If you want to save money, the proper geoarbitrage strategy is not moving to a developing country to save money. That's too disruptive for most people, especially households with kids. The proper geoarbitage strategy isn't relocating to another state either.

Instead, the the best geoarbitrage strategy is to first look within your own city. This way, there is minimal disruption and maximum cost-savings benefits. You won't have to take a salary hit either. You'll be surprised how much money you can save by moving just a few short miles away.

Back in 2014, I moved five miles west in San Francisco and ended up saving 40%+ on living costs! Then, in 2020, as fate would have it, the pandemic accelerated the demographic shift out west because more people were forced or able to work from home.

My Desire To Geoarbitrage Eventually To Honolulu

One of the most common pushbacks I got from my post, “Why You Need To Earn $300,000 A Year To Live A Middle Class Lifestyle,” is: why the hell don't I just leave expensive San Francisco if I've truly got enough passive income? I've now received the same pushback from my post, “Blew Up My Passive Income, No Longer Financially Independent.”

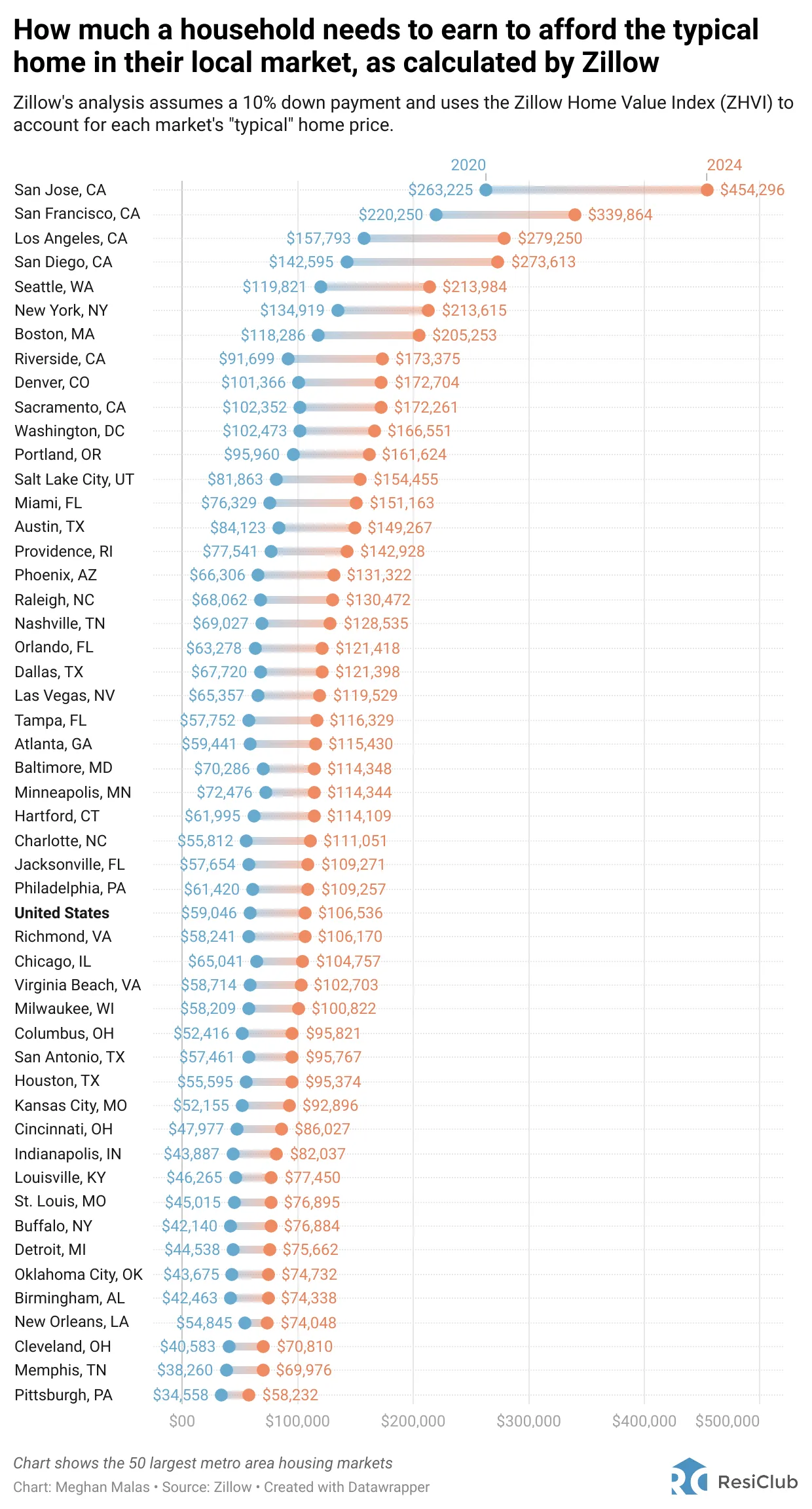

Believe me, I've been thinking about relocating out of San Francisco for years now. The high cost of living is high and it is only getting higher. Now that I've got to pay for two college tuitions, saving money is a must. The obsessive hustle culture in San Francisco is getting tiresome. Finally, I'd like to mix things up after living here since 2001.

My number one geoarbitrage destination is Honolulu, Hawaii, a place where stress simply melts away. My stress level averages about a 5 out of 10 in San Francisco. However, it immediately goes down to a steady state 3 when I'm in Hawaii.

Honolulu Is Cheaper Than San Francisco

Although Honolulu isn't cheap, it's about 20% – 30% cheaper than San Francisco in terms of housing. If you can save money and have nicer climate, that's a win in my book.

But relocating takes time when you've grown accustomed to living in one place for so long. There are friends to say goodbye to and assets to unwind. Then there's the small, but highly significant issue of raising a first child.

We figure we'd provide our daughter with a stable home environment up until she is three years old. At that time, we will then consider relocating for preschool. Our son will be five and can also apply to kindergarten.

Geoarbitrage Already Happened

When people think of geoarbitrage, people tend to think in extremes. Moving to the heartland or to Southeast Asia or Eastern Europe to save big bucks on living expenses is common. The reality is, such big moves are not necessary if you just take time to explore your own city.

One can simply geoarbitrage within one's own town or city to save lots of money. Below is a map of San Francisco that shows what I did to save a lot of money in 2014.

By moving out of our single-family home on the north end of San Francisco in 2014, renting it out, and buying a single family home just three miles west allowed us to save roughly $4,200 a month, or 50%.

I don't know about you, but when you and your partner don't have stable jobs, saving $50,000 a year after-tax sure alleviates a lot of financial pressure. Yes, the new house is 15% smaller. So a like-for-like comparison may be closer to a 35% monthly savings on housing. Still, not bad!

We've been hearing so much about a housing affordability crisis in cities like San Francisco and New York. Yet if people decided to not live in the most expensive parts of the city, their affordability would go way up!

For example, instead of paying $4,500 a month for a two-bedroom apartment in Pacific Heights, you could have a nice two-bedroom apartment in the Outer Richmond district for $2,700. A $1,800 a month cost savings is significant if your goal is to be financially secure ASAP.

Related: Housing Expense Guidelines For Financial Freedom

The Sacrifices Of City Geoarbitrage Are Not That Big

Moving five miles west means being five miles further from downtown San Francisco, where most of the jobs are located. If we had to work downtown, the extra commute time would be 15 minutes on average each way.

15 minutes is nothing given we all have phones to nourish our minds with Financial Samurai articles. It is simply amazing how quickly we can kill time once we're allowed to surf the web, listen to music, text with friends, play games, or watch some Netflix.

The cost to take the bus downtown from the north end where I used to live and the Muni downtown from the west side where I currently reside costs the same $2.5 each way, or $78 for a monthly commuter pass. Meanwhile, the invention of Uber pool and Lyft Line has lowered tax rides by ~50%.

Further, if you move to a less densely populated area, there are benefits such as less traffic, less litter, less crime, more diversity, more parks, and cheaper goods and services. In 2024, the west side of San Francisco is now a highly desirable region for individuals and families.

With the opening of the Chinese American International School on 19th Avenue and the $4 billion UCSF Parnassus campus, buying west side San Francisco property makes sense.

Pandemic Accelerates Geoarbitrage To Cheaper Neighborhoods

Once the pandemic hit, living out west became even more attractive. The demand for real estate in the less dense side of San Francisco is strong.

I even rented out one of my rental properties to a family of four for $8,300/month. In the past, I would never be able to land the unicorn tenant: a family. It was always just four housemates, which required a lot more work.

Where I live, you can get a haircut for $12 pre-tip and eat a nice dinner for $15 a person. Where I used to live, the same haircut costs $26 pre-tip. Further, you'd never be able to escape a restaurant for under $30 a person.

As you get older, you may not want to live in a home within walking distance of everything. Instead, you may want to live in a nicer home in a more tranquil area with views. People are great, but lots of people can cause too many disturbances. If you can work from home once in a while, take rideshare service, and order delivery, there's no need to live next to the hustle and bustle anymore.

Don't Let Your Ego Get In The Way Of Relocating

If you want to accelerate your path to financial freedom, you've got to squash your ego for that big fancy house in a prime neighborhood. You might also have to even relinquish your desire to live in an international city like Washington D.C. or Los Angeles.

During my late 20s, I felt I needed to live in the best neighborhoods. After all, that's where all my colleagues lived. It was a similar pressure to buying nicer clothes than I was accustomed to, to look the part.

But once I extricated myself from the workplace, there was no longer any peer pressure. Sure, living in a fancy neighborhood was nice, but I wanted a change of scenery 13 years later.

Lowering my housing expenses by 50% since 2014 while concurrently growing my passive income by 50% in the same time period has done wonders for our financials. Our monthly cost to live has now plummeted to well below 5% of our gross income as a result. Growing this gap is the key to financial freedom.

We used to feel a little guilty being away from our house for more than two weeks. That meant we were paying double living costs for that particular time period. Nowadays, our housing costs can hardly be felt, so we feel much freer.

Geoarbitrage is great for getting F You Money as well! Once you have F You money, you are more free to live your life that way you want.

No Need To Feel Embarrassed Living Farther Away

Some people used to arrogantly tell me, “Wow, you live so far away from downtown,” I think to myself: are you really justifying paying a premium in rent or purchase price just so you can live closer to work to work longer? You mindless fool!

Of course, I played dumb, nodded and told them it must be nice to live so much closer to work. Hah.

Now, there are less location snobs post pandemic. In fact, people who live farther away from downtown can now display reverse snobbery! I can't believe you live downtown when downtown is dead!

The best near-term real estate opportunity is buying in the less dense parts of your city. It is no longer “embarrassing” to live far away from downtown. Instead, it's very logical and smart given we no longer need to commute as much.

Start Small, Work Your Geoarbitrage Way Up

It's always good to start small when testing new things. Instead of relocating to a different country, try relocating to a different part of your city first. This is the best geoarbitrage strategy, especially if you have kids.

Once you understand the challenges and get comfortable with the new environment, then consider relocating to a cheaper part of the country. If living in a cheaper part of the country isn't enough, then you can rip off the band-aid and go international.

The last thing you want to do is uproot your entire life in a completely new environment and feel like you made a mistake.

One family of five I know paid $200,000+ in real estate commission fees to sell their house in order to relocate to Florida where the wife's family is from.

They ended up hating Florida because their adopted kids from Africa were being bullied and they are white. So they decided to move back to San Francisco seven months later. They then bought and remodeled a new house for multiple millions!

Try before you buy folks. Some of the cheapest cities in America are also some of the unhappiest. After all, there's a reason why the median home price for some cities are so low. Weather, culture, and economic opportunity have a lot to do with how livable a city is.

Moving Within Your City Is Great

Being able to work from home definitely helps with geoarbitrage no doubt. The global pandemic has certainly helped accelerate this trend.

But even if you had to go to an office with bright fluorescent lights that burn your skin and accelerate your aging process by 20%, having to commute an extra 10-30 minutes each way to save big bucks isn't much of a sacrifice.

Instead, it's a blessing to be able to enjoy your same city and breathe in the same fresh air while saving so much money every day. Once we moved to the less dense, west-side of San Francisco, we got excited again. There were new parks and museums to enjoy. New restaurants to eat at. And new types of people to meet.

If you think you deserve to live in the best area, then be happy paying higher prices. If you aren't happy with the cost, please relocate to a different part of town.

Best Time To Find Deals As A Renter

As a renter, the best time to find rental deals is in the fourth quarter. Conversely, if you are a landlord, the best time to find tenants is in the second quarter.

Nobody is saying you need to move to polar vortex country to achieve financial independence! In fact, once the pandemic is over, I bet there will be a lot of people looking to reverse-geoarbitrage back to coastal cities and states like California.

After all, people go where the weather is best and the job opportunities are the greatest.

If you’re interested in making a big change, you can check out a post by a reader who international arbitraged to Panama.

A Smart Way To Invest In Geoarbitrage

Geoarbitrage is a trend that's going to continue for decades to come. The pandemic has ensured a permanently flexible way of working. Therefore, expect to see a continued net migration to lower cost parts of the country.

For example, huge companies like Google and Apple are spending billions buying up heartland real estate for a reason. As a result, job opportunities will follow. Once borders open up, I'm confident there will be a flood of foreign investors buying up U.S. real estate. Therefore, it's best Americans buy up our own real estate first!

The best way I know how to take advantage of the geoarbitrage trend is through real estate crowdfunding. Real estate crowdfunding is a way to invest in real estate across the country in a cost-efficient and easier manner.

Instead of taking on concentration risk by buying the entire building, you can wisely own a portion of the building in a city like Austin or Charleston to diversify your portfolio.

The Best Real Estate Platforms

Check out Fundrise, one of the pioneers in real estate crowdfunding today. Their comprehensive platform is free to sign up and look around. I believe Fundrise is the best platform for non-accredited investors given it has eFunds to provide investors exposure and diversification. You can gets tarted investing with as little as $10.

Fundrise has 500,000+ investors and manages about $3 billion in assets and is a long-time sponsor of Financial Samurai. Financial Samurai is also an investor in a Fundrise fund. You can use Fundrise to geoarbitrage your investments by investing in lower-cost areas of the country with higher yields. Fundrise specifically invests in the Sunbelt region.

Also check out CrowdStreet, my favorite real estate crowdfunding platform for accredited investors. CrowdStreet's focuses specifically on 18-hour cities, those cities that are less expensive, but faster growing. 18-hour cities should benefit most from the long-term geoarbitrage trend.

If you are a real estate enthusiast with more time, you can build your own diversified real estate portfolio with CrowdStreet. However, before investing in each deal, make sure to do extensive due diligence on each sponsor. Understanding each sponsor's track record and experience is vital.

I've personally invested $954,000 in 18 real estate crowdfunding deals to take advantage of demographic trends and cheaper valuations in the heartland. As a father of two young children, it is really nice to earn income 100% passively. Below is my latest private real estate dashboard.

Both platforms are long-time sponsors of Financial Samurai and Financial Samurai has invested over $300,000 in Fundrise so far.

Subscribe To Financial Samurai

For more nuanced personal finance content, join 65,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. Everything is written based off firsthand experience. The Proper Geoarbitrage Strategy is a FS original post.

This is my geoarbitrage.

I live in Bangkok, Thailand. I travel 6 months a year – Thailand, Singapore, Australia, NZ, China, Japan, and occassionally Europe. While in Thailand my accommodation costs are about 30% of the rent I collect from property I own in Singapore. And with a ~$5m net worth, I can tell you, I live like a king. I hope to never have to return to a “Western country”.

So, my advice -> geoarbitrage to Asia. You will have experiences and a life of fulfiliment that exceed your wildest dreams. All the while spending a fraction you did back home and continuing to grow your wealth.

America is cheaper than southeast Asia for most things:

Cars

Phones

Computers

Processed foods

Corn/nuts/ cereal

Fuels

Electricity

Internet connection

Education (free in the US)

The idea that you save money moving to southeast Asia is a joke. You save if you go from living in a nice air conditioned apartment and driving a car to living in a hovel and riding a bicycle but that’s the same anywhere!

Living the same exact standard in Ohio is much cheaper than Phnom Penh or Bangkok.

Hmmm, have you been to SE ASia? Apprently not since i can debunked these items is cheaper and faster there than in mots US cities

Internet connection – $10-20/month

Education (free in the US) – no property taxes in many countries, so is not “free” in the US

Phones – Bring from the USA

Computers – Bring from the USA

Processed foods – is a good thing since it better/cheaper with UNProcessed & fresher foods

You didn’t debunk any of what he said. I pay close to $100 in SEA to get average internet and all of the other items he listed are spot on too.

Having lived in Asia, I’d say it definitely depends on your lifestyle. If you want to live in an apartment, don’t care too much about how big it is, in a convenient area and are happy to use public transit, your cost of living is WAY cheaper in SEA.

If you eat out a lot, it’s also cheaper in SEA.

Eating at home is a crapshoot. Cheese and beef are typically (much) more expensive in Asia. Most other foods are somewhat cheaper.

Cars are much more expensive, as are utilities. Landed houses are cheaper but not dramatically cheaper.

So if you want to live a typical suburban lifestyle, cooking your own meals, living in a big house with a good amount of land, eating a lot of burgers, and driving everywhere — your cost differences won’t be that much, and could even favor America.

On the other hand, if you’re happy in an apartment, using public transit, and eating chicken and rice out of the house, you’re going to have a dramatically cheaper lifestyle in Asia.

I, personally, was somewhere in between (lived in an apartment, but ate a lot of steak cooked at home), and ended up having about the same cost of living in Asia as I did in America. My overall material quality of life in Asia was probably slightly higher at the same cost, but I felt pretty isolated. I’ve moved back and working non-remotely in America has increased my income to the point where there’s absolutely no way I could match it in Asia.

Hey,

I just listened to your most recent podcast episode with your wife. If you want my 2 cents, I think she wins this argument to go to Hawaii. I hear and understand your points about Virginia and it potentially giving your son more opportunities to face adversity. However, your wife seems adamantly opposed to it. I’m not married nor do I have kids so maybe I’m not qualified to have an opinion on this but I do ;-)

My gut tells me that you’ll want to go somewhere you both like. It seems like you do not dislike Hawaii as much as your wife dislikes Va and as a matter of fact, you seem to love Hawaii. You’ll just have to not make it too easy on your kid (i.e enforcing him to get a job when he is able and having him contribute to the financial samurai household expenses). Just some thoughts from little ole me…

There is no chance you are travelling 5 miles through a city in 15 minutes. You will spend at least 15 minutes stopping at traffic lights/bus stops and another 30-45 minutes sitting in traffic. Best case scenario is riding an E-scooter ignoring traffic laws averaging 5-10 MPH. My two mile commute in DC can be done in 20 minutes by car, 15 minutes by scooter or bike, or 40 minutes walking.

Driving/ riding the bus for 5 miles through the heart of SF at rush hour will take 1 hour+. Losing 2 hours of time per day commuting is a loss of $200-$500 per day per couple.

Guess we have different experiences. The muni train, when on schedule, will take 15 min or less to travel 5 miles.

How long have you lived in San Francisco and how has your scooter experience been?

Hi Sam – I do not live in SF, but have visited several times and am frequently in major cities across the country. My daily 2 mile commute in DC cannot be done in less than 15 minutes by any mode of transportation. A 5 mile commute in DC (or any major city) would be very difficult to do in less than 40 minutes. 5 miles in 15 minutes door-to-door to downtown is absolutely impossible in any major city.

We had a similar logic to you in terms of not overpaying to live in a trendy neighborhood. Our goal was to buy the cheapest rowhome within 1-2 miles of downtown because it would be impossible to keep commuting time to less than 20 minutes each way if we moved any further away. Saving 1-2 hours per day per couple in commuting time is the equivalent of saving $1,000’s per month in gained productivity and reduced commuting expenses. Downtown is more expensive because there is a real cost to longer commute times. Commuting longer than 20 minutes for 10+ years will have a devasting impact on your health, finances, and overall quality of life.

You decision was obviously swayed because your family no longer had to be in core downtown on a daily basis so why pay the premium? But i think your analysis is incorrect for commuters because you are heavily discounting the time is takes to commute door-to-door in a city at rush hour.

Geoarbitrage is brilliant on paper, but finding a high quality of living area with good schools at a relatively low cost is virtually impossible in America. Affordability=Low quality of living and/or sub-optimal schools. High quality of living areas with good schools are all prohibitively expensive. I suspect that major cities and high quality of living areas are all now significantly overvalued for several reasons including the fact that my family cannot afford to live within even 5 miles of a major city at this point on $250K per year. Which isn’t a lot of money, but certainly should be enough if we are earning close to 2-4 median income in every city except SF.

I think Seattle, SF, NYC, DC, Denver, Boston, LA, and Austin real estate could all go down 15-20% over the next 5 years. We are sitting heavily in fixed income/cash right now praying for either a stock market crash or a Socal real estate crash to make our exit from the overpriced and low quality of living Northeast.

try maryville tn

Hi Sam!

Question for you: How do you define geoarbitrage versus just choosing a lower cost of living? What is the difference in your view, if any?

To me, it seems like moving from the expensive side to the cheaper side of the same city while still doing the same job is not geoarbitrage — it’s just spending less on housing. On the other hand, geoarbitrage is more like choosing a career or job that allows for unusually high income at unusually low cost of living, where you are arbitraging some sort of fundamental mispricing in the labor and/or housing markets.

Blogging while living in the heartland seems like geoarbitrage, whereas moving to west SF seems more like lowering the cost of living but not geoarbitrage.

Would love your thoughts. Just brainstorming here…!

Add another 25% discount for Brisbane or Daly City! My corporate relo clients frequently mention places they shouldn’t but are uninformed: The Bayview, Tenderloin, San Bruno, Half Moon Bay. In reality the margin is much narrower. The astronomical ‘habitable zone’ is similar to the housing zone which will realize positive value and improvement during your tenure there. Ask South Bay workers why they haven’t flocked to Gilroy or San Juan Bautista.

Great blog, Sam. Look forward to it always!

What’s wrong with half moon bay other than traffic issues?

if you are a minority, geoarbitrage might not be so relevant. There is only a handful of places for people of color to live in the USA. You are must pretty much struck to one of the large and expensive cities where there is some diversity for your family feel safe and accepted.

Yes, more restricted as a minority if you want more diverse cities. That’s where geoarbing to where you are a majority could ge great. For us it would be Taiwan, Singapore, Hawaii, Hong Kong, or China.

See: Financial Blind Spots On Your Road To Financial Independence

Weird comment. White people will be a minority in the United States by 2040. Amongst American children, whites are already a minority. The high school in my upscale suburban “whitebread” neighborhood is only 65% white. It was probably 90% white just 25 years ago. Most people don’t realize the extent and unprecedented pace at which demographics are changing in the United States.

This plus the fact that mainstream America, in all parts of the country, worships at the altar of multiculturalism, means that your concerns are mostly imaginary.

When talking cold hard finances I agree 100% with literally everything in this post; however, there are some realities in places other than SF which might make it more awkward. Specifically I’ll use my own example in Los Angeles, where mass transit is awful, and dating is sadly a lot harder I’m finding if you aren’t in a couple of specific spots when doing any sort of analysis even on something broad-based like Tinder or Match. Do try before your buy to your point.

That said the tradeoff for me was obvious: taking the 350k condo as an investment I’m living in down near the port of LA in 2015 instead of something non-trivially more expensive was absolutely a massive win financially for me and with the rise of virtual office work which finally I’m leveraging, well actually my former quality of life commuting to Santa Monica vs. currently working *two* mostly virtual office jobs is damned close to equivalent.

Not quite laughing all the way to the bank, but it’s close.

My family of 5 live in an expensive area in New York City. Prior to moving to this area, my wife and I thought through the pros and cons. Are the benefits enough to offset the cost. We decided that it made sense for us to live in Manhattan versus a more cost effective alternative.

I would look at the the question of “why aren’t more people willing to move to take advantage of cost savings” in a different way. I think we have to look at people willing to pay more for housing and ask the question “why are they willing to pay more for housing?”. When all else is equal, everyone would choose to pay less for housing. But obviously, not all housing variables can be equal so why are those people willing to pay more for the differences.

BTW, Hawaii is great. My wife and I would love to retire to Diamond Head one day if we can save enough to pay for it.

Wow, those are definitely San Francisco numbers :D

I’m in the middle of doing some local geoarbitrage right now! This was a very timely piece. I’m considering a larger leap, and to ensure I don’t end up like your friends that moved to Florida I’m going to do an extended stay in my would be next destination for a few weeks. That way I can definitely try before I buy, and if that doesn’t work out then I’ll continue to scout the city for even better deals.

I like your youthful 2019 version of Hawaii Dreamin, However, you are talking about moving to a somewhat isolated volcanic Island with a population of about 1,000,000 and an August to May school year, and I honestly do not think you will home school.

Hi Sam-

Timely post for me. I’ve lived in the same nyc rent controlled apartment in Murray hill for 6.5 years. Our rent is 2,850 for a 1BR in an older doorman building. We want something newer and nicer but those would be $4,500+ in Manhattan. We are considering moving to Long Island city or Brooklyn and paying $3,500 for a nicer place. Commute is longer (currently walk to work). I can’t decide if I’m crazy for paying more for a nicer space farther away or if it’s time to move on. I also get more and more stressed each year I’m delaying buying but property is really insane in nyc as you know.

Curious how you look at this scenario.

Thanks,

David

Hi Sam,

Interesting perspective on the classic choice between living in a higher cost area because it is close to work or a cool neighborhood vs living somewhere that allows you to save more money. I am trying to make a similar decision right now in the Seattle area. Cost of living has gone way up. We are considering a studio downtown or a 1-2 bedroom place outside of the city center. Traffic is a mess up here. That will also be a big factor.

Do you think you are less stressed because you are normally visiting Honolulu on vacation or would you truly feel less stress living there permanently?

Hey FS: I’m pretty sure Houston is 1 of the most racially diverse cities in the USA. The cost of living is also somewhat low there. Just an idea.

I’ve been fortunate to have taken advantage of geographic arbitrage but, I don’t think I leveraged down far enough in cost due to relatively high quality of life requirements. 10 years ago, my wife and I got tired of the California cost of living, excessive taxation and ineffective government spending. I was fortunate enough to work for a Bay Area high tech company in a Sales related role and the company preferred that I not work locally. We had the option of living anywhere in the USA and eventually selected Seattle. It was great. We bought a home in arguably one of the better Seattle close in neighborhoods. I made Silicon Valley wages in a city where my cost of living was 30%-40% lower than the Bay Area. Then over a 10 year period Amazon happened and Seattle local government became even more socialist than San Francisco. Our property taxes doubled, our car registration quadrupled and other cost approached those of the Bay Area.

Now, I work for an east cost tech company making NYC wages but I look at the money I have to invest after covering my monthly nut and, I don’t think it is worth the crap I have to deal with at work on a daily basis. Now, I’m thinking of moving again to a city in a lower cost area like Boise or Charleston or Austin or somewhere in Florida. However, I have young kids and I don’t want to uproot them. In retrospect, I wish I’d discounted the need to live in a sophisticated city and leveraged down to a place with 60% plus lower cost of living than California.

How bout geoarbitraging your withdrawal strategy in retirement and move to a different state. I think there are 7 states that don’t have a state tax on 401k, pension and social security benefits the Trifecta! Add it all up and could be saving and extra 15% to 20% in retirement, unless you think the government has your best interest. Remember you may have lived and paid into a high tax state your whole life, but that doesn’t mean you have to get wacked again when you withdraw in retirement.

Absolutely, I live in a city in one of those states now so, it may be as simple as moving away from the Seattle / Bellevue area. Washington has estate taxes although, these can be avoided with some planning. The want for warmer weather may drive us out of state. Then, the challenge is to determine whether our next move sets us up for retirement or do we relocate again once I start withdrawing retirement funds.

You picked Seattle? It’s expensive with crappy traffic and lots of rain and clouds . All these places like NYC, San Francisco, and Seattle are high cost because of the policies the citizens support ideologically but then later suffer the consequences. You mentioned Charleston as a potential city. My friend lives there and says so many northerners as escaping there, increasing the cost and in support of the same wacky rules and regulations they escaped from in the first place. Anyone thinking about geoarbitraging to a southern locale, please remember or become sober that liberal minded ideas lead to expensive living.

The bad part of town is cheaper no matter where in the world you are…

This comment is why I find there to be so much opportunity in real estate. A lot of people have negative stereotypes about cheaper or a different neighborhood.

But if you can see through the stereotypes by people who have no idea, you can make a fortune. Here is an example:

To Get Rich, Practice Predicting The Future

Amazing what impact moving just 5 miles makes on the bottom line. If I lived in SF I would go for it right away!

Often I’m just astonished what people are willing to pay to live in a nicer neighborhood. To me it just makes no sense. I fully agree that in many cases the ego is the problem. When meeting someone for the first time, they always ask where you live. No ‘better’ way to start a conversation then by saying you live in Pacific Heights…

“Nobody is saying you need to move to polar vortex country to achieve financial independence!”

Too true. However, my wife and I have always been here and it is definitely speeding FI up. :)

As for time to commute and saving money. That is definitely a trade-off that has many factors. Since my wife and I drive to work, we do appreciate being in the city for the shorter commute and the commute which offers more options than just one highway between work and home. Shaving off 30 to 60 minutes per day versus the suburbs has been worth it to us.

But…saving money living further out, taking a bus in and doing something constructive during the trip; I won’t give garbage to anyone for that. I may have in the past but I now see that it’s just a choice and that choice works for them.

People will move to more affordable areas once they are settled in their careers I believe. As far as commute many will try to find jobs closer to home as well. And many big companies (Amazon for example) are opening offices in smaller towns as well. I personally have a short commute, but still, like to listen to audiobooks going to and from work to optimize the time.

Come move to Panama with us this summer, Sam – the cost of living and beautiful weather will do wonders toward bringing down anyone’s stress! ;-)

I never would have pictured Honolulu being on the geoarbitrage list, but I guess if you live in San Fran, most places have lower housing costs. Us Clevelanders have to leave the country to get cheaper housing!

— Jim

Maybe in a different life. I’m excited to follow your journey to Panama! I hope you regularly update us with the experience. It’s fun to live vicariously through other people. I most certainly will share my experience in Honolulu. Good luck!

I don’t know where you found a house in the outer Richmond for $2700 a month in rent. It must either be a unicorn abode or a cardboard box?

Personally, I think that once you’re no longer making a bay area salary, it makes sense to leave the area. I would love to relocate right now, but my husband once to take one more crack at a start up. If he doesn’t get funding by July, we’re out. That’s the deal.

Neither do I, but a two bedroom apartment, absolutely.

It’s so funny how some people complain about cost-of-living, yet they insist on living in the most expensive neighborhood possible.

“Why aren’t more people willing to move?” My take, in general, humans seeks safety and familiarity; we are also lazy by nature. My father was in the Army for 20 years. I moved every 3-4 years. I believe that experience contributed to me to being very independent, seeking adventure and experiences, and not being anxious regarding change. I have friends who grew up in the same community from 0-18 years old, and even older. They had difficulty “leaving home” for college. My best friend from the latter years of high school wanted me to move elsewhere, so she could then join me; she wanted to experience another area, but was to uncomfortable leaving everything known to have to seek out new, which included the mundane like a new primary care provider, dentist, grocery store, gym……. My partner also lived in one community until college; he had no difficulty physically relocating to new areas, however creating a general change in life makes him anxious and irritable, causing him to avoid change.

Sam, you commented that you wanted to provide your son with stability until he is 2.5-3 yo. You and your wife are his stability; his stability is the love, guidance, and understanding of his parents, as well as the routines and boundaries you create as a family.

Remember, children are developing neural bundles. They are adaptable to so many situations that adults do not give them credit for. Additionally, they crave new experiences, stimulating sensory and brain-provoking interactions, to create strong neural connections that allows them to analyze and respond to daily situations with confident, problem-solving skills, without apprehension. Your stability is your family, its love, routines, and boundaries, not The locale is not the “thing” creating stability, as long as a child has a home to come to every night.

You touched on it some in the post, but your writings leads me to believe that your apprehension regarding leaving the familiar security blanket of San Fran is more of the reason you have not relocated than the reason attributed to your son’s upbringing. Parents desire what is “best” for their children, but also have the tricky job of being mindful that their own difficulties/weaknesses/fears do not adversely effect their children.

Sam, just do it!! Sounds like in the long-run, you will be happier in Hawaii–but if not, you won’t know until you try.

“Sam, you commented that you wanted to provide your son with stability until he is 2.5-3 yo. You and your wife are his stability; his stability is the love, guidance, and understanding of his parents, as well as the routines and boundaries you create as a family.”

Good point and I believe it.

In 2014, I found a real estate opportunity I couldn’t afford to pass up, so I bought my fixer back then with ocean views. It was my Hawaii compromise game and it was my beach home.

After the birth of our son in 2017, the last thing either of us wanted to do was move the first couple years of his life. It’s hard being first time parents. Do you remember these two years if you are a parent? Phew… moving would be a big pain!

But after 2.5-3 years, it’s cool now. We have a plan. I like to methodically plan. It’s fun for me.

How often did you move with children, if you have children?

Being someone who’s currently going through it and about to hit the repeat button with #2, I’d say you don’t have to wait that long to feel like the chaos has subsided enough to make decisions like moving (run-on? you decide). My 23 mo kid would love trying to destroy all the houses we’d see if we were moving right now.

Right now I’m planning on upgrading when the second one is ~1 yr old fwiw.

Cheers!

Same story here as a military brat that moved a lot until I was in middle school. My wife lived in the same area only moving 70 miles away from home. I went back to school in 2008 and moved the family to Nashville for 2 years. It was a great experience for the whole family which gave my wife courage to move anywhere now. Currently I commute about 780 miles to and from work! I think it was worth the 70k pay raise with the ability to increase that gap to just over 100k. I work 7 days on and 7 days off. I split an apt and spend 500/month and another 500 on travel. I work across the street from work and love the extra savings in time travel there plus not having a car. In my family’s town of Ga, living close to work is not worth the bad schools, no privacy, and noise.

There’s this idea that the Bay Area as a whole is unaffordable. If you look long enough for deals and are willing to make some tradeoffs, there are plenty of affordable places everywhere (relative to income of course). Our cost of living is not much more expensive than in Northern Virginia where we used to live but we’re making at least 60-70% more now.

Sam, have you thought much about Hawaii losing it’s “special-ness” once you live there full time? I am considering moving there, too. That’s why I’m asking. If you wake up in paradise every day, will it still feel like paradise?

Indeed. Where do Hawaiians go to vacation?

We plan to spend six months in Hawaii, three months in San Francisco, and the rest of the time traveling around the world. That’s the idea at least.

With Hawaii five hours closer to Asia, we would love to go explore Asia more.

“What do gynecologists do on their day off?!?!!” – Marty Keegan

That’s an awesome living plan! Enjoy! You’ve worked hard for it!

Hawaii resident here.. My vacations tend to be to mountainous regions in the summertime or snowboarding trips in the winter. Love taking the easy trip over to Hoikkado, Japan for the world class snowboarding and food.

It’s totally true that one can relocate within the same city to save money on housing and also to other places in one’s state, country and the world! I think people who want to save money but don’t move are held back by the effort it takes to find and secure a new place, the pita process of packing and moving everything, maybe even the temporary increased cost of hiring movers or a moving truck, and the fear of change. Change is hard

for most people, myself included.