Despite reported rents going down anywhere from 15% for 2-bedrooms to 30% for studios in San Francisco, San Francisco real estate prices keep going up in 2020. The question is, how come?

As a resident of San Francisco since 2001, a homeowner since 2003, a landlord since 2005, and a personal finance blogger since 2009, I'll share with you my perspective on why San Francisco real estate prices keep going up during the pandemic.

Big media like Bloomberg, SF Chronicle, and more love to focus on the negatives. Perpetually negative local blogs like SocketSite and Wolf Street, who missed the big run up since 2011-2012 also like to focus on the negatives because they're hoping they'll finally be right. However, I'm here to tell you a more balanced point of view.

Yes, I'm long San Francisco real estate. But I also sold a single family home in The Marina district for $2.74 million back in 2017. Therefore, I feel I have a balanced perspective on the market. I'm also a landlord who recently spent a month interviewing a dozen prospective tenants.

San Francisco real estate prices keep going up, as you can see in the chart below. Let's explore why.

Why Are San Francisco Real Estate Prices Going Up When Rents Are Going Down

There are the main reasons why San Francisco real estate prices are going up despite rents going down.

1) Mortgage rates are down even more.

Ever since the Federal Reserve and the federal government decided to unleash trillions of dollars of stimulus to counteract the pandemic, mortgage rates have plummeted.

Below is a historical chart that shows how much mortgages rates have declined since the end of 2018, when the Fed actually hiked rates.

Due to record low mortgage rates, affordability is way up. You can get a 30-year fixed mortgage for under 3% and a 7/1 ARM for between 2% – 2.25% with minimal fees.

With the average 30-year fixed mortgage rate dropping from 4.85% in lat 2018 to 2.85% in late 2020, that's a 41% decline. Rents going down 30% still makes buying a home cheaper on a relative basis. Further, rents and home prices could shoot back up if there is a vaccine in 2021+. But your mortgage rate will stay fixed at a low rate for years.

If you are looking for a great mortgage, check out Credible. Credible has the best group of qualified lenders competing for your business so you can get the lowest interest rate possible. It's free to get a mortgage rate quote and compare.

2) Great migration out west.

Instead of moving to Des Moines, Iowa to save money, most rational San Francisco residents are first looking within San Francisco to save on rent on home purchase prices.

There is a great migration from east to west because rent and home prices are cheaper, there's more space, cleaner air, more parks, and less congestion. Rent and home prices in neighborhoods like the Richmond and Sunset are 20-30% cheaper than home prices in SOMA and the Mission.

There is also some migration from the very pricey northern neighborhoods of the Marina, Pacific Heights, and Presidio Heights out west for similar reasons. Home prices in the Sunset and Parkside are 40% – 50% cheaper than homes in Pacific Heights and Presidio Heights on a price per square foot basis ($800 – $1,000 vs. $1,200 – $1,800).

Further, the best area to buy in San Francisco is Golden Gate Heights, given there are mainly only single family homes. Roughly half the homes in GGH have ocean views, which make current pricing extremely undervalued. If you go to any international city, homes with ocean views trade at 50% to 100% PREMIUMS to the median. Therefore, many savvy buyers are looking for ocean view homes in SF.

My Recent Tenant Hunt

I recently spent the second half of August and the first half of September 2020 looking for tenants for my 4-bedroom, 3-bathroom property for $6,700 a month in Golden Gate Heights. It was the first time looking for tenants for this property because it was my primary residence.

I met with a total of 12 sets of tenants and 10 of them came from San Francisco's east side. The most popular neighborhoods were SOMA and The Mission, areas closer to downtown. Another set of tenants were coming from the South Bay and another set of tenants were relocating from India.

Instead of trying to save money by relocating out of state, it is clear the many San Francisco residents are spreading west to find more space, less density, and better value as I first did in 2014 when I bought a fixer.

By 2H2017, Redfin named Golden Gate Heights one of its 10 hottest neighborhoods in the country. Now, the pandemic is simply accelerating the migration out west.

3) Tech stocks are on fire

Home prices are driven by income and wealth gains. With the NASDAQ up over 25% in 2020, tens of thousands of techies have gotten extraordinarily wealthy during the pandemic.

Companies like Apple, Facebook, Google, Tesla, Netflix, Nvidia, Square, Twitter, Zoom and more have all done well in 2020. I don't even work at a tech company and I feel richer despite my relatively small tech holdings.

It is highly unlikely that San Francisco real estate prices will go down when some tech stocks are up well over 100% during the pandemic.

I've met plenty of couples who work at Apple who are at least $1 million wealthier after the pandemic began. Many want to buy a new home to upgrade their lifestyle.

4) Way more time spent at home.

With much more time spent working from home, the intrinsic value of a home has gone way up. Before the pandemic, the average person maybe have spent 12 hours at home on average. Now that average time spent at home has shot up to around 20 hours, or 67% longer.

The more time you spend using something, the more valuable it becomes. Homes may not be worth 67% more. However, the intrinsic value of a home is worth at least 10% – 20% more.

People are buying larger homes to accommodate more home offices. People are buying more homes with more decks and outdoor space. Homes that are closer to parks are also seeing high demand.

5) Increased desire to own real assets.

After the S&P 500 corrected by 32% in March 2020, it was a wake up call to millions of San Francisco Bay Area homeowners to diversify away from stocks and into real assets. Real estate is the logical beneficiary because real estate is less volatile, provides shelter, and can generate rental income.

In essence, many tech workers are exchanging their funny money stock gains into real assets. This way, they hope they can make their winnings last longer.

Money is meant to be spent on living a better life. You can't live in your stocks and raise a family in your stocks. But with all of us spending more time at home, we are all appreciating the value of our homes more. As a result, you are seeing a consistent upgrade cycle among all levels of buyers.

6) The desire to buy ahead of an eventual V-shaped recovery.

Anybody who has lived through the 2000 tech bubble remembers that the city went quiet for about two years and then roared back. Same thing happened after 2008-2009.

Many savvy buyers are taking advantage of fearful sellers by buying now, before there is a potential vaccine. The opportunity to buy big city real estate has never been greater.

I know multiple wealthy parents who are buying rental properties and single family homes for their portfolio. They are also buying rental properties as a hedge for their children.

There has always been a real fear that investors would get shut out of the SF real estate market if they didn't buy. Further, there is a fear by parents that their kids will get shut out after graduation.

By buying rental properties now, investors can earn rental income and provide a hedge for their children in case they graduate jobless. Their kids can manage the rental properties and gain a sense of pride.

7) The value of cash flow has gone way up.

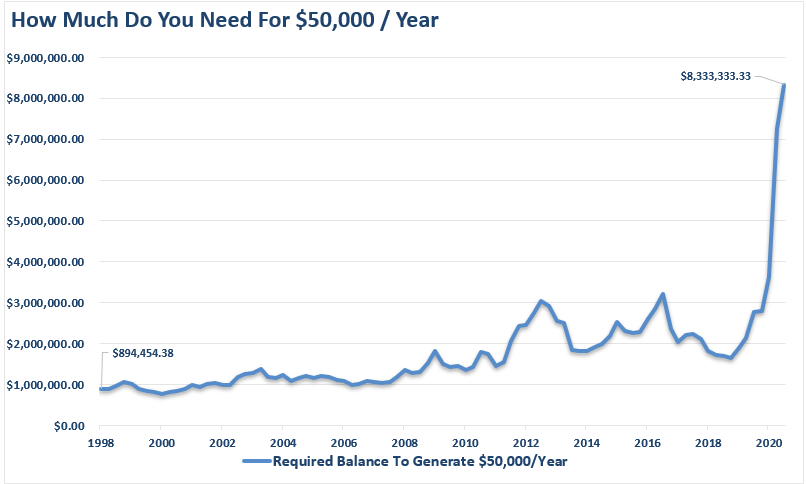

Because interest rates have gone way down, the value of any cash flow has gone way up. The reason is because it takes a lot more capital to generate the same amount of risk-adjusted income.

Below is a great chart that illustrates this point well. Generating $50,000 a year in cash flow used to be worth between $2 – $3 million. Now it's worth over $8 million thanks to lower rates!

Given the value of cash flow has gone way up, and rental property prices in San Francisco have either remained flat or gone down, savvy investors are beginning to buy rental properties now.

Please note this is different from single family home prices. Single family home prices are strong. Below is an example of a single family home in West Portal that sold for $455,000 over asking on 9/23/2020. Before the pandemic, it probably would have sold fo about $2 million, or a little over $1,000/sqft.

I've been keeping track of other great home sale examples in San Francisco during the pandemic here.

8) Tech firms are cutting salaries if workers relocate.

Few want to take a 10% – 20% pay cut to move to a different city and state when you can just relocate within San Francisco and save 20% – 40% on housing cost AND keep your salary the same.

Only if you have family elsewhere or you were already struggling to make it in San Francisco would you move away and take a pay cut and miss out on promotions, pay raises, and job opportunities when there is a vaccine.

The irony is that many San Francisco residents are happier with more flight. Less people make city living easier. As the population spreads out more evenly across the city, lifestyles get better for everyone who remain.

Fortunes Will Be Made In San Francisco Real Estate

With rents down in San Francisco, there is an opportunity to buy rental properties that are priced below pre-pandemic levels. When the inevitable V-shaped recovery happens in 2021+, investors are likely going to be rewarded. There will be a rush to buy after things are “all clear.” But to get rich, you must take risks before you know things are certain.

Single family properties in San Francisco will likely continue to do well. I have profiled many households who share their reasons why they are buying. The reasons are diverse and practical.

With so much wealth made in tech stocks during the pandemic, money is going to continue to chase the San Francisco and Silicon Valley real estate market. San Francisco real estate prices are likely to continue to going up for the foreseeable future.

The great migration to the western side of San Francisco is real. If you are looking to buy real estate in San Francisco, I would buy a single family home in Golden Gate Heights, Richmond, Sunset, West Portal, and Parkside. The city is fanning out and you want to get ahead or ride on this multi-decade trend.

And now, to nobody's surprise, San Francisco rents are going up and big city real estate prices are going up now. For real estate investors, this double win I think is going to last for years.

Recommendations

To keep updated on San Francisco real estate and all things personal finance, you can subscribe to my newsletter here. Financial Samurai is one of the largest independently owned personal finance blogs with over 1 million organic visitors a month.

For those of you who want to invest in real estate across lower cost areas of America, consider investing with Fundrise. Fundrise is one of the premier real estate crowdfunding platforms today for all investors. They have diversified private real estate funds that have performed well during times of volatility.

I've personally invested $810,000 in real estate crowdfunding to diversify my real estate holdings over the past four years.

Interesting article ….but …. residential prices in SF overall going up …errr…not even close. I’m constantly looking at homes re-selling now that are selling at the same price they did in year 2016, or 2017.

A few neighborhoods are showing strength, but overall week and condos are being mercilessly hammered.

This site has said for a few years now how Golden Gate Heights is “undervalued”. GGH has always sold “cheep”, always …for reasons being missed.

I’ve worked in real estate in SF since 1986…it’s been that way before then….

As for homes selling way over list…that’s common agent tactic to intentionally list the property artificially low …just had it done with a home I have in escrow.

How about a discussion of the exodus from SF, and Calif, who aren’t coming back ? I meet them weekly….

Anyway, I suggest you talk to people with “boots-on-the-ground”, for a dose of reality. It’s not a pretty picture …. at least for the time being.

The median single family home price is now about $1.95 million in San Francisco if you see my 1H 2021 update.

I’ve tracked many single family home sales during the pandemic, and they are up about 10% or s in general.

South Bay is going crazy as well. The below property sold 425K over asking price. It’s a complete fixer upper located in in Los Gatos however, rents have been going down a bit in this neighborhood.

https://www.redfin.com/CA/Los-Gatos/16526-Shady-View-Ln-95032/home/1336325?utm_source=ios_share&utm_medium=share&utm_campaign=copy_link&utm_nooverride=1&utm_content=link

Impressive price for such a small house. At least the lot size is nice!

It seems that a lot of couples can afford between two to $2.5 million. That’s the sweet spot nowadays versus 1.5 to $2 million just five or six years ago.

Mortgage rates and strong tech stock performance and overall stock market performance have really made real estate much more affordable.

Interesting article and fortunes will be made in San Francisco real estate. I actually know a person here in Edmonton that purchased a place in San Fracisco as a rental property. It was years ago now when they purchased, however, they still see it as a great place to invest and possibly retire. It is a beautiful city! They felt comfortable doing this because they have family in San Francisco and that makes it easier for them to manage it that way.

Your observations of the SF market ring true. I’ve been surprised at fast homes are selling during the pandemic. And I totally believe the migration out to the western part of SF. This crazy pandemic has really increased the value of having a nice home with outdoor space. And those properties are selling well in SF!

Thanks Sam. I am afraid you are spot on. We have been looking and looking at buying a primary residence in the NYC burbs and the inventory is completely different post COVID. The market is on fire and I have no clue what to do. 2 young kids and don’t want to rent forever. Can comfortably afford a $2M plus house, but don’t want to buy into this frenzy.

One thing you will discover is that once you have kids, the intrinsic value of a home goes way up. Your home is sheltering more people and your most valuable assets. Every it provides shelter and a place to create memories makes your home a little bit more worth it. There is this priceless feeling once you get the keys.

That said, discipline is in order. There is always a good deal somewhere. You just have to be patient.

Related: The 30/30/3 Home Buying Rule To Follow

Mike,

What is your take on Sausalito? I’ve always liked the weather, the Bay/ocean views, the vibe, and its fairly close proximity to San Francisco (ala via bike/ferry/drive).

I’m 28, single and can afford to buy a smaller place there (of which I’d like to first live, and then rent so that I always have a foothold in the Bay Area). I know there is less action in Sausalito for a young professional but I’m fine with that since I travel to NYC/LA for work a large percentage of the time.

My apprehension though is I’m afraid San Francisco may be the better investment – both for long-term appreciation and rentability.

Do you have an opinion on Sausalito? I’ve noticed you’ve never talked about Marin County.

-Mike

We’re under contract for a SFH in Pleasanton for $1.5m. In the market segment we targeted, we noticed a dearth of competition, allowing us to avoid a bidding war with anyone. We locked in a 30-year fixed-rate jumbo loan at 2.95% and 0 points. Sadly, there wasn’t a difference between the 30-year and a 7/1 or 10/1 ARM or we may have gone that route.

Almost 2,800 square feet on a third of an acre with the intention to stay put for many years to come. Hoping your prediction (and ours) on Bay Area real estate comes true.

Cool, congrats! I’m sure you’re going to love the space.

Over $2.5M there’s less competition in SF as well. Good you found the “dead zone” to get better value.

More renters looking to buy as well. There of been plenty of renters who have just been saving aggressively and they are finally deciding that continuing to rent a crappy place during a pandemic sucks.

There is also a growing a feeling that demand will surge even more after there is a vaccine in 2021.

Single family homes are going to do very, very well.

I agree that it is smart to buy San Francisco property now. Most of my wealthiest friends are buying single-family homes and rental properties before the inevitable V-shaped rebound.

It is good that the population is spreading west and more even throughout the city. The congestion downtown was really really terrible.

Jake / Sam: Are your friends basically waiting out and accepting short-term rental downside (tenants renegotiating rents -10-15%) and less cash flow and waiting for the rebound for rents to come back up, followed by longer-term (2022 and beyond) appreciation?

Are rental properties really going down significantly in price to have a chance of cash-flowing?

None of my three rental properties have had tenants who want to renegotiate.

The first rental property is probably because I was already below market. My tenants have been there for three years.

My second rental property was locked in this January and I think the value is pretty good. So no negotiations there. Maybe next year by $50 – $100, but I have my doubts b/c they are both doing well, my property is great value, and there’s an economic recovery.

I just locked in new tenants in October for my third rental property and the demand was very strong because it is a single-family home on the west side of San Francisco. The migration trend is real because I interviewed 12 parties and all but one more coming from the east side.

That’s great for you, Sam. It may be SFH are faring bettter. Just had one tenant in a 1BR ask for a -15% reduction, but that’s because it was market rate and now with all the press out there and the apt listings out there it feels like everyone’s asking.

I also have a few other multi-family units where people have asked over past 4 months, and my property manager says they get these requests daily. I just hope things pick up sooner than later.