Are you trying to decide between a 30-year fixed rate mortgage loan or an adjustable rate mortgage (ARM)? My opinion is that a 30-year fixed mortgage loan is a suboptimal mortgage that will cost you extra money.

For most homeowners, getting a 7/1 ARM or 10/1 ARM is the better way to go. You will likely save more on mortgage interest expense if you do. Getting a fixed introductory rate of 7-10 years also better matches the likely duration you will own the home.

After taking out multiple mortgage types since 2003, getting an adjustable rate mortgage is cheaper and will save you more money over time. We've been in a declining interest rate environment since the 1980s. To pay more for a 30-year fixed mortgage loan is unnecessary.

Of course, inflation and mortgage rates zoomed higher during the pandemic. However, since 2022, interest rates have once again resumed their long-term downward trend. As a result, if you get an ARM right before massive rate hikes, there's no rush to pay down your ARM before it resets.

Banks Love 30-Year Fixed Mortgage Loans

One of the biggest secrets banks don't want you to know is that they make more money off larger and longer duration loans because they can charge a higher mortgage interest rate.

Banks take advantage of fear of the unknown by selling borrowers peace of mind. There's certainly value in knowing that over a 30-year period, your mortgage rate will never go up. However, there's something bank also don't want borrowers to know.

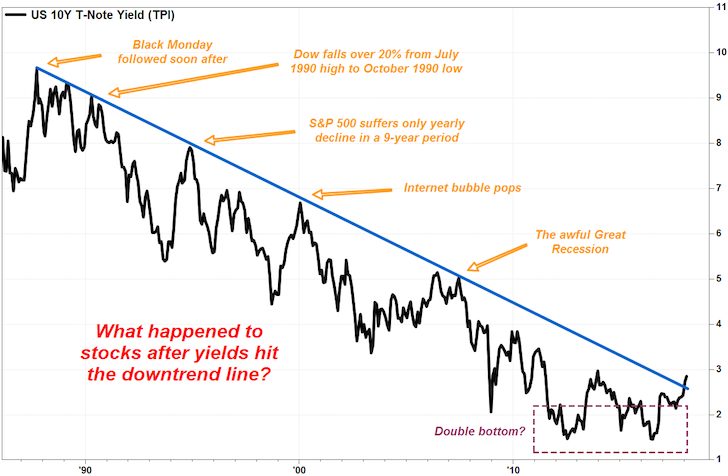

Interest rates have been coming down since the late 1980s as the Federal Reserve has become more efficient in managing economic cycles and the US has grown to the world standard for sovereign assets through the purchase of US treasury bonds.

From this simple chart, you will understand:

- The risk-free rate of return

- Expectations on interest rates

- Expectations on inflation

- Borrowing/credit costs

- Risk aversion, or lack thereof

- The health of the economy

That's right. By understanding what the latest 10-year treasury means, you will be able to save a lot of money, potentially make a lot of money, and stop being so fearful of the future.

Borrowing on the long end is a suboptimal use of funds. The people who are pushing you into 30-year fixed loans: 1) Are not economics majors or bond traders, but journalists and/or 2) Have a vested interest in you borrowing as long as possible so they can make as much money off you as possible.

The higher the rate, the easier it is for them to earn a wider spread. This means more profits.

Boost your income through real estate: Invest in real estate without the burden of a mortgage or maintenance with Fundrise. With over $3.2 billion in assets under management and 350,000+ investors, Fundrise specializes in residential and industrial real estate. I’ve personally invested $300,000 with Fundrise to generate more passive income. The investment minimum is only $10, so it's easy for everybody to dollar-cost average in and build exposure as mortgage rates decline and the economy continues to grow.

Why A 30-Year Fixed Mortgage Loan Is A Waste Of Money

Here are the reasons why I prefer most homeowners get a 7/1 or 10/1 adjustable-rate mortgage instead of a 30-year fixed-rate mortgage.

1) Upward sloping yield curve.

But, if you want to borrow money from me today, to pay back over the next 30 years, you better hell believe I'm going to charge you an interest rate above inflation to counteract inflation, make some money, and bake in some risk of default.

In other words, if you borrow at a 30-year fixed rate, you are borrowing at the most expensive part of the yield curve. Below is an example of a kinked yield curve, where there's a lot of value in borrowing at the 3-5-year fixed-duration mark. In general, the yield curve is upward sloping.

When the yield curve is inverted, it actually makes sense to borrow where the yield curve is lowest.

From the inverted yield curve below, you would strategically want to borrow with a 10-year fixed duration and buy one-year Treasury bonds. Here's a post on how to buy Treasury bonds and buying strategies.

2) Average homeownership duration is much shorter than 30 years.

First of all, the average duration one lives in and owns a home is about 12 years. If that's the case, what on earth are you doing borrowing a 30-year fixed rate mortgage for? A 17-year overestimation of ownership is a serious miscalculation based on the statistics at hand.

If you plan to live in your house for 10 years, take out a 10-year fixed-rate ARM that amortizes over 30 years. It is the most conservative loan duration. A 10-year ARM is cheaper than a 20 year or 30 year fixed rate. It is only logical that you match your mortgage fixed rate with your expected duration of stay.

Sure, you might stay longer, but you might also stay shorter as well. If you know you plan to stay in your house forever, it's more justifiable to take out a 30-year fixed, but I still wouldn't because 1) You will likely pay down your loan faster than 30 years, and 2) the spreads are unjustly high in this environment.

3) Adjustable rate loans have an interest rate cap.

People think, thanks to fear mongering by the media and mortgage officers, that once the adjustable rate loan period is over, your mortgage rate will skyrocket and make things super unaffordable.

This is not the case because everything is relative and rate adjustments are capped. I got a 7/1 ARM in 2020. In 2027, the maximum it can reset to is 4.125%. Whoopdee doo! After seven years, even if I don't pay any extra principal, my principal mortgage amount will be about 15% less. A 4.125% mortgage rate on a 15% lower principal amount is very digestible.

See: The Anatomy Of An Adjustable Rate Mortgage

4) If rates rocket higher, you will be OK because your house is likely appreciating.

Things don't happen in a vacuum. The 10-year yield is a reflection of inflation expectations. If the 10-year yield and mortgage rates are rising, that means inflation expectations for higher growth are also rising. You don't have inflation expectations going higher unless demand for real goods and services going higher.

Higher demand is a reflection of a stronger economy, and your real assets (property), by very definition or inflating. So what if inflation rises from 2% to 8.5% the year your ARM resets? There's usually a 2% cap. If your home is now inflating by 8.5%, you're making a big cash-on-cash return. Let's say you put 20% down. An 8.5% return is a 42.5% cash-on-cash return.

Real estate is one of the best asset classes to own in an inflationary environment. As we exit the pandemic, inflation will pick up, partly because there's been so much monetary stimulus. As a result, I've been buying rental properties and investing in real estate crowdfunding to ride this wave.

Not only will your house likely have appreciated during the fixed-rate period of your ARM, you will also have paid down a lot of principal loan. As a result, if your ARM does reset, the new payment won't be much higher, if at all.

5) Interest rates have been coming down for 40+ years.

Look at the historical 10-year treasury yield. Rates have gone down for 40 years in a row. Yes, there will be occasional inflation spikes mainly due to supply shocks, as we experienced in 2022 and 2023. However, you must look at the long-term trend. And the long-term trend is down-to-flat.

In these 40 years, we've become a much more efficient society who enacts monetary and fiscal policy in anticipation or with shorter lead times. I highly doubt there will be a 5-10 year continuous ramp in inflation. Therefore, your 7-10 year ARM will do you just fine.

Elevated inflation has proven to be transitory post-pandemic. Paying more in interest expense for a 30-year fixed rate mortgage is unnecessary. I don't regret getting an ARM during the pandemic. My 2.125% 7/1 ARM I got in 2020 expires at the end of 2027. By then, mortgage rates will have come back down from its initial spike in 2022 and early 2023.

What's fascinating is that despite interest rates coming down for so long, the percentage of loans that are adjustable is still quite small. We're talking less than 5% of all mortgage loans are adjustable rate mortgages. What a shame that so many homeowners with a mortgage paid a higher interest rate than they needed to for all these years.

What Is Your Peace Of Mind Worth?

Insurance salesmen and mortgage officers are very skilled at evoking fear. They will paint worst case scenarios of super inflation. They'll tell you about crushing payments so you can pay more money now than you should.

A 30-year fixed provides a great peace of mind that your payments will never go up. In fact, your real payments will actually go down over time given. The reason is because you will be paying back a fixed loan with ever depreciating dollars thanks to inflation.

The question is, at what price is this worth? The more you understand about how adjustable-rate mortgages work, the less worried you'll be about refinancing into one or taking out one. Even after the fastest and largest interest rate hike cycle in history, ARM holders will likely turn out fine.

If you have an adjustable-rate mortgage, there's no rush to pay down extra principal before the ARM resets. When the ARM does reset, your payment will likely be quite similar or even lower to what it once was.

Example Of Paying For Peace Of Mind

Let's say a 30-year fixed loan is currently around 4% vs. 2.625% for a 5/1 arm. Let's say you borrow $1 million. $1 million is the ideal mortgage amount. $1 million X 1.375% = $13,750 more in interest expense you will have to pay every year for the length of ownership.

If you own the home for 7 years, that's $96,250 more in interest expense you would have paid if you borrowed at 30 years. If interest rates stayed the same (not down as it has for the past 30 years), then you would have paid over $420,000 more in interest during the lifetime of the 30 year fixed loan! That is just ridiculous.

However, is your peace of mind worth $96,250 or $420,000? If you don't know the reality of economics and don't know your options, then go for a 30-year fixed.

The next time someone is hawking you a 30-year fixed ask them: 1) What their major was in college or grad school, 2) How many times have they refinanced before, 3) Quiz them on what the current 10-year treasury yield is, 4) Where was the 10-year treasury yield 10, 20, and 30 years ago, 5) If they are a homeowner, 6) How much more are they going to make off you.

An adjustable rate mortgage is the best type of mortgage to get for most people. Why pay more mortgage expense than you have to?

Big Difference Between Neg Am Loan And ARM

Please not there is a BIG difference between a negative amortization loan and a adjustable rate mortgage. A Neg Am loan causes your principal to grow larger every month because it is by definition, negatively amortizing. The Neg Am loan generally is only fixed for one year and a teaser low rate.

Hence, you have a lower than market rate + a payment that's based on a lower amount that gets added to the principal. This is where people get in trouble. People who have normal ARMs have not been getting in trouble. When their ARM floats, their rates are LOWER than when they first locked! Please understand this point.

Real Estate Recommendation

Don't have a down payment? Don't want the hassle of managing real estate? Need to keep your liquidity? Check out Fundrise, one of the largest and oldest real estate crowdsourcing companies.

Real estate is crucial for a diversified portfolio, and with Fundrise, you can invest flexibly across the country for the best returns. While cap rates in San Francisco and NYC are around 3%, they soar above 10% in the Midwest.

Explore Fundrise's residential real estate opportunities. With over $3.2 billion managed and 380,000+ investors, Fundrise makes real estate investment accessible and profitable. Sign up today!

Another private real estate platform to consider is CrowdStreet. Crowdstreet is a marketplace that mainly sources individual commercial real estate deals from various sponsors around the country. This way, you have more customization to build your own select private real estate portfolio.

Make sure you diversify your portfolio and do your due diligence on all the sponsors. Look up their track record, their management, and whether they have had any blowups before. Although CrowdStreet screens the deals, you have to do your screening as well.

Both platforms are sponsors of Financial Samurai and Financial Samurai is a six-figure investor in Fundrise funds. Our views about real estate are aligned and Fundrise is my favorite platform.

Financial Samurai was founded in 2009 and is one of the must trusted personal finance sites in the world with over 1 million pageviews a month. Sam has taken out both a 30-year fixed and an ARM over his 22 years investing in real estate. Join 60,000+ others and sign up for the free weekly Financial Samurai newsletter.

Hi Sam,

With the mortgage rates over 6%, are you planning to do an update to this post? I think it would be an interesting a post on how it seemed that the rates would be below 3% during our lifetime to the current increase, which few if any foresaw.

Keep up the good work and thanks for the information you provide.

Best,

L

I can update it. I am pretty confident mortgage rates will fade back down in 2023 and beyond inflation is coming back down.

Even if you got an arm in 2020-2021, it won’t rest for years. By the time it resets, mortgages rates will have come back down again.

Don’t think anybody thought the 30-year fixed would be below 3% for our lifetimes. But the magnitude of the rise in rates in 2022 was surprising.

Thanks Sam…I look forward to the updated post.

I have a dillema. Got a 30yr fixed rate at 2.55 that requires me to move my primary checking account to the lender (seems like a hassle. Also got a 10yr ARM at 2.375%, so less than 20bp spread.

Not sure if it’s worth doing the 10/1 ARM, we think there’s a 80% chance we’ll move within 10 yrs. The saving will be ~$2k a yr between those two loans. what would you do?

10Y ARM. If moving is a negative reason, even less reason to get a 30Y fixed.

Hi,

I am on a 30 year fixed at 2.5%. I have been offered a 7/1 ARM at 1.75%

Is it worth going to ARM, for a spread of 0.75% ?

Refi amount 600k, Current loan at 2.5% fixed is 1 year old and i have been in the house for 3 years now

I think so, especially if it is no cost.

It is clear that an ARM is superior. The one question I still have is if I should consider a 30 yr fixed if I plan to retire early and therefore wouldn’t have the same income to qualify for a refi at the end of my AR term (and don’t plan on paying off San Fran home before retiring). Would sufficient assets offset the lack of income for the underwriters?

I have the same question as BRog…it would be great to get Sam’s thoughts on assets vs. income that underwriters will look at to qualify for a new loan if you need to own the home beyond the ARM loan period. My guess at the answer is this: Your principal balance will be lower. You should be able to estimate your income (in my case two small pensions, Social Security, stock dividend income, and any side gig income) then factor in your estimated debt obligations to see if you might be over the 40-50% typical loan to value threshold.

Hi – great website!

Looking to do a jumbo loan. Trying to decide between a 30y fixed at 3.375% and a 10/1 ARM at 3.000%.

Realize they are both pretty good rates. Tempting to take advantage of the ARM, but we dont really plan to sell (ever?) and the spread between the 30y fixed and ARM isnt that dramatic.

Any thoughts appreciated!

Hi Bart,

I am shopping for a 30y fixed and 10/1 ARM, which lender are you working with? Those are great rates.

Hi Bart,

What is your peace of mind worth? In essence look at the additional cost of the fix mortgage as insurance cost. for peace of mind, you will be paying about 0.375% more but you sleep well at night knowing exactly what your payment will be for the next 30 years. Other factors i would look at will be your prepayment privileges which can make a serious impact on paying your mortgage faster. Making extra payments early in your mortgage life will make a significant impact down the road. Although your monthly payment is somewhat higher with the fix interest rate, it allow you the safety to plan ahead and to make sure that any extra income you have is there for you to use.

Hello, Can you please update this article for 2018???

It would be appreciated.

Thanks in advance for your insights :-)

Sure! The post is updated as of June 2018. Although rates have risen, my overall message has not changed. 30-year fixed is a waste of money.

Looking at buying our first home in Hawaii in 6 months or so. Fed is supposedly going to start unloading their massive balance sheet this month. Does this affect your position on ARMs ? If I understand correctly, shouldn’t this begin a steady increase in bond yields and mortgage rates?

Hi Sam! I have 3 30yr fixed mortgages!!

1st, about 20 yrs left is a rental 4.75% (300k)

2nd is a primary home for 4.50 (500k)

3rd is a vacation home 4.25% (300k)

Would appreciate any suggestions please

Hi – we live in the NY area, and looking to buy a property. Here is the info I got from one of the local banks: 30-year fixed at 3.75% Vs. 10/1 ARM at 3.125% for approx. $1MM loan. We plan to live in this house at least for 10-15 years till kids are off to college. Any advice?

7/1 arm for 3% for a home i will stay in for at least 15-20 years or FRM at 4.1255? Margin is 2/2/6. Can’t decide….. Payments are almost $250 less. i would like to think i would put that on the principle and more. $500k home with 10% down. Looking at a 30 year.

So rates have shot up in anticipation of the fed meeting. I’m stuck in the middle of it being in the market to buy a home now. Is 5/1, 7/1, still the smart play? I would assume there is a ceiling to this rate rising environment.

I have a 10/1 ARM expiring in May 2017 at 6%. In 2007 I never received a margin on my note, so I was a bit concerned. However, after reading your post it made me feel a little less worried. Should I refinance now or pay down the new reset for a while at the low libor rates? I will eventually sell or rent out the property, but for now will stay put for another year or two. Definitely signing up for your updates! Thank you!

Hi Angel,

You should do the math on the new rates and also check online with a mortgage lender like LendingTree to get competing bids to keep your bank honest.

You should read:

How Much Can My ARM Interest Rate Reset Higher After The Fixed Rate Period Is Over?

Refinancing With A Rise In LIBOR Rates

Thanks.

Do you still think ARM is a better way to go? Have your views changed with trump election?

I haven’t. The spread between the 30-year fixed and the 5/1 ARM is still wide enough where a borrower can save the difference. The median home ownership duration is 7 years. The difference in savings can be used to pay down principal. The hike in interest rates is concerning, but I don’t see it getting out of control. I expect the trend of lower interest rates for longer to continue.

See:

That’s amazing article and i’m in the middle of refinancing 30y fix mortgage on 4.25 vs 10y fixed at 3.25 with discount points – the difference is $365

I’m highly considering moving to the 10y as this is 2 bed house and I will definitely need 3 in future.

Smells like i’m moving to 10y.

Thanks for the insight and i’m subscribing!

Hi Sam,

I’m a first time homebuyer and completely confused and stressed. I came across your post and do understand and subscribe to the same view. Also, you have been proven right in the last few years.

However, the interest rates really is at an all time low now. I’m getting 3.125% 30-year fixed as a promotional rate and 2.75% as both the 5/1 ARM and 7/1 ARM. Since I’m in contract, I do need to go with one of the reputable lenders/agents who I can trust to close on time.

Since the difference is so low, what do you think ? People refinancing to a 30-year today are getting 3.5% while the ones refinancing a 5/1 or 7/1 ARM might be getting less than 2.5%, but for me the spread is less.

What do you think I should do

a) Lock in the best 30-year rate possible at 3.125% – goes against your overall suggestion

b) or go with the 7/1 ARM at 2.75% today with the intent of refinancing at a lower rate at the next opportunity I get hoping that the rates stay somewhat similar for the next few months. Then get into the same refinancing game as you have suggested.

Again, the reason for me asking this is the lower spread that I am being offered. In an post from a few years back, you have stated a comparison between a 4.0% 30-year fixed against a 2.625% 5/1 ARM, which was a much bigger spread.

Thanks,

StressedOutHomeBuyer

How did you get the promotional rate of 3.125%? That’s a great rate for a 30-year fixed and I would lock that in because you are right, the best normal folks can get is maybe 3.5% – 3.625%, and the best for 5/1 ARMs is around 2.5% e.g. 1% spread.

I’d g w/ 3.125% and be done w/ it. Make sure you live in the place for as long as possible! We are near or past the top of the cycle.

Related: The Inflation Interest Rate Paradox: Why We Must Continuously Invest

Hi Sam,

Thanks for the quick reply! That’s what I thought.

The rate was actually given to me by two different banks. The standard promotional rate is 3.25. The extra 0.125 is given if I move most of my remaining cash and stocks to that bank and have a $250k balance with them before the close of escrow.

I’m actually not sure if I’m going to be able to meet that balance – might run a little shy. So, if my rate turns out to be 3.25%, would you still suggest to lock it ? The 7/1 would be the same.

Another thought that I had when I read your article and noticed that the spread for first time buyers is less. This indicates that the banks want us to go for the 30-year fixed. Does that mean that the banks inherently think that the interest rates are not going to increase by a huge margin the next 30 years ?

Also, the plan is to keep the house for the long term. If we need to move, the effort would be to be able to keep this one as a rental property, if we’re able to afford it.

Hi Sam,

FYI, The banks offering me 3.25 (and 3.125 with that extra deposit by close of escrow) are Citi and BoA.

I just found from the loan document that the bank’s intention is to “service the loan through someone else” which means that they’re going to sell the loan. Should I be concerned about it ? If a different bank gave me the same rate (3.25) but lesser lender credit (approx 3k), but intends to service the loan themselves, is that better for peace of mind and/or bank service ?

Also, what do you think of my earlier questions ? About comparing 3.25 instead of 3.125 with the 7/1 ?

At what spread between the 7/1 ARM and 30-year fixed would you recommend going against your overall strategy and opting for the 30-year fixed ? Would that be 0.5 or maybe 0.75 ?

Don’t you think that the this low spread suggests that the rates are supposed to be at this current level for some time ? And could that mean that even with the small difference, it’s likely to still be beneficial to go with the 7/1 ARM in the current market, even though the savings would be considerably less than what you have suggested in the past based on earlier rates ?

Dear StressedOut,

Can I ask what you ended up doing? I am in a very similar situation: 30-FRM at 3.3% and 7/1-ARM at 2.7%. I don’t think it will be a forever home for me at all, but am thinking to rent it out in a few years. I am leaning towards ARM based on everything I read so far, but would love to hear what your final decision was and why.

My loan’s not closed yet so I have a chance to revisit this, but at the moment my plan is to go with the 30-year fixed.

I don’t think either is a bad option, but here’s what I compared:

– If I end up living here for 10-15+ years, 30 years is best because of the peace of mind. Going with 7/1 in this case could be good if you want to pay off the mortgage faster by paying more in principal for the next 7 years.

– If I end up moving in 7 years, and selling the house, then 7/1 is clearly the best. I do not plan this.

– If I move and rent this one then having a 30-year fixed is better. One of the benefits of a 7/1 is that you can keep refinancing to a lower rate when you get it. However, for a rental property (which it would become) the rates would be higher and would probably be much higher than the current 30-year fixed that we’re getting.

So my current decision is 3-year fixed. Would like to know what others think about it.

I guess it depends on the mortgage rates for each term. If you signed up for my private newsletter, you saw the notice that LIBOR is on fire right now. Therefore, I recommend all ARM holders who have less than 2 years left on their fixed rates refinance.

I say go w/ a 7/1 ARM if the rate is 0.25% or less higher than a 3/1 ARM.

This is my opinion below.

StressedOutHomeBuyer: I am in the same situation as you. I read all the advice here but I think there is a *big* assumption in going for a 7/1 ARM – that the refinance market will continue to stay open in future *and* appraisals will hold up as expected.

What if when you go to refinance rates are higher… or lending requirements are greater than now …. or, heaven-forbid, you lost your job… or you were renting your place out and now have to face a higher interest-rate anyway.

What if the market is in the middle of slow down? We are almost 8 years into the current up-cycle. There is a correction usually every 10 years. What if you are right that rates remain low but appraisals and home valuations do not. These two are not perfectly correlated.

Bottom line, you could be over-paying / under-optimizing if you took a 30 year and made the wrong bet against rates going up. But if you took a 7/1 and you are wrong you could be crushed. This is amplified in markets such as SF where people are pulling massive $1M+ mortgages.

I went with the 30 yr at 3.25% (extra 1/8th off for high credit score).

“Getting crushed” is probably an exaggeration. See: How much can an ARM interest rate go up after the fixed period is over?

There’s a cap per year and lifetime amount. Remember, after 7 years, you’ve paid off ~15% of the principal as well.

About to start construction on a new home (loan >1mm). Based on the logic from this article it seems like a no brainer.

One time close construction loan with 2.5% interest only during construction phase (up to 24 months, if necessary) then it rolls into permanent mortgage 7/1 arm on 30 yr am at 2.5%.

The amount of interest saved at 2.5% over the first 7 years is huge on a big loan. We can handle the payment risk and would probably refi again before it resets anyway. The principal is much lower when we refi also because we’ve been paying 2.5%.

I would assume you would agree with this logic Sam?

We’re actually selling/buying today.

Selling our 2br NYC apartment (with $340k appreciation in 5 years) which we had a 7/1 arm at 2.875%.

New house in nj will hopefully be our forever home but we still looked at adjustable mortgages. 5/1 arm was 2.75 but a 7/1 and 10/1 was 3.125 vs our 3.25 for the 30 year fixed. Maybe we don’t make it here more than ten years but the extra 1/8 (tax deductible of course) seemed incidental.

The real winner was 2.875 for the 15 year fixed. We sadly couldn’t make that work especially with a child in day care and hopefully a second one on the way soon.

What about a 15 year fixed as a compromise between a 5/1 ARM and a 30 year fixed? In my case, this would be for a 4 unit multifamily rental property

We have a rental that is appraised at $210,000. We have a first of $67,000 at 6.25%, 30 year fixed, started in 2002 and a second of $85,000 at 3.75% variable rate HELOC, 15 year started in 2015. Every time I look at the numbers of consolidating/refi…the closing costs are around $6,000. I am not sure how long we will keep the property, when the renters now move out it will probably need about $25,000 worth of work- it’s almost due for a roof and a bathroom upgrade.

Any thoughts? Be nice :) first time poster and I know that I am missing the light in this equation, thank you in advance for any suggestions!

A 5/1 ARM can be had for 2.5% nowadays. You just have to take your $6,000 cost and divide by your monthly interest savings. I recommend 2 years or less for break even.

Check out: All ARM Holders Should Refinance Today

Hello,

My question is probably not-uncommon; however, it is in that our local institution is offering us a fixed or 5/1 ARM for the same interest rate 3.875%. This purchase as been extremely difficult because the home we are interested in is over -priced for the rural community to live in. There has been difficultly in that there are NO comparable properties that have sold in the the last 12 months. The bank is willing to loan us if we put up 20% only under an ARM (conventional is completely out of the questions). We are okay with that but then what do we do in 5 years if we choose to try to refinance because of rising interest. Will we be in the same predicament when we got to refi and there are no comps? Do we risk the ARM? By the way we are scheduled to close next week. Any quick advise would be graciously appreciated!

Leslie

I think You will face the same issues in five years if you want to refi or sale.

I am 66 and retired. Sold my home in 2013 and have finally found a property to buy. I will put 25% down. I like the idea of a 7 or 10 year ARM. Good choice for someone like me?

[…] 3) The 10-year yield doesn’t fall or rise by as much as the Fed Funds rate. In other words, you probably don’t have to fear a large interest rate reset if your ARM mortgage expires. In fact, anybody taking an ARM mortgage over the past 30 years has seen their interest rates fall. Owning a 30-year fixed mortgage is a more expensive route. […]

[…] you have a traditional mortgage that pays down principal and interest, the mortgage “forces” you to save because you are forced to pay your mortgage every […]

Sam, I’m a faithful reader and agree with most of your posts, but I really think this topic needs more balance on your blog. By the way, I would have been super annoyed by the ignorant response of that “mortgage specialist” too! While ARMs might make sense for many people, I don’t think you give the fixed-rate mortgage (FRM) the credit it’s due. My argument is below, but first, in a feeble attempt to give my argument some more weight, here are my credentials: 1) I have worked in bond markets and housing finance for 11 years (NOT for a mortgage broker or lender), 2) I was an Econ major in undergrad and have a MBA 3) I have refinanced, 4) my job requires me to follow interest rates real-time, and I read financial history for fun, so I can tell you where a lot of markets were 10, 20, 30 years ago 5) I am a homeowner, 6) I don’t make any money from people going into a FRM versus an ARM.

Here are seven reasons why FRMs can be a great product for today’s borrowers:

1) The obvious one: the FRM provides payment certainty and stability. This can help with consumer budgeting and can reduce the likelihood of default through payment shocks. A rate increase from 2.625% to the 7.25% ARM cap may not be “very digestible” for the average American family! Let’s say Johnny Risk has a $200,000 mortgage balance with a 2.625% rate. His monthly payment is $803. At year 5, his rate resets to 7.25%, which increases his monthly payment by 60% to $1,277. The $473 payment increase equates to ~15% of his after-tax income (assuming he makes $50,000/yr). Just like your example, his principal is down 10% after 5 years, but it’s hardly a “whoopdee doo” scenario for Johnny.

2) While ARM borrowers have done much better since the 1980s, the 30-year FRM borrowers who locked rates in the 1950s were better off. The Federal Funds increased from 1% in the mid-1950s to 19% by the early 1980s. No one can predict exactly what interest rates will do in the future. However, the longer the Federal Reserve remains accommodative (keeps rates lower), the higher the likelihood of higher rates in the future. In a more normal economy, the Federal Reserve forecasts rates to rise by 2-4%. If rates rocket even higher because of a stronger economy, you’ll be celebrating even more with a 30-year FRM. The FRM is a nice inflation hedge

3) As you know, the yield curve is not always upward slowing. In 2000 and 2005, it inverted, which usually happens when the Fed raises rates. So, borrowing on the long-end is not always a suboptimal use of funds.

4) To your point about mortgage officers pushing people to get as long a fixed rate mortgage as possible. Lenders actually charge higher margin on ARMs, meaning they make more on them. Part of the housing boom leading up to 2007 was due to lenders pushing tons of people into ARMS. In 2006, ARMs made up ~25% of mortgage applications compared to 7% today. I do think there is some truth to lenders pushing more fixed rate product today, but that’s because the FRMs are simpler to originate than ARMs. Also, if bankers/lenders find FRMs so profitable, why are almost all FRMs (over 80% of origination) sold to and backed by the government or government sponsored enterprises like Fannie Mae and Freddie Mac? The government subsidizes that FRM rate.

5) The FRM borrower has protection against lower rates because he/she can refinance into a lower rate with no pre-payment penalty. Yes, I know it’s not an entirely free option (due to closing costs), but you should be able to take advantage of lower rates if you’re financially responsible and keep 3-6 months’ worth of expenses in your bank account. With an ARM, there is no protection against higher rates.

6) Long-term interest rates are at all-time lows. Sophisticated CFOs at firms like Apple and AT&T are taking advantage of the borrowing at low long-term rates. Why shouldn’t you?

7) You said you pay $13,750 more in interest per year in a 2.625% ARM versus a 4% 30y FRM. However, adjusting for the mortgage interest tax deduction, it’s ~$5,300 lower than that figure. Moreover, you say you pay $420,000 more in interest during the 30 year life of the loan, but factoring in the time value of money, the present value of that interest difference is ~$237,000 (discounting at 4%). So, almost half as bad as the picture you paint.

I love my 30-year mortgage. It’s locked at a rate of 3.375%, allowing me to leverage up at an after tax borrowing rate of 2.35%. Unless the global economy goes into a very, very dark place, the money I’m investing instead of putting towards my mortgage principal has a really low hurdle rate. Also, with some wage inflation, my fixed monthly payment will get easier and easier over time. Here are two reputable financial professionals who discuss the merits of a FRM, one young, one old.

Ben Carlson –

Ric Edelman – https://www.edelmanfinancial.com/education-center/articles/1/11-great-reasons-to-carry-a-big-long-mortgage

Thank you for your rebuttal and detailed analysis.

The question I always ask people is this: after 34 years of declining rates, why do you think now is the rear where rates rocket? And if rates rocket higher, your assets and income are also rocketing higher.

3.375% is a great 30-year fixed rate. One of the best I’ve seen. But I prefer my 2.5% ARM I got be id rather pay less guaranteed up front.

The average homeownership is 7 years. The average person doesn’t take 30 years to pay off a loan either. To take a 30 year and actually pay the higher interest for 30 years in a row is not a wise use of money.

Will you be paying for 30 years?

Not sure if this is the year that rates sky-rocket. I can make just as many, if not more arguments, for the 10y Treasury dropping even over the next year. One of my arguments for lower long-term rates would be a rise in short-term rates, leading to a flatter yield curve. This makes the FRM trade look better than the ARM trade. Also, your assets will not necessarily sky rocket higher if rates sky rocket higher – historical data shows that when inflation is too high, the market starts to worry about growth and the loss of purchasing power. It’s all about your personal risk tolerance and ability to absorb payment shocks.

My whole point is that it’s not fair to knock the FRM so much. Everyone’s financial situation is unique and no one can predict the future.

Do I plan to stay in my home for 30 years? I certainly hope so but I have no idea. Once you factor in the all-in cost of ownership versus renting, you probably shouldn’t buy if you don’t plan to stay there for at least 5 years. What if I decide to stay for 12 years instead of 5? Today, neither you nor I can say whether or not the ARM is better in this situation. That’s absolutely impossible. However, we can say for certain that my risk is highly reduced with the FRM, especially if I decide to stay longer.

Lastly, I’d argue that levering up and paying interest for 30 years is wise if the return on your investments is higher. This decision looks even wiser if short-end interest rates move higher over those 30 years.

Yes, starting from this point on, nobody knows for sure whether and if or when rates will rocket. But I’ve run this site for 6 years, and have been encouraging people to not waste money on a 30-year fixed during this time period, and I’ve been right. Before I started this site, I had endless discussions with clients in finance since 2001 with the same advice, which means I’ve been right for the past 14 years.

And today, I’m still telling people in the year 2015 that they are much better off taking out a 5/1 ARM than a 30-year fixed if they want to save money. Only time will tell. And people are free to do as they wish. Everybody does have different comfort levels, and that’s fine.

Let’s check back in 5 years!

Related: How To Profit In A Rising Rate Environment

It’s March 2, 2016. The 10-year yield has declined again to 1.8%, and was at 1.6% in February.

If you have a 30-year fixed, you are once again, paying too much interest. When will people realize that interest rates will be lower for longer? We are experiencing a deflationary environment around the world. See Japan and several parts of Europe?

1-year LIBOR, used for your ARM resets, has risen from 0.53% in June 2014 to 1.18% today, with little inflation over that time.

Yes, gun to my head, 10-year rates will likely be lower rather than higher going forward. But, choosing a mortgage is not about making interest rate calls, especially for those that don’t have material wealth. It’s about assessing one’s risk and understanding of the product.

Paying too much is all relative. I locked in a rate of 3.375% for a 30-year mortgage last year. That equates to 1.25% and 0.50% above what the U.S. government paid for 10-year and 30-year maturities in 2015. I may be crazy, but I think it’s hard to argue that I’m paying too much interest, especially when you factor in my option to refi! That option is worth something so my true spread to the Treasury is even lower than the ones mentioned above.

Exactly. Everything is relative. To me, and many other ARM holders, paying 3.375% is too much when you can pay 2.375%, which is what I’ve recently locked. If you’re happy paying 3.375%, that’s all that matters. We all try and justify our financial decisions and it is totally fine if you want to pay more since that’s what makes you happy.

LIBOR has risen too much based on what the Fed Funds has done, and what global interest rates are doing and will come back down IMO. ARM holders won’t suffer if they refinance. And even if they let it adjust, they’ll pay the same rate as you of 3.375% after paying much lower rates for the duration of their fixed ARM.

It is awesome that banks have subsidized borrowers by offering a lower rate with ARMs. For 13 years, I’ve had ARMs on multiple properties and couldn’t be happier. Even just one $1M mortgage at a 1%-1.5% lower rate equals $10,000 – $15,000 less interest a year. Multiply by 13 years and that’s $130,000 – $195,000 in savings.

Feel free to revisit this post in a year and tell me where the 10-year bond yield is and corresponding ARM rates. I’m pretty sure they’ll continue to be low like every year I’ve been encouraging people to borrow on the shorter end.

Can you share what you do now, how long you’ve had your mortgage and home, and anything else you want to share financially so I can get a better perspective? Thx!

Can’t argue with your savings. It’s great to borrow at a lower rate. The massive savings the wealthy get on the $1M mortgage is awesome! I’m not trying to dispute who is better off today…of course the ARM borrower is. What I’m disputing is that borrowing through an ARM does not come without risk. It’s important for everyone to understand this, especially those that are not financially savvy enough to monitor interest rates and refi before LIBOR sets higher. Yes, if they let it adjust, they’ll pay the same rate as me today, 3.375%, almost 1% higher than their initial rate…hopefully, the average person budgeted for this and hopefully, LIBOR doesn’t continue to tick higher as it has. Higher rates continue to be a tail risk, but it is a risk. My advice: if you are wealthy and can absorb the payment shocks, you should be ARMing all the time, just like you are! If a 1%, 2%, 3% shock is something your budget can’t handle, you should put a little more thought into it.

Sam, see the Switzerland chart on page 40:

https://www.bis.org/publ/qtrpdf/r_qt1603.pdf

So many new things to think about in a world where trillions of sovereign debt carry negative rates.

Sam,

I am at a dilemma. I used to work in mortgages and bought my first home in February of 2013, when we were at the lowest point of mortgage rates. I consider myself an opportunist. The only thing is my 3.5% 30 year fixed has PMI over 150$/mo which is insane to me. I have been doing some research and am very interested in a 5/1 ARM so I can also get rid of my PMI as my home value has increased substantially since purchase. Do you feel it is worth giving up an amazing 30 yr fixed rate to pay down principal faster with the risk of rates rising in the future?

I feel rates overall would not rise more than 5.5% as this will significantly decrease future homebuyers interest, therefore negatively impacting the economy. Yes I understand that 5.5% is significantly low compared to historical rates, but back in those days gas was less than 1$ a gallon. We are in a changed world. What are your thoughts to my dilemma?? Thanks so much, I really enjoy your articles.

Tom

I’m not making any predictions where interest rates are going – because no one can predict the future. You can make arguments for rates to go either way – but it boils down to this:

With a fixed rate mortgage – if rates drop – you can refi. If rates go up, your cost is fixed. All the risk is transferred onto the lender – which is why banks try to get the vast majority of these loans off their books as soon as the ink is dry!

With an ARM – if rates stay flat or drop – you save on interest vs. a fixed rate loan. If rates go up, your costs will go up – the question is how much. Look at the last 30 years of interest rates to see how much things can change in 30 years.

Everything boils down to one question – can your budget handle higher rates? What if rates double? What if rates triple? Do you have a flexible budget that could handle these scenarios? Or do you have little wiggle room?

ARMs are particularly attractive for people on tight budgets because they see that lower payment – meanwhile – those are the same types of people that will get crushed if rates go against them. Don’t expose yourself to risks that you can’t handle.