Hopefully everyone who has access to a 401(k) is contributing to a 401(k). To not do so is a mistake you don't want to realize when you're old and grey. This post discusses the top mistakes that are hurting your 401(k) so you can boost you balance.

The government isn’t going to save you. With a large Social Security funding gap, the government is having a hard time saving itself! In fact, the government will probably hurt your ideal retirement life. They will likely either raising the retirement age limit for receiving Social Security and Medicare, raise taxes, or both. With so much stimulus spending to support the economy during the pandemic, higher taxes is an inevitability.

I only had 13 years of experience contributing to my 401(k) because I left my job after 13 years. I rolled it over to an IRA and it has been growing eve since. But 13 years is long enough to realize plenty of things I've done wrong. My 401(k) mistakes have cost me probably close to $150,000 since I started. Scary!

There's a chance you're making the same 401(k) mistakes that I've made. This post is a reflection of such mistakes as well as the mistakes I've witnessed since starting FS in 2009. Hopefully this post will make you richer down the road as we analyze each mistake and solve them together!

Top Mistakes That Are Hurting Your 401(k) Returns

Here are the top eight mistakes that are hurting your 401(k) returns.

1) Being an uninformed bugger.

One of the top mistakes of investing in a 401(k) is not knowing the rules. You get a job and you’re so excited to start working that you don’t bother to read the employee handbook that describes all your benefits. It's very easy to overlook benefits. Benefits such as health care, paid time off, sick leave, retirement savings plans, and sabbaticals are valuable. But what do you care when you are young and just starting off? You've got your whole life ahead of you to save for the future. It's hard to think about ever burning out at work because you've only just begun.

The first thing you should do is thoroughly understand all your benefits. Once you've read your employee handbook, make an appointment with HR or your benefits specialist to have them elaborate on every section of the handbook and answer follow-up questions. So many people young and old are distracted with all that comes with a new job they forget to immediately start contributing to their 401(k)s.

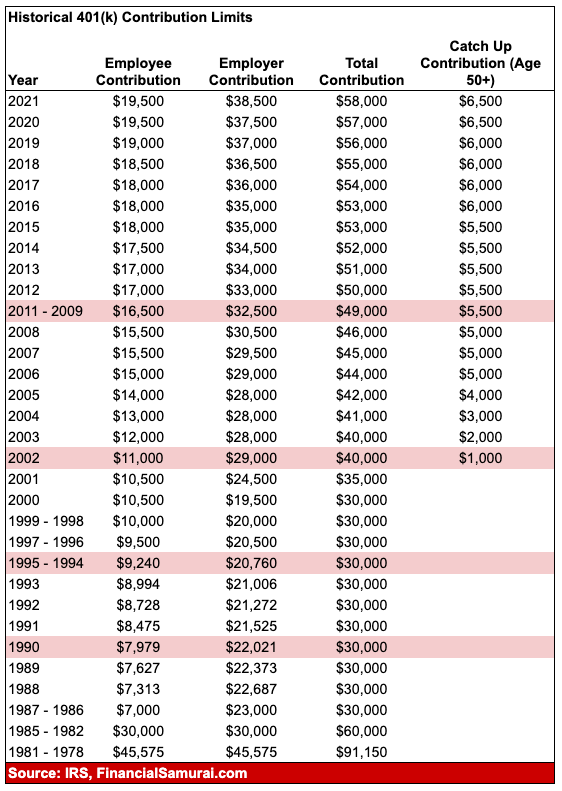

When I was making a $40,000 base salary in Manhattan back in 1999, I only contributed about $3,000 to my 401(k) that year because I just started work in July (graduated in May). If I had studied my firm's 401(k) plan, I would have known I could have maxed out to $10,500 by increasing my pre-tax contributions and contributing some of my year-end bonus as well to catch up.

But, who has time to figure out such things? I was going to Series 7 class for five hours a day, working non-stop afterward, then attending team building events with my classmates until the late evening. Not knowing the maximum 401(k) limit and your company match is one of the top mistakes you can make.

See: How Much You Should Have In Your 401(k) By Age

2) Not staying on top of your investments.

The world and your needs are changing all the time. As a result, it's important to stay on top of your investments. I highly recommend everyone rebalance at least twice a year, even if only minor tweaks are done, because such activity forces you to study up on what you have in your 401(k). “Setting it and forgetting it” is not a great investment strategy. (See: How Often Should I Rebalance My 401(k)?)

Everything was going great in 1999 with tech and internet on fire. Nobody could lose until the NASDAQ imploded one fateful day in the spring of 2000. After reading all about my firm's retirement benefits, I was diligently maxing out all I could in a hyper-growth Janus Tech fund that could do no wrong… until it blew up.

I didn't bother with diversification, cash management, or understanding bonds. I paid the price, but luckily I didn't have that much money invested in my 401(k) at the time. It's good to learn your mistakes when you're still young and poor!

Everyone should use a free financial tool like Personal Capital to analyze their 401(k) and keep track of their money. The most frequent top mistakes is not keeping track of your 401(k).

3) Not maxing out your IRA and 401(k) if both are available while you can.

If you have the ability to max out your IRA and your 401(k), do it. In 2021, the maximum amount you can contribute to a IRA and 401(k) is $6,000 and $19,500, respectively. After $69,000 (between $59,000 – $69,000 there is a phaseout), you aren't allowed to contribute any IRA pre-tax money at all. How's that for setting a low bar for income discrimination?

Of course maxing out $19,500 in your 401(k) and $6,000 in your IRA will be very difficult if you only make $59,000 or less, but give it a go because you'll be saving $23,000 for your future. The deduction won't hurt as bad because it's a pre-tax deduction. Surely many of you can live off $36,000 in gross income when you're still young and resourceful.

Back in 1999, the maximum contribution to an IRA was only $2,000. Even when I was only making $40,000 in expensive Manhattan, I scoffed at contributing $2,000 because I felt $2,000 would do very little for my retirement.

Furthermore, I felt that I would leave behind an orphan IRA fund once my income surpassed the income limit threshold. In retrospect, I should have just contributed $2,000 in 1999 when I had the chance. Something is always better than nothing when it comes to retirement funding.

4) Trading way too much.

Trading too much is definitely one of the top mistakes when it comes to your 401(k). It's been shown time and time again that trading in and out of securities is a bad idea. Not only will you never be able to time the market correctly, you'll incur unnecessary trading fees as a result. The time you spent trading your 401(k) is time you could have spent becoming a better employee. Getting promoted and paid is where the real money is for the first 20 years of your career.

Trading too much was my biggest problem. I worked in the Equities department of a Wall Street firm so stocks were all I thought about and talked about every day. I couldn't help but trade my portfolio, like a bartender who can't help but sip on his best concoctions until he gets a little too tipsy for his own good. Some trades made a killing. Other trades underperformed miserably.

At the end of each year I'd compare my gains to my losses, and most of the time the difference would be negligible (i.e., under $20,000). For years in a row I'd reach Fidelity's rebalancing limit and get a warning. Thankfully there was a trade limit; otherwise I would have kept on going.

If you have trading tendencies like me, try and keep your rebalancing to once a quarter, max. I can promise you that your actions won't make much of a difference over the long run, and your performance will suffer at the margin if you don't follow my advice.

But again, the real money is to be made by doing well in your career. And even if your 401(k) reaches meaningful amounts in the hundreds of thousands of dollars, you're still better off keeping trading to a minimum and focusing on your career.

Related: Active Versus Passive Investing Performance

5) Borrowing or withdrawing from your 401(k).

There is a reason why the government withholds taxes from us throughout the year. Humans cannot be trusted to do the right thing with money! Can you imagine the chaos that would ensue if the government allowed its citizens to pay everything they owed at the end of the year?

Half of us wouldn't come up with anything because we'd have spent all our money. 40% of us would probably fudge our taxes to the point where we'd argue to pay much less. Only about 10% of us would actually be good boys and girls and pay 100% of what the government tells us we owe.

Borrowing from your 401(k) puts a huge drag on performance. If you had borrowed from your 401(k) in 2020, not only would you have missed up to ~18% in returns, you would have had to pay interest on those borrowings. At least you are paying interest to yourself. If you permanently withdraw from your 401(k), not only will you pay normal income taxes, you'll also pay a 10% penalty on your money.

Of course if the choice is between death and borrowing from your 401(k), then pillaging the 401(k) is a better course of action. But hopefully no Financial Samurai reader will ever be that tight on money. Besides contributing to a 401(k), everyone should also be saving in post-tax investment accounts as well.

As soon as you let yourself borrow from your 401(k), the floodgates will open. You'll want to borrow every time there is an “emergency.” (See: Only Petulant Fools Borrow From Their 401(k))

6) Not contributing once you've left your job.

A job change is generally a stressful time. You could have lost your job due to a layoff, or you could have found a new exciting job opportunity. Whether you are self-employed or a new employee, it's important to continue the habit of contributing to your 401(k) or any pre-tax retirement savings vehicle while carefully monitoring your cash flow.

When I left my job in 2012, I was feeling very content to finally get out of the rat race. I wanted to spend all my free time writing and traveling, so that's what I did. I didn't bother researching things such as the SEP IRA or KEOGH 401(k) until the very end of the year because I had already rolled over my 401(k) into an IRA. The last thing on my mind was contributing to my retirement because I was already retired. I wanted to spend my money, not save!

But when you're ahead, you might as well keep on pressing ahead because who knows when bad things will happen. I could have been a 401(k) millionaire by 40 had I stayed at my job. Therefore, please think twice about retiring early. Your retirement and health benefits are more valuable than you realize.

It's better to be conservative in your retirement needs with too much money than have too little.

7) Converting your 401(k) into a Roth IRA.

One of the top mistakes high income earners make is converting their 401(k) into a Roth IRA. Paying huge taxes up from is a no-no when you will likely pay a lower tax rate in retirement. Only convert your 401(k) into a Roth IRA if you are in the bottom three marginal federal income tax brackets.

It's one thing to contribute to a Roth IRA for tax diversification purposes after you've maxed out your 401(k). It's another thing to convert your 401(k) into a Roth IRA if you reside in one of the highest taxed states in the country.

If you live in California, Wisconsin, New York, New Jersey, Connecticut, Pennsylvania, or Maryland, please consider delaying your ROTH IRA conversion until you move to a lower income tax state such as Florida, Wyoming, Washington, Oregon, Tennessee, or Louisiana. If not, you will be paying 3% up to 10% more in taxes than you otherwise should.

The greater your 401(k)'s value and the higher your taxes, the more you should consider never doing a ROTH IRA conversion. Simply rollover your 401(k) into a traditional IRA without paying taxes up front. If you're a young buck in a low income tax bracket who sees great earnings potential ahead, you're less at fault for converting to a ROTH IRA.

Just know that as soon as you give up your free will, you might as well give up your freedom as a US citizen. The government is extremely wasteful. The more you pay in taxes, the more you will realize this truth.

(See: Disadvantages Of A ROTH IRA: Not All Is What It Seems)

8) Paying way too much in fees.

You know who are the richest fund managers in the world? Those who not only gather the most in assets, but charge the most in fees. Given that The Vanguard Group runs about $2.75 trillion dollars, you'd think Jack Bogle, the founder, would be a mega-billionaire, right? Wrong! Jack revealed to the public that his net worth is in “the low double digit millions.”

Let's assign a $100 million net worth to Jack due to his humility. $100 million is nothing compared to so many hedge fund managers and all-star mutual fund managers who run much less. Steve A. Cohen of SAC Capital – who had one of his fund managers convicted of insider trading – got paid over $2 billion just in 2013. That's 23X more in one year than what Jack Bogle, at 83, has taken a lifetime to accumulate.

The money management business is one of the best businesses in the world because it is so scalable. It doesn’t take a person more brainpower to manage a $100 million portfolio than it does to manage a $1 billion portfolio. You, of course, want to invest in good money management businesses as an investor. But as an investor in public equities, you should be thinking about investing in funds that charge the lowest fees.

Analyze Those Fees Carefully

For 11 years, I never once looked at the fees I was paying in my 401(k) until I discovered Personal Capital in 2012. When I ran my 401(k) through Personal Capital's 401(k) Fee Analyzer tool, I was absolutely shocked to discover I was paying $1,700 a year in fees.

What's worse, Personal Capital smartly translated the fees into how many fewer years I would be able to enjoy retirement. I became irate enough to change. One fund was charging 1.6%, so I quickly found a matching Vanguard fund that charged only 0.2%. I also changed a lot of my portfolio into ETFs.

Below is an example of the 401(k) Fee Analyzer tool highlighting exactly how much in fees I would be paying for my funds a year. Not shown are my individual stocks (which have zero fees) below the Funds section. To run your 401(k) or rollover IRA through Personal Capital's free tool, simply sign on to your dashboard, link your account(s), go to the Investment Tab on the top and then click 401(k) Fee Analyzer.

Paying too much in 401(k) fees is definitely one of my top mistakes I could have avoided earlier on.

Maximize Your 401(k) Returns By Taking Action

It's unbelievable that almost half of America's workforce of 100 million do not own any retirement account assets at all. If you're one of them reading this post now, please follow step one of this post. Immediately schedule an appointment with your benefits manager to see what they can do for you. I don't want you going through your career not knowing that you could have been contributing to your 401(k) or IRA all this time.

For the millions of you who have the opportunity to contribute to a 401(k), please don't waste your opportunity to contribute the maximum amount every single year. Often times your employer will provide you free money through a match. If you're at a firm long enough, some employers will even inject year-end profit sharing contributions like my old employer did when I was a Director. Contributions add up over time to the point where the returns in your 401(k) could conceivably overshadow the income you make from your job.

Stay the course and know that every contribution makes your future retirement a little bit better. X-ray your 401k for excessive fees and keep track of your finances. the better you can track your finances, the better you can optimize your finances. Don't let the top mistakes in 401(k) manage hinder you from a great retirement!

Related: How Much You Should Have In Your 401(k) By Age If You Want To Retire Comfortably

Pingback: The Best Of Financial Samurai eBook | Financial Samurai

I’ll admit it, I am only starting my 401 this year. After many years of just getting by and not being able to put anything in, I am starting my 401k from scratch. Honestly, due to this it is very daunting, not knowing where to start, which funds, stocks etc to pick (from the limited list employer provides). I have spent the past few weeks trying to locate sites (like this excellent one) and look at what steps to take next and how to TRY and turn around the 401k contributions I have not been able to make in the past. Any other pointers on what to zero in on (specific mix, portfolio must haves etc) when looking at investing in an employer 401k (matched at 50% of first 5%) both in general and in terms of having to probably take a little more risk to increase account and make up for deficit is greatly appreciated.

Thanks all and thanks for the great info in this site

I have maxed out my 401K for quite a while. We can contribute up to 75%, up to the IRS maximum. Once you do that, you realize you can live on less too. Money in early is generally better too.

It’s amazing how many people do no even contribute enough to get the company match. For me it’s over $4K, which is a decent sum of free money.

Like a lot of folks, I wish I learned these things when I was in my twenties. Just maxing out your 401k and investing in low cost funds would have dramatically changed our financial lives. Oh well. No use crying over the past: at least we’re acting now, instead of in our forties or fifties.

For sure man. There’s no time like the present to execute and learn from my mistakes.

American’s retirement account stats are always depressing. I wonder what’s going to happen to all of the people who literally have nothing saved.

We are currently in the middle of rolling Greg’s two old 401Ks to Vanguard. It’s crazy how much his first 401K charges in fees (Edward Jones!) Not only were they front-loaded, but the ongoing fees are way higher than Vanguard’s. It really is a no-brainer.

I don’t think there is anything wrong with “set it and forget it” if you invest in target date funds. I use Vanguard and their low cost target date funds work great for a hands off no re-balancing needed approach.

All good points, however I would add not being aggressive enough. When you are in your 20’s and 30’s, you should invest aggressively. You still have time to makeup for any mistakes.

Great article, as always Sam. Learn a lot from your articles. I’m glad I started reading personal finance blogs early. I should have started maxing out my 401K. A year after starting my job after grad school, I re arranged how much I was withholding for federal taxes every month and my ESPP to max out my 401K. I was actually withholding too much at the expense of my 401K. Once I rebalance, maxing out 401K became easier and cash flow was not affected.

I like your last section telling people who are not contributing to their 401(k) to get with it and maximize their contributions every year. Your 8 top mistakes carry good advice, as well. Especially important are keep fees low, use an asset allocation that is appropriate for your age, don’t try to time the market, and never borrow from your 401(k).

Really good article (both this one and the one on rolling over your 401k). Last year after about 4 years, I had finally rolled over my 401(k) from my old company to an IRA. The only problem was that I paid absolutely no attention to what the agent suggested for me and now I can see what a rip-off it is using the personal capital tool!

To be fair, there isnt much in my IRA at the moment, but it is pretty irritating to see that the fees are more than double what personal capital charges on average. This is what I get for just blindly listening to some merrill lynch agent telling me to invest in one of their funds. Sometime this week I will most likely try rolling over that IRA to Vanguard.

Luckily I was able to keep contributing after I left my job. It’s great to be able to keep saving even when I’m self employed. The tax saving is substantial as well.

I don’t know about converting to Roth IRA, though. Maybe when Mrs. RB40 is retired, we’ll do it. Right now we still have some income.

My biggest mistake was/is not contributing enough. Especially fresh out of college when I didn’t have any major expenses like a mortgage.

I’m shocked at how many people I know who have borrowed from their 401k’s for various reasons. I always assumed it was kind of common sense that it was a bad move, but it seems too many people see their 401k as an accessible pool of money for any major purchase they want to make.

Both statements you make are correct.

It is a HORRBLE idea and MANY people do it.

All very solid tips, as usual, Sam. The underlying theme seems to be: put retirement planning at the forefront of your mind and don’t simply shrug it off as something you’ll do later. Having that mindset will make it much easier to stay on track via what you’ve discussed in this article.

My biggest mistake was trading too much as well. I am now a big believer in either balanced funds or target retirement funds. I probably would have 50K more today if I’d just put money in balanced funds like American Funds Income Fund of America or Vanguard Wellington, both of which were in my workplace plan. My employer changed providers and now we don’t have either of those 2 funds available, so I now have it set up between 5 funds, 75% stock / 25% bond mix and it rebalances automatically every quarter. I really wish I’d done it this way from day 1. Hopefully, other people will learn from my mistake!

Trading too much is one problem I’ve never had. I’m glad there’s an auto contribute feature that invests my contributions into the funds that I have specified in my setup. If I had to manually invest my injections each month, I’d end up with too much cash just sitting there.

I also waited too long to start my 401k, but at least I finally did many years ago. Every bit counts, and utilizing company match makes such a big difference. I didn’t realize that not all businesses offer match, so I’m very thankful that mine does.

I love Jack Bogle’s readings and books, the best move I made was to switch over to Vanguard. And setting up low index funds broadly diversified fitting a ideal asset allocation for my age.

Speaking of 401k mistakes, I recently talked with a friend who told me she has no idea what is in her 401k. I asked her if she wouldn’t mind me having a look at her account to make any suggestions or to leave it alone. I found that she had been in bond funds only since 2009! wow!!! Told her to read up on Jack Bogle and the world of low cost index funds. Told her well at least she got the company match. But seriously wow, on all the gains that were missed out on over past 5 years for not knowing whats in your 401k.

This is an embarrassing comment and absolutely hate typing this out on here but here is the BIGGEST MISTAKE made with a. 401K.

Yes I did it and yes it was stupid and yes… It could have been avoided.

Here it is… Rolling over your 401K to a Roth IRA in a state that has high STATE taxes!

One if my job transfers was to a lower tax bracket state (think Texas instead of NYC)…

If I just waited until settling down in the city BEFORE rolling over I would have saved by paying next to zero in state taxes… Instead clicked too early. Massive hit.

If you are going to move to a lower state tax area… wait until then to roll it all over.

Example: if you go from NYC to Texas… Or California to Florida… Just roll it over in the tax free state… 10% change on all of the roll over.

WSPB,

Thank you so much for sharing! This seems so obvious once after you learned your mistake. However, I’m sure many people do not think about this and make that mistake.

Never thought about this, now – I will try to never forget it.

Thanks for helping me and other readers save money!!!!

David M

No problem. It was embarrassing because this should have been a no brainer for a Wall Street guy.

No one is perfect though ha!

Hopefully someone won’t make the same mistake, it wasn’t a life changing mistake but it was a 5 figure lesson. (Ugly). 10% is a LOT!

Most excellent point. I’m anti-ROTH IRA conversions. To pay taxes up front to the government while they continue to demonstrate spending inefficiencies is like giving a drug addict more drugs. Just roll the 401(k) over to an IRA folks and keep hope alive that you’ll keep as much money as possible.

Sam 100% agree and going to play a little devil’s advocate here.

You are not in this situation.

But.

Let’s say I *forced* you to leave and work in Texas for one full calendar year 2015. You only have to stay one full year. After that you can go back to a city you like (SF NYC… Etc).

Knowing that you have an opportunity to avoid a 10% tax… Wouldn’t you at least consider it?

This is the AIRBALL of an opportunity that I missed!

Definitely something to consider by “locking in” that definite 10% lower tax rate. If I was forced to go to TX and had a job, I would definitely consider converting b/c I see myself retiring in California or Hawaii.

I’ve got a 401k from a previous jobs that I can’t bring myself to convert – 401ks are bankruptcy proof and judgment proof under ERISA; whereas, IRA protections vary according to state law (generally protected up to $1m, I think). I know the likelihood of a lawsuit is very low, but things happen. Assuming you have a good 401k plan, I guess I don’t really appreciate the value of a conversion from a regular 401k to a regular IRA, other than to simplify your finances? Good article.

Good viewpoint. If you like your 401k, just keep it then.

I hope you will never get close to the point of bankruptcy!

Also, if you are above the Roth contribution level, you can take advantage of the back-door Roth conversion method. With a rollover IRA you have to worry about the conversion aggregation rules.

Another great post Sam. One of the most important points here (IMHO) is about trading rather than investing. One of my favorite books about the market was “How I Made $2,000,000 in the Stock Market” by Nicholas Darvis. It was a great read about his adventures of dancing professionally and trading stocks as he traveled around the world. I tried it myself for 20 years traveling and working around the world. I succeeded in the world of travel but failed miserably in the trading part. I lost over six figures thinking I could outsmart the market. Lesson learned…the stock market is for investing not for trading. Warren Buffet had it right long, long ago. It appears I read the wrong book!

If you really want to be thrifty you could funnel some of your money into a small business you own and operate and the company can contribute up to an aggregate total (if you also have a plan from your day job) of $52,000. Just make sure your total personal contributions don’t exceed $17,500 and make sure you’re not writing your business activities off as a loss every year.

Austin,

I think the $52,000 you are talking about is limited to 25% of profits. That is to put in $25,0000 your small business would need to have net income of $100,000.

If I’m not correct could you please reply back with correct info.

My wife runs her own company and if what you are talking about is something I do not know about I would love to learn more about it.

Thanks,

David M

David M — you’re spot on for a solo-401K product. In addition to the 17.5K employee contribution, the employer can make a 25% profit sharing contribution. So, for w-2 wages of 100K, the employer can contribute 25K.

Since your wife owns the business, you might want to look at rules regarding spousal contributions. If you and your wife are the only two employees, you (in addition to your wife) can also make a 17.5K contribution to a solo-401K plus receive a 25% profit sharing contribution (provided you’re not already contributing to a 401K elsewhere).

Mikec,

Thanks for your reply.

I work somewhere and I contribute 17.5 to my 401k already.

I did not know my wife could cotribute 17.5k AND 25% of profits, thanks!

David M

First of all, I am not an expert on this (or much of anything else) and I am certainly not qualified to speak authoritatively on the matter.

But, it’s my understanding that you can achieve up to a maximum of $52,000 (but no more than 100% of compensation) through three sources; employee contribution, employer match and profit sharing. The total is raised to $57,500 if your over (I think) 50. I think the profit sharing is where your 25% limitation comes into play.

Obviously, this is something you’d want to discuss with somebody with a corporate pension/accounting/HR/legal background.

I’m maxing out my 401k from my current employer and I have a rollover IRA from my previous employer. Can I contribute any to the rollover IRA account? Or does that just sit there until retirement? Thanks for the help.

Ryan,

I believe as long as the IRA is a before tax model IRA (i.e. traditional/rollover IRAs are usually this way), you can roll your entire amount from your 401k over into the IRA and should not receive a tax penalty of any kind, but ONLY if you are not taking some of the money out to keep in your pocket while you transfer the monies.

Some brokerage firms can transfer without having to send you a check, however I received a full withdraw of my entire 401k to put into a rollover IRA that I already had when I left that employer. I also verified it with a CPA at the time.

If you transfer the money into a Roth IRA, brokerage account, or savings account for too long, then it becomes taxable including a 10% penalty. I believe the time limit is 60 days from when the check is written from your current 401k holder to when it is deposited into the rollover IRA.

I believe that you cannot transfer the money from the rollover IRA into another IRA account for 1 year. Here is a link that Sam may allow to be put onto the post:

Rollovers just sit there until you retire. Of course you want to ensure they’re properly invested in a low cost fund or funds, and rebalance once or twice a year.

There’s nothing stopping you from having another ‘contributory’ IRA alongside it. Even if you make too much money, post-tax contributions to an IRA make a good vehicle for Roth conversions.

As active duty military I’m restricted to the Thrift Savings Plan with no employer match. Our investment options are also quite limited, but at least we make out pretty well in the low fees department. Unfortunately I only started contributing a year ago, so I missed out on three whole years of tax-advantaged investing.

Those are all good points Sam. #7 really sticks in my craw, though. I worked at a firm that had very poor 401k options about 7 years ago. The fees were so high, even for the index funds, that I only invested enough to get the company match……and dumped the rest in other accounts. As soon as I could get out of there, I rolled my money over to an IRA. A much more palatable situation.

-Bryan