There’s a saying that goes something like this: To feel rich, take whatever you earn and triple it. Once you get there, triple it again. In other words, due to hedonic adaptation, it’s impossible to ever permanently feel rich!

We all know that making a top 1% income or top 0.1% income means you are technically rich. But I’ve noticed on my path to financial freedom there were several times when I felt incredibly rich and money wasn't the dominant reason.

Further, I've gotten to know many extremely rich people living in San Francisco since 2001. And some of them are more miserable than happy. What's going on?!

Let me share some of those times in this post where I felt rich without actually being rich. I'll also share more classical ways I felt rich.

Maybe you can share some of the times you felt rich as well. The more we can show gratitude for how far we've come, the better we'll feel.

When Do You Finally Feel Rich?

Looking back, here are some examples when I finally felt rich. Each moment of richness felt a little different and lasted for different lengths of time. I think these type of moments will make you feel rich as well.

1) When you visit a lower-cost country.

I used to live in Malaysia from 5th grade to 8th grade in the early 1990s. At the time, the exchange rate was ~2.3 Ringgit to 1 USD. When I finally paid a visit more than 20 years later, the Ringgit had depreciated to 3.7:1. One Ringgit bought the equivalent of $1 worth of stuff in the States.

Therefore, I suddenly had almost 4X the amount of purchasing power during my week-long stay. So perhaps making 3X more doesn’t really make you feel rich, but making or having 4X more does!

In addition to the increased purchasing power aspect, it felt particularly moving to visit my old house. It was overgrown with weeds. All the rich memories came rushing back of me skateboarding in my driveway and inviting friends over for fun.

It also felt good to realize I didn't fall through the cracks. Back in middle school, I was an undisciplined kid who got into way too much trouble. If I was my own father, I'd have considered sending myself to military school.

Unfortunately, within a couple weeks after returning to the United States, I no longer felt richer than normal. I can completely understand the lure of being a digital nomad in a place like Malaysia, Thailand, or Vietnam. In a different life, being a digital nomad is exactly what I would have been.

Check out the Financial Samurai Wealth Reality Ratio to see the minimum net worth needed to feel wealthy. It's a fascinating exercise given we're always battling our desires and being happy with what we have.

2) When you finally hit your passive income target.

It took 17 years to achieve my passive income target of $200,000. When I finally got there, I felt rich. There was little fear of running out of money anymore.

That said, growing up in developing countries where there was a lot of visible poverty and experiencing many boom bust cycles working in finance has permanently made me a little paranoid about losing everything.

Passive income feels like free money because you're not doing much to earn it. In a way, you almost feel guilty, even though you spent a tremendous amount of time building your passive income portfolio in the first place.

The amount of passive income generated is less important than whether or not it can cover all of your living expenses plus a nice cushion. Once it can, you will feel rich.

Passive Income Enables You To Speak Freely

Another reason why you will feel rich once your passive income is high enough is because you can finally freely speak your mind. You don't have to suppress your true opinions about anything. You're less concerned about displeasing somebody. You're also not afraid to lose your job any longer.

Curiously, once we had our son in 2017, $200,000 no longer felt like enough. With the cost of health care, housing, and college education rising far quicker than inflation, I felt like I needed to generate more passive income. There must be some type of biological trigger that switches on once people have a child.

Today, with two children, our passive income target is now $400,000. We'll make it work on less. However, if I want to feel rich, I require at least a 20% buffer over our expenses. Inflation right now is a killer. Luckily, we understand various ways to defeat inflation.

3) You feel rich when a new income stream comes out of nowhere.

None of us are maximizing our income potential. If we could make a maximum of $100 a month, I think most of us are really making only an average of $30 a month. It’s kind of like how none of us utilize more than 20% of our brains. If we did, perhaps we'd find a cure for all cancer already.

One of my issues for years was not caring about revenue maximization on Financial Samurai. I already had enough passive income. Therefore, I wasn't constantly hustling to find new business deals. When some of my peers would hire a team of writers to write affiliate posts, I was busy focusing on writing about fun topics that made little-to-no money.

But in 2018, I decided to become more entrepreneurial because I received poor feedback on a post I spent a lot of time on. I figured, if people didn't really care after reaching my 10-year anniversary, then I might as well start being selfish for myself. Besides, I had a baby boy to take care of.

Today, I feel rich whenever a new income opportunity appears on Financial Samurai when I'm not looking. I'm trying my best to be more entrepreneurial post pandemic because I'll have two kids in private grade school soon. After blowing up my passive income in October 2023 buying a sweet house, it's now time to grind once more!

Luckily, I live in San Francisco, the epicenter of the artificial intelligence boom. As a result, tech stocks in the SF Bay Area are doing well again and demand for real estate is rebounding.

In addition, I'm able to invest in private AI companies in an open-ended venture capital fund called the Innovation Fund. With an investment minimum of just $10 and the ability to get liquidity if I need it, I feel rich to be able to have this opportunity.

Here's my conversation with Ben Miller, CEO of Fundrise, about opportunities in AI.

4) You feel rich when you don't sell assets at suboptimal times.

Back in 2012, I listed my San Francisco single family house for $1,700,000. I didn't get any official offers, only whispers from a couple real estate agents saying their clients were willing to pay closer to $1.4 – $1.5 million. I refused and took it off the market until mid-2017.

My tenants had given me their 30-day notice. I figured I might as well test the market for both rent and sale again. My hope was to get at least $2,300,000 or $8,800/month, the same rent as my previous tenant.

Instead of getting $8,800/month, the best I could get was $7,500/month, a big 15% decline. At the same time, my realtor found a prospective buyer off-market who offered $2.6 million! After much back and forth, I was able to get the prospective buyer up by $140,000. Just by waiting five years and living my life I was able to get much more.

Not selling an asset at a bad time will make you feel richer as time goes on. The reason why is because the compound returns grow even greater. At the same time, selling at an inopportune time makes you feel poorer and poorer.

The only way to counteract the bad feeling of selling at an inopportune time is if you reinvest the proceeds in other appreciating assets. For the first 6-12 months, I felt a little melancholy having sold a home I had owned for almost 13 years. I had dreamed of starting a family in the home.

But thankfully, the reinvested proceeds provided a positive return, so it worked out in the end. Dealing with five male tenants who perpetually threw house parties was just too much.

Holding On To Something You Created Makes You Feel Rich

Perhaps more important than not selling an asset you did not build is not selling an asset you did build. I feel rich for not selling Financial Samurai back in 2018.

Back then, I was very tempted to because I was overwhelmed with fatherhood. I had a couple suitors offer healthy seven figure payouts. However, I wanted to reach the 10-year mark in 2019 before doing anything drastic. The site has since collected three years more of revenue and valuations are even higher thanks to a bull market.

In a low interest rate environment, you want to hang onto your income-producing assets for dear life. Any business that can operate unimpeded during a pandemic has also become more valuable. I see online businesses only getting more valuable over time. If you sell a cash cow baby, you will likely be filled with regret.

Further, Financial Samurai gave me something meaningful to do while I was stuck at home during the pandemic. I'm focused on keeping the site going so my kids can have a repository of thoughts about their dad when they are older.

5) You feel rich when something comes true after trying for so long.

The longer you spend working on something, the richer you will feel once you succeed. This is where feeling rich really doesn't have to do with money. It has to do with the satisfaction of gutting things out.

This rich feeling is why you don't want to just give your children everything. It's better to make them earn their success. Please don't envy the person who inherits everything. Feel bad for them instead.

Here are some good examples that take a long time to achieve, but once you do, you will feel rich:

- Studying for the MCAT, LSAT, Bar Exam, CFA, and passing.

- Writing a book for years and finally getting it published

- Working on building a relationship with a client for a year and the client finally agrees to do business

- Coaching your players for three years and finally winning a championship

- Dating for eight years and finally finding the one

- Trying to have children for years and finally giving birth to your first child

- Practicing for hours after school and finally making the team

- Diligently saving and investing for years until you finally come up with a down payment for a house without any help from your parents

Delaying gratification and demonstrating grit go hand-in-hand. It's very hard to appreciate something if it's just handed to us.

It took my two years during the pandemic to write Buy This, Not That: How To Spend Your Way To Wealth And Freedom. When I finally published it and it became an instant Wall Street Journal bestseller, I felt incredible rich! My kids were jumping for joy when they found my book in the bookstore! Check out the video still pic below!

6) You feel rich when you're surrounded by loved ones and friends.

Friends and family are everything. Having friends to joke around with brings so much joy. Having family that supports you in your endeavors feels priceless. We recognize this importance now more than ever before.

As a father of two young children, I feel richer than before I had children. It took years to conceive our first. Then to have another a couple years later felt like a miracle as older parents. Seeing them for the first time made me feel like the richest person ever. Every morning I wake up excited to give my children a hug.

I wish someone told me in my 20s and early 30s that having children would provide so much love. If I had been told, I would have tried to have children at least five years sooner and not been so focused on trying to achieve financial independence. To be an older parent means making up for lost time and trying to stay as health as possible. But I also realize raising young children is incredibly difficult.

If we could not have children, then we would spend more time nurturing friendships and adopt. Great relationships mean so much more than having a lot of money. We'd probably get a pet dog as well for companionship.

My main goal now is to spend more time with my parents, both of whom are in their mid-70s. The pandemic ruined creating a relationship with their grandchildren. I'm pleased to say after 23 months, I finally flew to Hawaii to see my parents. It felt very special and I plan to see them three times a year from now on.

7) You feel rich when you become a time billionaire.

A time billionaire is someone who has full mastery of his or her time. There's no greater feeling of wealth than being able to do whatever you want, whenever you want.

Even after my income plummeted by 80% once I left my day job in 2012, I felt richer. Sure, the unknown was a little scary. The first couple of months of not having a paycheck felt a little painful. But I was excited to have taken the leap of faith while I was still relatively young.

Being able to sit in the park and read a book on a Wednesday afternoon is nice. Being able to conquer your FOMO that you should be out there hustling for more money is truly rich.

Once you experience being a time billionaire, you will no longer be willing to grind as hard at work or at building a business or climbing up the corporate ladder. Some would saying being a time billionaire is even more valuable than being a financial billionaire.

8) You feel rich one you wake up healthy each morning without any physical ailments.

One of the biggest epiphanies I had after leaving work was that I had internalized all my chronic pain. I just lived through my TMJ, teeth grinding, allergies, sciatica, plantar fasciitis, lower back pain, and tennis elbow for over a decade. Then, about a year after I retired from finance, practically all my chronic pain went away!

Some of us work in such stressful occupations that we forget what living a pain-free life feels like. I remember seeing my first gray hairs at 33. The dam had finally broke, I had thought to myself.

But 12 years later, the gray hairs have not returned. I suspect the reason is because I'm truly less stressed on average each day. The health benefits of early retirement are priceless. And the body tends to tell the truth about how you really feel, no matter how much you try and say otherwise.

Unfortunately, I've noticed more random physical issues that are nagging me as I've gotten older. If it's not a sore lower back, it's a rickety shoulder, or an itchy ear. Most of these problems have to do with me playing sports too often.

Now I wonder whether being unathletic is better for living longer and having a more comfortable life. At the extreme, you hear about major health problems to NFL players. To live a rich life means living a pain-free life.

Cherish your health and your youth folks. You not only want to have full control over your time. You want to have full control over your time while you are healthy.

This means travel and explore while you can. Have the time of your life in your 20s and 30s. Health issues will inevitably pop up as you get older.

9) You feel rich when you learn something meaningful for free or cheap.

I love the internet because you can learn practically anything you want for free. You just have to focus your time reading and watching sites that are most helpful.

And because I love learning things for free on the internet, it's only right to share on Financial Samurai what I've learned along my journey as well.

It feels good to help people on personal finance matters without a paywall. Money consistently ranks as a top 3 stressor in people's lives. If I can help strangers solve difficult problems or give readers the courage to act, it feels very satisfying.

2020 was a difficult year for millions of people. 2021 was better due to incremental progress but 2022 was tough due to the bear market. I've found that during the darkest times, it feels good to regularly publish posts and write more nuanced newsletters to help folks through.

I thought about creating a paid newsletter, but I think it's awesome to learn something for free. That makes me feel rich and I hope it makes you feel rich too.

Tens of thousands of readers of my instant Wall Street Journal bestseller, Buy This Not That, feel rich as well. It is the best personal finance and life book today. Even better, it's selling at a nice discount on Amazon.

10) You feel rich when you buy something at an opportune time

Now that the pandemic is over, I feel rich because things have recovered so much. Let's never forget how dicey things were between March – June 2020!

In 2020, it wasn't just our investments taking a dive, but our day-to-day lives as well. To be able to sit here today with so many asset classes up so much feels like a miracle. We really need to be appreciative of our good fortune.

Further, some of us were able to buy some stocks near the bottom. After writing, How To Predict A Stock Market Bottom Like Nostradamus on March 18, 2020, I decided to invest around $250,000 in various stocks and indices.

I didn't hold onto my entire position until now. But I still feel rich for not panic selling.

Lucky to connect the dots

During the stock market meltdown, I also did an analysis on how real estate gets impacted by a decline in stocks at various levels of decline. My conclusion was to buy real estate when the S&P 500 was down between 15% – 20% for various reasons I highlighted in the post.

As fate would have it, one of my favorite homes came to market in early-April 2020, when the S&P 500 was down 15% – 17%. My son and I had walked by the home over 50 times during our neighborhood walks.

Every time we walked by, he would always run up and marvel at the double wide garage door. He'd also get a kick out of playing with the springy hose that hung off the fence.

The lockdowns were only one month in when they listed the home. Public open houses were shut down and many prospective homebuyers were too nervous or unmotivated to arrange private showings. One thing led to another and I managed to get a deal on our latest forever home.

Buying a home in 2020 makes me feel rich

Buying a larger home during the summer of 2020 makes me feel rich. As a father, my #1 responsibility is to take care of my family and provide them the best life possible.

With no in-person preschool for 15 months, the extra space made a huge difference in all our well-being. Just seeing my son run around in his new play area makes me feel so happy to have taken the investment risk. It certainly wasn't easy to pull the trigger when there was so much uncertainty.

Now I'm trying to figure out how to invest one million dollars after the Fed hiked rates eleven times to quell inflation. My focus is on buying private real estate funds again.

11) You feel rich when you discover easier ways to make the same amount of money.

The baseline way most people make money is working at a job. Trading time for income is what most of us get taught. However, as you discover easier ways to make money, you'll feel richer because you're getting a greater reward for the same amount of time or less.

For example, making money by owning physical real estate is one of my favorite ways to make money. While working, I invested the majority of my savings into real estate because I wanted the double benefit of capital appreciation and rent appreciation. Earning money as a landlord was much easier than earning money working in banking.

When I started investing in real estate crowdfunding in 2016, it became easier to make money than being a landlord. No longer did I have to deal with maintenance and tenant issues because the income was 100% passive. All I had to do was diversify my online real estate portfolio properly and do my taxes each year.

Find easier ways to make the same amount of money with less effort or more money with the same effort. Most of the time, the answer lies in investing. However, learning how to utilize leverage will make you feel rich.

12) You feel rich when you are free from listening to the gatekeepers.

After blowing up my passive income in 2023, I decided to take a part-time consulting job at a fintech startup in San Francisco. The pay was good, but I had to deal with a micromanager boss who didn't let me write freely. In addition, I had to be in a lot of meetings, which meant I couldn't do my job and write. After four months, I decided to leave and felt incredibly rich for doing so!

Being an adult and having to listen to another adult for decades of your life to make money is no way to live. To break free from the gatekeepers is one of the richest feelings ever.

Feeling Lucky And Grateful Makes You Feel Rich

The common theme to feeling rich is when you start feeling lucky. We can all work very hard to try and get rich. However, I truly believe luck is the main reason why some people are able to amass much more wealth than others. They either were lucky to meet the right people, have the right parents, or be in the right place at the right time.

Spend some time going through your lucky breaks. The more you are aware of your luck, the richer you will feel.

Luck makes you feel rich because it makes you feel like you got something for free. That or luck makes you feel like you got something you didn't fully deserve.

A couple of my other lucky breaks include:

- Getting into The College of William & Mary and meeting my wife my senior year. If I had attended the University of Virginia or had been one year older, I never would have met her.

- Getting handed the phone by my VP. On the line was a recruiter who ended up getting me a job at a competitor three months before I was to be laid off. That phone call brought me to San Francisco in 2001.

Of course, I've also had plenty of bad luck and failures along the way. Perpetual failure is the main reason why I continue to save. However, by focusing on the lucky breaks, I feel richer.

Other Examples Of When You Might Feel Rich

- If you walked away from a car accident unscathed.

- If you find a $100 bill on the ground with nobody else in sight.

- If both of your parents live long enough to hold their grandchildren.

- If you were diagnosed with a terminal disease and are still living past your due date.

- If you found the love of your life early.

- If your job is something you'd happily do for free or for much less money.

- If you're making a difference in other people's lives and also getting paid.

- If you were a C-student who now lives an A-lifestyle.

- When your investments return more than your income.

- When you have children.

- When you survive a global pandemic with your health intact.

- If you want to a public university but still make way more than Ivy League graduates

If you focus only on an absolute dollar amount, you’ll never truly feel rich. There will always someone with more money than you.

I have friends who are worth over $100 million who keep grinding because some of their old peers are now worth over $1 billion. Can you imagine?

Therefore, if you can focus on your lucky breaks and all the good fortune you are currently experiencing, you will feel like the richest person in the world. Please take nothing for granted!

Feeling Rich, Staying Rich

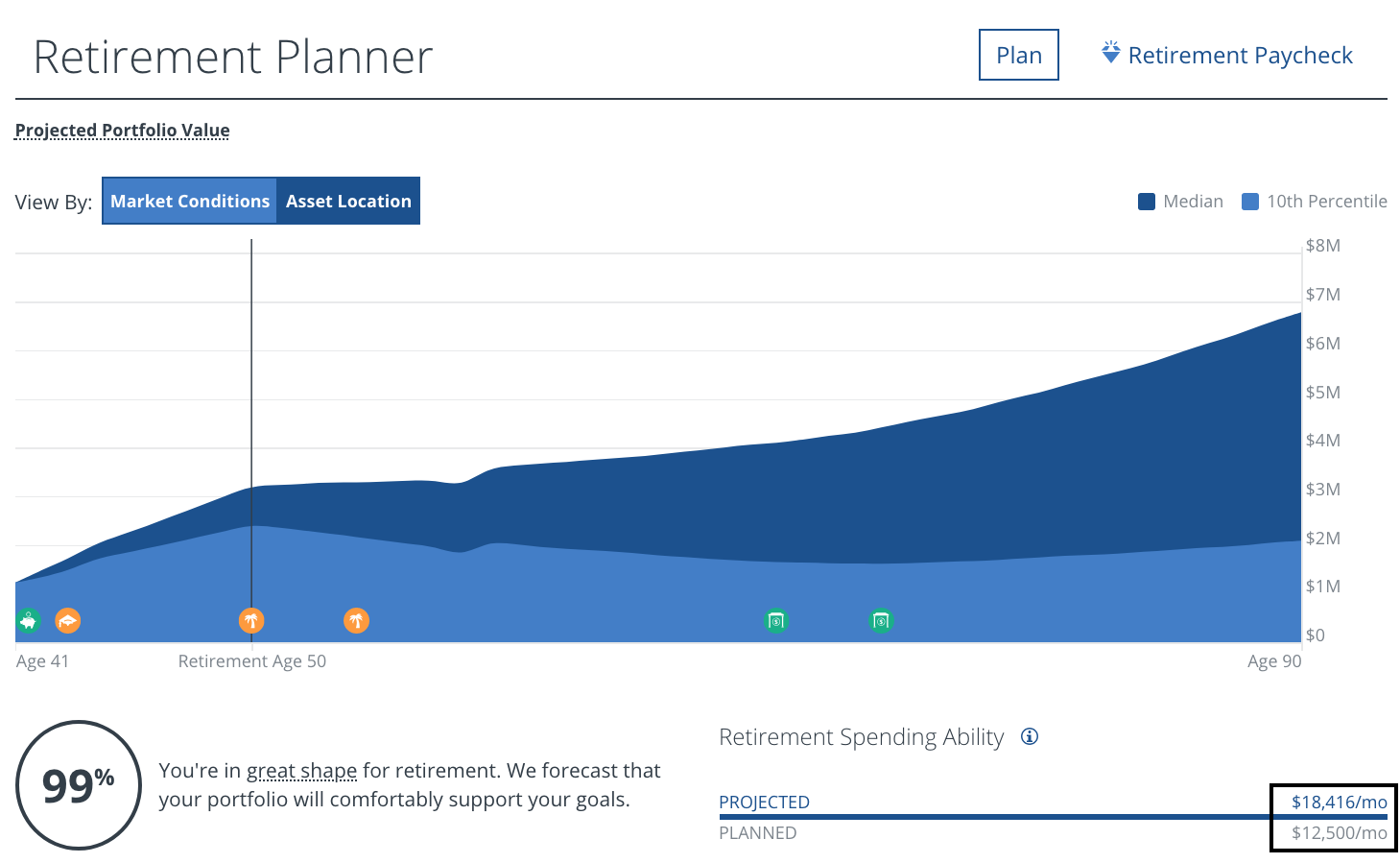

One of the best ways to feel rich and stay rich is to track your net worth with Empower. I've been using Empower's free financial tools to optimize my wealth since 2012. It's the best free money management tool on the web.

Just link up all your financial accounts to measure your cash flow, x-ray your portfolio for excessive fees, calculate your retirement income, and more.

Get you finances right the first time around. There's no rewind button in life. Once you do, you can focus on the other things that truly matter in your life.

Empower's Free Retirement Planner

Invest In Real Estate To Feel Rich

I feel rich investing in real estate given it rides the inflation wave. It feels great to own a tangible asset you can see and touch. Real estate is a core asset class that has proven to build long-term wealth for Americans. Further, real estate provides utility and a steady stream of income.

Given interest rates have come way down, the value of rental income has gone way up. It now takes a lot more capital to generate the same amount of risk-adjusted income.

Best Private Real Estate Investing Platforms

Fundrise: A way for all investors to diversify into real estate through private funds with just $10. Fundrise has been around since 2012 and manages over $3.3 billion for 500,000+ investors.

The real estate platform invests primarily in residential and industrial properties in the Sunbelt, where valuations are cheaper and yields are higher. The spreading out of America is a long-term demographic trend. For most people, investing in a diversified fund is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations and higher rental yields. These cities also have higher growth potential due to job growth and demographic trends.

If you are a real estate enthusiast with more time, you can build your own diversified real estate portfolio with CrowdStreet. However, before investing in each deal, make sure to do extensive due diligence on each sponsor. Understanding each sponsor's track record and experience is vital.

Both platforms are free to sign up and explore. I've personally invested $954,000 in real estate crowdfunding across 18 projects to take advantage of lower valuations in the heartland of America. My real estate investments account for roughly 50% of my current passive income of ~$380,000.

Both platforms are sponsors of Financial Samurai and Financial Samurai is a long-term investor in Fundrise.

Related posts:

How To Feel Rich Even If You Can't Technically Get Rich

What Income Level Is Considered Rich

Readers, when do you feel rich? What is the one common thing that ties feeling rich together? What are some recent examples that made you feel like the richest person in the world? For more nuanced personal finance content, join 65,000+ others and sign up for my free weekly newsletter.

I completely agree with you about feeling rich by being surrounded by loved ones, having no ailments and being a digital nomad in cheaper countries such as Malaysia or Thailand. I was a digital nomad in both countries and I have to admit that the exchange rate automatically makes you feel ‘rich’.

As someone coming from Georgia, the country, where average salary is an equivalent of about 300 and 1000 dollars at the very most, that is provided you are a total pro with a top work ethic and employed in an international company the sums you guys are casually taking about are like stuff from a movie. I can’t even begin to imagine how different growing up in a country like mine and in the west must be like but I can tell you that after almost 10 years of learning and trying and making the right decisions I’m finally making 2k usd a month which feels like wealth because I no longer have the same concerns I did before. If I was making that passively I’d probably stop thinking about money as much at all. Interesting thing is my spending is pretty much the same. True wealth is health, peace of mind and freedom to do whatever you like whenever you like, I think working all the time and restricting the above-mentioned just takes away the enjoyment out of life but maybe I think so because I haven’t experienced real world money yet, we’ll see. Can I see myself moving to a more developed country and spending 2k usd for rent? Hard to tell since I’ve no clue how the quality of life I have now would compare to that, the improvement would probably be in terms of opportunities only, here I’ve got tons of disposable income and no debt, this seems unreasonable to walk away from but then again everyone is working online now, including me, what kind of jump in mentality does it take to move from this to making six figures annually and where does one even start? I’d love to know, big goals move the soul. Making a high passive income feels like magic to me right now too which I feel with every nerve it should not.

In the past, I’ve suggested that you add an upvote button to your site. This is such a thorough article that I don’t have much to add other than “Great Job!”

Please, dont add upvote or like buttons. They add nothing.

Another way to finally feel rich is when you realize that you will never be living on a fixed income. That your wealth and income will only increase no matter how long you live due to your investments and your secure passive income.

Bonus: It may be that anti-agathic treatments will become available within our own life times. (Although it is unlikely that will be inexpensive, at least for early adopters, which is what we would most likely want to be.)

This would probably lead to virtually every pension and entitlement program (including Social Security) eventually being discontinued. If you are lucky, some of the private ones might provide a cash settlement, such as Pan Am employee pensioners got when that airline went bankrupt–but don’t count on it.

I also would expect that even if something like a universal basic income (UBI), a euphemism for “the dole,” should come about, it will never be something you want to be your sole source of income (and remember that thing about wealth being relative). The point being that, even if medical technology doesn’t allow you to vastly extend your life, but especially if it does, the only real security in retirement is for your wealth and income to still be growing, not the reverse.

This post surprised me, Sam. I assumed your answer would be the same as mine. I felt rich the day I received my first paycheck from first adult permanent job which paid a whopping $18K a year. And I have felt that way every day since. From that first day I have always had more money than I cared to spend. I had a great partner and great kids later and still had excess income. To me always having surplus, never being in need, that’s rich. I can do anything I want with my time and buy anything I want, just like Jeff or Bill or Elon or Warren. They want more expensive things, certainly, but I don’t want a thing I cannot easily afford. I’m just as rich as they are, and I’m still married to my best friend, so I’m richer than some of them! I know your life is equally rich, it colors everything you write. But I also get your point is more nuanced than my answer. Maybe I should say I have felt grateful and lucky since that first paycheck instead, but it has always felt like rich to me.

Congrats for feeling rich for so long! You have truly lived a blessed life.

I distinctly don’t remember feeling rich while making four dollars an hour at McDonald’s. And when I made $40,000 a year at my first job in Manhattan, I felt lucky to have a job, but I didn’t feel rich given the high cost of living there.

What would you attribute the reasons why you feel so rich so easily? And if you felt so rich with only $18,000 a year in income, what drove you to keep on working for so long after? Thx

Well, back when I earned $18K it was 1978. That was equivalent to $70K in today’s dollars and was well over the median family income in Arkansas and it was possibly the highest starting offer from the University of Arkansas of the entire graduating class. So it felt like a ton of money to me. I didn’t feel rich working my pre-college jobs when I made $1 to $4 an hour. But after college I lived in an ultra low cost area, my house payment, including taxes and insurance was $300 a month and that was with 8.75% interest rate! My wife worked too so we really had more money than we could spend. I averaged 9% raises across a 38 year career so my $18K became $430K the year I retired. And we never spent more than $80 to $100K in a year. I know we were not really rich, but we felt really rich because that’s how always having a bunch of money left over at the end of the month feels to me. I loved my job, it was a very fun hobby, that’s the only reason I worked until I was 60. And that’s a weird thing too I know, but that’s how I felt.

Ah, that makes more sense now! Yes, making $70,000 right out of school in today’s dollars in Arkansas is a lot. I made $40,000 in Manhattan in 1999. Equivalent to make $56,000 in today’s dollars. I was sharing a studio with a friend bc we lacked disposable income.

So perhaps the key to feeling rich for you is actually making a lot of money! $430,000 a year whenever you retired was a top 1% income.

Steveark your comment really spoke to me! I feel similarly. Sometimes when I go to the grocery store and realize I can buy ANYTHING I WANT I think how lucky I am, as a large portion of the world cannot do that. Or sometimes just thinking about the fact that I have a warm home, running water and a fridge stocked full of food really makes me feel rich. And the fact that I can save money on top of that, I live with my husband and two healthy kids just makes me so grateful. I’m sure having my mortgage paid off would make me feel REALLY rich, but for now the feeling of making more than I need is enough :)

It’s so important to count our blessings every day. When things are tough or I’m stressed out I try and remind myself that they could always be so much harder and to focus on the positives. I feel so fortunate to be financially independent and to only have mortgage debt.

This is another very well thought out article. For the most part, I look at US wealth/income data, my peers, my friends, my middle class mindset expectations, and even Financial Samurai, and I assess how rich I am. However, most people’s sense of feeling rich is far more emotional and complex, and you’ve covered a lot of ground.

I believe there is a difference between feeling financially secure vs. feeling rich. Despite growing up middle class, I’ve always felt financially secure (well-paid with good job prospects since college graduation). It’s been a steady march upward in income and wealth.

However, I did not feel rich until I was laid off in my early 40s. With my severance and modest options pay out, I could not work for 6 to 18 months. With my wife’s employment, I could not work indefinitely and still maintain our frugal but upper middle class lifestyle. It was a wonderful feeling of calm and optimism as I saw my other colleagues in panic, desperate to find any employment, many taking demotions and pay cuts.

I took the semi-retirement path devoting 10 to 20 hours each week to real estate investing. If I felt rich with X in net worth when I was laid off, then I certainly am ecstatic having achieved 4X net worth over 8 years working far fewer hours than I ever have in my adult life.

That has not been the case for my wife who who shares a very similar background with me. She has had a hard time with feeling financially secure or rich regardless of the numbers. With 4X of wealth, intellectually, she can no longer dispute whether we are rich. However, she still doesn’t feel rich, and now I understand this is a problem that more money cannot solve. I want her to feel comfortable with retiring and feeling rich and/or financially secure. A steady paycheck makes her feel financially secure. Short of winning a large lottery, I’m not sure how she will ever feel rich.

She is closer in mindset to retiring now, but I think that is more a function of age rather than money. As we approach 50, there are simply more people in our social network retiring or thinking about it. However, 8 years ago, it was mostly me reading some delusional guy’s blog who believed he was some sort of Financial Samurai. Think about this conversation. “Hey honey, this guy on the Internet thinks it’s possible for us to retire in our early 40s, maybe even in our 30s.”

Love it! And congrats on 4Xing a net worth you already felt was rich. Glad you discovered FS eight years ago.

It is fascinating that your wife still doesn’t think you guys are rich, despite so much wealth creation since. That’s worth looking into more. Both feeling rich would be ideal. I wonder what are some strategies to help you guys get there.

Thanks for this post, Sam. I feel richest when I am hugging my 7 year old!

I’ll work hard to achieve FI and hope to reverse my white/gray hairs like you!

Stress def plays a factor in having white hair. In the past year, my stress skyrocketed and I spurted out 20 white strands.

So awesome! Hugging our kids is the best. I hope we all live long enough until they are independent adults.

Feeling rich is relative. I have a neighbor who runs out and toys to one up others on the street when he hears they buy something. I think it is the feeling that you bought that but I bought something a little more expensive that makes some people feel rich.

If you’re not on social media, it just feels hard to tell what our neighbors or doing or what they’ve bought. We can look at their houses, but presumably, we have a house of similar value since they are our neighbor. So that leaves a car, vacations, and maybe where they are sending their kids to school.

Staying off social media is great for feeling rich!

I feel rich because I’m retiring from my current job at 59 years old, and building a new house in Arizona. My wife is younger and will work for a few more years, so healthcare will be covered. I’m also taking out a 30 year mortgage at 2.75%. I could pay the remaining balance, but I feel I can earn better than 2.75% investing those funds. From a cash flow perspective , my wife and I both have pensions and SS. I probably will only have to take about 2-3% annually from retirement accounts.

But, what really makes me feel rich is that I have two grandchildren and that I’m able to contribute a significant amount for their future college costs. I’m also much closer to them by living in Arizona, they live in California, and we’re closer to my daughter, who also lives in Phoenix.

Not fretting much about the cost of building a new home-about 600k-is nice. And added fact- my cost is pretty much fixed, and homes in Phoenix are expected to appreciate about 16% this year. I’ll take that any day of the week, and twice on Sunday! Really enjoy your articles Sam!

Hi Scott – Good luck with the new house build. Having a younger spouse who will continue to bring home the bacon and provide subsidized healthcare is huge.

I’ve tried to get my wife to go back to work to mix things up and reduce our $2,300/month healthcare insurance bill. But no luck yet :)

I feel very fortunate and rich in life. Worked very hard and for many years. Spouse never worked. Spent as much time with family as i could. Of course long hours and travel meant less than i would have liked. Travelled the world. Helped build my company into a large successful one. Built a net worth 10x what i would have imagined. About ready to call it quits. It’s been a great journey. Grateful to be an American. Peace to all.

10X more than expected is huge! Congrats. Happiness is all about managing expectations and surprising them. Enjoy your wealth!

Great post, Sam. I’ve been recently practicing being more grateful for what I have and where I live.

When I first moved to CA, boy did I feel poor. I still feel poor here, but I’m grateful. I wouldn’t want to live anywhere else (yet).

I feel rich when I go back to where I grew up. The median household income in my hometown hovers around $40k annually. Quite humbling as I’ve gotten older – in a good way.

Going back home always feels nice, especially if you still have friends and relatives there. Then, to go back to a much cheaper area is a huge bonus.

I’d like to go back to Hawaii eventually. Even though Honolulu is expensive, it’s still 25% cheaper than San Francisco!

Making it to the highest marginal tax bracket and realizing that the Federal Married Filing Jointly bracket amounts are not 2x that of the Single person, which is quite discriminatory. It makes you feel rich and poor at the same time.

Your newsletter cracked me up, Sam. Made me think of the movie Moneyball. Maybe give it a watch before you draft your next team. Hahaha! Also, I listened to an interesting podcast this morning by the brilliant Dr. Andrew Huberman. He talked about anticipation and its effect on dopamine. Maybe it’s the dream, the journey that makes us happy, and not necessarily the result.

Great perspective, Kristie, regarding the “journey that makes us happy.” I’d like to modify it to the journey that brings us joy. Joy is more of a state of mind vs. happiness. To be happy, you need to do something. If you don’t do what’s required, you’ll not be happy. Joy is more of a constant, sort of like the journey. In Maslow’s Hierarchy of Needs, Self Actualization is unattainable, but we’re always striving for it. It’s the striving for Self Actualization that gives us purpose and joy.

Great post! They key to a good life is fulfilling your Soul Purpose while improving your finances, health, and relationships. Only then can you reach your full potential. All the money in the world can’t buy you a meaningful life and the more you make, the more you need to feel ‘secure’. After all, wealth can be swept away quickly by bear markets and bad business deals.

I began to feel rich the day I decided that I had enough. For me, that happened to be three years ago. I hadn’t hit an arbitrary number in my bank account (nor a mathematically-derived multiple of any figure). And I was well short of what I had envisioned my net worth being before I felt I had enough. But it hit me that I already had enough, and that I would always have enough, regardless of what the future held.

I had to shift my frame of mind in order to gain a new peace of mind. For two decades, I surrounded myself with books, websites, documentaries, like-minded people, and a relentless ambition focused on financial independence. Even though I knew there was more to happiness than money, I was consciously and subconsciously telling myself that more money would provide more peace of mind (which was my primary motivation), and I was therefore always striving for more.

The problem with that mindset is that there are too many variables you can’t control, and thus arises the desire for more. Not for more materialistic goods, but rather for more peace of mind.

I knew material possessions wouldn’t make me any happier. I sense most of us on this website have reached that conclusion by now. But I had fallen into the trap of thinking financial security would give me the peace of mind I was seeking. And frankly, that was even worse. Because without the money I thought I needed, it wasn’t a new Porsche or Rolex I was missing out on, but rather contentment.

With $100 in the bank, you worry about how you’re going to buy food.

With $1,000 in the bank, you worry about how you’re going to pay rent this month.

With $10,000 in the bank, you worry about how you’re going to put a down payment on a house.

With $100,000 in the bank, you worry that you only have one or two year’s worth of living expenses saved.

With $1,000,000 in the bank, you worry about the stock market crashing, or the real estate market plummeting. You worry your income is decent but your passive income isn’t what you want it to be. You worry that a million dollars isn’t what it used to be.

With $10,000,000 in the bank, you worry about losing your fortune you’ve worked so hard to build. You may lose a million dollars in a single month in the market. The thought terrifies you. Your expenses have grown with your wealth. Your cushion isn’t what you thought it would be when you factor those expenses in. You don’t even feel like you live extravagantly, and yet you feel like you may not have enough if any tides turn.

With $1,000,000,000 in the bank, you worry about your empire. You worry about your competitors. You worry about monopoly lawsuits. You worry about what the media is saying about you. You worry about your reputation. You worry about where you sit on the list of the richest people in the world. You worry about how much you should or shouldn’t leave to your children. You worry if you have any real friends, or if everyone you know is simply looking for a piece of your fortune.

It’s no coincidence that as the money grows in each example, the length of worries grows too. And the reality is, each of these bank account figures can produce the same amount of stress on your body if you allow them to.

When I decided I had “enough” three years ago, I didn’t stop working. I just shifted my perspective to find peace of mind in knowing that I would always have the work ethic and the ability to make money. Practically over night, I suddenly saw money as abundant (certainly the US) and something easy to attain, and not something worth worrying about.

Essentially, I had spent my life up to that point knowing that money couldn’t buy happiness, but assuming it could buy peace of mind. What I learned was that peace of mind was already within me, and that no amount of money in the bank would ever provide me with what I already possessed but simply couldn’t see.

Sorry for the lengthy comment. Just thought it’d be worth it if it could help anyone dealing with a similar struggle.

Wonderful respective!

One of the problems I discovered once I adopted the money is abundance mindset, is that there were so many more opportunities I had more TEMPTATION to try and earn more money. So many low-hanging fruits. You ever feel this way?

Can you share exactly how you found contentment or share some tips on how you found contentment? I found that getting out of a wealthy neighborhood to a more middle-class neighborhood helped. Also, ignoring group chats with people very focused on money has helped.

I want to go to Hawaii partially b/c I want to be surrounded by less intense folks.

Thanks, Sam. I completely understand the temptation for more money when you have a mindset of abundance. One of the greatest challenges I had in my own journey was learning to turn down opportunities to make more money. One day I would be fine with where I was at, and then an opportunity to make X amount of dollars in a single day would present itself.

My mind would immediately think, “well, it’s just 8 hours of work, and that would cover six months of mortgage payments. Or healthcare for my wife and two kids for a year. And with market gains factored in, turning down X dollars now really means turning down Z dollars in the long run. That could mean reaching my financial goals X months sooner. There’s no way I should turn it down. Most people would kill for this opportunity. Make hay while the sun shines, right?”

You get the idea. I’ve always sensed we’re alike in many ways. We surround ourselves with that line of thought. It becomes part of our identity. We rationalize the decision over and over. And then we go and make more money, because we can.

But at some point, I realized that there would never be a number in my bank account where I didn’t play the same game with myself. I may SAY that once I have X dollars, I won’t think that way. But then X dollars comes along and—no surprise—same game. I’d just manage to rationalize it in a different way.

So where do you draw the line? When is enough truly enough? Everyone has a different answer. You’ve offered incredible wisdom over the years and provided so much food for thought on this question. I’ve always valued and appreciated your perspective. But three years ago, it simply occurred to me that I already had enough, even if it fell well short of an amount that would account for certain variables.

With the abundance mindset, I genuinely felt that I could make millions of dollars each year (side note: I don’t have millions of dollars). And I still feel that way. Not at all in an arrogant way, but rather simply knowing that money is limitless, that it’s not a zero-sum game, and that there would always be plenty if I ever wanted or needed it.

That mindset change allowed me to feel wealthy in an entirely new way. Yes, I could make a fortune. But did I want to spend the time away from my kids in order to do so? Even if it was just 8 hours setting up a new passive income source? 80 hours? 800 hours? At the end of the day (or end of your life), how much money is that time truly worth?

Everyone has to answer that for themselves. I don’t think there’s a wrong answer. I just knew I had found mine.

Nowadays, we still make more than enough money. 2020 was our biggest year yet, despite the pandemic bringing our primary source of income to a halt. And yet it was also the year I worked the least and worried about finances the least. Funny how life works. I remember watching a Jon Jandai TED talk, and his message was that “life was easy, so why do we make it so hard?”

That message resonated with me.

So, I suppose to answer the question of how I found contentment, the best answer would be that I had it all along. Watch your kids as proof—they already have it. The problem was that I spent the decades that followed making life complicated. Telling myself that I needed more. Rationalizing it with projections. Defending it with variables. Surrounding myself with people and environments that reinforced my thinking. An endless game of chasing the dangling carrot of contentment, when all I actually had to do was stop, reach out, and grab it.

From my extremely-limited perspective, your trip to Taiwan seemed like a taste of genuine contentment. I’d make a conscious effort to remind yourself of that feeling and that time, and what mattered versus what didn’t. I realize you make a substantial income from writing about personal finance, and it’s therefore more challenging to separate yourself from the environment. But the past few years, your writing has included more and more posts like this one. So it seems like we’re on a similar path. I look forward to seeing what the future holds in store for you and your family.

“ Nowadays, we still make more than enough money. ”

Does this mean you left your job three years ago and let go of trading time for money and live off investment income now?

Every time I’ve traveled abroad, I’ve enjoyed being an observer and taking in everything. It’s really such a great outlet for perspective.

I left my primary job three years ago, which was the only consistent W2 income for our family. We still have a business, but it’s growing more passive in its income and we only take clients and projects that we would otherwise take on for free, simply because we love it (photography).

Great perspective Mike. I grew up with a dad that chased that dangling carrot and we never saw much of him growing up because he was working 7 days a week. literally. Of course I benefited financially from his hard work.

I fear I am having those same conversations in my head even if I will never be as hard of a worker as my dad.

You write that “Surrounding myself with people and environments that reinforced my thinking…” My question is: did you shed some of these people or move out of these environments? Or was it purely a change in perspective?

While my friends are all great, super secure and not status seekers or competitive, they (and their lifestyles) do create a reference point or personal expectations on what’s normal.

One of the most dramatic changes we made was moving from a large city to a small mountain town where we’re now surrounded by friends who gauge their success by how much time they’ve spent outside.

Some friends make $15 an hour working as raft or snowmobile guides. Other friends make six figures working from home. But you’d never be able to tell them apart, because their simple lifestyles and limited possessions are identical. Many of them remind me of the fisherman in the Mexican fisherman parable. It’s certainly been inspiring to me.

I think it’s always possible to change your perspective. But I also think that the more you’re able to change your immediate surroundings (whether it’s where you live, who you spend time with, what you do for fun and leisure), the less hard you’ll need to work to change your perspective, because your perspective will begin shifting naturally.

I know Sam mentioned the idea of moving to Hawaii for similar reasons.

I think we’ll always have certain people in our lives that don’t exactly fall in line with that new shift, and I don’t think it’s necessary to shed them all. They have their own virtues and lessons to teach. I just think it’s important to bring some new friends / perspectives into your life as well.

Makes sense, Mike. Thanks for offering your insight.

In fact, I’m actively trying to figure out where to move to for a reboot geo-arbitrage opportunity…between my spouse and myself we have residency options in US, UK, EU and Hong Kong. Love the outdoors, ski, hike, beach…need them all. It’s hard to figure out where if it’s not based on an existing connection or community or due to a job.

I’m guessing most people probably start off with having a second home, and then eventually transitioning there full time. Sam has family in Hawaii so that totally makes sense. How did you decide on your current town? Did you just take a leap of faith and assumed you’d find your circle there?

I’ve been coming to this high mountain valley since I was born, and ultimately my wife and I decided that out of anywhere in the world, this is where we wanted to be. We didn’t know anyone here but have made great friends since then. Plus it’s only 2.5 hours from family and the closest city, so we can see family a few times each month.

I know it can be hard to narrow down the best place. I see life as being made of chapters, so we moved here knowing this would just be another chapter in our story. We have no intention of leaving at this point, but we’ll see what the future holds. Kauai has always been special to us as well……

My wife has taught me a lot. She is one of the happiest people I know and we met in college and have been married almost 50 years WOW. She is no more happy now when we were worth $3000 verses being millionaires now. She believes happiness is something you have work at and your goal has to happiness. She taught me a lesson when I was complaining about not making money in the stock market at one point. We were driving home and she says do you see that guy on the the corner begging for money. Do you think he made any money in the stock market today. Good lesson.

Good perspective. Given wealth doesn’t make a difference to her, did she leave her job early or encourage you to leave your job early as well?

I’m always looking to get to know the stories of more people who left well-paying jobs early because they didn’t feel money made a difference to their happiness anymore.

First time we (my wife and I )felt financially rich was when we left University for our first jobs

We were so well off that when I was not paid for 6 months!-we lived off her salary-my job gave me a house and car-good times especially when my pay finally arrived.

Next years were child oriented-satisfaction of a different sort-continuous low level pleasure punctuated by many high levels as they hit their targets

Now 75 retired-more money than we need-feel financially rich but the yearly photograph at Christmas of Granny and Grandpa plus 3 kids with their wives and husbands and their eight grandkids is the the outright winner in the feel “rich” stakes

xxd09

Yes! Those Christmas holiday cards are wonderful. We laminate them all to preserve them for as long as possible.

So many relatable points in this post. I have too many to count, so I’ll just pick the first one on traveling to a lower cost country. I have very vivid memories of visiting the Yucatan. I was really moved by what I saw and how humbly the Mayans lived in these small villages. I went on a tour with a really small group and our guide drove us to remote places that only a local would know about.

Seeing how little the families and children had was really eye opening. And yet, even with so little, the children and adults were all so happy, welcoming, gratious, and friendly. Their world was so incredibly different from anything I’d ever seen in person, and it really left a lasting impression on me. Naturally, it also made me feel very rich and fortunate to have so much excess and so many resources in comparison.

I remember when I had a layover at Taiwan. Their high quality airport food prices were like $8 USD equivalent… At an airport?! What is this madness?! I was used to paying $20 for a meal in an American airport and that’s when I started to feel rich.

Geographic arbitrage is a real thing.

When I feel the richest it never has anything to do with my finances. It’s usually when I recover money on behalf of one of my low income clients and I know it will have a profound impact on their lives even if they may not realize it. I feel Even richer when the client does realize it and truly appreciates the efforts I made. I think lots of my peers need to reprioritize their lives and what’s important.

The following recent accomplishments made me feel richer than I ever have:

1. I was able to withdraw $400,000 from our savings last year and pay off 2 mortgages. One on our vacation home worth $750,000 and the other a commercial real estate building worth 1.5M. This saved us roughly 20k a year in mortgage interest.

2. We paid off our primary home mortgage a couple years ago with a market value of 850k.

3. Have about 20k a month in passive income.

4. Lastly, having almost 3M in a 403(b)

Crazy on some levels I don’t really feel rich. I still shop at Marshall’s, TJMaxx and Costco & drive a 2017 vehicle. We only eat out once a week and I’m not sure my spouse and I would have enough income to maintain our lifestyle if we were to retire right now. Although, we would probably be okay, we would be giving up over 300k in work income.

I worry about losing passive commercial real estate income due to COVID related business closures in our area. My spouse has serious health issues and long term care can be very costly.

Right now, we’ll just keep riding the wave and see where it takes us.

I think commercial real estate will make a strong comeback. The real estate will just get repurposed differently. Keep the faith!

And, my wife’s favorite store is still Target :)

This article really hit home hard today. Wife and I decided to come into our office at 1pm on Saturday because we both have work to do. I read this as I ate my lunch. I’ve been a longer time reader 10 plus years now, rare commenter. I think I found your site when I was in grad school in 2010 or so.

I’ve always enjoyed your out look on everything. It was an insightful way to look at the world. Meet my wife about 5 years ago, she had a good career in health care administration, actually just completed her masters a few months ago. Either way prior to 2019, I had amassed about 1MM nest egg between various real estate interments and huge retirement accounts, which I thought was good having never had more than a low six figure income some years and being 31. My undergrad is in finance and a masters in accounting. In 2019, I decided to focus all my attention on my construction company and treat it like a full time job verse juggling between various other ideas/ventures. 2019 was the first year we earned 7 figures and 2020 was unreal and in 2021 my company will produce 30-40mm in revenue.

The last few months has been surreal to us. The asset base it has enabled us to build has set us for the rest of our lives which is great. But on the other side it stresses me to the extreme and honestly my wife is afraid of my health sometimes. I wonder sometimes if it is all worth it. I think if I can hold it together for a few more years, we can retire and live very comfortable lives in our Midwest city or honestly probably pretty much anywhere we want to move. We could retire now but would need to scale back our lifestyle slightly, we have developed a couple of expensive tastes, our 50k food budget makes me sick. I’m continuing the down the path our building my company having a blast while doing it but I know a time will come where I look back and wonder if its all worth it and if I am truly rich.

Amazing! What business are you guys in to see such a massive surge in revenue this year?

Perhaps you will agree that having at least $10 million is the ideal amount for retirement then!

$10m in rentals here in the carolinas, levered 70-75% with fixed rate mortgages, managing yourself, would generate ~$750k-1MM/yr in cash income, plus pay down $650k/yr in principal, plus appreciation. In theory at least – Can only get 10 mortgages with Fannie/Freddie, but can use credit unions plus portfolio loans at a slightly higher rate. I’m getting 15-20% cash yields on properties I bought last year and 10-12% on the ones I bought this year (plus principal paydown/appreciation). Can always pay down the mortgage of the lowest balance to free up another mortgage slot. I still have a ways to go before capping out on the 16 mortgages I think I can do.

One time I feel rich is when I go to the store and buy something. Then I go home and my wife asks me how much it was. My reply is “I don’t know, I didn’t look” Not having to worry about what I buy at the grocery store is an amazing feeling.

I really liked “ If both of your parents live to hold their grandchildren.” My mother (52 y/o) died this year and never got to meet her grandkids born within the year of her passing. I never realized how important & special making that milestone would be – and how much more enriched peoples’ lives are to have that.

I do feel blessed in other ways though! Was definitely one of those mediocre-students in college who is really making it out on top now.

Great article Sam!

I would say I first felt “rich” at the end of this year for the following three reasons:

1) Our household net worth hit $3.95M, at ages 50 (Me) and 45 (Spousal Unit).

2) 2020 net worth grew by $765K this year, compared to W2 income of $460K

3) LWR (Lifetime Wealth Ratio) hit 82.5%, and continues to grow.

My wife and I have a buy and hold strategy, live within our means, but still enjoy everything life has to offer.

Happy New Year!

SM, CPA

The point of reaching financial independence is not to acquire a lot of money. It’s to acquire as much time as you possibly can so you can enjoy life and do things you want to do. I would much rather be a time billionaire with a medium amount of money than a money billionaire with a medium amount of time. The potential is endless what you can do with your time.

Would someone review my asset allocation. Background 26 years old turning 27 in a couple months. Household family income $170,000 (Wife and my combined income).

Cash – $62,000

Taxable stock account – $5,000

401k, IRA – $101,000

Real Estate (Primary residence and 4 rental properties) – $2,000,000.

Real Estate debt – $1,200,000.

Is it okay to keep buying investment real estate or do I need to allocate more capital to stocks? I buy about $30,000 of stocks each year. I’m always a tad worried about liquidity with such a large amount of real estate debt; however, the tenants pay the mortgages and it produces a small amount of cash flow. What are your thoughts?????

You’re 27 with those assets…you are doing very well. My thoughts are you keep doing what you’re doing mate

Having 7X your income in debt is a lot. I’d get that ratio down to 5X by boosting income to $240,000 or paying down debt to $800,000.

And let us know how you were able to put down $400,000 in various properties by 26!

I’ve always believed there’s more money out there than people know. And yours is another example of this belief. Cheers

I am 70. I live in the least expensive home I have owned. I own the least expensive car I have ever owned.

Many days I make $40,000.00 in the market. This is great fun. I have learned I don’t need to spend money to be happy.

I am sure I am older than most of your readers. I can tell you having money is great fun. My sister cried with joy when she saw my check in her Christmas card. I can also tell you money is a poor substitute for youth. Go have fun. Buy presents for your family. Give your family wonderful memories. When you are 70, you will be grateful you did these things.

I use the money I make for my grandchildren. Yes, making $40,000.00 a day is fun. But what is more fun is spending it on family and making their lives easier.

If you want money for an expensive house and car, you are missing the boat.

Have fun and when you can afford it invest the rest in other people..

Great! Keep on giving! Your previous comments indicate a downward trajectory in happiness. Hope you’ve recovered and can continue to spread the wealth.

Sam, did your gray hairs turn back black?

In 2017, I was working in a stressful job and grew a few white hairs at age 28. However, after quitting, those same white hairs turned back black. The roots started to grow black while the bottom parts were white.

Fast forward 2020, work + Covid + life stresses gave me a few more white hairs. Hoping these white hairs will turn back black again.

They haven’t come back still! So perhaps I’m not as stressed as I think I am. Or maybe grey hairs isn’t a good measure of stress :)

But I clearly remember sprouting some grey hairs at 33 and now nothing at 43. It’ll be interesting to see how long it lasts!

First, to anyone who says being rich isn’t about having a lot of money – sorry but yes that’s exactly what it means. Only a rich person would try to convince the rest of us that having a lot of money is actually not that big of a deal. It IS a big deal and having a lot of money is better than not having a lot – otherwise the rich would be giving it away and they aren’t! Take it from someone who grew up in the lower middle class and worked his ass off to create a portfolio in the low 7 figure range.

As far as financial events that caused me to pinch myself to make sure it was really happening, here’s my list:

1. Paying off my mortgage on a (now valued at) 7 figure house

2. Paying for my kids’ college out of pocket

3. Giving multiple financial gifts to family members

4. Paying cash for most large purchases car, taxes, hvac, etc

5. Walking thru Costco and knowing I could buy anything I wanted but realizing I have everything I need and therefore buying nothing

6. Continuing to work because I like it not because I need the money

7. Knowing that my financial needs will be met for the rest of my life and my kids will also share in the wealth they helped inspire

8. Mentoring up and coming kids in the same way I was mentored by a friend who is now 97 years old and worth 50 million give or take

I do feel an obligation to encourage others who seek wealth because I feel so blessed at my good fortune. Capitalism and wealth accumulation now gets short shrift in our MSM, but the truth is there has never been more opportunities to work hard and gain wealth. Ok time to jump off the soapbox.

Here’s to a Happy and very prosperous New Year to all!

I liked your line about Costco. I go to car dealerships and walk the lot. I look at the sticker on a side window and realize I can pay cash for any car on the lot. I never buy one. I just like to know I can. Because I need a car, I own a 2017 Honda Civic. When I bought it, I asked the salesman which car was the cheapest on the lot.

It’s strange. Now that I can pay cash for what I want, there is little I want. Go figure.

I really like #6. I truly think that’s financial freedom.

First, off congrats on the great content, as always! This post, combined with the $3M as the new millionaire, are inter-related and very relevant to wealth discussions.

Agree with all points in both posts, but I’m wondering if your perspective is any different for those who start off on 3rd base? Many FI blogs, and the commenters, start with the presumption of striving, acquiring and then understanding what it means to be wealthy.

But what if you started out privileged, grew up in a wealthy, cosmopolitan international city, and many of your friends are high-achievers and/or come from wealth (parents have 8 figure+ net worth)? Many don’t want to downshift or unlearn their tastes or experiences – some would call it “downward social mobility.” How do you apply and internalize all the points when you are at least defined or inspired by your successful/lucky peers? Just as it isn’t practical for everyone to move from US to a Latin-American country to feel wealthier, nor even CA/NY to a heartland state, it’s never fun to exile yourself out of your group. How do you continue living in a world surrounded with style (periodic art, interior design, fashion purchases not for status but because it gives added color to life) and live a grounded, financially literate/responsible life, without having to marry well or enslave yourself to high-paying careers? Inter-generational wealth easily diminishes in one generation.

I know there’s not a lot of sympathy as these are first world problems, and everyone should be fortunate for their health, family and friends which I remind myself every day. I do find it interesting that no one in this set ever openly talks about money and how people manage, which is why I really enjoy your blog posts and learn a lot from you and your commenters. Hopefully there won’t be too much opprobrium.

Key is to stay humble and not take good fortune for granted. Share your knowledge and money so that others can benefit too. I enjoy writing here priceless because it’s free and can help others build confidence and wealth.

Giving is a great gift! And if you’d like to share your thoughts in a guest post to help others, I welcome it. One of my goals is to encourage more readers to take action, instead of wonder what action others should take. Let’s do it!

I felt rich when I rented out my personal paid off residence. I had quit my full time job 5 years previously to do consulting part time. I was moving to a cheaper area, and my partner and I had bought land and were going to build our own house.

The monthly rent was exactly half of my take home pay from my full time job. I didn’t need it because my consulting paid my living expenses It made me feel rich!

I noticed I started to tip more generously. Especially in tip jars at counters where I previously didn’t think tips were “necessary”.

My first taste of passive income!

Now 15 years later, I have replaced my needed income completely with 2 more rentals and a couple mortgage notes.

So yes I feel rich in both time and $!

I would say getting a full free 4 year ride at one of the top most expensive colleges in the world, making passive income as a student and surviving another 2nd semester of Zoom University:)

I started to feel rich once I used all six weeks of vacation a year to visit places around the world. That feeling increased a lot more as I gained even more freedom in my life and was able to set my own work hours. I don’t call myself rich but I definitely feel very fortunate and have more than enough money to live a comfortable life with my family. I also try not to think with an I’m rich mentality because that can lead to dangerous habits and taking things for granted

I feel incredibly rich when I can hold my kids tight and play with them without any distractions. It’s all these distractions about work, news, and stuff that tends to increase my blood pressure!

I started to feel rich when I started paying less attention to what people had around me and reading statistics on world income levels and net worth. To be in the top 1% of median household income in the world you only need to make $35,000 a year. Now I realize that $35,000 a year is not going to provide a luxurious lifestyle but it does give perspective on the 99% that are living off this amount or less in the world and how good we truly have it here in America. Many of us here make 10 times this median income a year and have multi million dollar net worths. We all should feel very rich !!

This statistic can’t be right. Median household income in the US is $68,703 and the US has about 4% of the world’s people and a greater % of households. So, right there 3-4% of the world’s households are above $35k. Add in the relevant proportions in Europe, Japan, Canada, Australia etc and the upper middle classes of developing countries…. And that’s before we take into account that the purchasing power of a US dollar is higher in most developing countries… This article says that you are in the top 20% globally with $35k:

washingtonpost.com/graphics/2018/business/global-income-calculator/

Average and median are different statistics

Technically, median is a type of average used to basically remove the left and right tails

I think passive income to cover your lifestyle is the true definition of rich to me. The day you are free to not have to work to cover your bills, but to only work for pleasure.

To step outside on your property and feel a great sense of peace. Also to be rich in experiences of travel, family, and friends.

It’s a long road there, but it is possible!

I believe we all have “a comfort group”–a socioeconomic group of people where we feel the most comfortable and can easily be ourselves. I don’t think you can easily switch groups and be content.

Mine? Middle to upper middle class — those with savings, modest cars, updated clean houses, who are family oriented and serve community actively. I was previously married to a local real estate tycoon. We hobnobbed with the local rich constantly, and I always felt uneasy. I was raised by a father who escaped Europe with his mother at the age of 9, so any display of extreme wealth seems absurd and self-indulgent. The obvious rich just seem insecure to me.

We were approaching financial independence but we didn’t really feel financially rich.

Part of it was because we were still working our day jobs for another 6 to 12 months.

Part of it was because all the money in the 401ks and IRAs was just numbers on a statement we saw once a year. It didn’t seem like “real money”.

We realized we were rich when we decided to buy a cool old house for $100,000 and pump up to another $150,000 into it to fix it up — just because we liked the house and it would be fun.

Our plan was to sell it once it was restored and on the historical registry, but if we didn’t make that $250,000 back it wouldn’t really hurt us financially all that much.

That’s when it registered that we really were rich.

(Of course, we not only plan to make that money back, we’re actively working to make money on the deal. We may be rich and nice enough to save a house that people in our community like, but we’re not crazy!)

Being rich =freedom

A Taxi driver takes off whenever he wants and visits his family in his country of origin for about 3 months every year. =pretty rich.

A hot shot lawyer works crazy hours, wont get more than 2 weeks off a year and that too when the companies allows, and days off are a no no. He does make a handsome chunk of money= Corporate slave.

I feel rich whenever I look up statistics on the median income and net worth of all persons living in the United States. Living in the SF bay area and working in a field that constantly exposes me to very high net worth individuals causes me to forget that I am better off than 98 percent of the population.

Great post! To me, feeling rich is not about having or making money, but feeling secure. The interesting point is making more money probably helps you feel secure, but it doesn’t have to. Rich is a mindset, not a quantitative checklist.

I feel rich when I can decide to buy something without worrying if I’ll have enough money for it or not. I think that’s really a direct result of budgeting and not only the amount of money one has.

I also felt rich a while ago when I was having some car trouble and talking about what to do with my wife in front of some other folks. We discussed the whole thing calmly and decided to take the car to the shop and rent a car for a few days. At the end of the 5-minute conversation I had already reserved a rental car over the phone. The onlookers had been watching in amazement the whole time and literally laughed out loud at the end of the phone call. I found out they were amazed because a broken down car would have upset them and because renting a car out of the blue would have been a strain on their finances. Not for us though. Good times.

I agree with this. To an extent, if you don’t worry about money, you’re rich.

It kind of reminds me of a little anecdote that I read in The Snowball: Warren Buffet and the Business of Life. Warren would always frame his money in terms of what it *would* be worth twenty years down the line (or so).

Instead of telling his wife, “I don’t want to spend $45 on a new dress for you,” he’d say, “I don’t want to spend $10k on a new dress for you” (guesstimating, but you get the point).

One time, when they were having one of these arguments and his net worth was in the hundred millions, she said, “If you were REALLY rich, you would go and buy that car right now.” I’m inclined to agree with her, and I don’t think we should praise people who are overly cheap. That’s not to say he should’ve bought the car, but the essence of the message is the same. People who obsess over money all the time, to the point that they don’t make purchases that they COULD make — they’re not rich. Warren Buffett is one of the richest men in the world, but he STILL has money problems. He STILL loses money, sometimes hundreds of millions, and it affects his daily life in the same way that it affects the daily lives of the wealthy: not at all.

And I would say, “If you were REALLY rich, you WOULDN’T buy that car right now.”

Having an extra $$ foundation gives you the freedom to make choices that others might not…and not caring whether they thought it was weird or not.