One of my biggest fears for renters came true. Rents surged due to rising home prices, increasing household formation, and not enough inventory during the pandemic. The main question now is: How long will rent increases last?

We shouldn't feel bad for those who've been against homeownership for years. You can find plenty of them commenting in my posts:

All those against real estate have rationally saved and invested the difference in the stock market and other classes. And given most asset classes have done phenomenally well over the years, renters who invested have also done very well.

However, for those of you who wanted to buy real estate but couldn't or want to buy real estate but can't, this post is written mostly for you. This post should help you better figure out your future living situation.

If you want to invest in real estate and benefit from rent growth, then check out Fundrise, my favorite private real estate platform. Fundrise has diversified private funds investing in residential and industrial properties in the heartland. After a weak 2023, real estate prices are poised to rebound in 2024 and beyond.

How Much Are Rents Up Year Over Year?

According to data from Zillow, 2021 rent was up 11.5% from a year earlier, or almost $200. In other words, the median rent price in America in August 2020 was around $1,530. In 2021, it is around $1,739.

In 2024, rents continue to rise, albeit at a slower pace. Let's look at the previous years' data.

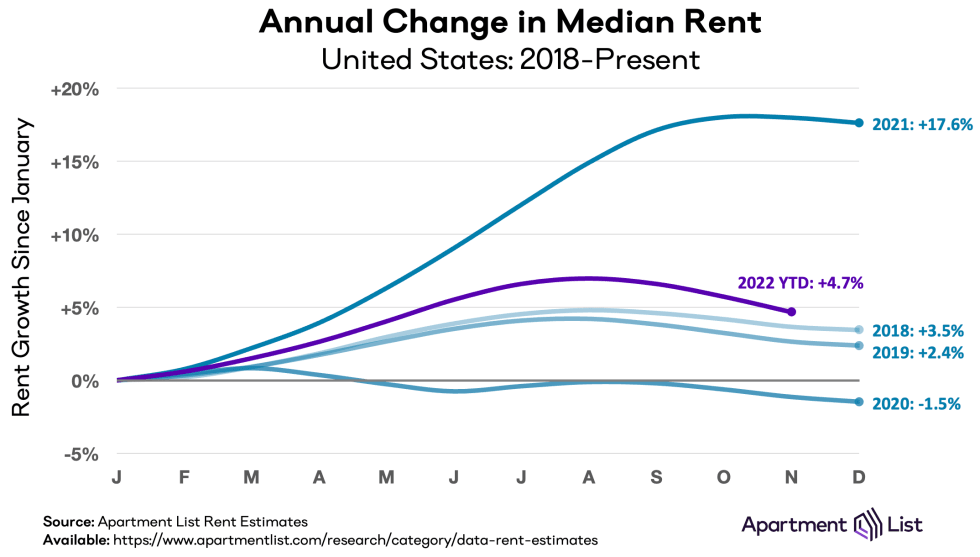

According to ApartmentList, the national median rent increased by a record-setting 17.6 percent over the course of 2021. 2021 was the highest rent growth year in decades.

In 2022, rent continued to creep higher by about 4.8% according to ApartmentList and consistent with my 2022 housing market forecast. In other words, rent increases finally slowed down in 2022 as the bear market took hold.

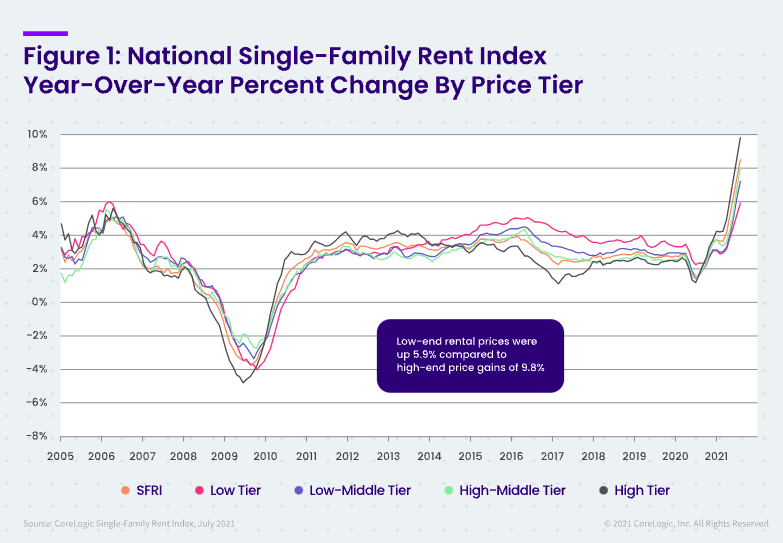

Here's another chart from CoreLogic. It shows a national single-family rent index for various price points is also up dramatically year over year in 2021 as well. It shows the High Tier segment (black line) increase the most.

Rent Growth Finally Slowed Down In 2023 And 2024

I think home prices in 2023 will finally decline by about 8%. As a result, so will rents thanks to a Fed-induced global recession. Due to aggressive rate hikes by the Federal Reserve in 2022 and 2023 and a ~20% decline in the S&P 500, rents should inevitably begin to fall.

Alas, as I'm updating this post in mid-2024, rents have continued to RISE, albeit at a slower pace. The economy is strong and bidding wars are back. As a result, homeowners are much more optimistic about the economy. Conversely, renters are much more pessimistic.

Here are some signs of lower inflation to come:

- Gas prices down 37% from June peak

- Used car prices down 19% from peak

- Global freight rates down 81% from 2021 peak

- Fertilizer prices down 45% from March peak

- Rents down in Sep, Oct, & Nov of 2022

- Home Prices down over 10% from June peak

As you can see from the National Rent Index chart below, rents have been declining month over month since September 2022.

New Tenant Repeat Rent Index

Researchers at the BLS and Cleveland Fed released a data series on December 19, 2022 called the New Tenant Repeat Rent Index. As you can see from the yellow line below, the New Tenant Repeat Rent Index has rolled over hard.

The Consumer Price Index tracks housing inflation through a large panel of housing units that are surveyed every six months. But because rental turnover is slow and CPI tracks contract rents for all units, CPI data lags current market conditions significantly.

Here is a great price that highlights home prices versus rents. Rents clearly softened in 2023.

How Long Will Rent Increases Last?

Rents cannot increase faster than wage growth indefinitely. At some point, rent increases will have to slow.

Therefore, rents began to moderate by 1H2023 as home price growth slowed. Enough people finally move out of their parents’ homes or shed roommates, and housing construction bottlenecks decrease.

The New Tenant Repeat Rent Index attempts to capture rent growth or declines in real-time. Therefore, it is highly likely CPI data for 2023 will continue to head south since rent is a large component of the Consumer Price Index.

Related post: How Landlords Can Easily Increase Rents With Minimum Tension

Moderating Rent Price Growth Versus Negative Rent Price Growth

Make sure to differentiate between moderating rent price growth and negative rent price growth. Instead of driving 85 mph on the highway, a car might slow down to 65 mph. The car is still moving forward, but just not at as rapid of a pace.

If median rent price growth is 4.8% YoY for the entire 2022, I suspect median rent price growth will slow to about just 2-3% by the end of 2022.

Before the Fed started aggressively hiking rates, I expected national median rent price growth to revert to the mean by increasing 2% – 3%. However, the Fed seems determined to cause another recession in 2023. As a result, I expect rents to decline by 5% in 2023.

2023 should turn out to be a better time to be a renter as rent prices fade. However, there should be a good opportunity to buy property in mid-2023. This is especially true if returns for equities and bonds dramatically decline over the next 10 years as well.

Demand For Homes Is Permanently Higher

Post pandemic, the intrinsic value of a home has permanently increased. We are all spending more time at home, and therefore, we all appreciate our homes more.

There is no going back to the way things were. The most likely scenario is a hybrid model where workers work from home part-time and work in the office part-time.

Therefore, I'm an investor in single-family and multifamily homes to take advantage of this long-term trend. In 20 years, I'm pretty sure our children will marvel at how cheap rents were today.

Advice For Renters Looking To Control Living Expenses

As a landlord since 2005, generating positive returns was important so I could escape work earlier. Today, generating positive returns is important so I can better take care of my family of four. Real estate income accounts for about 50% of our current passive income portfolio.

At the same time, as a personal finance writer since 2009, I also have a goal of helping as many people achieve financial freedom as possible. This goal is why I've encouraged readers to buy real estate as young as they possibly can for so long. Inflation is too powerful of a force to combat.

Whether you believe me or not is neither here nor there. If you are a renter, what matters is what you do and how you think about the current situation going forward. Therefore, here is some advice for renters as a landlord and as an ex-renter myself.

1) Eliminate misinformation, understand the latest market conditions

Although seeing rents and home prices increase can be frustrating, there's a positive for renters. Most landlords are incapable of increasing rents as fast as the market. The reasons are due to kindness, ineptitude, laws, and laziness.

Therefore, even if the national median rent or local market rent increased by 11% from a year earlier, your rent has most likely not increased by the same magnitude.

In a rising market, the difference between current market rent and the rent you are paying is your “profit” and a landlord's “loss.” Your profit is what you save by not having to pay market rent. A landlord's loss is the opportunity cost of not earning market rents. The longer you rent a place, usually the larger your profit grows and vice versa for the landlord.

Understand Rental Conditions

If a renter does not understand the latest rental market conditions, s/he might get erroneously upset at not getting their way.

For example, one tenant recently asked for a rent decrease when neighborhood rents are up between 10% – 15% ($400 – $615). Since 2H2020, there's been a huge flood of people migrating to the western side of San Francisco due to better value, more space, better air, more parks, and less density. I knew demand was up because I rented out a house in September 2020 and experienced more demand than ever before.

When I declined my tenant's request and just kept the rent unchanged, he was unhappy. But if he understood the latest market conditions, he would have felt more at peace.

Asking for a rent decrease when the rental market is up 15% is like asking for a raise during a bear market. It could happen if you've developed an amazing relationship with your landlord. But what's more likely to happen is your manager adding you to the RIF list for being so disconnected from reality.

Do not make the second biggest financial mistake if you want to achieve financial freedom.

2) Know that your landlord has rising expenses too

For those who have never owned property before, it's understandable to not know all the costs associated with owning real estate. Landlords often have the following costs: insurance, maintenance, mortgage, property taxes, special assessments, property management.

In other words, the increased rent never 100% goes to the landlord's bottom line. For example, even if I have no mortgage, I still pay about $23,000 a year in property taxes for one rental property. This property tax goes up 2% a year, usually forever.

The more a renter understands a landlord's costs, the more a renter won't feel as bad about paying higher rents. The same goes for voting on legislation to raise more money for some cause. If the money raised is coming from paying more property taxes, then rents will inevitability increase. Therefore, voters of such legislation should be fine with paying higher rents.

If you're lucky to not have any rent increase in a rising-rent environment, your landlord's cashflow is declining. Therefore, as a renter, you might gain comfort knowing your landlord is making less.

3) Keep things harmonious and don't get personal

If you have a good landlord who is attentive, takes care of issues, and communicates with you in a professional manner, cherish the relationship. A landlord who finds good tenants will certainly do the same.

At the end of the day, a harmonious relationship is better than a contentious one, especially if you know your landlord and see him/her every so often. If your landlord is a faceless corporation, then it's easier to be more aggressive or combative. But even still, it's usually worth keeping things cool with the property manager.

If you get too personal, you run the risk of offending either party. If you offend the landlord by bringing up some personal issue, he might decide to raise the rent to the legal maximum. Worse, he might give you notice, which would be bad if you don't want to move out.

At the same time, if a landlord offends a renter, the renter might damage the place, delay paying rent, or not pay at all. Therefore, when it comes to the lease agreement and negotiating future terms, keep things strictly business. Please don't bring personal issues and judgement calls into a negotiation.

Many landlords have a love-hate relationship with real estate. The older and wealthier a landlord gets, the less they want to deal with tenant and maintenance issues. As a result, the more a tenant can be self-sufficient, the less likely the rent will increase.

4) Practice Stealth Wealth

Before I had kids, one of the reasons why I enjoyed driving a Honda Fit was because my tenants wouldn't judge me when I came over to address an issue. Driving a cheaper car than my tenants not only felt good, it helped diminish envy.

Strategically, to minimize the chances of a rent increase, it's also best for renters to practice Stealth Wealth. If the landlord sees you rolling in a new car, fancy watch, $10,000 home theater system, or whatever luxury item, he may logically think you can afford to pay more rent.

When in doubt, it's better to be more low key with everything you do.

5) A renter really does have to save and invest the difference

Anti-homeownership advocates always argue that renting is better because it's cheaper, less hassle, and you can invest the difference in better performing assets. Yes, these are great reasons for renting in the short term or medium term.

However, just like how you wouldn't short the S&P 500 over the long term, you wouldn't short the real estate market by renting long term either. Instead, it's better to invest in the S&P 500 and at least own your primary residence to get neutral real estate.

If you rent, you must actually save and invest the difference. If you don't, you will likely fall financially behind your peers who do own. The main reason is homeowners have a forced savings account every time they pay their amortizing mortgage. The other reason is that real estate tends to inflate with inflation over time.

If a homeowner owns a $500,000 house that appreciates by 8% one year, a renter with a $80,000 income needs a 50% pay raise just to stay even. Or, a renter with a $100,000 stock portfolio needs to see a 40% return to stay even. Both are unlikely.

The average net worth for a homeowner is 40X or so greater than the average net worth of a renter. There are all sorts of reasons for this massive discrepancy. But one reason is the lack of discipline in saving and investing the difference over the long term.

6) Always be looking for buying opportunities

One of the great benefits of renting is trying out a neighborhood in a lower-cost way before buying. After about a year, you should have a great idea if you want to live in the neighborhood long-term. And if you don't, you should spend time at least once a month exploring new neighborhoods.

Thankfully, it's easier than ever to explore new homes online. You can even track rent increases in addition to property prices. I recommend setting up e-mail alerts with homes that meet your filters. It's just like signing up for my e-mail list that automatically e-mails you whenever I publish a new post. This way, you'll never miss a thing.

If you can afford to buy a home using my 30/30/3 rule, I would buy. Just make sure to leave in your home for at least five years to ride out the cycles.

There are great buying opportunities that pop up all the time. You might find a stale-fish listing that was priced too high. You might stumble across a great listing during the middle of a snow storm when nobody is looking. A couple might be getting a divorce and just wants a quick sale.

Gems are waiting to be snagged every day. You just have to spend time looking.

Rents Are An Economic Signal

Finally, another good way to look at rising rents is to view them as a positive signal for a healthy local economy. Rising rents usually mean positive demographic changes, rising wages, and more job opportunities. Conversely, declining rents general means a weakening economy.

If your rent is rising by 5% – 10%, but you can get an equal or greater raise, you're winning! If rents are flat or declining, it will likely be harder to get that raise and promotion. Which situation would you rather be in? If I was working, I'd much rather be in the former.

If rents are rising quickly, it might be a positive signal to invest in local companies. After interviewing many prospective tenants who worked at Google and finding out their mind-boggling salaries, I decided to invest in Google stock 10 years ago.

There's always a silver lining to every suboptimal situation. Even sitting in horrendous traffic everyday could be a positive signal for you to invest more.

Renting is absolutely fine during the short or medium term. Even in a rising-rent environment, renters can prosper by buying Treasury bonds and other fixed income investments. However, over the long run, I encourage everyone to own their primary residence, invest in real estate, and invest in stocks and other risk assets.

Your net worth and your descendants will thank you.

Real Estate Suggestion

To invest in rising rents, take a look at Fundrise, one of the largest real estate crowdfunding platforms today. Fundrise primary invests in residential rental properties across the country. You can invest in a Fundrise eREIT for as little as $10. Fundrise manages over $3.5 billion in assets under management for over 500,000 investors.

There's no need to wait until you have a down payment to invest in property. Nor is there a need to be a landlord anymore to take advantage of the residential real estate boom.

Read The Best Personal Finance Book Today

If you want to read the best book on achieving financial freedom sooner, check out Buy This, Not That: How to Spend Your Way To Wealth And Freedom. BTNT is jam-packed with all my insights after spending 30 years working in, studying, and writing about personal finance.

Building wealth is only a part of the equation. Consistently making optimal decisions on some of life's biggest dilemmas is the other. My book helps you minimize regret and live a more purposeful life.

It'll be the best personal finance book you will ever read. You can buy a copy of my WSJ bestseller on Amazon today. The richest people in the world are always reading and always learning new things.

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail.

Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. How Long Will Rent Increases Last is a Financial Samurai original post.

How would the 30/30/10 rule apply if we purchase a duplex to be owner occupied on one side?

It’s a great thing that I have an amazing landlord who hasn’t increased by rents in the past 3 lease negotiation cycles. Being a good tenant, not missing payments, and taking good care of the house really helps.

Have been very happy about my decision to rent and not buy a house so far. Absolute zero regrets. House prices in my city doesn’t appreciate as much.

I’m a landlord for 2 properties. We’ve always raised the rent each year due to increased costs on our side. This was the case during the early days of the pandemic, though the increase was nominal, and during the present. Renters should generally expect some kind of increase each year given the points Sam made in the post.

I wonder if rent increase still depends on property type and location. I rent out a 1br condo in SF/border Daly City. Tenant moved out in July. After advertising at the same price for 1.5 months, I dropped the rent by 10% due to lack of interest (at the suggestion of my property manager). Got a few showings, just one application and now a tenant. I didn’t want to risk going into slow holiday season and have the vacancy stretch into next year.

I know someone else in the same boat with a 3br/2bath house in San Jose. No applications in 2 months. Dropped rent by 7%(from what was a market rent price) and only then got renters.

Always enjoy reading your articles, Sam! You motivate me to strive for more and keep learning.

Rent prices are definitely property and location dependent. The bear area is lagging behind the nation given our tech focused economy. But as more people return to work in 2022, expect rents to rebound or continue going up.

I just paid off my home here in the subburbs in New York. Its worth about 500k, but yet I pay about 11k in property taxes that go up every year. So with a paid off house, I’m basically still “renting” from the town at a tune of $1000 a month. Not to mention up keep and utilities.

I could buy a home in NYC with lower property taxes, but the home cost more and less yard space. I was debating buying another home here but the property taxes alone are making me 2nd guess it. I could move to another part of the country, but that require moving away from friends/family. So not everyone can do that.

Indeed. At least the property tax is deductible. Hopefully your home has appreciated in value as well. Just think about its value as the price of not having to pay rent.

Nobody really ever owns anything. We’re just borrowers trying to maximize our lifestyles with the finite amount of time and capital we have.

Sam, I disagree with your statement that property taxes are deductible. While technically still the case, the SALT deduction of $10k makes this tax benefit to almost nothing.

Let’s hope the SALT cap gets increased or removed soon for primary homeowners.

Property taxes are 100% deductible for rental property owners.

I personally call Property Taxes “Paying the feudal landlord for the right to continue living on my serfdom for another year.” For those who do not agree, I suggest they attend their county’s Property Tax Auction.

At least in California we have Proposition 13 which limits the rate of Property Tax increase to 2% per year, so you can budget for it. It has to be rough in your state, because civil serpents willingness to spend your money is infinite. In your case, Property Taxes are like a mortgage that you never pay off and it increases instead of decreasing.

As a parting comment you cannot write off Property Taxes wholly because of the $10,000 cap on SALT deductions. However, before Trump passed his tax legislation, I still couldn’t write off my SALT because they triggered the AMT calculation.

Agreed. We never end up owning anything, just renting until we die.

But rental property owners can deduct 100% of the property taxes from the rental income.

Sam,

Your thought process never ceases to amaze me! In this entire article there’s talk about increasing household formation (which is extremely negative this year), inflation, declining housing inventory, and rental increases but not a single mention of risks due to rising interest rates or changes to property tax codes. You mention CA prop 13 by pointing out a 2% cap on tax increases YoY, cherry picking markets while then pivoting into examples of $500k homes which don’t exist in any good CA neighborhoods with job opportunities. Inflation is running at 5.35% YoY, the feds mandated inflation target is 2%, interest rates are at all time lows (0-0.25%) and we know that for every 1% interest rates increase, real estate buying power will decrease 11%! If we go back to when you were born, the fed funds rate was raised to 20% to break inflation! A 20% interest rate would equate to a 90% decrease in real estate buying power. Your articles are borderline irresponsible at best, just like your previous articles advocating Lending Club, which is now defunct from numerous scandals.

I’m glad to keep on amazing you Dan.

And that’s the beauty of the market. You’re free to deny rents and property prices have gone up. You can short real estate investments and continue to rent to follow your beliefs. Don’t let me encourage you do do anything. Do what you want. At the end of the day, your bank account doesn’t lie.

Lending Club (LC) is defunct? The stock is up over 500% in the past 12 months and up over 200% in the past 24 months. I wish I bought a ton of LC stock last year. Further, P2P lending is ranked dead last in my passive income rankings for the past 5+ years.

What is amazing is how two people can see things so differently. And this is why I LOVE to write about personal finance and the markets. Red is not red and green is not green in personal finance land.

I think your opinions are great. Please keep them coming! It’s always good to have a counterpoint to keep investment views in check.

Rates to 20%. Love it!

Your previous comment for background:

“I sold my stock in 2019 as I saw a correction coming, Since then I’ve been in cash and renting. Primary investment is my career. In May of 2020 my net worth broke 7 figures (I’m a millennial so I think that’s well above average) the job market is the best place to make money for people with skills.”

Yeah, after several reverse stock splits! LC is down 85% from their initial IPO back in 2014 and they don’t offer peer to peer loans! Keep up the cherry picking Sam! Maybe you can convince yourself that this was a great suggestion, how much LC stock did you buy over the past two years!?!? I think you should get a real job and stop drawing pancakes for folks that are hungry.

Lending Club’s last stock split was in 2019, and the stock is up massively post stock split since the beginning of 2020.

Are you OK? Or are you just ignorant?

I know it hurts to miss out on massive gains. But you’ve really got to face reality that you missed out selling your stock in 2019 and renting.

If you were truly happy with your decision, you wouldn’t be so angry here commenting.

Why do you think you are so unhappy? Do you see anybody else here as unhappy like you?

Lending club (LC) wasn’t founded until 2006, you must be looking at a different stock! I think we know who the ignorant person is … what should I have done differently with renting? Should I go all in on a $1.5M home and live house poor hoping to be bailed out with low interest rates in the future?

Correct. The stock is up massively since the beginning of 2020 as Sam said. I’m not sure how I can have a rational argument with you when you keep on spouting nonsense.

First you write “lending club is defunct.” It’s fully operational.

Then you write that the stock is only up due to the reverse stock splits, when it is way up post stock split in 2019.

Why do you think you continuously get everything so wrong? And why do you deny that stocks and real estate are up so much?

“In April 2020, the company announced it would lay off around one third of its employees in anticipation of the economic downturn resulting from the COVID-19 pandemic.

In August 2020, the company discontinued its secondary trading platform, hosted by Folio, reducing liquidity for existing peer-to-peer investors.

In October 2020, the company ceased all new loan accounts on their website as part of restructuring into a neobank after the acquisition of Radius Bank.

As of December 31, 2020, Lending Club will no longer operate as a peer-to-peer lender.”

Moron.

Dan, LC stock is up a lot after its last stock split in 2019. Although the company still only has a $3 billion market, it’s not defunct as you claimed.

Look, I know it doesn’t feel good for both stocks and real estate to go up since you sold in 2019. And I’m sorry you missed out. But it still looks like you are doing OK. So I would just look to what you already have and be appreciative.

I have consistently tried to share my views, which are not always right at all. As I wrote in my article, I think rents and property price appreciation will slow in 1H2022.

Here’s an example of buying stocks at the end of March 2020: https://www.financialsamurai.com/stock-market-bottom/

Here’s another example of buying real estate in mid 2020: https://www.financialsamurai.com/real-estate-buying-strategies-during-the-covid-19-pandemic/

At the end of the day, it’s up to you to decide what you wanna do. There’s no point in getting angry at someone for doing something differently than you. It’s your life to live and your money to invest.

Be happy with the choices you made. And if you’re not happy, change.

No, Lending Club is up big post split. If you can’t get this basic information right, it’s no wonder why you think interest rates could go to 20% and why you sold in 2019.

The risk is that you are too ignorant and delusional to know that you are ignorant and delusional. See Dunning-Kruger effect.

Did you really sell all your stocks in 2019? If so, I’m really sorry you did while still renting. The S&P 500 is up about 80% since, and rents and property are up about 20%.

So you not only missed out on huge equity gains, you are also getting squeezed in terms of living costs. That’s DOUBLE losing.

But worse, that’s taking literally years off your ability to retire. Property prices and the stock market could certainly go down. But you’ve got to snap out of your delusion and face reality.

You missed an enormous boat!

First of all, the S&P 500 is only up 35% from 2019, not 80%. Not a big deal for me Derek! I was able to reduce my apartment rent by 25% as I live in a suburb of LA that suffered a large drop in rent demand during 2020. There’s 50+ years of investing in front of me; I don’t invest in things I don’t understand, and that includes highly overvalued markets such as real estate and equities. What is your reality? Why don’t you share your perspective on “reality” for us? How great are things going for you with supply shocks and near zero interest rates?

First of all, I took the middle point of 2019. Are you cherry picking the High Point of 2019? If so, that’s fine. You still missed out on over 35% in gains.

If I had sold my portfolio then, I would have missed out on over $1 million in gains. That 1 million in jeans can pay for five years of living expenses no problem.

I’m sorry you missed out on 35% and gains and live in the suburbs as a millennial with no family. But only you can decide whether to change your life or not.

How close are you to retirement Derek? Can you afford to lose 35% of your portfolio in a down market? Glad your gamble paid off this time, do you want to try your luck again with the next correction?

Sam, stop advocating for home ownership!!! I wanna ride the rent increase trend in the next several decades by piling into Fundrise and Crowdstreet.

My rent in 2021 stayed the same rate as 2020. No increase.

Good stuff. Where do you live and how has the market done?

Downtown Chicago. Home prices continue to rise similar to the rest of the country, but a lot of the rental companies are still offering “month off” deals so that worked out well. Maybe next year it’ll be more, but I doubt it.

Real estate prices are overvalued in my opinion; especially in the coastal regions of the US. Yes, real estate prices will continue to increase because the US dollar will continue to be devalued due to excess money printing but so will every other asset that is fiat-derived. Real estate does have intrinsic value but most of its appreciation/value is due to monetary policy and not due to increased demand.

I’m not moving to middle America because the real estate is cheaper there than the coastal regions. I’ll be moving outside the US where I can get a beach-front home at a fraction of the price, lower standard of living, and work fully remote at a good paying job.

Interesting you think housing demand has not increased. Why do you think demographics isn’t a factor?

How long have you been renting and do you ever plan to own? Thx

The depressing part for me (a millennial making around median income living in Los Angeles) is that even if I saved almost my entire income I still can’t afford a home here.

I and most of my friends would love to own property but even with small side hustles unless I somehow win the lottery or something I don’t see how I’m ever going to afford a house, especially at the rate home prices continue to keep rising. Ironically, it is all my friends with high paying tech jobs who are able to work fully remote, while myself and most others with less lucrative jobs are unable to easily relocate to somewhere with lower home prices.

No need to win the lottery. Get a loan from the bank ! This is free money anyway with interest rates so low.

Just make sure you can put 20% down and afford the monthly payments easily and still have some money on the side.

That said, if you want to wait a while (one or two years) for the market to cool down a little bit, I don’t think it would be a bad idea. But don’t wait 40 years before buying something.

That is an irony and a somewhat unexpected arbitrage. Although, I have been investing in the heartland of America since 2016, because I expected more people who work in the knowledge economy to relocate to lower cost areas of the country.

To benefit from the trend, you don’t have to own your primary residence. You can buy REITs, invest in private eREITs, own home builder stocks, a real estate ETF, and online real estate companies.

I’ve decided to own all types of real estate because I am long-term bullish. Let’s see what happens over time!

“To benefit from the trend, you don’t have to own your primary residence.”

I’ve already thought about this for myself, but I think this is a bad idea.

I have looked at real estate prices in the US after the housing market crisis, mainly in Texas and Nevada. Prices were so low that I tought about buying something there and rent my place in Canada.

When prices were falling -20% per year in the US, prices were increasing +20% annually in Canada. So my main concern was to buy just before a housing crisis in Canada and lose a lot of money.

Finally, I decided to go ahead and still buy my primary residence in Canada. That was mainly because it would have been very complicated to buy something in a different country, and without the ability to go there because of work.

That ended up being a good decision, although prices have increased much more in percentage in Texas and Nevada, they have increased more in dollar amount in Canada – because the base amount (starting point) was higher.

There is always a risk of seeing higher increase for rents in the place that you live compared to the place you rent if they are in different locations. I think, if you like the place, and you intent to stay long term, this is more secure to just buy it.

Unless you are very rich – let say 10M$ and above … For that kind of wealth, rent disparity in different locations become irrelevant.

—-

I agree w/ you about investing in real estate of various types. They each have their advantages and inconvenients. I will look to increase my investment in that sector as soon as I see a good buying opportunity.

I’ve been a landlord for last few years and I’m no longer interested in growing rent portfolio despite growing rent because:

– Local governments can dictate never-ending eviction moratoriums

– Real estate cannot flee the state, raising property taxes is a certainty which cannot be easily passed on to the renter right away

True. Two good things to watch out for as an investor calculates their pro forma income statements.

The thing is, the higher property taxes go, the higher rents go. So it’s not entirely a one-way street.

I do hope readers at least get neutral real estate by owning their primary residence.

If I could, I would get neutral universities that charge Exorbitant tuition as well. I’m already neutral healthcare company since they are publicly traded.

I’ve wondered about this too. But many of the cities that are likely to raise taxes and have eviction moratoriums are also the cities that prevent development. Thus rents and values will likely go up.

I live in a midwestern college town and mapped out the parcels of land that can be developed within the city. It amounted to a few blocks in the whole city. Development is often rejected for various reasons; NIMBYs, protected birds occupying an old chimney, forcing a ballot vote on a specific property. The list goes on. Students often pay $7000/month for a 5 bedroom 1500 square foot apartment next to campus.

I’d be much more worried about shrinking demand in an area.

“It is my belief that the intrinsic value of a home has permanently increased.”

Absolutely! I think this is to the effect of trillions, with the value mainly coming from commercial real estate. People are working from home 1 day per week from now on? ~20% reduction in value in commercial, 20% gain in value in residential. This includes not only property prices but also brands in the home, like Restoration Hardware (up 40%+ YTD).

Renter here, so I missed the boat :(. Oh well hopefully things will cool off soon.

I suspect a lot of commercial real estate will be repurposed to generate more income and value as well. So stay tune for this transformation that will inevitably happen.

Even though you may have missed the real estate train, the train is likely to continue going forward. And it sounds like you have participated in the cryptocurrency boom? If so, that’s been way more lucrative so far!

Hate toward a particular asset when prices are at the lowest is pretty common. Look no further than Alibaba. So much hate about China in the investing world recently, yet the stock (BABA) gained +8% today ! Eventually, it will be back to 300$ and everybody will want to buy …

Same for real estate. Everybody hated it in the USA after the housing crash. Now that it’s going up, everybody wants to invest in.

It’s the same question of “what comes first : the egg or the chicken ?”. Does the “low prices” generates “hate” toward an asset ? Or the “hate” generates “low prices” ?

As for myself, I don’t try to answer this question. When I see that math don’t add up, I buy !

I can’t really answer to your question as to whether rents will continue to go higher or at what pace.

There are two reasons :

1 – I’m from Canada and the canadian real estate market is different from the US. I have a hard time believing how high prices are in Canada. But rents are still relatively low. That makes me think rents will catch up to real estate prices since no one who is still renting can afford a house right now.

2 – The economy is in a very “wierd” state actually, with so many disruptions and prices instability. I think the only thing we can expect is … the unexpected.

That said, I don’t see any reasons why rent would stop going higher (Canada and USA). My feeling is that the price increases will even … accelerate ! But who knows ? Anything can happen.

I feel bad for renters right now, this must be a very hard time for them to stress about whether they should get in or wait for a pull back. To avoid asking this question, I think anyone should buy as soon as they are ready to settle and have the capacity to do so. After all, shelter is a basic need. No one should “gamble” on whether they should “buy” or “not buy” the place where they live in.

As for investing in real estate, in Canada, prices are so high that I never felt confortable investing large amounts. I thought the stock market was less risky.

I also had a very small investment in a Canadian REIT (RioCan – Appartments, offices and retails). Since the stock decreased so much during the pandemic (while real estate prices are increasing and interest rates are lower ?!), I bought so much that it is now one of my biggest position.

I’ve noticed pretty consistent anti-real estate sentiment since I started in 2009. It’s interesting, bc real estate investors don’t hate on stock investors or stocks.

Was buying BABA and BIDU last couple of weeks. Hope it works out. Mentioned it in this post: Liquid Courage

In Canada, the sentiment is pretty much the opposite. Real estate is viewed as a sure way to wealth. Everybody who owns rental real estate is considered to be rich.

But I’m not so sure about that. The higher the cost to purchase, the lower the return. If prices don’t continue to rise (not likely, but possible), many will find out they are not so rich after all.

It’s different than the US where lots of people have been burnt by the housing crisis. And the sentiment was much less favorable. But inversely, real estate prices are much more interesting in the US when it comes to buying.

Stocks, on the other hand, have done amazing in the last 20 years after the tech bubble crashed. Today, everybody wants to invest in stocks, thinking it’s the easy way to riches. But I am concerned, I see less and less investment opportinities in the stock market, except for a few specific companies. For that reason, I have turned my portfolio to a more defensive position recently.

When I started investing about 20 years ago, it was a great time, bargains were everywhere. But no one wanted to invest in the stock market back then. The stock market was considered either to be boring or a form of gambling.

Sentiment goes from good to bad, to good again… I feel it’s more a consequence of how people have fared in the past rather than how they could do in the future.

Thanks for your blog. I think you have amazing content !

Very helpful insights in this post. When I was a renter, I really had no idea how much goes into home ownership, maintenance, property taxes, etc. And even once I became a homeowner, I didn’t really fully grasp how much goes into a home until I went through a big remodel. The crazy amount of logistics that a remodel takes really opens your eyes and makes you respect a property so much more. I also really like to garden, weed, and keep the outside of my home in good shape. It makes me so sad when I see homes that have totally let their yards go to ruin.

Why do you think renters who’ve been negative about the real estate market and clearly wrong, still aren’t will to admit they were wrong and should have bought?

It’s baffling and makes me wonder what other wrong thinking they’re are making with their personal finances and other stuff.

Honestly, I don’t know. Denial can sometimes be a good coping mechanism. But as investors, we must accept our losses or missed opportunities and move on.

Related: Unsure About An Investment? Go Halfsies

Regret Avoidance and Prospect Theory

My name is Cara I live Tacoma and rent. It is logical to rent when you barely make 43 thousand without overtine premium pay included. I work at a hospital across from my place. I Could go back to school to be a medical assistant or a Rad tech but that would put me in debt of nearly 15 thousand after tuition and books. I could not afford a house even an hour away. i live with my retired parents. I am also visualy impaired. my eye mucles are week and will not improve. I am one of miollions you people poor eyesight but do not meet the legal blindness requirement. I was told by an eye doctor that a restriction of day driving only would be on my drivers licences. recently I was looking at houses and the closes afforable house was 1 bedroom over a hour a way without traffic for $175,000 can three people live there witout falling over eachoher? most of the poeple i work with are in the same situation or are near retirement and bought years ago. What should people like me and my coworkers do?

I have a hard time increasing my current tenant’s rent. I just checked comps and I’m off by about 20% on one of my units, but the tenant has been there for 4 years. Even with my short comings as an owner and a manager, owning residential rental properties has worked out very well for me just by increasing rent with tenant turnovers and refinancing at opportune times. The tax depreciation alone is very valuable. It’s worked out so well that I question while I’m still toiling away at my stressful day job. Just got to finish funding college accounts, then I’m out!

I found it interesting that you mentioned the median increase has already gone up 11.5% yoy and you said “Therefore, even if the national median rent or local market rent increased by 11.5% from a year earlier, your rent has most likely not increased by the same magnitude.” It sounds like you think rent increases are going to taper off significantly by Q1 2022, but if the median increase is at 11.5% and rents tend to be sticky, would that not mean it is likely that we still have a significant amount of increase in reserve?

To put it another way, some sources have the housing market up 16.5% y/y June 2021, to keep cap rates consistent, we still have another 5% in rent increases just to catch up.

Yes, but I’m not sure I quite understand your question.

Please write out a rent dollar amount and use the percentages to explain like I have in the post. It would help clarify.

I believe the pace of rent increases will decline by about 40-50% by mid-2022.

My market, according to Zillow, is up 20% y/y August 2021 and rent is only up around 11% (national median), this leaves lots of room left for continued inflation unless cap rates fall drastically.

Something interesting has also come up in my own portfolio, had a tenant that was around 2.5 months of rent behind when I was finally allowed to file for an eviction. He was not particularly snide about it, just gave the normal excuses (though income was not impacted by covid). Asked if I had anything cheaper (I didn’t, currently 0% vacancy), and started the process of looking to move (packing, etc). One random day, (several days after he had been served judgement papers), he said he took a hardship loan from retirement accounts and paid the balance in full. My suspicion is that he looked at what was available in my area and found out that a tiny 2/1 apartment was renting for only $250/mo less than the 5/3.5 townhouse that he is renting from me. I fully plan to increase all rents by at least 10% when any tenant moves out, thus why I am saying I believe there is still a lot of pent up rent inflation that has not yet been realized.

If I were a tenant right now, I would be quite fearful, landlords (weather burned by the eviction moratorium or not) are going to be very aprehensive of “risky” tenants. I know in my case, my screening criteria is going way up or I am going to price the houses much higher to compensate for risk (probably both). For many, 2020 and 1H 2021 was an awful time to be a landlord, I believe the next 5 years will be the magical lands of milk and honey.

Agree with your sentiments

Two main factors are impacting real estate prices :

– Interest rates (cap rates)

– Rent

The reason why real estate prices increased +20% and rents increased only 10% is because interest rates dropped from 2% to 0% – variable – and from 3.25% to 1.50% – 10 years bonds. Mortgage rates are slightly higher but they follow the bonds rates.

If real estate prices rise 10% for each 1% drop in interest rates, that means the 20% rise in real estate in only for the interest rates decrease.

If rents increased by 10% in 2021, then real estate should increase another 10% in 2022 to take the increase in revenue into account.

That said, interest rates may go up at the same time. The Fed wants to raise rates back to 2% by 2024. Not sure they will be able to do it, but that would cancel the “cap rate” increase.

Rents are totally independent from real estate prices : rents determine the price of real estate, and not the other way around (if we pay more for real estate, that doesn’t mean we can charge higher rent).

Rent is entirely dependent on supply and demand for rent. If there is a shortage of rents (ex: 10 tenants looking for each appartement), then prices go up and we can do more screening. If there is a lot of vacant rent, then it is very difficult to increase rents + have to accept anybody that shows up.

I think eviction moratorium created another problem in the real estate market : they increased the shortage of appartment available. If bad tenants stick to an appartment even if they don’t pay the rent, then this appartment is not available for a good tenant looking for a place to rent.

If there is a lot of evictions, this could solve that problem and create pressure down on rent prices.

But, overall, I still think rent prices will go higher.

The main factor for the increase is – again – the interest rates. It make it basically free to purchase a home. But at the same time, housing prices increase so much that renters cannot buy real estate anymore. Therefore increasing the demand for rents. And pushing rent prices even higher.

Add some “help to the poor” type of policies voted by governments, this is like putting “oil on the fire”, pushing rent prices even higher.

And since interest rate have an effect on both rents and home prices, and that rent also have an impact on home prices, home prices have a possibility to rise exponentially.

This is only theoritical, and dependent on the fact that interest rates stay very low, and also not considering other practical factors, like employment, location, desirability, etc.

But this is why I think there is a possibility of accelerating rent increases in the future.

Sam think we could have a +5% rent increase in 2022 on top of a +10% rent increase in 2021.

I think there is a possibility we have a +15% rent increase in 2022 on top of that +10% rent increase.

This is all “pent-up” rent increase. Obviously, there is numerous restrictions on individual rents when renters stay in place. All the above discussions are for market rates only.

In conclusion, I think you are right in predicting a “magical lands of milk and honey” for landlords. Just don’t be too hard on renters. I think they will have their worst time – ever …

My tenant’s lease will expire at the end of the year. I kept the rent the same for 2 years so maybe it’s time to increase? However, I just checked and the rent is still pretty reasonable. I don’t think I can charge much more. They built so many new apartments in Portland.

I also checked the rent trends and Portland is tracking the national trend. I just don’t see the price increase in my condo’s area. Downtown had a lot of problems over the last 2 years. Maybe that’s a factor. Students are back in college by now so there should be fewer vacancies.

I’m 37 and a city renter for my only residence. I do not like to fix things and work around the yard/house.

However, I’m LONG real estate. Nearly 40% of my net worth is invested in Fundrise and other real estate-related assets (REITs, related stocks, etc.).

I think I get the benefits of both worlds – renting and owning.

Works for me – at least as of now.

Invested in non-physical real estate is definitely a growing trend. I had enough in 2017, which is why I sold one of my rental properties and reinvested 30% of the proceeds into real estate crowdfunding.

But good thing we can hire people to fix things when they do break!

But the cost of hiring people to fix things when they break rises right along with rents! And if homes do become more valuable at the expense of offices permanently, you best believe property taxes are going up! You really think that home prices will rise that much faster than inflation for that long? I agree with Mike here, if you save the difference and invest it even in the market index, I do not see how buying a house is the unquestionable choice.

Historically, HPA is right in line with inflation (and you could argue this was true even this year!), whereas market returns are more in the range of 8%-9% (and, as you acknowledge, much better last year). It seems to me that buying a house is the unquestionable choice only if you are a very conservative investor and expect returns lower than about 7% (after tax), or you are not a disciplined saver. Now that there are very few tax incentives on interest payments for a lot of home buyers, the benefits in the home ownership column are even lower.

I find your example about the owner of the $500k house versus the renter super misleading and troubling – it’s pure fear-mongering! The owner is paying interest, taxes and upkeep (which can run as high as 4% per year!), so he is not saving 100% of his gains over the renter, who can invest that owner’s down payment and the principal portion of the owner’s mortgage, all else equal. Furthermore an eight percent increase in the house value in one year is, honestly, really about as common as the renter realizing a 40% return on stocks, even though as I just mentioned, the renter’s required break-even is way lower than that after taxes, interest and upkeep. Not to mention that while both will pay taxes when they realize their gains, the owner has another 6% transaction cost – not on his gains, on the WHOLE home price. That’s huge!

I think this concept of the American Dream of home ownership is deeply oversold in the United States. If you are already good at saving money and even just an index investor, I think it’s much less clear, and in fact, because housing is so idiosyncratic, it’s actually a considerably safer bet to rent and invest in the stock market versus buying a house! Remember, HPA is on average, and doesn’t incorporate how much owners spent upgrading their houses between buying and selling, or how much they spent replacing roofs, buying new appliances, paying interest, paying taxes, and a whole host of things renters don’t have to deal with! What you as an individual realize on your house is never going to match the annualized home price returns. If anyone wants to see my math, I’m happy to share!

“You really think that home prices will rise that much faster than inflation for that long?”

No, which is why I predict that rent price increases will moderate by roughly 50% in 2022. Sorry if it was not clear in my post. Let me paste my commentary here again so it clear.

If you want to rent for life, you are free to do so. Just make sure to save and invest the difference. There’s a reason why the average net worth of a homeowner is so much greater than the average net worth of a renter (see chart by the Federal Reserve above).

If you think my $500,000 home appreciation by 8% example is fear mongering, just wait until you see what the national price appreciation rate is (+12%+) and what some cities like Austin, Texas have appreciated by so far in one year (25%+).

Related: Why The Housing Market Won’t Crash Any Time Soon

And now, to republish what I wrote in the post:

How Long Will Rent Increases Last?

Rents cannot increase faster than wage growth indefinitely. At some point, rent increases will have to slow.

Therefore, it is my belief that rent increases will begin to moderate in 1H2022 as home price growth slows, enough people finally move out of their parent’s homes or shed roommates, and housing construction bottlenecks decrease.

However, make sure to differentiate between moderating rent price growth and negative rent price growth. Instead of driving 85 mph on the highway, a car might slow down to 65 mph. The car is still moving forward, but just not at as rapid of a pace.

If median rent price growth is really about 11.5% YoY in 2H2021, I suspect median rent price growth will slow to about 6% by the end of 2022. That’s still a 18.2% increase in rents in two years.

After 2022, I expect national median rent price growth to revert to the mean of around 3.5% until some other unpredictable exogenous event occurs.