One big goal on Financial Samurai is to highlight to readers what is financially possible. Once you know what is possible, you minimize your limiting beliefs and tend to strive much farther. You can actually save more than $100,000 in your pre-tax retirement accounts per year! Let me explain with some basics first.

The 401k maximum contribution for 2025 is $23,500. The increases will likely continue by $500 increments every year or two to keep up with inflation. Contributing the maximum pre-tax a year for 30+ years will most likely make you a 401k millionaire by the time you retire.

Unfortunately, $3 million is the new $1 million, and in 30 years, $7 million will likely be the new $1 million if we assume a 3% annual inflation rate!

The 401k is not enough for most people to retire on. Sure, we potentially have Social Security to help us when we reach, at the earliest, 62 years of age. But I wouldn't count on the government to properly manage our money until then. Beyond maxing out a 401k every year, I encourage everyone to also invest at least 20% of their after-tax, after-401k money into a diversified investment portfolio.

As a contractor over the past year, I've discovered something that will really supercharge one's pre-tax retirement savings. The discovery still seems too good to be true, but it is true. The research I've done is based off the IRS website, my own experience, and speaking to Fidelity's small business retirement department where I have a rollover IRA, SEP-IRA, and Solo 401k.

How To Save Big In Your Pre-Tax Retirement Savings Plans

Let's say you've got a cushy job paying $212,000 a year. You contribute $19,500 to your 401k and get a nice 4% match. We're going to use 2021 numbers because that's when I first wrote this post. But the concepts are the same for today.

Furthermore, you can’t contribute to a traditional IRA because you make too much. Therefore, what is a retirement super saver supposed to do if s/he wants to save more than $19,500?

Answers:

1) Find a better employer who will contribute more to your pre-tax retirement savings account(s). $57,000 max 401k contribution for 2021 (employer profit sharing + $19,500 by employee)

or

2) Be an employee and a contractor/business owner! Max is $114,000.

Roll Over Your 401(k) To An IRA

The first thing I did when I left my old job of 11 years was roll over my 401k into an IRA. There are many benefits to a rollover IRA, including more investment options and lower costs.

The only issue with my rollover IRA is that I can no longer contribute pre-tax to the investment account. Its growth mainly comes from asset and dividend growth. I don't bother contributing $5,500 in after-tax money because of the two other retirement accounts I get to contribute pre-tax.

Explore The SEP-IRA

As an employee of an online media company, I get to participate in the company's SEP-IRA plan. Any self-employed individual or business owner with or without employees can open up a SEP-IRA. The funds are completely funded by the employer.

The employer can contribute up to 25% of compensation, up to a maximum of $57,000 in 2021. Doing simple math to discover how much income you need in order to save $57,000 using a 25% contribution rate = $57,000 / 25% = $228,000. IRS link on SEP.

Making $228,000 is not exactly a piece of cake as an employee. You've probably got to pay your dues over many years to get to such a level or more, but it's possible.

If you do manage to make $228,000 in income, you've still got to pay Federal tax, State tax (if you are not living in a no income tax state), and FICA tax (6.2% Social Security + 1.45%) on that income. After you make $228,000 or more, you've got to then convince your employer to contribute 25% of your income to your SEP-IRA.

You Can Have A Company 401(k) And A Solo 401(k)

As an independent contractor, I've opened a Solo 401k (aka KEOGH 401k, Self-Employed 401k, One-Participant 401k), which is meant for a business owner with no employees.

My duties as an employee for an online media business is different from my contracting business. The online business makes money mainly through advertisement. My contracting business makes money by me consulting with other companies mainly on their content marketing initiatives.

The Solo 401K has the same contribution limits of up to 25% of compensation, to a maximum of $57,000. So in other words, I can try and make $228,000 as an independent contractor to contribute $57,000 pre-tax in my Solo 401k as well.

The grand result is that a ~$440,000 combined income can ultimately save a total $114,000 in retirement accounts tax deferred. The combined adjusted gross income (AGI) is therefore $440,000 – $114,000 = $326,000, which is taxed at a 35% marginal Federal tax bracket.

Check With Your Accountant

I originally thought the total pre-tax retirement contribution was $57,000 across all accounts. But when I called the Fidelity retirement department for small businesses, they verified with me that I can indeed contribute $114,000 total if I have two separate accounts as an employee (with no ownership) and independent contractor.

The idea is to open a SEP-IRA as an independent contractor/business owner if your employer has a 401k program, and vice versa. If you open up a solo 401k while already contributing to an employer 401k, then the max you can contribute is $57,000 combined.

The Ideal Retirement Income / Savings Scenario

Given there is a progressive tax system in America (see chart), making $500,000 a year in combined income might not be the best move to avoid the marriage tax penalty, which has almost all but gone away after Trump's 2018 Tax Reform plan.

If you decide that you want to make $500,000 a year in income to contribute ~$120,000 in pre-tax retirement money, then you must make $500,000 as an employee and as a contractor/business owner.

Remember, there's only one type of main retirement account per business entity, and that one retirement account limit is $57,000 a year or 25% of income, whichever is less. In other words, if you make $425,000 in your business alone, you can't contribute $425,000 X 25% = $108,000. You can only contribute $54,000 to your SEP.

The solution is to therefore try and earn as close as possible to $220,000 in income as an employee for the SEP-IRA, and another $212,000 as an independent contractor for your Solo 401k.

Pay Attention To Government Policies

Remember, the government sets these pre-tax contribution rules, not you or I. President Obama made it clear when he was debating Mitt Romney that any individual or married couple making over $200,000/$250,000 is considered rich, and will be targeted for increased taxes and deduction/credit phaseouts. The compromise in the House was made for increasing taxes on income over $413,200 a year.

Now, Joe Bide says he plans to raise taxes on anybody making over $400,000 a year. That's much more reasonable than the $200,000/$250,000, especially due to inflation and residents in higher cost of living areas.

The above chart highlights five different scenarios that encapsulates most people. The first two scenarios in blue are for people who are employees only. Most people don't take full advantage of their pre-tax retirement contributions (scenario 1), but some people do (scenario 2) and will really accumulate a health financial nut over time.

The three other scenarios in red are employee plus contractor scenarios, which enables one to save way beyond the typical amounts due to the opening of a SEP-IRA or Solo 401k as a contractor, whichever your employer doesn't have.

Here are the five hurdles one must overcome to get into scenarios 3-5:

1) Your employer might not agree to let you start your own business or work as an independent contractor. The solution is to join a company that provides you the flexibility to consult after hours. Maybe you become an employee of a relative, a good friend, or simply a progressive company that allows for greater freedom.

2) Your employer might not value you enough to pay you $212,000+ in salary.

3) Even if your employer pays you a $212,000+ salary, they might not be willing to then provide profit sharing up to the maximum limit a year via a SEP-IRA or 401k plan. It is more common for larger corporations to offer 401ks over SEP-IRAs because once a business says they will contribute X % to an employee's SEP-IRA, they have to contribute X % to all employee's SEP-IRA. You can see how the cost to the business can get very cumbersome. With a 401k plan, a company allows the employee to choose their own contribution, and then offer usually a much smaller employee match.

4) You must not have common ownership in any of the employers you work for. As soon as you have common ownership because you started the company or you and your wife started the company, the IRS has new limitations of contribution for you. The IRS doesn't want you to open up 10 different companies, spread out your millions in income, and defer $550,000 ($55,000 X10) in tax free earnings in your retirement.

5) You've got to remove your limiting beliefs about how much you can make as a sole proprietor. If you think making $220,000+ as an employee is difficult, wait until you try making $220,000+ with your own two hands from nothing! But like anything that is done over a long enough period of time, things get better due to experience, expertise, and higher rates.

Come retirement time, we'll still have to pay taxes on all our pre-tax contributions when it's time to withdraw funds. By then, we'll surely be able to tactfully withdraw money in a way that gets taxed the least. Chances are higher that when we're in our 60s, 70s, 80s, and beyond, we won't be making as much money as when we were working anyway.

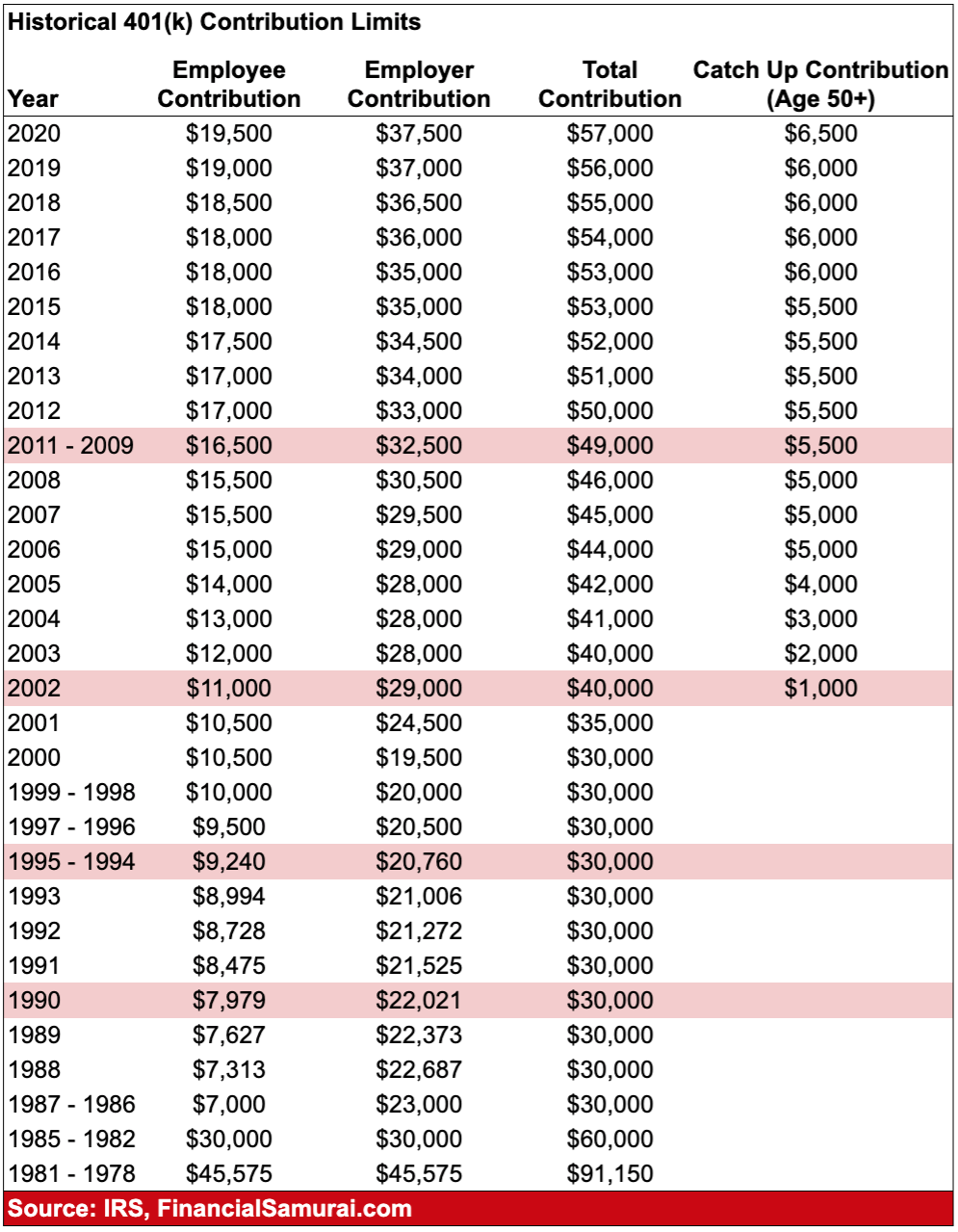

Historical 401k Contribution Limits

2021 401k limit contribution is the same as 2020. Hopefully the 401(k) maximum contribution limit goes up to $20,500 in 2022.

Note: I'm not a tax accountant. It's always worth speaking to a tax advisor about such things. 1099 income for an independent contractor/sole proprietor is tricky and you would have to make closer to ~$260,000 income to get to max out at $56,000 (for 2019) due to taxes and adjustments for a SEP-IRA.

The biggest confusion people have is thinking $56,000 is the limit across all accounts. I thought the same thing too. $56,000 for 2019 is the maximum you, the individual/sole proprietor/owner of your business can contribute. But if you are somehow an amazing person who can get employers to hire you, pay you lots of money, and contribute the max $56,000 a year, then it's the individual company's choice to contribute to your retirement up to the maximum if they wish. It helps to think like an employer when it comes to such dynamics.

Diversify Your Investments Into Real Estate

Stocks are very volatile compared to real estate. Therefore, if you want to dampen volatility and build wealth at the same time, invest in real estate. Real estate is my favorite asset class to build wealth.

The combination of rising rents and rising capital values is a very powerful wealth-builder. Further, investing in real estate is very tax efficient. Depreciation is a non-cash expense that lowers your taxable rental income. Further, you get to sell a property $250,000/$500,000 tax-free if you live in it two out of your last five years!

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $810,000 with real estate crowdfunding platforms. With interest rates down, the value of cash flow is up. Further, the pandemic has made working from home more common.

Take a look at my two favorite real estate crowdfunding platforms. Both are free to sign up and explore.

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified eREIT is the easiest way to gain real estate exposure.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build you own diversified real estate portfolio.

Free Tool For Retirement Savings

I recommend signing up for Personal Capital, the best free financial management tool online. It helps you track your net worth, analyze your investments for excessive fees, and manage your cash flow. I ran my 401k through their 401k Fee Analyzer and found out I was paying $1,700 a year in fees I had no idea I was paying!

Personal Capital has an incredible Retirement Planning Calculator that uses your linked accounts to run a Monte Carlo simulation to figure out your financial future. You can input various income and expense variables to see the outcomes.

FS – On a Solo 401k if you are looking to allow your spouse to make employee contributions because you are maxing out your contributions at another full time job.

Does the fact that you are paying your kids up to the Standard Deduction through the business – eliminate the ability to open a SOLO 401k? I was told that you can only open a SOLO 401k if there are no other employees, but didn’t know if the children were an exemption to that rule?

Correction:

“Furthermore, you can contribute to a traditional IRA because you make too much. Therefore, what is a retirement super saver supposed to do if s/he wants to save more than $19,500?”

Should have been can’t?

Good catch! You are correct.

I like how you said making $220,000+ from nothing. This is the hardest thing I have ever done in my life nothing even comes close to many other things I’ve done losing weight, etc.

What if you’re a W2 employee for a company but then also get 1099 income from that same company for your business? Would you still get the same 56k/year limit for each with a 401k for one and SEP IRA for the other?

Sam,

What if you are an employee of 2 different companies? One offers a sep ira and the other a 401k? I am in such scenario. My employer with sep ira will max the $55k per year for me at 20% contribution. Can I also max my other employer’s 401k at $18.5k/year plus get the match? Thanks!

Sam, there is one key tax you did not talk about when it comes to savings in income taxes.

For all the self-employed IRAs and 401Ks, one can contribute to all those plans if they have earned incomes. One has to pay self-employment taxes on earned incomes which is about 15.3% (social security plus medicare). Hence the net savings in income taxes have to account for the self employment taxes one has to pay. The bottom line is the savings will be reduced by the self employment taxes.

How do 403(b)s treated in all of this? Are they basically equivalent to 401(k)s?

What if you want to do a backdoor Roth and need to have zero money in all IRAs by December 31? If your consulting/contractor work was in a SEP-IRA, could you move that money by December to take advantage of the backdoor Roth?

First of all, that I you for your very interesting article. I hope you have your trade name protected under the Trademark statute. It’s a great name.

Now for my questions: Let’s say, hypothetically, I’m an attorney age 55 and own my own law practice that is organized as a PC in Texas. Through the PC, I provide legal advice to my clients. Through a separate business, an LLC, owned entirely by me, I do consulting work that is not legal advice (I sometimes testify as an expert witness, give speeches or write articles).

The PC has a 401(k) and I contribute to the max. Based on your research, how much can I contribute as the employer to my 401(k)?

The LLC currently does not have anything setup for retirement. Based on your research, what is the best option?

Again thank you for your blog. I agree that is well written and your research demonstrates that you are truly … a financial samurai.

Hi Sam,

Why do you need 212k income from your own solo owned business to put 54k in the Solo 401k?

From my understanding of you have your own S corp with you as the only owner and employee than you can run an annual salary of 144k for yourself. As an employee deferral you contribute 18k into the Solo 401k and as an employer match you contribut 36k (25% of gross wages 144k) into the Solo 401k. This will help you reach the 54k max with a gross income of 144k on W2 from your own S Corp (or any entity for that matter).

In other words, if my business earns 144k (plus some more to cover taxes or fees etc) and it pays me a 144k salary then I could still put aside 54k pre tax into a Solo 401k.

Is this understanding correct?

Please revert and thanks for this great website.

This may be correct. See: How Much Can You Actually Contribute To Your Solo-401k?

Hello! The content on this website is amazing (especially for those self-employed like me now)!

I’m trying to max out my the employer side of the 54k I can contribute. I can contribute 54k towards my single-person LLC. What is required to be an “employee” of the firm? I assume being an uber driver, independent contractor for mystery shopping, real estate agent, these things all do not apply?

Has anyone gotten a part time (high paying) job with a company part time? And if I do so, I can only contribute 25% of my salary with the company? If presented with a salary, has anyone ever asked for their salary in the form of a 401k “bonus/matching/etc” from the company instead of receiving the salary? So if you were offered making 100k a year with a company, ask for 36k in discretionary bonus, and have your salary on paper be 65k?

Sorry for all the question, hopefully someone has had experience with all this :)

Hey Sam, If my wife is in school and does not have a W2 job, but makes $ on the side by doing some independent contractor work, selling stuff on craigslist, etc, can she setup a solo 401k and dump all the income into that account and thus avoid paying any taxes on that income right now? (by “all income” i mean less than the $18,000 max)

Also when you have a solo 401k for a side business, if you are a sole proprietor does the business have to be one specific thing? or can you make money doing a variety of different things and consider it all the same business?

Thanks, Tippy

Check out: How Much Can I Contribute To My Self-Employed 401k for the contribution formula.

In an earlier comment

“~$424,000 is just the simple theoretical income amount one has to make combined between two entities to be able to contribute $106,000 in pre-tax retirement contributions. One has to make $424,000 across two entities, ideally at around a $212,000 split to max out $53,000 each. ”

SO:

My husband and I are business partners can we EACH contribute 53K to our individual SEP IRA’s?

My CPA can’t seem to give me a straight answer.

Thanks!

What is your income each? i’m surprised your CPA cannot answer you. You must contribute the same percentage of your income across all employees.

Last year combined we made ~437K total. Yes, We did the same percentage (~11.5%) between us and our one employee BUT OUR total for BOTH (mine and my husband’s) SEP IRA was 53K total. I’m trying to figure out if we could exceed 53K but not more than 106K, while keeping the equal % across the board. I’m not sure of our income total this year yet.

MY CPA just recited the IRS website to me which I have already read and does not seem to clarify our specific circumstance.

My investment banker seems to think we should be able to contribute more than.

I appreciate your help.

Kristin, you guys are two separate people, even though you are married. With a 401k, married employee couples can each contribute $18,000 pre-tax max. I don’t see what the difference is with a SEP IRA. Two people, two retirement accounts, two workers, two contributors.

I’m afraid to give you or anybody public tax advice b/c taxes are so darn confusing and I don’t know your full financial situation. I just know about my situation and used my example of how I could contribute to a self-employed 401k and also receive SEP IRA contributions from my employer.

Good luck and let me know what you finally decide to do. Also, how did you find my article btw? FS has been around since 2009. Feel free to check out my About page for more background info and my other tax-related articles.

Sam

I am going to consider us each individual entities and therefore contribute more that 53k total. I think that seems to make more sense.

I googled my question and your article was one of the top few that appeared on search.

I will look into other articles for yours, thanks you!

If I understand correctly in this scenario you could have sheltered the full 53k for both you and your husband in a solo 401k. 18,000 for you, + the business’ contribution of 25% of employee earnings or 20% of business earnings (not sure which) could net you a maximum of 53k.

All “employer” contributions are given to both employees. So he’ll get the same 20% or 25% from the business that you did as well as his own 18k contribution.

Solo 401k’s allow a little higher contribution than SEP if you’re over 50 with the “catch up” feature allowing up to 120k per year (2017) in tax deferred savings in a scenario like yours. I haven’t seen the same scenario confirmed with a SEP or I’d happily share my data on it.

I’m just an enthusiast and have probably horribly bastardized half the terms here, but I do believe it’s possible from my research. I hope this might be helpful to you next tax season.

Hey Sam,

Quick question in regards to individual/Solo 401k’s. So if i have a side business that generates $10,000 a year after operating costs, I can only contribute 25% of the $10,000 into my Solo 401k or Individual 401K? Or could i put the entire $10,000 into it and essentially have zero net income from that job?

Thanks for the great posts.

Aloha, Tippy

Started an S-Corp 1/1/16 that grossed 220k is net 100K coming into december….I have another w2 role that is 110K. Wife has no salary.

What should I do? put max 30K or whatever limit is into 401K?

Goal is to minimize taxes. Is the law for the scorp I have to pay myself a reasonable salary what someone would make in that position even though I dont need a salary from it?

I am looking for an accountant I can speak on the phone an pay for advice…Any recomendations?

I’m sure there are many accountants near you to call.

Related post: How Much Can You Pay Yourself In Salary And Distribution As An S-Corp Owner?

Hi Sam! Been reading this site for a long time. Wanted to ask if you ever thought of opening some sort of forum feature or something similar to help your readers network with each other? I have a hard time meeting other people I can talk about financial strategy with, and ideally want to meet people with same mindset to pursue business opportunities with. I know high earners but not many who want to save >50% of after-tax income.

I’m 27 with a net worth of approximately $550k. I fully admit $100k was a gift & early inheritance, then then rest was from saving W2 income, lived with parents a couple of years, luck, and pouring almost all savings into a high cap commercial real estate deal. My active income is going to increase substantially once I graduate from my master’s program (got a scholarship so $0 debt). My undergrad was finance and graduate degree in tech (data analytics). I’m set to make about $150K in W2 income + $45K in rental real estate income next year. My goal is to keep converting my active income savings into a passive income stream to reach FIRE. Ideally I want to enter high-tech entrepreneurship, but I need like minded business partners to achieve it.

I would gladly pay some nominal subscription fee for this kind of networking. Just an idea!

Hi there! Thanks for reading. I’m actually in the process of setting up for him. But it’s taking a little bit longer because I need some time to figure things out. I’ll give it a go and see what happens. It should be up before the new year.

This are some good ideas, but very difficult to achieve. It would seem the first avenues to approach would be getting income coming to your spouse, choosing a Roth 401k, and maxing out some 529 plans for a traditional earner.

Once you’re at the 18000 max and don’t have a real way of achieving greater savings, the only option is to go Roth 401k and effectively save more.

Very interesting article.

My wife and I have a company 401k that we max out every year and are owners of a side business that spins off about 500k/year.

How do we set this up so my wife and I can contribute an additional 53k/year each to reduce our taxable income.

Also, can we still do a backdoor Roth IRA doing this? I imagine we’d have to rollover the SEP IRA into maybe my companies 401k???

Side business is established as an LLC.

Hi There,

I am on track to make about 500k net for the very first time.

I have very in-consistent income given the field I work in.

I’ve had years of un-employment (4 years), zero income and struggled to make ends meet.

Next year I could make as little say 60k, If I find work, it’s that in-consistent.

I’d like to save as much as I can for retirement and pay as little in taxes as possible.

Is it possible to spread this years income over a few years?

I’d like to hear your thoughts on tax strategies to pursue.

I’m a single person S corp. Wife does not work.

Thanks

Thank you so much for your wonderful article.I learned something new.i have a question I am a self employed and i work online.Lets say if i make 100k a year or more and I have a SEP IRA and i contribute 25% of my income but i am not able to reach the 53k limit as you have to make 200k+ to reach that limit so i am thinking of opening a Solo 401k and divide the remaining balance money to reach the 53k..can i do this???it will be very helpfull if you answer this question.Thank you once again

I am married, filing jointly. My wife is a sole proprietor with very low net income after business expenses (she has a coaching business and is also an athlete so her business pays for the races/travel/equipment/etc she needs). Can we use earnings from my day job to fund Solo 401k? I am having trouble finding the rules on this.

Thanks!

Suppose you have your own biz and net income of 500k/year after all expenses. You pay yourself 100k and take home 400k in distributions. You have 3 employees that are each paid $30,000.

If you set up SEP ira, don’t you have to also put in 25% to your employees pensions?

I would first say be careful. Paying yourself a 1:4 salary:distribution ratio is a red flag by the IRS as it indicates an aggressive desire to avoid paying self-employment tax.

Shot for a 1:1 ratio instead.

Definitely would appreciate a CPA’s insight on this because I don’t think this scenario could possibly be correct. Here is goes:

I have my own S-Corp and have maxed out my 401k contribution for the year at $53,000. I am thinking about hiring my wife, who also has another job, for the remainder of the year for $18,000. She would put the entire $18,000 to the 401k as the employee contribution. If I were to hire her I think the scenario would play as follows:

Wife and my S-Corp collectively pay 15.3%; however since my wife’s other job pays her $120,000 and all of her social security has been paid out for the year; the actual percentage paid is the Medicare tax of 2.9% of $18,000 or $522.

Half of the Medicare tax, or $261, would be an expense on my S-Corp’s K-1.

My wife would pay neither Federal nor State tax on the $18,000 W-2 salary.

There would be minor miscellaneous fees and taxes associated with putting my wife on payroll – essentially $2 per pay run plus unemployment taxes.

So in effect my wife would be paid $18,000 that would go into the 401k and I/she would pay $261 + $159.21 (tax effective $261 * (.33 Fed tax + .06 State tax)) in Medicare taxes plus the minor payroll and unemployment fees.

I know I’ve got to be missing something because this scenario seems way to good to be true. If I didn’t pay my wife $18,000, I would be paying $7020 in taxes on the pass through income to me.

I’m fairly certain that even though she maxes out of SS tax at her other employer, your S-corp would still be responsible for its SS tax share. Each employer owes its share.

So if my wife earns $25,000 (net) from her own business, my understanding is that she could open up an Individual 401k plan and contribute $18,000 (as an employee contribution) plus 25% of her net earnings, or $6,250 (as her employer contribution). Thus only having to pay tax on $750.

Is that correct?

Does she owe self-employment tax on the net $25,000 or just the $750? I think the $25,000.

I am so looking forward to a solid response to this question. It sounds totally LOL question, but its absolutely valid question. Any takers?

No doubt entrepreneurs are creative! Gotta love’em:)

@S

Using your example, if wife files as single filer unincorporated sole proprietorship

Net Taxable Business Income from Schedule C = $25,000

Less 1/2 SE tax

(this is a deduction on page 1, 1040)= (1,766)

Net Profit= $23,234

SOLO 401k Employee Contribution= $4,647 ($23,234 X .20) and NOT 25%

SOLO 401k Employer Contribution= $18,000

TOTAL SOLO 401K Contribution= $22,647

And Yes, you will have to pay SE Tax on the $25,000 which would be $3,532.

NOTE: She would be in negative territory at (1,179) when all said and done.

Thanks for the info. Negative territory is ok. Sound like all of her income would be shielded from income taxes, at the 33% rate (for us). I figured she’d have to pay the SE tax. In essence she would be paying about a 15% tax on her income.

Duper – I believe your advice is only correct if the wife is a single filer unicorporated sole proprietorship which quite frankly no one should be if they are looking for max tax advantage and a solo 401k. If the wife were to incorporate, which she can do for about $100, and pay herself a salary of $25k the example would be:

W2 income = $25,000

Solo 401k Employee contribution = $6,250 (.25 x 25,000)

Solo 401k Employee contribution = $18,000

Total solo contribution = $24,250

SE Tax on $25,000 = $3,532 (actually this is really on $1,716 for the employee and $1,716 for the employer – no 1040 deduction – would love to know if you could actually write the employer taxes as a loss – need a CPA’s advice on that)

Federal Tax (assuming 33% bracket) on $750 = $247.5

State Tax (let’s use an effective 9% as a plug for California but obviously will vary by State) on $750 = $67.5

TOTAL TAX (SE, Fed, State) = $3,487

Total Tax if not contributing to 401k = $14,325

I’ll run the numbers in my tax software and get back to you. There’s the standard deduction and exemptions you guys are missing.

-Brian

Brian@brianchongcpa.com

@Brian, you are correct, I was just giving high level example on what S was asking.

I’m going to have to look at this in more detail. To give you some more info. We do not pay state income taxes. Wife is sole proprietor, not incorporated. I really wish to avoid incorporating, so as to avoid having to file another return, etc. We are in 33% tax bracket based on my income. The idea of contributing about all of her income into an individual retirement account seems too good to be true, but maybe it can be done.

@Chriva, as I mentioned the example is for sole proprietor. I wouldn’t be able to comment 100% for an S Corp entity. Would leave that to someone else to comment on with certainty.

How much can I put away? I own my own business, partner in PLLC, we have a simple IRA(i do not contribute personally wife does). I also work at a public University and have access to a 457b and a 403b. I also am a military reservist and put about 10k/year in the TSP. My combined income is around 300k, so I do i backdoor roth every year….. current savings plan…. 18K in 457b, 10K in TSP, 5500 in back door Roth, 2000 in 403b. Wife… 12,500 in Simple IRA, and 5550 in backdoor roth.

Am I maxing approproately….

IRS Publication 560 covers all the plans being discussed: SEP, SIMPLE and qualified plans (Keogh, 401K, etc). It seems pretty clear the maximum contribution of $52,000 (2014) is across all defined contribution plans (regardless of where the money originates) for a given individual.

===

IRS PUBLICATION 560

https://www.irs.gov/publications/p560/ch02.html#en_US_2014_publink10008830

More than one plan. If you contribute to a defined contribution plan (defined in chapter 4), annual additions to an account are limited to the lesser of $52,000 or 100% of the participant’s compensation. When you figure this limit, you must add your contributions to all defined contribution plans maintained by you. Because a SEP is considered a defined contribution plan for this limit, your contributions to a SEP must be added to your contributions to other defined contribution plans you maintain.

===

If you don’t like the IRS version, here’s a lengthier version in plain English.

Defined Contribution Plans Include Popular Profit-Sharing Plans

The way that a defined contribution plan works is that either an individual alone, or an employee and the employer make contributions into the plan, usually based on a percentage of the employee’s annual earnings. Each participant has an individual, separate account. There is no way to determine in advance what the final payout at retirement will be. Benefits depend on how much was contributed in the employee’s name and how well the pension fund investments performed. So, the risk of fluctuations in investment return is shifted to the employees.

The government sets a limit on how much can be contributed in an individual’s name each year no matter how many different plans he or she participates in. The total amount that can be contributed in one employee’s name for 2014 is the lesser of $52,000 ($51,000 for 2013) or 100 percent of the employee’s annual earnings. The contributions are allocated to separate accounts for each participant based on a definite, predetermined formula. Forfeitures can be reallocated to remaining participants.

The defined contribution plan category contains a broad range of plans including profit-sharing plans, money purchase plans, 401(k) plans, employee stock ownership (ESOP) plans and two types of plans especially popular with small businesses: SIMPLE plans and SEPs (simplified employee pensions).

~ Chris

Just to emphasize, the above quote Chris cites from Pub 560 refers to all the plans “maintained by you” i.e. as the employer. So this answers the previous question: “Can one have small-business 401k and SEP-IRA side by side?” You can be self employed and set up two defined contribution plans (solo 401k and SEP), but the max is $53K across both plans because you are one employer.

This Pub 560 quote does not address the situation FS discussed at top of this post, namely, having an employer with a SEP and being also self employed with a Solo 401k (or vice versa). I suspect that this paragraph might be responsible for some of the confusion, for example if people mistakenly think “participated in by you” when they read “maintained by you.”