If you're aiming for more value and cost-efficiency, you might find it surprising that opting for a more expensive home over a median-priced one could be the way to go. While it may seem counterintuitive, let me explain.

Since purchasing a pricier home in 2023, my family and I have been grappling with the budgetary constraints it has brought about. However, instead of continuing to focus on the negatives, I'd like to now focus on the positives of owning an expensive home. The thought came to me after speaking with several real estate agents.

In 2024, bidding wars made a comeback, fueled by a robust labor market, a thriving economy, pent-up demand, lower mortgage rates, and soaring stock prices. The downside of a bull market is that securing a favorable deal on a home becomes increasingly challenging. As people become wealthier, they tend to splurge on big-ticket items like cars and homes.

For Greater Value, Avoid Purchasing a Median-Priced Home

If your aim is to save money, you might want to steer clear of buying a home that falls within the median price range. Instead, strive to escape what I've dubbed the “frenzy zone,” which encompasses homes priced up to 150% of the median price in your city.

Once you venture into the territory of homes priced 50% higher than the median, demand tends to drop significantly. As you move further above the median price point, you'll typically find better deals.

Conversely, the closer you get to the median price or below, the tougher it becomes to secure a favorable deal. This is because there's a larger pool of individuals with household incomes sufficient to afford homes within this range. Everybody likes to go eat at 12 noon and wait in line instead of eat at 1 PM and save time.

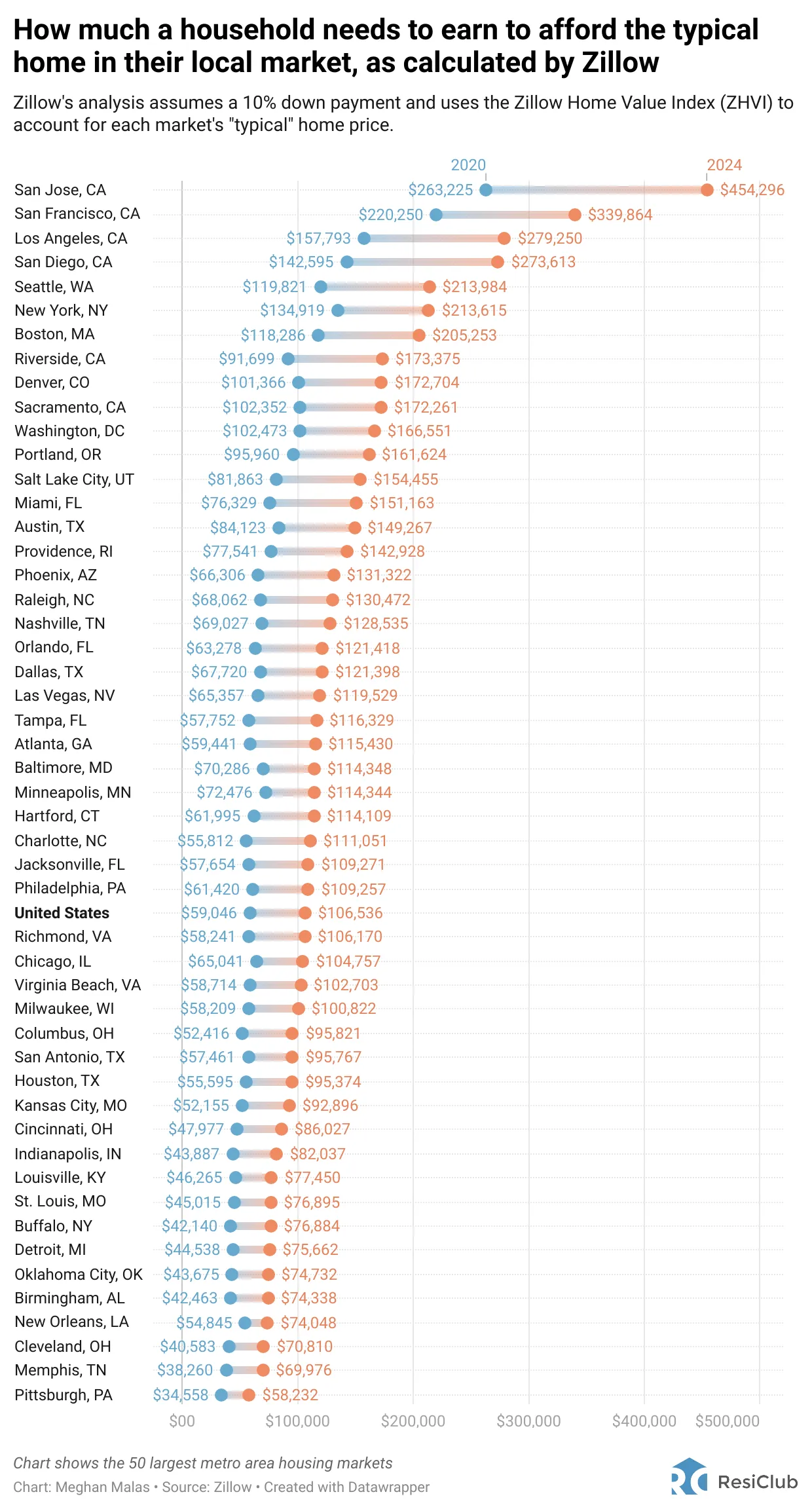

Household Income Needed To Afford Typical Median Home In Top 50 Cities

As a refresher, the chart below outlines the household income needed to afford a typical home (median-priced) in 50 cities, according to Zillow. To escape the frenzy zone and find greater value, you'll need to earn at least 50% more than the household income figures for 2024 to afford a home priced 50% higher than the median.

Let's consider the overall United States figure of $106,536 required to purchase a median-priced home of around $420,000. To escape the frenzy zone and save money, you'll need to explore homes priced above $620,000, necessitating an income of $160,000 or more or a larger down payment. Take the data from wherever you live and do the same math.

Demand is Soaring for Median-Priced Homes in San Francisco

While I can't provide specific examples of how median-priced homes are selling across the nation, I can offer insights into the west side of San Francisco based on my research and discussions with top real estate agents specializing in the area.

Homes priced at the median level or below (under $1.7 million) on San Francisco's west side are seeing robust demand partially thanks to the strength in tech and artificial intelligence. Here are a few examples of homes that hit the market and quickly garnered multiple offers, often selling well above the asking price.

Examples Of Median-Priced Or Below Homes Selling Way Above Asking

- 2455 22nd Ave: Received 32 offers in just one week, selling for over $450k above the list price. This 3-bedroom, 2-bathroom property spans 1,380 sqft, with a price per square foot of $1,200.

- 1335 28th Ave: Sold in one week for over $550k above the list price, with 21 offers. This 3-bedroom, 2-bathroom home covers 1,300 sqft, with a price per square foot of $1,277.

- 1755 11th Ave: Spent two weeks on the market and sold for over $300k above the list price. This 2-bedroom, 1.5-bathroom property spans 1,250 sqft, with a price per square foot of $1,295.

- 1736 11th Ave: Sold in two weeks for $195k above the asking price. This 2-bedroom, 1-bathroom home covers 1,075 sqft, with a price per square foot of $1,325.

These examples highlight the trend of modest homes attracting multiple offers and fetching high prices per square foot. It's hard to imagine competing against 10 or even 32 other offers. No wonder some buyers feel compelled to bid well above the market value.

In such a fiercely competitive bidding environment, having an experienced buyer's agent by your side is crucial to prevent potential financial losses. Despite the NAR settlement likely hurting the income of buyer's agents, don't overlook the importance of finding a good one to represent you if you lack experience.

Why Median-Priced Homes Command Higher Prices-Per-Square Foot

While median-priced homes are cheaper in absolute dollars compared to luxury properties, they often prove more expensive when viewed from a value standpoint, particularly on a price-per-square-foot basis.

In the examples provided earlier, the price per square foot ranged from $1,200 to $1,325, which is 20% to 32% higher than San Francisco's median price per square foot of around $1,000.

Generally, the more you pay for a home, generally, the more value you will get from a price per square foot basis (pay a lower price). The reason why is because people pay the most for necessities and less for luxuries or nonessentials.

For instance, the first full bathroom in a home typically holds more value than the eighth full bathroom. Same goes for the first bedroom versus the tenth bedroom.

Now let's look at why smaller homes cost more on a price per square foot from a cost perspective. The most expensive parts of a house, per square foot, are kitchens and baths. The smaller the overall square footage of the house, the greater the proportion of square footage is baths and the kitchen. This drives up the price per square foot.

Economies of scale also plays a role in why larger homes tend to be cheaper on a price per square foot basis. When constructing a larger home, the cost per square foot may decrease due to shared walls, plumbing, the roof, and other infrastructure.

Higher Rental Yields With Smaller Properties

While the price per square foot for purchasing a smaller home is typically higher, at least smaller homes often yield higher rental returns if you plan to rent them out. Additionally, there's typically higher investor demand for smaller properties, which further contributes to their relatively higher prices.

Consider renting out a 1,500-square-foot, 3-bedroom, 2-bathroom single-family home in a Sunbelt city, which might yield an 8% cap rate. In contrast, an 8,000-square-foot, 7-bedroom, 7-bathroom single-family home in the same city might yield only a 3% cap rate. Then, if you take the mansion and drop it in an expensive coastal city, its cap rate might only be 1-2%.

By focusing on buying homes priced 50% or more above the median, you're likely to encounter less competition and a reduced risk of entering bidding wars. Additionally, these higher-priced homes often trade at a lower price per square foot, offering potential savings in the long run.

Just make sure that if you plan to pay for a pricier home, you don't end up too house rich cash poor. If so, you might put your household's finances at risk during the time you're trying to build back your liquidity.

We're Seeing A Strong Middle Class

You might assume that higher mortgage rates would hit the median household income earner or lower the hardest, as they typically need to borrow the most and consequently pay the highest mortgage interest expenses. However, the robust demand for median-priced homes in San Francisco, and likely in other cities too, suggests otherwise.

The strength in demand indicates several things:

- The median household may be more financially healthy than we realize.

- It's easier to accumulate a smaller down payment through personal savings and family assistance.

- There's increasing upward pricing pressure building for homes in the next segment up.

When the middle class shows confidence in the housing market, it bodes well for the economy compared to when only the top 1% are bullish. This is because the middle class constitutes a larger portion of the population with greater spending capacity, thus exerting a more significant impact on GDP. As investors, we must observe what people DO with their money, not what they say.

Therefore, it's wise to start considering homes priced above 150% of the median. In San Francisco, where the median home price is approximately $1.7 million, aiming for homes in the $2.55+ million range makes sense. Here, you'll encounter less competition and receive better value by paying a lower price per square foot.

Over time, as the wave of households purchasing median-priced homes and those up to 50% higher gradually seeks to move up to the next tier, the median price per square foot of these pricier homes will also rise. And when the top 1% finally get as bulled up as the middle class, luxury home prices will explode higher once more.

Determining The Right Price Per Square Foot Is Subjective

The price per square foot of a house varies depending on factors such as location, finishes, age, architectural style, view, and lot size. Generally, the better these factors are, the more you'd be willing to pay per square foot.

Personally, I'm inclined to pay much more for a fully remodeled house with scenic views and ample outdoor space. After enduring a grueling 2.5-year gut renovation during the pandemic, I vowed never to undertake such a project again. The Remodeled homes should sell for greater premiums going forward given how difficult they are to complete.

With young children, having a large and secure lot where they can play freely is invaluable to me. In expensive cities, it is really the land that is valued the most. If you can find a house on a triple-sized lot or greater, you've found yourself a unicorn where you should try and lock it down.

Starter Homes Appreciating Much Quicker

Below is a great chart that illustrates how you can find better value buying a more expensive home. Starter homes are appreciating much quicker due to a lack of supply. Meanwhile, the highest-priced homes are appreciating the slowest, meaning you get the best value.

As an investor, you may want to invest in starter homes in your real estate portfolio. But as a primary home buyer, you should look for more expensive homes to live and enjoy. Learn about BURL, the real estate investing rule I recommend. The concept is similar.

Found Better Value In An Expensive House

Despite paying a substantial amount for my new home, I managed to secure it at a lower price per square foot compared to the examples mentioned earlier, even though my property is considerably nicer. This makes me feel like I received excellent value relative to the market.

I didn't engage in a bidding war to acquire my home. Instead, I exercised patience and waited for two previous offers to fall through. Truth be told, I would have been willing to pay the original asking price if I had the funds at the time.

Then, I waited another year before submitting my own offer, which was 14% below the asking price and included inspection contingencies. Following this, we spent two and a half months meticulously inspecting every aspect of the property and ensuring that the seller addressed any necessary repairs or updates before our move-in.

When you perceive something as offering great value, it tends to feel more affordable than its actual price. Sure, my home’s price could absolutely go lower. However, it will take a large decline to erode my perception of the home’s value as I also feel the immense satisfaction of providing for my family.

The 14% savings I secured through luck and patience could cover our family's expenses for many years. Adopting this perspective helps me feel more comfortable with the high absolute price I paid. Here are my reflections after one year of purchasing the most expensive house I could afford.

Example Of Great Value If You Can Afford The Price

Below is an example of an expensive home in Presidio Heights where the buyer got a great deal. It was originally listed for $9,800,000 on February 13, 2023. Very few families need 7 bedrooms, 7 baths and over 6,100 sqft feet of space. Perhaps even fewer households can afford $9,800,000.

After a month with no offers, the seller lowered the asking price to $8,900,000. Two weeks later, the seller lowered the asking price again to $6,995,000, when it finally sold for $7,340,000.

At $1,203/sqft, the home is great value for a buyer who could afford such a hefty absolute price. Presidio Heights is considered one of the most prime neighborhoods in all of San Francisco. Meanwhile, this home's architecture and build quality are superior to the median-priced homes above, which all sold for a higher price/sqft.

Yes, I acknowledge buying in May 2023 was better than buying in March 2024, since the bottom of this real estate cycle looks to be in 3Q 2023. But the value is still there if this house were to sell today.

Look For Better Home Bargains Up The Home Price Curve

Given that all sensible homebuyers purchase within their financial means, purchasing an expensive home may feel less expensive than it might for someone who got into a bidding war to buy a median-priced home. I know nobody who outbids 20 other bidders who then thinks they got a bargain.

So long as you comfortably buy a home less than what you think it's worth, your life will feel more affordable. The price saving difference between what you paid and what you think your home is worth can be used to pay for a lot of life’s expenses.

Go up the price curve if you want to find a better deal on a home. Be patient as you earn and save more. If you bargain hard enough, you might just be able to find what you're looking for.

Reader Questions And Suggestions

Have you ever felt your life got more affordable because you purchased a more expensive home? Why don't more people go up the price curve to find better deals on a home by waiting longer, earning more, or borrowing more?

Please provide some color on how median-priced homes are selling in your city. I'd love to get a feel of how real estate demand is looking for median-priced homes around the country.

For those interested in passive real estate investment, consider exploring Fundrise. Managing around $3 billion, Fundrise focuses primarily on residential and industrial real estate investments in the Sunbelt region. With lower valuations and higher yields, the Sunbelt presents an appealing prospect due to demographic shifts catalyzed by technology and remote work trends.

I've personally invested multiple six-figures in Fundrise funds to diversify my real estate holdings and invest in private growth companies, specifically in the artificial intelligence sector. Fundrise is also a long-time sponsor of Financial Samurai as our views are aligned.

I have to agree with this one.

In 2022 was looking for a SFH home in San Francisco in Pacific/Presidio Heights. It seemed most were around $1500 per Sq.Ft. without views. I did find a larger home 4000 Sq.Ft. for $1200 per Sq.Ft. a really good deal but over my self imposed limit. I did finally buy a smaller home, 2800 Sq.Ft. for $1350 per Sq.Ft. in late 2022. In hindsight a good deal for Presidio Heights, plus I love the neighborhood!

Nice. I go there often for Pickleball at the Presidio wall. How big is your household?

It’s only a good value if you actually need the space. If you’re a family of 2 DINKs or standard American family with 2 adults, 2 kids, if you go up in price to get a 5 or 7 bedroom house, it’s still not a good value, even if it’s lower cost per square foot because you’re paying for something you don’t need, that costs more to maintain, more property taxes, and so on. A sale on something you don’t need isn’t a value.

Something about this article just didn’t sit right with me, even though I usually love the Financial Samurai’s work. It is factual that, all things being equal, a larger home will cost less on a $/sq ft basis. There is a reason home builders don’t build smaller homes anymore: There is more profit in building larger homes consisting of mostly empty space.

But all things are not equal. Real estate prices are not just based on the size of a house. Location matters at the city, neighborhood, and even the street level. Lot size also carries value, especially in a large city. Age, layout, level of finish, style, and amenities also matter. Are you getting a better value by buying a bigger house, or are you paying for a more stylish home built on a bigger lot in a prime location with a pool and upgraded fixtures?

Then, there is the other use of the word value. In a city like San Francisco, where space is at a premium, there is likely a legitimate argument for a larger space increasing quality of life. However, I don’t think that is true for most places in the country. Does a family of four need a 3,500-square-foot home? If the parents work longer or harder to afford a larger home, does this bring value to the family? I am uncomfortable with the idea that a larger or more expensive home is necessarily more “valuable” in this context.

Finally, even if you get a better value, you still spend more money. The argument that a higher price improves the value of a purchase is potentially dangerous for the financially less astute among us. Does buying a luxury vehicle on sale provide more value than a Toyota Camry? I’m afraid this argument is a justification that can lead down a slippery slope of spending.

Having voiced my dissent, buy away if you can afford a larger home and value what it brings to your family. Your money, your choice. This level of highly nuanced article is meant for a sophisticated audience and is not for everyone. Despite my previous points, there is one example where a more expensive home may provide economic value that I believe you left out.

In many cities, choosing between lower and higher-priced homes is also a choice between neighborhoods and school districts. Unfortunately, the quality of the school district will often improve alongside the average price of homes in the neighborhood. The cheaper home in a less desirable school district may come with lower property taxes but may force you to choose a private school for your children, negating any tax savings. Conversely, while you will pay more property taxes for a higher-priced home, it may be a better financial decision if it allows you to utilize the area’s public schools.

In my home city of Austin, a $1,000,000 increase in purchase price comes with an increased annual property tax bill of roughly $20,000. Many private schools charge $20,000 – $25,000 per student per year. Since we have three children, this could be an annualized savings of $40,000 or more. However, you could also theoretically invest the $1M and offset the cost of private school with your returns. The financial impact of this decision will depend on the cost associated with getting into the desired school district and how many children you have.

Thank you for the interesting take on the home purchasing process. Even though I don’t agree with everything, it is good to read articles that make me think and force me to defend my own position.

Way, way, WAY back in the summer of 1987 when we were a young family with two little boys (ages 5 and 3), we were looking to move from the IE back to the OC where we both grew up. We thought $150k (it was a LONG time ago, remember) would be a sufficient budget. But every house we looked at in that price range just didn’t feel right. One was in a neighborhood across a busy street from a set of railroad tracks – with trains passing by OFTEN. Another one had a large drainage ditch just on the other side of the backyard fence. With two young boys, I knew THAT was not going to work! Since we weren’t finding anything we liked, our realtor suggested we should up our budget. After all, we would be getting raises as we advanced in our careers, making the mortgage payment easier over time. (I guess so? If you say so?) We didn’t really want to do that, but we weren’t having any success in finding a house we actually wanted to live in. So we increased our budget by 10% (which was a LOT for us). We found a hidden (in plain sight) gem (with no competing offers) in a nice neighborhood (it was probably the most run down house in the area) – with a beautiful park within walking distance, and all sorts of stores / restaurants within a one mile radius. The purchase price was $165k (it’s 1987, remember!), with 11.25% (!!!!) interest rate for a 30 year mortgage. We didn’t have enough income at the time to qualify for a 15 year mortgage *sigh*. It was SCARY because our monthly house payment went from $425 to $1800 (AHHHHH!!!!). Eventually we refinanced to a 9.5% 15 year mortgage, and paid off our home in 18 years. After 37 years, we still love living in the house we stretched our budget for.

BTW, we had to empty my workplace 401K account to come up with money for the down payment, which turned out to be a good thing after all – there was nothing in there to lose when the stock market crashed on October 19, 1987!

Thanks for sharing. 37 years is an impressive time to live and enjoy the house. I’m sure you have fun memories and a great love for your house.

During this time, period, as you got wealthier, did the desire to buy an even nicer house ever come up? And if so, how did you be back that desire to upgrade? This has been my problem over the past 20 years. But I finally found the whole my plan to on for hopefully forever.

Hi Sam,

Loved the new positive perspective about the home for middle class. My husband and I had a situation you described. We bought a more expensive home and gained sooo much value. We’re happy with it and glad we didn’t settle for the other price points we were considering.

I wanted to say I really appreciate your newsletter and perspective. Keep the naysayers hooked and engaged it means you’re on to something good.

Anywho just wanted to say thanks and that I really enjoy reading your newsletter. Hope you and your fam are well.

Sincerely,

L

Congrats L and I appreciate the support.

I like naysayers because they help shine light on my blindspots. They just have to comment in a respectful way, like how you’d speak to someone face to face. Alas, the internet can often make regular people in person unpleasant online.

Sam,

Absolutely agree on your point of view.

I am observing that trend in Madrid (Spain). The congested area has all sorts of stuff 150-1M. From €1.5M things change … and you can obtain better value.

Thanks for the post!

The biggest hole in this argument is you are not looking at the opportunity cost for that capital. The most in-demand homes are those that are still in the reach of a traditional 30-year mortgage, which for most people in the Bay area top out at $2-$2.5M at current interest rates (6%)

If you want to get a lower price per squarefoot, you are buying much more expensive homes ($4M+ in Bay Area), and paying cash. That cash is coming out of the stock market, and so you need to compare your returns with the S&P500 – which has returned on average 10% YoY. Your $7M Presidio Heights property will not return 10% YoY, 4% if you are lucking so you are leaving a lot of money on the table.

Real-estate is a great investment when you can borrow money cheaply.

This. QQQ returns 14% and if using leverage which is what a mortgage is, TQQQ returns 37% annually!

Why not do both have a nice house and leverage yourself to the moon with Stocks?

There’s no point investing in stocks if you never use it to enjoy your life.

Might as well use NVIDIA.

I think your comment suggests that we are all rich and have earned tremendous equity returns. And maybe we are. However, there needs to be a balance in terms of enjoying your wealth as well.

If you die with millions, what was really the point of working and taking risks and investing for so long?

“If you die with millions, what was really the point of working and taking risks and investing for so long?”

Generational Wealth?

If 3 million is the new 1 million, would need to leave at least 6million to two children.

Once you made it, why have the next generation start at 0?

Understand others have different opinions on this.

How do you think people who are able to buy a $4 to $7 million house in cash got their money from?

It’s mostly from equity and their company, or in another investment.

How are you investing your millions? Do you plan to just hold stock forever and live simply?

Hi Sam –

In terms of real estate, and Fundrise in particular, how are you increasing and building passive income? The Flagship Real Estate Fund has a yield of 0.40%. The Income Fund (mostly debt) has a yield of 7.75%.

I understand you are invested (and have done well) with the Heartland REIT. However, there again the yield is not high.

I like Fundrise and I am very interested in your thoughts concerning the low yields (excluding the income fund).

Best.

Tony

I’ve been investing in private real estate since 2016 and have a very diversified portfolio of funds, Fundrise funds being some of them.

With a combination of distributions and income, this provides for a passive source of income and diversification from my expensive physical real estate holdings.

Eventually, when you invest in private funds, you will receive distributions, which is like passive income in the form of capital gains and your original capital back. If you have a lot of investments, these distributions can come as readily as monthly or quarterly income payments. You just have to spend time building you portfolio.

I’m optimistic because 2022-2023 were two of the toughest years for commercial real estate, given the large and quick increase in mortgage rates. So I’ve been adding to my real estate positions as I think we’re past the bottom.

For reference, I invest for a 10+-year time horizon and try to dollar cost average during corrections. I’ve done this since 1999, and it has worked out well so far. When you have a long time horizon, corrections, our exciting, because they give you an opportunity to buy more.

Good article. I’ve been thinking this way too which is why I regret not going for a more expensive house at the top top of my price range. It’s nuts out there for homes I’ve seen up to about 170% of the median home price.

Great way to think about the benefits of going up the price curve.

Getting into a bidding war is annoying. Too much emotion can override making a rational offer.

I definitely would rather go to lunch at 1pm instead of wait in a long line at 12noon like the masses.

I think there will be people who don’t understand this concept of going up the price curve to get a better deal because the masses are unable to break free from herd thinking.

This is extremely shaky financial advise. Please stop.

It’s same as buy $100k electric car to save money in gas.

Hi Sanjeev, you can just stop reading FS instead. It’s for people who are able to think in derivatives and is not for everybody.

Sanjeevakumar – no disrespect, but out of curiosity, are you a socially awkward techie? I’ve run into a lot of socially awkward people who work in tech at meetups recently and I’m wondering what is it about them. Poor social skills or perhaps on the spectrum.

Assuming you read the entire post, it’s strange you cannot understand the logic of getting to pay a lower price per square foot the higher up the price curve you go.

The buyer is still buying within their means. This is a positive way to look at things.

Please don’t be offended by my questions above. For reference, I’ve purchased three homes over the past 18 years, and I found greater value with each more expensive home on an absolute basis.

Have you purchased an upgrade home before or on at home at all?

Logic of “It’s for people who are able to think in derivatives” or “are you a socially awkward techie?” explains the level of depth you guys can think.

Buy $10 million mansion to be more rich. Sounds like the best advise in today’s fraudulent finfluencer crowd, thanks for making it clear.

I’ve met many people like Sanjeev as well. Very socially awkward with low emotional intelligence.

Many are techies, and many of them come from India, so they don’t understand the social norms in America.

There is a high prevalence of people with Asperger’s in the tech industry. Many are also very lonely given their bad attitudes, so they end up trolling the Internet and leaving these type of prickly comments.

In India, there is a certain arrogance for the educated class, because of the caste system. So they treat other people disrespectfully a lot of times.

They have nobody to blame for their loneliness but themselves.

Boy, that wasn’t too stereotypical. The only things you left out were curry and gold jewelry.

Excellent article

We’ve always believed in buying as much house as one can afford. Stretch as far as possible. Forced savings can be incredibly beneficial. We live in Honolulu and over the decades have been slowly climbing the ladder and moving up in luxury and quality. Final resting place will be a $5M+ home with a beautiful ocean view. We believe in having a wonderful home over other luxuries (fancy cars, designer goods, travel, etc). After all , we spend about 90% of our lives in them (we are WFH). Spending money elsewhere is patently dumb. My personal advice is buy in the most expensive/most desirable neighborhood you can afford. A 70 year old beat up scary house in a fantastic location is worth many times that of a new beautiful home in an undesirable location. Never buy a condo or a townhouse. In our area luxury condos are enticing because they are beautiful and rife with endless fancy amenities but they are horrible investments. Over time they actually depreciate; almost exclusively. Always consider your home purchase an investment first and a “home” second. Homes are investment vehicles that happen to be great places to live if you buy wisely. Buy a home with an unobstructed view (I.e. a view that can’t be blocked in the future with further development). That view may be of the ocean or the mountains or the city lights. But try to get a view home. They will appreciate at a higher rate over decades than a home without a view. Avoid SFH in densely populated walkable areas. These areas will devolve over time and inevitable future zoning changes will allow further increases in density to allow for dense addition of more affordable housing. This will diminish the quality of life in those areas. These are my unconventional opinions that not many will agree with but feel will be beneficial to most.

Yes, maybe you can get better value for money higher in the market as in your examples (though I’m skeptical that applies elsewhere), but you still are spending more money on the purchase and paying more in property tax and maintenance, so the title of the article – “for a more affordable life” isn’t true!

It’s all relative. If you’re buying within your means, you get to save more and get more value as you go up the curve.

Folks have to look at percentages of income and net worth instead of absolute figures. The savings you get from paying a lower price per square foot can be used to pay for lots of other stuff.

I appreciate your feedback and I think a new title is less confusing and more appropriate.

Can you do some research and see if you see a similar occurrence in your city? I bet you will.

I see you changed the title now :) In my city I am pretty sure the price per square metre of house rises as you go up market. Mostly they don’t report square metres – usually the land area is reported for houses. But here are some numbers for sales in the last month in my neighbourhood. Last number is Australian Dollars per square metre:

$1.7m 184 m^2 $9,200

$1.47m 176 m^2 $8,350

$1.152m 173 m^2 $6,660

$975k 120 m^2 $8,125

$725k 117 m^2 $6,200

$541k 85 m^2 $6,365

The bottom three houses are townhouses, the top free standalone houses. The reason the price per square metre rises is because there is more land and better build quality as we go up market.

Got it. But wouldn’t it be better to compare free standalone houses to other free standalone houses of different sizes? If so, will the price per square meter keep going up?

If so, Americans really are fortunate with some of the cheapest housing in the world.

Yes, it would be best to do a regression analysis with lots of characteristics. BTW the most expensive house on my list is USD 600 per square foot.

I take issue with this statement: “The savings you get from paying a lower price per square foot can be used to pay for lots of other stuff.”

Saving $200/SF by purchasing 3000 SF @ $1000/SF ($3M) versus the 2000 SF you actually needed @ 1200/SF ($2.4M) leaves you $600k poorer (before accounting for the higher annual property taxes, insurance, maintenance and such) when going to “pay for lots of other stuff.”

No worries. The assumption is that at the higher price point, you are buying within your means as well, using my 30/30/3 or net worth home buying guide.

So you are saving money within your affordable range by going up the price curve and not competing against the masses.

Assuming there are no price wars, would you change your stance and buy the lower priced house vs. the higher priced house? Even though you can afford either?

That is a personal decision based on your financial situation, family needs, and future.

And my experience, it’s generally been a winning, financial and life strategy to buy the nicest home you can afford. With the word “afford“ being an important point.

Given real estate, like the S&P 500, tons to go up, long-term, you will tend to make more money if you are on a more expensive home. But of course, if you buy at the wrong time or you over a stretch and lose your income source, you could be in a lot of trouble, hence my 3033 rule for homebuying or my primary residence guide.

I live in the South SF Bay which is roughly similar to San Francisco and other expensive neighborhoods south of the City. This article matches our house buying experience perfectly.

We were originally looking for a bit more space once wife and I started to WFH. Stepping up from our $2.2m house to $2.7m kept us in the frenzy zone in our neighborhood/town. After looking for a few months we decided to sell some assets (capital gains) and get into a $4m house.

We had tons of offers (some all-cash) on our $2.2m house in the same neighborhood while no one was submitting offers at the time on houses over $4m. Ultimately we got our new house for $3.7m (originally over-priced at $4.25m – lucky timing for us during middle covid) due to no other bidders.

Similar situation here – we are in SF and since WFH our place has felt quite small when it was perfectly adequate before. One thing I grapple with is the property taxes on a house for $3-4M. It just feels wrong (and a giant budget drain) to pay 4k a month in taxes for something you own outright (and something that isn’t lavish by any means if you’re in the Bay Area). Any advice on how I should think about this?

I feel your concern. It feels like a real waste, especially with government corruption, bureaucracy, and inefficiency.

At least there’s Prop 13. Think about the prices are kids have to pay in 25 years.

My wife and I recently purchased a home in Northern California and were chosen after there were competing offers $5k and $10k greater than ours. After we closed we learned it was due to the real estate love letter that we wrote (following your example) and the fact that we didn’t have a selling contingency and could close in 2 weeks.

Thanks for the great advice! You saved us at least $5k :)

Wonderful to hear! Congrats on your new home. Spending time trying to make a connection through writing can certainly make a difference.

If you would like to return the favor and leave a podcast review on Apple and a book review on Amazon, I appreciate it.

Ah yes the frenzy zone. Great analysis. I remember you writing about that before and totally relating to it. I’ve experienced it firsthand myself. To get around it I held on, stayed patient, kept saving, and eventually bought off peak. I had a higher interest rate than I wanted initially but refinanced to a much better rate when rates came down.