The average saving rate by income increases the more you make. That's logical since living expenses like housing and food tend to more relatively more fixed, unless you suffer from tremendous lifestyle inflation.

However, the average saving rate doesn't always increase with more income due to a lack of discipline. We all know people who spend way too much and live paycheck-to-paycheck despite huge salaries.

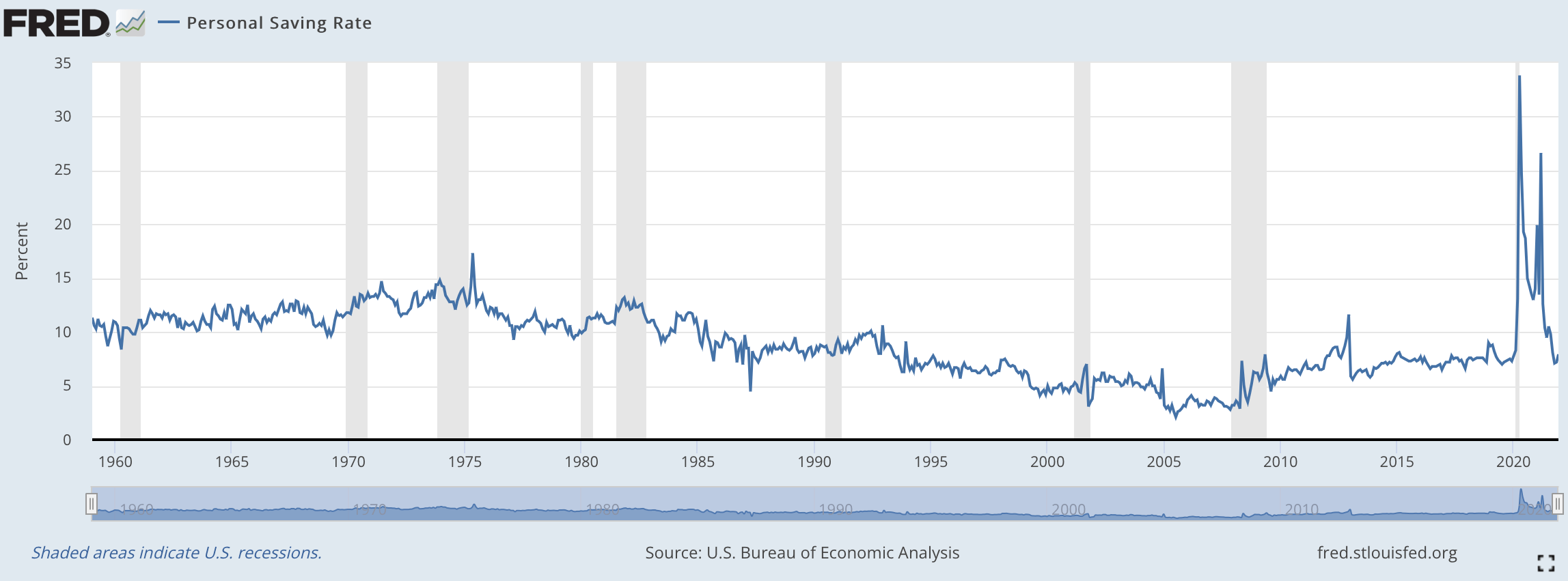

Before the global pandemic began, Americans as a whole didn't save a lot of money. Up until May 2020, the average saving rate was only around 7%. At least 7% was better than the average saving rate of only 2.4% in 2006.

In other words, it takes the average American 13 – 45 years to save just one year's worth of living expenses. That is a disaster if you want to achieve financial independence sooner, rather than later. And Financial Samurai is all about readers reaching financial independence ASAP.

When you're 60-something years old and only have several years worth of living expenses to buttress your declining Social Security checks, life isn't going to be very leisurely. You'll probably be mad at the government for lying to you and mad at yourself for not saving more when you still had a chance.

Americans Can Save More Money If We Want To

Thankfully, Americans have learned their lesson. The average saving rate shot up to 33% in April 2020, but fell back down to below 8% in 2022, and is now just 4% in 2024. As the economy recovers, people feel confident spending more.

The good thing about the huge ramp in the average saving rate in April 2020 is that Americans can save if we want to! Sure, there was a lot of free money from the government that helped boost our savings. But when we are locked down and everything is closed in real life, our saving rate naturally goes up.

Just be careful spending too much, given our economy could go into a recession after 11 Fed rate hikes and a prolonged inverted yield curve. Here's a recession preparation checklist to survive bad times potentially once again.

A Distortion In The Average Saving Rate

The problem with averages is that averages distort reality. Median is a more appropriate metric, but how does one find the median saving rate?

For example, according to the latest Consumer Finance Report, the average household has a net worth of approximately $1.02 million. That's right, the average American household is now a millionaire! However, you and I know that this is unlikely based on common sense. But simple math doesn't lie.

Take the total household wealth in the US of about $110 trillion (according to the Fed) and divide by 115,226,802 US households (according to the Census Bureau) and you get almost a million dollars per household.

But as we also learn from the Consumer Finance Report, the median net worth of an American household is closer to only $192,000. $192,000 is much more reflective of the typical American household. Hence, the average saving rate you see may not be reflective of the typical saving rate of the American household, given wealthier households can easily save much more.

Related: How Much Should My Net Worth Be By Income?

I'm absolutely positive more than 90% of Financial Samurai readers save more than 4%. We are personal finance enthusiasts after all, obsessed with trying to achieve FIRE ASAP. Therefore, what's the reality behind this ~4% national savings figure? The truth is that savings rates vary by income.

Average Saving Rate By Wealth Class

Take a look at this fantastic chart by economists Emmanuel Saez from my alma mater, UC Berkeley, and Gabriel Zucman from the London School of Economics. It shows the average saving rate by income, or wealth class as they call it.

The dotted line shows the often quoted 4% figure, which is made up of the bottom 90% of income earners. The top 10% to top 1% of income earners save roughly 12%, which I find surprisingly low. It's only the top 1% who saves an impressive figure at roughly 38%.

Related: Who Are The Top 1% Income Earners?

Average Saving Rate For The Top 1%

The average saving rate for the top 1% is 38%. This average saving rate of 38% is key for EVERYONE to try and shoot for, no matter your income.

The top 1% of income earners can clearly save more of their income because less of their income is being taken up by necessities such as housing, transportation, food, and education.

The 38% savings figure also blows away the feel-good myth by the middle class that rich people tend to blow their money and end up broke in the end like the rest of us. The rich are rich for a reason. And one of the reasons is an impressive savings rate.

Related: How Much Do The Top 1% Make?

The Average Saving Rate By Income Needs To Increase

I strongly believe everyone should start with a minimum 10% savings rate, and gradually increase their savings rate by 1% a month until it hurts.

After staying with the painful savings rate figure for several months, the pain starts to go away. We humans are adaptable and will naturally change our spending habits to adjust to our incomes. I

If your savings rate doesn't hurt, you are not saving enough. The average saving rate by income needs to drastically increase. It needs to stay elevated for decades to help people achieve financial independence.

The ultimate goal is to shoot for at least a 20% steady state savings rate so that every five years of work equates to one year's worth of savings. By the time you work for 40 years, you'll have therefore accumulated at least 8 years of savings. Thanks to compounding, you will likely have even more.

If you don't want to kill yourself at work for 40 years like the typical person, then you must figure out a way to save more. Once you regularly save 50% of your income, then there's no doubt you'll achieve financial independence within 20 years.

No Excuses To Not Saving More

Making at least $30,000 per person should enable you to save at least 10% of your gross income. To save more, find a roommate, live at home, cook your meals, abolish alcohol, skip out on the latest Justin Bieber concert if you have to. Make savings a priority if you want to be free.

If you are making less than $30,000 a year supporting only yourself, then consider: 1) finding a more lucrative job, 2) building multiple income streams, 3) developing more financial buffers and expanding your knowledge and skills. Of course everything is easier said than done. But that's what this site and many other personal finance sites are here for.

The Average Saving Rate Poll

Come take my savings poll to see what the average personal finance enthusiast saves a year. To clarify “savings rate,” a 20% gross income savings rate on $100,000 = $20,000 in the bank for simplicity's sake.

The reality is that you are saving more than 20% if you calculate your after tax income since $100,000 gross is really only around $80,000 net of taxes. Hence, a 20% gross savings rate is equivalent to a ~25% after-tax savings rate ($20,000/$80,000). I've added an after-tax savings poll to be thorough.

Build More Wealth Through Real Estate

A high saving rate is fundamental for achieving financial freedom. However, your savings must be invested to beat inflation and produce passive income. Inflation is high now, which means we need to invest in real estate, which benefits tremendously from inflation.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $810,000 with real estate crowdfunding platforms. With interest rates down, the value of cash flow is up. Further, the pandemic has made working from home more common.

Take a look at my two favorite real estate crowdfunding platforms.

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and manages about $3 billion for over 350,000 investors. For most people, investing in a diversified eREIT is the easiest way to gain real estate exposure.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build you own diversified real estate portfolio.

Both platforms are long-time sponsors of Financial Samurai and Financial Samurai is a six-figure investor in Fundrise. I see great opportunity to invest in commercial real estate today. Prices are down almost as much as they declined during the 2008 Global Financial Crisis, yet the economy and household balance sheets are much stronger.

The Average Saving Rate by Income And Wealth Class is a Financial Samurai original post. I've been helping people save and invest more since 2009. Come along for the ride and subscribe to my free weekly newsletter here.

While the overall average U.S. savings rate dropped to just ~4% by 2024, the chart highlights important variance across wealth levels—top earners (top 1%) typically save ~38%, underscoring how discipline and margin matter far more than income alone

Good info but bad education by author. Less than 20% of Americans make over 6 figures. 6 figures isn’t anything crazy anymore. I’m making around 30-60k a year (health business) & I’m barely able to save $300 a paycheck by weekly & I have no debt. Get another job? Oh wow why didn’t I think of that? Oh wait I’m in the top hourly rate for my city and have another job. Get a roommate? Have one. Cook at home, have only $30K in student debt. Invest in real-estate? I would need to be making $310K a year just to get a mortgage. You people doing these stats are really out of the loop.

How do you categorize income after tax that is reinvested into downpayments for rental properties and investments into stocks? Are those savings?

My paycheck: Taxes – 21%, Health ins – 5%, retirement (401K, etc) – 16%, mortgages for primary and rentals and prop taxes – 27%, reinvest into downpayments – 21%, spendings (food, car, etc) – 10%.

Yes, savings. It’s a part of your assets in the net worth equation.

I am 58 years old and would like to know where I stand. I have been out of work for 3 years and my total net worth is $1.9 millions. I have no house and my yearly net income is about $60,000 out of which I have been able to save $28,000 to $30,000 annually. Will I be in financial trouble in the future relying on this income? Your comments / reply / feedback are appreciated

If I’m hearing you right, then I’ve got good news! You’re not “out of work”, you’re retired! If you’re managing to save $28-30K from your net income of $60K, then your annual expense must be hovering around $30-32K? Even with a very conservative annual withdrawal rate from your nest egg, you should be able to pay your bills for the next 100 years!

But don’t take my word for it. Here’s where I get my info:

https://www.financialsamurai.com/how-much-savings-needed-to-retire-early/

Cheers to you!

I just did our savings rate (gross) and it’s about 68%. I don’t know the net rate yet (which I feel like matters more) but I think anything hovering around 50% is healthy and doable for 6 figure income households in an average cost US city.

Thanks for this breakdown.

It confirms that the “rich” do save and invest more.

It is embarrassing to note that the average American savings rate is currently well below 3%

I never had a fixed savings rate but it likely average around a third of gross. Which is about 1/2 of net income. I reached FI in about 17 years so that goes along with what you are saying here.

“It confirms that the “rich” do save and invest more.”

I sure hope so. Given the enormous difference in discretionary income, if they didn’t save and invest more then their behavior would be vastly more irresponsible than the people making less than they do.

In any case, please be careful about that statement. First of all, it implies that the poor are less responsible with their money, which is often asserted incorrectly. I know I was a lot more frugal when I made $25K vs now making multiples of that. I think there are just a significant subset of people who can’t manage money, in every socio-economic group. Note also the difference between mean and median, which has implications in every grouping above.

in the zuckman chart above with savings rate, is this saying the cutoff for the top 1 percent is 38% savings, or is it the average? In addition is this gross or net and does this include retirement savings to 401k, etc?

Military officer stationed overseas here. My savings rate is a bit extreme and probably not a model other people can mirror, but at 75-80% it’s an achievement that I’m proud of. With bonuses and tax-free housing allowance and cost of living allowances, I’m netting about $18K/month, and together with spouse we are netting $24K. Biggest expense is housing. 2.875% mortgage on a Manhattan coop apartment (my spouse lives in it while I am stationed overseas) and monthly maintenance of $1525 gives us housing expenses of roughly $5K a month but really it is $2600 (since 2400 goes towards paying down principle on the mortgage I subtract that). I have no housing expenses where I am. Other major expense is flights to see one another as often as we can, but otherwise expenses are pretty low — shopping in commissaries, $10 haircuts, no healthcare expenses). No kids. Total monthly expenses come in at around $5-6000 and that’s without any hardcore budgeting. Net worth is around 1.3M after working for 15 years (I always saved but it took me a while to get up to this high in absolute terms and percentage terms). We are heading towards a nice pension as well so we aren’t really relying on that money for anything and are pretty risk tolerant with our investment portfolio.

have some kids—- the world needs em, and u at 65yo r gonna need em.

Saving 80 to 95% is foolish to the extreme. What if he dies tomorrow (or soon)? Does the money go to charity?

One must know and understand what “balance” and “common sense” is all about when it involves life’s choices.

[…] No sane person would save 80-95% of his income if he didn’t love money wouldn’t you agree? It’s clear to me that Jon has a frugal gene and will accumulate much more wealth than the average American who saves just 4% or less of their income. […]

[…] reader asked on my post, The Average Savings Rates By Income, whether I consider paying down debt part of my personal savings rate calculation. My immediate […]

[…] the bottom 90% of Americans have had an average savings rate between -3% – 5% over the past 20 years, it’s clear that most Americans don’t have the capacity and/or […]

[…] the tide comes in we can see who’s been swimming naked. The average savings rate in America is at best 3-4%. This is a recipe for financial disaster. Life throws unexpected events at you, and if you’re not […]

I would like to know if you think I am sitting good based on age and saving and overall debt. I currently have about 75k in debt that includes me having 3 properties and a car. 1 property is free and clear. The current value of the 3 homes is about 200k even selling at a reduced rate of 20% still brings the vale to about 160k. Total purchase and repair for homes is about is about 120k. I currently cash flow about $1200. My total living expense are about $1000. I just turned 30 and have about $$29k in my 401k and about 15k in and ira and about another 20k in cash.

At your age and motivation to do well, you are doing better than most your age. Property are usually good investments based on location, but also do your own due diligence on other investments to balance your portfolio. I also owned property, but sold them when I retired, because I didn’t want to “manage” anything after retirement. Today’s investment opportunities have decreased substantially from the coronavirus, and nobody really knows when we’ll be back to “normal.” You have a good start; keep at it, and you’ll succeed.

Sam –

I’m curious, do you consider paying down debt part of your personal savings rate? For instance, if I own a rental property and pay down $10,000 a year in principal, is that $10,000 a year that I am saving?

It’s a good question. I don’t because I’m conservative. I don’t even include my 401k max contribution, only what I save after taxes and 401k contribution to stay conservative. I figure that if my 401k and my property is there for me in 20-30 years, fantastic. If not, then I never relied on it.

I don’t include the extra principal pay down I lob towards my rental properties either. Maybe I should, as I’m on an aggressive pay down mission now.

* Why I’m Paying Down My Mortgage And Why You Should Too

* Pay Down Debt or Invest? Utilize FS-DAIR

Sam, I’m struggling here. I’m saving/ investing while in quite a bit of debt. Conventional wisdom says “Pay debt off fast!!” but the math does not. I owe $300k (at anywhere between 3% – 4.5%). I am paying more than minimums but also maxing my 401k and want to start dabbling with investing. I make approx $215k (just started making that this year after grad school – I’m 31).

Pay the debt or invest in hopes that my ROI is greater than 4%? I know your pain threshold is 6%. What would you do in my shoes?

Matt, That’s a great income – congratulations.

Here’s one way to think about the math of paying off the debt: Since you’re using after-tax dollars to pay down the debt, you can factor in your tax rate and think of it as a guaranteed rate of return. For example, 4% divided by your tax rate is probably over 6.5% equivalent.

Keep maxing your 401k, as well.

Average savings is a very poor metric, because it depends on where one lives and its cost of living. Saving for the long term and where you invest are the important issues. If a worker begins to invest early, and maintains that habit for their entire working career, that’s one important issue. The other is where one invests and how to determine the mix between equity and bonds. Many so-called investment gurus tell you to invest in a mix between equity and bonds based on age. That recommendation is wrong on all fronts. When the economy is strong as it is in our country – growing at over 2% every year, it behooves us to take advantage of it. I’m now 82 years old, and have been investing for most of my working years. When I studied investing for retirement, it mattered where and how much in fees one paid. I found Fidelity and Vanguard to have the lowest fees. Most investment gurus tell you to increase your bond holdings as you get older. At my age, we’re supposed to have 80% in bonds and 20% in equity. Why? Bonds are paying less than 2%. My one year return was 12.3%, because my investments are favored in equity over bonds. Oh, my liquid cash position is 4.5% (under the recommended 5%). So what? I get my social security and I withdraw $2,000 a month from my investments. In this way, I don’t withdraw when my investments when they are at its highest or lowest; it averages out. Over the past 3 years, I withdrew $20,000 less than my gains from investments which was 2.5%. Everybody needs to manage their own money. Financial advisors are paid handsomely that takes away from investment income. That’s my .02c worth of opinion for today.

Tak, what is your net worth now and how do you plan to do estate planning at the end? It sounds like you’re gonna have a lot more than you need?

My net annual income is $12K and I spend $6K to rent a room. How much do you expect me to be saving?

I hope you can still save 10%, or $600 a year. It’s more of a habit than anything.

But can you try and find another job to make more?

Just for clarification. When starting, do I save 10% of gross monthly income or 10% of net monthly income i.e., after taxes and social security are deducted?

Great questions Renate. If you can start by saving 10% of your gross salary, then fantastic. If not, 10% after taxes is also good. Saving 10% of gross salary is obviously a higher absolute dollar value than 10% after taxes.

The rich save a lot because they can afford to save a lot. When your income is barely enough to pay your bills and raise your kids, you are lucky to save 4%. Easy to bash on the poor when you make enough to make ends meet.

The rich save a lot *because* they are rich—they are not rich because they saved a lot.

Plus, let me remind you that the purpose of life is not to save money. To forfeit meaningful experiences while you can enjoy them is more idiotic than saving money while you can save it. I am not saying you shouldn’t save—you should. Just within reason.

Besides, we pay social security for a reason. If that SS check doesn’t come when we need it, then maybe we can all decide to stop paying SS taxes.

I will hands down take the other side of your argument. I believe a big reason why the rich are rich is because of simple and consistent savings. Good financial habits go a long way to building wealth.

Check out the millionaire next door.

What is your current savings rate, age, etc

Thx

Obviously you didn’t even read this entry (or clearly it didn’t sink in). We have a 12% savings rate even among those in the top 10% earners. That’s pathetic. Do you really mean to say you can’t enjoy life as a top 10% earner and still save at least 15% or more?

We save 20% of gross. That number goes to 25% when you include employer 401k match. We both received nice raises this year so we expect that number to rise.

This does not include principal paid on our mortgage. I know some people argue that the principal paid should count as a form of forced savings.

The chart attached to this story is incorrect (although it could just be a labeling error). It is saying that from 2005 to 2014 the fall in TV prices is greater than 100%. I have yet to be paid to take a TV from a manufacturer.

It also is saying that there has been a 23% overall increase which would mean college tuition and fees would dominate all other costs (all other costs have risen less than 23%).

Excellent observation! What it’s showing is probably negative value of the same TV now vs 2004.

I tried to give away my 2003 50″ projection HDTV on CL and nobody wanted it. It was heavy, huge, and old tech even if it was brand new.

Technology has advanced so far that you can pay someone to accept old new tech!

I think it also depends on what type of saving you are talking about. I have this conversation with my wife often. If we are saving in mutual funds and/or retirement – that is much different than saving for a vacation next year or to buy a car in cash (consumption). One of these truly leads to an increase in wealth, the other is delayed customer consumption. Just a thought.

Jacob

I find your advice for a savings rate to be ironic. Most Americans take on debt until it hurts! Understanding why we do the exact opposite than what we should psychologically would make a fascinating conversation.

I welcome a post on the subject if you’d like to contribute to the conversation! Just shoot me an e-mail and let me know.

In the meantime, read: How To Blow Lots Of Money, Enjoy Life, And Not Give A Damn!

I would like to know the median household income. The 1% can skew the mean average up quite a bit. Truth is that it would probably be in the 100k range. The minimum pretax savings should be the 401K match of the company and max out the IRA. You should then save you net income as well after the rainy day fund is complete.

Have you ever done a poll where you have your readers do a poll to select their approximate net worth? That would be cool to look at… I am new’ish here so not too sure if it has already been done.

I have, in a post on how many credit cards is too much and a correlation with net worth.

Check it out: https://www.financialsamurai.com/is-there-a-correlation-between-the-number-of-credit-cards-one-has-and-net-worth/

I might just do a straight up, what is your net worth post in the future. Might as well!