1H 2021 turned out to be a raging bull market! The S&P 500 closed up 14.4%. At the beginning of the year, I had predicted an 8% rise in the index. However, my original year-end target price of 4,088 was quickly breached by early April.

Then, after 1Q 2021, I upgraded my year-end target to 4,200, and it was breached again on May 6. Now it feels like we're just running up the score. Let's really cherish the good times. We deserve it.

In this 1H 2021 Financial Samurai review, I'd like to highlight some things I've learned about investing, family, and business. I also want the review to provide a glimpse of life during the pandemic for future generations.

1H 2021 Review: Money

Public Investments (~30% of Net Worth)

After outperforming the S&P 500 in 2020 (+40% vs. +18%), my public investment portfolio underperformed in 1H 2021 (+9.14% vs. +14.4%). The reason was because my single stock tech names like Tesla, Netflix, and Apple underperformed the S&P 500 YTD.

Further, about 20% of my portfolio is in individual long-duration municipal bonds, which don't really move much. Bond funds were also down slightly in 1H 2021 because rates went up. Even though comparing a stock/bond portfolio to an all-stock index fund isn't apples-to-apples, it's still an interesting exercise.

I wasn't smart enough to rotate out of tech at the beginning of the year and into banks and consumer cyclicals. However, I also have an allergic reaction to creating taxable events in my taxable investment accounts. Therefore, I tend to just focus on a holding period of forever so long as I believe in the company.

My taxable investment accounts are much larger than my pre-tax retirement accounts out of necessity. I need them to be large enough to generate enough passive income to fund my lifestyle. Otherwise, I wouldn't have left work in 2012.

What's Next For Stocks In 2H 2021?

So far, I've been too conservative in my outlook. But at least I got the direction right. The below chart shows how the S&P 500 has performed after increasing by more than 12.5% in the first six months.

After a strong first half, the average return over the next six months was 7.1% and the median return was 9.7%. 75% of the time, the next six months showed a positive return.

The S&P 500 is currently trading at more than double its historical median P/E ratio of 15X. The Shiller PE ratio is more than double its historical 15.85X multiple as well. Therefore, valuations are sky-high. But these valuations are on depressed earnings.

Besides my remaining SEP IRA contributions, I'm no longer investing new capital in stocks. Companies now must prove to investors earnings will indeed rebound to lofty estimates so that valuations can normalize in 2022 and beyond. So far, they are.

Although I'm not enthusiastic about the stock market, historical data and positive earnings momentum are why I'm leaving my equity exposure untouched. I'm letting it ride.

With valuations so expensive, we should all expect another correction. However, will it feel so bad this time given we're up so much since January 1, 2020? Probably not as the likely overall sentiment will be to buy the dip.

Lessons About Stocks

It's hard to get your forecasts right. Therefore, focus on an appropriate asset allocation and net worth composition.

As you grow wealthier, the amount invested may start feeling a little scary. However, if you focus on the percentages, not the dollar amounts, it may help you overcome your fears of investing.

The other lesson is about mean reversion. You can get lucky investing in individual stocks some of the time. However, performance tends to mean-revert over time. Therefore, having the majority of your equity investments in an S&P 500 index fund makes sense. Keep it simple.

Below is another chart from Personal Capital showing my public investment performance since January 1, 2020. My hope is that my tech names start outperforming again. However, nobody knows the future.

Mean reversion also means the S&P 500 may give up some gains since the historical annual average is about 10%.

Real Estate (~40% of Net Worth)

Every real estate indicator shows that real estate performed well in 1H 2021. The S&P/ Case Shiller composite index of 20 metropolitan areas gained 14.9 percent through the 12 months ended in April 2021. This was the largest annual price increase since December 2005.

Even lowly San Francisco, where 23-year-olds can make $200,000 all-in right out of college, saw a median single-family home price reach a record-high $1,950,000 in May 2021 according to the MLS.

Big city living is making a huge comeback. Therefore, I think it's smart to search for rental properties in big cities that will benefit from both the rise in rent and principal. Big cities have underperformed the overall U.S. housing market during the pandemic, which is one of the reasons why I find big cities attractive.

What people don't seem to realize is that many big-city residents have made a lot more wealth than the average American. When you start off with a higher average net worth/income, you tend to make more money in a bull market.

Yet, our real estate values have not grown as quickly as the rest of the country. Therefore, we are finding much better relative value.

Heartland Real Estate En Fuego

My long-term investment thesis of investing in heartland real estate since 2016 has been proven correct. I couldn't foresee a pandemic normalizing remote work. However, I felt strongly the “fanning out of America” would continue thanks to technology.

I've been working from home since 2012. Working from home is more efficient and provides for a superior lifestyle than working in an office. Therefore, now that millions have finally experienced the same thing, there's no going back to the way things were.

I was speaking to a small tech company CEO the other day who said that remote work is a boon for their hiring needs. Pre-pandemic, it was tough to compete with big tech, who would always pay top dollar. But now, his company is finding talent everywhere.

When it comes to investing, focus on long-term trends. Once you identify a trend, position your capital accordingly. Gaining exposure is the main goal. Unless you are an investment professional, spending your time finding the best deals within the trend may not be the best use of your time.

My strong belief in the fanning out of America is why I invested $800,000 in a real estate crowdfunding fund that is predominantly invested in the Midwest and South. As the fund begins to return more capital, I will reinvest the proceeds in more heartland real estate to maintain or grow my position.

In the next 10 years, I want to have more of an equal exposure between coastal city real estate and heartland real estate.

Venture Debt

I've invested in three venture debt funds and I plan to invest in a fourth. So far, the returns have been in the mid-to-high teens. However, the returns could ultimately end up being much higher because the funds own warrants in some of their companies.

I like venture debt investing because of where it is in the capital stack. It's riskier than traditional lending, but it isn't as risky as private equity investing. If you can lend money at a high-interest rate to a well-capitalized company that is growing, your investment tends to work out. We're talking 10% – 15% interest rates.

If you can then get warrants (option to buy a company's equity at a particular price by a particular date), your venture debt upside can increase. You can learn more about venture debt investing here.

Overall Net Worth Growth

Below is my net worth chart using Personal Capital's free tools. The big dips and peaks are from money recognition timing issues. For example, if I transfer funds from one bank account to another.

The chart shows a 6% increase. However, it is misleading because it only reflects my public portfolio's growth and savings divided by my net worth. 70% of my net worth is in real estate, private equity, and various private funds that have not been revalued all year.

If I were to mark-to-market the 70%, my overall net worth is likely up closer to 12% – 15%. My target annual net worth growth rate is 10%. In a future post, I'll explain why I like to keep real estate valuations static for years.

1H 2021 Review: Family

Children have made our lives more meaningful. They give me the motivation to focus on my health and our finances every day. For if I were to die young and end up broke, that would suck for everyone. Children have also made me a little more compassionate.

When I come across really angry or disrespectful people online, I always wonder whether they were neglected growing up. Besides a genetic disposition to be a certain way, what else could cause people to be so nasty sometimes?

We should all try and treat others with more empathy and kindness. Who knows what is going on behind closed doors or what type of difficult upbringing people have had.

Raising young children during a pandemic has absolutely been the hardest thing my wife and I have ever had to do. Childcare is the greatest test of endurance, especially if your kids don't sleep through the night and don't nap during the day like our son. But once we get through it, I'm positive we'll get stronger.

Suggestion: If you're a hiring manager, hire a parent who has had to homeschool their kids during the entire pandemic. This parent is used to working at all hours of the day and night. This potential employee will also likely be super pumped to get back to working full-time after their kids go back to school.

Have Children Sooner Rather Than Later

If I could snap my fingers and ensure zero complications in mother and child, we would have another baby. For those of you with many children, you are truly blessed! Although, there are many costs to raising many children as well.

My wife and I started too late because we were too focused on our careers. However, I don't blame us because it's expensive living in New York and San Francisco.

As parents in our 40s, we worry about health issues if we were to have another child. Roughly 15% of the world's population has some type of disability. This is another reason to show kindness to everyone.

If you know you want to have kids, have them sooner. Although I do believe the ideal age to have a baby is in your early 30s from a biological and financial standpoint. There really is no perfect time.

As far as our children are concerned, the pandemic has been a time of joy! From picking cherries on a Tuesday to visiting the zoo on Wednesdays to running around the playground every day, they've been thoroughly loved.

It's good to shield our young children from the cruelties of life until they are ready. Goodness knows there's enough bad things that happen every day.

1H 2021 Review About Business

Business was great in 1H 2021 partly because I tried harder. There was also huge pent-up advertising demand as corporates felt more comfortable spending. Even though I made more money, I'm not any happier.

In fact, I've had more periods of frustration because I crossed my ideal balance of 80% fun / 20% business for too long. For most of 1H 2021, I was closer to 60% fun / 40% business. As a result, I'm reverting back to my old ways for the rest of the year.

They say it's better to focus on one or two subjects to grow your business. However, life is way more interesting than just talking about various ways to make more money. And if you've got enough sustainable passive income, the marginal joy of making more money declines.

For example, I'm currently all-in on fatherhood. Therefore, I'd love to discuss more about education, building self-esteem, developing a strong work ethic, and learning how to play nice with others. Of course, I'll also discuss estate planning topics like using a 529 plan to transfer wealth as well.

Part of having fun is doing whatever I want online. Having a business model based around free is definitely more freeing.

If you no longer enjoy running your business, you increase the risk of burnout. Therefore, make sure you properly calibrate your time to improve your odds of survival. Surviving is half the battle!

How To Keep Pushing On When You're Losing Financial Motivation

One of the most difficult things I've found is trying to make more money when you feel you already have enough. Partly due to frugality, I have a relatively low threshold for how much is enough. It's one of the reasons why I left maximum money behind at age 34.

The main way I was able to push myself to make more money during the pandemic is by focusing on what the new money could buy. More specifically, I came up with a list of what the new money could buy for our children.

For example, one of a parent's main responsibilities is to provide a rich education for our children. Therefore, with preschool starting back up this fall, I made it a goal to generate $3,000 a month in after-tax income to pay for tuition.

Depending on how much motivation you need to make more money, you can come up with an endless list of things to tether your money-making endeavors to. Other common examples include a mortgage, healthier food, health care, after-school activities, and college.

At some point, you may find that making more money becomes a soulless endeavor. Therefore, identify specific purposes for why you are working so hard.

A Time For More Joy

My goal is to reduce Financial Samurai-related activity back down to a maximum of 20 hours a week until August 25, 2021. A 50%+ average reduction in time should work wonders for my mental health and happiness.

After August 25, when my son returns to preschool, I will re-evaluate whether to continue my sabbatical or not. My suspicion is that I will itch to do more again since I'll have six more hours of free time a day. However, I won't know until I get there.

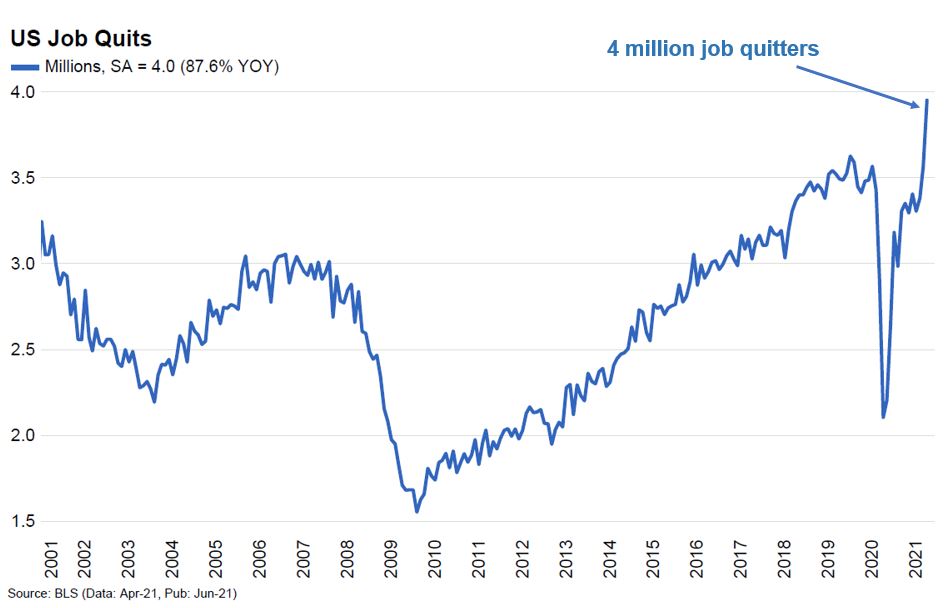

It feels great to join the ranks of 4 million job quitters in America! If work is not giving us joy, more of us are collectively saying no mas!

However, old habits die hard. I'm afraid I won't be able to take things down in the second half of the year as much as I imagine. Therefore, I'm going to count on my wife to slap my ass once I hit the 2.85-hour mark a day. I'll also encourage her to encourage me to go out and play more.

The ideal scenario is for all our investments to continue going up while we do less work. That's the beauty of passive income. That said, none of us should be surprised if we see a correction in our investments. At the same time, we're so far in the money that I'm not sure many of us will really care too much.

The financial windfall since the pandemic began doesn't seem real. Therefore, I encourage all of us to spend our boot and live it up more.

Readers, how was your 1H 2021? What are your plans for 2H 2021? Anybody quitting their jobs and YOLOing it? Who else is deciding to take things down a notch?

Related posts:

2022 Goals: Work Less, Have More Fun

For more nuanced content, subscribe to my free newsletter here. I've been helping people reach financial independence sooner since 2009. Everything is written based off firsthand knowledge and experience.

“From picking cherries on a Tuesday to visiting the zoo on Wednesdays to running around the playground every day, they’ve been thoroughly loved.” –That sentence made me happy and reminded me of my years raising my now-grown children.

Hi Sam,

As always, thank you for all the information you provide your readers.

I disagree with you regarding children. I married late, 45 (I was in the military and was always deploying), and now have six adorable little monsters, ages 10 to four months. Having kiddos late, at least for men (my wife is 16 years younger) is not an issue if you keep your health. I still maintain the Marine Corps’ height and weight standards and due to my kids – this motivates me to stay fit. Also, my wife an I are not into keeping up with Jones’s and our kids are all thriving.

I attained FI several years ago and being involved in my kids life, sans deployments, has been a blessing.

I look forward to your next post.

Semper FI,

Luis

Only disagree on one thing here. Biologically, the best time to have a baby is in 18-25 age range, if you are a woman. Risks increase slowly up to 32 and exponentially from there.

Sure, if we’re only talking biology. I’m using two variables: Biology + Finances.

My wife and I, both 29 years old, had a solid 1H2021. We’ll probably end up making $150k this year combined and bought our second house at the end of last year. Our official net worth ended the first half of the year a hair over $450k (although I only revalue our real estate at the end of ever year). However, if I was more realistic in how I calculate the value our real estate, we would be over $550k. The goal we set out at the beginning of this year was to have a NW of over $500k by EOY (started the year at $410k).

Even with breaking the FS car buying rule this year (and not including car values in our NW), we are still on pace to hit our goal for the year and I think we’ll have the opportunity to exceed our goal of hitting $1M by age 35!

Moving forward, we are considering trying to put more of our savings into roth and/or after tax accounts so we have the flexibility to use it sooner than 59 1/2 (or whatever arbitrary age the government tries to enforce in the future)

Always appreciate the updates!

It gives me a lot of things to think about

I appreciate your conservative approach, in fact I don’t know anyone over 45 (who is a serious investor) who hasn’t rotated out of the market at least 40% of their gains from the past year. Most have moved over to Treasury or corporate/muni bonds. A select few have opted for real estate and even interesting collectibles like art and antiques. An even more select group have gone on a spending spree of large boats, luxurious vacations and even start up angel investing. Why not? So much of this year’s gains literally came out of the blue and was not expected, at least not at these levels.

On the flip side, that means that a whole bunch of new investors, young investors and “Stimmy” check investors are blowing the bubble up all by themselves. While I appreciate the massive gains that seem to be falling from heaven for no apparent valid economic reason, I fear these new investor will be burned so badly when the bubble pops that they will misunderstand how the market is supposed to work (long term etc). When they finally decide to leave in utter disappointment and despair…watch out.

Wow! Long read but enjoyed it. Congrats on your business Sam and Good luck on your goal to reduce financial stress. May you success with your goals!

Can confirm first-hand about the SLC housing market going nuts over the past year. Up 27% over the past 12 months, and everyone else’s house has pretty much followed the exact same trajectory. I feel legit terrible for first-time home buyers right now. Just brutal.

Bought my house in 2012 for 380k — it’s now valued at $855k. I don’t think houses are supposed to increase at a ~9% annual rate, but here we are.

Sam, hope you get to recharge your batteries during your sabbatical. Here’s to even more growth in the coming quarters (and months and years).

Congrats on the great 1H 2021, Sam. Finances and Fatherhood seem to be treating you well. Although an avid follower of yours, I am very glad to hear you are taking it down a notch and will reevaluate in August. I wish you and your family continued success, luck and happiness. Thanks again for helping us all get through the pandemic. As I’ve mentioned before, your site was paramount to my financial navigation, before, during and hopefully after, the pandemic.

“Readers, how was your 1H 2021, what are your plans for 2H 2021”

1H 2021, NW improved by a crazy 14%. Now pushing 2.3 mil, I’ve blown by my 2 year goal of 2 Mil by 2022. Mostly attributable to real estate appreciation, its been a great 6 months.

On the personal side, my oldest graduated from Highschool and we will be taking her to University of Colorado Boulder, in a little over a month. Weren’t we just taking her to preschool as well?!?!

To start off the 2H of 2021, I have an appointment Thursday at my Bank, to transmit the final payoff payment on my second rental owned without a mortgage. 2 rental homes down, one to go with a mortgage. I will now focus on continuing to enjoy my two remaining daughters (11th, 9th grade) time in highschool and in our home. Then we will game plan a route to get them all through college with minimal (hopefully zero) debt.

Very best wishes to you, on your sabbatical. I’ll be eagerly waiting the Samurai’s return.

Jim

Thanks Jim and great to hear! Congrats on achieving your financial goals sooner and your daughter going to UC Boulder!

Great six months of posts!!! Thanks for all the interesting content.

Will be good to see what happens with the equity/everything bubble.

How amazing would it be if the everything bubble went up another 10%? It is just nuts right now.

Normally, I would be more worried. But with the government so willing to stimulate us, I have faith a new administration will save us from ourselves.

Congratulations, Sam! A positive increase to net worth is mountain times better than a negative increase. In the alternative, you not only lose money but also lose the time it takes just to get back to even.

I’m so confused by the stock market. Actually, not just the stock market but in real estate as well. One of my friends bought real estate last year. Guess when? That’s right, March 2020, at the bottom of the bottom of real estate. He showed me his house valuation estimate and wow, a 56% increase in just a year.

If he does a cash out refinance, he would be SWIMMING in cash.

I’m just a confused investor who doesn’t know what to do. I only think the stock market will go higher because of the pent up demand that will be UNLEASHED from having double digit savings rate. It just feels greedy to let the price increases ride…

Dang, 56% is huge! Is he in the Midwest? What was the purchase price? I’d be curious to know his mindset back in March.

I did write about mine here: https://www.financialsamurai.com/real-estate-buying-strategies-during-the-covid-19-pandemic/

It’s kinda sad SF is only up ~10% YoY. But I believe it will normalize!

He’s in Texas. I can tell you that he didn’t have any rationale going into buying the property besides “Yeah, I need to buy a house”. He’s one of those people who will do everything at the last second and somehow have it all work out by the end of it all.

I remember on the day of a final exam at 9:00am, he called me at 8:15am to ask for my help in getting ready for the final exam. He passes it with a B, which was all he wanted.

He didn’t study for CFA I Exam until the week before the exam and somehow passes it.

It doesn’t surprise me that he just decided to buy a house and have the timing work out to be the best timing that anyone in the world could have ever done.

Am I smarter than him? Yes. Do I think that me being smarter than him matters in our overall financial well being? Nope. I suspect he’s doing better than me in terms of finances.

Enjoy increasing your % fun category. Still working on the balance myself. Nowhere near the 80/20 target you described but this is a good reminder to keep moving towards that as a goal.

Love the update as usual! I hope you enjoy your sabbatical! I am just coming off a sabbatical made up of relaxing, my wedding, honeymoon, and moving across the country. Ready for a strong 2H2021. I’d love to connect with you more to help you extend your sabbatical if that is of interest to you!

Sounds like an eventful time off! Hope you were able to rejuvenate as well. Best of luck in 2H!

Dumb question, if we are keeping actively managing our investments, why buy bonds?

Don’t understand your question. Sorry!

Bonds have performed incredible well over the past 20 years. If you believe in low interest rates, you don’t mind holding bonds.

Congrats on a successful past six months! I am surprised at how the markets are continuing to be strong. I often find myself thinking “how can that be?” when I pull up the 10 year chart of the S&P. I should probably start legging into my holdings again and putting small chunks of cash to work. But, it’s also hard to buy at all time highs!

Anyway, thank you for all of your articles and newsletters throughout the entire pandemic and longer. I hope you get to have more time for fun in your sabbatical. You certainly deserve it!

Thanks! When unsure, pay down debt. Can never go wrong.

Agree

But, @Sam, Why not stash/buy the high yield in a Roth, even if you’re self- employed, you should be able to fund a Roth..it only says you have to be working to fund/contribute to a Roth.. I’ve seen nothing about the type of employment/working in any Roth literatures. Have you❓

Great update as usual. Keep kicking butt and enjoy your sabbatical!

I highly recommend the maximum 20 hours of work a week. So far that has been working out great for me and the family.

Oh and you are 100% right parenting little kids is the hardest job in the world. So anyone out there who can, please consider hiring a parent who will be gung ho to kick down doors and get back in the office!

Thanks! I’m really betting on 20 hours as the max limit a week for maximum happiness and feeling of professional contentment. After that, there’s a plateau. And after about 40-50 hours, I think it starts going downhill.

read about what Jeremy Grantham is thinking about an epic bubble

Yep! He’s been mega bearish every year for years. Fun read. Yet he still manages long-only money and has gotten extraordinarily wealthy.

Gotta love it!

I definitely believe we could see a 10% to 20% correction in the stock market. What do you believe it?