The average daily percent move of the stock market has increased over time. The reason for the increase in stock market volatility is mainly due to technology and the speed in which information moves and trades are executed. In the past, information moved more slowly, thereby affecting stock prices more slowly.

Today, it's much more common to have “flash crashes,” where stocks hit an air pocket and take a dive. You should expect to see 5%+ corrections multiple times a year. Then, there are days where stocks melt up thanks to algorithmic trading and lightning fast information transfer.

In March 2020, the S&P 500 plunged by 32% from peak to trough in one month! Then, within several months, the S&P 500 gained back all its losses. Now there are huge stock market swings again in 2025 due to the trade wars.

Due to investor psychology, the S&P 500 generally goes up like an escalator and goes down like an elevator. This volatility in the stock market is one of the main reasons why I prefer investing in real estate over stocks.

If we're long-term investors, it's a good idea to understand how much the stock market moves a day on average. When stock market volatility spikes, we'll feel more calm and reduce our chances of doing something irrational.

Let's look at the average daily percent move of the stock market.

The Average Daily Percent Move In The Stock Market

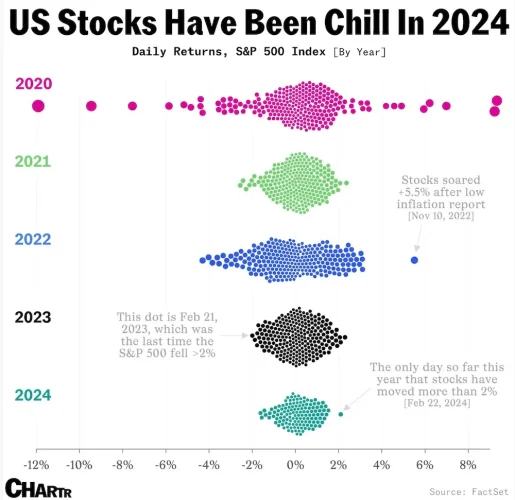

Below is a fantastic chart that shows the average daily percentage movement of the S&P 500 over the last 10 years. Each dot represents one day.

As you can tell from the chart, the average daily percent move in the stock market is between -1% and +1%. The S&P 500 represents the stock market.

Therefore, if you are a long-term investor in the capital accumulation phase, you should consider buying more than your normal investing cadence when the S&P 500 is down greater than 1%.

If you're in capital preservation mode, you might consider selling some of your S&P 500 index position when the S&P 500 is up greater than 1%.

Of course, nobody knows the future. Trying to beat the S&P 500 over the long run through market timing is unlikely to work. This is why I recommend dollar-cost averaging over the long term, especially as the average stock market swings get larger.

We're not trying to outperform the S&P 500, we're trying to asset allocate to match our risk exposure. The majority of active fund managers underperform the S&P 500 or their respective indices over a five and 10-year period.

What we're trying to do is figure out how to best invest our cash flow, or larger-than-normal cash injections, during the capital accumulation phase and vice versa.

Here's another historical average daily percent move of the stock market for good measure. It shows the average percent move is +/- 0.73%.

Previous Bear Markets Performance

We've had 12 bear markets since 1929. A bear market is defined as a 20% or greater sell-off. Let's look at what happened during the four most recent bear markets to see what's possible.

If you're trying to reduce your investment volatility, consider investing in private real estate. Real estate tends to outperform stocks during times of uncertainty and chaos because investors want to own bonds or tangible assets. Stocks inherently have no value and can lose value over night, real estate is much more steady.

You can invest in real estate without the burden of a mortgage or maintenance with Fundrise. With about $3 billion in assets under management and 350,000+ investors, Fundrise specializes in residential and industrial real estate in the Sunbelt, where valuations are lower and yields are higher. The investment minimum is only $10, so it's easy for everybody to dollar-cost average in and build exposure.

1) August 1987 to December 1987

On October 19, 1987, the Dow fell 22.6 percent – the worst day since the Panic of 1914. By early December, the market had bottomed out and a new bull run had started. From August to December, the S&P 500 lost 33.5 percent. Thankfully, this bear market only lasted three months.

2) March 2000 to October 2002

The NASDAQ bubble burst on March 11, 2000. I remember sitting on the trading floor watching all my B2B and internet stocks start plummeting by 10%+ for no reason. Over the next nine months, the NASDAQ declined by 50 percent and I finally gave up hoping the dotcom mania would come back. The S&P 500 went from a high of 1,527 to a low of 777 for a 49 percent decline over 30 months.

3) October 2007 to March 2009

The housing collapse was the most brutal collapse for the majority of Americans alive today. Not only did the real estate market get crushed, the S&P 500 declined from a high of 1,565 on Oct 9, 2007 to a low of 682 on March 5, 2009, a 56.4 percent decline. The bear market lasted 17 months, which at the time, felt much longer.

Based on these past three bear markets, we shouldn't be surprised to see another decline of 30% – 55% over a 3 – 30 month period. Therefore, if you are in the capital accumulation phase and are bearish, you might want to start legging in only after a 2% or 3% decline instead of just a 1% decline.

4) March 2020 – August 2020

The latest bear market where we saw a 32% correction from top to bottom. Luckily, your boy here wrote a very precise stock market bottom prediction post to help the community not panic sell. Some of you actually profited by buying the dip.

By August 2020, the S&P 500 recouped all its losses and returned to its pre-March level. Currently, the S&P 500 is above 4,500. As a result, I'm not buying any more equities. Instead, I'm investing more in real estate.

As someone who is going back to retirement mode under the Biden administration, I want to ensure my capital is preserved. Further, it's always good to keep as much of your gains as possible.

5) 2022 Bear Market

The S&P 500 corrected by 19% in 2022. The NASDAQ declined by 33.47% in 2022. In other words, the bear market of 2022 wiped away all of 2021's gains, and then some, if you were a tech growth company.

If the Fed continues to aggressively raise rates as inflation and the economy slows, there will likely be another recession in 2023. We already had a recession in 2022 with GDP declining in both 1Q and 2Q.

Based on all the bear markets we've experienced over the past 20 years, it's good to have a bear market checklist to prepare for the next one. Having a proper asset allocation of stocks and bonds and your net worth are also vital.

6) 2023 Bull Market

What a difference one year makes. The average percentage move of stocks increased during the bank runs caused by SB and First Republic. Stock volatility then decreased after the Federal Reserve and Treasury Department stepped in.

Now stocks are back in a bull market, up well over 40% since its October 2022 lows. The largest 10 tech stocks are up even more.

7) 2024 Stock Market Strength

The S&P 500 and Nasdaq performed well in 2024, closing up 23% and 29%, respectively. However, both experienced another 5%+ correction from their 2024 highs. This is just the way things go. If you invest in growth stocks, like NVIDIA, you saw a 20% correction from its 2024 high.

Now, with Trump as the next president, volatility in the stock market will likely return. Trump is known for doing a lot of saber-rattling, which tends to roil markets. This is his last term and he's likely going to be really aggressive in implementing change. From raising tariffs to kicking out criminal illegal immigrants to forcing rates down, he is going to disrupt and cause more volatility.

As a result, I suspect more money will flow into less volatility, income-generating assets like real estate to help preserve capital.

Below is a great updated chart that shows the daily returns of the S&P 500 index in 2020, 2021, 2022, 2023, and 2024. Notice how much more volatile stocks where in 2020 and 2022 (bear market). Meanwhile, stocks have been very calm in 2024 so far. Expect volatility to increase over the coming four and half years if Trump becomes president.

6) 2025 Bear Market Due To Trade Wars

The S&P 500 closed down 20% from March through early April due to the onset of Trump's escaping trade wars. All the stock market gains from 2024 were wiped out in under 45 days.

Then on April 9, 2025, the S&P 500 closed up 9.5% and the NASDAQ over 13% after Trump delayed his tariff hikes for 90 days. This was after a huge 12% drop in the S&P 500 over three days in early April 2025. In other words, if you want to be a stock market, investor, you have to stop more of these huge swings.

The Biggest 20 Gains And Losses In The S&P 500 In History

Take a look at this chart that shows the S&P 500's 20 best and worst days in its history. Notice how the biggest swings are occurring more often in recent history. As time goes on, the stock market volatility will likely only increase given technology, information dissemination speed, and the ease of investing.

Find Your Own Investing Methodology

Now that you know the average percentage move of the stock market, it's up to you to decide your investing methodology. You may want to invest in private funds to dampen visibility investment volatility in your public investments as well.

Personally, I like to invest in multiple tranches with each additional amount of capital earmarked towards an investment. It makes me feel better about risking my hard-earned money because I spread out my chances of buying at the top.

Feeling better might sound trivial, but if you don't feel good about your investment methodology, you will likely under-invest or never invest.

Over a 5, 10, 20+ year time horizon, your lack of investing might leave you far behind the investing class. Then you might get angry and blame the world for all your financial problems.

Example Of Investing In Multiple Tranches (Dollar-Cost Averaging)

Every year my wife earmarks $16,000 towards our son's 529 plan. $16,000 is currently the maximum gift exclusion amount for 2022 without having to file a gift tax return. I can no longer contribute to his 529 plan because I superfunded it in 2017 with five years worth of contributions.

Back when the gift tax exclusion amount was $15,000, we decided to split her $15,000 into three tranches of $5,000 – $6,000 each. We invested $5,000 at the beginning of January and another $5,000 at the end of January because we felt the ~17.5% sell-off in 4Q2018 provided a buying opportunity. In the end, we held off on contributing the remaining $5,000 because the market kept marching higher.

In March 2020, we invested $10,000 of the planned $15,000 for each of our children. We should have invested the remaining $5,000 each, however, we didn't think the stock market would rebound so quickly.

We have an 18-22 year investment time horizon for our son's 529 plan. As a result, for his plan, we are in the capital accumulation phase. We can afford to ride out a 2-3 year bear market.

As a DIY investor, investing family money can be stressful. However, you must stay on top of your family's investments and almost treat it as a second-job. One wrong move could wipe away years of progress.

Find Your Investing Comfort Zone

Back in 2012, I had just left my day job of 11 years. I received a six-figure lump sum severance that June and was thinking about hoarding it.

When you go from making a healthy income each year to suddenly nothing, it's hard to get the courage to invest your valuable cash into a risk asset.

Despite my fear, I felt the worst had passed. I also felt my severance check was like winning the lottery.

I almost didn't get it because I had inadvertently e-mailed an old confidential client file to my personal e-mail address when I was clearing out all my stuff. Luckily, my old firm recognized I did so in error.

To get over my fear of investing, I talked to my personal banker to see if there was some type of instrument that provided downside protection in exchange for giving up some upside. It turns out there was.

Invested In S&P 500 Structured Notes To Minimize Volatility

I ended up investing my entire six-figure severance check into a Dow Jones Industrial Average structured note that provided 100% upside participation and 100% principal protection in exchange for only receiving a 0.5% dividend yield instead of a ~2% dividend yield at the time.

Without the 100% principal protection, I wouldn't have had the courage to invest even 25% of the six-figure severance check naked long into the S&P 500. I likely would have just bought a CD earning 3.5% instead. Contrary to popular belief, not all structural notes are bad.

Below is a graphical example of a structured note that provides at least a 15% return over two years so long as the S&P 500 is not down more than 30%. If the S&P 500 is down more than 30%, you participate in the full downside. For the 30% downside protection, you have to give up collecting all dividends.

Today, my portfolio is defensive because I'm afraid of losing my gains. The average percentage change in the stock market seems much higher than +/-1% nowadays.

Everything earned after 2012 feels like funny money because I left work with enough. Now, I've got two people to take care of and maybe even more. The #1 rule after reaching financial independence is to never lose money.

Find an investment methodology that makes you comfortable enough to consistently invest over the long run. Make sure you also have a specific purpose for each of your investment portfolios.

Stock Market Volatility Is Part Of Investing

As long as we risk our money in stocks, we are always going to be subject to volatility. We must accept this fact. The average percentage change in the stock market may go higher or lower, depending on the economy.

Since 1950 the S&P 500 has seen an intra-year drawdown of 5% or worse more than ~90% of the years. ~40% of the years, the S&P 500 has fallen 5% to 10% intra-year. ~38% of the years, the S&P 500 has fallen 10% to 20% intra-year. ~16% of the years, the S&P 500 has fallen in excess of 20% intra-year.

It takes a tremendous amount of discipline to always pay attention to your cash flow and then have the confidence to invest it in the stock market. As a result, most people fail to regularly invest.

Based on my experience, the best investing methodology is to automatically invest a certain amount each month and then invest extra during large selloffs. For your retirement accounts like your 401(k), your company should provide an option to make contributions automatic.

For your after-tax investment accounts, the easiest way to invest is to go through a low-cost digital wealth manager like Betterment that automatically invests your money into a risk-appropriate portfolio. Link your checking account to automatically contribute a set amount so you don't have to think about it.

Predicting short-term performance is nearly impossible. However, over the long term, chances are high that things will turn out all right.

Invest In Real Estate To Reduce Volatility

If you hate volatility, as most investors do, I suggest investing more in real estate. Real estate is my favorite asset class to build wealth because it is tangible, produces income, and provides utility.

Once you've purchased your primary residence you are considered neutral real estate. Since you have to live somewhere, you will simply ride the real estate cycle. To be long real estate you must own investment property in addition to your primary resident.

Once I had my son in 2017, I decided to sell my PITA rental house. I reinvested $550,000 of the proceeds into real estate crowdfunding. Today, I have over $1 million in real estate crowdfunding across a couple funds and 17 investments.

My Preferred Private Real Estate Platform

Check out Fundrise, a vertically integrated private real estate firm that allows you to 100% passively invest in residential and industrial real estate. With over $3 billion in private real estate assets under management, Fundrise focuses on properties in the Sunbelt region, where valuations are lower, and yields tend to be higher.

As the Federal Reserve embarks on a multi-year interest rate cut cycle and pent-up demand for real estate grows due to structural undersupply, real estate demand is poised to grow in the coming years. With a $10 investment minimum, diversifying your portfolio has never been easier.

Invest In Private Growth Companies

In addition, consider investing in private growth companies through a fund. Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment.

One of the most interesting funds I'm allocating new capital toward is the Fundrise venture capital product. The Innovation fund invests in:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 75% of the venture product is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI!

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum. In addition, you can see what Fundrise is holding before deciding to invest and how much. Traditional venture capital funds require capital commitment first and then hope the general partners will find great investments.

Fundrise is a long-time sponsor of Financial Samurai and Financial Samurai is an investor in Fundrise as our investment philosophies are aligned.

The Average Daily Percent Move In The Stock Market is a Financial Samurai original post. I've been writing about personal finance since 2009. Further, I worked in equites at GS and CS for 13 years. To build more wealth, join 60,000 others and subscribe to my free weekly newsletter.

I have adopted a strategy of paying myself first with each payday I invest in my Vanguard account a set amount of money and I have a Roth IRA with them. My employer gives a profit sharing to me in a 401K without me having to match it of 3%. Besides what I earn from my employer I took a paper route and every penny of that goes toward paying off my mortgage early. My Roth is great to have as an emergency back up since the original investment isn’t taxable and if I wait until age 59 and a half none of it will be taxable so I’ll use it first before using my 401k and social security if I decide to go part time at work but I’m not sure if I will want to. It’s good to have many types of investments to fall back on just in case of emergency and I can’t wait to have my mortgage completely paid off.

Thank you for your advice on investing.

Wonderful! Where there is a plan, there is a way. Everybody has to do what’s best for them and try to stick to their plan in good times and bad times.

For readers of FS who are currently in their 20’s, the fact that you are interesting all the financial discussion on this site – financially, you will be in the top 10% of the population in your 40’s or 50’s.

Do invest into the market on a regular basis, but DO NOT spend all your time worry or try to position your investments in reaction to the market RANDOM behaviors.

Here is something worthy of your precious time – BUILD a family!

This is the best window of opportunity – DO NOT wait until you have achieved some arbitrary financial targets.

During the wealth accumulation phrase, as soon as you have accumulated one year worth of after tax saving – HAVE CHILDREN.

This is the main PURPOSE for all form of life – including yours!

Good luck!

Having children is your main purpose in life? That’s rather presumptuous, isn’t it? Some of us have zero interest, and unlike animals we have a choice.

In fact, some of us only have money precisely because we don’t have kids and thus avoid the arms race of consumption that is very difficult to avoid if you have kids.

Liam – there is no absolute in life. We all here to create something for the benefit of our individual selves or the benefit of the species.

Having our DNA represents in the next round is hardwired into our biology – the money is not a possible substitute.

Unless, there is a biological limitation. I do not believe not having children is the optimal choice for a full life – unless you can make contribution in the same par as Albert Einstein, Mahatma Gandhi, MLK.

Just be creative and useful as much as you can all the way – it will work as well!

I invest 12% of my pre-tax earnings into my 401-K where most of my allocations are in ETFs. I am 80% in equities but with recent market swings I am pulling back into bonds and CDs. To keep my blood pressure up a little bit I bought some Bitcoin and Ripple. Why not?

Everyone has their own crystal ball and mine is no better or worse than anyone else but here are my thoughts. I like to do some scenario planning during times like this and especially since I am advancing in age and need to shift our portfolio to a more conservative bend. I turn 62 in Oct. and my wife is 58. We are FI and I retired from my corporate role in 2015 to help get a startup off the ground and my wife continues to work in a Sales VP role. I am not taking any salary right now in our startup but do have a pension from an F100 company I worked at for 18 years.

My belief is that the recession is still 12-18 months away. I predicate this on the fact that I believe Trump wants to get re-elected and will get a deal done with China in the near future. I think this might calm the markets a bit and lead the next leg up in the market. Simultaneously, the Fed remains very dovish and will issue a series of rate cuts in 2020 to increase liquidity in the market and try as best they can to either fend off recession or help assure it is one that is short-lived and not very intrusive, similar to the late ’87 recession.

I think the Presidential election in November 2020 may be the tipping point. If Trump wins, the market is already familiar with him and his policies and probably won’t overreact. However, if the Democratic candidate wins, the market will hate the uncertainty of not knowing exactly what changes are coming and I would expect it to act badly and be incredibly volatile, leading us into the next recession. How long it will last depends largely on the policies of the new president and the impact on the economy. How the mix in Congress changes will also be important to watch.

So for me, now is the time to make some decisions. As far as asset allocation, I have been heavy toward equities (75%), AI = PE + REIT (12%) and Cash/Bonds (13%). I’ve moved some money recently and now the mix is 71/15/14. I will probably continue to downsize equities and build up cash with some moves in Q1, 2020. I am planning for my worst-case scenario which is a major recession in 2021 where my wife loses her job and my startup goes under, pushing us both into full-time retirement.

Our only debt is our mortgage which has 5 years left so I’ve put enough money in CDs and Savings Bonds to pay it off or just keep making the monthly payments. I’ve done the math and looked at the amortization schedule on the remaining interest to be paid and it is still considerably less than the interest I am earning in CDs and Bonds so no great incentive for me to pay it off early.

In April of 2021, my wife’s pension begins and in May, our daughter graduates from college so two good things financially speaking in that a new income stream kicks in and our expenses should drop considerably as we stop having college expenses and our daughter gets a job and begins to support herself. In her field, even in a recession, she should still have plenty of job opportunities.

Since we will have the cash to continue to pay the mortgage and we have 2 pensions to continue to cover our basic living expenses, we should be able to weather a recession just fine. I know most people won’t care about my scenario but thought I would just share it as food for thought. If you are younger and have a longer time horizon to weather the next impending storm then you probably don’t need to do a whole lot but for folks like me, now is the time to create your own plan around whatever scenarios you could be facing.

“I think the Presidential election in November 2020 may be the tipping point. If Trump wins, the market is already familiar with him and his policies and probably won’t overreact. However, if the Democratic candidate wins, the market will hate the uncertainty of not knowing exactly what changes are coming and I would expect it to act badly and be incredibly volatile, leading us into the next recession.”

Your logic is sound and makes complete sense. However this is exactly what people expected for the 2016 election. If Clinton won, no change in the markets because we would basically get a continuation of the Obama administration. If Trump won, there would be a huge selloff because of the uncertainty it would bring. Though there was a big selloff in the overnight hours after the results came in, the market ended up with a huge rally the next day that continued for the remainder of the year. Just goes to show how difficult predicting market swings is.

Market sentiment is very fickle for sure! I think a lot may also depend on how the economy is doing a year from now and whether the market is on edge or feeling pretty good about itself leading into the election.

Do you have a plan to hedge the election?

Methodology in a nutshell: Investing in growth funds primarily and S&P & dividend funds secondarily. They are more volatile in a downturn (i.e., lower prices to buy), but have larger gains when times are good. In the accumulation phase, and still got decades left. It does take a LOT of courage to invest when times are bad, easier said, but hard to execute.

Does this method sound crazy?

The easiest way to invest is auto deduction every month. This worked really well for me when I was in the accumulation phase. Now, I’m in between phases. I still invest, but only occasionally.

This is way trickier. You never know what the market is going to do next.

The best thing to do at this point is to keep a comfortable allocation and keep investing. Our investing horizon is still 30+ years. It should work out fine if we can stick to the plan.

It seems that a lot of people have success in employing a dollar-cost averaging investment strategy. Which is investing regularly (typically monthly) in stocks.

Also, I liked your use of graphs in this article. It makes the data easy to read, and helps you drive home your point.

I am glad I increased my allocation to individual bonds. My bonds have returned on an average 20% YTD so it has been a winning strategy

I follow the pay yourself first model. I have two accounts. One for my active trading, which is minimal, and another that I rarely look at. I call the latter my Set It and Forget It account (SI&FI). Each month the SI&FI account pulls money out of my active and invest in low cost index funds. The nice thing about that account is that I never log into it, thus the market downturns hurt less when I don’t see the actually amount lost on paper. I only do the auto-investing with 50% of my yearly savings. The rest I invest when the market presents opportunities such as last December. My method feels great when the market goes down and rebounds by 20%+ like the second half of 2018 into 2019, but I’m always second guessing myself when the market continues to climb and I feel like I missed my investment window. Your percentages of when the market sees 5% or 10% moves is reassuring that volatility will continue for bargain investing.

Dollar cost average into a S&P 500 index fund or buy the SPY by setting up a buying schedule on a monthly or bi-monthly basis and sticking to it.

Adjust to buy more when the market drops significantly (~20% correction). Continue to stick with S&P 500.

Hard to be a good individual stock picker. What you believe to be out-performance is really additional risk taking. Many professionals are paid to try to pick good stocks. The truth is if you are good enough to consistently beat the market by picking stocks, you would be working for a hedge fund.

Hey Sam. You have talked about the yield inversion curve before as a possible indicator of a looming recession.

I have read that an inverted curve has preceded a recession 7 of the last 9 times in the past 60 years. Do you know what was different with those 2 outliers? As we have an inverted yield curve now of course the likely scenario would be to follow the 7 preceding instances where recession followed.

I’ve dollar cost averaged into a S@P index fund for over 20 years now. Money comes out of my checking every Wednesday and Friday. I’ve bought during recessions, bubbles, scandals, republicans, democrats, and euphoria. Vanguard says I’ve averaged 10.9 percent since inception. I’m NOT a great investor. However, I’m an a extremely consistent investor. Anyone, and I mean anyone can replicate this. You just need consistency and time.

Man, I’ve been wondering if you would do a post addressing all the recent market volatility, and here it is right on cue! I love that you factor in the emotional part of investing. For a lot of us, investing windfalls (or maturing CDs, or whatever) in tranches during periods of extreme uncertainty (especially with an inverted yield curve) is the only way we will invest at all. It might end up being a wash (or even a slight loss relative to investing it all immediately) if a truly vicious bear never materializes, but at least the peace of mind allows us to keep investing.

I know you are currently holding a fairly large amount of bonds and CDs, just as I am, for capital preservation in an uncertain market, but I’m curious. If there is another vicious bear — say, a drop of 30% or more in the next couple years — will you then up your risk profile and go more heavily back into the market again? That is currently my plan, and I have specific amounts in mind depending how far the market drops (with the amounts growing larger if the market continues to decline). Are you planning something similar if there is a big drop?

Hi Sam,

In Europe, I’ve lately seen quite a bit of discussion that savings account rates could soon become negative. It might push more money from savings accounts to stocks and realestate. Do you have any thoughts on this?

I am very risk averse, my portfolio is positioned as follows:

70% Preferred stocks (mostly on REIT’s), yielding an average of 8%

10% Short term (4 & 5 years to maturity) corporate bonds, ave. yield of 6%

10% Equities (ave. yield of 7%)

10% cash (yielding 2.2% and used to covered puts sold on several equities, cash-covered puts)

Peter Lynch managed the Fidelity Magellan Fund from 1977 to 1990, and averaged a 29.2% annual return that more than doubled the S&P 500 index. In “One Up on Wall Street,” he relates how he was playing golf in Scotland when someone brought him word of what became known as the crash of ’87. He said his first inclination was to run for a phone. Before he did, he recalled that he had invested soundly and had faith in his selections. He then continued to play his golf game instead.

Well, if this is finally it, I’m not pulling out of the market. I made my investments with careful deliberation and am as confident as I can be that I made the right choices.

The mutual funds are run by money managers with decades of experience and a proven track records through past tribulations. A third of it is invested extremely conservatively, and the rest is as good as it gets these days.

I’m holding only a small amount in cash and a similar amount in individual stocks (less than 100k each), just because I like to dabble some and it seems to be good for me (Amazon, Google, and some automation interests).

We both plan to retire in five years, but don’t need to touch any of it until we have to start taking RMDs, well over a decade from now. If there is not a full recovery by then, people will more likely be investing in canned goods and ammunition.

Long term, I suspect that, probably after the next recession, intense waves of automation are going to dominate the markets, through the 2020s, to the tune of at least 7 or 8 trillion dollars in investment increases. Towards 2030, automation hitting lower and middle income wage earners with somewhere around a 25% “occupational displacement” will dry up demand and stagnate markets with way too much investment money (it will have been piling up at the top) chasing too few investment opportunities.

At this point, those of us wanting to retire early (or who already have, will be in a very touchy situation as governments will be “encouraged” to do “something,” and, if history is any guide, instead of doing anything meaningful or useful, it will be the folks above 90%, but below 99%, where most of the axe will fall.

There just doesn’t seem to be much chance that most of the people with 7 figure savings will be able to protect themselves the way the folks with 8 or 9 figure wealth will be able to.

But for now, some more quotes from Peter Lynch:

“It would be wonderful if we could avoid the setbacks with timely exits, but nobody has figured out how to predict them.”

“That’s not to say there’s no such thing as an overvalued market, but there’s no point worrying about it.”

“You can find good reasons to scuttle your equities in every morning paper and on every broadcast of the nightly news.”

“More money is lost from people trying to avoid the next correction than has ever been lost by the corrections themselves.”

“I’m always fully invested. It’s a great feeling to be caught with your pants up.”

“Gentlemen who prefer bonds don’t know what they’re missing.”

“Equity mutual funds are the perfect solution for people who want to own stocks without doing their own research. (EDIT: And don’t want to be doing that research every single day).”

If only I could rewind time and buy bonds when they were paying over 10%. Not only would I get my 10%+ a year, I would have gotten another 5%+ appreciation with less volatility.

Ah, the good old days!

Seem to recall my mom getting 10% on her CDs when I was a kid.

Overall, however, if I could rewind time I think I’d pick up certain stocks. Heh, no stress about volatility when you already know where they are going.

Appreciate your thoughts on holding solid until RMD time…my plan exactly and that gives me a calm feeling at times like this…I have an 18 year window however.

“I ended up investing my entire six-figure severance check into a Dow Jones Industrial Average structured note that provided … a 0.5% dividend yield instead of a ~2% dividend yield at the time. Without the 100% principal protection… I likely would have just bought a CD earning 3.5% instead.”

Wait, why didn’t you put it in a CD?

To get over my fear of investing, I talked to my personal banker to see if there was some type of instrument that provided downside protection in exchange for giving up some upside. It turns out there was.

I ended up investing my entire six-figure severance check into a Dow Jones Industrial Average structured note that provided 100% upside participation and 100% principal protection in exchange for only receiving a 0.5% dividend yield instead of a ~2% dividend yield at the time.

Without the 100% principal protection, I wouldn’t have had the courage to invest even 25% of the six-figure severance check naked long into the S&P 500. I likely would have just bought a CD earning 3.5% instead.

During the wealth accumulation phase toward Financial Independence, the best strategy is “buy low” when the market sells and not automatic investment. Anytime the market hit a new high, that high will become a historical value and will show up again as stable price sometime in the future.

As long as the share is bought below the high and is not sold before the high become the stable value, the gain will be permanent sometime in the future and going forward.

Once the Financial Independence mile marker is crossed, any new cash flow including any access from the systematic withdrawal schedules during wealth de-accumulation phase should not be invested back in the same financial vehicles prior to FI – unless you have found your passion in the process of the FI execution.

The 100% of new money should be invested in you. Otherwise, you are walking in a circle to the conundrum endpoint that triggered your financial independence journey in the beginning.

Your last sentence about short-term timing being impossible and long-term investing working out is what keeps me from worrying too much.

As a rule, I’m always fully-invested. As soon as I have cash to invest, I do. If I get a bonus, I invest the whole thing immediately, since dollar-cost averaging is purely a psychological benefit (and historically a drag on performance). I may change my strategic asset allocation as conditions change, but I don’t time flows with the market. This way, it’s practically automatic, and no overthinking is necessary!

Really great post.

I currently invest a set amount each week into a mix of bond index funds and stock index funds. The automatic investing keeps me invested, encourages savings and lessens the fear of missing out.

I also have a general rule if that I that I go out to eat or buy something like a pair of shoes I put that same amount into a robo advisor.

It’s so true that one needs to be comfortable with your own investment methodology in order to regularly invest. It took me some time in the beginning to get comfortable with my own and I was definitely much less regulated during that time with making contributions.

Really informative data points in the post and love the graphs btw. I love reminders of past bull markets and remembering how I felt during recessions. I’m starting to mentally prepare for the next one and am adjusting my investment strategy a bit so I’ll feel ok when it eventually comes again.