Mass layoffs happen during bear markets and recessions. Let me show you how to protect yourself from a mass layoff if you feel your job is at risk.

One of the most curious things about the stock market is that it's slow to rise and FAST to fall. This phenomenon simply points to the human condition of being cautiously optimistic when times are good. And then people absolutely freak the freak out when times are not!

Scared that your job is at risk? Don't panic. If you pick up a copy of How To Engineer Your Layoff, you will learn how to benefit from a suboptimal situation. Use the code “saveten” at checkout to save $10. My bestselling and one-of-a-kind book will help protect you from a layoff and teach you how to negotiate a severance package and break free with money in your pocket.

Mass Layoffs Hurt Millions

The government forced shutdowns in 2020 due to the coronavirus has led to many a company having a RIF through a mass layoff. RIF stands for reduction in force.

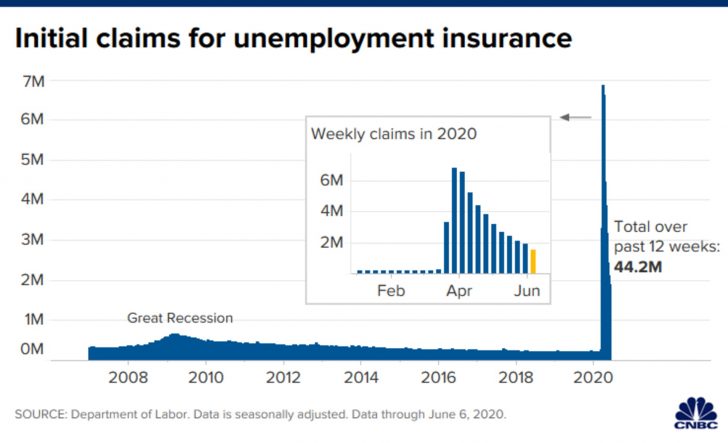

Unemployment levels in the US and around the world skyrocketed. Over 44 million Americans filed for unemployment as a result of the lockdowns. Take a look at the chart below.

Lucky employees have managed to escape a mass layoff, but still fear losing their jobs. Others, have been temporarily furloughed and anxiously await news on if and when they can return to work.

After 11 Fed rate hikes, the economy is finally cooling. There could be another global recession once more. As a result, employees need to be prepared to get laid off again.

Laid Off Versus Furloughed

Getting furloughed is different from getting laid off. When an employee is furloughed, they must take an unpaid leave of absence. The leave of absence may be short-term or long-term. It all depends on the employer and the state of its financial hardship.

However, furloughed employees can typically retain employee sponsored health insurance and retirement benefits. In addition, furloughed employees are eligible to receive unemployment benefits.

In contrast, when an employee is laid off they lose all ties to the employer. They are not able to return to their jobs in the future. They also lose employer sponsored benefits as well. However, some benefits may still be available for a short-term period after their last day of employment.

Employees who are able to negotiate a severance package, leave with the most. They can receive severance money, retain health insurance for a short time, collect unemployment, get paid unused vacation days, get paid deferred compensation, etc.

Managers Overreact On The Way Down

Hiring managers are just as bad as investors. Not only do they tend to over-hire on the way up because it's not their money they're spending, but they also tend to over-fire on the way down because it's not their lives they're hurting.

They selfishly think that the more people they let go, the better their chances are of keeping their own jobs! Stock market corrections of 10-20% are enough to make managers wig out, even if the markets are still up 50% since the day they started.

Is Your Job At Risk?

I was a manager for several years and someone who also awkwardly sat as a lame duck for two months after telling everyone I was leaving. Let me tell you three simple signs that indicate your job may be at risk.

Three Warning Signs A Mass Layoff Could Be Coming

1) You don't get a top review score even though you're doing great.

Even though most employment is at will in the United States, every responsible manager must have some documentation before s/he can lay you off.

If you have top marks in your review, get laid off, and the department doesn't shut down, you have grounds to raise a fuss that you were illegally targeted for reasons other than performance e.g. race, sex, political views, religion, sexual orientation, etc.

2) You're starting to get excluded from e-mail chains you were normally CCed on before.

If your future is at risk, managers don't want you to know about future company plans. Managers tend to avoid you until SURPRISE, you're FIRED! The reason why managers do this is because managers generally dislike ripping the band-aid off in one violent move.

Trying to lay someone off is like breaking up with someone you no longer like. You hope to drop enough hints for the person to leave voluntarily (and save the company from paying a severance).

But if the person just doesn't get the hints, there's no choice but to confront and say your services are no longer required. A manager's reluctance to confront is one of the key strategies to take advantage of according to my book, How To Engineer Your Layoff.

3) You just don't get along with your manager and colleagues.

Poor performance is one thing, but not being able to comfortably grab a beer or a lunch one-on-one with your manager or immediate colleagues is the biggest reason why your job is at risk.

In an optimal world, only the most productive people thrive. But companies are made up of people who show tremendous bias towards people they like, regardless of productivity.

At my old office, my office manager seemed to favor colleagues who donated to his favorite charity. After work, he'd only hang out with people from his same background. If you were different, he avoided eye contact when talking with you. He was a shifty character who finally left recently to join a hedge fund to nobody's surprise.

It's important to realize that during a mass layoff, it becomes a numbers game for survival. You want to blend in with the masses, and stand out as someone who cares and tries harder.

Industries At Risk For Mass Layoffs

In a recession, no job is safe. Even our bloated government had to cut Federal workers during the last downturn. But some industries are more at risk than others. Be on red alert if you work in one of the following industries:

1) Manufacturing

The fabrication, processing, or preparation of products from raw materials and commodities are all under attack because margins are razor thin. This includes all foods, chemicals, textiles, machines, and equipment.

2) Finance

Investment banking, private equity, venture capital, money management, and hedge fund employees are all at risk because a bad stock market usually means investments are going sour, deal flow is drying up, and trading volumes are declining.

While there are plenty of ways to short the markets, it's generally much harder to make money in a down market than an up market.

3) Technology

The tech/internet sector is equally as cyclical as the finance industry.

Creating technology requires massive capital expenditure. As a result, there tends to be years of either massive oversupply or undersupply that wreak havoc on demand, pricing, and profitability.

For example, it costs over a billion dollars and several years to build a semiconductor foundry. By the time the factory is built, the cycle could have already turned. Production of new wafers exacerbates pricing even further.

4) Luxury Goods

Nobody needs a $100 t-shirt, a $2,000 hand bag, or a $50,000 automobile. In a recession, most people make do with what they already have.

5) Housing

Housing goes through the same boom bust cycle as technology due to building oversupply and undersupply. Building a home usually takes at least a year.

Building office buildings can take multiple years. Get caught in the wrong cycle and you'll see many unfinished buildings dotting the skyline as we saw in Bangkok during the Asian Financial Crisis of 1997.

6) Oil & Gas

It goes without saying that with WTI oil at $30/barrel or lower, oil & gas companies will go under because their cost to dig out a barrel of oil is greater than $30/barrel.

Oil producing countries like Canada will suffer. Towns in North Dakota will go under. Houston may be in trouble with 50,000 jobs employed in the space.

7) Restaurant

Why eat out when you can eat ramen noodles and drink free tap water at home? Fast food such as McDonald's might do OK as people subsist off $1 meals like I have, but paying up for food is the easiest expense to cut.

8) Money losing startups

If your startup has no profits, requires $3 in spending to acquire $1 worth of revenue, produces a product that nobody really needs, and only exists due to venture capital money, your startup will be laying people off or going under eventually.

Nobody needs the services of any on demand company. People will just start taking the bus, cleaning their own houses, washing their own clothes, and parking their own cars. It's a good thing that most people joining startups already realize they are underpaid and have equity options that are equivalent to lottery tickets.

Increase Financial Security

The people who are most financially secure have the following:

1) Multiple income streams

You've spent years building up multiple streams to bolster your main day job income stream. Various income streams include P2P lending, dividend income, CD interest income, driving income, teaching income, and online income. In other words, you have financial buffers for your financial buffers.

Those who are the most secure have also built multiple passive income streams. Take a further look at the best passive income streams.

2) Flexible living cost structure

When times are tough, it's important to have the ability to lower expenses according to a decline in income or a heightened sense of risk from your day job. The more you can live below your means, the more you can adapt.

3) A diversified net worth

The majority of your net worth is not invested in things over which you have absolutely no control. Your net worth is diversified and some of your assets can be positively affected by your effort e.g. real estate and a business. See: Recommended Net Worth Allocation By Age

4) An Armageddon Fund

Roughly 10%-20% of your net worth is in CDs and cash. If all goes to hell, you sleep well knowing everything will be OK. Your Armageddon Fund helps you stay the course and not panic sell. Your cash hoard helps you take advantage of opportunities.

5) Self-awareness

The more self-aware you are about your strengths and weaknesses, the more you can take action to minimize your weaknesses and emphasize your strengths.

Because I tend to get emotional about stock investing, years ago I stopped trying to pick stocks for the large majority of my investable assets. Instead, I invested in index funds, ETFs, and real estate.

Further, I realized at work I started not trying as hard anymore, which meant making a change to be fair to all parties.

Develop Job Security

If you want job security from a mass layoff you must do the following:

1) Swallow your pride and kiss your boss's ass

Your boss could be the most terrible micromanager on Earth. That's your problem, not hers! You must figure out what makes your boss happy. Maybe she loves cats.

Make sure you let her know you're considering adopting a cat! Maybe Marissa Mayer and Sheryl Sandberg are her heroes. Make sure you're able to quote a line from Lean In to her while also telling her how mean the mass media has been to Marissa.

Maybe your boss loves the New York Yankees. Make sure you know each year the Yankees won the World Series. Bosses have a very difficult time letting go people they like. Make sure your boss loves you. Is your nose brown enough to get ahead?

2) Make yourself indispensable

If you were let go today, would your colleagues and boss miss you? If not, you're as dispensable as toilet paper! You must take on a project or do a job that only you know how to do well.

If you're the only one who knows how to use the latest inventory management software, how can they fire you? Whenever possible, build relationships with your firm's most important clients.

In addition, if you are buddies with a large client, your manager is less likely to let you go during a mass layoff. They won't want to let you go for fear of losing the client's business.

3) Work longer than everybody else

You don't want to be one of the delusional ones who only works 40 hours a week and complains why s/he can't get ahead. During difficult times, it's all about getting in before all your co-workers and leaving after all your co-workers.

Hopefully you are doing something productive with your time, but even if you are just twiddling your thumbs, the immediate thought from a manager's perspective is that your hard work will be desperately needed when things get really rough.

The people who are out of sight because they work from home will be the first ones to be let go. You must take one for the team and suffer more than everyone else to avoid being cut in a mass layoff.

4) Always look for another job

While you're putting in your time and becoming indispensable, you must also secretly be looking for a new job. I know this sounds disloyal, but when a company is conducting a mass layoff, they are not being loyal to their employees.

Pensions are a rare animal as well, so don't bother trying to hang around for a certain amount of years. During times of crisis, you must look out for number one. Hopefully you've already started your website to brand yourself as a rockstar and create a platform to make extra income.

5) Take people who matter out to lunch

Nobody can resist a free lunch. At the same time, very few people have the wisdom, courage, or generosity to take people who matter out to lunch! When was the last time you treated a colleague or a manager to food and beverage?

People who matter are generally the ones who always take others out to lunch. Therefore, your kind gesture will shock them into liking you. Give, give, give, in order to get.

Managers do not lay off thoughtful people they like during a mass layoff. And if you start volunteering at your manager's favorite charity, you almost become untouchable. Managers fire people who duck out early, gossip all day, and never do what's more than asked.

Preparation Is Key

In 2012, I got laid off from a job I spent 11 of my life doing. Although my layoff was strategic, I'm sure several people were happy to see me go. I no longer kissed my boss's ass.

I spoke up when I thought things were unfair. I'd already spent two years training a subordinate to do my job, who I knew was chomping at the bit to take over. And I was taking 6-7 weeks off a year, which is unheard of in the finance world, even though that's what I was entitled to.

The key to handling any mass layoff well is preparation. You don't need to follow my example and negotiate a 5 year severance package. Although I can't for the life of me think why anybody would prefer quitting with nothing in their pocket.

In anticipation of change, start locking down your finances now. Utilize free wealth management software. And for goodness sake, do things today to make your boss and your colleagues like you if you don't want the freedom of an unemployed person.

Even if you do get laid off, things might not be so bad. There's a plethora of things you can do with your one and only life!

Recommendations

Start Your Own Website, Be Your Own Boss

There's nothing better than starting your own website to own your brand online and earn extra income or freedom income on the side. Why should LinkedIn, FB, and Twitter pop up when someone Google's your name?

With your own website you can connect with potentially millions of people online, sell a product, sell some else's product, make passive income and find a lot of new consulting and FT work opportunities.

Every year since 2012, I've found a new six figure consulting opportunity thanks to employers finding Financial Samurai online. Start your own WordPress website with Bluehost today. You never know where the journey will take you.

Negotiate A Severance Instead Of Quit

The worst thing you can do is simply give your two weeks notice and quit a job you've been at for several years. If you quit, you don't get unemployment benefits, health insurance benefits, or a severance package that can give you a financial runway to rest easy until the next thing.

I've written the book on severance negotiations after negotiating my own 5-year severance package in 2012. I highly recommend getting smart about your rights as an employee!

How To Engineer Your Layoff is the only book that teaches you how to negotiate a severance. In addition, it was recently updated and expanded thanks to tremendous reader feedback and successful case studies.

Updated for 2025 and beyond. It's a bull market, but nothing goes up forever. Always be prepared for change. And protect yourself from a mass layoff at every job you take.

Don’t forget leaving on good terms. I worked for an unusually open minded company that rehired former employees, sometimes more than once. A shame that more companies aren’t like that.

Very interesting article with a lot of good points. I’ve always been fascinated by people that never put any effort into building relationships with their bosses and co-workers and then act shocked when their career doesn’t advance. It’s one thing to be good at what you do and quite another if nobody likes you.

I also agree that it’s good to be prepared at all times and I definitely have work to do in that area. Working as an IT professional for a tech company, it always seems like there’s risk present. My previous employer had yearly layoffs for at least three years running before I made my exit. Thought it would be better to make the move of my own initiative. Too bad I hadn’t heard about your book at that time, but I did get a 40% increase by leaving.

Howdy mate, can you elaborate on your 40% increase? In what? Thx

Apologies. A 40% increase in salary. I was able to negotiate a better position with the new company.

I have multiple streams of revenue and have lived through some dark times – but I will tell you – the sky is falling mentality benefits only a few. We need to analyze the reasoning behind the Royal Bank of Scotland’s call to sell everything and the alarm sounding for the economic death spiral in the New Yorker. When the general population panics and sells the kitchen sink the wealthiest swoop in for bargain basements prices. I wonder when we will all take note that value has everything to do w. confidence. Thanks for the article I enjoyed it.

You need a second job until you can survive off passive income and also try to deleverage. Sell your car, cut your cable…etc etc.

I learned my lesson after 2008…

I got laid off from Intel due to a bad coworker. I tried to escape him three times, but each time he became the tech lead of the new project after I had switched (he was trying to get promoted – would blame everyone else when things went wrong and took credit for the team’s work). When I finally was on a new project with a new lead (completed a team quarterly objective on my own, was helping across the team and well integrated), the damage had been done. I’ve always done the work of 2-3 others, but unless you’re a minority in the tech industry – you can always be replaced. Intel’s new “diversity” policy is just a bait and switch to distract from firing experienced workers to hire H1B’s and recent college grads. It’s more than just cyclical – some tech companies intentionally “renew” their workforce.

Network outside of your company and always be looking around at what’s available. It helps to keep your skills current and even if you think you’re doing great – someone else can be a better buddy with your boss.

“But companies are made up of people who show tremendous bias towards people they like, regardless of productivity.” Wow. Truer words cannot have been said. I think the same can be said for promotions and hiring. Managers promote on who they like, not who is most productive. Once you get a job interview, whether or not you get the job is really is based on how “likable” they find you. IQ probably gets you in the door, but EQ gets you the job and the promotions. I would also add that your reputation is also one of the most important things to maintain. Once you’ve been labeled a “jerk,” hard to escape that label.

This was a great article with really great tips, especially the Developing Job Security section. Number 1 is the hardest for me since I’ve always believed in meritocracy, but reality has hit too many times for me to ignore the benefits of brown-nosing. Although many people think number 3 (staying longer at work) is an anachronism in this day and age of telecommuting, I happen to be a firm believer in this. You can’t discount the power of perception. Stay late = work hard. Keep up the great work!

Sam, would you book work during a mass layoff as well?

My book is well geared towards helping employees during times of mass layoff and getting ahead of the curve.

Great tips and advice. It of course rather timely as usual with the market hiccups, the price of oil dropping, and the fed beginning to raise rates. Who knows when housing will begin to be effected?

I like your broad approach to prepare for these events like mass layoffs. For us, the multiple streams of income and a diversified retirement fund (70% index/30% bonds) allows me to sleep at night.

The only challenge is making the jump to leave our employers this year while the market is doing its thing. It will be years before we draw on our index funds, however it is appealing to sock some more money away and continue to work.

The thing that is constant is change, and I think this is become the case at an accelerated rate each passing year. Best to accept that reality and always be vigilant and proactive to both protecting oneself and making strategic moves. These are really good tips that may not be what are taught in B-school, but are the way things really are.

With the new office hires, I’ve been getting the distinct feeling my layoff is coming and one of them will be my replacement. I figure I’ve two more years before they drop the axe but I could be overconfident and they may pull the plug sooner. I need 59 months to stabilise myself to my accepted level.

I really wish I’d gotten a wake up call (in 2010 preferably) before the new hires rocked up last year (2015) but I was suffering from severe imposter syndrome until late 2013 and it was only after a bad (non-deserved imho) review that I woke up. Well, no use crying over spilt milk now. It is what it is.

Building up varies income streams are the best advice. Something you can control. Layoffs are the new normal nowadays. From experiences, honestly I don’t want to be the last batch of employees to be on the chopping block. They get the worst severance package, deal with low morals, need to take on all the works from the people who got let go etc….They usually burnout within a year and look for a new job.

Agreed. If there is word of impending layoffs, you want to get laid off in the FIRST round, not the LAST round. The first people to go get the best severance packages. They also have more time to find a new job before the markets gets even more flooded with employees.

I always believe I have to pay and work my own way. One day I heard a friend said employers should pay their employees first before paying themselves. I thought this was odd, that was dumb. I later learned that his dad worked at GM plant, unionized. So to have a secure job, join a Union!

Great post Sam! You really do need to build your own safety net. My decision to get into dividend investing eight years ago was one of the best decisions I ever made. My dividend income isn’t enough to cover all my expenses, but it’s more than enough to cover bills or it could be applied to covering a good chunk of my monthly mortgage payment. In short, I have *options* with a passive secondary income.

Even if you do have job security (there’s no such thing, but let’s just say that it does), there’s also the problem of wage stagnation. If you’re lucky and get a regular 3% raise every year, you’re actually only getting about 1% when you factor in an inflation rate of 2%. Having additional sources of income not only provides a safety net in case you’re suddenly unemployed, but it also helps you overcome feeble wage growth as well.

One should accept to work for someone for only these reasons:

Learn a transferable skill.

Getting ” temporary “a minimum wage to cover expanses

Learn to sell.

After that taking the risks to build a business or at least working at sells depends on the character and the preparations of the person.

If the person is not meant to do business it’s better for him to follow strictly your advices to minimize risks of being fired.

Your advices are pertinent as always!

Jobs are fine as a means to an end. But true financial security only occurs when you create something that you are in control over. Whether that be a business, rental income, large stock portfolio, etc. I never felt safe during my working career. I never got laid off or fired but it was always a possibility in my mind. And management has no qualms at all about treating its employees very poorly from time to time. There is a ton of hypocrisy (do as I say, not as I do).

Just not for me. I am the boss now and my job security is 100%.

Its also never too late to put a plug in for investing in yourself through education. There are a multitude of sources to keep learning whether through resources like coursera or enrolling in your local college and take one class a semester. A lot of them now offer a lot of flexibility for distance learners or employed professionals. Education is something that will always stay with you.

My entire department is the small local office of a foreign company that has mostly forgotten about us for now. I genuinely expect to find the lights off and doors locked when I show up each morning. My individual performance is pretty irrelevant in such a binary situation, so I don’t bother with all the politics. I’ve seen colleagues expend a huge amount of effort on this and only get crappy tasks, static pay, and disappointment for their trouble. They’re being used, and I feel bad for them.

I’m enjoying a good salary and low hours for now, but effort spent on new income streams and investigating the job market is definitely time well spent. Winter is coming.

Definitely feeling the possibilities here in Houston. Always good to be able to sleep sound at night knowing your dividends, rental properties, and digital revenue streams will keep chugging along regardless of your day job.

I agree with your premise that there are many reasons to expect financial headwinds for the next 18-24 months. I was more bearish than many in one of your recent surveys.

I think your best advice above is to become indispensable. If you are worth as much or more as a free agent, your company will not show you the door until they are turning out the lights. Moreover, if you are a great free agent you will always have someone else who wants you and you will have many opportunities offered to you that you never even considered. I remember clearly when other attorneys I had viewed as more accomplished than me first started asking me out for lunch, dinner or drinks to pitch their firms to me in an attempt to have me leave the firm I’ve been at nearly 20 years now. It was startling and unreal to me at first, since I saw nothing particularly different about me other than more grey hair and higher billable rates, and honestly still failed to view myself as an equal. I don’t think my experience was unique when I say I was one of the last people to realize I had “made it.”

The fact is that whatever market you are in, that market will recognize and respect hard work and a singular focus on the highest possible standards. And if you are wiling get up a little early and work a little late you are frankly already doing much more than most people are willing to do.

I would also tell the folks in their 20s that you may absolutely end up in the last job you have sooner than you think. A lot changes in life very quickly, including priorities. And you may actually like your job and want to stick around to build something meaningful if you pick the right job at the right place. The internet’s current infatuation with retiring early only to hustle around digging up multiple side gigs for years on end is curious to me. My practice involves being around many very wealthy people. If I have learned anything from them, I would say that most of us will make more money picking one thing and focusing so sharply on it that few do it as well, and none do it better.

Great post David, it mirrors my perspectives almost exactly based on nearly 30 years of high level professional and executive experience. I think most people who “make it” will engage in a run of excellence based on one area of superior performance and be recognized for it in terms of relationships, networks, advancement, compensation and wealth building opportunity.

David,

Your post resonates w me. I’ve been w the same Hi Tech Co for 3 decades. I guess I look at it year to year… the years just go fast! :)

20 years at one firm is impressive. I do believe you can make plenty of money staying with one firm, getting promoted, and getting the retirement matches/profit sharing. Do you ever get bored or wished you did something else though?

After 10 years in finance, I started getting bored doing the same old thing just about the time I discovered online media. 13 years finance, 7 years online media, with at least thee more years of interest in online media until maybe I might try something new.

At some point, it stops being about the money, and more about exploring new things.

I think it stops being about the money when you have accumulated sufficient wealth and are well-adjusted enough to recognize it. Both are difficult, I’d say the latter more than the former.

One of the most delightful things about you and your blog, beyond your truly gifted writing, is that you have accumulated wealth through your own effort, recognize that you have, and have zero interest in apologizing for it–particularly to all the people unwilling to exert the effort you exerted (read: most people). This speaks to a specific type of person at all different stages of that person’s life. Thus you have people enjoying your blog in their 20s just starting out as well as me, soon to be 48, with (let’s hope) the majority of my financial mistakes well in the rearview mirror. And so I hope you stick with the blog because I know you have interesting life choices that are still in front of you to make regarding family and children that, if you make them, will definitely change what you mean when talk about exploring new things. And I firmly believe will change what you think of side hustles. And I’d love to read about the journey.

As for your question about boredom or wanderlust, it’s a great question which, if to be answered honestly, would require a nuanced answer going several hundred words. If I were to boil it down though I would say that if I can assume my personal experience is somewhat universal, it’s not hard to get old but it is hard to grow up. If burnout counts as some part of boredom or wanderlust then yes, especially at the early stages of my career (about 3 years in), I suffered from it significantly. Before going to law school I had spent 2+ years living on the beach with buddies, surfing, playing music and waiting tables. 3 years after law school I had a live-in girlfriend, student loans, and a job that really shocked me at the level of stress it induced. It took time but rather than change my circumstances–which after all did not involve skipping meals or working in a coal mine–I changed how I felt about my circumstances.

Today burnout is still a real problem, for the legal profession in general and certainly for me. I’m fortunate now to have reached a place (1) in my practice where the more distasteful parts are done by others (cataloging and analyzing discovery responses, for instance), (2) in my finances where vacations and other non-work activities can help me appreciate what the work brings with it, and (3) in my personal life where cute kids and a smart, pretty wife keep me constantly engaged and aware of what this world is really about. Burnout so far has been no lingering match for these three things.

I’m in the airline industry which is very cyclical, but there are huge orders for planes which take years to build. There could be a slowdown and cancelled contracts, but I think it should be fine for at least a year.

How can a blog, which I frequent often, that is centered around financial freedom and the pursuit of F-you money be so spineless with regards to …kissing your bosses ass.

Kissing a bosses ass only allows you to do shitty tasks that no one wants. When your colleagues discover ( too many times the kiss ass is the biggest sh*t talker of management) that your the kiss ass they begin to use your one-sided relationship against you.

If this same person (kiss ass) is to aspire to have F-YOU money then their actions should mirror their mindset. Can’t expect someone who’s feet are hanging out of the bosses ass to utilize the f-you mantra. IT HAS TO BE HABITUAL.

Sidenote: Sam, I enjoy reading your blog daily, If that wasn’t the number 1 idea, then I probably wouldn’t of posted anything.

I highly do not recommend having an FU attitude at work before you have FU money. You can try at your own peril, but based on my experience the difficult people were always first to go. I’ve been through and survived over 30 rounds of layoffs, and the consistent denominator among those who got let go were attitude problems.

Note: the gist of my FU post highlights how it is actually still difficult to say FU to others once you have financial freedom.

I’ve been in the Actuarial field for a while now, and I’ve never seen anyone get laid off (although I have seen people get fired). I think it ultimately comes down to how important your role is at your company. The indispensable employees will always be the last ones on the chopping block.

In the insurance industry, there are undertones among the staff as to who runs the show. Everyone tends to know everyone else’s worth, and even a new hire could pick out the weak links by the end of his first week.

If people refer to you as the ‘smartest guy in the room’ when you’re not around, you could wear t-shirts to work and not get fired. But there are only a few of these people at any given company, and I wouldn’t risk my butt trying to figure out if I were one of them.

I don’t kiss my boss’ ass per se, but I do show a genuine interest in his life. I’ve found that asking to see pictures of his hobbies engenders an overwhelmingly positive response. For example, if your boss is into fixing up antique cars, ask to see some of his work. Even if he is the busiest guy in the world, he will race to his phone to show you.

Other tips based on my own experiences:

1. Not bringing personal problems into work

2. Only show neutral or positive emotions; don’t ever get upset

3. Never turn down a date: lunch, beer, etc.

4. Ask questions and then follow up. If your boss tells you he is going to a KISS concert on Friday, you better show up Monday morning asking to see some pictures.

5. Be a nice guy

6. Don’t be lazy

7. Make your boss feel smart with phrases like “Thanks again for that tip. I would have never figured out the problem without it”

-ERA

From a company profitability stand point – won’t the brown-nosers potentially cause problems down the line?

A company that decides to only keep the “yes” men is going to have a rough time making the tough decisions, especially when it needs those dissenting voices the most in a down turn.

Taking the kiss ass strategy might mean backing the sinking ship. Agree that not being an asshole is generally a good idea though.

I got lucky to get into health care in late 2014. My company has had record revenue each year except in 2008 where there was a slight dip. Profitability each year has also been a record except in 2008 as well, with typical profitability growth greater than 10% per year. So I’m actually getting a solid raise this year. However you are right in you post as even though the business risk is low, there exists political risk. There will be a new corporate CEO coming in late this year and since I report into that position if there is a poor chemistry fit with the new hire that is a big career risk for me. Will have to wait and see and keep delivering value. I’m not big on puckering up but I do try to find something to respect and admire in everyone I work with because otherwise I am just unable to fake it.

-Mike

A new CEO is the riskiest new hire. S/he has the power to hire and fire cart blanche. Work that relationship with care! Good luck!

Yup, the firm I left last year got a new CEO a few months after I left and has done a lot of layoffs of the “old guard” in the last 3 months. I expect more to follow.

I think many people think they are performing well, but are really not. They take feedback in a defensive manner and also believe they are so efficient that 40 hours each week is allready enough. I try to communicate more often so they know where they stand. I also make sure to mention often when people do not get in earlier or stay later than me (especially when I am their bosses boss).

I don’t always agree with your posts, but I definitely think people need to listen to your advice on adapting to your boss. It’s not butt kissing to make changes that can make both of your lives easier (I wish I knew that 15 years ago!).

I’m curious to know what posts you disagree with!

Honestly, I work under the assumption that my job is ALWAYS at risk. As a result, the effort and quality work I do, even when things are looking good, has spared me from a few rounds of layoffs (even over more senior employees) when managers overreact to profits dipping.

Like you said, managers overreact to both good and bad times. The best thing you can do is control what you can (which is effort and quality of work) and have a plan intact for a worst case scenario.

This comment was hypocritically posted from my work desk while on the clock.

Assuming you are always at risk is a good mode to be in. You won’t take your job as for granted, and will constantly be pushing yourself to add value.

The busiest times for FS is during the workdays! Once the weekend hits, folks don’t read as much. Gotta love it.

Interesting, I’m catching up on my favorite financial blogs every single day of the week including weekends!

This was really informative article. I agree with everything on what you said under ‘Is your job at risk?’ I work in a small publicly traded company and I see these things happening to others all the time.

BeSmartRich