999 at age 22. The past 26 years have zoomed past.

If I had only invested in index funds, I wouldn’t have been able to leave the workforce for good in 2012 at age 34. Don’t forget, there was a “lost decade” for both the S&P 500 and NASDAQ from 2000 to 2012. Relying solely on index funds would have delayed my financial freedom indefinitely.

Besides getting lucky, the only way to achieve financial freedom sooner than average is to take above-average risks by investing beyond index funds and ETFs. Looking back, I wish I had more courage.

The Average Rich Versus the Richest Rich

First off, if you’re rich—or feel rich—congratulations! You’re ahead of at least 90% of the world, which also means you’ve bought yourself more freedom than most. Although it’s tough, try not to let someone richer than your already-rich self get you down. The key is appreciating what you have.

That said, it’s important to distinguish between two types of rich, because they’re not the same. The personal finance community mostly focuses on the first kind—The Average Rich—partly because it's easier to explain and attain, and partly because many financial creators don’t have finance backgrounds. We come up with crazy sub-FIRE types, such as Coast FIRE, which is really no different from a full-time employee who saves for retirement.

In fact, the lack of financial depth in the space was one of the main reasons I launched Financial Samurai in 2009. Back then, nearly every blogger only emphasized budgeting and saving their way to wealth. That’s solid advice for most people, however, I wanted to go beyond that. You can only do so much saving your way to wealth.

I wanted to escape the finance industry altogether and retire early. That’s when I started writing about FIRE for the modern worker. With the internet making it possible to earn and live in non-traditional ways, I saw an exciting opportunity to pursue a different lifestyle.

Ironically, it was 2009—during the global financial crisis—when the digital nomad trend really took off, as millions found themselves out of traditional jobs and searching for something new.

Now let's definite the two types of rich people.

1. The Average Rich

This group includes individuals or households with investable assets between $1,000,000 and $5 million. They tend to be highly educated, dual-income professionals who max out their 401(k)s, invest in low-cost index funds, and own their primary residence.

Most of their investments are in public markets and real estate, and they typically feel financially stable but not truly rich. Some would describe this as the mass affluent class. Many started off or are HENRYs (High Earners Not Rich Yet), but then often slow down their pace of wealth accumulation once kids arrive.

You might think of the everyday rich person as someone with grey hair, a portly figure, and retiring around the more traditional age of 60–65. They've got a median-priced home and might fly Economy Plus if they are feeling particularly spendy. They aren't eating at Michelin-star restaurants, except maybe for a rare special occasion, like a 30-year wedding anniversary.

The Average Rich know they’re wealthier than most, yet they still don’t feel rich. Instead, they feel closer to the middle class than to the truly wealthy.

2. The Richest Rich

These are the people with $10 million-plus in investable assets, often owning second and third vacation homes, flying first class, and making high six-figure or seven-figure investments. Their kids mostly go to private grade school, which they can comfortably afford without financial aid. They also freely donate significant sums of money regularly.

Instead of investing mostly in index funds to get rich, their money came from:

- Building and owning businesses

- Investing early or joining early in private companies

- Owning a slew of rental properties with leverage

- Allocating capital to private funds and venture capital

- Betting big on speculative assets like Bitcoin or angel investing

They might own index funds, but it wasn't a driver for them to get rich. Instead, index funds are a place where they park their money, almost like a cash plus, until they find a potentially better opportunity.

20% plus or minus moves in the S&P 500 don't phase them as the Richest Rich often experience much more volatile swings. In fact, the Richest Rich often have investments go to zero as they continuously fortune hunt for the next multi-bagger investment. So often, index funds and ETFs are a small percentage of their overall net worth (<20%).

The Richest Rich Tend To Be Seen as Eccentric

The Richest Rich are often viewed as eccentric, agitators, or downright weird by the general public. That’s because they tend to reject the status quo and do things their own way. As a result, they attract critics—sometimes lots of them—simply for not following societal norms.

They refuse to spend their entire careers working for someone else to make that person rich or organization rich. They aren't spending a fortune to get an MBA only to work for someone else. Instead, they bet heavily on themselves through entrepreneurship and alternative investments. Index funds and ETFs? Boring. Too slow. These folks would rather build something from scratch or swing for the fences.

Many of the Richest Rich also go all-in on optimizing their bodies and minds. They train hard, eat clean, and track every metric they can—often in the hopes of staying fit enough to extend their grind and lifespan.

To most, they come across as quirky or intense. But from their perspective, it’s the rest of society that’s asleep, trapped in a system they’ve managed to escape.

Real-World Net Worth Breakdowns

Here are a few anonymized examples of the Richest Rich:

Example 1 – $30 Million Net Worth

- 30% ownership in business equity they started

- 30% real estate

- 20% public equities (65% individual stocks, 35% S&P 500 index funds)

- 15% venture capital funds

- 5% muni, Treasury bonds, cash

Example 2 – $300 Million Net Worth

- 40% ownership in business equity they started

- 20% real estate

- 20% in other private companies

- 15% stocks (half in index funds)

- 5% cash and bonds

Example 3 – $600 Million Net Worth

- 5% ownership in a massive private money management firm as one of their senior execs

- 15% real estate

- 50% in other private companies

- 10% stocks (half in index funds)

- 20% cash & bonds (~$180 million at 4% yields a whopping $6.4 million risk-free a year today)

None of them got rich by only investing in index funds. Instead, index funds are simply a low-risk asset class to them where they can park money.

Net Worth Breakdown By Levels Of Wealth

Here's a good net worth breakdown visualization by net worth levels. The data is from the Federal Reserve Board Of Consumer Finances, which comes out every three years.

Let's assume the mass affluent represented in the chart below is at the $1 million net worth level. Roughly 25% of the mass affluent's net worth is in their primary residence, 15% is in retirement accounts, 10% is in real estate investments, and 12% is in business interests.

In comparison, for the Richest Rich ($10M+), at least 30% of their net worth is in business interests. Intuitively, we know that entrepreneurs dominate the wealthiest people in the world. Therefore, if you want to be truly rich, take more entrepreneurial risks and investment risks.

Time + Greater Risk Than Average = Greater Than Average Wealth

Building meaningful wealth often comes down to how much risk you take—and how early you take it. When you’re young, lean into bigger bets. Invest in yourself. Build something. Own something beyond just index funds. If you lose money, you’ve still got time to earn it back—and then some.

If I could rewind the clock, I would’ve taken more calculated risks in my 20s and early 30s. Rather than playing it relatively safe, I would’ve gone bigger on business opportunities and leveraged more into real estate. I also would’ve made larger, concentrated bets on tech giants like Google, Apple, Tesla, and Netflix. The CEO of Netflix, Reed Hastings, spoke at my MBA graduation ceremony in 2006 when the stock was only $10 a share.

In addition, I would have started Financial Samurai in 2006, when I graduated business school and came up with the idea. Instead, I waited three years until a global financial crisis forced me to stop being lazy.

But honestly, I was too chicken poop to invest more than $25,000 in any one name—even when I had the capital to put $100,000 in each before 2012. The scars from the dot-com bust and the global financial crisis made me hesitant, especially after watching so many wealthier colleagues get crushed.

Still, I still ended up saving over 50% of my income for 13 years and investing 90% of the money in risk assets, most of which was not in index funds. I've had some spectacular blowups, but I've also had some terrific wins that created a step function up in wealth.

Don’t Be Too Easily Satisfied With What You Have

One of the keys to going from rich to really rich is pushing beyond your financial comfort zone—especially while you’re still young enough to bounce back from mistakes.

You’ve got to be a little greedier than the average person, because let’s face it: nobody needs tens or hundreds of millions—let alone billions—to survive or be happy. But if you're aiming for that next level of wealth, you're going to have to want it more and take calculated risks others won’t.

I was satisfied with a $3 million net worth back in 2012, so I stopped trying to maximize my investment returns. Big mistake. The economy boomed for the next 10 years, and I missed out on greater upside.

Then in 2025, after another short-term 20% downturn, I shifted my taxable portfolio closer to a 60/40 asset allocation. The temptation of earning 4%+ risk-free passive income was too strong. From a pure returns perspective, that’ll probably turn out to be another mistake long term.

To balance things out, I’ve deployed a dumbbell strategy—anchoring with Treasury bills and bonds on one end, while taking bolder swings in private AI companies on the other. And you know what? It feels great. I get to sleep well at night knowing I’ve got protection on the downside, while still participating in the upside if the next big thing takes off.

Final Thought On Investing In Index Funds And ETFs

Index funds are great. I own multiple seven figures worth of them. You should too. But they are best suited for those on the traditional retirement track or those looking to preserve wealth.

If you want to achieve financial freedom faster or join the ranks of the Richest Rich, you’ll need to invest beyond index funds. Build something. Take risks. Own more of your future.

That’s how the richest people do it.

Free Financial Analysis Offer From Empower

If you have over $100,000 in investable assets—whether in savings, taxable accounts, 401(k)s, or IRAs—you can get a free financial check-up from an Empower financial professional by signing up here. It’s a no-obligation way to have a seasoned expert, who builds and analyzes portfolios for a living, review your finances.

A fresh set of eyes could uncover hidden fees, inefficient allocations, or opportunities to optimize—giving you greater clarity and confidence in your financial plan. The richest people in the world get regularly financial checkups.

The statement is provided to you by Financial Samurai (“Promoter”) who has entered into a written referral agreement with Empower Advisory Group, LLC (“EAG”). Click here to learn more.

Diversify Your Retirement Investments

Stocks and bonds are classic staples for retirement investing. However, I also suggest diversifying into real estate—an investment that combines the income stability of bonds with greater upside potential.

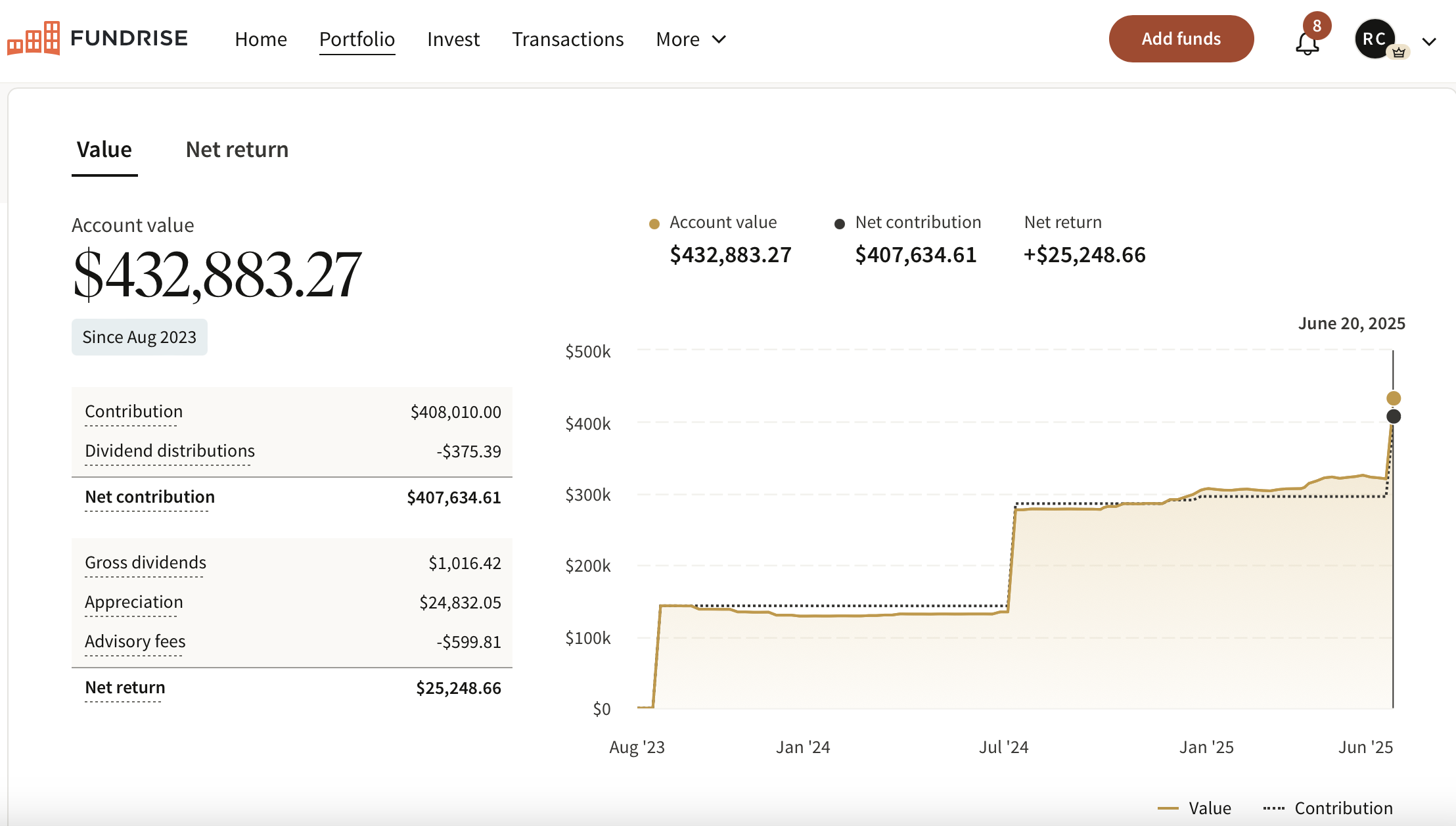

Consider Fundrise, a platform that allows you to 100% passively invest in residential and industrial real estate. With over $3 billion in private real estate assets under management, Fundrise focuses on properties in the Sunbelt region, where valuations are lower, and yields tend to be higher. As the Federal Reserve embarks on a multi-year interest rate cut cycle, real estate demand is poised to grow in the coming years.

In addition, you can invest in Fundrise Venture if you want exposure to private AI companies like OpenAI, Anthropic, Anduril, and Databricks. AI is set to revolutionize the labor market, eliminate jobs, and significantly boost productivity. We're still in the early stages of the AI revolution, and I want to ensure I have enough exposure—not just for myself, but for my children’s future as well.

I’ve personally invested over $400,000 with Fundrise, and they’ve been a trusted partner and long-time sponsor of Financial Samurai. With a $10 investment minimum, diversifying your portfolio has never been easier.

To increase your chances of achieving financial independence, join 60,000+ readers and subscribe to my free Financial Samurai newsletter here. Financial Samurai began in 2009 and is the leading independently-owned personal finance site today. Everything is written based off firsthand experience.

I agree with nearly everything you say in the article, to really reach the upper echelons, you really need to take different kinds of risks (or otherwise just have a very large, stable, and long-term salary). However, as mentioned by another commentator, the omission of survivorship bias as almost certainly the primary factor for this outcome is irresponsible in my humble opinion. And it’s frustrating, because of course you know this, but it needs to be a huge caveat in the take-home message here. Nothing wrong with saying, to get into the “Richest Rich” you need to take extra risks, but the additional message should be, beware (and mentally prepared), the odds tend to be heavily skewed against your favor. It’s easy in hindsight to say that 10 years ago I saw the potential of some currently booming investment and should have put a huge portion of my net worth in it back then, it’s very very very difficult to truly succeed doing that in the moment and outperform an index fund in the long run. Luck is a massive factor! We all know how grim the percentages look in any large-scale study comparing active investors (retail or professional) vs. index benchmarks. And the very definition of survivorship bias is that those very few who are massively lucky, putting chunky investments in the likes of BTC, TSLA, NVDA, etc. at a very early point, will necessarily land in the “Richest Rich” category. The other 99+% of people who take YOLO risks without sufficient financial cushion will underperform significantly, and we rarely read about their stories. Another illustrative data point, of the new entrants into Forbes 100 richest Americans in 2020 compared to the list in 1982, 75% of those new entrants earned their wealth through founding companies/early equity (How People Get Rich Now). One could say, startups is the easiest way to get into this rarefied level of rich these days. Yet, how many startups fail relative to the creation of a single unicorn? A high variance market gives rise to potentially the greatest opportunities, of course, but people need to soberly self-evaluate, are you truly good enough/lucky enough to pick (or found) that needle in the haystack? If you have that level of conviction and have the capacity (achieved some reasonable level of financial independence) to take moonshot risks I’m all for it, I too have benefited those, but my advice is don’t underestimate the mental preparation needed in being okay with seeing massive or total loss in that bucket of capital.

All good points Alvin. I think you’ll appreciate this post: Your Outsized Wealth Is Mostly Due To Luck, Be Grateful

There certainly is survivorship bias. However, after publishing 3 posts a week for 16 years straight (since July 2009), I gradually have come around to thinking there is also a lot of hard work, sacrifice, and strategic risk-taking involved in building outsized wealth as well.

If you do not try, you certainly will not succeed.

If you try, you might succeed.

Thanks for the reply! Been a long long time reader of this site, big fan of you and the wonderful content here. Somehow I missed that article about luck you wrote, it does complement this one immaculately. Agree with what you’re saying, hard work and other controllable factors can for sure tilt the odds in your favor.

No problem Alvin! You can sign up for my posts to your inbox here and/or my weekly newsletter where I aim to capture all the most important items here.

Right now, I’m enthralled with AI and am investing the majority of my free cash flow into private AI companies. I figure, if I’m willing to pay over $500,000 in college tuition for just one child in 10 years, I should sure as heck be willing to invest $500,000 in the very companies and technology that will make my children’s college education obsolete!

The biggest problem I have is simply not having enough money to invest in the amount that I want. Ah, the problem of not having a well-paying day job. Just gotta keep finding a way.

Related: The Acceleration Of AI Growth

Hi! Do you know of any platform like Fundrise Venture that works with non-US residents? Would love to have this type of investment opportunities, but I wasn´t born in the land of the free..

I’m Jamaican currently studying to be optometrist and own my own practice . I’m black and 24 . I really want to open up a sugar cane juice business right now and invest my money in cryptos . I really like This blog I read the chances of becoming a millionaire are slim but if one thing I want is not to ever work for a Boss I want my own thing :

More people lose money in crypto and only few gained (a lot). To me it’s more of a gamble. I would stick with more traditional way of investing. Once a in while enjoy a night at the Casino.

Save 50% of income. Invest in index funds for 15-20 years and you would have enough to retire. It just takes determination and discipline. I’ve done it. If you’re looking to have Elon Musk money, then you have to invest in other ways.

Becoming a doctor and earning a lot of money is a big part of it. And not many can save 50% of their income their first 10 years of work.

Are you part of the richest rich though? Defined as having more than $10 million in investable assets?

You mentioned you are still working part time, so I’m not sure. How long after working did you start saving 50%?

Can’t argue with this wisdom. The thing is most high-earning W-2 professionals don’t want to hear it. They’re convinced that by earning more W-2 income each year, they’re on the fast track to wealth. But, they really have no idea how the truly wealthy people are doing it through owning businesses and real estate.

W-2 employees should view their primary jobs as a way to raise capital to build or buy wealth-building investments that they own. Think of it like this: when you’re a W-2 employee who is also building a business on the side, you provide your own capital. Your W-2 income gives you runway to build that true wealth-generating asset.

If you didn’t have W-2 income, you’d likely need to hunt for outside investment capital to grow that business. That’s a job in and of itself. Your W-2 can instead be that outside capital for your business.

So, if you are a W-2 employee, use that money you’re earning as your runway to build something great for you and your family.

Great post,

Matt

Your net returns of ~25,000 for a contribution of ~407,000 is only about ~7%. If I am calculating it correctly, isn’t that very low returns? I invested some money into Fundrise’s Venture Fund too. While the returns are good, the fee is ~4%.

Good question. I just invested $114,000 at the end of June 2025 ($100,000 in the Innovation Fund and $14,000 in the Flagship Real Estate Fund). And I also started investing in the Flagship fund early 2023 as the commercial real estate market was declining.

The Innovation Fund fee is not 4%. It’s not even 2% and 20% of profits, like the traditional venture capital model. Instead, they charge a 1.85% fixed annual asset management fee and no carried interest.

For reference, I’m paying a 3% fee and 35% carried interest on two Kleiner Perkins funds. It’s feels like too much, however, nobody forced me to. It was the price of admission.

So with the Innovation Fund, owning the private AI companies that it does, and charging a much lower fee, I thought it made sense. I wish I had more than $114,000 to invest this summer. Also, do note there is a usual J-curve with traditional venture funds, where the investments are loss-making for the first 3 years or so before winners start helping the fund make positive returns.

I saw 3.85% as the total fee. There was additional fee , Operation, than the 1.85%. I saw it somewhere on the app or their website.

The Innovation fun has 20% annualized returns for me. I wish I had more cash to deploy on this specific AI strategy of theirs.

Let me double check, but I don’t think so. Here’s the page on fees: https://fundrise.com/help/articles/7878302037133

I just had lunch with Ben Miller, the CEO yesterday, btw. He met with a dozen AI and other companies in SF…. and is very enthusiastic about what he’s hearing. Hard for me not to get FOMO and want to join these companies too!

And yes, I too wish I had more money to invest. $100K in June was almost all I had to invest in the Innovation fund. Well, I guess I had more but I wanted to deploy my dumbbell investing strategy.

GRS is correct. If interested in this fund then read the Innovation Fund’s prospectus (https://fundrise.com/offerings/26/view). Below the description of the fund strategy is a description of the annual fund operating expenses: Mgmt. Fee = 1.85% and Other Expenses = 2.1% totaling 3.95%. The fine print indicated there was a fee waiver and expense reimbursement of 0.44% contractually agreed upon by Fundrise. However, that waiver was valid only through July 31, 2025. So, how does one compare a near 4% annual management fee/expense vs. traditional PE structure of 2% plus 20% of net profit — especially when an investor typically has to wait 3+ years before realizing significant appreciation? Based on the Innovation Fund’s historical net returns presented in the prospectus, an investor recognized a 9% annual return for the first three years (2022-2025). One of my two, private credit funds has average nearly 28% during the past three years with similar longer term, illiquid lockup period. The other fund is averaging 11% annually during the same investment period…both have 2 plus 20 fund expenses. Unless the IPO market takes off dramatically in the back half of 2025 or by 2026, investors who tie up their funds in a significantly more expensive investment like the Innovation Fund may have to wait much longer to realize a similar (or potentially outsized) long term return.

Good find! There’s actually another 6-month fee free waiver (0% fees) for those who sign up today. I just invested $26,000 today in my personal account.

When you invest in venture funds/private equity, there is commonly what’s known as a J-curve. The J-curve is where there is a loss for the first several years before the gains start picking up. So I’m actually thrilled there are already positive returns from the start.

The IPO market for tech growth companies, as evidenced by Figma’s IPO looks to be heating up with its 122% pop on the first day and 40X over subscription. For example, the Kleiner 17 fund which owns Figma is up about 18X since 2017. But the problem is, you need connections to get into those funds to pay 2-3% management fee and 20-35% of profits, as I am with my Kleiner investments. Not with the Fundrise Innovation fund.

And the problem is, you can’t get into these funds for the privilege of paying a 2 to 3% asset management fee and 20% to 35% of profits without connections.

The Fundrise Investor Relations team said that the expense waiver ended July 31 with no exceptions (perhaps YOU may be an exception given your special sponsor status). Please elaborate on the 6-month fee waiver that you mentioned. Are you referring to the .015% waiver for opening a new account or something else?

I just invested $26,000 into the Innovation Fund this week with a new account earmarked for my kids. There’s a promo where if you invest $25,000+ in a new account, you get a $500 bonus. On my dashboard, it says if I review and do 7 things, I’ll get a six month fee waiver. Here’s a link to the image if it doesn’t show below. But 2 of the 7 things involves investing in the credit fund and the flagship fund.

I don’t think I got special exemption as an affiliate partner. But I’m happy to pay the fee as they deserve the fee for setting up the fund and finding and managing these deals. There’s no way I’d be able to get access to OpenAI, Anthropic, Databricks, Anduril, and other companies otherwise. Also, I’m thrilled not to have to pay a 20% to 35% carry on the profits.

The $500 bonus and the six-month fee waiver is a surprise to me because I haven’t opened a new account for years until this week. I’ve just been dollar-cost averaging into my existing corporate account. They are certainly nice incentives.

Here’s what I saw when I was deciding how much to invest, so I decided to invest over $25,000 to start.

What about the holding of cryptos? Do these people have a great appetite for crypto? Could you share your thoughts on crypto investing? TIA

I was just going to comment the same. I have been weekly DCA into bitcoin for many years and this has proved to be profitable. In my opinion , as a physician, i would rather invest in bitcoin rather than deal with the hassles of real estate. Also as a physician, i am limited on “side hustle “ gigs due to a contract I have with my hospital.

Cool that you posted the 0.1% chart by country …that takes some of the hyperbole over what’s truly rich. Is that by individual or family though?

Totally agree. My experience is a case study. I got to my high net worth as an avid saver and investor, but mostly due to being part owner in a business. It carries more risk, but also doesn’t need to be all or nothing. I had 3 mill NW when I became an owner, but only bought 1.5mill in restricted stock in the company. Left the other 1.5M in mostly index funds. the 1.5M in the company has ballooned to 8M (principal + distributions) in 10 years and the 1.5M in the market is about 3M.

Thanks for sharing, and congratulations! What type of business was it?

Engineering

Must be careful to avoid survivor bias. Sure is the case with index investing too, but survivor rate is much higher. As one goes up the risk level, number of survivors decreases and it should be taken into account. i.e. people doing same exact thing but year sooner or later, those who started at the same time but sold out wrong time, those who did not have enough time, etc..

Another point to make – as your NW as multiplier to your daily expenses increases taking higher risk becomes less risky. So someone with 100x annual expense capital will be more inclined to put higher percentage into risky investments compared to 20x who will likely have to rather go with higher bond percentage.

This article ignores highly-paid corporate execs, BigLaw lawyers, MDs/partners at investment banks, and doctors with specialized practices. Each of these professions easily earn over $1mm per year and often earn much more than that. What about someone in this category who saves over 50% of their income and puts all of it in the S&P 500? I work with many corporate execs myself who earn about $1.5mm/yr, live in nice (but not glamorous) homes, and have $25mm or so net worths when they’re around 50 years old and most of it is in mutual funds. Most of these people don’t have the time to manage real estate investments or track individual private, venture capital, or individual stock investments. They have a cash cushion, a sizable percentage of their NW in company stock because of ownership guidelines and Section 16 considerations, and they plow the rest in index funds as they watch their NWs relentlessly march higher and higher.

Sounds good to me. In these cases, their income is their biggest driver of wealth m, not so much their investment returns until later. But if they can continue to earn a high income for a while and earn, S&P 500 returns year after year, then they are going to do incredibly well.

Sam, great article, thanks! As you’ve written elsewhere, $10M is the ideal NW for retirement. Would love to see an article on what various annual retirement budgets with $10M, $15M, etc. in investable NW might look like. Would help add some context to what hitting that $10M number would provide as far as quality of life in retirement.

I’d also like to see this. I’m above the $10mm mark but in my early 40s so I think it would look different based on age—too many years (hopefully) ahead.

Actually, care to share yours? It’s different for everybody.

$10 Million should be able to provide for a comfortable $300,000 – $500,000 a year in gross investment income.

Here’s a $300,000 gross income household budget for $10 million in investments:

https://www.financialsamurai.com/living-a-middle-class-lifestyle-on-300000-year-expensive-city/

And a $1 million a year household budget, if you can boost your investable assets to $20 – $30 million:

https://www.financialsamurai.com/when-earning-one-million-a-year-is-not-enough/

As Mr Buffett said, “Diversification is protection against ignorance. It makes little sense if you know what you are doing.”

The reality is it’s nearly impossible to get rich with a W-2. You need to own a business.

I suppose if you make a good wage and live frugally and invest in indexes you might break into 7 figures by 60 but what fun is that? I find FIRE mentality to be miserable.

As far as beating the market, forget it lol. You are competing with hedge funds, AI models, Wall Street etc. It’s nice to believe you can, but only a tiny fraction of the smartest hedge fund managers beat the market consistently, and even then their streaks end.

Thanks again for another intellectually stimulating article. I agree in general with the concept that it is difficult to get significantly wealthy with index funds. However, in my particular case, I was blessed with a very high salary, and before I had kids, had a few years of investing about 60-70% of it into index funds at the beginning of the early 2010’s. Im still putting tons away at this point as well. I am in my early 40’s now and have > 10 million in investable assets. I did make one angel investment that hit, but at that time I was pretty early on and didn’t invest much. I also made a passive real estate investment with a sponsor who has “never lost investor capital” and had a track record thriving in the 2008 era. This has completely stalled out since the interest rates spiked despite this wonderful reputation. I would’ve probably looked at other assets, but my wife is very risk averse and even getting her to agree to index funds was hard enough so I gave up and went all in with index funds.

I have a colleague who went in the opposite direction and has done a lot of different things including, owning a large apartment building, going deep into crypto rabbit holes on weird exchanges with weird people, and putting tons of money into other start ups, ventures, opportunity zones, etc. She’s very smart and has done tons of research. However, none of these attempts have actually hit, and I am far better off than she is right now. Maybe one day she will get lucky and surpass me with one big victory, but getting into our mid 40’s….time is starting to run a bit shorter.

Point is, there are instances where slow and steady can win. At least with index funds there is no “unforced errors” and isn’t dependent on a person or a group of people that you hope know what they are doing, like real estate sponsors, start up founders, etc. Sometimes the best move is not not out “dumb” the room, even if more profitable approaches could certainly be out there.

Thanks again for all the fun articles you share!

Well done! Having over $10 million invested by 45 is impressive through mutual funds.

Can you share how much you were earning in the early 2010s and today? What do you do?

Thx

work in healthcare. Combined household income at beginning about mid 200k….now sitting about 500k to 700k household

Cool. Thanks for sharing. Having 20X your average household income is my definition of FI. How long do you plan to keep on working? At 20X, I definitely did not want to work anymore.

I’ve been buying some UnitedHealthcare recently. Hope it turns around as it takes our money each month as customers!

You know, I’ve basically got my job to where to creates as minimal stress to me as possible, and as long as my employer continues to give me autonomy, I can do this for a few more years. Was initially thinking of reevaluating at 50.

Also want to demonstrate to my kids it’s important to work hard. However at this point if my workplace changes and doesn’t suit me anymore I could pull the cord. The next step I have to figure out is the deaccumulation phase. I think this will be the hard part for me, especially with straight index fund portfolio. Need some sources on that at some point!

Having autonomy and getting paid is a wonderful combo. I’d definitely ride that lucky bull until it’s no more. I couldn’t take all the micromanagement and directives anymore.

Decumulation is a tough one! You have to be just as intentional with accumulation as you are with accumulation. So far, I found the best way to accumulate is to just buy a really nice house that you don’t really need. We can spend plenty and maintenance, gardening, utility bills, and property taxes.

Check out: https://www.financialsamurai.com/the-best-decumulation-age/

You’ve missed the newest and best asset class: Bitcoin. There will be many newly minted deca- and centi-millionaires in the next decade with BTC as their main holding. Somehow you’ve totally missed the boat on the future of money.

Maybe if I didn’t buy Bitcoin from 2015-2018. But I certainly could have bought more, hence why I’m a struggling writer without a beachfront mansion. But it’s still been a good journey so far.

How much did you buy and when? And are you buying more?

One of the reasons why i’m so optimistic about our citizen’s finances is that I consistently get feedback from people who have invested very well. So congrats!

First bought in 2017. Instead of buying a McMansion, I used the entire down payment to buy BTC. I can buy 10 mansions now if I wanted, but real estate is my least favorite asset class. How much did you buy? Yes, whenever there’s a dip, I buy more. Perhaps you can write a blog post about BTC. I’m sure you’d get lots of feedback and interesting stories..

Great! Either government pushing crypto, I suspect the asset class will continue to do well.

Mansions here in San Francisco generally start at $10-$15 million. So if you can buy 10 of them, that’s great.

Did you retire early as well? I bought enough to help me stay unemployed since 2012. It’s truly kinda nuts how well so many asset classes have done. There’s also so much more wealth out there than people know.

I retired at 35. I was only able to hodl and not sell this entire time b/c I have strong conviction, which came from studying BTC for over 500 hrs. It wasn’t luck. It’s not easy when everyone around me was against it, but as soon as I talked to any of them, I realized they barely put in even 10 hours of work trying to understand it.

This is a once in a lifetime opportunity, a paradigm shift. Incredible that main street was able to front run wall street. I’m not at all surprised that IBIT is the fastest growing ETF ever. I guess I just expected you to have done a deeper dive since you have a background in finance. It’s not too late though, I believe it’ll reach $1M within 10-15 years. Everyone gets BTC at the price they deserve, and the amount they deserve.

Cool, you retired a year after me. If bitcoin is going to $1 million, then we are still so early. How awesome is it to ride the wave!

Now you can spend more time with your wife and children if you have them. Family time and freedom is really what I appreciate most about investing and FI.

Did you feel any different after you surpassed $10 million or $20 million net worth? If so, maybe you can share about your experiences in this post. I haven’t been able to tell any difference after $10.

How you’ll feel reaching various millionaire milestones – https://www.financialsamurai.com/how-youll-feel-reaching-various-millionaire-milestones-1m-5m-10m-20m/

I’d love for you to share a guest post about bitcoin and investing in the future. I only feel comfortable writing what I have expertise in. So getting people in the community to share, their expertise is always great. How about write a post on why you believe bitcoin will go to $1 million?

Felt no different after each milestone. The only difference in behavior is that my spouse and I always fly business or first class now. We are happily childfree, so I only have to shell out for 2 tickets and not 4. Maybe if I reach $1B, then I might also purchase first class tix for family members. I’d never buy a private jet though.

Thanks for the invite to guest post, but while I enjoy reading, I do not enjoy writing, teaching or being in the public eye. The whole point of financial freedom is to only say yes to things you enjoy.

Perhaps if you open the invite to all of your readers, you might get some ppl who are dying to write about BTC. :)

Sounds good. No worries. You’re not alone in not wanting to write. People ask me to write something all the time, but when I ask them to share their thoughts, 99.8% decline.

You should look into flying private. You can buy 1/16 of a plane on Nejets for about $2 million. And then you’ll have access to 50 hours a year at $10,000-$15,000 an hour. If you guys ever have kids, the convenience is pretty amazing. So about $60,000 one way to Honolulu from SF, for example.

Here’s to a billion!

tIF only BTC has performed as well as NVDA…While btc has returned 9,900% since 2017, NVDA has returned 38,800%, blowing btc out of the water. Every asset class has its big winners. Alot of losers in crypto too.

Good points. We tend to only see the winners. But as we know, there are plenty of losers in every asset class. They just don’t speak out to announce how much they’ve lost as that is the human condition.

they either will, or they will not. So far its doing good, but i wouldnt bet everything on it. for me, its bit of a coin toss from here on

I checked with ChatGPT and compared total return of s&p500 against Fundrise Real Estate from January 2014 to July 2025. Return on spy was 299% verses Fundrise Real Estate 200 to 300% based on whatever platform.. what do you think.

Not bad! Especially since the Fed hiked rates 11 times starting in 2022, the most and fastest ever, significantly impacting CRE prices.

It’s important to think about diversification and volatility. Because in the past, when the stock market is getting hammered, real estate tends to outperform and hold up much better.

Diligent savings and diligent investing puts you far ahead of most people on the planet. This is definitely something useful and admirable to strive for. Well done to anyone who can accomplish it.

However, you can’t get “rich” this way, relatively speaking. You can only do that through accelerate risk-taking in business, or investing, as Sam discussed.

I did it through harvesting my business’ earnings. I spent a lot, had a fantastic lifestyle, and what I didn’t spend I accumulated and that accumulation made me “rich”.

I certainly didn’t do it with investing (to my great chagrin)!

I never would have achieved my “rich life” during my career or my “rich life” during retirement based on investing alone.

It’s a philosophical choice. Do I need to have Home Runs and Grand Slams, or just execute on a bunch of singles and doubles. No effort “doubling of invested amount” in 7-10 years seems scoff worthy – until it works. Live 20 years on low risk investing and it’s worth while seeing the changes that the high-fliers, high risk individuals just couldn’t close.

Once you reach your “comfortable number” be it $1M, $5M or $10M, that’s when diversification is more meaningful….Because for me, this is about generational wealth and changing the trajectory for my progeny rather than self

I think everybody needs to try to hit a home run several times in their lives. Because if you never try, you’ll always be left wondering “what if.”

And that regret of not trying your best and going for glory may haunt you when you are old and look back on your life.

But that’s the point, my friend, a consistent set of singles and doubles (to keep this analogy going), leads to a higher than expected batting average….this might be one of those instances where two opposite and successful philosophies seem contradictory…but aren’t.

Sure, it’s whatever floats your boat. I like to push myself to the edge and see what I can do – what is possible.

During the pandemic, I played softball regularly. And yes, hitting line drives and doubles to get on base and advance runners felt good. But none of the hits felt good when I’d point to the left field 10-foot high wall, 300 feet away and jack it over! It was so gratifying, that it just makes me always want to try at least once per game.

Regarding Empower and other similar financial advisor services (thinking Personal Capital), how good are they at providing help to the non-traditional “Richest Rich”? I found that the one advisor I spoke with at Personal Capital was very opposed to my concentrated stock portfolio. If I had not made a big bet on Apple in 2004, I would still be slogging away at a desk working for a boss I don’t like.

I think one of the best benefits of speaking to a financial professional is simply getting a different perspective. Over the years, we often get caught up in our ways and only see our point of view. But if the Financial professional can highlights and blind spots, that can be very helpful.

I love hearing from them what other people in my demographic, net worth, and age group are doing with their investments. There is always something going on and something we just don’t think about because we’re just too busy doing our own thing.

That is useful advice. Having another perspective or insight into what similar folks to me are doing sounds nice. I do not like to be preached to about asset allocation and diversification.

I have concentrated positions in Apple and Amazon, and Personal Capital advisors have been suggesting me to “balance” for over five years now. And I am not even average Rich. I continue to have those positions.

I can totally believe how people with great wealth have taken great risks to get there. Status quo just doesn’t lead to huge levels of wealth. And I’m also too risk averse to stomach it. I tried a little bit when I was younger but lost all my bets and decided I was best off being more conservative with my money.

we see the rich guys success because they are the ones that made it. it would be interesting to know how many people were left in the dust by taking the same big risks. my first guess is that for every super rich guy you see out there, there are at least 15 guys that lost everything or almost everything.

this is where hitting for average comes handy instead of trying to just hit for homeruns.

it would be interesting to see if anyone has some hard data about this.

I agree with you. We always hear about the winners, but never the losers.

Sam, Another great post. I think it’s easy to question your choices when the market and tech sector reaching all time highs, but the fact is you’ve likely amassed north of $15M which is top 1% – a significant achievement given your exit from the traditional workforce in your 30s. In my opinion, you got the risk balance exactly right. Enough risk to surpass 99% of Americans (real estate, equities, PE), while hedging against the downside — especially while raising 2 kids. Seens like the optimal balance to me. We have to remind ourselves to appreciate what we’ve accumulated + enjoy it AND resist the temptation of always wanting more. For high achievers, there will never be a number that = enough….

Hi Dan, how are things with you though? How much is enough and how much risk are you taking at what stage in life?

Finding enough is hard to do, as I find it to be a moving target after I felt like I had enough in 2012. If I didn’t feel like I had enough back then, I would’ve kept trading my time for more money.

But I do enjoy the challenge of being a provider to three people in my family. Everybody needs purpose in life, otherwise, the doldrums start setting it.

Share something about your situation. Cheers

Thanks for the thoughtful question, Sam. Things are good.

The idea of “enough” has been top of mind lately. It reminds me of that great anecdote John Bogle shared in Enough, where Joseph Heller tells Kurt Vonnegut at a billionaire’s party on Shelter Island, “I have something he will never have… enough.” That line has stayed with me.

For a long time I was focused on building: career, assets, options. Now I’m entering a chapter where compounding does more of the heavy lifting. I’ve shifted from maximizing to refining. Living simply, writing with intention, training hard, and letting compounding do its thing.

Like you, I enjoy the challenge. I still take measured risks, mostly in equities (AI) and in myself through learning, creating, and staying physically sharp. But the deeper focus now is on legacy, not leverage.

Appreciate your work and the thoughtful reflections. Always good to exchange with someone who’s thinking long-term.

Dan

Not sure if you saw this post? https://www.financialsamurai.com/the-best-way-to-determine-if-you-have-enough-money/

I also discuss the topic in my latest podcast episode.

It’s one of my favorite topics. The journey and the challenge of building wealth is the most fun! And when we have enough for our families to have shelter and food, being able to take more calculated risks is also quite rewarding.

It’s crazy how comfortable life is in America compared to so many other places. We gotta appreciate but also take advantage.

Nice article and I agree – I was able to get to a few million $ saving in index funds but it took selling a business to get to $50M+. Two questions.

First, do you have any more current info on asset levels for the top 0.1, 0.05, and 0.01%? The sources you provide are several years old, and there has been a lot of wealth concentration in the past few years. I’m just curious to see where I stand :-)

Second, would you be comfortable giving a ballpark figure for where you are now? I’m guessing ~$10-15M from what you’ve written but as you’ve often said it’s good to hear where others are coming from. Apologies if this is too personal.

I think you can bump everything up by 20 to 30%.

Have you tried shooting for $100 million? Might as well give it a go since you’re more than halfway there. How are you investing your Wealth now? What percentage of your net worth is in index funds? Are you mostly taking me back now?

For me, I measure net worth in terms of time freedom. We’re finishing our fifth week here in Honolulu and I’m on the beach right now typing this message. So even if we could have made more, I feel rich, especially since leaving in 2012. So it’s enough.

Good questions. I’ve been thinking a lot about Charlie Munger’s comment that you only need to get rich once. Perhaps I lack imagination but I don’t think my life would be meaningfully different, let alone better, with $100M. That said, I am investing in VC and PE funds, with an ultimate goal of ~30%. Since the business was a cash purchase I’ve been dollar cost averaging and put-writing into the market, using direct indexing instead of index funds to better utilize tax-loss harvesting and appreciated share donation. Ultimately I’m shooting for ~30% in public equities, with the rest in bonds. I’m not really interested in RE aside from my primary residence.

I’ve been struggling with the freedom question. I work in healthcare and I feel that I can make a difference to society, so it is harder to step back. That said, more beach time sounds nice.

Like with most things, the more you have, the more risks you can take. I think reaching that $1-3M net worth is the point where your risks can actually A) be large enough to make a substantial difference in your wealth … and B) be small enough that it wouldn’t bankrupt you.

I have my first opportunity to invest in a founders level business venture this year which I’m excited for. But this is the first opportunity I’ve had to do so in my nearly 40 years alive. Any tips for creating more of those opportunities?

The best tip is to network with other investors in this business, as they surely have other private investments.

If you don’t have anything more to add than your capital, then developing a network is key to getting invited to investment opportunities.