Real estate is my favorite way to build wealth over time. Not only can you live in your house for free, you can actually make money over time due to principal appreciation.

I hate to say it, but renting is throwing money away. After 10, 15, 30 years of renting, you are left with zero equity. Meanwhile, the homeowner has built up tremendous equity during this time and benefitted from inflation. The housing market will likely stay strong for a long time to come.

Mortgage As A Means Of Forced Savings

The only reason why I open up my primary monthly mortgage statement is to check the split between principal and interest. My payment is fixed for three and a half more years at 2.625% so there's never a change in absolute payment. It's just fun to see the principal portion as a percentage of total payment go up over time. Progress is happiness.

The flip side to less interest payments is less deductions. I've calculated that mortgage interest payments are only truly worthwhile if you're in the 28% tax bracket or higher. In other words, if your income is less than around $100,000 for singles or $200,000 for joint you're not getting that much bang for your mortgage interest buck. This is due to the standard deduction (~$12,950 for singles, double for married couples) and the Alternative Minimum Tax. You'll still be able to itemize and save on taxes, just not an optimal amount.

Mortgage is a means of forced savings. And whenever you are forced to do something, you tend to do it versus when you have options.

In this post I'd like to share with you how every potential homeowner or existing homeowner can live in their house for free using two main strategies that occur over the long run.

THE CASH FLOW POSITIVE WAY TO LIVE IN YOUR HOUSE FOR FREE

Goal: Lock in a mortgage rate equal to or less than the risk free rate.

It's important to realize that if you take a fixed rate mortgage you are essentially SHORT bonds at that fixed price. If interest rates go up, you are winning because you're locked in at a lower rate.

Shorting a bond means you are making money on principal if the price goes down and interest rate goes up. Saving on monthly mortgage payments and increasing the value of your mortgage holding with the anticipated rate increase is the reason why I've been encouraging everybody to refinance their mortgage for the past three years.

If you still have difficulty grasping the concept of shorting bonds as a fixed rate mortgage holder, let me highlight my situation to help elucidate the point more clearly. I'm now living in a single family home in San Francisco for free because my CD yields and municipal bonds are higher than my mortgage at 2.125%. The CD and municipal bond investments are roughly the same size as my primary home mortgage. With the median SF home price over $1 million dollars, this is a significant milestone.

How To Continue Living For Free

To ensure that I continue to live for free in my home long after my CDs come due, I can invest an amount equal to my mortgage into any low-risk investment that yields greater than 2.125%. The proceeds from a Treasury bond investment will pay for my mortgage and property taxes. I've been anticipating this day to come since the beginning of 2012 when I went through my 100 day refinance process. Dreaming of one day living in my house for free is what kept me from pushing on through the refinance pain!

Rising rates slow down house price appreciation in the short term because rates move on a daily basis and economics takes longer to adjust. But the reason why rates are rising is because of higher inflation expectations due to higher demand and tapering by the Fed. As the economy opens up post pandemic, demand for goods and services increases. And when demand increases, prices go up.

In other words, if you are a long term holder in property in a rising interest rate environment with a locked in mortgage you should feel BULLISH. Your assets are inflating and the real value of your debt is declining. Only those who are trying to flip properties quickly panic.

Just be careful about buying a housing after large appreciation. There is a risk you could be buying a property at the top of the market. If you do, you'll likely have to wait 3-5 years until house prices bottom.

THE PRINCIPAL APPRECIATION WAY TO LIVE IN YOUR HOUSE FOR FREE

Goal: Invest in a property whose annual appreciation grows faster than your cost of ownership.

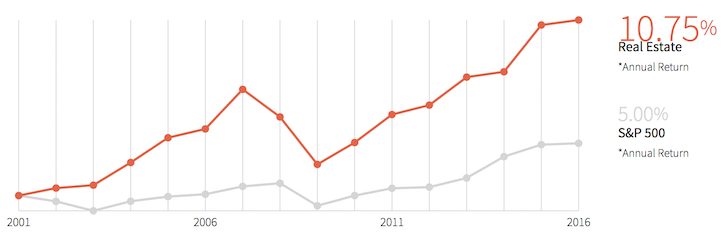

We've now discussed the cash flow way of living in your house for free. Whether you want to invest only in a 2.125% yielding instrument is another story. Perhaps you'd like to invest in stocks with a strong belief you'll make more than a total 2.85% return given the S&P 500 dividend yield itself is around 2% and all you need is 1% stock market appreciation. But the only things risk free are US government bonds, CDs, or cash.

Some of you might be thinking why not pay the mortgage off completely instead of arbitrage. You certainly can if you've got more liquidity behind and have a stable income flow. For most of us, it's better to have liquidity just in case opportunities or disasters arise.

The last thing you want is Hurricane Sandy destroying your home and the insurance company not making whole on their contract. What if your friend starts the next Twitter and asks you to invest? Keep your net worth diversified because strange things happen all the time.

Invest In Assets That Appreciate Faster Than The Cost Of Your Mortgage

Let's now talk about the principal investment way to live in your house for free. Let's say it costs $25,000 a year in mortgage interest, property taxes, and maintenance (4% annual cost to own on a $625,000 property). Your goal is to essentially make a call on the direction of the property market over the next 10 years.

You can look on Zillow and punch in your the specific property, city or county for predictions. It's important to understand the strength of the local job market, zoning laws, and existing housing supply to come up with the best guesstimate. Personally, I like investing in the heartland of America and trying to find real estate deals in big cities that people fled during the pandemic.

If your investment property can appreciate by more than 4% a year in this example, you will have essentially lived in the property for free if you decide to sell 10 years later. If you decide to hold on to the property for much longer by renting it out after 10 years, chances are high you will start making a nice cash flow return on your investment and see principal appreciation at the very least thanks to inflation.

What can you say about the West Coast and East Coast dynamics in terms of price appreciation? Remember, as a housing economist you want to be unbiased and focus on demographic trends to make the best investment possible.

The markets don't care that Chicago has some great deep dish pizza with an expected 1.5% depreciation in home prices. Areas are cheap for a reason! Perhaps the 760 shooting deaths in 2016 has something to do with Chicago not performing so well.

Living For Free Doesn't Have to Cost A Lot

When you are able to gather at least a 20% downpayment to buy a property, please think about the two dynamics of comparing your mortgage interest rate to the risk free rate of return and the expected price housing price appreciation to your estimated cost of ownership in percentage terms.

I'm pretty confident if you regularly analyze these two dynamics you'll be a much wealthier property owner in the long run. There's no greater feeling than getting something for nothing after years of patience, due diligence or both.

Don't be one of the thousands of knuckleheads out there who got in way over their heads, defaulted on their mortgages, and caused pain for the rest of us. Spend as much time as possible before buying what could potentially be the biggest purchase of your life.

Invest In Real Estate For Capital Appreciation And Income

If you don't have the downpayment to buy a property or don't want to deal with the hassle of managing real estate, take a look at Fundrise, my favorite real estate investment platform today. Fundrise is a leading institutional real estate investor that has opened up access to high-quality real estate deals for retail investors.

Real estate is a key component of a diversified portfolio. Fundrise enables you to invest as little as $10 into various diversified eREITs to help you benefit from real estate appreciation. Sign up and take a look at all investment opportunities Fundrise has to offer.

I've personally invested $954,000 since 2016 into private real estate funds to diversify my real estate holdings and earn more passive income.

Refinance Your Mortgage Today

Check the latest mortgage rates online through Credible. If you haven't refinanced in over six months, you will probably be surprised with how low mortgage rates have gotten. I personally refinanced to a 7/1 ARM for no cost at 2.125%.

Credible has one of the largest networks of lenders that compete for your business. You can get free, no-obligation quotes in minutes. The more lenders compete for your business, the lower your rate.

For more nuanced personal finance content, join 50,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. Check out my Top Financial Products page for more great products to help you make and save money.

[…] I have a fundamental problem with paying a 5% or greater selling commission in this internet age. It is amazing that the internet has cut costs for every single industry except for the real estate industry. I encourage sellers to go on strike and never sell their property until such costs are lowered to a flat rate or more reasonable rate. Selling a property now means you are automatically losing 5%-6% to fees. Furthermore, if my return on equity can beat the 4% per annum ownership cost, I’ll essentially be able to live in my home for free all these years. […]

If you are willing to push yourself through a learning curve, you can “retire” in months, not decades. Just buy one multi-unit residential income property with 30+ units and you can earn enough monthly income to pay all property expenses, a manager to run it and all your personal bills too. With a good manager, this type of income can be 95% passive.

Rentals get a bad rap sometimes because the owners don’t have enough units to afford to pay a manager and to pay others to do repairs. Landlording can quickly burn you out if you try to do it yourself. In my experience, 30+ units is the magic number. I’ve chosen mobile home parks because they provide the most income with the least capital expense. If you self-educate, you really can buy just one property and “retire” as soon as you can complete your learning curve.

Because your tenants are paying all your property and personal bills, you’re living in your home for free despite it having a mortgage. Multi-unit residential rentals are an income stream that you can control. As inflation eats your income, you can raise rents, lower expenses or buy another park.

I self-educated and learned how to buy my first park for $1,000 down and closed on the 5th so I’d get the prorated rents for the remaining month at closing. So I was actually paid over $5,000 at closing to take over the park. When you have no money in the deal, your yield is infinite. Ten years later, the park is worth 1,500 times my original investment, which was more than returned to me at closing.

I now own two parks and my only “job” is to manage the managers. It’s secure, monthly, 95% passive income that allows me to be retired, live in my home for free and own appreciating assets I can later sell, 1031-exchange or just live well off the rents as the properties pay themselves off. Because of the many allowable tax deductions available from owning rental properties, my taxes are very minimal too.

I highly recommend this way to live “free” and retire early.

Gotcha…. Your primary concern is collecting rent for decades (or forever) and riding out property value fluctuations is fine. And you are considering geographical diversification?

The past few days, I’ve been doing some research on California real estate. Those prices are just wow! I can see why lower/middle class people are upset.

They realistically cannot afford a home there.

In the Chicago area, it is common for middle class families to own several homes. I run into this all the time. You have people with a primary home and then they have a home in Wisconsin or Michigan with a lake. Or you have people with a home in Chicago and then a home down in Florida. Or even folks with a house in the suburbs and a condo in the city. And none of these people are landlords.

Yes. I have Hawaii and Tahoe along w/ SF. Wish I had Manhattan too, but I was too poor in 2000 to buy.

Sam,

Interesting link to a very short article in regards to the Chinese purchasing US real estate (as diversification?):

I’m not quite sure I understand the Detroit thing.

Sam,

Are you doing anything to hedge your real estate downside risk? Dude, you have a full blown bubble going on out there.

Those prices left the real world a long time ago. California should reverse Proposition 13. That market is extremely distorted.

You should see how much college graduates are earning out here at Google, FB, Twitter etc. Incomes are huge that it’s no surprise rents and prices keep going up.

Might be a good idea to buy up Chicago though given the expected decline to diversify. I don’t plan to sell my properties for 25+ more years if ever.

Isn’t this really just shifting thought processes about investment returns? For example if I invest my mortgage balance of $375k (3.3% mortgage) in 30yr treasuries (3.65%) I can either say 1. I’m living for free with my returns or 2. I still pay for housing but I make $13687.00 a year in interest. You’re not really living free, you are just making certain your investment returns pay for the cost of your debt service. Its a shift in thinking. A refreshing one, but capital intensive requiring much liquidity. Or, I can leave my $375,000 in the stock market and with the 7% average annual return you should get, sell the winnings every Dec 31…then say I am living for free because I’m now paying off mortgage with my stock appreciation….again, just shifts in how you allocate your investment returns.

I don’t think most homeowners consider these two factors. Great post Sam. I will definitely help spread the word. I’m going to share it next Friday on our Dinks Finance weekly roundup.

Hopefully the appreciation over 3 years will provide a downside buffer, and rates continue to stay low which I think they will. Look at the 35 year chart of the 10-year yield.

We just closed on our new house and I am ready to tackle this mortgage again! It’s a small one, and only at 3.5% but still. I’m over it. I also like seeing the principal part of the payment rise with each passing month. It makes me happy.

3.5% is a great rate. Hope you’re enjoying your new digs!

Hey, you’ve redesigned the site! It looks great.

We are not living for free yet. We are working on it, though. We have a rental component to our primary living property which does help us live for less, but we’ve refinanced as you have mentioned and have taken some solid steps to living for free.

Hi Tushar, good to hear from you man. Hope your new gig is going well and your tenants continue to pay on time!

I live for free as one of my rental properties generates enough cash flow to allow me to cover my living expenses even if I had to rent myself. I am in a paid for house but used to rent when moving countries a lot, it offered more flexibility while the tenants covered the rent. Hopefully principal appreciation will also play a role, I wouldn’t use cash flow as I prefer to have it on the markets, although I do have about half of my rental mortgage on a 3% savings account and the mortgage is 2.29%.

That is an interesting approach for the risk averse though.

I love your posts like this that have great ways of looking at financial scenarios that I never would have been able to think of on my own. You’re a great problem solver Sam. You think in so many dimensions. I need to work on being more analytical when it comes to personal finance situations. I brain tends to freeze when I start seeing numbers, hear unfamiliar financial terms, or new ways of approaching scenarios. And to answer your question, no I don’t think the average homebuyer thinks about these two dynamics. I’m happy to help spread the word about this post. Thanks for the insights!

Thanks Sydney. I really want to come to conclusions and solve problems. We need to do more than just present problems.

Very interesting point about going short bonds by taking on a fixed-rate mortgage.

I think the intended holding period of the property and the price-to-rent ratio are also essential in the principal appreciation calculation, especially if the property is financed on a long-term, fixed-rate mortgage. This is because if the annual ownership costs of the property (your 4% example) are equal to the annual cost to rent the property, or less, then nominal wealth is created over the term of the mortgage.

The net cash outlay for the purchase is the 20% down, the ongoing costs are roughly the same as if renting the property, and then you end up with the full property value when the mortgage is paid off. You will have created nominal wealth unless the value of the property declines by more than 80% over the life of the mortgage, right?

There’s definitely many ways to calculate how one can come out ahead, and the things you mentioned work too.

What I do know is that every 5 years that go buy, I wish I owned more property.

We’re currently going the paid-off mortgage route, but there are big opportunity costs associated with what we did. We’ve made peace with them, and now have a lot of liquidity to invest, while enjoying a pretty risk-free and nearly-cost-free way of owning a home.

Love the analysis, especially the first method with shorting bonds. Pretty savvy stuff there, Sam.

Nothing wrong with paying off the mortgage, especially if is to coincide with full retirement!

I doubt the average home-buyer thinks about this kind of stuff. Most people think housing prices will increase like magic & make them rich. So all they think about is whether or not it has granite counter tops & huge closets!

Imagine a world where every home buyer and owner thought about these dynamics. The world would be much more stable.

My wife and I were JUST talking about how the value increase can let us live for free. I love that example.

I am a huge fan of real estate! I have 8 long term rentals and a 9th under contract. I’m actually trying to buy 100 SFRs in the next 10 years.

I paid off our 7 figure house as I had liquidity and job security. I built an income property on my second lot. The net rental income pays for my property taxes, insurance, and some of my maintenance. Basically, we are living in our house for free!

When we choose to downsize, we can move into the rental home and have a tidy 7 figure sum (in addition to retirement accounts/brokerage accounts) to live on. It’s been a lot of years of hard work and planning, but patience and persistence pays off!

Sam, if my interest rate is higher than the 10 yr would it make sense to actually prepay the mortgage with the “bond” portion of my portfolio?

BTW it is higher since I have a 30 yr fixed because I wanted to avoid the rising interest rate scenario to hurt me down the line.

Please read this article on 30 year fixed vs. ARM mortgages first: https://www.financialsamurai.com/30-year-fixed-mortgage-loan-vs-adjustable-rate-mortgage-arm-the-choice-is-obvious/

I would say to delicately balance the payoff with your desired liquidity.

Sam,

Good article. A couple of thoughts here: If you don’t have a mortgage, rising interest rates are irrelevant!

The west coast is usually the trend setter in the macroeconomic environment. They are the first to collapse and the first to recover. The rest of the country lags by several years (so this is actually a very positive outlook). Although, this double digit appreciation forecast looks to me to be approaching bubble status (of course this is just for 2014). Median house prices should really be closer to about 4 or 5 x median household income at most (healthier at about 2.5 x median income).

The macroeconomic trends going into this decade are really changing rapidly.

1. Wages in China are now approaching $9.00/hour. Once you add the cost of transportation, manufacturing in China is no longer economical.

2. Fracking….. This is a game changer! The USA is well on the way to energy independence.

So…. What are we really looking at? There is a reason why Houston is doing so well. High paying energy/fracking jobs.

What’s next? Cheap natgas means manufacturing moves back to the states….. What states do big manufacturing? Look it up.

Money is pretty irrelevant in general if you are a billionaire also.

“Buy low, sell high” my friend.

Those zillow projections for Riverside and Sacramento are quite stunning, considering how far inland these cities are. I’m rather surprised that they were able to run through excess home inventory so soon.

Sam,

I’d say the cash flow matching is the best way to analysis this. I think it would be a good goal for a new home owner to increase his/her “risk free” savings until it matches the mortgage amount if possible (but this would be too challenging for most people). I prefer not taking on so much liquidity risk. Perhaps a partial cash flow match would be a fine goal?

There is a very active argument from many intelligent people at different websites in regards to paying off the mortgage as soon as possible versus investing the money instead.

Overall, I’m neutral about the argument, but I recognize that most Americans have little investment knowledge and/or undisiciplined (or just generally challenged). I’m begining to think that many families would benefit from setting a goal of paying off their mortgage as soon as practical (provided they maintain an adequate emergency savings account). Afterall, no mortgage, no possibilty of floreclosure. Of course, in California this may be impossible! LOL!

While leveraging mortgage loans in a time of rising interest rates can make living in your house for “free” possible, my wife and I were more comfortable just paying off our mortgage, and also living in our house for “free.” Of course we still pay insurance and taxes for the privilege.

Definitely not a bad thing to be mortgage free. I personally want to keep liquid to move money to potentially higher returning investments with rates still low.

Eventually the markets will turn down, but that still means the money in your house will also go down too.

Great article. I can think of at least three people that should read this immediately. I’ve considered the principal appreciation, but never with this granular of an analysis.

My MT&I carrying cost is a whopping 7.5% of the original purchase price on a 3.25% note. This is because Texas tends to have high property taxes (no state income tax). Because of this burden we bought a home that was priced at about 1.5 times household income.

Please e-mail those three folks to read the article!

I’m happy to pay higher property taxes on a way lower property value in TX and pay no state taxes too. However, I still haven’t been able to get over living in Texas yet.

What is the prop tax rate in Texas? In CA it is 1.2% a year.

It’s different in different cities, obviously. If you’re not in an incorporated municipality it’s considerably less. I believe ours are fairly high compared to some other cities. Where I am it’s roughly 2.6%.

Interesting perspectives on the dynamics of property ownership, Sam.

Personally, I worry more about the principal appreciation aspect than the cash flow. They’re both out of my control, but at least with mortgage rates you can refinance if they go lower. Not ideal due to transaction costs, but it’s more in one’s control than local property values for long term capital appreciation.

I’d be more particular about these criteria for buying rental property – aiming for the best mortgage rate for cash flow and a promising market for capital growth.