This is the Financial Samurai 1Q2018 investment update and outlook.

Hopefully everyone got some laughs this April Fool's! It's always good to poke fun at yourself once in a while to stay grounded. Yes, Twitter is indeed like high school where there are gang ups, non-stop gossiping, and outbursts of hormonal rage. One of the main reasons why Disney decided to back out from their purchase of Twitter was due to the fear that all the hate would spill over and tarnish its reputation.

Anyway, I stand by my belief that if you are a happy person with a healthy dose of self-esteem, it's hard to tell others to f off once you have f you money. Money simply magnifies who you already are. Let's show empathy to the ones who dislike us the most.

For 2018 and beyond, I've decided to do things a little differently by taking away the absolute dollar amounts I invest. Given that there's been so much rage against the middle class in expensive coastal cities, I don't want the numbers to be a distraction. Only my family cares about how much we invest anyway.

Financial Samurai 1Q2018 Investment Update And Outlook

Stock Market Overview And Outlook

After rising as much as 7.22% in January, the Dow and S&P 500 closed down ~4% for after April 2. The initial ascent was unsustainable since such continued performance would lead to an annualized gain of over 100% for the year after a strong 20% in 2017.

Unfortunately, the government is no longer a tailwind, but a headwind with the start of trade wars with China and other countries. It's now all about protecting special interest groups and asserting one's dominance over others. It will be interesting to see if Trump can survive full-term if the stock market continues to falter.

Tech is out of favor at the moment after a huge data breach at Facebook, Uber's self-driving car killing a woman in Arizona, another Tesla crash on autopilot with negative talks about Model 3 production, and Trump going after Amazon for not paying enough taxes (Financial Samurai pays more corporate income tax than Amazon).

With the S&P 500 down about 11% from its peak and having tested its bottom again in March, the market is trading at about ~16.8X 12-month forward estimated earnings. Prior to the selloff, the S&P 500 was trading at 18.2 times expected earnings, pricey compared to its 10-year average of 14.5. In December, the S&P 500’s forward PE reached as high as 18.9 before analysts began to increase their estimates for companies reporting their fourth-quarter results.

Therefore, even at ~16.8X forward P/E, the S&P 500 is not cheap compared to historical averages. However, if earnings grow by an estimated 18.4% over the next four quarters, you've got a P/E to Growth (PEG) ratio of less than 1X, which seems reasonable if the world can get along.

The best way I see the stock market regaining its footing is by companies reporting solid 1Q2018 results in 2Q. We've been whiplashed around by news and government rhetoric. If the majority of companies in the S&P 500 can meet or beat earnings expectations, then the expectations for an 18.4% S&P 500 earnings growth estimate will become stronger. If this happens, confidence will return to the stock market since stocks trade on earnings fundamentals at the end of the day.

I deployed a fourth of my remaining house sale proceeds at the beginning of the year, another fourth in February after the meltdown, and another fourth at the end of March when we hit a “double bottom.” I invested the rest of my house proceeds + cash flow into the bond market, which we'll talk about next.

Stock Market Outlook At Current Levels: 7/10. I estimate 10% further downside at most and 15% upside if everything falls into place. I always look at investments with a risk / reward ratio.

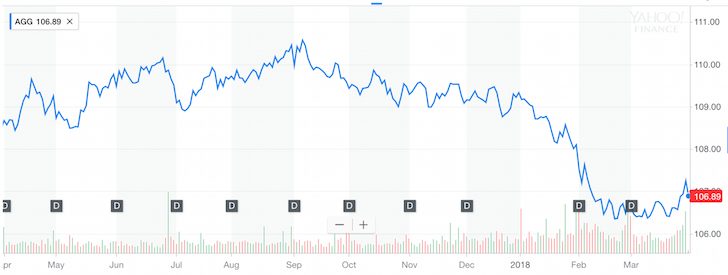

Bonds Market 1Q2018 Overview And Outlook

With fiscal stimulus and tax cuts, the market decided that such moves would be highly inflationary. Bonds sold off as a result, causing bond yields to rise and stocks to fall.

My line in the sand for the 10-year bond yield is 3% for 2018. It came close to breaching 3% when we got up to 2.94% on February 21. But yields have since come back down to around 2.73% with all the turmoil going on in the stock market.

Although the Aggregate Bond Market Index is down about 1.2% for the year, that's better than being down 4% in the S&P 500. We might be in a situation this year of what asset classes loses us the least. But it's too early to tell. Even if bonds end up down 2% for the year, you're still up 0.75% if the yield is 2.75%.

I'm sticking with my belief that the 10-year bond yield does not breach 3% for 2018. Even if we do, it won't be for very long (less than a couple weeks). In other words, the yield curve will continue to flatten if the Fed does not slow down its rate hikes, providing an ominous sign that a recession is coming.

Given the Fed isn't stupid, I'm confident they will adjust their rate hike count and amount if the labor market weakens, inflation comes under expectations, and the stock market continues to correct.

I bought California muni bonds and some longer term treasury ETFs at the end of February after the 10-year yield broke 2.9%. A 3% muni bond yield is equivalent to a 4.3% gross yield if you have a 30% effective tax rate. A 4% gross yield has always been my post-work retirement target return.

Bond Market Outlook At Current Levels: 6/10. 1-2% downside, 3%-4% upside. When the 10-year yield was at 2.94%, I would give the bond market outlook a 8.5/10, but the yield has since come down.

Real Estate 1Q2018 Market Outlook

One of the good things about global uncertainty is that investors seek the security of bonds, thereby lowering bond yields. With the 10-year bond yield coming off its highs, the real estate market may not get squeezed as hard as it could. That said, we are still ~45 basis points higher than we were in December 2017, so debt servicing is more expensive.

I continue to be very cautious about expensive coastal city real estate. Unless you are super bullish about your career prospects, have a massive liquidity event, have at least 30% of the value of the house you want to buy in cash (20% down, 10%+ cash buffer), or are starting a family plus at least one of the things I just mentioned, I would not be buying coastal city real estate, especially if you don't plan to own the property for 10+ years.

See: It Feels A Lot Like 2007 Again: Reflections From The Previous Top Of The Market

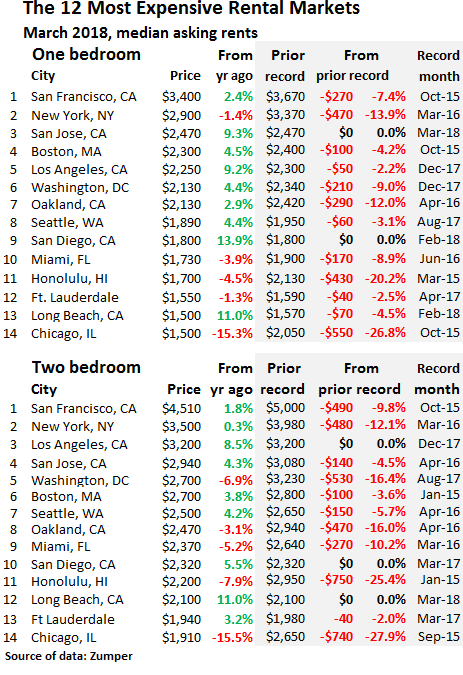

The risk reward for leveraging up at current valuations is unwise for the average person. Rents are falling in places like New York City, San Francisco, Chicago and Honolulu. With more supply in Seattle coming online than any other time in the past, Seattle rents are also starting to soften.

Please read BURL: The Real Estate Investing Rule To Follow, if you haven't done so already.

If earnings fundamentals are important to you, as they should be, the price you decide to pay for your property should be equivalent to the price from the record month MINUS the rental price change since that record time period. In other words, if you are planning to buy a 2-bedroom apartment in Honolulu this year, look up what the price of a comparable apartment was in January 2015 and subtract 25%. That price will give you a rough idea of where you should offer or counter offer.

Now is the time to be picky and negotiate, not be the foolish winner of a manic bidding war.

As for non-coastal city markets, they've got further room to run due to lower valuations and stronger demographic trends. That said, each market is different, and eventually, their waves will also crest. Focus on demographics because some places like Denver and Dallas have gone bonkers.

The stock market should give real estate investors some insight into the future. Look at sectors that are heavy in the city and state you want to buy and see how they are doing. Stocks reflect future earnings, and if earnings are at risk, so is job growth, wages, and housing demand.

Geo-arbitrage within the United States is going to be a multi-decade trend, which is why I'm investing in the heartland of America.

Housing Outlook For Expensive Coastal Cities: 3/10

Housing Outlook For Non-Coastal Cities: 7.5/10

Alternative Investments 1Q2018 Outlook

Even though many investments are struggling in 2018 so far, there's one investment that has struggled the most: cryptocurrencies! It was absolute carnage in the space. Names like Bitcoin, Ethereum, and Ripple are all down 50%+ for the quarter, so don't feel bad if you're down single digits in the stock market.

The collapse of cryptos is a great reminder to keep your alternative investment exposure limited to what you can afford to lose. For me, I keep all alternative exposure to no more than 10% of net worth.

One interesting note, I did have a long conversation about cryptos with a multi-billionaire a couple weeks ago who believes the crypto space will be completed diluted with an endless supply of new cryptos, partially because his company will easily enable all his customers to create their own.

Elsewhere, I was surprised to get a $2,623 payout from real estate crowdfunding in February, since I've been modeling only ~$9,600 for the entire year in my 2018-2019 passive income estimates. I haven't received any notification yet for March as it usually takes a couple weeks after month end to update, but I'll update the chart once the numbers come out.

At the moment, investing $300,000 in real estate crowdfunding in December 2017 looks like the right choice. I've got a total of 17 different investments, the large majority of which I like. But it will take years to find out how well they do given all my investments are equity deals.

With the sale of my SF rental house and the sale of my private gin investment to Campari in 2017, I tried to keep my income as low as possible since the sales shoved me into a higher marginal tax rate before expenses. For 2018, I don't expect to see another large windfall, hence I'm more open to earning more this year, especially since taxes have declined.

Risk Control Is Paramount In 1Q2018

You must go through your net worth asset allocation and do an honest assessment of your risk exposure. Do not be caught with your pants down at a highway rest stop. Predators come out. So long as you know how your money is being allocated and have a plan for what to do in different scenarios, you will go through life with much less financial stress.

As for me, I still feel good reducing ~$815,000 (mortgage) worth of risk exposure in 2017 and diversifying the house proceeds into various other investments. I'm actually considering selling my remaining SF rental given the last piece of avoidable stress in my life is dealing with a power-tripping HOA that has hired a terrible property manager as its minion. They hate landlords.

After verifying with my Personal Capital dashboard, I've got about $295,717 in cash left. It's a little deceiving because $185,000 of the balance is from a CD which is coming due this summerl. The CD was paying 3%, and I'm sad to see it go. At the same time, given asset prices are finally pulling back and interest rates have also moved up, the timing for reinvesting the proceeds is better.

Further, I've got to pay tens of thousands of dollars in extra taxes to support this great country of ours! Once I pay my tax bill I'm going to come up with a cash accumulation + investment game plan once again. This year is too tricky not to be on point.

I'd love to hear your thoughts about the stock market, bond market, and real estate market. Would you be happy with a 3% – 4% return in 2018 given all that's gone on so far? Please invest at your own risk. Every investment decision you make is yours to keep. Related: Things To Do Before Making A Single Investment

Financial Samurai 1Q2018 Investment Review And Outlook is a Financial Samurai original. Check out the Top Financial Products page to help you achieve financial freedom.

Hi, As for investing in stocks, my personal approach is to take the guesswork out of my investing decisions. My investments are mostly in stocks but I keep ample cash for both rainy-day needs and as dry powder. 1Q 2018 was my first such opportunity (after a long while) to deploy some dry powder into stocks. Stocks went down by 10% so I invested 10% of my dry powder in it. I try not to worry where the market might go next. If it drops by another 10%, I will have more cash to deploy. If it recovers, fine. I will be able to replenish my dry powder then. This strategy does not work for everybody, I realize. I tend to be more risk tolerant than others. And I also have weathered multiple bear markets and as a result I am perhaps more sanguine than others. It had worked out well for me over the years.

By the way, you mentioned Dallas as one of those middle markets that has gone bonkers! North Dallas suburbs (where I live) have appreciated in last few years but nowhere close to sellers market yet. In fact, Zillow rates Plano and Frisco suburban cities as “cold” and “cool” today.

Thanks for this… it’s great.

I am less financially technical than you…can you help?

I live in San Francisco…sold my house last year and been renting since. I hated the home repairs/upkeep, property taxes, the high mortgage payment and the small space of my last house (2.05M and I had put 20% down so mortgage was 1.6M).

Now I have been renting for a year and hate my place even more… because I was stingy on budget (in a California kinda way) … what I am getting for $4680 a month is not acceptable. I really need to like where I live, i.e. be comfortable in my space, for any price point in San Francisco.

Rental on a place I like would be $5500-$6000 a month, which seems like such a waste, so….

I’m thinking about buying again… in an “emerging area” on the south side of the city, so I can get a house I am comfortable in and excited about ….and not pay at/above $2M.

I found a 1.5M gem (which is the upper end price wise for this area but less than the new SF home price median of 1.6M).

I have 2.7M net worth right now (and spend 150K annually so I am OK) and am not worried about job security as the job market in bio is very healthy. I would put down 750K, so 50%, as that would allow me to get my mortgage down low to less than 4K/month which I can stomach. Caveats are I plan to leave San Francisco sometime between 3-7 years from now…. so I’d sell my house at that time.

I do not have to MAKE money on the house (beyond my cumulative equity) but I do not want to LOSE money on the sale…

So thinking about all of the guidance you provided about only buying if you are bullish on your career, have a massive liquidity event (what does his mean?), will put down >30%… and something about the rental market that I didn’t understand…. what is your advise on me jumping back into the market and purchasing this home where the area is a little bit questionable … but I love the house and am excited I could finally get comfortable in it?

Thank you Sam et al!

Sam thanks for insights. What are your thoughts about shorting Real Estate?

Sorry, I misunderstood. I am short.

Sam, thanks for the insights.

But I am not sure your real estate logic is bulletproof. Everything you are saying about the SF Bay Area market was just as true a year ago. Yet home prices in Silicon Valley rose a whopping 22% over the last year! So, at the very least, buying a year ago would have been a terrific investment, wouldn’t it? At the same time, with the resurgence of tech IPOs this year and next, and the growing pervasiveness of tech in all industries, there is every reason to believe the Tech jobs – and therefore home values – will be just fine in the Bay Area for years to come.

What am I missing?

If you can lend me your Time Machine, I’ll give you everything I have! :)

It’s much more helpful to look forward. Big area is strong, but there are clear signs if you look at rent prices. The price appreciation is unsustainable.

And I saw the latest first quarter numbers for the median home price. It might be due to mix, or one last hurrah. Those sales are mainly reflections before the stock market correction as it takes 45-60 days on average to close. But no doubt there is still a lot of demand and prices are strong.

Are you long? I’d happily take a $700K appreciation in equity + any appreciation in Lake Tahoe prices if the 22% is true!

I don’t know if I am “long” enough from a pure investment standpoint, but figuring out if I’m long enough to become a first-time homeowner (albeit maybe a short term-oriented one).

Don’t get it. Are you currently renting your place in the Bay Area or did you buy? If you bought, you’re long! If you rent, you’re short.

Per Zillow, e.g., in Mountain View the yearly appreciation was 26.3%!

Sam, thanks for the insights.

But I am not sure your real estate logic is bulletproof. Everything you are saying about the SF Bay Area market was just as true a year ago. Yet home prices in Silicon Valley rose a whopping 22% over the last year! So, at the very least, buying a year ago would have been a terrific investment, wouldn’t it? At the same time, with the resurgence of tech IPOs this year and next, and the growing pervasiveness of tech in all industries, there is every reason to believe the Tech jobs – and therefore home valuesbe- will be just fine in the Bay Area for years to come.

What am I missing?

Great analysis, Sam. I will be rereading several times and trying to assess the impact on markets, interest rates, and my investments.

I don’t jump in and out of the market. Doesn’t matter when you buy stocks as long as you ride a stock up (and sell if it goes down, i.e. stop loss). You don’t need to buy at the bottom or sell at the top to make a very good return. You can do this stock by stock or sector by sector. But not if the entire market goes down. Then you hold on and ride it back up.

We are in a (slow) rising rate environment, so I would not be investing in bonds or equivalents. The time to buy bonds is in a declining rate environment. Unless you plan to hold to maturity. My preference would be dividend stocks with growth that would at least have capital gain plus dividends.

Okay to hold cash because it does not go up and down with interest rates and it can soften the effect of a correction. Bonds don’t always do that. In fact, they never have for me. I gave up on a balanced portfolio and asset allocation decades ago.

Not very sophisticated, but that’s what I do.

I think you’ll be surprised with the bond market. Rates have been on a downtrend for 30+ years. Perhaps now they will finally go up a lot, but I doubt it.

Right now, your dividend stocks have negative appreciate + dividends. It’s a trick market right now. Hang tight!

Back when interest rates were normally over 10%, my rule of thumb was go 5 year term mortgage renewals if the rate was under 10% and 5 year with CDs if the rate was above 10%. Will watch bond rates with interest. Right now, my stock portfolio is up 5.55% (as of yesterday). My stocks pay small dividends and have growth so I am good there. I have FX working for me too (CAD keeps sinking and I have more than 50% in USD). I am hoping interest rates stay low because I have a lot of mortgage debt, and with rates low, it boosts the stockstoo. Right now, everything is working for me — low interest rates, low CAD. The low CAD is a killer on travel though. If I had your NW and earning capacity, I would be doing the same — big bond portfolio. Based on valuation of my pensions, I sort have the equivalent of that (according to your valuation method). Keep writing, you are the best on the net.

Very good update! Now I’m just training my brain to see opposite colors (e.g., red in the market means green in the long-term AKA buying opportunity). I’m not saying timing the market, but I believe we will have ups and downs this year and whenever there are downs are good times for investors to pour money in. For me, it will be into solid ETFs or index funds. And I’d be ok with 3-4%.

I think the stock market was due for a correction, but in my opinion, after the market had gone up 12 months partly as a result of the Trump effect, tax-reform, market-friendly policy decisions, etc, we have hit the second Trump effect. This trade rhetoric has caused the market to tumble more than it should have wiping out the first Trump effect, and if this continues especially in China targets Trump states like she said, that would not bode well for Trump’s re-election. I was planning to de-risk some of my portfolio but now I just might ride it out. Hopefully some confidence will come back into the market come earnings season – if Trump can just go on vacation without his cell phone.

I am not so focused on the annual return of this year or the next or the next. I prefer to focus on the overall return against the benchmark I have.

I cannot control what the economy will do, all I can do is pick solid investments. I get paid to wait with dividend income and I get at least 2.5% from my portfolio regardless of what the market does.

Hi Sam,

In my opinion, anything that beats inflation is good, so a 3-4% return seems fine. :-)

About the markets, I prefer not to predict. I have an algorithm that calculates the ideal portfolio allocation mainly based on risk, returns, and correlations. But nothing crazy, the changes are gradual… a very long-term approach.

Here is my performance in various sectors.

My #1 looser was Bitcoin. I invested $200 and it is now worth $100. I used Coinbase. It took me a while to figure out how to set it up and it also got me a good idea of how friendly it is to use. It’s not easy to use and the lag for clearing transactions is crazy. My opinion is now that I blew $200 on Bitcoin I am convinced it has no future.

On the real estate front, I converted my 2nd home that I was using less and less in a rental. I am did that because of the Trump tax changes and the 20% pass thru. I am betting that it will work better than making a sale and redeploying the cash equity. I basically did. The opposite of what you did with your SF home rental. The similar point is that is is invested in MN which is the heartland and fits your new strategy.

I sold all my growth stocks: BABA that I owned since the IPO for example has been sold with a double.

AMZN and the other tech names I had for about 15 months (except for AAPL) have been sold too. All that has been converted to Dividend stocks with a focus on Energy companies, Telecom Utilities and YieldCos.

Lost 10% on the SPY from its high for the quarter. I use SPY and not the vanguard or other S&P ETF because SPY is safer even though it is 5 bps higher in fees. I think it’s worth it considering it is more liquid too. Finally I like it best because I can sell 2 standard deviation weekly call for a few Pennies a week and that adds about 2% of financially engineered dividend on top the regular 1.8% yield. Can’t do that with the less liquid ETF.

My largest position for the past 10 years remains AAPL. I sleep at night best knowing that there is $300B in cash and this feeling is reinforced by the new tax repatriation which only fuels more cash. I see AAPL going to $200 this year. Next month the yield should get closer to 2% too on earning release. I also like the low P/E relative to the FAANG considering the recurring revenue growth.

I have about 5% in cash that will need to be redeployed. I am thinking that I will wait for one more down day and will load up on more SPY.

No bonds for me.

Net worth is flat for the quarter even though I was down about 5% at the lowest part of the quarter. My goal is to beat the market. It is a little arrogant to think that way considering most money managers don’t beat their index but so far so good.

This year I also switched from the 401k to the Roth 401k contribution because of Trump taxes.

I’m super with you about dissolving some RE liabilities. Not that I’m not long term bullish on housing for tech driven cities but there’s going to be some pain coming in at the rate it is going and unless you are holding 10+ years to ride out (which we’re personally not) it might be better to cut loose. My city hates landlords too!

Thanks for sharing your outlook. These quarterly updates are very useful. I think you’re spot on with real estate. Rent in Portland is starting to flatten out now.

Investors are still bullish because they are still buying and renovating old apartments. I doubt this will continue, though. The economy here isn’t good enough to support these high prices.

I’m still somewhat bullish about the stock market this year. 5-8% would be great, but I would take 3% without complaining.

Still enjoying these! I don’t think it matters if you put actual numbers or not. For those that get offended by how much you are investing each month I think it is easy to judge someone after years of hard work, sacrifice, and consistent investing.

As far as outlook for the year I can see your point for each asset class. In reality I think no one knows and you just have to make sure that personally you are positioned well.

For my position as a data point for readers, as I know I love them, I am building post tax advantaged accounts cash. Nothing has changed for tax advantaged still 100% equity and investing each pay period at 28 years old. However, I think timing for me personally along with the investing cycle might line up to purchase our second property.

We worked hard to get this property in a good position to rent out when we are ready and most likely will transition into a new home in the next 1-3 years.

Grateful to be in a position where I am comfortable with how I am positioned but excited to buy the next one when the opportunity presents itself.

As someone who just bought a home in Los Angeles for some pretty serious money, I actually wouldn’t mind if prices dropped and things normalized for a change. We are having a baby and have enough saved that a drop or short term unemployment doesn’t really scare us. Really enjoy these updates and your outlook on things. I think cryptocurrency is definitely done to death with everyone launching a new ICO each week. Blockchain though, is a very powerful concept that could have legs and is worth researching.

Very thorough and insightful outlook! I can tell this post took a lot of time and thought to put together. Not many people can write about the things you do! I’m curious to see how the Fed acts in the next few quarters. Q1 was so volatile.

Good analysis across the board. Especially the risk control.

The equity markets are at a technical crossroads here. 200 day moving average for the S&P looks pretty critical to hold and build off of. If not then I think a lot of the trend following and momentum trades will liquidate longs and flip short. Both the weekly and monthly charts still remain stretched from their moving averages. Like you pointed out, valuations are still certainly not historically cheap either and have more room to contract, even if earnings are strong. It could go either way from here. The short squeeze attempts do not seem to have the same oomph since January though. I think tech needs to reemerge as the leader again for the bull case and corporate buybacks can’t step up soon enough. If the 200 day fails then the 2200 level looks like a magnet to me with low volume profile, 50 day on monthly, and 200 day on weekly all right around there. I’m actually leaning a little more than 50% chance of the bear case short term, but a strong week or two could change that.

My 3% 10 year in 1H2018 guess came within a few basis points of hitting so far. We’re only seeing a modest jump in inflation though, so I think the possibility of a 4-4.5% ten year rate shock on this Fed hiking path is still pretty low. With the spending bill and tax cuts the treasury auction supply has jumped a bunch though, which will continue to be a headwind for the bull case. Despite the 10+% drop in Equities since February you have a 10 year at the same levels. The wild card is still a jump in inflation (possibly on a dollar plunge), or a trade war escalation causing China to dump treasuries. With what you can earn on cash and shorter duration, and the risk/reward at these levels I think you are giving up very little waiting for a better opportunity or a shift in the Fed path.

Your large property sale seems very timely and at a great multiple. Not only are rents saggy across the country, but the price/rent ratio remains unsustainable in coastal and most high-priced cities. If you can find something similar for your other property than why not reduce the headache, take profits on a high valuation asset, and increase liquidity in a late cycle?

The last thing that I would consider is some Dollar hedge if most of your assets are US based. I think I’m becoming a full blown gold bug at these levels. We’re late cycle, CB intervention will be ramped up again on the next recession, the US deficit is growing at a time that we should be reducing, the debt path is completely unsustainable, demographic shifts will be a huge headwind for decades. I think there are a lot of reasons you do not want all of your assets in dollars going forward.

Thanks Larry. Let’s see where the dollar goes. The SF Bay Area real estate market sub $2M continues to be kinda nuts. But it’s always the retail investor towards the lower end of the market the gets left holding the bag unfortunately. Institutional investors have all cashed out.

China real estate for the win! :)

Sam,

Just curious. You mentioned that you paid more taxes than Amazon?

As I understand it, Amazon paid $400,000,000 in taxes for 2017 and employed pver 500,000 people. Yep! That’s 400 million (Fed, State, Local).

I worked for them as a senior during Christmas Season (three months) at age 77 a few years ago (as a scanner). They are an excellent employer. The warehouse in Fernley, NV was seven football fields long. First two weeks was mainly trying to find my work locations. Tough physical work of 50 hour weeks but enjoyed it immensely. Had a great Filipino lady boss who was excellent. Met lots of immigrants on the job who put me to shame in terms of work efficiency.

Obviously, Trump is out to get the Washington Post. I have no doubt that Amazon and Jeff Besos will get the last word.

Yes, Amazon paid no corporate income taxes in 2017 due to lots of write-offs and other things. Got to love being big and rich!

http://seattlebusinessmag.com/business-operations/amazon-didnt-pay-any-federal-income-taxes-2017

What are your thoughts on Philadelphia from a RE investing standpoint? I’ve always lumped it in with the rest of the major cities in the north east but its not technically a coastal city. Do the same rules apply? Relative to DC, NY, and Boston it looks affordable.

I have a Philly real estate crowdfunding investment actually b/c I’m bullish on the Philly area. So cheap in comparison to DC and NYC!

See: https://www.financialsamurai.com/crowdsourcing-knowledge-for-a-real-estate-crowdsourcing-investment/

Interesting to see you write, “I would not be buying coastal city real estate,” given your long-standing boosterism for home-ownership. How long should a sub-middle class family throw away money on rent in the San Francisco area?

Until you have at least 30% of the value of the house in cash (20% down, 10% buffer), and know you plan to live in the Bay Area for at least 10 years. If you have this, I think you will be fine.

> We might be in a situation this year of what asset classes loses me the least. But it’s too early to tell.

If you’re worried that stocks and bonds might go negative for the year… why not park a chunk in cash?

T-bills are yielding 2%. You can sit for a few months and buy in at a better spot.

Opportunity and uncertainty. I’ve got almost $300,000 in cash at the moment + monthly cash flow from passive income and our online business. How much cash do you recommend I accumulate?

What are you doing with your money and what is your outlook for the asset classes above?

Thanks for the advice and thoughts.

> How much cash do you recommend I accumulate?

Great question. The smart way to think about risky assets in your portfolio is to ask, “How much risk do I actually need to take?”

If your target return is low enough, you don’t have to be 100% invested in stocks and bonds at all times. You can keep $300,000 in cash. It’s easy to invest in T-bills or a CD ladder. The 2% to 3% annual return is measly but it matches inflation. If there’s a recession, almost every asset will lose value in real terms, but cash will outperform stocks and bonds.

> What are you doing with your money and what is your outlook for the asset classes above?

I agree with your outlook for stocks and bonds. If earnings growth is strong, I really don’t anticipate the S&P 500 entering into bear market territory from here. Of course, a further 10% correction is possible.

Thanks. Sounds like a guest post opportunity if you’d like to write one! It’s pretty easy.

Related: How Much Investment Risk To Take In Retirement

Hi Sam, great post. I really enjoyed the analysis here. I’m wondering, have you tracked your past performance? How did you do? If you already wrote a post about this, please let me know!

I’ve done well, but I don’t think anybody really cares :)

My goal has been to always try to grow overall net worth by at least 10% a year. That way, I will double my net worth every 7.2 years.

I care:) i value your advice. I also value the replies posted here. I think at my age I think I will look for about the same return percent as you. Definitely don’t want rental unit. To much stress. My home is my castle. Tomorrow is not promised, but planting seeds is always a good idea.

I wouldn’t touch bitcoin or any of the cryptocurrencies with a ten foot pole. While blockchain technology may be here to stay, I don’t see a way to possibly come up with an intrinsic value, or an appropriate valuation range.

I totally agree about the coastal valuations in real estate. It seems like most cap rates you’ll get are ~2% in those locations so you’re definitely buying for appreciation. But that ship left around 2010-2011. It’s all a cycle though, so we’ll just have to be patient.

Good point about the flattening yield curve. I’ve always used it as a recession/downturn predictor. You might be interested in another indicator — the CAB (chemical activity barometer). Lead time with this data set is around 8 months until a recession. The theory behind it is that there are certain chemicals, pigments and plastic resins that are used at the very beginning of the supply chain. When demand begins to wane with those inputs, its usually a signal that broader overall demand is stagnating. Take a look: https://www.americanchemistry.com/Jobs/CAB/

Funny, if you think you are middle class in an American coastal city. From what you’ve told us, don’t think you’ve ever been middle class as an adult (post college graduation). :)

In regards to recent stock market declines, my trigger finger is itchy :)

Middle class 4 life! Check it out: https://www.financialsamurai.com/rich-spoiled-clueless-work-minimum-wage-job-at-least-twice/