Trump's middle class tax hike affected millions of Americans. This article was written to help prepare for Trump's middle class tax hike. Now that Trump is no longer President doesn't mean his middle class tax hike isn't here. The Tax Cut And Jobs Act Lasts until 2025.

With Joe Biden as President, taxes shouldn't go up for the middle class, only the top 2% making over $400,000 a year. However, it's too soon to tell what's going to happen.

How To Prepare For Trump's Middle Class Tax Hike

Higher interest rates are already a tax on consumers through higher mortgage rates, higher student loan rates and higher consumer loan rates. Is the economy strong enough to withstand a sudden ~30% increase in borrowing costs? Hopefully yes, since the actual rate we pay takes time to adjust higher, e.g. 5 years for a new 5/1 ARM to adjust.

Given the market determines rates, we can't fully blame Donald for making borrowing more expensive for everybody. But what about Donald Trump's plan to increase taxes on the middle class? Let's learn what's going on here and help find solutions for millions of Americans who are increasingly getting squeezed.

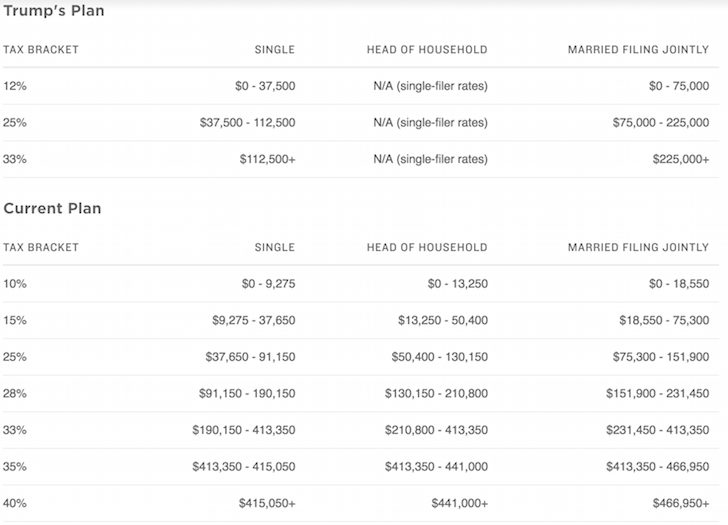

Below is a comparison on Trump's PROPOSED tax plan versus the current plan. Can you spot the tax hike?

Individuals who make $112,500 – $190,150 will see their federal marginal income tax rate go up by 5%, from 28% to 33%. The closer you are to making $190,150 as an individual, I estimate the closer you are to paying ~$3,000 more in federal income taxes.

The math is simply $190,150 – $112,500 = $77,650 in income now taxed 5% higher at 33% rather than 28%. Therefore, $77,650 X 5% = $3,882.50 more in taxes.

However, due to the the tax cut for income between $9,275 – $37,650 (15% to 12%) under Trump's plan, you get a savings of about $851.25. Therefore, the Modified Adjusted Gross Income after deductions that is subject to taxes really is between $130,000 – $190,150.

Some of you might be thinking $112,500 – $190,500 isn't a middle class individual income, but I absolutely believe it is for 50% of the country who live in expensive coastal cities and other large cities such as Denver and Chicago.

If we believe we shouldn't responsibly spend much more than 3X our gross annual income on a home, then all an individual earning $112,500 – $190,150 can afford is a $337,500 – $570,450 home.

With the median home price over $1M in SF and NYC, you've got to earn closer to $330,000 just to buy something mediocre! Even with a $190,150 salary, you can barely afford the median $505,000 Boston home. You're certainly stretching to afford a $594,600 median home in Seattle as well.

The Democratic rhetoric has recently been that any individual who makes over $200,000 is deemed rich and should be subjected to higher taxes. The Republican party rhetoric has recently defined individuals who make over $400,000 to be rich. Therefore, it is baffling there is a 5% marginal tax hike for those individuals who make essentially HALF these amounts.

Half of $200,000 (Democratic rich) – $400,000 (Republican rich) = $100,000 – $200,000. Half = middle. Middle = middle class. Why is the middle getting penalized?

Why The Tax Hike?

I'm not sure why Trump wants to raise taxes on the middle class. It's good to hear he plans to abolish the Alternative Minimum Tax (AMT) and the 3.8% Net Investment Income tax on individuals/couples who make more than $200,000/$250,000. But those benefits accrue mostly to individuals who make more than $190,150.

It's nice Trump doubled the estate exclusion limit (death tax) for individuals to $11.4 for 2019. Getting taxed again after you already paid taxes on your wealth sounds like robbery. But given most of us don't plan to die within 4-8 years, any changes to the death tax don't really matter because they'll surely be changed again.

A 5% tax hike on the middle class and a 6.4% tax decrease on the top 1% income earners who make over $415,050 is not helping the majority of people keep their hard earned money. In fact, it's estimated that the top 1% will enjoy ~50% of all the tax benefits.

Related: How To Live Like The Top 1% Without Being In The Top 1%

Why aren't more middle class people upset about this tax hike? Is it possible that most people making between $112,500 – $190,500 are simply unaware they will be paying more a year in taxes? Or maybe the middle class is actually doing just fine and is happy to pay higher taxes? You tell me savvy readers.

After surveying more than 25,000 of you, more than 45% make over $100,000 a year and will likely be paying more taxes.

Below is a realistic budget for a single father with a child. He works at Mega Corp and will see his year-end money buffer decline to only ~$2,000 a year after paying ~$3,700 more in income taxes under the new Trump tax plan. One miscellaneous expense or mishap and he's in the red.

Below is a more complicated example of a single mother with two children earning $200,000. She saves 15% of her gross annual income a year through her Solo 401k. Her biggest expenses are childcare assistance and healthcare, which is spiraling out of control for those who have to pay 100% of the monthly premium. I've estimated her effective tax rate goes up by 3% after Trump's tax hike, leaving her in the red each month.

Before you complain about the accuracy of the numbers, they are just rough estimates. Each person has different deductions allotted to them. The bottom line in that the closer you get to $190,150, the closer you will pay the $3,882 in increased taxes. The 3% tax savings on income between $9,250 – $37,650 is only $852. If you want to save on taxes, you really shouldn't make more than ~$130,000 per person.

The Solution To Lowering Your Taxes

If you are one of the millions of Americans who is facing an impending 5% federal income tax hike, your solution is to get married and make no more than an modified adjusted gross income of $225,000 combined. This way, you can keep on paying a 25% federal marginal income tax rate and benefit by paying 3% less than the existing system on income between $151,900 – $225,000.

Under the current tax plan, household income between $151,900 – $231,450 is taxed at a 28% federal marginal income tax rate.

Here are some sample marriage income combinations for the perfect tax minimization solution:

1) Stay At Home Spouse

Spouse 1: $225,000 income

Spouse 2: $0

2) Two Professionals Who Met At Work

Spouse 1: $115,000

Spouse 2: $110,000

3) Public School Teacher And Private Industry Professional

Spouse 1: $55,000

Spouse 2: $170,000

Of course, you can make more than $225,000 by the amount equivalent to your mortgage interest deduction and property taxes. If you run your own business, you can make more than $225,000 by the amount equivalent to your expense deductions.

The key is to not stay single. It's bad enough you've got to compete with DINKS, and DINKS + their parent's money to buy a home or pay for other big ticket items. To add on higher borrowing costs and pay higher taxes is just too cruel.

Related: When Does the Marriage Penalty Tax Kick In?

My Solution To Paying Less In Taxes

As an individual, I've either got to kill myself to try and make as much as possible over $415,050 to take advantage of the new 33% marginal federal income tax rate. Or, I've got to limit my individual adjustable gross income to $112,500 to pay a reasonable 25% marginal federal income tax rate.

Which is harder to do?

The Strategy For Making Less

Because ~70% of my traffic on Financial Samurai is from search engines like Google, the traffic is very passive. In other words, if I do nothing all year my online income would still be greater than $112,500, the individual income level where taxes go up from 28% to 33%. Passive income is one of the beauties of having an online asset. I just write a lot because it's fun and there's always something interesting going on to learn about.

I could sell all my dividend paying stocks and hold cash, but that still leaves about $200,000 in passive income that cannot be reduced immediately because there's an early withdrawal penalty for CDs, tenants with signed leases, and private investments with multi-year commitments.

One solution is to just sell Financial Samurai once new tax legislation passes and call it a nice eight-year run. That way, I'll have no more taxable online income. Let's say I can sell Financial Samurai for $10,000,000 after taxes. I can just hoard cash earning 0.2%, which equates to $20,000 a year. $20,000 + $180,000 in passive income = $200,000. I can then deduct about $40,000 in property taxes and mortgage interest from my primary residence to get to a $160,000 taxable income.

As time passes, I can slowly convert all passive income assets to cash, thereby further lowering my income. Paying taxes on <$160,000 equates to about a 26% effective marginal federal tax rate under the new plan. Not too unreasonable, especially if I can just plunder my cash to live.

Of course, I can actively give money away to reduce my taxable income further while helping other people in the process.

Related: Focus On Building Your Net Worth More Than Growing Your Income

The Strategy For Making More

Making a lot more than $415,000 is not easy. But it's possible with some planning and extra labor.

1) Don't sell Financial Samurai, but continue to grow it. Minimum $150,000 income.

2) Keep passive income portfolio as it is. Minimum $200,000 income.

3) Do more corporate consulting. Minimum $120,000 income.

4) Do more 1X1 personal finance consulting. Minimum $30,000 income.

5) Get a J.O.B. Minimum $150,000 income.

Total baseline income = $650,000

Unfortunately, doing 3, 4, and 5 will require an extra ~50 hours a week, which means my total weekly work hours would sky rocket to 70+. I'll also gain weight, get stressed, start getting gray hairs again and be more bitter at the world.

The tax savings from making $650,000 would equal ($650,000 – $415,000) X 6.4% = $15,040. When I put it this way, working an extra 50+ hours a week to “save” $15,040 in taxes doesn't seem worth it at all! Further, at $650,000, I'll have to pay 13.3% California State taxes instead of “only” 10% on income up to $250,000.

The reality is, if my baseline income is $350,000 ($200K passive + $150K online income) for ~20 hours a week and I add 50 hours a week to get to $650,000, I'm really paying ($650,000 – $350,000) X 33% = $99,000 more in federal income taxes. It's the whole “buy more save more” mental scam. Given I'm already paying over $100,000 a year in total taxes, paying another $99,000 a year in federal taxes + another $53,200 in state taxes would actually start to piss me off.

It seems like highway robbery to have to pay over $250,000 a year in taxes when you're killing yourself and not using massive public resources. And for what? To one day live a better life that's more free and less stressful? I'd rather just kick back, pay less in taxes, and be free right now! After all, happiness does not increase with an income over $250,000 a year.

Obvious decision made: It's much better to go the easier route by making less money to pay less taxes and live more freely. I believe in enjoying life to the maximum because I'll never be able to make another minute of time. I know plenty of deca-millionaires who are no happier than an average person still looking to save for retirement.

For those who object to going the easier route, answer me this: Are you willing to work 50+ more hours a week to try and make $300,000 more just so you can pay $100,000 more in taxes? If not, then you've caught yourself in an incongruent state of mind.

Latest Marginal Income Tax Rates

Here is are the latest Federal marginal income tax brackets to understand a future tax hike. Thankfully, they aren't as punitive as first proposed. That said, there have been plenty of reports saying those who earned between $60,000 – $150,000 in 2018 are paying more in taxes.

The good thing about the latest tax brackets is that it essentially eliminates the marriage penalty tax for singles who make up to $300,000 a year and decide to marry.

Middle Class Americans, STAND STRONG!

Being middle class is the best class in the world. But we're now getting squeezed by higher taxes and higher interest rates. First the government wanted to raise taxes on those making over $400,000 a year. Then they went after individuals making over $200,000 a year. Now they're going after folks making even less. See the pattern?

Eventually, the government will come for us all. Everybody needs to make some pro forma calculations of their annual total income and decide how hard or how smart you want to work.

The only beneficiary of higher interest rates and higher taxes I can think of are those who take advantage of higher savings and short-term CD and bond rates.

If you aren't maxing out your 401k, definitely start doing so ASAP to shield as much income as possible from the impending tax hike. You'll be amazed at how much you can accumulate if you stick to the program. Max out for 10 years in a row and you should easily have over $200,000 for retirement.

Wealth Building Recommendation

Manage Your Money In One Place: Sign up for Personal Capital, the web's #1 free wealth management tool to get a better handle on your finances. In addition to better money oversight, you can run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. Definitely check to see how your finances are shaping up as it's free.

I've been using Personal Capital since 2012 and have seen my net worth skyrocket during this time thanks to better money management.

Updated for 2021. Trump's tax plan hurt coastal city income earners the most due to the SALT deduction cap of $10,000. However, with President Biden, there could be a SALT cap repeal, which would help expensive city residents. Just watch out for the income tax hike and capital gains tax hike.

The secret to not paying more taxes is to get married? Hah. That’s a good one. Even though current tax law fixed some of the marriage penalty it’s still very there. You even noted if you earn $200k as single you are subject to 3.8% cap gains tax but if you are married you can only earn $175k per person! So you pay 3.8k more on 50k if you are married. If you make over $500k (which is very possible at middle class in coastal city), your partner has little incentive to work as their income will be taxed higher. I don’t understand marriage tax rates at all. All taxes should consider everyone individually!

Well here we are in 2020 tax season…. Just like many who have spoken out. My son who I have claimed as a dependent joined the military, therefore I can no longer claim him. My taxes went from getting a tax return to owing taxes. This is huge for me because I am a single father and the difference was $6000. I am completely at a loss as to how our tax laws are still gouging the middle class worker who busts their asses off to make a living…. When will our lawmakers STOP giving our hard earned money to foreign countries and look at the monetary crisis right here in the USA…..

Man, that seems wrong. Hopefully it is an error and you can get that $6,000 difference down.

Seems like tough times are back again with the stock market melting down and the coronavirus slowing the economy.

Hang tough folks!

We just did our taxes and I instantly took to google because I didn’t know what was going on! This new tax law has hit us hard! We made 137,000 combined which is not rich at all, but we owe 2,000 in Federal. My daughter graduates college this year so next year will be even worse. My wife and I both claim 1, but will now go to 0 and possibly still not break even!

Worst is the SALT Credit. If my wife and I were divorced and filed separately we would both get the credit, but since we are married we get 10,000 combined? What a way to promote the sanctity of marriage. The Tax law is broken and needs fixed!

My wife and I are not rich. We busted our ass to raise two great kids. We have never had a handout and for years I worked two jobs. I understand there grown now, and we lose those deductions, but to get a double whammy by this new tax law is upsetting to say the least!

Thank you for you great article. I know it’s a older write, but you predicted the future! I never thought I needed a financial adviser at our income but I will get one now because they are after all our money, and not just the rich guys!

Just did my taxes and have to pay about $1,000 more on virtually the same fixed income. Retired with social security and annuity income. Married filing jointly 2017 about $75,000 income, $23,000 itemized deductions(mostly health expenses and premiums) and paid about $3,400 in fed taxes. Same circumstances in 2018 as far as income and deductions (new standard deduction was used as it was a bit higher) but because of the loss of the two personal exemptions my new fed tax is $4,350. Thanks for the tax rate cut as it would have been worse.

You may want to add to your examples that anyone who had itemized deductions between $16,000 and $24,000 will pay more taxes on the same income despite the higher standard deduction-it does NOT make up for the loss of the $8200 personal deductions for my wife and I.

Wished that I had read this article back when the new law was enacted. I was hit with the double whammy of less withholding and loss of deductions, including SALT, and Education expenses. My wife and I have a combined income of $175K (which puts us at 24%) and are paying $5000 more in tax for 2018. I’ve already taken steps to decrease my allowances and increase contributions to my tax-deferred retirement plan. I’m still contributing to charities but this has got to affect charitable giving.

I didn’t even vote for the guy wonder how some of supporters feel about him now.

I think the income examples forgot a couple of things on the tax side of things.

Childcare FSA

Health FSA

Health insurance deductions/healthcare deduction % of gross income

Mortgage interest deductions

Property taxes etc.

It doesn’t refute the main point though, but it does change the numbers a bit.

My tax liability went up $500. My son’s went up $12,000. Thanks for nothing, Mr. Trump!

My tax burden went up almost 20%, From 14K in 2017 to 17.5K in 2018. Everything was same, but i lost 21K in deductions. Thanks Trump, you orange clown. Look, everyone with a modicum of intelligence knew the middle class was getting screwed to pay for trumps buddie’s tax gift, i just hope the “normal” republicans who think Dems just want to tax them so they vote R, i hope this tax increase wakes them up.

Losing deductions is a slap in the face for my husband and myself. I may not even vote this next election what does it matter, Trumps tax plan is a farce and what the Dems proposed seemed on the surface worse but the final outcome may have been better. We are also paying much more in taxes and see no end. We might be better off to rent not own and work minimum wage that way we could pay our bills. We get NO breaks full price for our kids college, now that they are grown a child tax credit doesn’t help. We are not in any position to retire especially not now. This stinks!!! Retirement in another country maybe?

Currently, I am a stay at home spouse with a spouse that earns $40,500 annually.

We reduced the items claimed on the tax form to 0, and still have to pay in.

According to the guide lines from the IRS an income at $40,000 is taxed at 22%.

How do they arrive at this number, when you are saying we should only be taxed at 15%?

Are those brackets and %s correct in the article?? I thought it was 10%, 12%, 22%, 24% 32%, 35% and 37%?

Single

Tax rate Taxable income bracket Tax owed

10% $0 to $9,525 10% of taxable income

12% $9,526 to $38,700 $952.50 plus 12% of the amount over $9,525

22% $38,701 to $82,500 $4,453.50 plus 22% of the amount over $38,700

24% $82,501 to $157,500 $14,089.50 plus 24% of the amount over $82,500

32% $157,501 to $200,000 $32,089.50 plus 32% of the amount over $157,500

35% $200,001 to $500,000 $45,689.50 plus 35% of the amount over $200,000

37% $500,001 or more $150,689.50 plus 37% of the amount over $500,000

Married filed jointly?

10% $0 to $19,050 10% of taxable income

12% $19,051 to $77,400 $1,905 plus 12% of the amount over $19,050

22% $77,401 to $165,000 $8,907 plus 22% of the amount over $77,400

24% $165,001 to $315,000 $28,179 plus 24% of the amount over $165,000

32% $315,001 to $400,000 $64,179 plus 32% of the amount over $315,000

35% $400,001 to $600,000 $91,379 plus 35% of the amount over $400,000

37% $600,001 or more $161,379 plus 37% of the amount over $600,000

I can’t really feel bad for those who voted for trump and now have to pay more taxes. I feel bad for myself because I’m caught up in that. I hope by 2020 the democrats will grow a spine and revert EVERYTHING that trump has made.

My husband made 20K less in 2018 than 2017 yet our refund is much less this year under Trump’s “tax reform”. I see they are robbing from the lower middle class with no child dependants to give the new double rate to all the welfare and anchor babies. Robbing from the lower middle class to give to the poor entitled losers who refuse to work and to the top 1% in tax cuts. THIS IS INFURIATING

Here in MD, if you itemize, the new tax law will likely have you picking standard deduction, which is a loss for us from previous years, especially since this year we bought a new house (high interest payments by 4x previous).

Middle class person here. I checked the updated tax bill, and I’d come out ahead from it by a lot! Most people will get a tax decrease here, I’m pretty excited.

Thank you for saying something positive

single; no kids; 2 properties in a high tax state; high income tax. I am being robbed

by this new tax. 12K is nothing. I want to live in a cardboard box by the side of the road

or just go to jail for noncompliance. :(

Seems like the latest bill negates this, and everyone gets a tax reduction for an equivalent taxable income.

Of course, those who itemize are unlikely to have an equivalent taxable income. It seems clear that all of those who live in california and have enough mortgage interest and property taxes to justify itemize will get a tax hike under the latest proposal (due to loss of state tax deduction).

Those who earn $12,000 single or $24,000 married pay $0 taxes under Trump’s plan. So it has a positive impact for low income earners. So this changes nearly everything and makes most of your assumptions wrong.

That is great right?

Why shouldn’t the super wealthy do their part since they are usually the greatest polluters with private jets, gas guzzlers and huge homes that produce children that do the same while manipulating our elections and laws for their own benefit! We need to keep the estate tax to even out the damage they do to our Country and planet! As far as home values/expense/mortgage payment to income ratio don’t tell the facts!1st $150,000@$650 home with $100,000@$8,333mth income vs 2nd $200,000@$900 home with $150,000@$12,500mth income ($650/$8,333) ($250/$4,167mth) Payment to income ratio increase) vs 3rd $300,000@$1,300mth home $300,000@$25,000mth income ($650/$16,667) & ($400/$12,500 payment to income ratio increase over each previous figure) vs 4th $400,000@$1,700mth home $400,000=$33,000mth income

$150k home $100 income to $400k home $400k income ratio increase ($1,050/$24,667) 2nd 300k to 400k ratio($800/$8,000) Not very fair ratio comparison or a wealthy person’s rational!

At one time Trump was proposing the “1-5-10-15” income tax policy consisting of the following:

* Those making up to $30,000 will pay 1 percent.

* Income from $30,000 to $100,000 results in a flat 5 percent.

* $100,000 to $1 million income will be taxed at 10 percent.

* On $1 million or above will be taxed 15 percent.

https://www.thepoliticalinsider.com/donald-trump-unveils-his-bold-income-tax-proposal-this-is-a-big-deal/

But if I am understanding the situation, now all that is out the window. (Is Trump just another lying politician?) Now many will get a tax increase including single tax filers making between between $112,500 and $190,150, or joint filers earning between $225,000 and $231,450.

If the above applies to you, you’re going to be kicked into a 5% higher tax bracket. You will also being paying more on capital gains.

Those in states like California already have to deal with high state income taxes. In California the people above are already in a 9.3% marginal tax bracket. Combined with Trump’s increase they are looking at a whopping combined 42.3% tax bracket!

You could be paying thousands of dollars a year more than when the DEMOCRATS controlled the House, the Senate and the White House. Yes, more than you did under Obama!

How can we stop this?

What can we do besides write or call our Congress Critters?

Under the Trump plan I would have paid ~$2,300 less in taxes this year. Single, $89K.

That is great!

I did do the math before voting and didn’t vote for him. I’m unmarried, income of $173,500 living in an expensive area with a child due in 2017. I’m paying student loans at 6.875%. I could refinance them, but there are only rate savings on variable rate loans and you’d have to be a fool to lock student loans in to a variable rate product. With Clinton, I had a fair chance at federal refinancing and wasn’t looking at increased taxes. Granted, her childcare proposal is 10% of income wasn’t helpful, but otherwise she was a much better outcome for me personally. Great post, Sam.

Another solution I would like to add for those individuals earning $112k or more… start your own business. Under Donald’s tax proposal, you would only pay 15% tax rather than 33%. Trump has stated that under his tax plan, all businesses whether fortune 500 companies or small home based freelancers will pay no more than 15% tax.

Exactly even if it is party lite or any deduction. That is what he is encouraging from what I understand the benefits to that are amazing!

To those single individuals earning over $112k, I suggest getting married! Between my wife and I our taxes will actually be going down thanks to Trumps tax plan, from 28% down to 25%. Thank you Donald Trump!

The tax code is nothing more than a system of incentives. The government wants you to get married and is willing to give you a tax break for doing so. You should listen :)

Also I can’t express enough how excited I am about the corporate tax being slashed down from 35% to 15%. The US will finally have a globally competitive corporate tax rate. Here are the corporate tax rates of a few other countries:

Ireland 12.5%

Canada 15%

Germany 15.83%

Switzerland 8.5%

Paraguay 10%

Cyprus 12.5%

Qatar 10%

Iceland 20%

Montenegro 9%

Liechtenstein 12.5%

Albania 15%

Get ready for businesses to start popping up left and right.

It doesn’t make sense for single people to marry for a tax savings because Trump’s married brackets are twice what they are for singles. The only time it makes sense is if one partner doesn’t work, or if kids are involved because head of household is going away. Trump really isn’t giving a handout to married people…its more of taking a benefit away from single parents which I’m all for. Nothing against single parent’s…but I don’t see why I should have to subsidize someone else’s life choices like that.

As a single guy making six figures if I married a woman with an income close to mine, we wouldn’t save anything as long as we both continued to work.

If middle class taxes do increase I think it’s more important than ever for people to get a handle on their personal spending. There are some things we can control financially, and beyond writing letters to our Congresspeople, taxes ain’t one of them.

But we can go through our budget line by line and try to eliminate or minimize whatever we can. I’m fairly certain the vast majority of Americans have not done this within the past year. Money saved would more than make up for any extra taxes paid for the year. If you’re going to pay $3,000 more in taxes for the year you just have to save $250 per month. That’s pretty much cutting cable and getting cheaper car insurance.

And listen to Sam don’t buy a car that’s more than 10% of your income. More expensive car means more sales tax paid and usually higher insurance premiums!

Syed, a lot of people are already maxed out. I’m not sure why you would think that they can eliminate more. $250 a month may not be a lot to you but it is a lot to them. Even if they could eliminate to save $250, $100, or $300, they be able to keep the money and contribute to a 401k for THEIR future instead of always being expected to give it away via taxes?

As I said, I’m fine and I could find that $250 but because I already pay a lot I think I pay enough. Besides, in my case not only am I putting money away for my elderly years, being that we are a sandwich generation we are also having to help OUR OWN elderly parents and believe me that takes a chunk of money. Hillary and Trump talked about the elderly living in poverty (elderly people who make too much to get government help but not enough to be able to take care of their medical bills). Why should we always have to give our money to government instead of being able to take care of our own.

I do however agree with your last statement.

If people don’t save and invest for your future today, then you become tomorrows poverty.

Just because you make enough to live on today doesn’t mean you should be required to give away extra money instead of using your money to build your own wealth to take care of yourself when you can no longer work.

The biggest expenses are medical bills and taxes. We need affordable healthcare and a reasonable tax system. Both of these need to reform, if not, the working class and below will still live on the edge regardless which party is running the country.

This topic talks about taxes however, people in this wage group are paying full ticket price for their healthcare insurance. My premiums went from $450 a month pre-Obamacare to just below $1,200 a month this year with double the deductible. And if you can’t afford the premium you pay a “tax” based on your income. The Obama economy, taxation and policies are a real mess!

yes, when I pay more taxes, I can eliminate all discretionary spending- and how will the small businesses like it when I NEVER eat out, NEVER buy new clothing, NEVER travel, NEVER get anything dry cleaned, NEVER hire any workers for home maintenance….how will that benefit the economy? Thanks Trump. Simple = stupid.

Marginal can go up and you can still pay less in taxes. For the single tax payer:

Old plan: $18,558.75 + 28% * ($112,500 – $91,150) = $24,536.75

Trump: 12% * $37,500 + 25% * ($112,500 – $37,500) = $23,250

Next, to your point, taxes are 0.05 higher per dollar of earned income.

$24,536.75 – $23,250 = $1,286.75 difference

So, another $25,735 ($1,286.75 / 0.05) until we hit the breakeven point.

$112,500 + $25,735 = $138,235

So singles making $138,235 – $190k pay a bit more. Honestly, that’s a pretty decent income for a single.

Thanks for doing some math. I wish more people did their own math to see what their pro forma tax bill will be.

$138-$190K pay is not bad, if you don’t plan to have a family and buy a median priced home in an expensive coastal city.

No it isn’t bad income but who are we to judge how much income is justified. There are different situations.

It’s comparative to people who don’t want to make the pie but want a piece after the pie is made.

For example, people who gave up years of working to go to medical school, accumulated large debt to go to med school and now because they make good money they are expected to pay higher taxes. What about people who took risks, took on large debt to start a business and once they become successful (and many times they employ others) but because they make good money they have to pay high taxes.

Again, people who don’t want to make the pie but want a piece after the pie is made.

In the case of living in NY. A friend of mine lives in NYC and he has to make higher income to live there yet he pays federal taxes based on the same income scale that I do in PA.

Believe it or not, the same issue exists for the elderly where benefits are based on income. A lot of middle class people think there is a safety net for them but they don’t realize how low the income limits are to qualify for help. $1.00 above that income limit and you are disqualified from receiving benefits. In other words the middle class is heading for a train wreck in their elderly years.

That is why it’s wise to build wealth, understand at minimal the difference between high income and wealth as well as taxation and in the middle class / low middle class case income limits. People seem to be fine letting life just surprise them instead.

“So singles making $138,235 – $190k pay a bit more. Honestly, that’s a pretty decent income for a single.”

take out the property tax and State income tax and Social Security and State unemployment/disability from the salary and you will see that the $138,235 – $190k

is not really what you think it is. Then subtract out the cost of health insurance and

you will see that number get smaller yet.

Thanks again, Sam for the wake-up call that we all need! The ‘best-case-scenario” living on $200,000/year is the best plan ever!! The main component, as you have taught us, is to make sure you have cash reserves in event of an emergency.

I love reading your articles, and the comments section– I am glad you have a thick skin and can hear views that differ from yours-dialogue is always stimulating!

One important reason for the surprise Trump victory lies in the “any one but Hillary” voters-people who didn’t strongly support Trump, but also don’t trust Bill and Hillary… also felt like “Hey lets roll the dice here, after 8 years of Democrat power-give something else a chance” I will finish by saying I live “inside the Belt-way’ as we say here, in the Wash. D.C. area…

Sometimes, I can’t tell whether you’re being intentionally obtuse or merely provocative. However, I know you’re a bright guy, so I’ll chalk this up to a good, old-fashioned click baiting effort. Kudos. As you’ve noted, your readership skews toward higher earners (and the balance who don’t self-identify as high earners, aspire to the category). I would venture that the vast majority are also coastal, and live in one of the few hundred counties that tilted heavily for Hillary Clinton. The other 2000 + counties comprise Trump Country. You’re incredulous that the Vast Middle voted against their self interest by voting themselves a tax increase; an honest definition of the Middle Class would reveal the opposite.

Let me state that I’m a skeptic (ok, maybe an agnostic) on whether Trump’s tax plan will work for the betterment of the USA—too many promises to too many people. However, I can certainly see the appeal for the Vast Middle: the promise of bringing jobs back, made by an actual wealth creator, is too good to ignore. If the media would have provided cover for Trump the way they covered for Hillary, I believe he would’ve won by a popular vote landslide- but that’s another story.

Trump’s promise to make America great again has already paid dividends in the eyes of some voters. A couple of weeks back, Ford promised to keep auto production in Michigan instead of Mexico; now, it appears that he’s received a similar commitment from Carrier for Hoosier jobs- real, middle class Hoosier jobs-

https://www.nytimes.com/2016/11/29/business/trump-to-announce-carrier-plant-will-keep-jobs-in-us.html?_r=0

The promise of fantastic wealth will still draw people to the coasts, but too often, only a handful get rich. And while 6 figure jobs might be a dime a dozen in Silicon Valley, median home prices are in the 7-figure range. Trump wasn’t trying to win over the young techie in Parkside or Golden Gate Heights; his target voter lived in OH, and PA, and WV, and MI…

In the end, it does no harm to speculate on what your taxes will look like in the future. But don’t soft-peddle the notion, that the Vast Middle don’t know what they voted for.

I thought Ford was going to keep its plant in America already?

I actually believe the middle class knows what they voted for and Trump supporters know what they voted for in particular. Given there is a middle class tax hike, it is logical to assume that the middle class is stronger than many of us would like to believe. And that is a fantastic thing. If we can all pitch in to pay more taxes, we can all do much to help support the fiscal stimulus that is planned to help keep jobs and grow employment opportunities.

When it comes to taxes, I would give myself a B- in understanding the code. there are so many forms and so many phaseouts in so many rules to remember that it’s hard to keep everything straight. This is why I rely on readers to help rectify where I am wrong.

What is your background?

Regarding Ford’s decision: if you read between the lines, Ford was considering a move to Mexico without advising the UAW . The anti-Trump media glossed over this–

https://fortune.com/2016/11/18/donald-trump-ford-mexico-kentucky/

Regarding the strength of the Middle Class: I believe the upper Middle Class has been resilient and will remain strong. The lower middle class? Not so much (and I mean these as income labels, not behavioral labels). That is the great dilemma for the US, because the nose-to-the-grindstone middle is a disappearing breed, and they have long provided ballast in the US economy. Trump spoke to these people, who have been ignored for the better part of 20 years. In my earlier post, I labeled them the Vast Middle; in reality, they’ve been shrinking for years. Some lower middle class Millennials have “hacked” their life by reading the Gospel according to MMM or Financial Samurai (and believe me, this is not a slight; I sincerely believe you have helped hundreds, and perhaps thousands, see that they can work their way to success). For most, however, a lack of productive work in the heartland has forced many to turn to welfare and indolence, or worse, heroin and meth.

Regarding the tax code: if a foreign power wanted to provoke an uprising in the productive classes in the US, it would scuttle Turbotax for a month or two.

Regarding my own background, I am a worker bee in a sales job- not in the vaunted 1%, but not far from it, either. For me and most of your readership, the winner on 08 November mattered about as much as the winner in a sports contest, at least from an economic standpoint. We may have a candidate preference, but we are adaptable to the shifts in the economy. I voted for the President-elect because for too many of the United States, adaptation is not a viable avenue. Trump’s intention, to put Americans first, is a tonic for many who see CEO’s get stock options for shifting jobs out of the country. Whether it is a healing tonic remains to be seen. Please God, bless America.

You said….. “If we can all pitch in to pay more taxes, we can all do much to help support the fiscal stimulus that is planned to help keep jobs and grow employment opportunities.”

First, it’s better to grow employment opportunity via the people instead of the government. With government employment you’ll always need “just a little bit more” to fund it. It won’t end.

I am so tired of the attitude of “just a little bit more”. Maybe it’s time gov spends a lot less. I live in PA, yes, there are people who do well here, I’ve fortunate to have done better than many and no, we are not uneducated, toothless, back woods, neanderthals, despicable’s that hate everyone as they portray us to be here in flyover country. I’m surrounded by both republicans and hard working blue dog democrats, both who were once solid middle class but slipped financially and are struggling. Worse, they can’t put money aside for their elderly years, most say they’ll have to work the rest of their lives and sadly they are right. So just “a little bit more” to you is a lot more to them. You can’t help others unless you are healthy and in this case financially healthy yet for some reason politicians think the people are swimming in money that the people can afford to help everyone who extends a hands out.

So when is “just a little bit more” going to be enough, 2008, 2012, 2016, 2020, … will it ever be enough? It is easy to manipulate people who don’t understand the difference between high income vs true wealth and point to them as the culprit. It’s easy to manipulate people who don’t have a basic understanding of the tax code to gain that support for “a little bit more”.

Sorry, I got off track but nothing is solid yet and we’ll see.

It’s never enough.

Now that the hurdle is $112,500 for individuals, a 50% drop, next could be anybody making over $60,000 will see a tax hike.

The key is to build WEALTH and not income so you can just live off your principal and not pay ever increasing taxes.

I always said… “Never take pleasure in government raising taxes “on the other guy” because sooner or later those higher taxes will trickle down to you”. Another saying is government will always use rhetoric to gain the support of the people to raise taxes on the other guy. I sincerely hope you are wrong in the end :) We’ll see.

Yes, I agree, the key is to build wealth. High income makes it easier to build wealth but it does not mean you are rich. Naturally we want a better life and nice things but when people get a raise or come into some money the 1st thing most people do is spend it.. and buy liabilities. Hey at one time I was just as guilty. Thank god I grew up and changed lol.

I read an interesting forum thread and the question was, “If you won $1 million what would you do?”. The answers were interesting. People thought they were uber rich…. they would live it up!.. buy a big boat, buy a luxury car, go on vacations, most interesting was people claiming that they would give money away. Only a few said they would invest it. Then came the catch, (this is income within one year’s time). The OP calculated how much was left after taxes. The reaction was funny.

I am grateful for this post because I can honestly say I had not looked into the new tax plan, assuming rates would decrease for the middle class. It looks like I will be seeing the 5% tax hike, although it does not affect my desire to create more income. I’m willing to work as hard as I can to make as much as I can, however I have not made it to that magic $200K yet. Perhaps when I’m there my desire to work harder for more money will subside. Currently I am working about 60 hours a week at my day job and spending my spare time getting my new blog up and running. BTW – I have this site to thank for motivating me to start a blog. Financial Freedom, here I come!

Great job hustling! Make sure you save as much as you can while you’re working you’re 60 hours a week. It is hard to keep that up for more than 10 consecutive years. I know I burnt out after 13 years, and I’ve got some pretty good endurance.

Build your brand online on the side, watch your options to do something you multiply. Only people knew how many opportunities there are once you establish yourself on the inter-webs.

Just keep going, no matter what someone tells you. Growing athick skin is just part of the business.

Sam,

A quick and dirty example on how to lower your tax bill without reducing your income. Buy your favorite asset class, real estate. In the suburbs of Denver if you put 20% down on a $400,000 house and rent it out, you will have cash flow of approximately +$400/month, or $4800 for the year. When its time to do your taxes you get to deduct the mortgage interest, which will be about $1000/month ($12,000 for the year) and you will get to depreciate the property, which is about another $1000/month ($12,000 for the year). In this scenario, your income will actually go up by $4800/year, but due to $24,000/year in deductions, your net taxable income will be reduced by $19,200 per year.

Someone who makes $190,000/year who wants to reduce their taxable income down to $112,500 per year just needs to buy the equivalent of 4 of these properties in Denver, CO.

Thoughts?

Meh, the example was too quick and dirty, I double dipped on the income deduction, so remove that from the example above, but you still get the depreciation deduction, so the point I was trying to make is still valid. Buy more properties to reduce your taxable income. You’ll just need to buy more than 4 to get your taxable income down to $112,500.

I don’t think right now is the right time to buy property. Maybe if you can buy it with cash and there is an immediate 4% or higher net rental yield. But to leverage up and buy property now after such a big run I think is risky. I’d rather buy municipal bonds or real estate deals at $10,000-$25,000 a pop.

but yes, the depreciation and the deductions are great for not having to pay any rental income taxes.

DON’T FORGET THE INCOME PHASEOUT KILLER TOO

Back in 2011, if you have an adjusted gross income of over $166,800, your mortgage interest starts to get phased out. For every $100 of income over $166,800 you lose $3 of itemized deduction X 33.3% up to a maximum loss of 80 percent of your itemized deductions. Talk about another overly complicated rule the IRS/government has implemented. –

See more at: https://www.financialsamurai.com/mortgage-interest-deduction-limit-and-income-phaseout/#sthash.l7oAjZzs.dpuf

I was considering investing in real estate but opted not to. Because of my income, even though I had a mortgage I couldn’t take deductions on my mortgage because of the phase out rule, to make it even worse, I got hit with AMT.

This is a good article that talks about “the sweet spot” and the phase out of deductions.

The ideal income for maximum happiness is not far off of $200,000 a year. If you make $200,000, the government won’t persecute you, and you will only lose $331 in mortgage interest deduction as your income is $33,200 above the $166,800 phaseout cap.

See more at: https://www.financialsamurai.com/mortgage-interest-deduction-limit-and-income-phaseout/#sthash.l7oAjZzs.dpuf

$200,000 a year is the magic number indeed! it’s enough to live a good life. And it’s low enough to not get incessantly attacked by the government. With a $20,000 gross income and $30,000-$50,000 worth of deductions, the balance is pretty good.

Mortgage interest on a rental investment property has nothing to do with the limitation and phaseout on homes for personal use.

Sam – I don’t think someone making $200,000 is going to save a lot in taxes under the trump plan nor do I think they will pay a lot more. I guess my point was that I don’t think the difference will be all that significant for the few (emphasis on “few”) who might miss out to make it the focus of a post when contrasted with with the vast majority of people expected to benefit. That’s not to say that it won’t suck for the few that do miss out but at least as proposed I think you are searching for needles in the haystack.

I’m not going to go into all that much detail because 1) I am much lazier than you; 2) I’m not incentivized to do so; and 3) I’ve learned you can make statistics tell whatever story you want. In other words I could find examples to support your argument – I just think they are going to be few and far between.

That said I will give you 4 reasons (2 already mentioned and 2 new ones) that even single people making $200,000 including small business owners living on the coast like in your example won’t be paying that much more in taxes (if anything) if Trump’s tax plan is enacted as currently proposed, which at this early stage, is far from a sure thing.

1) Childcare deduction (from your example $25,200 – I am going to assume this amount is the state avg for California w/ 2 kids so I will take this and subtract $6,000 (current tax plan amount used to determine the childcare tax credit) = $19,200 x .20 = $3,840 in tax savings.

2) Standard deduction increase – I think most single people making $200,000 won’t choose to take the standard deduction, including the person in your example, however, I include it because it may offset some of the additional tax paid by a single person with kids due to the elimination of the personal exemptions. It could also benefit a large number of those who currently choose to rent while saving up for a home. Elimination of Personal Exemption $12,000 x .20 = ($2,400) cost

3) Elimination of AMT – Although in your example this single person does not look to be impacted – I know many of us in the middle class especially the so called upper middle class are impacted and greatly so. In fact you could argue much more strongly that without the elimination of the AMT tax Trump’s plan won’t have the intended impact on the middle class as it intended as it may just shift more people into paying the AMT. The elimination of the AMT must be a central component to any middle class tax relief. I mention this because if enacted this on it’s own should favorably impact more middle class than all the people negatively impacted who fall in the donut hole under your scenario.

4) Reduction in Corporate Tax – It’s not clear to me at all how Trump’s proposed reduction in the Corporate tax will work but it if the corporate tax is lowered to 15% as proposed it may make sense for a lot of small business owners maybe even the person in your example to convert to C Corp at least for tax purposes. I realize you defined this business income as “passive” but if truly passive then I see no need for her to be paying for childcare expenses unless she was also running a side hussle which was outside the scope of your example. But lets face it without being forced to pay for childcare the person in your example would be saving $55,200/yr (not an example that will garner much sympathy from the masses). I also mention this because trump’s proposed corporate tax reform could set off a wave of business restructurings. Having the ability to moving income from a personal return to a corporate return would allow many small business owners to save in other ways perhaps in extreme examples by eliminating all other federal income tax (capital gains, dividend, interest income, or even all that income as a result of side hussling). The incentives to work harder should not be overlooked. Sam I think you may find this option might work even better for someone like you. In the end you may be in the sweet spot – you may be able to work less and make more after tax.

Aw shucks. So close to getting a guest post so I can learn what a great post should look like. If you change your mind let me know.

I am eager to see if the pass-through income for S Corp owners drops to 15%. That would be huge.

What’s your current financial situation?

For a real world example, I’m single and make about 200k. In my case Trump is increasing my taxes by about 2.5k. I don’t expect anyone to weep for me. I know its hard for people in other areas of the country to believe but I’m definitely middle class. I live in modest 1000 sqft house that is 40 years old in a working class neighborhood about an hours drive out of silicon valley. My commute is 2 hours each day. Two of my nearest neighbors have been in prison within the last year for violent crimes. So I’m not exactly rubbing shoulders with yacht owners. 200k is not the fantasy lifestyle some people might imagine.

What grinds is that the yacht club folk are getting a tax cut, while my taxes are going up!

Yacht club! Perhaps it’s time to get a second job to try and get your own yacht as well! Just kidding.

It’s fascinating the American people voted to lower taxes on the 1% while raise taxes on the middle to upper middle class.

OMG – people who have skated away forever as burdens on my tax bill now have to contribute? Say it isn’t so….

Long-time reader, first-time commenter. Let me just say I’m a big fan of you and your website and find many of your viewpoints directly applicable to my situation. That said in my opinion this may just be the laziest post you have ever written (easy for me to say because I find most have considerable value). I hadn’t crunched the numbers on the Trump tax plan so when I saw the title of this post I assumed you had found a legitimate donut hole in the plan that would swallow up the middle class, however, after just briefly looking at Trump’s plan a little more closely it seems unlikely that many people will find themselves paying more taxes. Even in the scenario’s you have drawn up it would seem these taxpayers will find savings because Trump’s plan also includes making childcare expenses an above the line deduction. I also think the increase of the standard deduction to 15,000 from 12,600 will help in examples similar to yours even though I realize people in high cost areas like NYC and SF will benefit less from that. In addition just this morning within minutes of reading your article I saw an excerpt of an interview with Stephen Moore, a Trump economic advisor, who suggested a tweaking of the tax plan should certain situations result in an increase in the tax on some of the middle class. When all is said and done I’d be surprised if there weren’t some losers amongst the middle class once this gets finalized but being that it is likely to be such a select few I don’t think it’s time to inform the middle class as a whole that we need to prepare for this event as if the sky is falling. To the contrary I think your readers would be better served by providing your insight in how we might best spend a sudden increase in our disposable income as the vast majority of taxpayers particularly those who are married and living away from the coasts will be seeing a significant boost in the bottom line.

Now you know the truth and my secret that I really am a lazy person. It’s something I’ve tried very hard to fight ever since I was a kid, but I know I’m not doing a very good job at it.

I’d love for you to write a guess post for me on why someone making $200,000 a year will save a lot in taxes under the new proposed plan. In your post please include actual numbers and charts so we can follow along and see the math. I think it would be fantastic to help readers in this regard.

Thank you so much for your contribution. It’s always best to take action and rectify a situation, especially if you are not satisfied with what you’ve read. I think it will be great and I can help you edit the post.

Best,

Sam

I’ve been meaning to post this but this article starts off talking about mortgage …”higher interest rates are already a tax on consumers”… when it was bound to happen sooner or later. Rates should have increased long ago and this is the Fed.

Trump has proposed increasing the standard deduction to $30,000 for joint filers, up from $12,600, effectively eliminating income taxes for anyone earning less than that amount.

Hillary wanted to raise the FICA tax which is the very people you are referring to middle class.

Currently, pass-through profits are taxed as individual income for owners. In this structure, the businesses aren’t taxed under the corporate rate; the profits are taxed as individual income for the owners. The Trump campaign has not specified which pass-throughs, exactly, would be eligible for the lower rate under his plan.

This administration has been particularly hard for small business but when small business (pass through entities) gets relief they may invest for growth which would result in hiring and as the need for hiring goes up so may income due to competition.

Elizabeth, you seem to really know your tax stuff. What is your background? I appreciate your insights. Tax it’s something that I try really hard to understand, but I just can’t figure everything out with so many laws and changes.

Even if the Federal Reserve “should have an “raised the fed funds rate earlier, it is still a punch in the gut for those who are looking to refinance their mortgages or general loans after a 30% increase in interest rates from a low base. Everything is relative.

I do hope that corporate income can be passed through at the lower percentage rate as well. That would be so huge for small business owners like myself. That will fundamentally change the way people consider making income in the future.

LOL, yes and no. A 70,000 page tax code would make anyone’s head spin. If gov truly wanted to help people they would make the tax code so anyone could understand it, instead they use the tax code not only for revenue but to manipulate people to do what they want. That’s why W2 income is the worst type of income.

Early on I figured out that it’s not “all” about how much you make, it’s also how much you keep, accumulate then put to work for the right type of income. The accumulation years are very important but if government keeps taking your money it’s hard to accumulate seed money and that’s why people always feel like they can’t get ahead.

I think of taxes in a different way. Lets say 2 people, married filing jointly, you get to reduce your taxable income by standard and personal exemption. In 2016. That’s a total of $20,700 money you earned without the government taking any of it… It’s as if the gov has determined $20,700 is enough for a family of 2 to live on for that year. Income above is seen as excess money and they can take some of it. As you climb the income ladder and tax brackets, gov take a higher % of that excess off the top earnings.

Government will always take as much as the people allow them to get away with without causing push back. That’s why this administration went after HENRY’s, they understood the middle class was tapped out and angry. They spun words to mean what it doesn’t mean.. (high income = wealth), to gain their support for taking more money from the other guy, the HENRY’s (High Earners Not Rich Yet). As we both know, high income does not mean you are “rich”.

At one time I was also of the mindset that “if I could just get that raise then things would get better. The problem is people are always after higher income but don’t do things that allow them to keep a good chunk of that raise, instead they spend it on things that keep them locked in the rat race and round and round they go.

That’s my history, at one time a W2 worker stuck in the man hole climbing up the ladder to get out of the rat trap, make what is deemed “excess” and instead of being able to accumulate that excess money for my future, had to pay higher taxes and get pushed down a rung or two. Now a small business owner who was shocked at the government’s take. I did the best I could but my business model does not give much in write off’s which is why I’ve considered real estate.

I like learning about taxes because understanding taxes help me know how and when to spend money while accumulating, and using it to make the right kind of income. I understand that the government needs revenue but just as with anyone with a credit card with no limit, it’s being abuses and we the people are paying for that abuse.

I like learning about taxes for I might find a little nugget in that 70,000 page tax code that allows me to keep more of my money :-)

For what it is worth I actually thought this was one of your more technical and meaty articles Sam! I think it is also a very interesting and discussion-worthy topic. Its fun to think through the scenarios and by providing numbers and tables you gave us something to think about. Kudos!

Why thank you! Don’t worry, I get called lazy, dumb, and other names all the time but I will continue to try my best.

I always dream that one day someone who says my writing is no good will just post something great themselves. Just write 2000 words, put up a couple supporting charts and graphs, and write something unique with some new insights. So easy even a lazy person like me can do it.

lol you make it sound so easy. I can vouch for the fact that it is much harder than that. “writing is thinking” and most folks are not up for the hard work it takes to put together a really good 2,000 word post.

What about the impact of the vastly lower corporate tax rates? this will increase earnings of companies and allow for increases to salaries and bonuses. I would think this would more than make up for a slight increase to certain segments of the middle class. Also, with deductions for kids, interest on mortgage, and charitable contributions, does anyone end up paying the marginal rate anyway? I pay an effective tax rate in the low single digits.

Nobody ends up paying the marginal rate, unless you make well over $1,000,000 a year.

If you really only have an effective tax rate, may I ask you to pay more of your fair share for the greater good of America? We all need people to pay more!

FICA/Payroll taxes alone are 6.2% for employees. Then there’s Federal and State. Can you share how you are only paying only single digit effective tax rate?

Thx

Its a combination of interest deduction on my home, child tax credits for five kids, exemptions for seven people in the family, and contributions to charity. I would have thought a single digit effective tax rate is normal though?

The great thing about lowering the tax rate for corporations is that it frees up more money for corporations to invest. This is essentially diverting money from welfare programs and allocating it to corporations to help drive our economy. The subsequent increase in jobs, salaries, and bonuses should more than offset the slight increase in the marginal rate for those few who it applies to.

Killing the AMT will be great as well!!!!

Wow, 5 kids! are they expensive to raise? I feel like kids are not that expensive because so many families have so many kids with a very average income. I thought the child tax credit was only available for couples making under $100,000?

They really aren’t all that expensive. It’s like most things – if you try to keep up with the Joneses it is tough but if you are frugal it isn’t bad. You can send to private school and pay for after-school care and buy your kids all new clothes. Or you can homeschool/public school and buy your kids pre-owned items. The difference in those things is thousands of dollars but doesn’t have too huge of an impact on the child. Actually, I would argue the more expensive options can sometimes be worse. Kids need to learn to work for success.

Don’t forget your “other” 401k… if you’re eligible for an HSA at work, take it. An individual can put away $3,400 pre-tax in 2017. Families can go up to $6,750. If you’re 55 or older, add $1k to those numbers in catch up contributions. Most accounts these days have investment options, too.

Sweet thing about HSA money is in addition to paying for medical care essentially on a pre-tax basis, you can pay your Medicare part a,b, c and/or d premiums out of it when you’re ready. Long term care insurance premiums, too.

Hi Sam

First off – love the post! Like all of your articles, it’s a great conversation starter.

Generally speaking, I don’t think it’s completely correct to have the mindset of working below capacity just to pay less taxes. In most cases, paying more in taxes means you’re putting more in your pocket too (unless you’re not minimizing your tax liabilities). Everyone here would agree that more money is better, but that time is of equal or greater value to money. For people that don’t believe time > money, people can gain perspective by putting themselves in the shoes of a 50yr old billionaire on his deathbed as his grandchildren fight over his money. He/she must be thinking that he’d rather have another 10 years of life and be broke – atleast he would rest assured knowing that no one would fight for his monstrous wealth!

I earn about $800k/yr, my marginal tax level is 51.8% (married, living in CA), and I work 1,800hrs/yr (25 vacation days), which works out to be $444/hr using my pre-tax comp. While I want to make more, I definitely subscribe to the idea of working smart and efficiently. It’s usually true that higher income usually correlates with higher stress, but I would say that correlation does not imply causation. A few lucky people earn a lot doing something that they love and don’t consider themselves stressed. I earn a lot doing something I really enjoy, but it comes with a stress-package. So when I think about side-hustles that could make money, I like to use my time value/hr (call it tv/h) to decide if it’s worthwhile. I used the <> and tweaked the answer a little bit based on personal situation and age. What I found is that I value my time at about $100/hr post-tax.

Below are some examples of how it’s helped my decision making – YES/NO for more profit

1) YES – Spent 30min doing a survey for Prosper P2P lending to receive a $100 Amazon Gift Card. Earning $200/hr

2) YES – Spent 1hr signing up for 2 (me and my wife) Chase Sapphire Reserve credit cards to get 200k bonus points and save about $4k on travel. Earning $4k/hr

3) YES – Spent 3hr gathering paperwork and communicating with new bank to refi $1m 15yr fixed 3.375% to 7/1 interest-only arm at 2.5%. Earning about $10k/hr using first 7 years of post-tax deduction interest cost.

4) YES – Paying someone $50/hr to clean my home. Saving $50/hr

5) YES – Researching new investment opportunities. Unknown, but hopefully positive earnings.

6) NO – Driving Uber during down time

7) NO – Scalping tickets. Even if I get tickets cheap, I’d rather give them to friends.

8) NO – Going out of my way to meet people that aren’t important to me.

9) NOT SURE – Buy a fixer house in Bay Area

The main trend is that I jump on tax-free opportunities.

Reasons my tv/h might increase: have more children, I find out I have a terminal illness, aging, my net worth increases, etc

Reasons it might decrease: my opportunity cost is lower due to lower income

Hope this helps people make better financial decisions!

Good analysis.

What is it that you do? What is your target net worth? And have you considered not working so much at your age?

I’m in finance, target NW 8m by 45. I just recently entered my 30s, so if anything, I enjoy working harder with the mindset that it’s about the journey, not the destination!

Sounds good. Might as will shoot for 10 million instead of 8 million net worth. Then there is the special welcome Club you get to join with a special gift as well. It’s worth it.

All about fighting inflation!

Do let me know in 10 years whether you still feel you have the same amount of enthusiasm for work and wealth creation. I think it’ll be very interesting.

A very interesting book about why the middle class votes against its own self-interest, and for policies/candidates that support the rich is “What’s the Matter with Kansas?” https://en.wikipedia.org/wiki/What's_the_Matter_with_Kansas%3F

Arrgh. Sucks to be single and making a “middle class” salary in Silicon Valley when a decent house costs a cool $1m. I had just begun the process of evaluating what I could afford to buy, anticipating pulling the trigger in the next couple of years. Now we get rising interest rates *and* a tax increase. Oh joy.

Guess I’d better find something to start blogging about, eh, Sam?

The best time to start was yesterday! Thank you for contributing more to next years government coffers! America thanks you.

Interesting that you don’t mention the case for small businesses. It’s in the tax plan that small businesses (including LLCs, S Corps, and even Sole Properietors) will have a 15% tax instead of a top marginal tax rate of 33%, so it’s a huge incentive to start your own thing!

It’s unclear so far. As a business owner with the S Corp., the K-1 income is a pass-through and it is treated as normal income tax. So I need to figure out what exactly is going to be positively affected or not.

But for investors, this is a good thing as the S&P 500 should see a 10% or so boost to earnings, bringing down the PE multiple. All else being equal.

What business have you started or plan to start and how are you planning on making top 1% business income?

It’ll be interesting to see how it pans out! I agree it will be good for investors. I’ve been consulting as a sole proprietor. According to the tax plan this counts as “pass through” income and business income to be taxed at the 15% rate.

Excellent breakdown Samurai! Thanks for taking the time to do what few others will – break down the proposed changes with several data scenarios, in order to find the “tipping points”.

As a middle class earner, you are under fire / in the kill zone. Ducking for cover and deliberately earning less than the single earner tipping point of $112k a year is (sadly) unrealistic for most folks that are currently embedded in their lives earning more than that. They’re comfortable there, which lowers the motivation to aim higher – which makes it even harder for them to shoot for more and get above that the top range of $415k a year.

It’s their “achievable comfort zone” (sweet spot) and for most folks, they’re likely to just sit there and take the shots the government sends their way. When you’re in your “sweet spot” you become blind to the negatives of staying there, you’re lulled into complacency somewhat. Which is why the government can and will keep coming for you. You’re just sitting in that big tub of warm water, enjoying a bath. Little do you know, it’s a cooking pot and the water is slowly coming to a boil. When do you get out? Eh, later. This feels pretty good.

Oh, and for anyone who actually considers marriage as a tax avoidance strategy? Sure, short term you might save a few bucks on taxes. But be VERY careful in your analysis, and focus on the overall financial downside risk potential as well. i.e. “divorce” – which is the single most ruinous financial event in a lot of people’s lives. The #1 cause of divorce is marriage. :)

Sensei

“Divorce is the #1 cause of marriage” is such a great line.

All folks have to do is take their tax savings from marriage and discount it by the divorce rate (50%) to get their expected true tax savings and see if it’s worth it.

Great post, certainly making the case to get married for taxes! I’ve never met anyone who weren’t in love, but got married just to save on taxes. I’m curious how they would handle a budget or who gets what in a divorce!

I’m definitely not happy about the middle class getting squeezed more. It seems like the worse place to be from a tax perspective! You have to pays considerable amount in taxes while a number of tax deductions that lower income people qualify for get means based tested and reduced when you make certain amounts. Not good! And to see the tax come down for those making over $415K…hmmm….

But I won’t be resorting to municipal securities or anything like that to lower my tax. I still think that equities will give me the greatest long-term return net / net.

As far as you are concerned, I’d vote for you working less and paying less tax and maximizing life enjoyment. It is a total trap to stress yourself out to get to the high tax brackets to take advantage of the relatively lower rates…on a dollar basis you will be paying through your nose!

I’m considering a move to London for work right now and higher domestic taxes makes it easier to make the jump to the higher taxes in the UK. I’ll be able to take advantage of Foreign Tax Credits when I return which will be more valuable in a higher federal tax environment. Perhaps more folks will be motivated to jump to higher tax countries for work like me…

Paying no federal income tax on the first ~$96,000 working abroad would be great! Which state will you domicile? Hopefully one of the 7 no income tax states as well.

London will be an AMAZING journey. GO FOR IT! I wish I bought a flat in London when I visited in 2002. Damn…

But London is so darn expensive it is ridiculous.

Go to Aldgate East and Brickfields to eat the best Chicken Shashlik Bhuna in the world!

Related: London: You Are The Most Expensive City In The World!

Sam

“Why aren’t more middle class people upset about this tax hike? Is it possible that most people making between $112,500 – $190,500 are simply unaware they will be paying thousands more a year in taxes?”

No, its because I won’t be. I’m a single person making 130k a year. Under current tax rates, I’m putting 18,000 into my 401k, 3,350 into my HSA, and claim a standard deduction and personal exemption of 10,350. This lowers my taxable income to 98,300.

10% of 9275 = 927.50

15% of 28375 = 4256.25

25% of 53500 = 13375

28% of 7150 = 2002

So my total federal income tax liability under current brackets will be 20,560.75.

Under the Trump plan, he does away with the personal exemption but my standard deduction will be increased to 15,000. With the same 401k and HSA contributions my taxable income will be 93650.

12% of 37500 = 4500

25% of 56150 = 14037.50

My total federal income tax liability if the Trump plan was enacted as is will be 18,537.50. Trump’s plan would save me 2023.25 a year.

His plan will also cap itemized deductions at 100k/200k for single/married filers. I doubt many poor and middle class people will be hitting these numbers…this will clearly be a tax increase on the rich. Obviously its on a case by case basis as far as what the rich have for deductions, but for some of them I think this will definitely negate some of the benefits of a lower top bracket.

Additionally, I’ve seen a lot of people focused on single parents and doing away with the head of household status, which funny enough you used a single parent for your example in this article as its obviously a way to show the most extreme example of who “loses” under the Trump tax plan. Well, here is my take on that…GOOD! Marriage rates are plummeting with my generation(millennials). Not only have we watched divorce wreck many of our parents financially, but under current tax codes if I have a kid with my girlfriend, I could file head of household as the higher earning of the two since I’d save more in taxes, and she could file single, and we would pay less taxes than we would pay if we married and filed jointly or as singles. How the heck does it make any sense at all to give us tax breaks just for refusing to marry?

Additionally every single parent I know is either receiving child support from the ex, in which case they are still effectively financially mingled and basically the equivalent of married filing as singles, or they are on welfare, in which case they are already subsidized by the tax payers and I see no reason to subsidize them further through the tax code. Adios head of household, I won’t be missing you!

GREAT JOB doing your own analysis! This is what I want everybody to do. Run your own numbers to see how your tax bill shakes up BEFORE tax legislation passes. You want to be armed with information to make the right move.

Since most people would rather not work, these incremental expenses or benefits may help persuade people to CHANGE THEIR LIFE.

And I’m not kidding about changing people’s lives. Once I decided to cut my income by 80%, my life was changed for the better. So much happier. So much less stress. So much more fun.

Related:

The Fear Of Running Out Of Money In Retirement Is Overblown

Overcoming The “One More Year Syndrome” To Do Something New

Fantastic post! I did not realize itemized deductions would be capped. The middle class is truly better off under this plan. By eliminating or reducing loopholes wealthier folks will be paying more but this will be accomplished without the introduction of a new tax or demonizing them.

As a single taxpayer making between $112,500 – $190,500, thanks for getting the blood boiling! Once I account for Trump’s proposed standard deduction of $15,000 vs. the current standard deduction of $6,300 my overall taxes decrease around $1,300.

Maybe it’ll be time to propose to the girlfriend? Trump’s tax plan would have an even better outcome for us when compared to the current marriage penalty tax we would face.

Yes. Stop wasting her time. She ain’t getting any younger!

And try to stay away from making $190,500 if you decide to delay the wedding.

Relax at work! Take 2 hour lunches. Enjoy life more.

I already “paid my dues” earlier in my career so I am probably in the office less than my entry level employees…although I work from home from time to time outside of normal office hours.

Sure I could exert less effort and make less money…giving a smaller percentage of my money to the man, but I would probably be at the office about the same amount of time. That being said, I don’t find it beneficial to avoid a higher level of income that requires about the same amount of my time.

I’ll take the extra $100K, perks, and ability to take 1.5 hours lunches. Maybe 2 hours someday!

Sam,

I think you should take the route of earning more without putting in so many extra hours if you can. Or write another book on website optimization.

If FS is earning $150K a year after tax, how can that be sold for $10M after tax? Who pays a P/E of nearly 100 for a website? Or am I out of touch on how this is valued? Please educate me.

Thanks,

Mike

Hi Mike,

Selling for $10,000,000 is only a P/E of 66, not 100. If the site is growing at 66% a year, that’s a PEG ratio of just 1. Not too unreasonable if the grow rate keeps.