And just like that, another year is almost over. I don't remember too much about what happened at the beginning of the year without scrolling through my photos. Most of your managers don't either, which is why it's good to keep a log you can reference in your year-end review, especially if you did something positive.

For this year in review 2021, I'd like to go over three main categories: investments, family, and writing.

Investments are what support my family. Family is what I care about the most. And writing is what I enjoy doing to help others. It gives me a sense of purpose.

FS Year In Review 2021: Public Investments

Overall, my 14 public investment portfolios with roughly an 85/15 stock/bond weighting are up 24.58%. This is a 2% underperformance of the S&P 500 and a 11.8% outperformance of a 60/40 portfolio. The 2021 stock market returns were truly incredible. In 2020, my stock portfolio was up over 40%, outperforming the S&P 500 by over 25%.

Two of the largest funds account for the majority of my stock and bond passive income. They are relatively less aggressive given their greater focus on income. My tax-advantaged portfolios have outperformed the S&P 500, but they have smaller balances. I take more risks in those portfolios because I can’t touch them for a while.

The reason why I have 14 portfolios is because I have multiple taxable portfolios, multiple tax-advantaged portfolios (Solo 401(k), SEP IRA, Rollover IRA), two 529 plans, and custodial investment accounts for my children. The portfolio balances range from as little as $15,000 to as much as $2.75 million.

All of these portfolios make managing them complicated, which is why it's nice to use Personal Capital to keep track of everything.

Return Target Post Work

Ever since leaving work in 2012, I've had a minimum investment return target equal to 3X the risk-free rate of return and an ideal return target of 10%. For example, with the 10-year bond yield at ~1.5%, my minimum investment return target is 4.5%. However, the bull market has helped my investments surpass these targets.

Below is a chart that shows the S&P 500 annual performance since 2014. 2019, 2020, and 2021 have been phenomenal years. Therefore, I attribute 60% of my return-over-ideal to luck and 40% to staying disciplined.

You may find that as your investment balances grow, the volatility may become more unsettling. Suddenly, instead of only losing $100,000 on a $500,000 investment portfolio, you might find yourself losing $1 million on a $5 million portfolio.

To increase your chances of making money over the long run, it's important to follow an appropriate asset allocation, stick with it, and keep investment fees as low as possible. You could try to time the market by getting in and out. However, all the data shows market-timing doesn't work long term. I've tried many times before and failed more than I’ve succeeded.

Because my investment returns have surpassed my expectations since leaving work, the excess returns don't seem real. It feels like funny money. Therefore, I plan to spend some of the overage to live a more comfortable life. I also plan to give a lot more money away.

Below is a snapshot of my Solo 401(k) performance that I contributed to when I was consulting part-time and working side gigs (e.g. Uber driving) from 2013-2017. It is the only portfolio I contributed nothing to (light blue line) all year because I didn't do any consulting.

FS Year In Review 2021: Real Estate Investments

It has been a fantastic year for real estate investors in 2021. The median home price is up around 18% YoY, which is unprecedented. If you bought real estate 12 months ago with 20% down, your cash-on-cash return is up 90%. Even after subtracting insurance, maintenance, and other expenses, the return on your cash is still up massively.

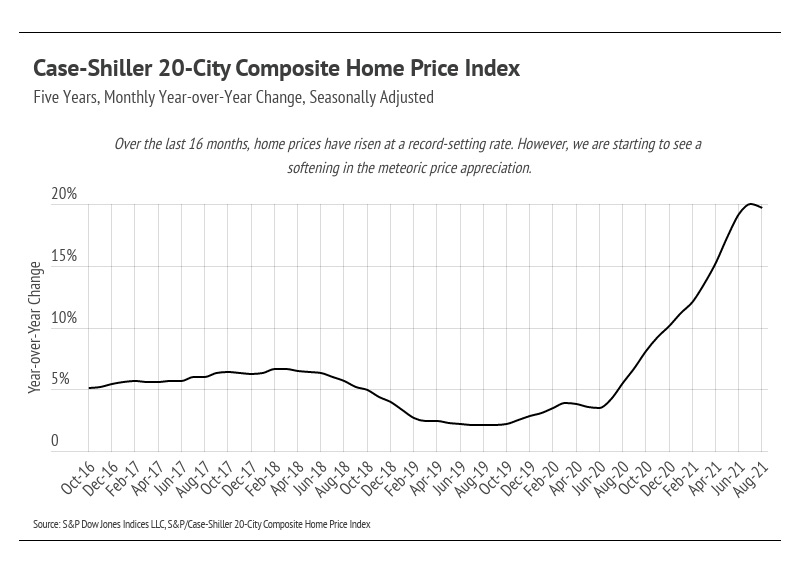

Check out the Case-Shiller 20-City Composite Home Price Index. Prices began moving higher in June 2020.

Unfortunately for me, most of my real estate holdings are in San Francisco, which the media loves to bash. Apparently, everybody is leaving in droves, causing rent and home price appreciation underperformance. It doesn't matter that tens of thousands of employees have seen massive equity gains in stocks like Google, Facebook, and Apple. It's game over for the city by the bay!

Actually, San Francisco real estate did just fine in 2021. From January 2021 through November 2021, single-family home prices supposedly rose 22%, while condo prices supposedly increased 21%. We're talking about a $325,000 gain for single-family homes and a ~$239,000 gain for condos.

Frankly, I don't believe the gains have been that great. I think prices went up more like 10-15% this year. But below is SF median home price data from the MLS.

The luckiest thing I did in 2020 was buy a home after writing the post, Real Estate Buying Strategies During COVID-19. The post was first written on April 27, 2020. I utilized my strategies and got into contract 45 days later.

I had been eye-balling this home since late-2018 when I began taking my son for neighborhood walks. The home went through extensive remodeling in late-2019 and early 2020. Then, the owners inexplicably decided to put the house on the market a month after lockdowns began. Public open houses closed and it was just me and the listing agent talking about life for hours.

Our larger home has been a panacea for my family during the pandemic. It could very well be our forever home until our kids go off to college. For the home to also appreciate by 10%+ in 2021 feels like winning the lottery. This ability to enjoy your investment is the main reason why I love real estate so much.

Real Estate Crowdfunding

After a dicey 2020, when most distributions were put on pause, distributions continued in 2021. On November 22, 2021, I got a distribution from my main real estate fund for $46,106.09, bringing total distributions for the year to $53,545.69. Not bad based on the ~$400,000 left in this one fund.

The 100% passive nature of real estate crowdfunding is hard to beat. It also feels good to diversify away from expensive San Francisco / Lake Tahoe / Honolulu property. Demographic shifts towards lower cost areas of the country are going to continue.

When you invest in a private real estate deal, make sure you understand the capital stack and where you are on the capital stack. If you plan to invest in equity deals, there needs to be enough equity raised and skin in the game by the sponsor. Otherwise, you may be better off investing in debt.

For most investors, I think it's better to invest in a diversified fund like the ones offered by Fundrise and a real estate ETF like VNQ. The goal is to gain real estate exposure and hit singles and doubles over the long term with most of your capital. Ride the inflation wave, not get pummeled by it.

You can then supplement your real estate exposure with individual deals or real estate stocks you find most interesting if you wish. This is how I invest in equities: ~80% in index funds and ~20% in individual stocks.

FS Year In Review 2021: Alternative Investments

I have investments in venture debt, venture capital, and crypto. These investments make up a total of roughly 10% of my investable assets. I have always tried to allocate around 10% of my capital in highly speculative names ever since my big win in 2000 with VCSY.

The most speculative investment I made in 2021 was in HUT, an ethereum mining company. I mentioned it in my post, How I'd Invest $100,000 Today. I bought at $4 and it went all the way up to $14 before collapsing back down to $8. LTH also did very well the first 30 days after purchased. Then it round-tripped after omicron came out. Sigh.

My investments in venture debt and venture capital are not as speculative since they are funds with multiple positions. My four venture debt funds have returned in the mid-teens. They are steady providers of passive income. These funds also own warrants, which provides potential further upside.

I invested $200,000 in a new venture capital fund in 4Q2021. The capital will be called over two years or so. This is the operator's second fund after he had a successful stint as the CFO of a public company for about 13 years. He is a pretty connected guy in the Bay so I thought it would be nice to get plugged into his network and potentially co-invest in future deals.

In 2019, I invested $140,000 in a heavily oversubscribed venture capital fund. It is one of the gorillas in the VC space. I wanted to invest more but was throttled in the friends and family round.

Below is a snapshot of the paper returns. It has provided zero passive income or distributions as it's still in the capital-calling stage. It is also a 10-year fund. I really enjoy not having to think about these funds on a day-to-day basis.

FS Year In Review 2021: Family

When I'm feeling unmotivated, I just think about my wife and children. Then my batteries recharge because I will never quit on them.

Although the pandemic stinks for most adults, perhaps it hasn't stunk for most young children. My wife and I spent so much time with our kids in 2021. We took them to playgrounds, soccer fields, beaches, the zoo, and the science museum every week. We also took them to pick cherries and ride the trains in Sonoma. As far as they're concerned, 2021 was a blast!

After our daughter was born in December 2019, we decided we wouldn't travel for the first two years of her life. So in retrospect, if there's ever a time to have a baby, it's during a pandemic. She's hitting all her milestones and we feel really blessed to have her. She will most likely be our last child, so my wife and I are trying to cherish every moment before she goes off to school.

School Restarts

After multiple rejections from various preschools and 16 months of homeschooling, we found out in 1Q2021 that our son got into his target preschool. He started school on August 25, 2021 and he's had a blast. You just never know how your kids will adapt to a new environment. I'm proud of him because he didn't cry once the first week of school. Instead, he was filled with excitement and nervousness.

Getting into school provides relief because it means our daughter will likely get to attend our son's school as well. The preschool admissions process is tough in SF. The school goes through the 8th grade, which means we don't have to worry about the application process in a long while.

However, we applied to another school for 2022 anyway because she can't start preschool until 2023 due to her late birthdate. The 2022 school is only three hours a day for two days a week, which I think is perfect for a 2.5-3-year-old. We will probably get rejected, but I think it's always worth trying.

Saw My Parents

After feeling negative symptoms for ~40 hours after getting my booster, I decided if I was going to feel ill, I might as well make the most of it by seeing my parents. Further, I had finally squared away my life insurance needs with a new 20-year term policy. As a result, I felt more at peace leaving my family behind to see my parents.

Thus, after one year and 11 months, I finally flew out to see my parents for six days in December. The trip felt like I was in a time warp because nothing really changed, thank goodness.

I swapped out my dad's phone battery, which he has been using since 2017. Uber Eats and Uber were installed on his phone with my credit card. Then I donated five boxes of stuff and mailed a package for my mom, filled up a tank of gas, and removed the weeds in the driveway.

I am comforted knowing my parents have shelter, food, transportation, and each other. I am bummed we live so far away and COVID has prevented us from visiting each other. It would have been great if they got to spend more time with their grandchildren.

After my visit, now I can say that I saw my parents in 2020 (Jan) and in 2021 (Dec). This way, COVID's negative effects won't feel as bad when I look back at history.

Year In Review 2021: Financial Samurai

I wrote over 310,000 words and more than 160 posts in 2021. This is slightly more than normal because I spent more time at home. Once the pandemic hit, I decided to be more entrepreneurial to make the most out of a suboptimal situation.

Although 310,000+ words might sound like a lot, remember, I don't have a day job. But I do have two young children, which meant I needed to consistently wake up by 5:30 AM to write before they started jumping all over me. Thankfully, most things get easier with practice. Here are the best posts on FS for 2021.

My extra focus on entrepreneurship resulted in increased online income. It's nice to know there is a correlation between effort and reward. I think that's all any of us really want. Most of the extra income just got reinvested or used to pay down mortgage debt.

Despite increased income, I'm not happier. In fact, I became less happy because I had to spend more time negotiating business deals. This took away from my main joy of writing. To keep up my writing cadence, I spent more time working beyond my ideal 20 hours a week.

Thankfully, I set a two-year deadline for my entrepreneur sprint. On March 18, 2022, that deadline will be reached and I will strictly limit my online activity to no more than 20 hours a week again. It'll feel like going into semi-retirement as taxes goes up.

Finished 99% Of My Book

Perhaps the thing I'm most proud of is finishing a ~110,000-word book (320+ pages) with Portfolio / Penguin Random House. I spoke to a couple of authors who said that writing their book was all the work they did until it was finished. But I didn't want the process of writing a book to cannibalize my writing on Financial Samurai. Therefore, the only thing I could do was work more.

No wonder why I feel so beat. But the great thing about hard work is that it's over.

My book is in the final production phase. It has gone through more than a dozen revisions with two editors. Now it's getting polished by a copy editor, who will go through the grammar, formatting, and layout. I never knew there were two types of editors.

I'll revise it one last time in mid-January 2022. Then my revisions will be reviewed again by the same two editors in February 2022. Finally, the copy editor will review it one last time. Only then will it be sent off to the printing presses for a July 19, 2022 release date.

Holy moly! Based on how much time I spent writing and editing the book (2 years), I can't believe hardcover books generally cost under $30. They are the greatest bargains. I feel like I put in at least $400,000 worth of my time.

So if you plan to write a book, please know it may be the hardest thing you will ever do in your professional life. It also likely won't be a lucrative endeavor. But as writers, we care far more about producing a great read than making money. It’s partly why there’s the term, starving writer!

Going through the process of writing a traditionally published book has significantly increased my appreciation for books in general. I'm now reading all my unread books at home, taking careful notes on what makes them great.

Once I get through my final revisions in January 2022, I'll unleash it to the world for pre-orders.

Overall Grade For 2021: B+

2021 was one of the most challenging years of my life. I constantly felt overwhelmed with fatherhood, Financial Samurai, managing our finances, and writing my book. My sabbatical was an utter failure because I didn't feel rested afterward at all.

If you work for yourself, there's always something more you can do. You may be hating your day job at this moment. However, try to appreciate being able to take paid holidays while you let your mind and body decompress. In 2021, I sometimes daydreamed of going back to work to ironically take a break.

Stress can often negatively affect one's health. And for several months, I did have shortness of breath issues due to elevated stress. My vision also worsened, which is part of the hazards of working from home on a computer for too long. Therefore, 2022 will be the time to take things easier. I can't wait!

Related posts:

FS Goals For 2022: Less Work, More Fun!

2022 Financial Samurai Year In Review

2023 Financial Samurai Year In Review

Recommendations

Check out Personal Capital, the best free tool to help you become a better investor. With Personal Capital, you can track your investments, see your asset allocation, x-ray your portfolios for excessive fees, and more. Staying on top of your investments during volatile times is a must.

Give yourself the gift of financial freedom by pick up a copy of Buy This, Not That. It is an instant Wall Street Journal bestseller. The book helps you make more optimal investing decisions so you can live a better, more fulfilling life. Amazon is having a great sale right now.

For more nuanced personal finance content, join 55,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

Sam, been a follower for over a year and this is my first comment =) First of all, Thank You for all your content. I’m a 2nd gen Chinese Canadian residing in Greater Vancouver BC Canada in my early 40s with a wife and two small kids with a love for personal finance and I’ve really been inspired by your posts. I started a death file, a gratitude/luck journal and became more health conscious because of you.

Anyhow, with gratitude, I’d rate us with a A- for 2021:

Investments: Our principal residence made a paper gain of 28% to $2 Million CAD ($1.6 Million USD) in the last 12 months. We count ourselves super lucky in one of, if not THE, priciest real estate markets in the world. My primary investment via Retirement Savings Plan, in an S&P ETF, gained 21%.

Career: While my wife was unemployed for several months at the beginning of the pandemic (2020), we remained comfortable and in 2021 I got a promotion to become a first level manager, finally creeping past the income happiness threshold. Again, counting ourselves lucky to afford our mortgage.

Family: Got to spend much more time with the kiddos and while home schooling early on in the pandemic nearly broke us, I feel we grew closer during this time.

Health: Good and bad. despite a 12-month pause on elective surgeries, I was able to get my hernia repaired just before wave 3 shut things down again. Having said that, since my promotion I’ve been working way too much and both my mental and physical health have suffered, along with my family life. Your baseball buddy who passed away really resonated with me, and I had two colleagues impacted by cancer (one a mom in her early 40’s with a sudden stage 4 diagnosis and given 6 months to live). I’m committed to focus on this area in 2022. If not for my kids, to enjoy the aforementioned paper gains in my retirement =)

Luck has been good to us. Wishing you and your family all the best in 2022. I’ll be picking up your book for certain.

-CS

Thanks for reading and sharing CS! Glad you got to spend more time with your children and congrats on the promo.

Please do take care of yourself. What I realized after leaving work is that it is abnormal to always feel so stressed and experience chronic pain. But I had been used to it for 13 years and FORGOT what it was like to feel OK!

Thanks for supporting my book. I’m in the final final stages of copy editing now and I’ll think you’ll love it.

Congrats on completing your book, Sam! How can we purchase a signed copy when it’s out? :)

I’ll be sharing the link to buy in my newsletter by the end of February 2022! Thanks for your support Ceci! I can’t wait to share the book. But first, I need to do some final, final stage edits this month.

I’d probably give us a solid B grade. Our investments were up about 13% and our home was up 24% in a hot market (Scottsdale). I survived a near-death experience with a bacterial infection in July and my wife, 2 weeks ago, just came out of a car accident without serious injury where an uninsured motorist rammed her from behind. Thankfully, it was in her company car so someone else gets to deal with all the insurance and legal issues on our behalf. Our daughter graduated from college in May and landed a nursing job at Duke.

We give God all the glory and are grateful for all His blessings and protection! Happy New Year everyone.

Glad you made it! And thanks for writing the guest post on creating a Death File. I created one after your post and so did my wife.

Thanks, Bro! It was my pleasure to do the guest post on the death file and very glad you and your wife were inspired to complete yours. It does feel good to know you are leaving behind good instructions for those you care about. Happy New Year!

Sounds like a great year, except not as much R&R as needed! Thanks for all your insight and hard work!

No problem Rob! Yes, R&R is definitely in the future. At least I took 5 days off last week to visit my parents. Hope you had a good 2021!

All things considered, a good year for my family. We welcomed a new grandson in February and my son was somehow able to buy a house in San Jose area for $1.3 million for his family. My personal investments gained about 13.4%. Sold my Indiana home for $440K and retired at the end of this year. Next year: moving to Arizona end of January-our new home is supposed to be finished by then. Very happy for no more winters, and we’ll be closer to my kids-my daughter lives in Phoenix-and grandkids in Morgan Hill.

Amazing to be able to have grandchildren and know your own children are doing well. I’m not sure there’s anything more I want as a parent. Congrats!

Warm winters are wonderful. It’s pretty cold and rainy here in San Francisco compared to Honolulu.

Can buy the big things, and some of the little things. Love the articles Sam, keep it going!

In regards to the wild year for real estate: we had an appraisal on our house in December 2020 (for a refinance) which came in at $625,000. We had another appraisal in November 2021 (for a partial release) which came in at $1.2 million. Pretty unbelievable year. Especially considering we only paid $320k for our place less than six years ago.

Because of the astronomical real estate values, we were also able to split the 43 acres into 40 acres and 3 acres. And because of the equity created by the real estate market, our mortgage lender released the 40 acres to us, meaning we now own that free and clear, regardless of future market levels. Pretty exciting 2021.

Just sharing here since I can’t share with anyone else.

Wow! That’s huge. What city is this property located in?

This is got me thinking about the value of big city real estate, because if smaller city real estate is going up that much, the price differential is much smaller now. So eventually, the area that has the most job opportunity will reignite again.

We’re in a small rural town in Colorado with a population of around 1,500 (although the “valley” we live in has closer to 15,000).

There has always been a lot of tourism here (skiing, rafting, mountain biking, etc) but once COVID hit, there’s been a huge influx of folks moving here now that they can work remotely.

For our particular property, the land really bumped up the value since it’s becoming extremely hard to find 40+ acres of land near popular towns. We got lucky.

Good to know. Yes, 40 acres is a lot!

I wonder if these ski boom town values can last. I have ski town property that has gone from 500k to 1.7 million in last few years. And condos that I picked up from 150k now pushing 500k.

The pace of price appreciation is highly unlikely.

Yes, but do you sell? Mine are in VT, which is still less $$ than CO, but sitting at the highest prices ever. My real estate equity is almost twice my stock market equity exposure at this point.

Congrats on another great year Sam and thanks for all the awesome content along the way.

I would rate mine a B.

– investment returns (net of VC/angel which I don’t mark up) are looking like 30%. This is with a 12% cash position which is too much. I could have done better so this is where I took off points

– VC/angel doing very well but just like the rest of the market

– kids are thriving; back to school and activities

– Awarded my blue belt in BJJ and increased markers in other fitness pursuits

Good job staying fit and progressing with BJJ! I know you’ve been set for a while since we last spoke. Very inspiring.

For venture-capital returns, I’m finding it hard to take any of my quarterly market update seriously. It’s just so hard to know if given the market is less liquid than the stock market.

But it is fun to see the market values go up!

Sam,

You are a good man, husband, and father. Your writing is always fantastic, insightful, and continues to prove helpful. Truth be told, my own interest in personal finance has dwindled a bit over the years. However, I always check FS every week because your journey and your underlying motivation have always resonated with me.

You have always been extremely hard on yourself, and those high standards have brought you immense success. Every year, I secretly hope you’ll slow down and give yourself a chance to soak it all in more, and at a more relaxed pace. So I’m really glad to hear you plan to move in that direction in 2022.

As a fellow husband and father of two young kids, I know we are both blessed with immeasurable wealth beyond anything that Personal Capital can track. I wish all the best for you and your family in 2022. You deserve it.

I appreciate the love Mike. There was this one writer who gave a commencement speech. He said that one of the best pieces of advice he did not take was to “enjoy the moment” after one of his books, Sandman, became a huge success. Instead of enjoying the moment, he just kept on grinding away.

This resonated with me, because we’re all getting older. And so I’m trying to do my best to enjoy the moment with my family, because they are growing older the quickest.

I’m going to listen to my body more. If it is in pain or gasping for breath, I will slow down. Are you still enjoy what I do most of the time. And launching my book in 2022 is going to be a fun new challenge where I will probably have to do some interviews and find some creative ways to market.

Personal finance does get boring after you have your fundamentals established. It is the reason why I would like to delve into many different types of topics about real life situations.

I hope you had a great year and an even better one next year!

Sam great year in review. I agree a journal with up to date notes and or achievements is necessary. My question is on real estate specifically in California cities where the highest return on investments. An example my mother sold in Mission Viejo California. Orange County that was a rental for over 10 years. House sold for $729,000, and now almost two years later, Zillow has it at $990,000. House next door sold for over a million dollars last month 11/2021 albeit a bit bigger. My question is Zillow accurate can prices keep rising in 2022? Or a we headed for a market adjustment or crash. Thanks

The Zestimates are often wrong. Zillow blew up a big portion of the business model this year because their estimates were fault. See link.

That’s good, prices are up tremendously since your mother sold unfortunately. And I do believe they will continue to go up in 2022. I’ll be sharing my thoughts about real estate for next year this week.

Wow Sam – you deserve way higher than a B+!! Sounds like you had a really well rounded year and that’s not an easy feat. And getting 99% done with your book – CONGRATS! I can’t even imagine how much time and effort that takes by itself, let alone on top of keeping up with regularly posting articles on FS.

That’s great you got to see your parents and before the year is up as well. Sounds like it was a successful trip. I haven’t seen my parents in about 3.5 years. I probably would have tried if they were closer. But no direct flights, having to rent a car, and juggling kids and of course trying to avoid the virus was just too much of a deterrent for me. Thankfully FaceTime has helped us stay in touch virtually. It’s certainly not the same, but helps for sure.

If I were to rate my own year, I’d probably only give myself a C. I had some good wins, and even though I felt busy on most days I just don’t feel like I did enough. But maybe that’s part of my problem – I focus too much on what I didn’t do versus what I did. Thankfully I keep a log of my wins as you suggest. Otherwise I’d probably totally forget the good things I did! And the year’s not over yet, so I can still get more things done this week! So off I go! :)

Thanks! And yes, thank goodness for FT! What does 60% of the job, which is way better than just calling on the telephone.

I like the attitude of still having time left to get things done that you haven’t done yet. There’s no time like now!