If you ever find yourself in a situation where you are unsure about an investment, to minimize regret, I suggest you go halfsies. Halfsies is when you either buy or sell half your normal amount.

When $520,000 worth of equity structured notes matured, I faced the challenge of figuring out how to reinvest the proceeds. The S&P 500 was at 4,500, and I was unsure about whether it was wise to jump back in the fire.

These structured notes fortuitously rode the bull market from September 10, 2016 through September 10, 2021, with leverage. Given I wrote about revenge spending and the YOLO economy, I began wondering whether I should finally blow some of it on a Lamborghini Huracan Spyder.

When you're in your mid-40s and live in sunny California, driving up to wine country or down to Carmel by The Sea in a convertible is a fun thing to do. However, after my five minutes of daydreaming was over, I decided to think more responsibly about our family's future.

Unsure About An Investment? Go Halfsies

To become a successful investor, one of my core philosophies is to consistently make positive expected value bets.

For example, if you find yourself with pocket Aces preflop in Texas Hold'em, you have an 85% chance of winning if you go head-to-head. Therefore, you should always try and get as many of your chips in as possible preflop.

Of course, you will also lose about 15% of the time. But over the long run, you will become a very rich person if you consistently make bets that have an 85% chance of winning.

When you are unsure about an investment, you are literally straddling the 50/50 line. You believe there is a 50% chance your investment will make you money and a 50% chance your investment will lose you money. Therefore, if you go halfsies, you are investing in line with your beliefs.

In general, I believe you should only make an investment if you believe you have a greater than 70% chance of winning. However, there are some scenarios where you have the cash, know you should invest for the long run, but are just uncertain about how much to invest.

This is the situation I currently find myself in. In the short run, I haven’t been this uncertain about investing in the S&P 500 in a long time.

Investing Half Of The Structured Note Proceeds

When the S&P 500 was above 4,500 in September 2021, I didn't mind that my structured notes exited. I hadn't been investing new money in the S&P 500 since July 2021, mainly due to high valuations and my preference for real estate.

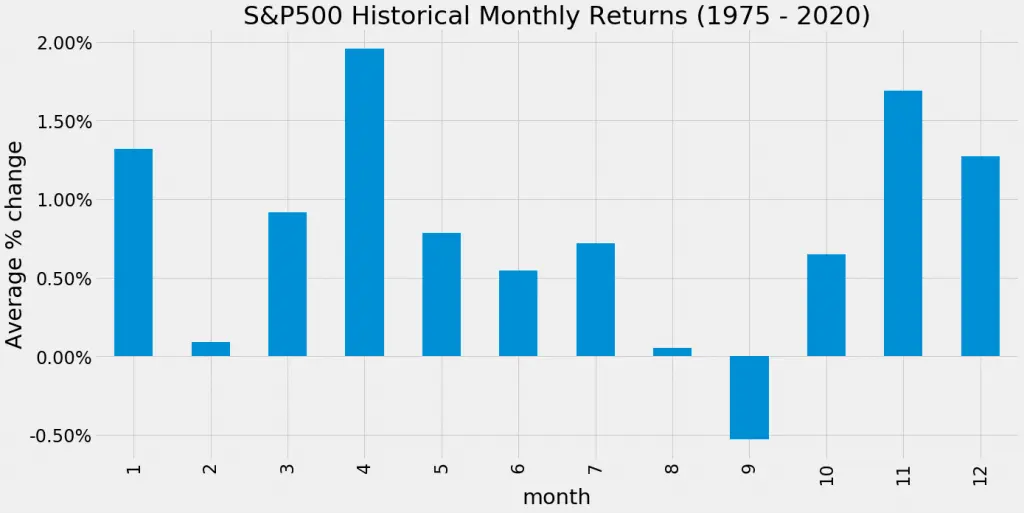

I was and still am worried about a 10%+ pullback, especially during the months of September and October, historically disappointing months for equities. Add on the fact that interest rates are rising and the Fed will be tapering starting in November, and the markets could get very dicey really quickly.

On the flip side, I believe there is a 70% chance the S&P 500 will be higher 12 months from now. Therefore, investing some of the proceeds is likely the right move. That said, nobody knows the future.

Calculate The Expected Upside And Downside

Given my uncertainty, I've decided to go halfsies by buying up to $260,000 worth of S&P 500 stock. I'm currently still in the process of buying shares right now, having surpassed $200,000 in purchases so far.

When the news of the China Evergrande debt debacle emerged, I decided to start using this information to accumulate shares. The S&P 500 traded down to 4,318, which meant up to a 4.3% discount to where my notes had exited. It wasn't the 10% correction I was expecting, but it was still better than nothing.

By investing six figures back in the S&P 500, I had to feel OK with potentially losing tens of thousands of dollars during the next correction. At the same time, by keeping six figures in cash, I would feel good saving tens of thousands of dollars if there is a correction.

If the market rebounds and reaches new highs by the end of the year, I should feel good knowing that I participated in the upside. Sure, I will feel disappointed that hundreds of thousands of dollars in cash didn't appreciate. But I should also feel fine knowing that at least I didn't lose any money.

Set Your Upside And Downside Investment Targets

In my opinion, the maximum realistic year-end target price for the S&P 500 in 2021 is 4,700. The maximum realistic year-end downside target price for the S&P 500 is 4,000. In other words, at an average purchase price of 4,350 in the S&P 500, the maximum upside and downside I can expect after buying the shares is 8%.

Therefore, if the S&P 500 actually gets to 4,700 by end of the year, I will have missed out on $20,800 in gains (8% X $260,000). But at least the other half of my investment will have made those gains. In addition, the rest of my portfolio will have returned 8% as well.

If the S&P 500 closes at 4,000 for the year, then I will have lost $20,800 with half of my investment and saved $20,800 by keeping the remaining $260,000 in cash. Unfortunately, I will end up losing multiple six figures in my overall equities portfolio in this scenario.

But hopefully, during a correction, I will have the liquid courage to buy the dip. My plan is to fully deploy my remaining cash if the S&P 500 gets below 4,200.

Focus On Your Asset Allocation To Overcome Uncertainty

It's generally not a good idea to invest in anything you are unsure about. To improve your certainty you need to do more due diligence and follow an investing system to remove as much emotion as possible. Emotionless investing is one reason why regularly investing with a robo-advisor or financial advisor is beneficial.

You must always accept the fact that when it comes to investing there is never a 100% sure thing. As soon as you start getting overconfident, your risk of losing money goes way up. The reason why is that you tend to bet too much on an investment that had a lower expected value than what you thought.

It's not every day that I invest six figures in the stock market. My usual stock investment amounts are between $10,000 – $50,000 a transaction. But this time, I overcame my hesitation of investing more than normal by focussing on my overall asset allocation.

I like to have between 25% – 30% of my net worth invested in stocks. The $520,000 of exited equity structured notes lowered my desired equity allocation below 25%. As a result, I'm reinvesting some of it back into equities, despite my uncertainty.

For all of you who consistently live way below your means, investing larger sums of money as your net worth grows can become a mental challenge. However, once you focus on percentages, moving around large sums of money gets easier.

Below is the transaction activity in my rollover IRA where a $390,202 structured note matured on 9/10/21. I began buying the dip and redeploying capital on 9/20/21. Due to my uncertainty, I decided to buy in multiple tranches across multiple days.

Halfsies Is Congruent With Uncertainty

If you are unsure about an investment, but believe in its long-run potential, then going halfsies is a reasonable way to deploy capital. Selling or buying half the amount ensures that you are always participating and always hedged.

Let's look at things from a different perspective. Let's say you are up 100% on an investment and are unsure whether to take profits or ride it out. In the past, you've lost plenty of money by round-tripping an investment. Therefore, you decide to take profits on half your position.

Even if your winning position continues to go up over time, you won't feel terrible since you still have half your position gaining. You're just not winning as much as you could have. At the same time, you have new liquidity to diversify into other investments or spend it for immediate satisfaction.

If after buying or selling half your position, you find yourself upset with the outcome, then you were never perfectly unsure (50/50) in the first place. In such a scenario, you should work on better recognizing your true level of uncertainty so you can better invest accordingly.

At the end of the day, all we can really hope for is to align our beliefs with our actions. If you aren't taking actions based on your beliefs, then you're wasting time and energy.

Related posts about investing:

A Better Dollar-Cost Average Investment Strategy

Your Risk Tolerance Is A Delusion, Wait Until You Lose A Bunch Of Money

Reinvestment Ideas From An Expiring CD: Stay Conservative

Investment Ideas After Selling A Home For Big Bucks

Readers, if you are unsure about an investment, how do you approach it? Do you think most people don't have a solid grasp on their true risk tolerance? For more personal finance insights, join 50,000+ others and sign up for my free weekly newsletter.

Hey Sam, have you written any posts about tax-efficient strategies to invest in taxable brokerage accounts? I’m sure many of your readers who are striving to save a high percentage of their income would be interested in your lessons learned.

I like halfies. I’ve made so many mistakes. The worst one being seeing a stock you like and waiting for a dip to buy in. Then you watch it go higher and higher and it never come back down. Going halfway helps me take action.

My biggest mistake was in 2017. Sold 100 shares of MSFT @ 69$ thinking it was too expensive. I would have $30,000 today if I had not sold. :-(((

Thankfully, some of that money ended up into AAPL, GOOGL and TSLA. So I’m not too bad. But I would have preferred to have sold something else instead. In insight, that was a bad decision.

Since then, I always do halfies. If I sell something and it goes up +50% right after the sell, it’s still painful, but less so.

I try not to care too much about stocks volatility. I have had stocks that dropped -50% or more and ended up being 10-baggers after a couple of years. One example is Best Buy (from 11$ to 120$ – bought at 23$).

The math behind equity is that growth potential is “infinite” while maximum downside is “total loss of capital”). Since an average including “zeros” and “infinity” gives always a large number, a diversified portolio of equity has the potential to give outstanding results with limited loss potential.

So I try to buy stocks that I like. When they go down, I buy even more. Obviously, that is easier said than done.

I think BABA is a good company. I bought recently 50 shares @ 225$. Waiting to see what’s happening at the moment with China. I would be glad to double my position. But if it starts going higher now, I would be happy with the position I already have.

I hear you loud and clear regarding making so many mistakes. I have done the same, and I learned no matter how hard I try, I can’t get it right all the time, even close. Focusing on asset allocation that aligns with my response is the way I go.

I’m always impressed with people who can go all Lynn and swing for the fences most of the time. With the family to take care of and neither one of us having any jobs, play some premium on the value of our investments and passive income now.

I just don’t want to go back to work and missile on my Children’s early years.

Personally, I’m not impressed with people going all-in on an investment. This is a good recipe for failure. Those people will talk loudly about their moves when they were successful, but they will stay silent when they hit the wall and lose 75% of their net worth on an investment.

When you look at Warren Buffett, even him didn’t went all-in on Apple. Even if it was a big purchase, it was still a small portion of its total net worth ($36 billions investment on $350 billions shareholders’ equity – F/S 2018).

I prefer the slow and secure method of generating wealth. I try to stay away from “get-rich-quick” that can turn badly.

Did you consider replacing one of the two with QQQ?

Brought the highest yields in the last 10 years and i believe it’ll continue that way..

Not to mention the two above are high invested in tech (large-cap, at least, like MSFT, AAPL, AMZN, FB, TSLA, GOOGL), but comparing SPY with QQQ in the last 10 years you will see huge difference…

I have some QQQ and FTEC as well. The thing is, I’m already hugely overweight tact with large holdings in Google, Amazon, tesla, and Netflix. So I don’t need more QQQ exposure. I need more industrial exposure actually.

How about you

Heavy on QQQ (and a favourite sector of mine, in which i trust very much it’ll continue to grow for the next 10 years at least, Semiconductors – SOXX/SMH).

If i had to go all-in on a single stock for at least a decade, that’ll be MSFT (not AAPL, AMZN or TSLA!) – i believe they have the most balanced sheet, good management, various products of all of them; and MSFT beat SPY by large in the last 20-30 years…

also, i like to swing trade NVDA, AMD, ADBE, TSLA, GOOGL, NFLX and other large cap techs, and other sectors ETFs like XLE, XLB, XLY, XLU, XLRE, XLF.

i’m more of a trend investor, so long as they are above 200 days moving average, i remain invested, when it crosses under, it’s obvious a bear market that could continue to fall further…re-enter when above 200 again. ;)

You’ll always have some level of uncertainty. I’ll invest part in the investment (e.g., single stock) and most of the rest in an S&P500 or total market index fund. And I try to DCA, usually around the beginning of the month.

Sam: This China Evergrande thing will be bigger than Lehman. That company alone borrowed up to 3% of China’s GDP, and China real-estate sector is 30% of China’s GDP, unlike US it’s <10%. Their top 10 developers are all in the similar situation.

During 2008, US was able to bail out the economy by bailing out the banks, few developers went into bankruptcy. In China, it's not just just simply bailing out this or that developers, because their system is very different:

– home buyers pay developers in installments, not to banks, for homes that wont get built in 2-3 years!

– will you buy a home now, knowing the price will not go up for the next 10 years?

– if you're a bank, will you approve mortgages for homes that are yet to be built by EG, or any other developers?

– if you're a supplier to EG or any other developers, will you continue the work, or insist on getting paid immediately?

It's going to be a big mess.

Got it. What are you shorting or how are you positioned to take advantage?

I sold most of my Chinese stocks a few months ago when their government declared war on BABA, DIDI, Tencent. When PDD announced they’ll donate their next year profits, i thought that was insane and all China’s high-tech companies will eventually become non-profit or state-owned. There’re simply too much risks and uncertainties I don’t understand. I don’t know how to short China’s stock index, but maybe Tesla sales in China will tank soon? All their real-estate companies are already down to pennies. Shorting is very difficult and I never had any luck with that. I’d rather buy Tesla when it tank (if ever).

Hope not. I remain long Tesla. It’s funny, but I’m buying BIDU, BABA, and Tencent here. Just goes to show you there’s a market!

Sam, I wrote an interesting article recently about a good opportunity to buy into Tencent cheaper: cypherinvestor.com/naspers-npsny-stock-write-up-what-is-the-value-of-optionality/. I think you may find value in the name

I like the halfies approach and often utilize it in my long-term investment strategy–to certain extent. I say that because I tend to dollar cost average into my 100% over several tranches over time. I like your point on the flip side, whereby you can sell half your profit to take some capital off the table. Selling can be difficult (as even most professional investors find). I think this is prudent investing and is something I should think through more with my investments.

Fun article, I always enjoy your writing Sam. It’s an interesting proposition. One on hand you want to get the upside of a market that does well on average. On the other hand you want to keep the optionality of cash to your advantage. If it were me I’d invest it all, but I’m not in nearly the same financial situation as you. Interesting to think about, thanks!

Thanks for sharing that screenshot of your buying activity! I typically wait out the dips and only buy monthly on my kid’s birthday so it’s spread out through the year. But I’ve been getting major FOMO with all these dips. I like this idea of going halfsies. I decided to buy 1 share a day for now. That way I get my toes a little wet but not going all in!

I enjoyed this article, thanks Sam. Funny I actually did that recently but went slightly less than halfsies. I went thirdsies haha. I was inputting an order to buy some IVV and choked a bit and cut my initial order down to a third. I’m impressed with your discipline and patience to place all of those trades. Watching intraday charts would give me too much stress. I usually just look once, pull the trigger, and walk away.

Thanks for sharing so much of your investment insights and techniques!

Nice mean

4,350 is looking very dicey at the moment. But I feel good knowing that at least it’s lower than 4,500, when my notes exited.

I’m ready to leg in some more of the markets go much lower. There is no way the 10-year bond yield hits 2% this year. Even with 3 Fed Funds hikes over the next 2 years, the 10-year yield will probably stay around 2% or lower. Certainly not above 2.5%.

Let’s see let’s see!

Sam, I think the halfsies approach makes sense for those more risk averse. When investing large chunks of money, going halfsies over two dates and dollar-cost averaging into the market can make decisions palatable. I often recommended this to clients in my prior job who were nervous about the market. However, I personally prefer the all at once approach. If I am uncertain still, it means I am not ready to make an investment or a bet.

Yes, there are many things I am uncertain about so I consider myself relatively risk averse. Unlike in March 2020, when I was more certain it was a good buying opportunity, today not so much.

I don’t have the ability to go all-in on many decisions because I’ve made so many mistakes in my life, not just financial ones.

May I ask what is your normal investing amounts and the largest amounts you have had to invest before? And what are some tips or strategies were you have been able to develop the courage to go all in? How are you investing your money now and what is your asset allocation?

I find that as I get older, I get more risk-averse as well.

Sam

Sam,

Certainly! My regular investing sums that are automatically dollar-cost averaged with my income hovers in the low thousands. Most recently, I put $10k into the market at the start of this month, and last September, when I had a more considerable windfall, I put ~$80,000 in over the 1st through 20th. While technically spread out, I placed the orders consecutively and intentionally. So, I consider it all at once. It was nerve-racking and exciting, as is each time I invest in larger chunks. When going in all at once, my preference is to do it regularly over a multiple-day period to smooth out volatility and bid/ask spreads. Such endeavors are usually done in taxable accounts with ETFs.

Alas, I am not perfect. It took me sixty days to convince myself to go all in, but I eventually did and set a plan on how I would repeatedly do it (i.e., over three weeks in chunks). I try to make financial decisions objectively and logically, but this can be hard, given that investing is an emotional endeavor when it is your own money.

As to tips and tricks, statistically, time is on your side when you invest in big chunks rather than averaging it out over the long haul (one year or greater). Here is an article to a study confirming such:

cnbc.com/2021/08/12/which-investment-strategy-is-better-lump-sum-or-dollar-cost-averaging.html

The biggest takeaway I can preach is to not invest above your risk tolerance. If you do, you will be bound to have regrets and make poor decisions. While this is not advice, only educational, it is a good strategy for all things in life.

Your SEER strategy is an interesting take on this. I think it is an honest conversation people need to have before investing a penny and then regularly reevaluate, as the market is ever-changing.

I do semi-annual reviews on my portfolio and update my backtested portfolio models, determining if any changes are warranted. Currently, my portfolio is around these percentages:

20% REITs (index)

20% Small Cap Value (index)

20% International (index)

40% Domestic Large Cap (primarily index, with a small active allocation)

I do have a cash fund for emergencies, but I do not consider that part of my investing portfolio. When I have kids, my situation may change, but as it currently stands, my partner and I are happy with where we are. Risk is an interesting thing, and everyone perceives it differently. Additionally, my views are constantly evolving as life isn’t static, nor is our perception of the world around us.

If you wouldn’t mind sharing, what was your biggest mistake or series of errors that led to being more risk-averse?

Sidenote: I never seem to get notified of your replies on my comments, or to any for that matter. I do have notifications enabled for responses to my comments…

Olaf, the Mile High Finance Guy

How do you evaluate which index fund to buy? I see VTI and SPY in your list.

I also have both, and some others, but I can’t say there is a ton of reasons why!

Thanks for all your writing!

They are pretty much the same with similar low cost ratios. I’m just building on legacy positions from 10+ years already. I could easily just hold one.

Psychologically, if I buy one at a high point in the day, I will often switch to buy the other at a lower point. It’s all mental!

Thanks, good thoughts and that’s how I ended up with both too.

My brokerage switching to no commission (Schwab) has led to more options here vs the in house funds, which is ultimately great!