Early retirement sounds great and it is great for the most part. But there are negatives of early retirement life that also needs to be discussed. I retired early in 2012, at the age of 34 after a 13-year career in banking. But the years that followed felt unnatural, so I decided to keep busy doing some part-time consulting from 2013-2015 and write on Financial Samurai.

Since leaving my day job in 2012, I've redefined what early retirement means to me. As a result, I now call myself a “fake retiree.” I say “fake” because I'm still writing on Financial Samurai three times a week. I'm also recording a podcast twice a month. Even though these activities are enjoyable and intellectually stimulating, they require about 15-20 years of work a week. OK, maybe I should say semi-retired instead.

Over the past 12+ years, I ended up actively doing a lot of things that provided meaning and purpose, including writing Buy This Not That, an instant WSJ bestseller. And such things ended up making me money, hence my fake retirement.

The Desire To Really Retire Again

Today, however, I want to re-retire because I’m exhausted! I've been a stay-at-home father of two young children since 2017 and the job has wiped me out. Fatherhood during a pandemic was at least 50% harder than even the hardest years I had in banking.

With the economy also slowing, grinding harder if you don't need to grind harder is a suboptimal choice. There's a futility of working hard when your net worth is slowing down or even declining. In addition, the higher your net worth, the lower your Return on Effort for making money. Often times, your investment returns for surpass any income you could generate.

You won't really know what early retirement life feels like until you actually walk away from a steady paycheck. This also means not depending on working spouse either. It's easy to pontificate what you should and shouldn't do in retirement. Further, you can assume a high safe withdrawal rate when you are gainfully employed.

However, I promise you your expectations about retirement and the reality once you are in retirement will be different. Don't be fooled by early retirees who only crow how amazing early retirement life is. Be wary instead. The Instagram life is not reality.

For all the positives of living an early retirement lifestyle, there are plenty of negatives as well. I know why we revert back to our baseline state of happiness, no matter how much freedom and money you have.

Negatives Of Early Retirement Nobody Likes Talking About

Now that I'm a grizzled early retirement veteran, and one of the pioneers of the FIRE movement since 2009, here are the six main negatives of early retirement few people like talking about.

1) You will suffer an identity crisis for an unknown period of time after you retire.

When you’ve spent at least a decade working in a profession, you’ll find it incredibly jolting to no longer be identified as the person who is a marketing expert, an investment professional, or the management consultant who can figure out how to optimize a business. It’s only after you leave your job do you truly realize how wound up you were in your profession.

Your identity crisis may last as short as three months or it might last for years. It all depends on how wrapped up you were in your job and what you plan to do next. It also depends on long you spent getting educated after high school and whether you have a clear plan post-retirement.

Doctors are some of the people who suffer the most identity crises after leaving their occupations. Conversely, high school graduates who somehow struck it rich with a product or an invention seem to adjust much easier in post-retirement life.

Job titles can be incredibly addictive. Why else do people get so depressed when passed over for promotion? Why else do people try so hard to get promoted sooner and faster than everybody else? Do not underestimate the importance of being a manager, director, vice president, or even a C-level executive.

After all, the most common question people ask when they first meet each other is: What do you do for a living? And if you tell them you don’t do anything for a living, well then you might just feel like a sheepish loser. You’ll want to try to explain yourself, but by then, your three-second first impression will no longer hold the other person’s attention.

Negatives Of Early Retirement #1: What happened to me

After working in the Asian equities business for 13 years, it felt hollow to no longer have my Executive Director title or be identified with my investment firm. I felt sad that I could no longer go to Asia for conferences or travel with clients. For so long, taking a business class trip to Hong Kong, India, China or Taiwan was part of my quarterly routine. Shallow as it may sound, it felt special to have priority boarding. I felt important when clients would entrust me to show them around in a foreign land.

For the first year after leaving my job, I wondered how the business was doing without me. Could they really survive without my expertise? After all, I was there for 11 years. Surely, they needed my relationships. But after months went by with no email or phone call from my old firm saying they wanted me back, I had to come to terms that I was no longer important to them.

I wanted to believe that my position meant something to the firm and to the people that I serviced. But at the end of the day, the person I trained to replace me as part of my severance agreement, was good enough. And because he was good enough, I concluded that I was no longer any good.

This ego hit took me a full year to get over.

2) You will be stuck in your head after retiring early.

When you suddenly have an extra 10 – 14 hours a day of free time, it can be very difficult to optimize your time wisely. Just like how bedrooms naturally get messy, your mind naturally gets lazy the more time you have to do anything.

Your productivity will suffer in retirement. You will no longer feel motivated to achieve great wins. As a result, you may slowly start to get depressed. Only after some really deep soul-searching and some, what the hell am I doing with my life questioning will you begin to organize your time better and become more productive.

Your mind can be very dangerous because it can always second-guess your actions. Did I retire too soon? What if I run out of money? Will people think I'm a loser? What if I can't ever get back into the workforce if things go wrong? When you have a lot of time to think, your doubts go on and on.

Perhaps one analogy is to compare being stuck in your head with Locked-in syndrome. LIS is a condition in which a patient is aware but cannot move or communicate verbally due to complete paralysis of nearly all voluntary muscles in the body except for vertical eye movements and blinking. This could be one of my worst nightmares. Retiring early may render you inoperable for a while.

Negatives Of Early Retirement #2: What happened to me

Because I left work at the age of 34, I was worried for about the first two years whether or not I had made the right choice. No rational person leaves a well-paying job to be unemployed in their mid-30s. Your late-30s is when you start to finally make good money. And by the time you reach your 40s, you should be at your maximum earnings power.

During my first year of early retirement, to the outside world I proudly proclaimed I was retired from a career in finance. But on the inside, I was second-guessing my decision to leave. Because of my uncertainty, I decided to do some part-time consulting with a financial technology startup for ~20 hours a week. It was a great way to distract my mind from all my fears.

I also earned some side income and got to replug myself into society. I also kept in touch with multiple banks until my Series 7 and 63 licenses expired.

Finally, I dived deep into my writing on Financial Samurai. Writing has always been my most cathartic way to deal with any uncertainty or problems I might have. For example, now that I have a son and daughter, I've been worried about whether our passive income is enough to support a family of four if they don’t win the SF public school lottery system. It's taken almost 20 years for me to generate this passive income level, and it still doesn't seem like enough.

Given this worry, I did a deep dive budget analysis for a family earning $300,000 a year. It it sure seems like we need to earn $100,000 more to maintain our lifestyle in San Francisco. Alternatively, we can always move to a lower cost area of the country.

3) People will treat you like a weird misfit as an early retiree.

Whether it's because retiring early is unconventional or because people are secretly jealous you aren't grinding away at a day job, people won't give you the same amount of respect as working class citizens. After all, if they can't describe what you do for a living, then they can't pigeonhole you into an archetype that is comfortable for them.

Having a job means you are a productive member of society. If you retire at a young age, people will assume you are simply slacking off and not paying any taxes. They'll sometimes look at you as a leech they want to flick off.

Further, if you are an outcast, then you won't be invited to parties or events that other working people always get to attend pre-pandemic. You're simply not top of mind to them and you will feel more lonely as a result. If you are an extrovert, early retirement will be much more difficult than if you are an introvert.

Negatives Of Early Retirement #3: What happened to me

After the first year of early retirement, I no longer told anybody I retired early. Instead, I told anybody who asked that I was a writer, a tennis teacher, or a fintech consultant. Prior to that, I think a lot of people just assumed I was a trust fund baby who did not have to work. And the last thing this middle-class guy who went to public school wants to be known as is a trust fund baby.

My favorite time of the year was during the winter holidays. I loved going to all the holiday parties and getting tipsy with fellow revelers. Now, I get invited to zero holiday parties because I don't work for anyone. Nor do I get invited to client holiday parties either.

Even though I have several partners who are based in the SF Bay Area. It may sound silly, but having a drink with good people with shared interests really means a lot to me.

It takes a lot of effort to build new social networks if you aren't part of a larger organization. There is no weekend BBQ party a colleague is hosting on Labor Day Weekend to attend. I've had to participate in various meet-up events in order to find new people to hang out with.

So far, my social network only revolves around tennis and softball. But even then, it's not like I've found buddies who will come over and just chill in the hot tub over a beer or anything.

I know. Cry me a river. but those parties to be merry with others were amazing! Maybe more people will empathize with the need for more social connections thanks to the pandemic.

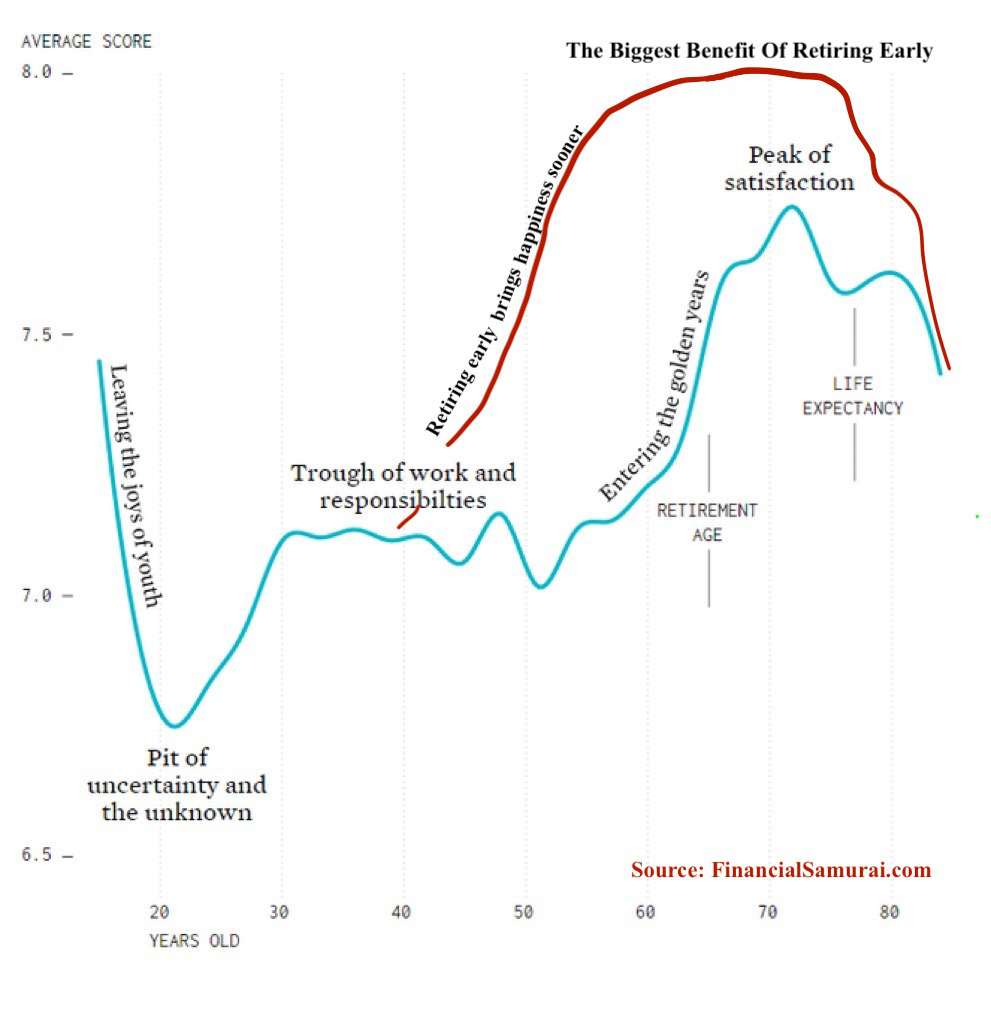

4) You'll be disappointed you aren't much happier after you retire.

So many people think that once they achieve financial freedom or leave a job they dislike, they'll suddenly be permanently happier. The truth of the matter is, your elevated happiness will only last at most three to six months. Eventually, you'll revert to your natural state of being.

Think back to your high school or college days when you didn't have any money compared to now. I'd venture to guess you were just as happy, if not happier when you were a broke college student. I felt rich even though I was poor.

Having the freedom to do what you want is priceless. But you will eventually take your freedom for granted like the air you breathe. On the days you feel angry or sad, you will start questioning what the hell is wrong with you since you've got more than the average person. You might even feel stupid for feeling unhappy when there are literally hundreds of millions of people in the world wondering whether they'll have enough to eat the next day.

You think, if I can't be happy when I'm financially independent, surely there must be something seriously wrong with me. And you could be right! Can you imagine being unhappy as a Norwegian? Norway is perpetually ranked as one of the top five happiest countries in the world.

What happens after grinding so hard for so long is that once the grind is done, you may experience a trough of sorrow. You sometimes feel this emptiness inside where you long for more. It’s a baffling feeling!

Negatives Of Early Retirement #4: What happened to me

I thought I'd be much happier not having to report to a micromanager boss I did not respect. But my increased happiness was fleeting. It only lasted for about a week before I was back to my regular self. Instead, my happiness was weighed down by months of uncertainty on whether I had made the right move to leave my job. It was only after about two years did my doubt finally start to dissipate.

Although corporate politics no longer piss me off, other things end up filling the void. For example, drivers who decide to double park on a busy street in rush hour traffic really piss me off now. So do dog owners who let their dogs poop in front of my house and don't pick up after them. In the past, I could only allocate a small amount of annoyance to such incidences.

I also thought I'd be happier once Buy This, Not That made the Wall Street Journal bestseller list. After all, less than 0.5% of nonfiction authors make the list. Alas, the happiness only lasted for about five days. Without anything else to look forward to, an emptiness developed inside.

Despite not being permanently happier after publishing, I'm still proud Buy This, Not That will help readers develop more wealth and make more optimal decisions. I've also decided to write at least another book with Portfolio Penguin as well.

Instead of being permanently at a happier level, I'm simply no longer as annoyed at things as frequently. Further, the volatility around my steady state of happiness is lower. In other words, I’ve mellowed out. That said, don’t offend me because I still enjoy a really good fight!

Related: If I Could Retire All Over Again, These Are The Things I'd Do Differently

5) You constantly wonder whether this is all there is to life.

Retiring early is like finishing up your favorite longstanding TV show. You’re glad there’s a conclusion, but you’re also sad that it’s over. You hope to find a show that’s as good or better, but there are no guarantees.

Most of us spend 13 years going to grade school so we can spend four years in college in order to get a decent job. Then we spend decades trying to earn and save money in order to provide for our family. We make sacrifices to achieve financial independence sooner. Then one day we hope to retire by 65. With good luck, we'll live for another 20 years to enjoy all the fruits of our labor.

When you retire at a much earlier age, you are constantly left wondering what's next. A potentially 50-year retirement is a very long time! You are mentally twiddling your thumbs waiting for the next big thing while your close friends are all at work. Early retirement can get extremely mundane and boring because you have nobody to spend time with.

As a result, you're repeatedly forced to will yourself into action. This constant self-starting attitude can become extremely trying. It may get to the point where you long to rejoin the workforce and be told what to do.

Negatives Of Early Retirement #5: What happened to me

I probably drove my wife nuts during the first two years of early retirement. I constantly told her I was bored. Only boring people get bored right? Wrong. Everybody gets bored at some point.

When you're working, you don't have time to get bored because you're working. There's only so much tennis, golf, and softball I can play before my knees break apart. There are only so many churches to visit in Europe before they all start looking the same. In fact, I decided to apply to some AI-related jobs after retiring for so many years. So far, no luck getting a job!

She used to have vacations from me because I would be away traveling for work every month. Now she was seeing my cherubic face every single day! It's a good thing we had three bedrooms at the time. Otherwise, I'm pretty sure we'd both have gone crazy from seeing each other so often.

Kids gave me a lot more purpose

It was only after our son was born in early 2017 that I felt a renewed sense of purpose. Before my boy, I felt my purpose was to help educate as many readers as possible about personal finance.

After my boy was born, my purpose has expanded to keeping Financial Samurai running long enough to teach him about operating an online business. I fear he may have a tough time getting ahead. In addition, I now need to live long enough until both my kids find someone who loves them as much as I love my wife.

I don't think I'd be able to die in peace if there's nobody to replace his mom or me. As a result, I'm exercising more, eating healthier, and meditating longer. My wife and I also locked down matching 20-year term life insurance policies during the pandemic through Policygenius. Once we did, we felt a huge sign of relief our then 2 and 5 year-olds would be protected until adulthood as we focus on paying off our remaining mortgage debt.

More expenses to cover

But with kids also comes a lot more responsibility and expenses. The cost of college today is outrageous. Sadly, it will only be more outrageous in the future. As a result, I do have this urge to return to work to make money to pay for college once my daughter attends school full time.

It's interesting, but now that I've fulfilled my roll as a stay-at-home dad to both children for the first five years of their lives, I now am experiencing a parental existential crisis. I need to find new purpose to fill the extra 20 hours a week of time I have. This feeling I have tells me that those of us who retire early may constantly be looking for purpose and meaning. If we don't find it, we can get depressed.

6) Your relationship with your significant other might suffer.

As more people retire, I'm noticing an increase in breakups and divorces post retirement because there is a mismatch in retirement philosophies. The most obvious one is where one spouse retires first and the other spouse keeps working for years.

Resentment naturally builds up by the working spouse who doesn't absolutely love his or her job. And nobody loves their job so much that they'd rather work than be free to do whatever.

There is also an interesting anthropological trend where the man retires early and the wife still works. Instead of the man saying he is a stay at home dad taking care of his children, mostly due to ego, he tells everyone he retired early.

Meanwhile, he is frantically behind the scenes trying to make supplemental retirement income. Sadly, they don't truly have enough money for both to comfortably retire. We men have fragile egos.

To minimize relationship problems, it's important to have the same philosophies. It's also important for couples to have enough passive income to cover the couple's desired living expenses. It would be a shame to let money get in the way of a happy retirement!

Negatives Of Early Retirement #6: What happened to me

When I retired in 2012 at age 34, my wife and I made an agreement when she was 32 that she could retire early before she turned 35 in 2015 as well. We shot for equality. With almost a three year deadline, we created some cash flow and financial goals.

When she finally retired, it was great b/c financial and career objectives were met, and she also negotiated a severance package much better than expected. We traveled together a bunch and it was nice.

However, I did have some resentment for the first couple of years because she was able to sleep in while I couldn’t after 13 years of getting up at 5 am. In other words, I was jealous she was enjoying her initial years of retirement so much! During my first year of early retirement I was always wondering: hmmm did I do the right thing leaving my job so young.

To solve this jealousy and resentment, we agreed that she would spend more time working on the back end work for Financial Samurai. Once we had our son in 2017, there was no more jealous and resentment at all. Being a full-time mom is the hardest job in the world! Now that we have a 3-year-old daughter, I'm super grateful for any support she can provide with FS.

In 2024, I also had a psychological breakthrough that has helped improve our relationship. In 2022, at age 45, I started decumulating wealth. It hasn't been easy. But I realized that one of the best ways to decumulate wealth is to give the gift of freedom to your spouse or partner! Once I realized this, it made me focus on the positives of my wife not having to work a day job anymore.

7) You will feel more stressed in a bear market.

One of the best times to retire is in a bear market. If you can, your finances will have been properly battle tested. Your downside is limited. When a bull market ultimately returns, everything will feel like gravy as both your net worth and passive investment income increase once more.

However, the downside of retiring in a bear market is the increased stress you will likely feel. Because when things are going bad it's easy to extrapolate how bad things will continue to get. As a result, your worry will naturally go up even though the average bear market only lasts around 14 months.

Negatives Of Early Retirement #7: What happened to me

Until 2022, I had not experienced a prolonged bear market since I first left work in 2012. Sure, risk assets turned down slightly in 2018, but the downturn wasn't very deep nor did it last very long. The March 2020 crash was scary, but the stock market rebounded within two months. Real estate, my favorite asset class to build wealth took off.

2022 was a year of endless down days. With the Fed aggressively raising rates, they seem determined to ruin the world. Most of my tech stocks that performed so well in 2021 gave up all their gains and then some. Facebook, Amazon, Google, Netflix have all been crushed. Then there is the cryptocurrency debacle with FTX.

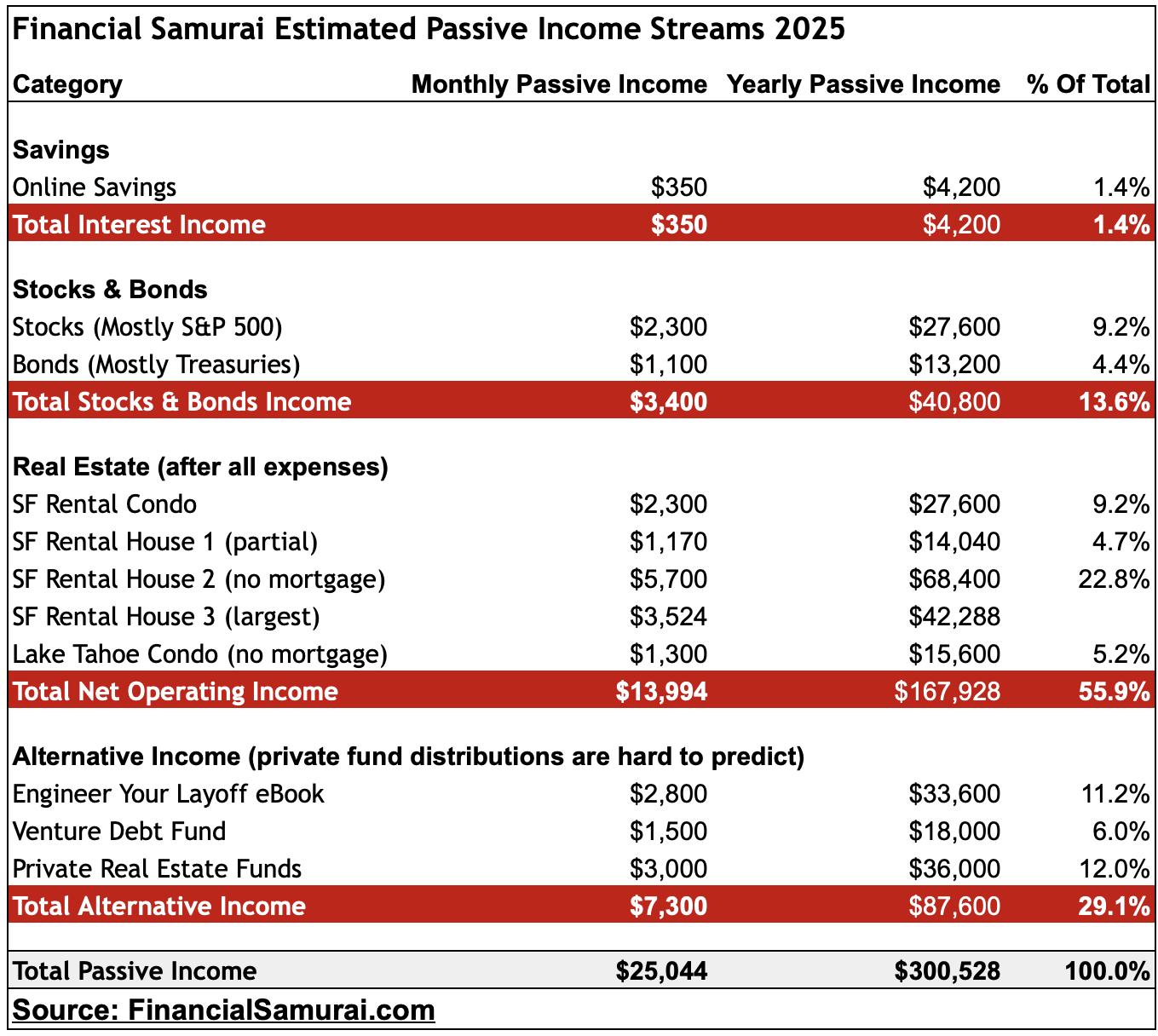

When you depend more on your investment portfolio to survive, as we do, you will be more concerned about the state of the world. But one of the biggest ironies of a bear market due to high inflation is that it's actually easier to generate more passive income!

Thanks to rising rates, I've actually been able to boost our overall passive income by ~10%. Therefore, I should feel even more secure in early retirement because cash flow is more important than net worth. Cash flow is real, whereas net worth is more subjective. Below is my latest passive income estimates for 2023.

However, buying a forever home in 2023, I blew up my passive income. Losing $150,000 worth of passive income, or roughly seven years of progress hurts! But ironically, how I feel more motivated to manage our finances and earn again, which feels great. A little more than a year later, I've recovered about $70,000 of the passive income because I rented out my house and saved and invested more.

Early Retirement Is Great, But It Doesn't Solve Everything

It might sound like after reading this article that I’m depressed. But I’m not. There are some nice surprising benefits of retiring early as well.

I’m simply highlighting some of the negatives of early retirement you will probably go through if you decide to leave the workforce early. The more extroverted you are and the higher your position, the more you will have difficulties making the early retirement adjustment.

Having the freedom to do what you want cannot be overstated. However, your mind will play games with your spirit during the first few years after leaving work. Some of you won't be able to handle early retirement life and will go back to work.

Just know that with enough conditioning, you will eventually embrace your freedom. Nobody I know who retired from corporate life early has stayed retired. You will find your purpose. Once you do, you will take steps, such as building passive income, to ensure you remain free forever.

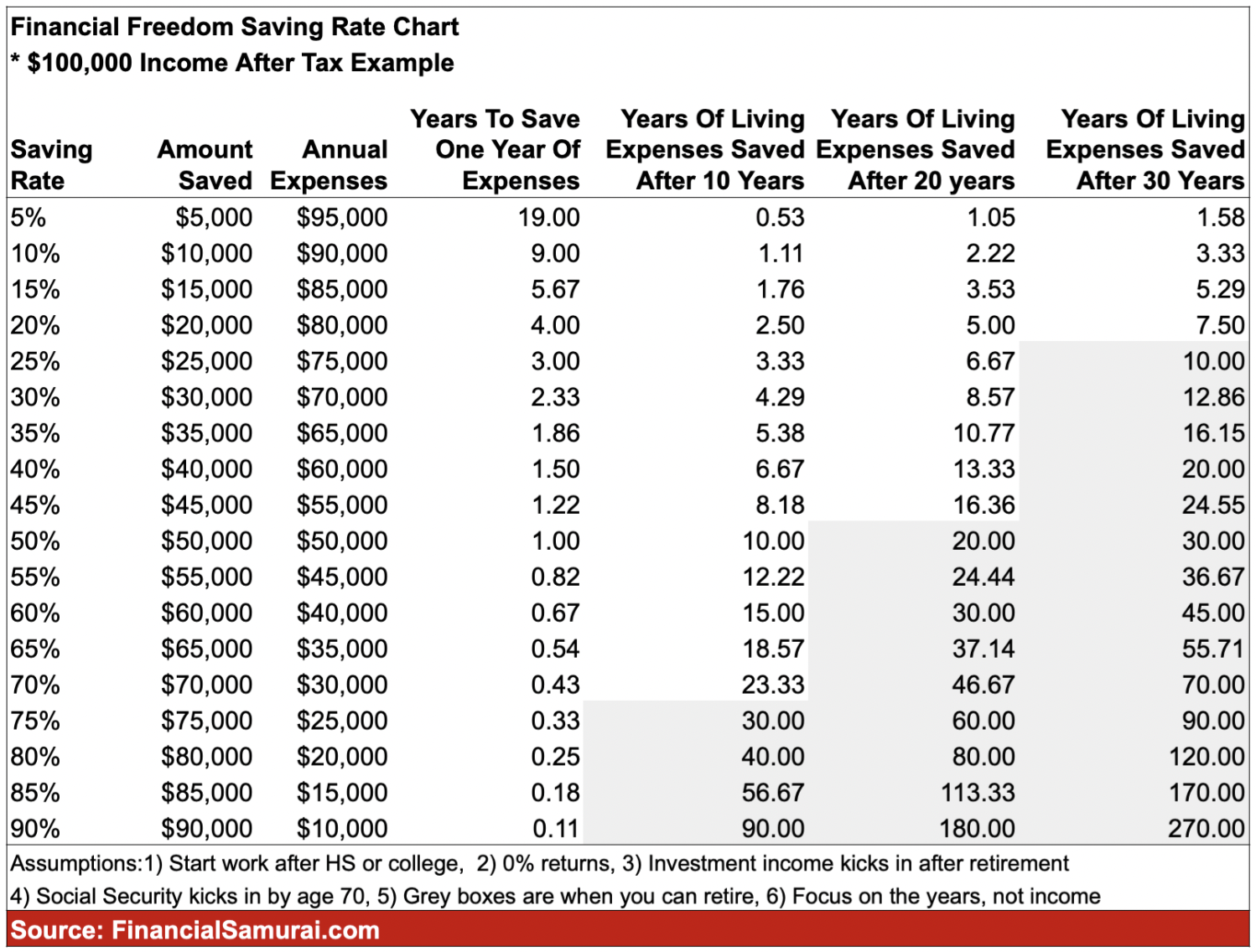

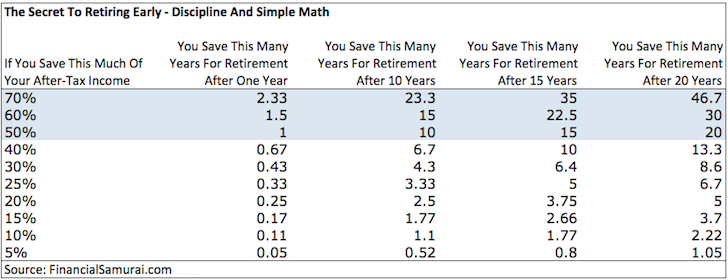

Here's another chart to help get you motivated to save more in order to retire earlier. After 10 years of saving 30% a year, you will have saved up 4.3 years of freedom. After 10 years, if you average a 60% annual saving rate, then you will have saved 15 years of freedom!

Figuring The Investment Amount You Need Where Work Becomes Optional

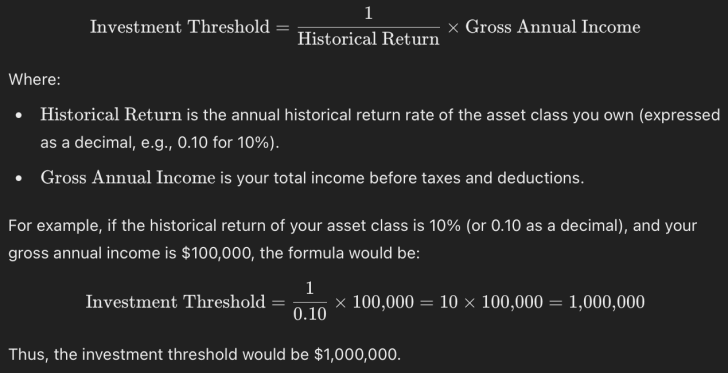

Finally, if you want to know the exact amount of investments you need where work starts becoming optional, follow my proprietary Minimum Investment Threshold Formula. This Investment Threshold Formula is a personal finance breakthrough and is one of the most important personal finance formulas you can calculate.

Take the inverse of the historical return of the asset class you want to own and multiply it by your gross annual income. The output is the investment amount you need where you can start taking things easier at work or even taking a break.

Below is visual representation of my formula, followed by an example of an individual who is OK holding 100% stocks and makes $100,000 a year. They would need a $1 million stock portfolio where work becomes optional.

Having Enough Money Is Important For Happiness

Since 2012, I have not spent a single dollar of my investment principal. Instead, I've been living off the income my investments generate. This is due to the rise in the stock market, real estate market, and the growth of Financial Samurai.

With the return of a recession and a murkier future. I recommend everyone build more capital before retiring and lower their safe withdrawal rate in retirement. You won't regret being more conservative with your money during times of uncertainty.

Hopefully you can appreciate all the negatives of early retirement I've shared with you in this post. It is one thing to run the models and pontificate about what early retirement is like when you are still gainfully employed. It's another thing to actually experience early retirement when you no longer have a steady paycheck.

In the end, I believe the positives of early retirement outweigh the negatives of early retirement by a 3:1 ratio. Further, after 12 years of fake retirement, the best reason to retire early is greater happiness for longer!

Therefore, you might as well shoot for early retirement and discover what all the fuss is about for yourself!

And if you're already retired, consider going back to work after FIRE to regain some appreciation for the freedom you once had. I did, for four months in 2024 in a part-time consulting role, and it wasn't fun. But because of this experience, I'm much more appreciative today. It's easy to take your money and freedom for granted after 12 years!

Recommendation To Retire Earlier

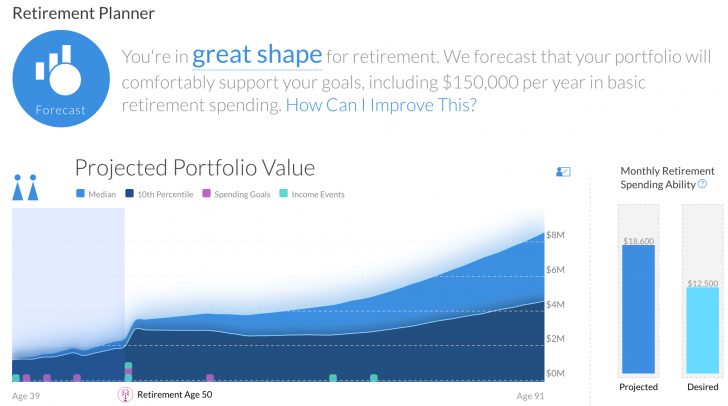

Sign up for Empower, the web’s #1 free wealth management tool to get a better handle on your finances. In addition to better money oversight, run your investments through their award-winning Investment Checkup tool. It will sow you exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator to help forecast your future. The tool pulls your real data to give you a great estimation of your future cash flow. Definitely run your numbers to see how you’re doing.

As a great alternative, check out the retirement planning tool by Boldin. Its software specifically focuses on retirement planning and nothing else. Boldin takes a panoramic view of your finances by incorporating things such as real estate, Roth conversion strategies, saving for college, and more.

It has even more customizable retirement planning features to track your real estate investments and model out “what if” scenarios to better plan.

Subscribe To Financial Samurai

The Negatives Of Early Retirement is a Financial Samurai original post. I've been writing about FIRE since 2009. The journey to financial independence has been full of twists and turns. Make sure you enjoy your journey!

Join 65,000+ others and sign up for the free Financial Samurai newsletter. To get my posts in your inbox as soon as they are published, sign up here.

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Please share, rate, and review!

Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

I have to laugh for 1 friend who took early retirement @61, she said you could have breakfast for several hrs. :) I don’t know anyone personally who took early retirement in their 30’s. Only my partner @58,is the earliest…which I knew his retirement really well and very productive for 20 yrs.

Now you know one! But after 18 months, I was too bored of early retirement and decided to do some part-time consulting at a financial technology start up in San Francisco. That was eye-opening and lasted for 2 1/2 years. After that, I returned to early retirement for a while because my son was born in 2017.

At the end of the day, everybody needs to have a purpose if they retire early. Otherwise, they’ll just wither away.

This post reminded me of my aunt’s early retirement experience. She faced some unexpected challenges, but moving to a well-supported retirement community made a huge difference. It provided her with a vibrant social life and plenty of activities, which eased the transition. If you’re considering similar options, Silvergate Retirement Residences is a great place to explore.

Thanks for penning your experience, feelings and insights Sam.

I’m just started year 2 in early retirement and I’m certainly experiencing everything you’ve written about. It’s hard really hard, emotionally, mentally and personally (marriage). So much so I’m feeling like blowing up everything I’ve worked for and to start again, so at least I have something to do other than spending money out of boredom and at the same time feeling so disconnected/alienated from others, but at the same time envied. It’s such a weird feeling.

Hi Peter,

Hang in there! Perhaps you could do some part-time consulting, volunteering, or get really into a sport or other hobby. That’s what many other early retirees do to keep themselves sane.

You may enjoy this post: If I Could Retire Early Again, Here’s What I’d Do Differently

Hi Sam,

Thank you for this article. It really helped me emotionally this morning.

Molecular biologist at a biotech who retired at age 32 in 2002. Grew up poor. After 2 years of early retirement, I went to law school because I was bored. No business lunches, etc. – exactly what you wrote. I didn’t care about titles. I had academic freedom.

Boredom and loneliness because your friends have to work and socialize with their co-workers and clients.

Thank you for sharing. Great to know I’m not alone in feeling isolated. I’m glad you have transition well.

Interesting. When my partner took early retirement @58 yrs., we moved from Ontario to VAncouver. He had planned all that, including home. I left a management position and had no job in hand in new location. So I did sell my place and relocated across the country for love.

He threw himself in local cycling advocacy volunteer work for several organizations, wrote reports, served on boards and grew his network of locals/distant friends. Meanwhile I worked full-time after landing a job 9 months later. I did have 2 other unemployment periods which thankfully during each time while applying for jobs, we did longer bike trips together. He also created 3 different public blogs. For about 8 yrs. he, also did the accounting online and set up Shopify ecommerce site for son’s Toronto butcher shop. To make a long story shorter: he died 2 yrs. ago while I’m still workng at tail end of my career.

Though I’m sad not to spend my retirement with him for at least a few years, I’m so grateful he had a happy 20 yrs. retirement that was highly productive. (By the way, I’ve been happy to work full-time, since I grew more in my jobs.) I worked more….it pushes me forward while also earning more money. Admittedly I nearly worry for my own retirement — after living with a beloved who had a exemplary retirement.

Definitely got me thinking about a few of those topics as I am planning ahead for early retirement in 10-15 years (currently 38yr old).

One point you keep returning to is the happiness metric and how retiring early, the variety of aspects to this, don’t necessarily make you long term happy. This is great insight and something I’ll continue to keep in mind!

I’ve found that I return to my Christian faith as the ultimate barometer of happiness or joy. If I have a right relationship with God, then all else becomes gravy, as you say :)

Just wanted to offer this perspective as I’ve found it to be the greatest source of peace, even though I do look forward to the freedom of allocating time differently during early retirement.

Thanks for all you do and write about!

I could hardly believe how closely your thoughts on retirement matched mine. I found myself devouring every word! I too, retired at a young age (45) and experienced everything you discussed in this article. I am 67 now and I still suffer pangs of regret for selling my company. You are correct, the sad feelings dissipate with time, but oh my, how it still stings sometimes.

I have reinvented myself over the last 20 or so years and it has been wonderful to be able to use my talents to help others.

Thank you for this…a much needed emotional check for many of us.

Thank you for reading Tina! And I’m glad you reinvented yourself over the past 20+ years. You actually retired at the age I think is ideal. Check out this post: https://www.financialsamurai.com/ideal-age-to-retire/

But it sounds like you have a different perspective. I’m 45 years old now and there is no way in hell I would ever go back to working for someone else. But I also will never sell Financial Samurai so long as I have a joy in writing.

How quickly things change! Less than a year and a half after writing “there is no way in hell I would ever go back to working for someone else” you’ve changed your tune. I guess it’s a great example of never say never. Life has a funny way of twisting in unexpected ways. Best to always be ready and flexible for the unpredictable.

I’m a 55-year-old software dev who stepped away from work 7 years ago. Still think it’s one of the best decisions I’ve made even though there have been some ups and downs. Was close to having to work again during the COVID market crash; happily, the market turned around and I’m feeling pretty safe now (knock on wood!).

Man plans, God laughs as they say!

Yeah, I didn’t anticipate finding my forever home for a reasonable price in 2023. And I’m so tired from being a stay at home dad for almost 7 years now. I need a vacation and doing some consulting to fill the void will be a good solution IMO.

It’s been a good 12-year run of financial freedom. Consulting part-time for 20 hours a week this year could be the ideal balance once both kids are in school. There’s just so much excitement in SF now.

My new worth is also up, but it’s boom times again in SF. I’m excited to see what’s out there.

Hi Sam. This really hit home for me. I retired at 42 in 2000. I was the CEO of a bank that was sold abruptly and I joined my stay at home husband in unemployment. I haven’t worked for pay since but have served on a number of non-profit boards. The section on social interactions really resonated as we moved shortly after retiring. I too get antsy during a downturn and 2007 was tough as our real estate also lost 50%. Having lived through that I’m a bit calmer this time. Knowing that tomorrow isn’t promised we are now traveling more and spending more on experiences. If we eventually run out of money, we still haven’t touched principal, we have told the kids we will move in with them!

This is one of your masterpieces, it is so true!

And one will realy feel this only when you retired early. If you read this when you are still on your journey, maybe you think about it rationaly, but feeling and knowing it is different.

Best thing about early retirement is, that you have so much more time to work on becoming a happier person. Because when you retire you are still the same person as before.

Hey Sam, great read! Your comment that physicians (dentists and pharmacists and nurses included) have so much difficulty defining themselves outside of medicine. I saw this first hand with my father. He retired in his 70s from dentistry and he has wasted away in retirement. He never found a way to define himself as anything other than a dentist. As such he mostly just watches television, mows the lawn, and opens a glass of wine for himself around 4PM. Rinse and repeat. He enjoyed this for about a month, then he became depressed. He is now 3 years into retirement and nothing has changed. With dementia setting it, breaking this familiar cycle has proven to be difficult. I write all this to say, reaching financial independence and retiring early are incredible goals. Im pursuing the same! But I think it is critical to really explore your interests and build hobbies well before you retire. This way you can have something to transition into when you retire. I think ‘fake retireing’ for a few years after retirement may actually be helpful for many approaching retirement. I would imagine it can be confusing to go from ’60 to 0.’

Thanks for another great article. Cheers!

Sorry Sam, you are NOT a “grizzled veteran” of early retirement, you went back to work a year later and have been grinding it out since. I ACTUALLY retired at 40 years old (end of 2014) and have been quite content in BEING RETIRED. Am I happy ALL OF THE TIME? Of course not, no one is. But, I am content. VERY contend as a matter of fact. See, here’s the thing…I don’t even call myself retired…instead, I am FREE. I can do whatever, whenever I feel like…I don’t have anyone (outside of the government) telling me what to do. And sorry, I don’t do social media including Instagram, so I am not sharing my adventures of freedom with the world. So stop talking down early retirement. Folks are different for you and me.

Greg, congrats for being more retired than me. You’re right that I “went back to work” by continuing to write on Financial Samurai. This site has brought me a lot of joy and meaning.

I think you’ll enjoy this anniversary post:

10-Years Of Fake Retirement Later: Key Lessons Learned

How do you keep yourself occupied in your true retirement?

Sam

Yes! I thought the same thing. Sam didn’t retire, he just found himself working outside the traditional office politics. Retirement will be defined differently for each, just as success is.

Check out: 10 Years Of Fake Retirement Later: Some Leasons Learned

Hey Sam, so glad you shared this with your readers. It hit home for me and it was very reassuring to see someone else go through the same journey. After 20 years of selling my business I still struggle with some of these same emotions. My happiest days were when I was building a business and achieving success.

Planning for retirement typically includes saving enough to cover your expenses, reducing costs and maybe downsizing your home. All of this is done in anticipation of the day when you will finally be “free of working”! But will not working really bring you the happiness you are anticipating?

Or is what you are seeking a way to spend your time doing something that you are passionate about? Being constantly under time pressure and on the hook for various nonsense and then constantly worrying about restructuring and being laid off does create a lot of stress. This can sap the enjoyment out of life, but suddenly going from the rat race to idle time with no commitments does not seem to lead to ultimate happiness. In fact, my observations have been that suddenly having nothing you must do can lead to feelings of boredom, isolation, depression and having no purpose. I have witnessed this happening within my own family.

Family gatherings have gone from discussing:

· How stressful work is, how bad management is, how unfair the policies are and what a bad boss they have and how they cannot wait to retire and get out.

To

· Aches and pains, complaints about the government and society, dealing with limitations due to medical issues, losing touch with other people, regrets about opportunities not taken when they had the chance and never getting to enjoy retirement before it was too late.

The point is, long term happiness is not as simple as ditching your job and then being totally stress free. The human mind is always active and you need something to focus your thoughts and energy on to keep you engaged and maintain your mental and physical health. This must be something compelling and meaningful to you. What we are really seeking is not to stop “working” but to spend our time “working” on something that brings us joy and satisfaction. Haven’t you heard people quoted as saying something like “do something you love and you will never work a day in your life”? The fact is that the people who are working in jobs they really enjoy don’t feel stressed and burned out, even if they are putting in many hours and lots of effort into their work. Think about people who could easily retire with the wealth they have built over many years, like Warren Buffet or Oprah Winfrey or Paul McCartney. But they keep “working” why? They choose to keep on with their work because this drives them, it is not a chore at all. And this is the one to the big keys to enjoying our “retirement years”.

How many times have you heard some say “Once I retire, I will finally have time to …………”? So the questions is – why wait to retire? Why not start now? There are many part time ventures which can be started on the side while still working a full time job, and these can be scaled up or grown as appropriate. Pick something that you enjoy doing and could make you some extra money. I have a friend who has started a side business making furniture and has set a woodworking shop. Someone else I know makes jewelry and sells it online, another person I met makes stained glass window ornaments and sells them at flea markets on her website, and another friend write fiction novels and edits movie scripts on the side…

For me my passion project is information publishing; writing instructional ebooks, how-to guides, business plans and printable items. This satisfies my creative side while utilizing my technical experience and I can see myself continuing to do this once I “retire”. It makes me enough money to fund itself and extra to invest and enjoy on fancy dinners and weekend getaways. Who knows, it might grow to make me enough money to retire earlier that planned. This is not just a sketchy get rich quick scheme. I view my side business as an investment in my long term happiness and health, just like investing in retirement funds, I am, investing in myself. You never know where this may lead you and you never know what will happen with your current company that says they are doing so well, as I’ve learned several times the hard way. Now is the time to start! Remember, it is never too late…until you decide to give up.

Thanks for sharing your thoughts and perspectives Erik Kopp. I totally agree with them and even saved what you posted. I am FI and can retire at any time, however I haven’t because I have been struggling with what to do when I retire: how to remain productive and challenged after I retire. The easy choice is to actually just continue working.

Thanks for your comment. After reading and thinking about a lot about what I should do after I retire (since I could reach FI in a few years), I believe your comment was the best I’ve read, I mean, everywhere so far. It did resonate with me.

Thanks Sam also for sharing your story.

Live long and prosper.

I retired from the Foreign Service at 53 and consider it the best decision I have ever made. I have always loved traveling and retirement gave me the opportunity to truly be free and see the world without having my life controlled by the State Department.

However, I do agree that for the overwhelming majority of retirees that your concerns are very true. My biggest concern is that with increasing age I may no longer have the physical ability to do what I most enjoy

All the negative things about Early Retirement are stated as if they WILL happen. But actually, it is more true to say they MAY happen. Most of these negatives are predicated on the idea that work is much of how you identify and value yourself. Since work (and colleagues) go away once you retire then the negatives the author listed seem inevitable. The author must be a very self-actualized man (remember Mazlov”s “Hierarchy of Needs” anyone?). But for many of us work is just our J-O-B and once you see that most of his negatives melt away. Also, although it took a great deal of planning to be able to retire early, it seems the author totally forgot that retirement requires much more than finances to be successful. It can take years of planning to be successful in retirement; such as finding value in other things besides work and colleagues, since they are by definition actually quite transient.

Retirement sucks. Especially when you r forced out due to a hostile take over, State Government interference. 45 years of service with needed2 more years to actually retire safely. I feel for us and many like us. We now face poverty. We have always lived on a budget to prepare but so much for that. U truly find out who ur friends r when this happens. It will kill us before our time. God’s hands is all we have.

Hi Sam,

I’m reaching out to say how much I liked your article a lot.

I’m in a bit of a similar situation, where I was able to stop working at 35 and move down to South America with the goal of learning Spanish and experiencing a different culture.

I think you really hit the nail on the head with the article and I totally resonate with the downsides you’ve mentioned. It’s been the best decision of my life, but when people ask I tell them you still have good and bad days and your problems don’t all go away once you take work out of the equation and change locations. It was really interesting to see someone write an article talking about the same thing!

I count myself as really lucky to have been hit with those realizations at 35, though. I think they’re bound to come at some point in life, so better to learn these things about yourself and about life at this age than to work your whole life at something you hate and then be hit with that feeling of purposelessness and regret at 65.

Anyway, great piece! I’ve sent it to a number of friends who are in the same boat and who I’ve had similar discussions with.

All the best,

John

This post really helped. I retired early and I’m now second guessing all my career choices, realizing my identity was defined by my work and I have an empty feeling that isn’t going away. I’m also driving my wife nutzs! The fact that we are isolated during a pandemic isn’t helping much. Thank you.

You’re welcome. If you haven’t found satisfaction by the end of 12 months, I would just try and look for another job.

I agree Andy. I wish you all the best. Ed

I hear you Andy. Hang in there things will get better I’m sure.

Duane

I have no problem with the free time that comes with early

retirement. I never get bored and instead feel there’s not enough time in a day and how quickly time passes. It’s up to you to give yourself a job. If you have the cash you can go to as many conferences and vacations you want and even make a YouTube out of them! The only worry about retirement is money – to ensure you don’t outlive your savings. Yes, money DOES bring happiness!

Money reduces stress because much worry and anxiety is related to lack of money.

Searched up this topic after a visit to the dentist yesterday. He shot me up with novocaine and then asked me “what do I do for a living” and proceeded to pitifully explain “early” “savings” “consulting” “used to lead” all while my mouth slowly stopped working. Realized I need to get my arms around retiring early and not being ashamed of it. I retired at 52 and now focus on my three young children. This article really hit home. Thank you for writing it and capturing all this here for it to help others.

Thank you, I retired 2 years ago At the age of 50 and got depressed that I had to go back to school to work on my doctorate degree. I’m still retired and a stay at home dad of two boys in elementary. I just wanted to research all my feelings and see if anyone was struggling with outside achievements like I was. these past 2 years.

“Thank you for this article.”

No problem! Glad you found something to do.

Before people retire, I always encourage them to retire towards something, not just retire away from their job.

Being able to write for and connect on Financial Samurai has been my main activity post retirement. However, since 2017, my main focus has been my children :)

GL!

I am planning to retie in 6 months and then having worked 41 1/2 years of federal service. I am 67 now. I am having a little trouble figuring out what my purpose will be in retirement. You have helped me realize that retiring early doesn’t solve this problem of finding your purpose. I still need to find my purpose. I shall pray and focus on finding my purpose and will see if i can negotiate a way to stay at my job and find my purpose if I go or stay. I don’t think it matters if I work or retire. It really comes down to finding my purpose. Thank very much for your perspective. ED

Good article but only relatable for people who retired early as well.

I’m one of them. Retired in my mid 30’s and moved from Europe to Thailand. It was great first but I hated the question “What do you do?” when meeting new people.

Most of the time, I was traveling, working out, reading books, volunteering (that one helped feeling useful and productive). Then, I started to envy people who are working. It felt like they have a purpose.

I retired early because it was my dream to live in a warm place and being able to travel full time. But once I achieved it, I got bored very quickly and I ticked it off my list now.

Some suggestions what we can do, after retiring early:

1. Work part time somewhere to have a routine

2. Start a business (online or offline)

We need work and a regular routine to stay mentally healthy.

Yes, you can find a purpose in life. Look & observe – dirty, dreadful places. Next, go to a beautiful park – with flowers blooming, fruit trees, & different variety of plants. Indulge all your senses, look and think.

After that, find the most accurately translated Bible. READ, imagine and meditate. Start reading the book of Ecclesiastes. May you find answers to those questions that you have entertained for a long time.

Many people get bored and develop all kinds of sicknesses when they retire. I think semi-retirement is the way to go

Imagine someone telling you consistently about their retirement 10 years prior and 10 years after.

– Are these people invested in your life. No mostly they are people who are nice enough to say hello to you but, the constant 2 dimensional mindset of your upcoming retirement and after retirement is only important to you. No one is jealous. No one finds you interesting. You don’t even find yourself interesting. You live for retirement and your looking for someone to impress with the fact that you are going to retire.

Usually none of these people know you. We do not share finances. Most of all we wouldn’t be attending your funeral.

But, here we go again it’s morning and here you come with your fixed income speech looking for approval from someone who is busy..

Nobody cares. Most of all YOUR FAMILY.

Great article. I agree with all five of your points. I chuckled at your point about people thinking you are a slacker because you retire early. I get weird looks from people when I tell them I retire early too. That’s why I now tell people I’m a business consultant even though I’m no longer working.

Hi Sam, fantastic article and I pretty much related on every point you made. I was asked to leave my senior role at a biotech about a month ago, have been saving avidly for 5-7 years and am a little shy of the 15k a month target that you set for yourself and I incorporated into my own planning. I’m 34.5, out of shape from 12 years working a job that was okay during the best of years and miserable during about half of them. I’m happy to be removed from the last situation which was squarely miserable, but have the identity/whether the money will be enough/whether I shouldn’t be living out a purpose that I believed during working that my job was keeping me from.

I don’t know if this is the end of my worklife or whether I’m just burned out and need to reset, or whether I should be taking the leap of becoming and entrepreneur or investor of some sort. I know I’m physically and mentally worn out though, so an extended pause at a minimum seems to make sense. You’re about 7 years ahead of me, I’m not sure if you would be open to some consulting/coaching arrangement as I navigate this new path, which clearly you have already walked. An experienced sounding board for some of my future plans would add a lot of value to my life, and hopefully would be enjoyable for you if you were open to that sort of thing. Even prior to leaving employ, I’ve been playing with the idea of an executive coach, which hopefully will help me level up in life, and we share a number of background/career/philosophical characteristics.

Really love your content and particularly your method of thinking through problems and data.

Cheers,

Jason

I never understood SJWs before I read this article. Okay I still don’t really but I do really understand some of the use of one of their favorite words “privilege”. This article to me basically reads “I got REALLY lucky and made a few million dollars and retired and things aren’t completely perfect boo hoo.” Give me a BREAK! As a currently unemployed person struggling to get another job this article made me sick! Shockingly I don’t have a few million bucks what a surprise! Now do I have some “privilege”? Sure of course I am getting unemployment and I’m lucky enough to have a fairly in demand skill so I’m hoping my unemployment is brief and I’ve averaged around 2 interviews a week. But this article would be the equivalent of me walking up to a homeless person and complaining that my Starbucks is only luke warm instead of piping hot! Get over yourself! Anyone with half a brain would never think money solves all problems but it sure does make things MUCH easier!

You are right. Being born an Asian male and getting to live and work in america makes me extremely privileged. I absolutely attribute the large reason why I was able to retire early due to luck.

I hope you find better luck in your life too.

Here are some articles that might be worth reading:

https://www.financialsamurai.com/solving-happiness-things-that-will-make-you-happier-and-wealthier/

https://www.financialsamurai.com/income-by-race-why-is-asian-income-so-high/