Over the years, a number of you have asked me to write a review about what exactly goes on with a free Empower (previously Personal Capital) consultation. Personal Capital was purchased by Empower in 2000 and made the firm even better. The consultation is worth $799 according to them.

Common questions include: Is the consultation really free? Is the consultation a high pressured sales call in disguise? Will I get something out of it even if I don't sign up? Is a free Empower consultation really worth it?

The short answers to the questions are: Yes, the consultation really is free. There's no high pressured sales tactics, just an understanding they'd like to work with you if you've found them helpful.

You can continue to use their free financial tools if you don't hire them. Empower has the best wealth management tool today.

Yes, you will definitely get some good tailored advice. In addition, you get the opportunity to pick someone's brain who sees and advises on multiple different types of financial situations for multiple different types of people.

And yes, spending time getting a review of your finances for free is worth. It gets you to think about your portfolio construction and discover any blindspots.

Empower Free Portfolio Consultation Insights

I sat down with Patrick Dinan CFP®, a Empower Financial Advisor, over the course of 1.5 hours in two sessions. Then, I spent about four hours putting this post together to share with you. This article provides transparency on the advisory service process as an insider.

My goals for the Empower consultation meeting were three fold:

- To understand what a prospective client goes through during the call to advise on a better experience,

- Understand Empower's value proposition for the 49-89 bps under management a year they charge, and

- Learn what specific advice they could give me, a personal finance enthusiast who has been in the business for over 15 years.

I'm sitting in a unique position given I'm very familiar with Empower's free financial tools. I was a DIY user for two years before I joined as a consultant to help build out their online content from November 2013 until mid-2015.

I've gotten to know some of Empower's financial advisors. And I've also sat in on various important meetings with Empower's management team. The CEO, CPO, COO, and CMO gave me a better understanding of their products and desired messaging.

Benefit: Empower Is A Registered Investment Advisor (RIA)

An important takeaway I've gotten from working more intimately with Empowerl is that the firm is a Registered Investment Advisor (RIA). In other words, Empower has a fiduciary duty to do what's in your best interest.

They are registered with the SEC, and are not a broker dealer. Broker deals only have a “suitability standard” for their clients, not a fiduciary standard. Whereas RIAs have a much stricter fiduciary standard.

For example, if you want to invest your entire $500,000 retirement portfolio in Apple after you dreamt Steve Jobs reincarnates, Empower won't let you because that violates your risk parameters and is not in your best interest.

A broker dealer, on the other hand, would probably also advise against such an aggressive move. But, if push comes to shove, they could execute the transaction. The more a broker churns your portfolio and puts you into higher fee mutual funds, the more s/he gets paid so long as you don't leave.

But, no matter how much your portfolio turns over with an RIA, the firm gets paid a fixed percentage of assets under management. The main way an RIA gets paid more is if you're happy and your assets continue to grow. Thus, interests are better aligned with an RIA like Empower.

My Empower Consultation With A Financial Advisor

Even if money and investing aren't your strengths, don't worry. There's nothing intimidating about a Empower consultation. For those of you looking for professional financial help, I'd like to highlight exactly what I went through. I'm personally pretty wary about everything. And I'm admittedly impatient over the phone.

But, after using Empower's tools for two and a half years, meeting the advisors, and interacting with the leadership team, I'm confident their financial advisory service can help certain people. Many clients come from traditional brokers like Merrill Lynch, Raymond James, or Edward Jones who are paying more in fees and are not satisfied with the results or their service.

Another group of clients are those who've been able to accumulate a decent chunk of wealth, but are now finding it too cumbersome to DIY. They'd like another set or two of eyeballs looking after their wealth because they aren't financial experts.

For your free financial consultation with a Empower financial advisor, all you have to do is sign up, link at least $100,000 in investable assets (savings, checking, brokerage account, rollover IRA, etc) and schedule an appointment when prompted.

If you don't schedule an appointment, a sales associate will call you to arrange a time with a financial advisor. There will be two calls in total with a financial advisor.

The First 30 Minute Call: Discovery Session

The first Empower consultation call will consist of a five minute intro about the firm and the advisor's background. This is followed by a roughly 15-20 minute discovery period about you.

The advisor will ask you basic questions about your net worth, budget, goals, risk tolerance, current investing strategy, investing experience, and any other pertinent information.

The discovery process may feel a little intrusive to some, but it is important for the financial advisor to get as much information as possible to provide the best recommendations possible. As a fiduciary, it is the financial advisor's duty to thoroughly understand your financial background.

The visit is almost like a doctor's visit where you have to share some details before being treated.

Confirm Your Assets And Liabilities

Your financial advisor will be able to see the assets and liabilities you've linked on your dashboard. But sometimes it's hard to see what's exactly what that entails. So, the financial advisor may ask you to clarify things. In my case, I own multiple properties so I had to clarify which mortgage goes with each one.

The advisor will also reconfirm your net worth and investable assets. Because I manually input my structured notes portfolio into the assets section, Patrick saw around $400,000 less in equity investments than reality.

Getting the total figures are important because so much about good financial planning is creating proper asset allocation based on your risk tolerance. The downside is Empower doesn't analyze and manage your other risk assets, like real estate. Although, your FA can definitely talk to you about real estate and your entire net worth.

The last part of the Empower consultation call will consist of any final questions from both sides before the advisor conducts a review and recommendation of your portfolio.

My objective is to earn 3X the 10-year yield per year in as low a risk manner as possible, i.e. 6-9%. The second call will usually be done within a week or sooner, depending on your respective schedules.

The Second 45 Minute Call: The Recommendation

The second Empower consultation call is also free with no obligation and usually lasts around 45 minutes. This is where the real value begins. I was pleasantly surprised with how smooth the process.

Before the second call started, I received an e-mail from Patrick and a link that showed a customized powerpoint presentation with his recommendations. This made it easy to visualize his talking points.

Most of you won't get to sit down with a Empower financial advisor face-to-face unless you live in San Francisco or Denver. So a live powerpoint presentation is really helpful. Post-pandemic, doing Zoom video calls is both comfortable and common.

The below slide is the agenda for the call. I used my Rollover IRA account for Patrick to analyze and highlight to all of you. There are a total of roughly 20 charts your financial advisor will go through in the second call. I've just highlighted eight of them.

Set Goals In Your Empower Consultation

We first went through a brief recap from our discussions from the first call to make sure we spent our time wisely for the second call.

My main goal is to produce a 6-9% return on my money with the lowest amount of risk. I want to protect my financial nut I spent 15 years after college building at all costs because it is a passive income machine. As an early retiree, the ideal financial scenario is conservative returns and steady income.

The below slide shows my current allocation of my Rollover IRA. I recently sold half my positions and am sitting on a large chunk of cash.

You'll also notice that I'm 100% allocated towards Technology, something that nobody should do. But as I've written before, my Rollover IRA is my “punt portfolio” where I take very concentrated bets in specific stocks or sectors.

My extreme allocation is actually great for illustrative purposes.

Here are the official observations from Patrick about my existing allocation. A couple pros but lots of cons as discussed.

Please note that the recommendations provided by Patrick are specific to my own situation and you should not use them as a basis for your investment decisions. That's the purpose of going through your own financial consultation with them.

Optimal Allocation

Based on Empower's model portfolio recommendation for someone my age (45), with my moderate risk tolerance and objective of a 6-9% annual return, here is the recommended asset allocation.

The split between stocks and bonds is roughly 75/25, with Alternatives as a new asset class.

Below is my recommended optimal allocation in detail. It's interesting to see US Real Estate and International Real Estate in my Alternatives section because I'm already so heavily invested in real estate with 35% of my net worth tied to SF, Tahoe, and Hawaii properties.

Patrick explained that the real estate alternatives was more focused on commercial real estate with a different return profile. That's something I never considered. The total real estate exposure is only 5% of the portfolio.

If at any point you disagree with the allocation recommendation, voice your opinion. Your financial advisor can work on a solution that is most suitable to you. Remember, this is a working relationship. The sole objective is to allow you to achieve your financial goals in the best manner possible.

Tactical Weighting = Smart Indexing

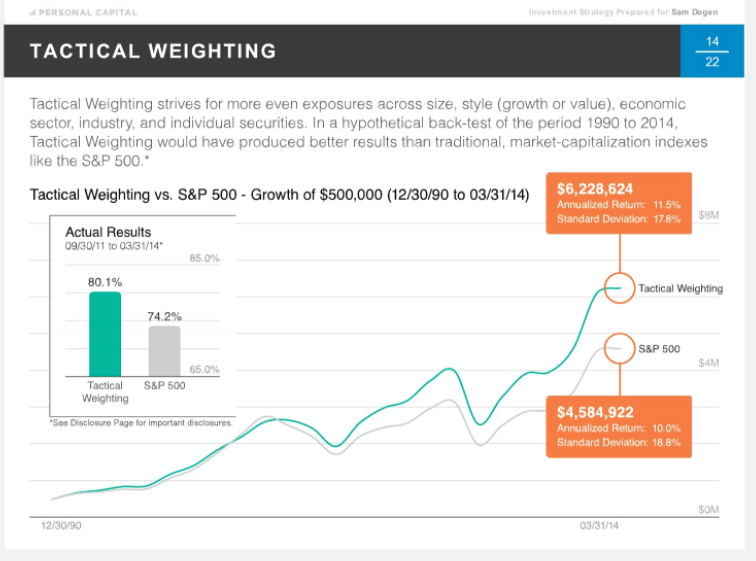

One thing that is unique with Empower is their belief in Tactical Weighting aka Smart Indexing. The idea is to provide equal weights across styles and sectors so one isn't overly exposed over time.

Most people benchmark their performance to the S&P 500, which is market cap weighted. The stronger the bull run in a particular sector, the higher its weighting. Sometimes, bad things happen if you are overly exposed such as in 2002 with Technology and 2008 with Financials.

Intuitively, having a more equal weighting across sectors through constant rebalancing makes sense. Although it's arguable as to what is the right steady state sector weighting. We all would rather be more exposed to sectors with the highest growth rates and potential for growth. However, you never know.

Below is the theoretical tactical weighting performance since 12/30/90 of $500,000. Due to 1.5% higher returns per annum for Tactical Weighting, one earned roughly $1.7 million more during this time frame.

Composing The Ideal Portfolio With ETFs And Stocks

The above slides should provide you a great idea of what you will receive during your second 45 minute financial call. I was curious as to how the portfolios were structured. So during my Empower consultation, I asked the below questions. You may have similar questions as well.

How is the domestic portfolio constructed?

Answer: Solely through individual stocks.

How is the international portfolio constructed?

Answer: Solely through ETFs and not individual stocks. The ETF allocation for international is mainly because of the diversification constraints of owning individual companies across multiple countries.

When do you rebalance and how is it determined?

Answer: Rebalancing is based off our software analytics and careful monitoring of your account to maintain the target weightings.

How many securities would make up my entire portfolio?

Answer: There will be roughly 75 securities total the consists of stocks, alternatives, and bonds. We will build the portfolio using roughly 15 ETFs and 60 individual stocks to keep you diversified.

Where are the assets held?

Answer: We use Pershing LLC, the institutional clearing house who holds your assets. They hold over a trillion in assets, is SIPC insured (protects individuals up to $500,000 for fraud), and has additional coverage through Lloyd's of London. We believe being independent and having Pershing LLC as a custodian adds an extra layer of security. We never touch clients' money.

The great thing about the construction of your Empower portfolio is that there are no transaction fees. They are included in the annual 49-89 bps fee. In other words, if you tend to rebalance a lot, you get better value with an RIA. This is definitely unique to Empower. Most of the RIA custodians (TD, Schwab etc.) still charge the trading fees. It just doesn’t end up in the RIA’s pocket.

Tax Location And Tax Loss Harvesting

Patrick and I had a good discussion on taxes, one of my favorite topics. Tax location is the practice of allocating dividend bearing securities in tax-deferred or tax-free accounts and allocating capital gains driven securities (growth oriented stocks usually) in taxable accounts.

Thus, tax location is good practice especially for those in the 25% tax bracket or higher. If you never plan to sell your Google stock, and Google doesn't pay a dividend, then it's better to hold Google in a taxable account for example. Empower will optimize your portfolios using tax location.

Tax loss harvesting is also something helpful to conduct. But, it is difficult to do on your own if you have a well diversified portfolio. Empower is constantly looking to optimize your tax liability by finding losers to offset your winners based on their technology and advisor's observations.

The Benefits Of Tax Loss Harvesting

According to Empower's research, tax loss harvesting can add after-tax returns of up to 1% per year. That's a boost that can cover Empower's annual fees alone.

In other words, the process of tax loss harvesting is like getting the financial advice for free because there are no mutual fund fees or trading costs when you purchase or sell a security through Empower either.

Those 1% expense ratios for owning actively managed funds are now gone for good. Empower builds your customized portfolio from the ground up with ETFs and specific stocks. This is exactly as a fund manager would do, but with the added element of providing individual financial advice.

Know that mutual fund companies will incentivize brokerages to sell their products through revenue sharing agreements. Or also known as “pay to play.”

The Final Value Proposition

Empower financial advisors can construct an optimal investment portfolio for your retirement. And, they can also provide ongoing advice as your financial situation changes over time, even if they don't manage the accounts.

For example, you can get advice about your 529 plan for college savings, your 401k, insurance planning, mortgage refinancing, general estate planning, and income distribution strategies.

Unlike traditional advisors, Empower doesn't have any incentives to sell products tied to any of these topics. Thus, they can truly offer unbiased advice.

Finally, you won't just get one financial advisor, but a team of two financial advisors. You'll also get an operations specialist to look out for your portfolio and retirement planning needs. To become a client is relatively easy. It is completely paperless thanks to Docusign and the award-winning user interface they've created.

Get A Free Financial Consultation With Empower

Many of us will continue to be DIY investors with the help of various free financial online tools and special types of funds with embedded fees that could help us meet our retirement goals. But, for those of you who are looking for more specific guidance so you don't have to worry as much about your financial future, Empower can help.

The tax loss harvesting and consistent rebalancing can ensure you have appropriate risk exposure. That alone sounds worth it for busy people who aren't all over their finances.

If you are interested in signing up as a client after the Empower consultation call, I'd start off closer to the minimum amount of $100,000 first. See how the experience goes before allocating more assets. Make your financial advisor earn your trust and hard-earned savings.

You can sign up for Empower's free financial tools here. Schedule a call if you are a new user. For existing users, simply schedule a call via your dashboard.

Utilize Empower's Retirement Planning Calculator

At the very least, run your financials through their new Retirement Planning Calculator. It uses your real data you've linked, and runs a Monto Carlo simulation to ascertain whether you need to make adjustments to your income and/or expenses to meet your retirement goals.

Join 60,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. Everything is written based off firsthand experience.

I watched Personal Capital Portfolio posted performance since they came on the scene with semi-robo advisory service. Honestly I haven’t been impressed with their performance. Gratefully, and very fortunately I have done better than personal capital with a help of an advisor that was personally recommended to me by a good friend.

I like your review, it very insightful and full of good details. I don’t find the amount they charge AUM fees seems to be too high for their portfolio performance. I’ve looked at their portfolio of etfs and stocks through Whalewisdom and it seems like they heavily depend upon etfs more than stocks. Also they seem to be trading too much in their portfolio to really truly realize long term compounding and good return on the stocks and etfs they own for their clients. I think the amount of trading they do hurts their overall performance.

I have had a several sessions with different advisors with Personal Capital and found their knowledge of investments and their knowledge of the finances to be lacking in many areas. I also found their sales pitch to be weak and ineffective in my mind.

In honest opinion they are too expensive for portfolio results that they post. As compared to their created benchmarks, they doing much better than those benchmarks. I am deeply curious if they are doing their benchmarking correctly. Something seems fishy on this. I just don’t believe the performance posted returns.

Thank you for the good review of them.

Hello,

I have been a PC free software uses for several years but recently conducted the free review. I am very intrigued and am considering moving my portfolio over. One detail that I want to confirm is that because the US domestic stock portfolio is managed by them, there is no underlying management fee. What I mean is that there is not a management feed associated with an underlying mutual fund and then the PC management fee.

I am very impressed with the consultation and gained a sense for how they are using modern portfolio theory supported by technology to enable a scalable investment advisory service.

Hi Jan, I believe that is correct. Their management fee is not on top of another management fee. The fee is the fee they charge for building and maintaining your portfolio. Although there are small fees if they build part of your portfolio with ETFs, which have the smallest fees.

Contrast this with let’s say a JP Morgan, that charges a management fee and they buys a JP Morgan fund in your portfolio that also has a management fee. Fees overall are coming down though. And digital wealth advisors like Personal Capital and Wealthfront are leading the charge.

Sam

Hi Sam

I am a regular reader of your blog. How is your experience with the 100 K you invested with Personal Capital? I have a call set up with them in the next couple of days and would love to hear your perspective.

Hi Karan,

I have only aggregated all my accounts on their free financial tools platform and have not let them invest my money. Their current business model is that you need a minimum of $100,000 to invest with them. But that’s still much lower than the $500,000 – $1,000,000 minimums other wealth managers have, at a higher fee to boot.

Let me know how it goes!

Sam

Hello Sam. Nice in depth review — i also love their software and recently completed the 1 on 1 review.

So, for you, what changed from the 2014 post where you “absolutely plan to have PC manage at least $100,000 to start this year and go from there” to the 2017 reply of not letting them invest your money?

I have been doing much research on their money mgt service and have not actually found anyone that has used them. Everyone raves about the software, and i agree – but concerned there are not more folks who are delighted and talking about their mgt service.

I’m in the middle of a review with them as well – we both might have been leads for their March/April free-iPad-for-signing-up campaign. I also haven’t been able to find people who use their service except for one guy on Reddit. Beside him, there’s another guy who had a bad experience with the 1-1 review. So…

I think most of their customers are people who have been disenfranchised for a long time by traditional wealth managers who charge much more and do much less, and from their perspective, I can see why going with PC would be a great decision.

My finances are not (yet) complicated and I can do it myself. Sure, I may not be as efficient as they would be with my money, but I don’t have enough motivation to take the leap with them just yet. I have nothing against their investment philosophy – I actually quite like it, but like you it does make me a bit weary that I can’t find anyone that uses them.

Would be curious to hear what happened with Sam’s decision to let them invest $100k of his money though :)

Don

Great review! I am currently looking to see if there is an update regarding Sam’s decision to let PC invest $100k as a diversification strategy? I would love to hear the results and feedback!

Pingback: How To Pick A Robo-Advisor In The Digital Wealth Management Era | Financial Samurai

I love the app that Personal Capital has! As far as their wealth management services, I’d caution all, to not get caught up in the fees being low or high. When you go with them you are essentially signing up for a actively managed mutual fund.A fund that uses reits, etfs and individual stocks and possibly bonds. I also highly suggest you look at their portfolio performance track record. In addition,if you want to know what your portfolio will be invested in, because they may not share that with you. Be as informed as possible.

How do I get a consult if I have less than the stated amount in assets?

How do I get any advice if I never have enough for the cutoff? (100K, 250K, etc)

Thanks for the article. I have had my portfolio reviewed several times by different people. I also recently went to a presentation by Ken Fisher’s organization. His concept is similar, but the starting amount under contract is $500K, which is more than I want to do. It also sounds like TD Ameritrade’s Amerivest division also does similar management programs on a smaller scale. I appreciated that almost half of your IRA was in cash as that is somewhat like mine. I keep meaning to invest it, but don’t get around to ‘pulling the trigger.’ Anyway, thanks for the information and sample suggestions from PC. (They have recently called me for a review, but I haven’t decided whether to set it up or not.)

Great article. Thanks for doing the work. I’ve been using Personal Capital’s DIY for a few months and I think I will take them up on their offer for consultation. Thank you for explaining the fiduciary responsibility of an RIA versus a broker. I feel a stupid for not knowing that.

One question: About a third of the way down, you wrote: “…Patrick saw around $400,000 less in equity investments than reality.” Are saying Patrick found $400,000 that you didn’t know you had? Why isn’t that the headline? Isn’t $400k a big deal for you? It would be for me, I’ll tell you.

Anyway, thanks again for the very informative post.

Hi Chip,

It’s because I didn’t note my rollover IRA properly, so he couldn’t see. The great thing about the system is that the PC advisor sees what you see, and therefore it’s very efficient when it comes time to giving advice. But the inputs are dependent on us, so we’ve got to be meticulous as well.

Have a good consult!

Sam

I really like Personal Capital. They reached out to me with an offer for a free consultation in late May. I was really busy then and couldn’t schedule it. I wrote to them about 2 weeks ago (to my personal “advisor”) about scheduling it but never received a response. What gives?

What is your adviser? I’ll shoot them an e-mail to follow up with you.

I have talked to Michelle but haven’t decided if I want to continue with her or not. Maybe I’ll take your advice and start with 100k first.

Is this finally a confirmed sighting of The Financial Samurai in the picture at the top??:)

Maybe! That’s Patrick in the picture. I’m in there too though as you can see closely.

Thanks for being so transparent about the process, Sam. I would definitely consider this for the future. It sounds like there’s nothing to lose.

No problem. I asked all the questions I could think of that others should know and might think to ask. It bothers me when I don’t have a firm grasp of how everything works if I’m going to be spending money.

I am scared that someone would look at my full financial profile and think: “This guy is either an idiot or a nut”.

I see PC has a functional affiliate program. You should totally serve opt-in lightboxes on older articles.

Nah, they, like me are kinda like financial doctors. We’ve seen it all, and we just want to find reasonable ways to help.

The goal is to not judge, but take the situation in and come up with a viable game plan. I can see why someone people just love being financial advisors because they are helping people solve pressing problems. Very rewarding experience!

Good stuff, Sam. I came to many of the same conclusions when I had my one on one with Personal Capital. They do a thorough job.

I’ve been through their free consultation and they do call me from time to time. It wasn’t as hard of a sell as I had thought and I did like the fact that it was via video conference, so I could see they person on the other end. They could also show me slides without being there physically. It was a very slick presentation in general and I actually did learn some things about stocks.

It looks like they have a great dashboard to keep track of your securities. But, for me, it didn’t make sense because of two main points.

First, the online management tool is still way too light on real estate asset management. It’s never been a focus for them because they don’t derive income from any RE activity.

Secondly, I have low confidence in the strategy as it applies specifically to retirement. For working people and especially for potential FIRE people, they’re going to be relying only on a small percentage of their portfolio churning out ultra-low dividend percentages and only slightly higher REIT income. Under this plan, even if you save like crazy, it’s still Friskies for dinner.

Sam, you know RE. I’d talk to PC about providing real estate solutions for their investors. Get them to partner with solid turnkey companies, RE note providers, tax lien suppliers, you-name-it. Then, supply the consumers with the software to track the numbers and maybe even to purchase these things online. The demand is definitely there.

Even if you retire early, you’ll still have to manage your money carefully. I would say it’s more important to keep close watch of your money in FIRE.

I’m not sure whether RE will work with their business model for, but it can certainly be a value-added service on advising on the market, cash flow, and taxation which they do.

Didn’t realize once you are with PC there are no more trading fees and mutual fund expense fees! Why would anybody buy an actively managed fund over the long term for 75-120bps when they could go with an RIA who can help advise during all stages of life on financial needs?

Seems like active mutual fund fees must come down to compete unless they are superstar performers.

Great write up, I’ve avoided the free consultation because I figured it would be a hard sell for the advisors services. I’ll have to give it a shot and see what they say about my portfolio.

Might as well give it a shot and let them know you read my post. Tell em Sam sent ya!

I learned a lot from this post, thanks. I like the idea of avoiding mutual fund fees and getting a free consult to boot. Thanks for sharing some of the charts and what your experience was like. I will check it out thanks.

No problem April. I’m not sure many people put two and two together that if they go with an RIA like PC, there are never any trading or mutual fund fees to pay because that’s part of PC’s fee and they build your customized portfolio from the ground up.

Rather pay PC and get ongoing financial help than pay the same fee to an active mutual fund and have nobody to consult with when various financial issues come up.

I went through the free sessions as well and found them very helpful. Patrick also did mine and help me discover I had much more bonds (~28%) than intended (5%). When he started to discuss they PC does portfolio management I was surprised as I did not even know they did that. He was never pushy and answered all of my questions. At the time I went through the session, 100k was a third of my total net worth and do not feel comfortable handing someone that much. I tried to get them to take 50k but they explained the way their methods work it would not be that beneficial to me. If all goes as planned around October 100k will be a quarter of my assets and will probably give them a chance.

You said it is easy to sign up and transfer money but did not state if you actually jumped in. Does PC now have 100k of Sam’s money?

That’s cool you spoke to Patrick as well and that e wasn’t pushy. One of the reasons why I asked to speak with him was because he was always nice and friendly when we’d pass by in the halls. I naturally gravitate towards easy going and smiling people because I’m almost always smiling and saying “hi” myself. Another advisor named Tom is really nice as well. I’m slowly getting to know everyone in SF, and maybe I’ll go visit the Denver office sometime as well.

I absolutely plan to have PC manage at least $100,000 to start this year and go from there. I plan to farm out various tranches of money with a hedge fund, some structured notes, paying down my rental property mortgage, and PC. Good to be diversified.

It really is a great product PC has created. I love the online interface and refer to it a lot. Even when I am trading for my own account, the charts and graphs I recall for sector/style/allocation come up in my head (though I’m usually ignoring them) as a reminder to consider a more even approach.

I see myself managing my own investments for quite a while, as the majority of new capital is coming in the form of 401k & Roth contributions (which are automated).

My weighting will be completely off, and would probably give a PC advisor a heart attack, with what will be nearly 25% alternatives (after my Prosper IRA goes through), BUT I got the idea to wind down my taxable Prosper account from PC in order to quit paying so much in taxes! Right now, it’s only a few hundred $ per year, but that will add up to a lot over even 10 years, and much more over 35+ years.

Great product! I do plan to at least get the consultation to see if they can tell me anything I don’t already know.

Kudos for a great creation

Good stuff Ravi! I think it’s wise for everyone to DIY finances for a while before hiring some help.

It’s similar to the idea of encouraging people to do their own taxes before they get too unwieldy so at least you have a basic understanding of investments and your money and can have more fruitful discussions with your financial advisor.

I don’t have time to read all of this right now, but I’ll be coming back. I have wondered about the free consultation and just reading the introduction made me definitely want to do it! Hopefully I’ll get around the reading the rest!

Definitely read the post before you decide to do the calls. I spent a ton of time writing this 2,600 word post to help provide people some clarity on what to expect.

The more you can takeaway from this post, the more helpful questions you can ask about your financial situation beyond the basics since the consulting time is limited.

Thank you very much for this, I was hoping that you would do a write-up of the consultation process for Personal Capital because i am currently in the position of needing to decide how I want to utilize their services.

My account is brand new and I was just recently contacted to schedule a financial review with them. Due to some bad experiences with brokerages in the past I am naturally a little leery of any investment service or counseling. The insight of the process from this article gives me the confidence to at least take the next step to see what they think they can do with/for me.

Great to hear David. I’m very leery myself of everything that requires potentially costing money hence the six hours I spent meeting with the advisor, taking notes, asking follow up questions for clarification, and writing this post.

I think it will help if when you speak to the PC advisor that you read this post and Sam sent you, or something to that nature to get better service at the margin. It certainly won’t hurt!

Let me know how it goes.

Cheers

A recent visit to the institution currently managing most of my assets left me walking away shaking my head. They have never really made any money off me because I have never let them touch it (because what I had done before they inherited me as a client was performing like mad). Since my account had sort of fallen into their hands we have never had a fee discussion because they have never really performed any services for me. The time is now approaching where I need to start looking to move those assets around and I want to understand how they will charge me.

I asked them earlier this year what their fees would be and they would only say “We make money when you make money”.

My follow-up was to ask them what they would do with my money if I gave them $100K to invest today so I could start to see how things were performing. Their statement to me was “That’s not enough money to get you properly diversified. If you gave me $100K I would just stick it in a CD”.

Now perhaps that response is justified because my portfolio is not well balanced or diversified but can you see why I would be looking around now to find a better fit for someone to act as steward for my nest egg? As it is I am not really their target client as my assets fall below their the threshold they require for a client to open an account, which is $5 million. I cannot help but wonder if they would ever have my best interests at heart when working with me.

Great write-up! I’ve always wondered what a free financial consultation was like and it’s good to see they are pretty thorough with understanding one’s financial situation and coming up with a customized plan instead of just trying to aggressively pitch for business.

I never heard the term “tax location” and didn’t realize there were such benefits to tax loss harvesting. Makes sense, but hard to do if I’ve got 50 stocks in my portfolio. I’ve got a day job!

The older I get, I’m finding the less I want to actively manage my money. I want to spend more time traveling, spending time with family, working on my business and crossing off bucket list items.

The act of tax loss harvesting is a PITA for individuals. If they can enhance after-tax returns by 1%, that’s huge.

For me, I’m looking for more piece of mind because there’s part of you that actually worries a little more the more you accumulate because the more you have to lose.