Although the Roth IRA is an important tax-advantaged retirement account, there are also disadvantages of the Roth IRA that are seldom discussed.

For years I've been an opponent of the Roth IRA. After the government came out with its tricky way to let us all do a “one-time” Roth IRA conversion from our traditional IRAs, I knew something was up.

The government was so successful in getting people to pay huge sums of taxes on their IRAs up front during the financial crisis that I just shook my head in disbelief.

With so much stimulus spending to fight off the global pandemic, I'm afraid the government will do the same thing. The government needs to find a way to raise taxes. And President Biden is on a mission to do just that.

As a personal finance blogger who wants to help you achieve financial freedom sooner, rather than later, it's my duty to write this post to help you see the error in contributing or converting to a Roth IRA if you have not maxed out your 401(k).

Contributing To A Roth IRA Is Better Than Not Saving

Of course if the choice is between NOT SAVING and saving via a Roth IRA for your future, then the answer is that one should open up a Roth IRA rather than piss their money away on stupid stuff that depreciates in value.

However, do know that you are still pissing money away by giving more of your money to the government. And if the choice is between choosing a traditional IRA over a Roth IRA, choosing the traditional IRA is likely the better way to go.

Please read all the disadvantages of the Roth IRA to keep an open mind. You can contribute to a Roth IRA if you are in the 24% federal marginal income tax bracket or lower. However, there are strong arguments as to be made why you shouldn't contribute to a Roth IRA if you're in a higher tax bracket.

Disadvantages Of The Roth IRA

Here are all the disadvantages of the Roth IRA. For those of you who are in the higher federal income tax bracket, you should be especially wary of contributing to a Roth IRA. For 2025, the maximum Roth IRA contribution, if you are eligible, is still $7,000.

1) The government is inefficient.

I'm all for patriotism, but if you think the government is efficient with your money, then you are simply not paying attention to the enormous budget deficits on a state-wide and country level. By participating in a Roth IRA, you are paying your taxes up front, thereby giving the government more of your money to waste.

Would you give an alcoholic a beer? No. How about giving a drug addict some meth? No. Would you eat a double cheeseburger in front of an obese person who is trying to lose weight? Of course not! There is a reason why there are $2,000 staplers and $10 staples in the government budget.

There's a reason why there is at least $64 Billion in fudged Army accounting every year. Why do you think the Social Security system is underfunded by ~25% and will remain underfunded forever? The government wastes your money, so don't give it more.

Due to the global pandemic, the Federal Government is unleashing trillions of stimulus money to help support the economy. As a result, the government will eventually come for you.

2) The government is smarter than you.

The government realizes people are bad with their money. This is why it sets up a withholding tax system to make sure people pay throughout the year. If it was up to everybody to pay their year-end taxes at the end of the year, all hell would break loose because people are not disciplined to put money away to meet their obligations! The country would go into instant default.

As a result, the government has pushed propaganda on the masses to get them to pay MORE TAXES UPFRONT. Hence the introduction of the Roth IRA. They will spend millions on marketing to highlight why converting to a Roth and participating in a Roth IRA is a great idea. Yes, it's a great idea for them, not for you!

3) You allow asymmetric reward or punishment between equals.

Not everybody can participate in a Roth IRA. Only those fortunate enough to make less than $161,000 a year as an individual or less than $240,000 for married couples can contribute the full Roth IRA amount in 2024

After making more than about $161,000 a year for singles and $240,000 for married couples, you cannot contribute to a Roth IRA. Sorry, but the government doesn't believe you have the right to save in this way. It's only if an individual earns less than $146,000 can they contribute the full $7,000 to a Roth IRA. And it's only if a married couple makes less than $230,000 can they contribute the full $7,000 each to a Roth IRA.

Discrimination is not OK, just because you aren't being discriminated against. If constant protests have taught us anything, it's that we need to fight for equality for everybody! The income cap for contribution is too low.

The irony is, the government is actually saving people who make more than the Roth IRA maximum income limit for contributing from paying more taxes and getting tricked into entering the Borg.

Unfortunately, there are income limits for maximum contribution to get a tax deduction for a traditional IRA as well. They are an even more egregious at $87,000 for single filers and $143,000 for married filers in 2024. Talk about a low income level cap to contribute to a traditional IRA.

4) The math is the same whether you pay now or later.

Whether you pay taxes now and let your investment grow tax free, or you let your pre-tax investments grow, and then tax it upon retirement results is more or less the same! Don’t believe me? Do a calculation yourself.

Here’s an equation: Y = A * B. Re-arrange to A = Y / B. Or Y = A * B is equal to Y = B * A. But just so you know, the math also depends on the future performance of your investments.

Let's say you pay $2,000 in taxes to contribute $5,000 to a Roth IRA, and that $5,000 miraculously grows to $1 billion dollars. Your total tax bill will be around $400 million dollars if you had contributed the money to a 401(k) or IRA instead.

However, don't forget about the opportunity cost of the $2,000 that would have also grown as well had you not paid $2,000 in taxes up front. The $2,000 would have grown to around $400 million.

The main benefit of a Roth IRA over a traditional IRA is if your tax rate upon withdrawal is lower. What you believe the future tax rate will be is the biggest determinant of whether you should contribute to a Roth IRA or not. If you think your tax rate will be higher in retirement, then contribute to a Roth IRA while working.

Tax-Free Income And Capital Gains In Retirement For Most Americans

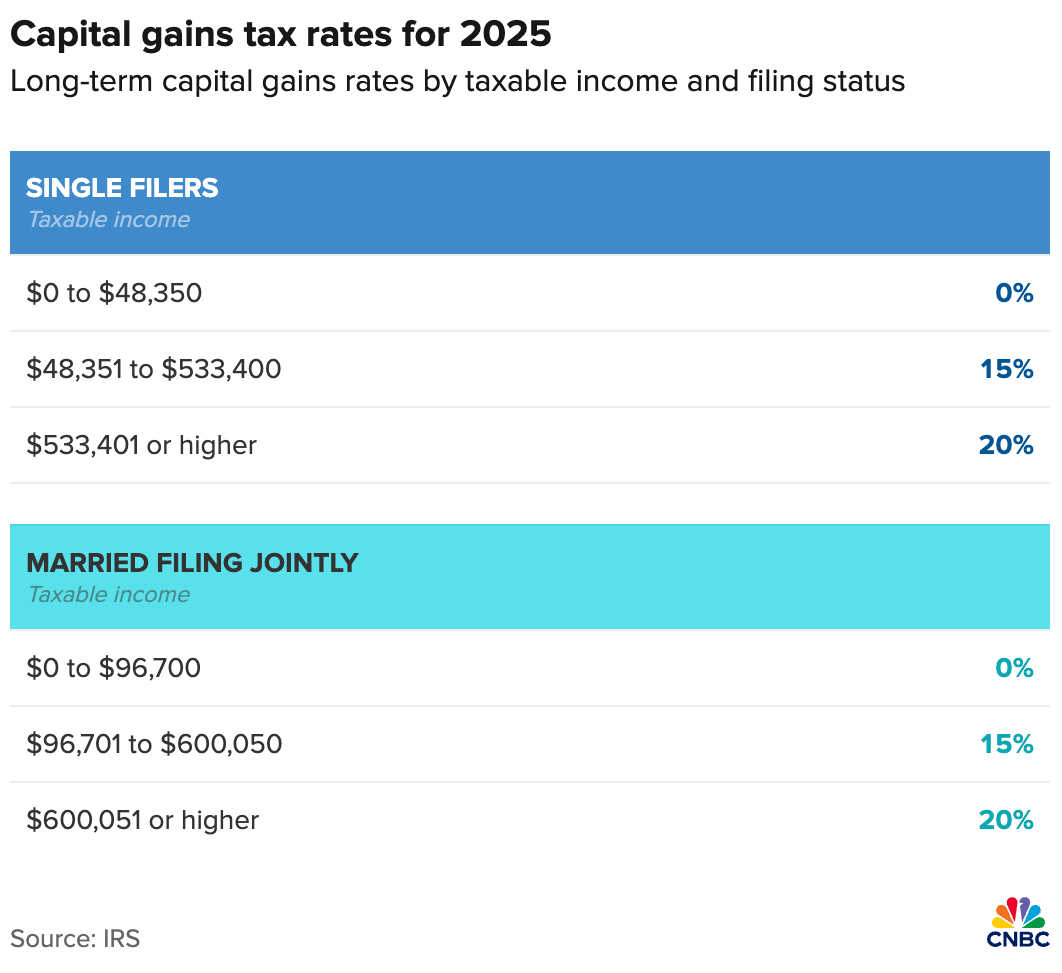

Thanks to the standard deduction and the 0% capital gains tax threshold, retirees can earn and withdraw $63,350 (single) or $126,700 (married) tax-free in 2025. The 0% tax bracket for qualified dividends and long-term capital gains applies to income up to $48,350 (single) or $96,700 (married). The standard deduction amounts are $15,000 for singles and $30,000 for married couples.

At a 4% withdrawal rate, this means a single retiree needs a portfolio of $1,346,250, while a married couple requires $2,417,500 to fully optimize this strategy. Given that most Americans fall short of these savings, the need for a Roth IRA may not be as critical as often suggested.

5) What will $7,000 do for your retirement?

A max contribution of $7,000 a year isn't going to get you to the promised land. If you are already maxing out your 401K (pre-tax contribution up to $23,500 for 2025), and you are eligible for a Roth IRA maximum contribution for a single filer ($150,000 income or less), you probably will get more out of spending your $7,000 on life now.

I am a big proponent of aggressive savings. However, if you are earning up to ~$130,500 a year in gross income after maxing out the 401(k), I'd rather you not tie up that $7,000 in a government savings vehicle until 59.5.

Invest your money in a low cost investment account like Empower the leading digital hybrid wealth advisor today. Or keep your cash liquid, especially now that interest rates are rising.

6) You may never reap the rewards of a Roth IRA.

Let's say the math wasn't the same. You continue to contribute to your Roth IRA because you believe in the tax benefits. Unfortunately, you die at age 59. What a waste of contributions.

All those taxes you paid upfront to the cunning government, and you'll never once get to utilize the returns on your Roth IRA. What a shame.

Guess what? Over those 37 years, the government has happily spent your tens of thousands of dollars on themselves. That makes me sick, and it should make you sick as well. But maybe not, since you are a patriot.

Speaking of losing out on all the contributions, make sure you get married before you die before hitting the age of Social Security collection. If you end up paying FICA tax for 40 years and then die single, the government gets all your Social Security benefits! Again, the government is smarter than you.

7) Early withdrawal penalty for Roth IRA.

The are no withdrawal penalties for the after-tax money you contribute to your Roth IRA. However, if you decide to withdraw money that has been earned from your after tax contributions before age 59.5, then will be penalized by 10% + your normal tax rate.

For example, if you contribute $10,000 to your Roth IRA and it grows to $15,000. There is a 10% penalty on the $5,000 + your normal tax rate. Just don't be naive to put it past the government to one day tax your after-tax Roth IRA contributions again upon exit.

Look at Social Security, for example. They raised the base case age for full retirement from 62 to 67 for those born after 1960! That's five long years more one has to wait to receive full SS benefits. At least Social Security COLA is keeping up with inflation.

Just note that distributions from Roth IRAs do not count as provisional income and, therefore, don't cause any of your Social Security to be taxed.

8) You eliminate the benefits of moving to a lower-cost state to save on taxes

America is a free country where we can relocate at will. If you live in one of the 43 States where there are State income taxes, then it behooves you not to pay more State income taxes.

In California, our state income tax is 8%-13.3% and we've got a huge budget deficit, especially due to 4+ months of economic lockdowns! There's no way I'm giving 10% of my hard-earned retirement income to the politicians up in Sacramento to waste.

Instead, once I retire, I plan to move to one of the 7 no income-tax states (Nevada, Washington, Wyoming, Florida sound reasonable), and avoid paying 10% state taxes altogether. You have the power to save on taxes just by moving.

See: States With No Estate Taxes and The Best States To Buy Real Estate. Also see the nine no income tax states. Heck, you could also move to Canada to save money too.

Choose The Traditional IRA And Max Out The 401(k)

Hopefully you now recognize all the disadvantages of a Roth IRA.

If you are a recent college graduate who is at the beginning of their earnings power, then choosing to participate in a Roth IRA is less egregious than someone who is older and makes more money. When you're earning less money, you pay less taxes. You might even pay no taxes due to the standard deduction limit of $15,000 for 2025. It goes up every year to account for inflation.

Your tax rate is low. You might as well save and make a bet that you will make more money as you gain more experience. However, even though you are in the lower tax bracket and assume to make more, make sure you at least max out your 401(k) first.

For those of you in a higher marginal income tax bracket, doing a backdoor Roth IRA conversion could very well be a waste of time.

In my opinion, so long as you are in the 22% marginal income tax bracket or lower, contributing to a Roth IRA is fine. If you are in the 24% marginal income tax bracket, then contributing to a Roth IRA is likely to be a wash.

Always Do The Math Before Contributing To A Roth IRA

Let's say you make $50,000 a year and contribute to a Roth IRA. At $50,000, single, with no deductions, your Federal Tax bill is estimated at around $6,250. This equals an effective tax rate of 12.5%.

However, you are squarely in the 22% federal tax bracket. Therefore, the $7,000 you are contributing to a Roth IRA is paying a 22% federal tax rate, not your effective tax rate of 12.5%. 22% is OK, but don't forget state taxes.

Let's say you are hot stuff now and make $160,000. $160,000 is the very income edge of where you can still contribute to a ROTH IRA as a single in 2024. Your Federal Tax bill is now around $21,000, or an effective tax rate of 17%. However, your $7,000 maximum Roth IRA contribution is paying a 24% federal tax rate.

You're not really saving because it's not about moving up and down the Federal Tax Brackets. It's about what you think future tax rates will be at for income levels below $160,000. Over $160,000 you start to get phased out.

The $160,000 and below income level for single filers is the protected middle class where no politician dare assaults. The middle class is what puts politicians in office, therefore, taxes will unlikely ever go up for this income group! In fact, Biden has promised he won't raise taxes for any household making under $400,000. Not bad.

Final Disadvantage Of A Roth IRA

You will unlikely make more in retirement than while you are working. As a result, you will likely be in a lower income tax bracket in retirement. Let's crunch the numbers.

Let's say you make $160,000 a year or less for your entire life. As a result, you are able to contribute to a Roth IRA. Do you really think when you retire, your income will now be more than $160,000 a year? Only if you earn $160,000 or greater are you in the same tax bracket.

Be realistic. At today's 10-year risk free rate of ~4.5%, you need $3.55 million dollars to generate $160,000 a year in income! And that's before taxes! OK, let's say you can generate a more realistic 4% annual rate of return. To generate $160,000 gross a year in retirement income would require capital of $4,000,000

$4,000,000 is a more achievable amount of investment capital to accumulate in retirement. But if you look at the data, the average net worth in America is closer to $500,000. And worse, the median net worth in America is below $70,000 according to the latest global millionaires report.

Therefore, you will likely NOT make more in retirement than during your working years. Stop being delusional! Even if you received the average Social Security benefit of around $21,000 a year, you will likely not make more in retirement than while working.

If you have not maxed out your 401k, please do so before even considering contributing to a Roth IRA.

The Bloated Government

You never want to give the government more money than you need to. We are all idealists in college and just out of college. However, once you start paying attention to what's going on up in the various State capitols and in Washington DC, you will realize how manipulative our politicians are.

If allowed, the government will take you for all you're worth. Power is addicting and you must help fight Capitol Hill's addiction by holding on to your own money.

You know what's best for you. You have the power to make a good living. Don't be fooled by the government who want to make money off of you. The more money you make, the more you've got to get into the tax savings mindset. There are people out there who actually pay a higher percentage of their income in taxes than they save. Shocking.

Fight on and open your mind.

Slowly Warming Up To The Roth IRA

Thanks to all the wonderful feedback over the years, I've been less dogmatic about the disadvantages of the Roth IRA.

If you have children, opening up a Roth IRA for your children is a no-brainer. They can earn tax-free income up to the standard deduction limit. Then they can contribute $7,000 of the income into a Roth IRA to earn tax-free returns. Finally, they can withdraw the money tax-free. That's a triple win and should be taken advantage of.

People should diversify their retirement savings for tax reasons. The tax cuts implemented by the Tax Cut and Jobs Act were set to expire on December 31, 2025. Therefore, converting or contributing to a tax-now Roth IRA may make more sense.

That said, with Trump as president again, it's unlikely tax rates will be going up under his second term. He has announced middle class tax cuts, which means the urgency to do Roth conversions has lessened under his second term.

I don't believe power-hungry politicians will ever raise taxes on the middle class. If they do, they will risk losing votes. Therefore, if you're paying less than a 25% margin federal income tax bracket, contributing to a Roth IRA is fine. But once you're over 25%, I don't think a Roth IRA makes sense.

Finally, after 16 years of contemplating the merits of contributing to a Roth IRA, I’ve gained clarity since launching Financial Samurai in 2009. The power of compound returns, combined with the fact that 401(k) and IRA contributions are tax-deferred, means that more retirees could end up earning more in retirement than they did while working. As a result, these retirees may face higher taxes in retirement.

Paying more taxes in retirement isn’t necessarily a bad thing—it’s a sign of financial success. However, contributing to a Roth IRA when you’re in a lower tax bracket is simply smart retirement income diversification. It provides flexibility and reduces the potential tax burden on your future earnings.

Build Wealth Through Real Estate

In addition to investing in stocks and bonds through your 401(k), IRA, and Roth IRA, I recommend diversifying into real estate as well. Real estate is a core asset class that has proven to build long-term wealth for Americans. Real estate is a tangible asset that provides utility and a steady stream of income if you own rental properties.

My favorite private real estate platform is Fundrise. Fundrise has been around since 2012, manages almost $3 billion, and has over 380,000 investors. It focuses primarily on residential properties in the Sunbelt, where valuations are lower and rental yields are higher.

Another great private real estate investing platform is Crowdstreet. Crowdstreet offers accredited investors individual deals run by sponsors that have been pre-vetted for strong track records. Many of their deals are in 18-hour cities where there is potentially greater upside.

If you want to get more surgical in your private real estate investments, Crowdstreet is a strong solution. I've met the people at Crowdstreet on two separate occasions and came away impressed with their risk-management and product offerings.

I've personally invested $954,000 in real estate crowdfunding across 18 projects. My goal is to take advantage of lower valuations in the heartland of America. My real estate investments account for roughly 50% of my current passive income of ~$300,000 so we can live free.

Both platforms are sponsors of Financial Samurai and Financial Samurai is a six-figure investor in Fundrise funds.

Invest In Private Growth Companies

Consider diversifying into private growth companies through an open venture capital fund. Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment.

Check out Fundrise Venture, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 65% of the Innovation Fund is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI!

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum.

Stay On Top Of Your Finances With This Free Tool

The best way to build wealth is to get a handle on your finances by signing up with Empower. Be the captain of your own ship. They are a free online tool which aggregates all your financial accounts on their Dashboard. From there, you can optimize your finances.

Before Empower, I had to log into eight different systems to track 32 different accounts. It was nuts! Now, I can just log into Empower to see how my stock accounts are doing. I can also check to see how my net worth is progressing and where my spending is going.

One of their best tools is the 401(k) Fee Analyzer. It has helped me save over $1,700 in annual portfolio fees I had no idea I was paying. You just click on the Investment Tab to analyze your 401(k).

Finally, run your numbers through their newly launched Retirement Planning Calculator. They use real data that you've linked to produce as realistic a financial scenario as possible in your future.

Disadvantages Of A Roth IRA is a Financial Samurai original post. I've been helping people achieve financial freedom sooner, rather than later since 2009. Join 60,000+ others and subscribe to my posts or free newsletter to achieve financial freedom sooner.

I have to disagree. It’s true that with a Roth the gov’t gets my money more quickly to use as they please, but with a standard IRA or 401k you end up with an amount that’s an illusion and just keeps growing faster as it accumulates but you can’t get to it without income taxes. Those taxes affect everything else in your retirement, like Medicare premiums.

The notion that your income bracket will be lower when you retire is not necessarily true. After 30 years or so of contributions, an IRA can be high enough so you have to withdraw more for RMDs and who knows what income tax brackets will be. The gov’t gets even more, later but more. They are going to win either way.

I’d rather pay earlier, get it out of the way, and let my money grow tax free with a Roth, or in a taxable account and have just interest and dividends for income tax and no RMDs. Plus my balance reflects reality and I’m not counting on lower tax brackets that may not materialize.

Great points—you’re absolutely right that Roth accounts provide more clarity and control when it comes to taxes in retirement. Paying taxes up front means your balance is truly yours, with no looming tax bill or RMDs to manage later on.

I agree that the assumption you’ll be in a lower tax bracket in retirement isn’t always realistic, especially after decades of compounding and contributions. RMDs can push your income higher than expected, which in turn could increase Medicare premiums and even lead to taxation on Social Security benefits.

That said, I think there’s still a role for both types of accounts. Traditional IRAs and 401(k)s can be useful during high-income years when the upfront tax break is significant, while Roths and taxable accounts give you more flexibility and predictability down the line. It’s really about having a tax-diversified portfolio so you can strategically manage withdrawals based on your situation in retirement.

In short, I hear you—the government is going to get its cut either way, but having more tax-free options later on can definitely give you a greater sense of control.

One item not mentioned here – if you have $5M-$10M in your IRA, your RMD is taxed at INCOME rates (30% up to 37%), so you don’t have any step-down in tax rates. If you have just a normal, taxable non-IRA, non-401k, you are taxed at capital gain rates (15% or 20%). Or 0% for a ROTH IRA. There might be substantial savings due to income tax rates at the higher end vs cap gain rates.

Thank you for the financial advice you share.

Being a “blue-collar worker. I’m not knowledgeable about financial strategies, but my small company contributed to a 401K account which was rolled over to a Traditional IRA account.

At age 70, my main concern is if there’s a time when the tax amount that has to be paid, won’t be as high? I had assumed that the tax bracket would be lower for senior citizens after 70?

I think there’s a RMD at age 72.

I wanted to use money for pre-planned funeral arrangements for my wife & I.

Social Security benefits are not enough for extra expenses.

I have to disagree on thinking a Roth IRA is not tax efficient. I use my Roth for aggressive stocks & mutual funds, while my regular IRA has less aggressive stocks/mutual funds.

In my situation, I started contributing to a 401K Roth in 2007 when my company first introduced it. The company match was always put into the regular 401K by default. 10 years later, I was luckily able to retire early at 50 yrs old. I ended up contributing overall $146K to my 401K Roth, and calculated that I paid an additional $36K in upfront taxes based on my yearly tax bracket (generally the 25% bracket). Now it’s 2021, and the $146K in my Roth has grown to $567K and I’m 54 years old.

Since I can’t touch my money until 59.5 years, let’s assume I wait 7 more years and that $567K will be worth about $1.1M (assuming the rule of 72) – all tax free. Now with the Roth money, I can artificially keep my AGI in the lowest tax bracket (10%) until Social Security & RMDs kicks in at 70\72 years.

If I had only contributed to a regular 401K, now that $1.1M is taxed at a minimum of 10% – which means that is $110K in federal taxes, plus probably another 10% in state taxes. So that comes out to $220K in taxes I would pay with a regular 401K. With my Roth IRA, I paid $36K in taxes upfront.

The only way a regular IRA would have been better is if the lowest tax bracket drops below 3% – which will never happen.

Sounds good. I hope your Roth IRA does double in 7 years. Although that seems aggressive unless you are 100% in equities and our bull market lasts that long.

Don’t forget to calculate what the $36,000 in upfront taxes could have grown to as well.

I think the Roth IRA is a good way to diversify your retirement income, but only if you are in a lower tax bracket.

I completely disagree with pursuing a more aggressive strategy in roth. Let’s phrase it another way. If you are playing russian roulette, would it be better to pair up with another person and split the risk? Well that is what you are doing with tax-deferred money. In tax-deferred accounts, you are essentially playing with someone elses money (the government’s portion that was supposed to be taxed). So lets say you went full blown risk mode and lost half the invested amount. Well guess what, a decent chunk of that money was the government’s money you just lost. I don’t feel bad for the government. Do you? Now, let’s say you hit it out of the park and your investments quadrupled. Well, guess what, you made a lot of money on the government’s money, so you have more money to pay the taxes with than you otherwise would have just using your own money that was taxed. I don’t know about you, but I wouldn’t play russian roulette all by myself.

Also keep it mind that by not being taxed on that money now, you have more take home money that you can now invest into other areas- rental properties, a business etc. Or maybe you just want to actually enjoy your money now and go on some trips while you can still walk without artificial joints.

At the end of the day it’s a balancing act. If your marginal tax rate is 37%, then you should almost NEVER do roth. If you are just starting out and making 80k lets say with expectations to make a lot more during peak earnings years, then you have a better case for roth. Once you hit that top marginal tax rate, it makes little to no sense to do roth.

“5) What will $6,000 do for your retirement?

A max contribution of $6,000 a year isn’t going to get you to the promised land.”

$6000 per year invested for 40 years at 10% will net you 3 Million. That’s nothing to sneeze at.

Personally, I am dividing retirement dollars between Roth and my simple IRA plan at work.

I make 70K and contribute 3% to the simple which is matched by my employer for a total of $4200. I then max out Roth IRA’s for my wife and myself for another $12,000. That’s about 23% of my gross income.

We have 280k combined in our Roths and 135k in pretax IRAS. Having both types of accounts allows me to diversify between stocks and bonds with the more aggresive investments in the Roth and the more conservative in the Traditional. This should help to lessen my tax burden later on.

Additionally, If the tax structure remains relatively similar, having both types of accounts to pull from will actually allow me to withdraw a significant amount of my Traditional tax free due to standard deductions. For instance in the current tax year If a couple filing jointly needs 100k, they can receive 35K from Social Security, withdraw 21k from a traditional IRA and 44K from a Roth IRA and they would owe no taxes. If the same couple took 35K from Social Security and 65K from a traditional They would owe about $8k in taxes.

Yeah I fell for the Gov’s whole propaganda about stressing the importance of establishing an IRA for retirement. But as I dug deeper there’s really no reason to do it in the first place. It’s my money and I should be able to access my investment portfolio’s as I see fit! Why the hell is the Gov even saying oh it’s in your best interest to save until you’re 59 ½. Otherwise be prepared to face a tax penalty. Like wth, what is up with this bs?

Life happens and I should be able to sell some positions and withdraw from my retirement portfolio as I see fit. To hell with still getting the same taxes taken out on top of an additional 10%. I also read somewhere that it’s 25% if you have an IRA for less than 2yrs and decide to close it!

Im already using two brokers for personal stocks and crypto. Atleast with these they have the exact same growth opportunities as an IRA would if you had the same positions in the IRA like you did with your personal portfolio. I basically treat my personal portfolio as my own personal IRA. It’s an investment for a reason. I’m not delusional in the least bit, I’m not day trading unless I see a stock has a chance to gain some substancial gains. Otherwise I’m already investing for the long term. No matter how you look at it in this case, an IRA just has way too many drawbacks. Plus I don’t like the fact that the Gov dictates that I’m a bad investor for withdrawing early, so now I have to pay an additional 10% tax on top of what I’m already getting taxed. Well to hell with that.

So now I’m facing this exact conundrum. I started using Stash strictly for ETF’s. They just seemed to have a better platform for long term investments with etfs, bonds, reits, etc. They created some of their own etfs for you to choose from. I like their stock back reward program. Plus I use it as my bank account, but namely as a sort of secondary savings account. I was planning to set aside 20% of my income to my main savings, 15% to my personal portfolio, 15% to stash as a secondary savings and for ETF’s. I may switch it around here and there. But essentially I am wanting to deposit $500 a month in Stash so I would get a decent amount in compounding interest rates at a 5% annual growth rate.

So when I first created my stash they automatically put my in the highest subscription which was only $9 and had all.the bells and whistles. Well they took it upon themselves to start me an IRA. Well I caught it or so I thought and switched to the basic subscription that’s only $1 per month. Well unbeknownst to me it set it on the mid their subscription that’s only $3 a month. But they deposited $45 towards the IRA! I’m not sure how the hell this even happened to be honest. I had already deposited $400 in the personal portfolio for my etfs. I was planning to slowly sell of my stocks from my other portfolio’s in Robinhood, etc. I figured this could take awhile as I already have a substantial amount in my positions with my other brokers. I’m in no hurry but was looking forward in using Stash.

Anyways I’m not sure how they just automatically deposited $45 in an IRA? Apparently I was set up for $45 per week reoccurring deposits. I stopped it immediately when I found out. Fortunately it only chosen 1 etf which I already own in my other portfolio. So it only made a 2 cent gain. But now I have to go through the headache of having to sell the positions in the IRA and close everything out.

I’m glad I caught it early and this was because I was alerted when they withdrew the $45 from my bank account. I did hesitate for awhile and thought to myself wth maybe I should have an IRA. But then logic dawned on me and I said hell no! I do not like the fact that I have to wait a quarter of a century until the Gov deems me worthy enough to touch my money. Plus If I would of been indecisive and waited too long I’d just get penalized even more. So better to stop it immediately and just pay the damn 10% on the $45.02 that’s in the IRA right now.

I’m liking Stash so far besides this whole fiasco. But I’m willing to leave it up to this being a mistake of my own doing. I may of did this unknowingly while I was getting familiar with the app. It is what it is, it’s just bs now that they are going to tax me on my own money. Income that has already been pretaxed that alone is enough for anyone to be alarmed about getting an IRA. So if anyone is up in the air about getting an IRA don’t!

Just get you a pretty decent diversified portfolio. Make sure to get you a few stocks you believe in, some etfs, bonds and maybe a few reits even. Either way if you ever want to sell your positions for any reason. You can do so without worrying about getting penalized. Be smart with your money, most of don’t be giving it away to the Gov by getting taxed upon being taxed!

Hey, I am 74 and saved most of my retirement funds in my 401K at work. I am pretty financially savvy, but really struck out on how much appreciation my investments had, so now I actually have a higher income than I had working and am still stuck paying taxes at levels ABOVE what I did when I worked. I think the 401K is a TAX TRAP. I agree wholeheartedly w/you that our government deserves NOTHING. It is hell trying to figure out how to pay fewer taxes. I live in Illinois like one of your commenters, and I have been considering what he says he will do, but if you are not careful you will jack your Medicare premium up and never get it down. I help all my kids and their significant others invest and I am having them utilize the 401 K, but ONLY to their company’s match and then MAX the measly $6 K in their Roth. But if I only had had my Apple stock (from 1999) in my Roth instead of my 401K life would be good. Maybe my kids will turn their Tesla into a windfall of sorts. If we didn’t have such corrupt unions and politicians things would be better. Good luck to everyone!

Roth IRA Kick in the Gut

I haven’t seen anyone mention the fact that if you are not rich enough to pay for years and years in a nursing home for yourself, to the tune of probably $200k/year in a decade’s time, out of your assets, then you will go on Medicaid. Double that if you have a spouse that needs assistance too. How many years of spending $400k can you afford?

Medicaid rules vary by state and most states considered IRAs “countable” (things that you have to spend down before going on Medicaid, even if it is your spouse’s IRA). However, currently there are some states that do not consider IRAs as “countable” if they are in payout (RMD) status. I can’t post links, so you’ll have to search for this info yourself. Currently only three states don’t consider you and your spouse’s IRA as countable even if they are not in payout/RMD status.

So here is the kick in the gut – you and your spouse’s Roth IRAs are NEVER in payout/RMD status and therefore (in most states) ARE countable assets that you have to spend before you can go on Medicaid. So a good chunk or all of your years of contributing to Roths and filling your tax brackets by back dooring into Roths will be for naught if you are forced to spend it on assisted living or skilled nursing care – which ~70% of us will for some length of time. Remind me again which states allow assisted suicide?

This is definitely a concern, but this is easily fixed. Regardless of your state’s rules, you can keep a $600 S&W .357 Magnum around in case you deteriorate to the level of needing nursing home care. POOF! You’ll still leave behind an inheritance for your heirs and save yourself years of suffering.

Not a good idea to say things like this in a world where a fair chunk of people can be clinically depressed. It would be a service if you would delete your comment, which might just move some marginal soul to make a very bad “momentary” decision.

Sam

One question- assume you max out your 401(k), but make too much $$$ to contribute to a Roth IRA or to deduct from your taxes any contribution to a traditional IRA. In this scenario, would you (1) contribute to a traditional IRA, and (2) if yes, would you convert to a Roth IRA (you already paid taxes on the contribution anyway). Thanks

Also curious about this. My understanding is if I am maxing my 401k and not eligible for the tax deduction for giving to a traditional IRA, I may as well contribute to the traditional and convert to Roth.

With this, I pay taxes now but can let it grow tax-free and withdraw without paying taxes.

Seems like a no-brainer.

Scott — I can give you my answer. Yes I would do a backdoor Roth IRA by contributing to a non-deductible traditional IRA then converting it to a Roth IRA. There’s an aggregation rule that applies which treats all traditional IRA as a single IRA. So if you already have an IRA with only pre-tax money for whatever reason (even rollover IRA which came from a 401(k) from a previous employer), the backdoor Roth conversion can have tax consequence beyond just the increase between the time you invested into the non-deductible IRA and the time you convert to a Roth. Not sure if I explained it clearly enough, but this link may help. https://www.kitces.com/blog/the-impact-of-the-ira-aggregation-rule-on-after-tax-distributions-roth-conversions-60-day-rollovers-rmds-and-72t-payments/#:~:text=The%20IRA%20Aggregation%20Rule%20And%20Roth%20Conversion%20Strategies,Roth%20conversion%20is%20treated%20as%20a%20taxable%20distribution.

My company recently started offering tax deferred retirement accounts, where we can contribute a large amount of after-tax dollars and then immediately convert to roth. I’m paying tax up front on that money anyway, but this allows me to put away a lot more money towards retirement that I can take out tax free. I’m planning to max this out. Even though I’m a high earner I also mostly did Roth 401k at my company this year. My husband maxes out his Solo 401k so we get that tax savings for pre-tax. Is there any reason to not max out the tax deferral account if we can afford it (and convert to Roth?) This and next year are prob going to be my highest earning years for a long while.

Hi – I am not sure about the Roth/converting during high earning years. I find there are two major factors at play here, only one of which most people account for. The first one is optimizing your income + conversions over your lifespan in such a way to minimize the amount that is earned/converted at higher tax rates. For example, one might only convert in lower income years. I recommend many clients create a low earnings period after retirement by deferring SS and use this period to convert traditional IRAs => Roths. In short, there is no easy rule of thumb; it takes some analysis. The other angle is the value of the extra tax deferral on obtains when converting to Roth due to no RMDs. The value of this can be significant, but most plans and software I see ignore it.

Upon reading your reasons, the biggest take away I am seeing is “The government might change their mind”. Well yes, they might come and take all our gold like the 1930’s. They might decide that all 401k retirement accounts are now part of Social Security and distributed equally. However you still state that 401k is the best. I contribute to 401k and Roth, and each have their advantages and disadvantages. I am single, and that is unlikely to change, so that is my viewpoint.

With a Roth, I can take out my contributions if I want (tax free) and I cannot do that with my 401k/IRA. This is a big one for me, as if I want to retire before 59.5 I can have an additional place to get money if I come up short/hit a bad market, etc. With a Roth, I can pass it to my heirs, 100% tax free (cannot do that with a 401k/IRA, and is subject to the whims of the federal inheritance tax rules). Yes the taxes and opportunity costs might make sense from what you are saying (I didn’t hyper-analyze them), but at the end of the day, sometimes you pay a little more for more benefits.

I don’t know, I think that 1/2 your arguments are spurious and speculative, and the other half might not fit due to the financial situation you are in (income, life expectancy, life goals, etc.) Take it with a grain of salt I guess .. as I do with every article I read.

Correct. Folks have got to do what’s right for them. And if they want to pay taxes up front, even at above a 24% marginal income tax rate, that’s great. The country especially needs tax revenue right now with so much of the economy closed.

It is good to diversify retirement funds. If you are maxing out your 401(k) and get to contribute to a Roth IRA, then I say why not.

I don’t plan to make more in retirement than while I was working. Therefore, I will be in a lower tax bracket. But I’m proud of those who will make more in retirement than while working. That is an incredible feat.

Incredible? Hardly. JeffD has already nailed the point of contention here. We’re blind to the situation of others. FS advice makes sense for a high income earner from early career, which isn’t most people (by definition of average of course). For average earners who are successful in their investments over a long period, they’ll be withdrawing in the highest tax bracket when they retire, and they’ll be forced into RMDs that they’ve no control over. Now you can say “who are these average pay folks who amass large amounts” and call this incredible. But it’s not incredible, and in fact it’s the whole damn point of investing. Sometimes I think the financial advisor industrial complex mentally socializes everything, so that following their advice tends to defeat the purpose of investing. If we all get similar returns, then I guess we should all focus on attaining the highest yearly income since that’s the remaining differentiator among us.

Screw that. My portfolio is 65 times my payroll income and I’m not 60 yet. Because, um … compounding? It could conceivably be 90 or 100x times in a decade or two if I’m lucky. What’s that? I’m not average? Right, but my income is and will always has been and will be. Assuming others fit our own demographic profile isn’t wise. At the low end it doesn’t matter (if and when low income = low motivation), and at the high end it may not make sense. But in the middle income ROTH often makes a lot of sense, though diversifying pre and post tax is good and likely necessary for most.

Here is link to JeffD’s comment. https://www.financialsamurai.com/disadvantages-of-the-roth-ira-not-all-is-what-it-seems/comment-page-5/#comment-425015

And one more argument for the Roth that may finally change some minds:

Social security benefit payments are subject to taxation. Your Federal taxes are based on your adjusted SS income which is calculated as your taxable income plus one half of your social security benefit amount. If you are married, filing jointly, then your tax is 0%, since Roth IRA distributions are not taxable in this particular formula (look it up). That means you and your wife can earn a combined $63,999 in social security benefits without any Federal taxes if your income outside SS comes solely from your Roth withdrawls. Since most states do not tax SS benefits, that would make your entire SS distribution tax free. Combine that with the fact that the Federal government is likely to soon tax income at pre -1982 levels, and you are looking at gargantuan savings from using a Roth vs other investment vehicles.

Hey Financial Samurai,

I think this is a cool article, while everyone might not agree, I love the different view point you give. Question for you. Do you see any disadvantages in using some of your Roth IRA towards the 20% down payment of a first home.

I’ve read a number of articles on financialsamurai over the years. Some I found insightful, some less so, but always fairly sensible, working with a well-defined set of assumptions and drawing reasonable conclusions. It is only occasionally that a link sends me (or reminds me) of these bizarre anti-Roth tirades. They’re bizarre because they are utterly irrational. I’m not arguing that anyone should contribute to a Roth IRA (I think there are plenty of circumstances where it’s the right move, but that’s irrelevant for the present purposes). They just make no sense.

You argue that Roth plans are both a poor choice, and also that the tax policy is unfair because that poor decision is only available to some people. Are Roth plans bad because they don’t make financial sense? Or as part of taking an ethical stand? And I’ve never seen the same logic applied elsewhere, like, “You could worry about avoiding short-term capital gains taxes. But you shouldn’t, because long-term capital gains rates are unfair! Only people with capital gains can use them!”

You argue that the government is bad, so you shouldn’t give them taxes early, they will just waste them! But hypothetically, you are giving the government more money with a standard 401(k) or IRA, because in the intervening years, you will invest that additional capital more wisely than the government, and so when it comes time to take their cut (at withdrawal), there will be more to take. Yes, assuming your marginal tax bracket is constant, the amount you see at the end will be the same.

One thing you definitely get with part of your retirement being in post-tax funds is the ability to withdrawal funds according to your needs, attempting to keep constant the amount of pre-tax dollars you take out in a year to minimize the overall tax burden, regardless of changing cash flow requirements. So there are benefits to the Roth.

I’m in late 30’s in 24% bracket (married, with kids), and thinking of doing a conversion to Roth while staying in 24% bracket. I’m in Illinois, which doesn’t tax IRA distributions (even if they’re converted to Roth). Tax rate here is 4.95%. I’m already maxing out 401k on both of our accounts. I’ve already contributed 20k to kids’ 529 – that’s the max that the state income tax-deductible. I’ve also had a grandparent contribute 2k to each kid’s Coverdell account.

My reasons:

1. Taxes are historically low

2. Feeble attempt to time the market

3. Possibility of using the principal if such need arises (eg purchase of new residence, etc)

Am I missing anything?

No. You’re correct. I’d add these as well.

4. It’s easier to convert at within a reasonable tax bracket with a lower balance than a higher balance in the future. For this reason, even if you aren’t at your contribution limit, Roth often makes more sense.

5. How much of your social security income will become taxable depends on provisional income and filing status. Some relatively low income people are in insanely high income tax bracket because of this.

6. Obamacare premium credit is a stealth tax based on income if you are interested in retiring before age 65. It effectively adds about 15% on top of your normal tax below 400% of federal poverty level. So a 12% tax bracket might turn out to be 27% tax bracket making your conversion cost more if you wait until you retire early.

7. Income related Monthly Adjustment Amount (IRMAA) causes some people to pay more for Medicare Part B and Drug Coverage based on income and whether you are single or married. Remember, even if you are married now, one of you may die at one point before the other. For the moment, the cost is about 5% but with Medicare cost rising, I suspect it’ll be closer to 7% in the next 15 years.

8. 3.8% Net Investment Income tax thresh hold is not indexed to inflation so it’ll impact more people down the line.

9. State income tax.

10. State and Federal estate tax

11. Stretched IRA is largely dead. If you die with a traditional IRA, the heir has to distribute the balance with 10 years in most cases. The same rule applies for a Roth but at least they won’t have a tax problem when pulling money out at a time they might be earning good money.

12. The math isn’t the same if you start maxing out the contribution limit. If you put $6000 into a Roth, you paid tax to get it in there. If you put $6000 into a traditional, the tax deduction you had must be kept somewhere which presumably will be in a taxable account thus will not grow at the same rate of return even if your tax bracket stayed the same at contribution and at distribution. Some idea applies to Roth 401(k) if that is offered to you.

13. The first two reason ranting against the Roth of government being inefficient neglects the reasons to offer the Roth to begin with. They want to give some incentive to invest. Many will invest in U.S. stocks which the companies are hiring people, growing the economy, and pay U.S. tax. With people saving for retirement, they will spend more or at least not need government hand out later in life.

14. You can invest in a Roth at any income if you use a backdoor option by investing in a traditional IRA first then converting it to a Roth.

15. Argument for deduct at marginal and pay tax at average rate is flawed because most people have social security during retirement thus you’re actually going from deducting at marginal to paying at marginal.

16. Many places have property tax breaks for somewhat lower income seniors. The income limit varies even within a state. Often you will get a discount and/or frozen assessment as long as your income is within a certain range and don’t move.

I’d lean Roth with maybe a small amount in a traditional for those reasons. Many people think they’ll be in a lower bracket some point in their career or at retirement so far, with all the stealth tax and incentive to keep income level low, their tax bracket is often higher than when they were working.

I must be missing something here:

“Let’s say you pay $2,000 in taxes to contribute $5,000 to a Roth IRA, and that $5,000 miraculously grows to $1 billion dollars. Your total tax bill would be around $400 million dollars if you had contributed to a 401(k) and had to withdraw!”

I thought there is no tax on investment gains in a Roth IRA? Roth costs more up front but if you invest wisely and grow that account the gains will vastly outweigh that early tax loss, whereas in a traditional IRA you have to pay tax on everything. That seems like a huge difference to me, what am I missing?

Yes, you’re absolutely right and this a reason one would contribute to a Roth.

Yes, gains from Roth IRA investments are tax-free upon withdrawal.

It’s the opportunity cost of paying $2,000 in taxes up front. If you didn’t, and invested the $2,000 like the $5,000, it would have grown to $400 – $500 million.

Her’es what sucks about ROTH IRA.

In a regular IRA, you pay no tax now (you write off the amount contributed) but pay tax when you take it out.

In a ROTH IRA, you pay tax now and then the govt says you won’t have to pay more tax later.

The problem is, the government needs to steal your money to pay for welfare. What’s to stop them from double-taxing you by deciding in the future to steal part of your ROTH IRA?

At least with a regular IRA you get the benefit of the tax write off now, when you probably have a low or moderate income and need that tax savings. With a ROTH IRA there is no guarenteed tax benefit, since the govt can change their mind on tax schemes.

Don’t think they won’t do it, either. As soon as the dollar collapses or govt defaults on their debt or something else terrible happens and they need to steal more money, they will rob retirement accounts and probably bank accts as well.

I think you meant to pay for the military & subsidizing insurance companies. Please look up a government spending chart somewhere credible so you can educate yourself on where tax payers money actually goes.

FACTS!

Uh, pay for welfare? Apparently you don’t have the slightest idea where most of our tax dollars go. I’ll give you a clue: it ain’t to “welfare.”

First off I just discovered your site and really enjoy it – great work! I may not represent the situation you are describing, but I view a Roth as both a bet on myself (having high income in retirement), and a hedge against more progressive tax policy in the future. Am I off-base with this thinking?

I am a 30 yr old above-average earner who maxes out Roth 401k, plus the max allowable after tax contributions ($9k) w/ in-plan Roth conversion. I also max out Traditional IRA w/ Roth conversion (above the income limits for Roth contributions). I am also maxing out my company’s ESPP (~$8k), contributing to a 529 (I am the beneficiary until I have kids) and I have a modest taxable brokerage for some riskier conviction plays. I am also lucky to have a great pension plan at work, a high income earning wife, and a great company 401k match (5% of salary which will increase to 10% in a few years). Should I be diversifying my tax liability?

Matthew – You seem to be making good decisions and this probably explains why you are in such a good situation overall. Well done. I agree with your views and generally do not *diversify* tax liability. Speculative perhaps, but I advise and allow clients to chose. The only things I see missing from your statements are (1) the value of extra deferral a Roth can provide (no RMDs) and (2) the higher effective contributions you can make via Roth vs traditional ($X post-tax in Roth > $X pre-tax in traditional as it will eventually be taxed). Hope that helps, but wishing you continued prosperity!

If you retire early like I did at 48, you can Roth convert a big chunk of money from your traditional IRA every year into a Roth IRA. In my current tax situation, I am able to do this and pay $0 state and Federal taxes. Most people could do this paying at most 10% in taxes. Having the right balance between taxable and non-taxable investments while I was working is what has allowed me to keep my taxes so low. Developing a tax plan for your future is more than half the fun of investing!

I am totally baffled by this post. When you systematically contribute towards retirement, the overwhelmingly large part of your balance at retirement is GROWTH, not the piddly principal you have put into the account. I think maxing our your Roth 401K is best, followed by doing Backdoor Roths. In this way, the 95%+ of your account that is due to the growth in capital is tax free in retirement.

While the dollars you’re investing do have a high opportunity cost since they’re after tax dollars, I still think you come out WAY ahead because of all the tax free growth. Plus if you build up other non-retirement investments (think rental properties, non-retirement mutual funds, etc.), you also don’t have to take required minimum distributions.

To Sam’s point about dying before age 59 1/2, in that case, your heirs have a stepped up basis. They can liquidate tax free at your death, or they can reset the basis of the mutual funds.

What am I missing here?

Thanks,

BR

The key value of the Roth is for “average” earners who start their retirement savings in their early 20s. They will very likely be in a lower tax bracket while making their maximum contributions each year in their early career, and almost certainly be withdrawing in the highest tax bracket by the time they retire. In that case, traditional IRA or 401(k) contributions can leave a person “poorer” than they otherwise would be. Who is to say that the top brackets will be well north of 50% in the near future, like they were before the 1980s?

I am with you on your assessment. I’d rather pay taxes on ~5% of a Roth 401k account due to contributions and receive the other 95% of the account tax-free (regardless of what the government ends up spending it on).

Also, having a Roth IRA will then allow me to transfer from my Roth 401k to my Roth IRA to avoid RMDs (again tax-free since both accounts are Roth). This will allow the best flexibility for year-to-year planning in my golden years.

If you have a 401k, contribute.

If you can open a Traditional IRA and contribute, do it.

If you can open a Roth IRA and contribute, do it.

And now you can pick the best investments for each, like putting all of your REITs into your ROTH. Why?

REITs are required to pay at least 90% of their income, usually derived from rents, each year as dividends to their shareholders. Normally, these dividends are totally subject to taxes, at the ordinary-income rate. But not if they’re held in a tax-sheltered Roth…

Investing in something that gives you a tax break will almost always be preferable to investing inside a taxable account.

If you have tax advantage opportunities given to you (IRA, 401k, etc.) then why not take them? I rather have 6k in a Roth than in a brokerage account.

People talk about diversification for risk.. well I think of the retirement funds as tax opportunity diversification!

Putting diversified index funds in is not a bad move. It’s the simplest method. But it’s important to consider all of your accounts together. You might have a 401(k) at work, a Roth IRA, and a taxable brokerage account as well.

If you own domestic stocks, foreign stocks, bonds, and maybe some alternative assets, rather than spread them all equally in all of your accounts, you can get a better bang for your buck by prioritizing the least tax-efficient investments to put in your tax-free Roth IRA (think REITs in Roth IRAs, instead of brokerage accounts, etc.).

Also, you can follow me on instagram @arandomwalkdowninsta

Cheers

There’s no situation where the Roth IRA makes sense???

Just a few examples…

– teenagers with earned income who can enjoy decades of tax-free compounding

– business owners with incomes that continually rises until death

– retirees with RMDs generating significant taxable income

– super savers that have already maxed out traditional retirement accounts

I never said “no situation.” I highlight that those above the 24% federal income tax bracket should think twice about contributing.

Here are some good follow up articles:

The Only Reasons Where You Should Contribute To A Roth IRA

Why I Never Contributed To A Roth IRA But Why You Probably Should

Chris,

Yes, Roth’s are good for the edge cases. They aren’t good for the average person.

If you look at a bell curve, the situations you described above are not in the center standard deviation, they’re out at the edges.

Only 6.02% of Americans own their own business, which means the other 93.98% work for someone else.

Most people do not have incomes that exponentially increases (after inflation is taken into consideration). The average person is not in college studying to be a doctor or a lawyer.

The average person gets a 2.7% raise every year. Inflation is at 2% right now, the average person won’t be jumping tax brackets because remember those tax brackets are adjusted up each year for inflation.

For the vast majority of Americans, they will not retire with more income per year than they made while working. Most people, myself included, will exit the work force once my nest egg replaces my regular income. If I make $100k/year at a 4% withdraw rate that means I will need $2.5 million (present term value). I say present terms, because $2.5 million today will be worth significantly less a few decades from now because of inflation. If I need $2.5 million today, then next year I will need $2.55 million because of the 2% inflation.

Financial advisors tell their clients to aim for 80% income replacement. Most don’t even hit this mark.

Most people, once established, never leave their inflation adjusted marginal tax rate.

Only 13% of people max out their 401k. In fact, the average savings rate is 6.9%. Couple that with the average household income that’s in the high $50’s, and you can see the vast majority of people are no where near maxing out their 401k’s or being labeled a “super saver”.

My list of averages could go on and on and on. But you’re right, you’ve captured the edge cases in the bell curve.

If you’re in an edge case, then yes, the Roth makes sense. Keep investing in the Roth while you’re in the edge case. However, for most people the traditional 401k is far superior.

I disagree with this article and there’s also misinformation. It’s almost as if there’s a motive here.

1. If you make more than the income cap for a Roth, you can do a backdoor Roth, which is simply converting a Traditional into a Roth. You just can’t contribute to a Roth directly.

2. Why not have a combination of a Traditional and Roth? When Republicans are in power, convert a percentage of your Traditional’s account value into a Roth. When Democrats are in power and raise taxes, don’t convert.

3. If you’re young and anticipate a higher income in the future, why would you want to get taxed at a higher rate? Get that money taxed ASAP.

4. There’s uncertainty of where things will be years down the road. For all we know, taxes could be through the roof. Why gamble?

5. 401ks cannot outperform good decision in a Roth or Traditional. You have no control when to buy and sell in a 401k, which is why many Americans saw their 401ks tank and couldn’t do anything about it. Why not trade in a Traditional or Roth? Invest in some ETFs and companies that buy back their stock? When a crisis is unfolding, sell your shares and buy them back at a cheaper price.

What do you mean “You have no control when to buy and sell in a 401k”. Can you please explain.

Some 401(k)s give you a menu of ten crappy mutual fuunds to select from with zero ability to put your money anywhere else. You *must* allocate among the ten crappy funds.

There are a lot of reasons to put money into a Roth. For early career folks I do not believe that maxing out your traditional is a good choice especially if your employer offers a roth 401k. For people in this situation you can potentially put away $24k per year, while you are in the 12% tax bracket and then withdrawal it tax free when you retire in the 24% tax bracket. It may make sense for you to stop contributing to the roth and go to the traditional once your income gets close to your retirement income, but in the early years go for the Roth. I am not sure about all the points regarding lack of access and low contribution amounts either. You can always make backdoor contributions to a Roth or if you have a Roth 401k option you can contribute $19k just like all the traditional investors.

I’m a teenager working a summer job. I agreed to invest in a Roth IRA.

The thing that gets me confused, but I’ve slowly been getting more clarity on is if

1. you don’t make a ginormous amount of money (I’m between $30-35k, with side hustle of $5-10k/yr. Easily $2-3k of this is cash that I don’t report, whatevs. Not looking to expand greatly- I have 3-4 days off in a row per week, and both of my careers I love. Something to be said for quality of life)

2. you have PAYE student loans

If I can do my IRA (solo 401k, I’m self-employed) then that gets my taxes to a minimum for reporting purposes. Yeah, I’ve run the numbers on the tax bomb, it still seems to make sense to pay less now, have more forgiven later. Also my health insurance is way lower. I’m eligible for a marketplace plan with HSA too, my current option is $40/mo, but could be less if I put more towards retirement, which is the plan now my biz expenses are paid off.

I don’t have any reason to expect to be making significantly more money, there’s a much greater chance I’ll be making less at some point. I don’t see how the Roth is better.

In your situation, I would absolutely do a Roth IRA to save for retirement. You are in a low income tax bracket and there’s basically nothing but upside. Makes no sense to think you can’t and won’t make more money.

But of course, it also depends on your student loan interest rate. I would pay off your student loans more aggressively if it is 5% or higher.

See: FS-DAIR: The Debit And Investment Strategy

I don’t see any reason to expect I would make much more. In my 20 years in the work force the only reason I’ve ever made significantly (difference between $10-15k/yr, and now $30-40k) more is because I switched careers. My work was fairly static for the most point (still have a foot in my old career, but $ has only kept pace with inflation. Fewer opportunities overall and a lot of them pay the same or less than 10-20 yrs ago). My job I have now they put me at the max salary after the initial trial period since I had more experience than their typical person. I could leave, but I’d rather have a low-stress job with supportive boss and a 3 or 4 day weekend, than a 40 hr job where there’s a lot of pressure to network, make sales, etc. Seems to me the best thing is to be the smartest with the money I have, while still living a good life now.

I also forgot to mention that if I invest in trad or SEP IRA or solo 401k now, that can get me lower than ~$25k which lets me do various low income first time homeowner programs. The program I’m on the waitlist for gives me $2 for every $1 I save towards closing/down payment. They said it’s off of AGI not pre-tax income.

I was looking at Dave Ramsey’s blog and it appears that he indicated it’s always more advantageous to contribute to Roth instead of traditional due to growth not being taxed.

But when we assume the tax rate stay constant, the results are the same. Thank you for pointing that out in bullet #4.

With the push for socialism and Medicare for all. Combined with federal debt, social security being underfund….it’s responsible to assume taxes will be higher in the future. Hence, a Roth would make sense. Nobody has a crystal ball, but based on current factors, it seems to sustain a decent standard of living, taxes will need to increase. Why not do some Roth and some pre tax.

haha, according to all the left wingers pushing for socialism and medicare for all, the money is going to come from the uber rich not you and I. According to Bernie, Warren, etc, it won’t cost the middle class person a dime.

So one of three things will happen:

1) You believe them and by some act of God, they are able to follow through with it. In that case your tax situation should be better in the future not worse. Which means the 401k makes even more sense!

2) You recognize what they’re preaching is complete BS and you don’t vote them into office. Thus those things never come to frustration and the taxes stay relatively the same. 401k wins again.

3) You believe their lies, and then they sock it to the middle class. Which will happen and I don’t understand how the public is so blind to this. When has a government social program actually worked? Never! In this case though, you can only blame yourself for voting those clowns into office. And in that case, I have some prime swampland real estate to sell you as well! But on the positive your Roth investment turned out to be a better option. lol.

It’s actually not the same Sheryl. If the tax rate was constant as you say, then we’d be in a flat tax rate system. In that case you would be right, the results would be the same.

However we don’t live under a flat tax system. Our U.S. tax system is tier’d. This is what people aren’t understanding. Any dollar you invest in a Roth you’re paying taxes at your highest marginal rate (highest tier) now. However if you invest in a 401k, later when you retire and withdraw the money, you’d be taxed in tiers plus you get to take a standard deduction. This is called your effective tax rate. If you don’t believe me look at your tax return from last year. Your effective tax rate is always lower than your marginal tax rate! Always!

Everyone’s tax situation is different. For me, I’m at my peak earning years where my salary is likely the highest it’s going to get (adjusted for modest raises and inflation), it makes absolutely no sense to invest in a Roth for me! My effective tax rate in retirement will absolutely be lower than my marginal tax rate now! That’s guaranteed! So the Roth is stupid for me to invest in. But everyone is different. If you get a pension, if you’re currently a student but expect to be a doctor later, etc, etc. All I know is that for my personal situation a regular 401k is the best option!

Also, Dave Ramsey is awesome for the average Joe that needs help with basic things like budgeting, which, lets be honest, the vast majority of America is under this umbrella which is why he’s so famous. However, for those that take control of their life, have discipline, and know how to make money work for you, then Dave Ramsey is not the person for you. Dave believes in absolutely no debt and to pay off your house as soon as possible. I, along with so many other people, believe in the power of leveraged money at low borrowing rates. I will never pay off my house early. Why would I pay it off early when I can use that money to invest instead. I’ll gladly borrow money at 3.5% (and is tax deductible) so that I can instead make 12%+ investing! That’s how your grow an empire! It all comes down to risk and warm fuzzies. If you want the warm fuzzy of paying off your house, go for it. No one will judge you. But financially, that isn’t the best option if you want to grow your net worth! if you pay it off as slow as possible and invest instead your net worth will be significantly higher in 30 years than it would be by paying it off early and then investing! That’s what all businesses do, they leverage low interest debt in order to make higher returns elsewhere. So again, do you want an emotional warm fuzzy or do you want a higher net worth in the future?

Taxing growth or avoiding that is not the issue. The math is multiplying by (1- tax rate) before or after the growth and it works out the same. This assumes the applicable tax rate is the same which is what everyone else here is debating. Here is a link to an article (I wrote) laying out the math as clearly as I could. Note: The other moving part related to Roths is avoiding RMDs and thus allowing the money to stay in the IRA longer and thus benefit from no taxation of dividends, interest, or rebalancing.

Aaron, you need to re-read my post because you didn’t understand it or our tax code. 1-tax rate works if we lived in a flat tax world. Meaning 22% taxed on the front (Roth) or 22% on the backend Trad 401k wouldn’t make a difference. But we don’t live in a flat tax world. Trad 401k withdraws are treated as normal income. You get to take a standard deduction, then the money is filtered through the tax tiers. The final tax is called your effective tax rate. Look at your tax returns last year if you don’t believe me. Front end tax (Roth) is not the same as back end tax (401k).

Here’s food for thought, if your 401k withdraw is less than $12,000 for the year your tax bill is absolutely $0 because you get to take a standard deduction. Why would I pay a high tax rate on a Roth right now when I could pay a significantly lower (or none in this situation) later in retirement on a traditional 401k?

As for RMD’s. Most people will retire on less money per year than they did when they were working. RMD’s won’t even matter in most peoples situations because their 4% yearly withdraw depletes the account faster than the RMD’s. RMD’s only come into play if you have a very significant amount of money that you intend to pass down to someone.

In response to your question posed in the article, YES, I expect to be in a higher tax bracket later, so am converting part of my IRA to a Roth. I retired at 57, and began collecting a small pension at 60. I will begin collecting another pension at 65, and SS at 66.5. It makes sense to convert now while my income and tax bracket are low, and before tax rates revert back to higher levels in 2025.

It is great that you feel you’ll make more money in retirement then during your highest working years. This is why the American con of me is so strong. Everybody is rich and optimistic about the future.