Are you wondering how real estate performs when stocks sell off? This article is a deep-dive look at how real estate gets impacted when there is turmoil in the stock market like we saw most recently in March 2020.

The post was originally published in March 2020 and has since been updated to reflect the real estate and stock markets today. But once again, the stock market is selling off in 2022 and more people are wondering how real estate will get impacted.

Given real estate is a hard asset that provides utility and produces income, real estate generally outperforms during times of uncertainty.

How Real Estate Gets Impacted By A Decline In Stock Prices

When the S&P 500 initially corrected by 10% in 2020, I immediately thought to myself: thank goodness for bonds, cash, and real estate! I had bought a slightly larger home last year with stock proceeds and existing cash.

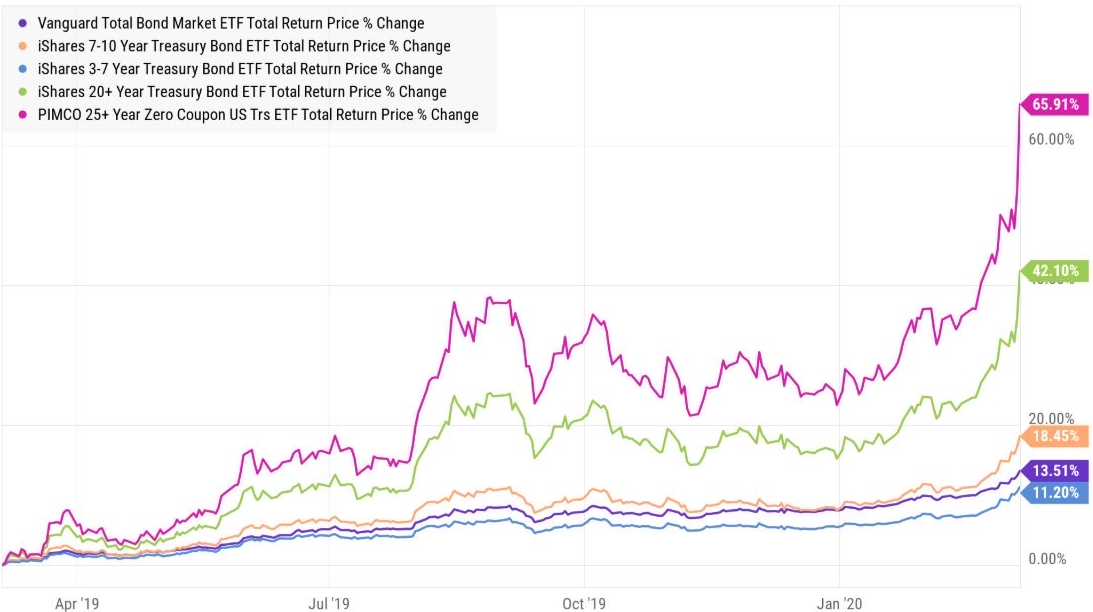

Bonds were looking fantastic as investors piled into safe havens. At one point, some bond ETFs looked like the famed parabolic internet stocks of 2000. Given real estate is considered a close cousin of bonds, real estate prices were surely rising as well.

However, at some point, investors will stop buying real estate and even bonds out of fear that an economic collapse will take down even the most defensive of assets.

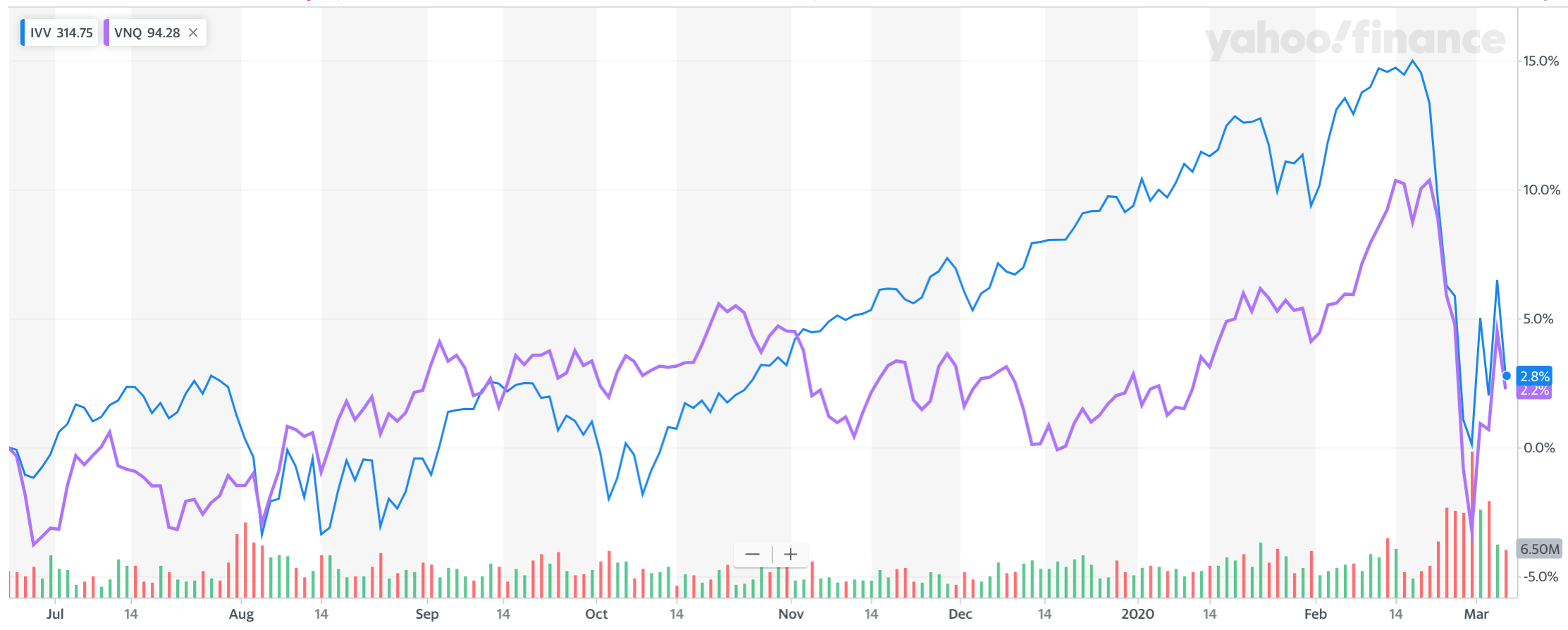

One of those points came on Thursday, March 12 when the S&P 500 declined by 10%, the Vanguard Real Estate ETF VNQ declined by ~10%, municipal bond funds declined by 4 – 6% and even Treasury bonds declined by 1 – 3%. March 12 was a day that wasn't supposed to happen, but it did.

Let's have a discussion on how low stocks have to go before they start negatively impacting real estate prices. We'll talk intuitively about the level of price declines and duration. I'll also highlight historical price comparisons between the two.

How Low Will Stocks Have To Go Before Investors Stop Buying Real Estate?

COVID-19 is the latest reminder of how quickly stocks can lose value. Sure, stocks are a 100% passive investment that have historically generated 8% – 10% returns a year.

However, the downside to stocks being 100% passive is that you have no control. You are at the mercy of management's decisions and random exogenous variables.

A stock's rapid loss in value is one reason why I prefer real estate over stocks. Real estate is less volatile, provides shelter, and generates income. However, not all real estate is created equal.

Let's go through a thought exercise about real estate investing when the S&P 500 drops 10% – 15%, 15% – 20%, and greater than 20%. These percentage points will show how real estate gets impacted when stocks fall.

How Real Estate Gets Impacted When The S&P 500 Drops 10 – 15%

When the S&P 500 corrects by 10 – 15% money tends to surge into real estate. Unlike stocks, real estate prices change much more slowly. When the S&P 500 corrects by 10 – 15%, mortgage rates tend to fall, thereby making real estate more affordable. As real state becomes more affordable, demand for real estate goes up.

Real estate not only holds its value, but it will likely see an acceleration in price appreciation when the S&P 500 corrects by 10 – 15%. Again, look at the bond performance chart above and think about it as a proxy for real estate price performance, depending on what type of real estate you own.

My belief is that your primary residence will increase by 1-2 percentage points above its normal rate of appreciation when the S&P 500 corrects by about 10% – 15%.

For example, if your city's property market was expected to increase by 4% one year, during a 10% – 15% stock market correction, we could instead see prices increase by 5% – 6% as money rotates out of stocks and into real estate and other defensive assets.

See: Real Estate Outperformance Examples During COVID-19

Bonds And Cash

As for bonds and cash, the purpose of investing in bonds and cash is not to make lots of money, it's to SAVE YOURSELF from losing a lot of money. An online cash savings account might only generate a <1% guaranteed interest rate, but it will save you from experiencing double-digit percentage paper losses.

Bonds are usually strong in a 10% – 15% correction. Not only do they provide a greater yield than your average online savings account, but the value of the bonds also tend to go up as well. However, in 2022, bonds have experienced one of the worst drawdowns in history given elevated inflation and the Fed wanting to hike rates aggressively.

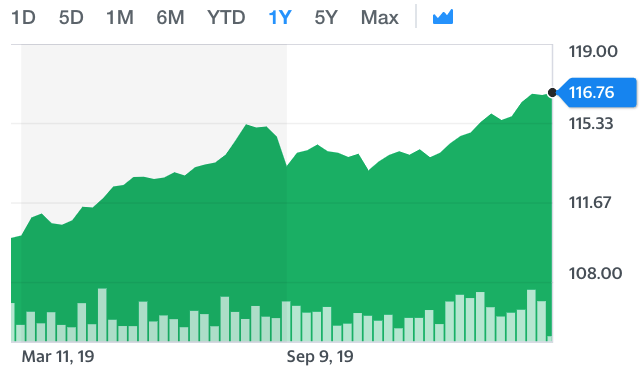

Below is the chart of MUB, the iShares National Muni Bond ETF. MUB went up about 1.8% when the S&P 500 lost 12% that week in 2020. Usually, bonds do well. But with bonds depressed now, they look attractive. Further, you can buy I Bonds for a 9%+ guaranteed return nowadays.

How Real Estate Gets Impacted When The S&P 500 Drops By 15% – 20% (Sweet Spot)

Once the S&P 500 is firmly between a correction (-10%) and a bear market (-20%), real estate investors begin to hesitate a little. The longer the S&P 500 is down between 15% – 20%, the more hesitation there will be.

Real estate should still strongly outperform the S&P 500. However, this outperformance starts losing steam when the S&P 500 edges toward -20%. Instead of getting five offers, a home seller might only get two or three offers. The demand for real estate is still strong due to increased affordability and the literal seeking of shelter.

Most Americans who own real estate have the majority of their net worth in their primary residence. As a result, during a stock market correction, most Americans find great comfort knowing their greatest asset is not only holding up in value, but it is also providing shelter.

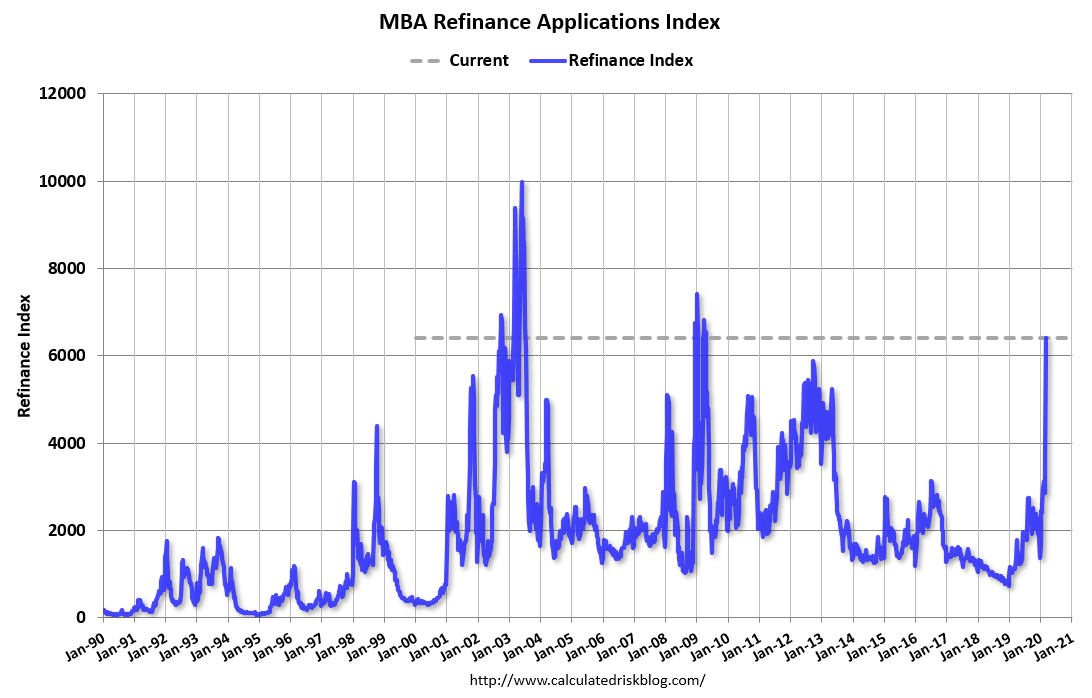

Millions of Americans are likely refinancing their mortgages during a 15% – 20% stock market decline as mortgage rates collapse the hardest. With lower living expenses and a greater appreciation of real estate, demand for real estate continues.

Everybody needs to refinance their mortgage with mortgage rates ticking higher as the Fed hikes. Check out Credible, my favorite mortgage lending place where qualified lenders compete for your business. You'll get free quotes in minutes.

When the S&P 500 is down between 15% – 20% from its highs, I'm actively looking to buy equities. I'm also looking around for real estate deals more than usual.

However, the real estate deals won't be there unless you look hard and give a lot of low-ball offers. A 15% – 20% decline is like receiving a body blow. It is not a knock out punch.

How Real Estate Gets Impacted When The S&P 500 Drops Greater Than 20%

Once the S&P 500 drops greater than 20%, however, it's natural for real estate investors to start worrying about the possibility of a recession. A recession has happened ~70% of the time the S&P 500 declines by greater than 20%.

The longer the S&P 500 is down greater than 20%, the higher the probability of an impending recession as companies start laying employees off due to slower growth and lower profits.

If there is a 25% – 30% S&P 500 decline that lasts for longer than a couple months, real estate prices will begin to drop.

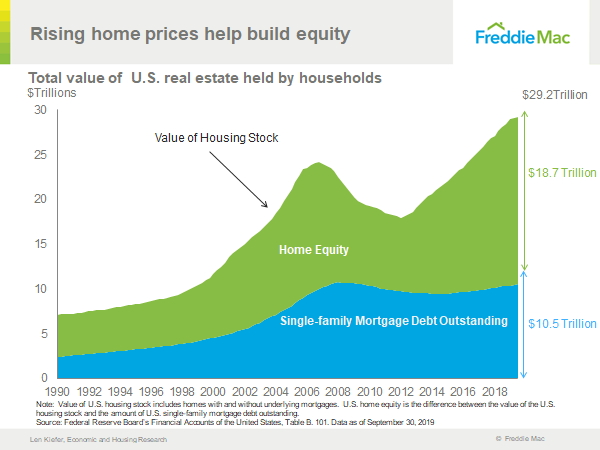

The 2008 – 2009 financial crisis was unusual in that a double-digit percentage decline in real estate prices due to overleverage caused the S&P 500 to decline and not the other way around. Today, thanks to much more stringent lending standards since the financial crisis, the credit quality of homeowners is much higher. Mortgage debt outstanding has declined while home equity has surged.

Not All Real Estate Is Created Equal

How real estate gets impacted by a decline in stocks depends on the type of property you own. Many investors like real estate due to its less volatile nature. But not all real estate is created equal.

If you want less volatility in your real estate investments, then you want to own the following real estate in this order:

- Primary residence (least volatile)

- Physical rental property

- Private real estate syndication investments and private eREITs

- Publicly-traded REITs and real estate ETFs (most volatile)

Your primary residence is your rock. The valuation is changing by the day, but you don't know what it is nor do you care as much as with other real estate investments. You're too busy enjoying your house and living your life. When it's time to sell your primary residence, that's when you'll care about price.

Your physical rental property portfolio is also a steady asset. What you care about above all else is whether your tenants will pay their rent on time. Your physical rental property portfolio is all about cash flow generation. The price of your rental properties is secondary.

Real Estate Alternatives

Private real estate syndication investments and private eREITs are also less volatile because you don't get a daily valuation update. The most you'll get is likely a quarterly update on how the project is doing. In the case of a eREIT, you should get a quarterly dividend.

The underlying value of your private real estate investments are changing every day as well, but you don't really care due to the long-term nature of many of these investments. We're talking 3 – 7-year holding periods on average.

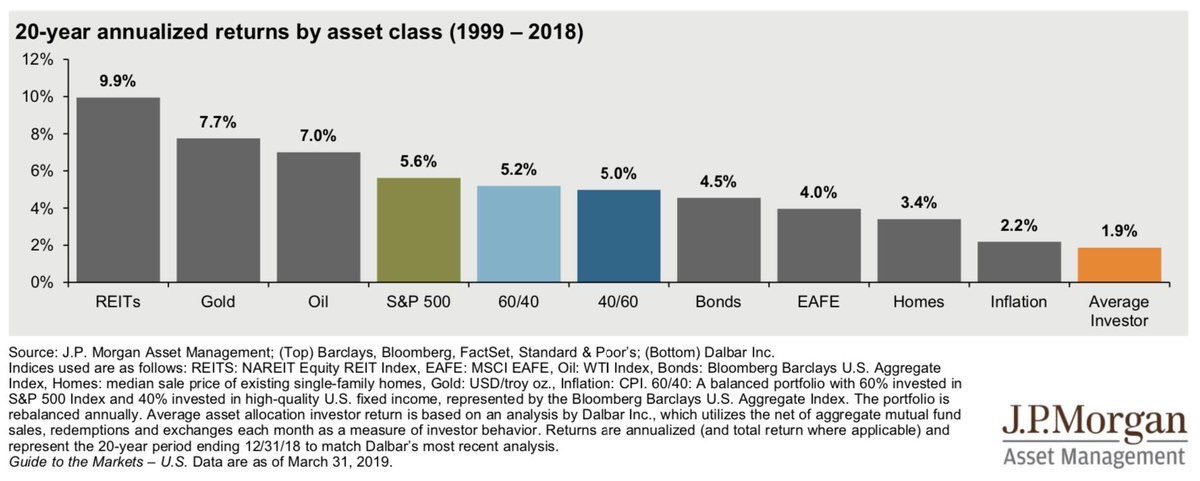

Now we come to publicly-traded REITs and ETFs like O and VNQ. They were the best performing asset class between 1999 – 2018 and again from 2001 – 2020.

However, public-traded REITs and ETFs tend to act more like stocks than like real estate. If you are an investor seeking less volatility, investing more in a publicly-traded REIT or real estate ETF is not the way to go.

Real Estate Crowdfunding Outperformance

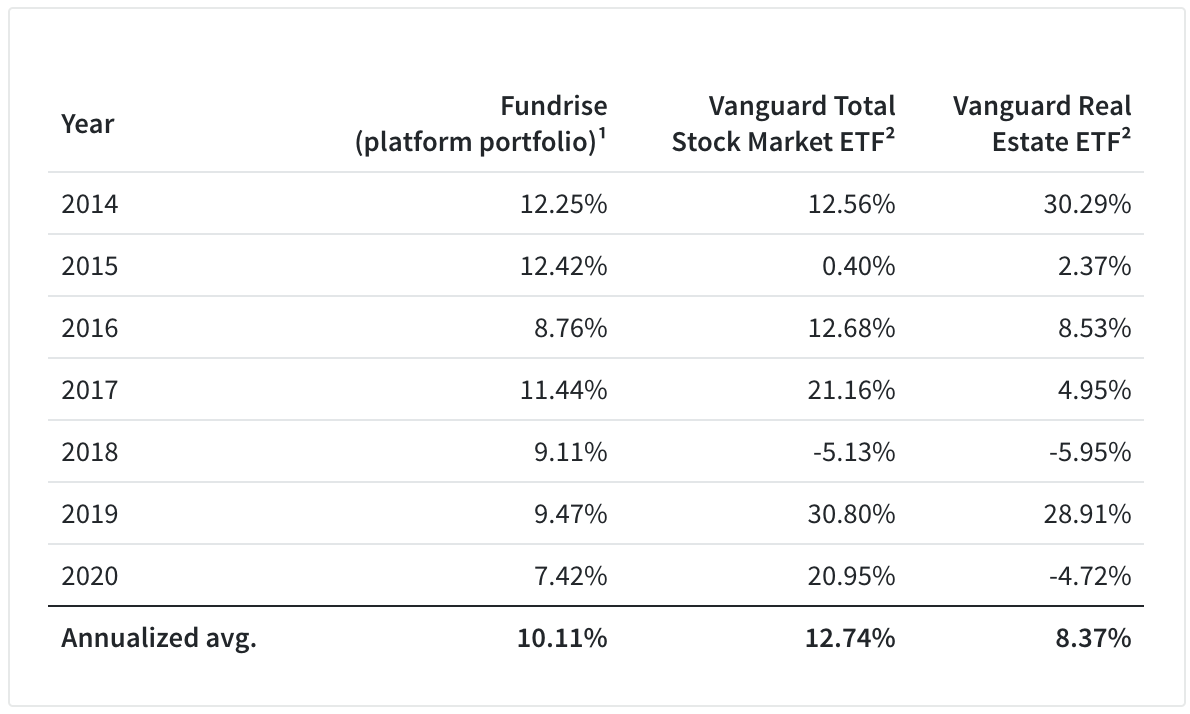

Take a look at the chart below by Fundrise, my favorite real estate crowdfunding platform for non-accredited investors. The chart compares Fundrise's platform portfolio to the Vanguard Total Stock Market ETF and to the Vanguard Real Estate ETF.

Look specifically at the year 2018 and then at 2015. It shows how real estate gets impacted by a decline in stock prices.

In 2018, when the S&P 500 closed down 5.13% the Vanguard Real Estate ETF VNQ closed down an even worse 6%. Investors treated publicly-traded REITs closer to stocks than to real estate. Whereas, the less liquid Fundrise platform portfolio was not at the mercy of market forces. Fundrise Portfolio of funds actually closed up 21% in 2021.

Now let's take a look at how VNQ performed when the S&P 500 lost 11.6% between Feb 21 – Feb 28, 2020. VNQ fell from $99.57 to $87.33, or a greater 12.3% decline.

Once again, VNQ did not provide the defense that some REIT investors had hoped. Perhaps this was a special case due to the coronavirus threatening the heart of office work versus remote work.

The S&P 500 Down ~30% Is Likely The Breaking Point For Real Estate

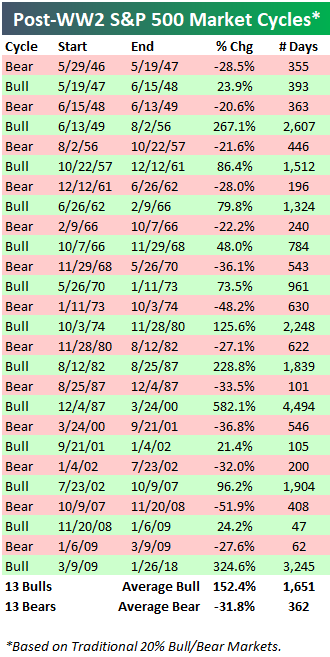

I've already lived through three bear markets: 1) the 2000 – 2001 bear market that saw a 36.8% decline over 546 days, 2) the shorter 2002 bear market which saw a 32% decline over 200 days, 3) and the devastating 2007 – 2008 bear market that saw a 51.9% decline over 408 days.

Now I'm living through my fourth bear market, which has shown to be the fastest decline in history. Over the years, I've been badgered by so many random people who say that I'm too conservative with my investments. Why be bothered with what I do with my money? Hopefully, this bear market will provide some perspective. Remember, the first rule of financial independence is to never lose money.

My expectation is that given this bear market is due to a sudden paralysis in consumer demand and a supply-side shock, when the worst of the coronavirus is over, the recovery will be closer to a V-shape rather than a fat U-shape some time in the second half.

How Real Estate Performed Back In 2000

Beginning in 2000, I remember money rotating out of tech stocks and stocks in general and into real estate. This lasted all the way until 2007. Real estate performed very well around the world, through two bear markets (-32% and -37%). At the end of 2006 real estate prices stopped appreciating.

Then around 2008, everything started collapsing, including bonds because Americans were over-leveraged. There was really nowhere to hide except for in cash and CDs.

Therefore, it seems like real estate, except for publicly-traded REITs and real estate ETFs, tends to do well or hold up so long as the S&P 500 doesn't decline by much more than 35%.

There will certainly be a fade in real estate demand as stocks decline closer and closer to minus 30 – 35%. But once that -35% threshold is breached, the majority of people tend to hold onto cash and start freaking out.

Just think about your own situation. Between a 20% – 30% decline, you're probably thinking about buying both stocks and real estate. But when the S&P 500 is off by more than 30%, you'll probably wonder whether you should start buying stocks and hoarding cash instead of buying physical real estate given it's easier to buy stocks.

You also know the average bear market has seen a ~32% decline. Therefore, if you buy stocks now, you're unlikely to see much more than 10% further downside.

Here's a great chart that shows how Real Estate is less volatile than US Stocks with a 7.41% Standard Deviation. However, US REITs have been more volatile than stocks with a 18.31% Standard Deviation. Now that 2020 is in the books, this data highlights exactly what had happened in March 2020 with US REITs.

The Fear Of More Loss Rises

When the S&P 500 is down 30% or more, you'll probably also start worrying about your job. As a result, you won't want to leverage up and buy property since each property is such a concentrated bet.

Instead, you'll probably want to hold more cash. Maybe you'll nibble at the stock market or make smaller real estate investments. This can be done through real estate crowdfunding or publicly-traded REITs and real estate ETFs.

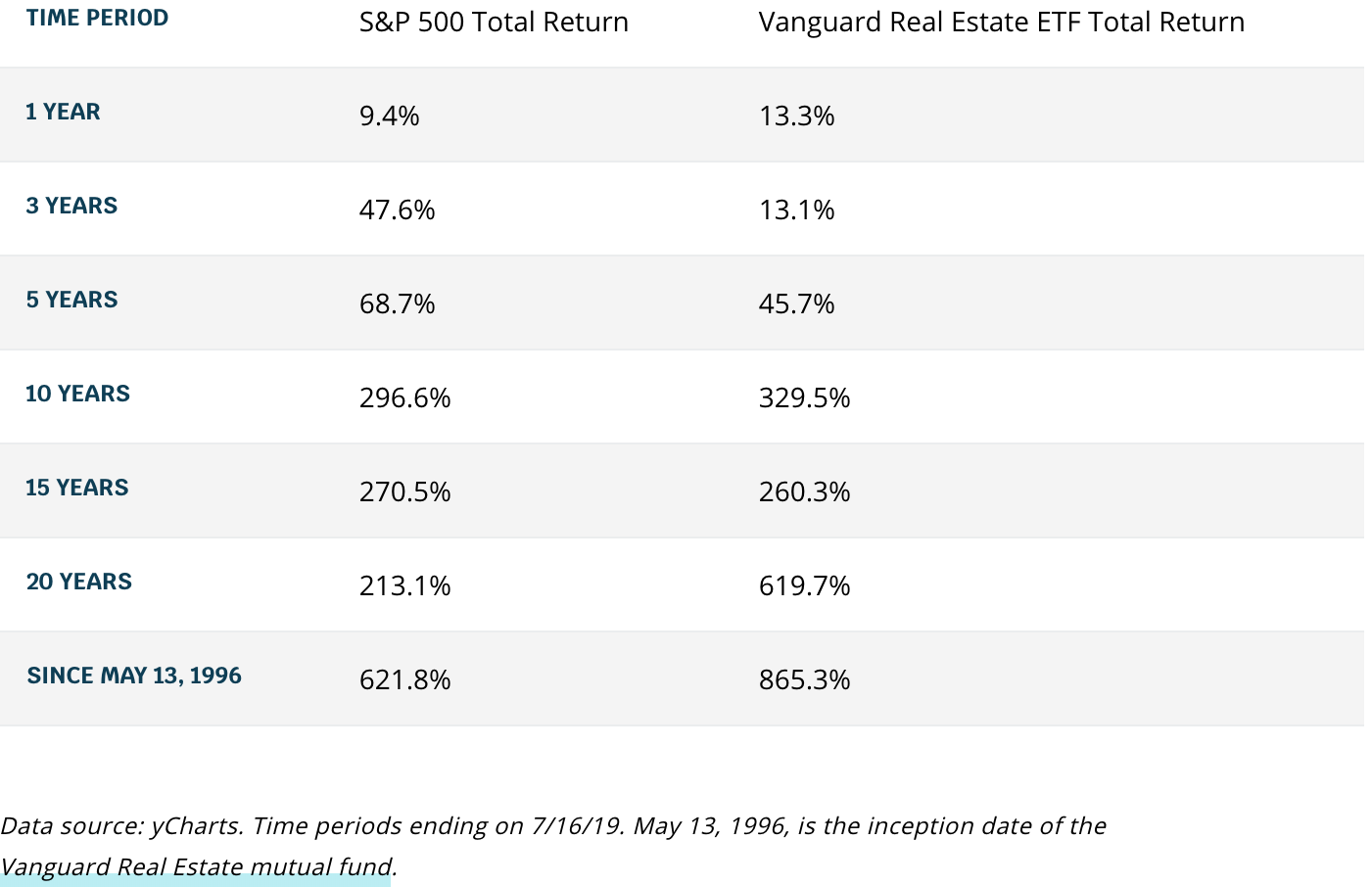

For more perspective on stocks versus real estate, below is a chart that shows the total returns between the S&P 500 and the Vanguard Real Estate ETF since 1996.

We see that after about the 10 year mark, real estate began to outperform significantly. Therefore, during a downturn, the Vanguard real estate ETF may “mean-revert” by declining more than the S&P 500.

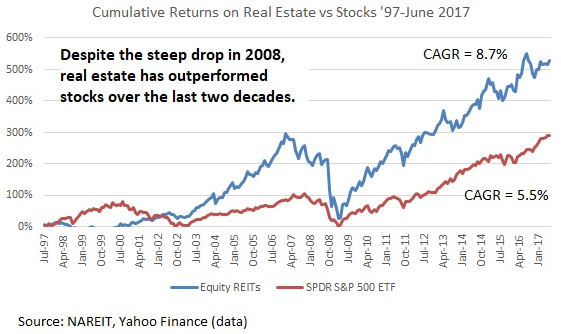

Below is a graphical representation that shows how well real estate has performed compared to stocks between 1997 – 2017. In 2008, it was real estate's implosion that pushed equities to correct by 50%+ and not the other way around.

Real Estate Is A Core Investment

Public REITs and real estate ETFs are just as volatile as stocks when stocks melt down. In March 2020, a lot of publicly-traded REITs sold off even harder than the S&P 500.

Therefore, if you hate volatility, consider owning physical rental property, private eREITs or individual private real estate investments. In order to truly be long real estate, you have to own real estate beyond your primary residence.

For my rental properties, the rent checks kept coming in during the 2008-2009 financial crisis. Occupancy was full and rent prices were stable for two years before they were increased to keep up with inflation. I expect the same to happen again this time around.

When the stock market is imploding, real estate becomes an attractive asset class up to a certain point. That point is up to around a 35% decline in the S&P 500. After a 35% decline in the S&P 500, expect real estate prices of all types to start declining as potential buyers fear an upcoming recession.

If you do plan to take advantage of a decline in real estate prices, as I always try to do, please don't over-leverage yourself. Leverage is what destroys even the largest of fortunes. Be patient and be aggressive when looking for deals.

With the S&P 500 closing up 16% in 2020 and the NASDAQ closing up over 40%, the demand for real estate is soaring. Real estate outperformed stocks in 1H2020, but now real estate is lagging stocks. Therefore, I expect more money to flow to real estate in 2021 and beyond.

Real Estate Recommendations

The easiest way to build real estate exposure without a lot of volatility or leverage is to buy an eREIT from Fundrise. You can invest as little as $500 in an eREIT with dozens of properties for diversity. It's free to sign up an explore. For most people, investing in a diversified eREIT is the way to go for exposure.

If you are an accredited investor, it's worth checking out CrowdStreet. CrowdStreet focuses on individual properties in 18-hour cities where valuations are cheaper and growth rates are potentially faster due to strong job growth and demographic trends. If you have a lot of capital, you can build your own select real estate fund.

I've personally invested $810,000 in real estate crowdfunding to diversify my investments and earn income 100% passively. Now that you know how real estate gets impacted when stocks sell off, you can now use real estate crowdfunding as a way to more surgically invest in real estate without the need for much leverage.

How Real Estate Gets Impacted By A Decline In Stock Prices is a Financial Samurai original post. I've been writing about real estate, stocks, and financial freedom since 2009.

With rates going up so high and property values likely poised to go down. Do you think investments such as eREITS via fundrise are likely to get negative returns/lose value over the next couple years?

Hello,

I have heard that one of the greatest factors for real estate is whether it is commercial or residential. Residential real estate can go in different directions than the stock market. However, commercial real estate is correlated to the stock market (not too strongly though). After all, if businesses are not growing, commercial real estate is not being bought nor rented by businesses. Therefore, to truly diversify I have invested in residential real estate REITs. Is that true, or is there more with commercial real estate?

Hey Sam – I am new here, and am really enjoying your very insightful articles!

Question for you, as I am formulating my strategy for passive income streams, which include real estate:

– My goal is to be able to retire in another 5 years or so, and I am currently 46.

– You had mentioned in an article entitled ‘Recommended Net Worth Allocation By Age And Work Experience‘ that if a person is near the age of 45, then the recommended asset allocation should be 40% stocks, 20% bonds, 30% real estate, and 10% other (risk free).

– I am currently at the following split: 40% stock (401k), 10% bond (401k), and 50% real estate, with the majority of that money (40%) being in one investment property that is currently cash flowing. No REITs, which I am now considering, but more on that later, and no personal investment account in stocks and bonds.

– Given current overall market conditions, I am taking a ‘wait and see’ approach, and continuing to invest via my 401k, and have actually increased my dollar cost averaged contributions recently.

– I will also be doing a cash out refinance of the investment property, as my money in one asset in a relatively flat area is not really working hard for me. I plan on using this money for other real estate transactions in high growth areas in the Southeastern part of the country.

– Just like most others, I am closely watching the real estate market, listening to the mostly crappy news, and trying to make my own conclusions. That being said, and given that we’ve never experienced anything this before, I believe that there likely be a prolonged recovery, as people have been psychologically impacted by this problem, and it will likely take some time for us to fully recover.

– Given all of this, and my goal, what would you recommend that I change in my overall portfolio? Obviously, I will not be jumping into a heavily concentrated transaction, such as buying property right now, as I am watching the market very closely prior to jumping in.

Thanks in advance for the review and comments, as you are better at this than I am!

Asim

Hi Asim,

Welcome to my site. It seems like you have an appropriate net worth mix that fits your goals.

I would not do a cash out refinance to invest in risk assets like stocks. Instead, I would just earn and save more money. Co-mingling funds and taking on more debt to invest is not something I like to do. Focus on continuing to pay down debt instead.

We’ve had an amazing run since I wrote about my stock market bottom call. I would not chase the market now. Stay conservative since you are so close to the finish line.

Remember, the #1 rule of financial independence is to never lose money. Don’t go backwards in time b/c time is way too valuable!

Thanks Sam, and agreed, I would never do a cash out refinance to dump money into the stock market, which would be a very poor decision! Instead, I am maximizing my 401k contributions, and even plan on doing catch-up contributions when I become eligible to do so at 50.

I plan on using the cash out refinance money to invest in more real estate. However, like most others, I am using the “wait and see” approach to understand where the real estate market is headed prior to jumping in. Although the picture is becoming clearer, I still plan on holding off for another couple of months prior to jumping into my second investment property, as I still consider myself relatively new in this space, despite having gone through several months of recent learning.

Thanks again!

Yeah, I’m looking for deals. I want to buy real estate from the seller equivalent of a person who sold when the down was at 19,000 or the S&P 500 at 2,250. I know they are out there and feel the world is falling apart. Just gotta look aggressively.

But inventory is way down and pent up demand is building. Not sure if we will be able to find the opportunity b/c the stock market is rebounding so fast, so confidence is coming back quick.

Agreed and great insight!

Don’t work to be rich. In 2019 I paid $300,000 in federal income tax and all the other taxes related to wages. That year I worked very hard. I never saw the $300,000. I realized if I quit work I no longer had to earn that $300,000. I no longer had to pay the other taxes. I could lose $300,000 in gross income and still have the same amount of money. I was working very hard for the federal govt. they ended up with more money than I had left after family expenses.

I decided I no longer wanted to make much money. I bought a 2017 Honda Civic and bought a house with cash. I learned how little money I needed w/o debt.

It is better to be debt free than make more money. You can’t be debt free with young children. What you can do is develop the mind set that once you can get out you do. If you have to move then move. If you have to drive a Honda then drive a Honda. You buy a house w/o rooms you will never use. You buy a bicycle, golf clubs and a fishing pole. Trust me you will be happy, healthy and learn to play. This is all you wanted as a child. We just forgot that.

Hi Asim,

I’ve been reading FS since 2013 when I first dipped my toe into early retirement. It was also at that time that I started to get serious about real estate investing–mostly in-fill apartments. I’m only a few years older than you and Sam. This site has been instrumental in discussing issues pertinent to me and other early retirees.

While I see eye to eye with Sam on many points, I hope I can offer a slightly different viewpoint. I retired in my early 40s, live in a high cost of living area, have two young kids, and worked a normal W-2 consulting job for the first 20 years of my adult life. My wealth has grown much faster as a “retiree” than when I was a W-2 employee.

On a high level, Sam has a “never lose money” approach whereas I am willing to accept volatility for long-term returns. I live a more or less middle class lifestyle despite my wealth. I am willing to adjust my retirement my lifestyle should my investments not work out (Covid-19 will be a big test), e.g., work part-time, pull my kids out of private school, reduce/eliminate leisure travel. I’d rather roll the dice on a bigger return and suffer some setbacks rather than be conservative so that I can maintain my lifestyle. In truth, I could probably retire on half of my net worth, but again I can be quite frugal, and I don’t mind “depriving” my kids if it comes to that. I grew up middle class, so I have no problem with my kids doing the same.

My net worth is 46% in stocks, 46% in real estate and 8% in cash at the moment. I own very few bonds because real estate is a proxy for bonds for me. Whenever I get the chance, I refi my apartments or home up to the maximum LTV (usually 70%). I use those proceeds to buy more more properties and sometimes stocks. My goal is to maintain a 50/50 split between the two. If it were not for lenders pulling back their lending requirements because of Covid-19, I would have at least 3 cash out refis in process right now.

If my cash outs had been successful, I would have either bought stocks or real estate as deals presented themselves. I would have invested a lot more in stocks than I did when the market was down 25% to 30% last month. But because my cash out resources have been cut off, I’m stuck.

Normally, I would use my 8% cash reserves to invest but now I have a different problem. The state of CA has issued a rent/eviction moratorium during the state of emergency plus another 6 months of moratorium after that. That means if a tenant chooses not pay rent, for any reason (documentation is not required), I cannot evict that tenant. At the end of that period, it will take another 3 to 4 months to process the eviction. I must cover all real estate expenses whether or not the tenant pays rent and I need enough reserves to cover 2 + 6 + 4 months of non-payment. Hopefully most tenants won’t game the system but some will. For those that fall behind, it will be tempting and my collection rate will be $0. Such people typically have no assets.

Where normally this would be great investing opportunity, I need to maintain cash reserves to account for the very tenant friendly laws in CA.

My biggest suggestion for you is to cash out refi when you get the chance, whether it’s your primary or a rental. Interest rates are low, asset prices may become lower, and cash is king. I would take a big cash reserve and a slightly higher mortgage any day than a low cash reserve with huge equity in real estate. Equity locked in real estate doesn’t help you achieve your long-term goals to increase wealth.

Thanks Money Ronin, and that’s exactly my thought process! Return on equity is very low, as it’s tied up mostly in one investment property. If the cash out refi is successful, and I find a few good deals out of state, my return on equity automatically goes up, along with all of the other benefits that come with rental properties.

Since I am new here, and not sure if there is another way to stay in touch, please feel free to reach out to me at asim.g.sheikh@gmail.com, as I would love to hear any additional thoughts/experiences that you have to share. Thanks again!

I suggest you register for the Financial Samurai forum where members (including Sam) can more easily keep the discussion going. https://www.financialsamurai.com/forums/index.php

You also have the option to PM members. I have the same handle on that site–Money Ronin.

FS – Is now a good time to buy or do you think the housing market is going to take a dive? I’m relocating to Idaho and would like to buy before I move. I’ll have $150k for a down payment but not really looking for anything above $400 – $500k. I’d hate to put down 20% on something and then see the market dip 10% and lose half my investment.

I’m looking at the Boise or Coeur D’Alene/Sandpoint areas to buy. I’d like to stay in it two years and then buy another pace and leave the other behind as a rental. Do the same thing again two years later.

I’m personally looking at buying if there is weakness because real estate significantly our performs in a stock market Bear market.

The sweet spot of real estate is a bad -20% to 25% for the stock market. So if the stock market doesn’t crash by more than 35%, real estate is going to hold up pretty well IMO.

The thing is, transactions have come to a halt. The housing market is probably fine for now, it is the real estate brokerage market that is crumbling because of the lack of transactions. But I think things will come back within a couple months.

Thanks for the reply. I know someone who is putting their house up for sale in FL so I’ll be interested to see how long it takes to move and what the final sale price is. If I could get a 5-10% discount I think I’d be pretty happy.

You need to speak with a local agent and ask him or her how that market is doing. In my market, both apartment deals and house deals are being affected. At a minimum, deal flow will slow whether prices take an immediate hit or not. Apartment deals are definitely taking a hit because tenants have eviction/rent moratoriums and lenders have increased borrowing costs to hedge their risk.

After talking to Wells Fargo on Friday, it doesn’t seem rates for single family homes have changed all that much. People tend to freeze at this time. Only those forced to sell, will sell. You would be better off waiting for such an opportunity. I can’t tell you where the bottom is or how much prices might drop. But I’m fairly certain prices will not go up during this period of crisis, so why not be patient?

Wow! Only 39 comments so far on this topic. There is a storm silently brewing in the real estate market. If you’ve read my other comments, you know that I refinance a lot. I am two months into a refi on my primary residence. That will likely/hopefully close.

I also started the refi process on my apartment portfolio about 3 weeks (submitting documents) but my refi’s are effectively canceled. While primary residence mortgage rates have stayed more or less the same, apartment loans (defined as 5+ units) have shot up by 1% this week and so have underwriting fees. Lenders are responding to the rent/eviction moratorium. I am already dealing with renters who are seeking rent deferrals. A good portion of them will likely never pay it back because they are hourly workers living paycheck to paycheck who are permanently out the income.

Any commercial deal not closed will be re-evaluated by all parties and will likely be cancelled because the lenders can’t lend based on previous underwriting standards. For sellers that need to sell during this term, they will definitely be taking a haircut.

I’ve only experienced what’s going on in the apartment space. For hotels, retail, office, etc., I’ve heard it is far worse. There may be raiders looking for any excuse to foreclose on these owners and picking up the real estate at a discount.

Hey Sam,

Long time reader here. Thank you for the valuable, transparent content!

Husband and I were planning to buy a primary residence this April. We have 2 investment properties. In light of COVID and recent market impact, would you suggest delaying this acquisition until later this year or next?

When do you think we should buy our starter home in the Bay Area — currently want to buy houses priced at $1.6M selling for $1.7M. Hoping to spend $1.5M. Think prices will come down this year?

Real estate started shooting up in 2000/2001 because of the introduction of the $250K/$500K capital gains exclusion on the sale of a primary residence. Laws can change.

In the current environment, surely there will be laws a change in favor of the American public rather than against.

I haven’t posted in a while, old friend :)

My in-laws have a rental property in Florida. They got a call from their tenant this past week and the tenant said they can’t pay the rent this month because their hair salon is closed. Another friend says her Airbnb rental that she depend on has dried up. These are the “real” real estate impacts. It’s going to be really bad.

Multiple reasons for that. The first being airbnb is less of a rental property and acts more like a hospitality business which means it will be affected like hotels are during times like this. True rental property owners know that tenant turnover kills cashflow and therefore airbnb isnt a true “rental property”. The second point that I want to address is your in-laws rental property. Of the many reasons why your in laws tenant may not be able to pay rent the chances of them not paying anything for an extended period of time is unlikely given the fact that shelter is the 2nd most important component in life after food/water. Most people, not all but most, would stop paying for many other things before they just completely stopped paying rent. Your in laws could work out a payment plan with their tenant to pay 1/2, 1/3 or even a much smaller percentage of their current rent instead of literally “0”. This is also why I am against single family rentals 99.9% of the time and lean heavily towards multifamily. If I lose a tenant on a triplex, I still have 2 other tenants paying. Or If i had to cut rents in half during time like this I would still be getting 3x times rental check (In theory) than another landlord with 1 tenant is getting. Also, there are landlords insurance that all landlords should have that cover loss of income for a specified amount of time for certain events, I dont know if an event like we are experiencing now would count. But all in all real estate is far better than stocks, think about this Apple will stop paying its dividend before it stopped paying its landlord. The first thing to go would be stocks, owning hard assets is the way to go.

AirBnB are getting killed at the minute.

Unemployment is going to surge.

Jobs won’t come back due to a sudden and necessary push for automation.

Salaries must go down.

Rents become unaffordable.

Landlords who were highly leveraged collapse.

The market is flooded.

People who die have their properties sold.

The market is flooded.

Property prices collapse.

The only hope right now is a vaccine.

Good thing Airbnb mortgages are such a tiny part of the market. Further, most Airbnb hosts are simply renting out rooms and losing income they wouldn’t have had otherwise if it wasn’t for Airbnb.

But I do love your pessimism though. Without pessimism, the market cannot rise.

There are only two ways the market rises

– herd immunity is reached, this is likely to take 1-2 years and there will have to be waves of lockdowns to prevent the healthcare systems around the world from being overwhelmed, other ways of working and existing will pop up in the meantime but ‘normality’ will not be achieved until herd immunity n.b. this assumes there is no mutation of the virus

– a vaccine is developed and a rapid roll out occurs

To believe any other reason for the market to rise is mere folly

Hopefully the tenants will get a $1,200/each stimulus check in April!

Good thing there is the CARES Act stimulus package and the massive PPP program for small business owners to help out during difficult times.

What amount of leverage do you feel is too much on future purchases? For talking purposes say your net worth is $4M with a paid for home. Would taking on a $500k mortgage be about right, what about $1M. Basically what % of your net worth would you be willing to lever up with debt? Assuming the future property would be purchased at greater than 30-40% discount to recent values, planned to be income producing, and financing was as crazy low rates?

As I look at this train wreck unfold, I have a hard time believing my own luck. Of my total assets, I only have 10% (kind of) exposed to stocks and that’s in the form of a defined benefit plan. The rest, 80%, is piled into zero leverage real estate rentals and my primary residence. My home is roughly 30% of my real estate. The rentals are comprised of single family starter homes. The rest of my money is in cash or cash equivalents. No debt. I haven’t felt anything- yet. I took quite a beating in the last melt down- on paper anyway. In reality I lost nothing since I sold nothing. I’m glad you wrote this article. It serves to show that complete safety is a myth. Some of us can be better positioned than others, and you can and should try to place yourself in the best possible circumstances. But every safe haven has its Achilles heel.

I’ve been keeping an eye on auction properties since we are looking to purchase at the end of this year or early next year. About 3 weeks ago, there were only 2 properties up for auction in my town. Now there are a dozen. But, it’s probably coincidental since it’s been less than a week after the dam broke. I haven’t the slightest idea how low the S&P needs to go before demand for real estate wanes but I’ll know a good property deal when I see it! I’ve been envious anytime I hear about the lucky person that had funds to purchase after the 2008 housing bubble. When others are holding onto their cash, I’ll be more than ready to pounce! I suppose I don’t feel a need to hold onto cash since I have a steady job with the same employer for 18 years and no mortgage on a primary home.

I’m actually expecting movement downward in some real estate areas due to the impact on Main Street, not Wall Street. My thinking goes long the lines of the gig economy – quite a few people have bought up real estate in order to put it on VRBO or AirBnB. Not primary residences. While certain cities have tried to fight it, it has become quite commonplace….I’ve even taken advantage of these options as I’ve traveled (great way to slow travel the world).

These people are going to get crushed in the coming months. Now if the markets rebound quickly (V pattern) then the pressure will letup, but if the market does a U for between 12 to 18 months it will be hard for these people to ride it out. I know it takes a long time for repossession, but the hook will be faster than 2007-2010.

Thoughts?

I’m not for owning vacation property and I’m a vacation property owner.

https://www.financialsamurai.com/reasons-why-you-should-not-buy-a-vacation-property/

https://www.financialsamurai.com/the-only-time-you-should-consider-buying-a-vacation-property/

Never been interested in vacation property especially after reading about your trials and tribulations (long time follower).

I’ve got two kids coming out of college and the timing might be perfect to assist them in getting into home ownership…

Two of the three reservations at my Airbnb, for March, were cancelled by the guests but I’m not worried about the Airbnb. We’re in FL and Cornell University did a study on how high temperature and high humidity reduce the transmission of COVID-19 (https://arxiv.org/abs/2003.05003). Even if the coronavirus did stick around, the Airbnb could be converted back to an annual lease or month-to-month corporate housing since it is within walking distance to a major university and hospital and only a couple of miles away from shopping/entertainment. Location can be the saving grace when demand is low.

Really impressive interpretations! I learned quite a lot. I’m invested in both stocks and real estate and feel fortunate to have exposure to both with plans to hold long term. Recessions can be quite unsettling to watch my portfolio get hit but at least I had some cash to deploy. And even though the markets have sunk lower since I bought, I’m not beating myself up over it because I don’t need to sell in the short term. It’s been wild watching the RE market evolve in San Francisco over the years too. With the recent “shelter in place” restrictions just announced for SF I’m curious to see if anyone has open houses over the next 3-4 weeks. My guess is no. Will be interesting indeed

This weekend I could not go to open houses for first time and my realtor has stopped doing showings (in South SF Bay/ peninsula). If I desperately wanted the property I could see it but probably damage my relationship with her. Nothing was that appealing and the pricing on one was 100-200k lower than zestimate and what I would expect. Looked nice. Didn’t see disclosures so could just be pricing strategy.

One listing said shown by appointment only and without presence of your agent. Odd!

Sam

It feels a bit insensitive but we all knew that something like this was coming – it was only a matter of when. While the pandemic helped trigger the stock market decline, I suspect that that past six months will be historically seen at the period of exuberance at the end of any great bull market. The last few weeks have been painful but hopefully your readers have been assessing risk tolerance and properly allocating their assets accordingly. I, for one, am a little disappointed that I didn’t get more defensive at the end of last year but I tried to time it (poorly) and stock pile cash in the first half of this year in hopes of buying into a drop in 2h2020. Having cash and buying quality assets on the decline is a key to making a long term jump in wealth.

Just trying to hold off on getting to exited chasing yields with some historically great dividend paying companies hitting all-time highs in div yield. I am especially curious about your opinion on how the oil majors will weather this storm. They seems to be getting hit from a variety of angels (Russia/OPEC disagreement, environmental and now global slowdown/virus concerns). Does anyone have a perspective on whether they will recovery slower/quicker than the rest of the market, specifically the big guys, BP, Exxon, RDShell…

Thanks as always for keeping the topics current and interesting. I was sorry to hear in your Sunday email that page views had slowed. You have a fan for life here and I’ll keep spreading the word.. for whatever that is worth.

Spot on with your comments about the high points of exuberance.

I’m on a number of trashy Facebook groups which day trade stocks. In the last 6-12 months, 23 year old kids and other newb investors have been posting how much they made on long short small caps, or otherwise seeking stock tips.

I’ve seen this before and it turned out same-same but different.

in the O&G industry. Honestly, there is more pain coming in that industry. Too many small companies (private and public) that cannot make money at $50, much less $30.

The quicker the pain occurs for the small guys, the quicker production drops and the large guys recover. sub $30 should accelerate that, however, it will be painful for majors as well. I would think all their dividends are in jeopardy, however, I don’t follow the majors so don’t know.

Sam – Do you have thoughts on valuations in the market. Currently about 19x earnings on the S&P, which is higher than historical median and average

Oil WT Crude just hit 19 today. You are direct on the 30 threshold. A lot of US production has been with alternative methods and smaller companies – they need about $50/barrel to break even. Also I think we are close to the 30% threshold mentioned in the article. Not to mention mortgage rates just went UP even after all the QE and fed rate reductions. Perfect storm.

Sam,

The problem with real estate is that you don’t get these 30 percent discounts like you do with stocks. I’ve been buying for a couple weeks now and I’m getting killed as you’d expect. However, if you have cash and a stomach and you buy when everyone else is selling you should be able to handily beat real estate returns over time.

Stocks are definitely a harder asset class to own and buy during these times than real estate. That’s why you get paid more over time to own stocks.

Thanks, Bill

Agree. I’ve been buying on the way down as well, but that’s how it usually goes since we can’t time the bottom. Just let into the market as we go and know the historical lower limits.

I’ve got an article coming up this week to discuss a stock market bottom. Good thought exercise. Hang in there.

I can’t wait to hear your thoughts o stick market bottoms.

Hi Sam

Would also be curious about your thoughts on the bond market.

To me it’s a bad sign the 10-yr is going up after the fed drops to zero – a sign of struggling companies and liquidations to cover losses. I don’t see that improving near term, cash does appear to be king once again.

Curious because I have found real estate gets better discounts when purchasing because it allows you to buy at price that is not reflective of market price.

I have also found RE has done better than stocks on a % gain.

however the problem is scaling that success.

There are only so many local houses you can buy than get you 30% – ∞% ROI

Equities you can buy as much as you can afford when the market opens everyday.

All

The real estate I bought was cash, yes I understand there is another side to that argument but it’s times like this is exactly why I paid cash- not everything is purely a numbers only decision- for example I’ve had 2 people already cancel reservations on the STR I own and not relying on that cash flow allows me to breathe

Thank you for this, Sam! About two months ago I changed my asset allocation to be a little more conservative based on some of your articles and a thorough understanding of my personal situation.

You always put out quality content.

I’m glad Deanna! I’ve received a number of e-mails over the past month from readers who have said they took a hard look at their risk exposure at the end of 2019 and make adjustments according to their risk tolerance. I know in your guest post you mentioned Financial SEER to help quantify your risk tolerance, so that’s great. The feedback gives me a lot of motivation to KEEP ON GOING!

In times like these, I feel it’s important to provide as much perspective as possible. I’ve been waiting for this kind of disruption ever since I sold my rental in 2017. It’s so hard to navigate the choppy financial waters now. But it’s worth trying. I’ve got lots at stake as well.

VNQ is dropping like a rock. Seems like publicly-traded REITs don’t provide any diversification.

Now I’m thinking what’s the point? Might as well invest in stock or more directly own real estate/private syndication.

I think we’ll reach the “people holding on to cash” point a bit quicker this time. Main Street is driving this crash, not Wall Street. Lots of households don’t have any emergency savings. They’ll feel the pain very quickly and everyone will hold on to cash very soon.

Unfortunately, COVID-19 is spreading very quickly in the US. We haven’t reached the peak yet. Some people are still in denial. It’ll get much worse before the stock market improves. IMO…

Indeed.

Many investors like real estate due to its less volatile nature. But not all real estate is created equal. If you want less volatility in your real estate investments, then you want to own the following real estate in this order:

Your primary residence is your rock. The valuation is changing by the day, but you don’t know what it is nor do you care as much as with other real estate investments. You’re too busy enjoying your house and living your life. When it’s time to sell your primary residence, that’s when you’ll care about price.

Your physical rental property portfolio is also a steady asset. What you care about above all else is whether your tenants will pay their rent on time. Your physical rental property portfolio is all about cash flow generation. The price of your rental properties is secondary.

Private real estate syndication investments and private eREITs are also less volatile because you don’t get a daily valuation update. The most you’ll get is likely a quarterly update on how the project is doing. In the case of a eREIT, you should get a quarterly dividend. The underlying value of your private real estate investments are changing every day as well, but you don’t really care due to the long-term nature of many of these investments. We’re talking 3 – 7-year holding periods on average.

Now we come to publicly-traded REITs and ETFs like O and VNQ. They were the best performing asset class between 1999 – 2018. However, public-traded REITs and ETFs tend to act more like stocks than like real estate. If you are an investor seeking less volatility, investing more in a publicly-traded REIT or real estate ETF is not the way to go.

Sam,

You no longer mention realtymogul, versus fundrise. Any changes?

Also, when you look at your asset allocation, stock/equity, real estate, bonds etc. do you include public reits (o, vnq, ohi, etc) as part of your real estate or equity allocation?

PS buying a bunch of O and a bit of OHI/STOR.

Yes, public REITs are part of my real estate allocation. But they act more like stocks. I’m focusing more on CrowdStreet for accredited investors given they are focused on 18-hour cities, which aligns with my thesis of investing in the heartland of America.

Sam, great analysis. I have a couple questions, knowing that nobody really knows, but curious to hear your perspective.

1. What data are you looking at to help determine when a bottom may form? Do you think most of the negative news is already baked in at this point? Your data on the average bear market decline is interesting. Looks like only minimal risk that the bear market extends much past 30% based upon past data. However, this is somewhat unprecedented with regards to potential length of “shutdown”. Way longer than 9/11….

2. When looking at potential to buy some stocks that have really gotten beaten up (such as airlines, hotels, cruise lines ,etc.), how much bankruptcy risk do you foresee and what numbers are you looking at? I was lucky enough to go all cash with my market investments in late 2019. Now I am doing a ton of homework to determine when the right time is to get back in. I am contemplating taking about 20% of my portfolio and dividing it up between about 10 individual stocks that have really gotten hammered in a bit of a contrarian play. Even if 1 or 2 go BK, the others could more than offset.

Thanks again for the solid analysis.

Bogey

Well done Bogey. Actually, with you going all cash in late 2019, I’d love to hear your analysis on when to get back in. You are likely a top 1% outperformer. I only went to a roughly 25%/75% equities/fixed income allocation in my public investment portfolio.

For reference, can you share where are you only your financial independence journey?

One of the reasons why I remain pretty sanguine about the situation is that most people I come across or rational investors. I consistently come across people online who have made excellent investments and decisions.

Thanks

The main reason I went out (it was August 2019, so not at the peak) was that it felt like there was all good news, every stock would go to the sky, etc. With all the We Work news, it felt like the market was overheated (they were losing more and more money but valued at $90 billion). I’ve always been a contrarian.

I actually went back in this morning with 20% of my capital, and I spread it across 12 stocks that had been particularly hammered (airlines, banks, restaurants, resort/hotels, etc). I don’t usually buy individual stocks, but I felt compelled with this chunk of my portfolio.

It looks like we have further to fall, but I was pretty happy to redeploy 20% of my capital at valuations that were all off 40% plus from 52 week highs.

I have no clue where the bottom will be. Late last week I was thinking 18k to 19k, but today, who the hell knows.

I am not all that far into the journey, so to speak. I am 35 years old. I spent 7 years in commercial banking to begin my career, and I’ve spent the last 6 years as President of a manufacturing company in Oklahoma. I certainly have an above average net worth for my age and location. I have also invested heavily in commercial and residential real estate for the past 10 years, although lately, there have not been many good deals to be had. That may change.

I think deploying 20% of capital today is a GREAT move. Thanks for sharing.

I deployed some capital today as well. But what I really want is to buy more property and I’m not finding any good deals yet.

Nice work, Bogey.

@Sam – How do you feel about asset allocation within retirement accounts vs. after tax savings? I bought a house last year and tied up a lot of capital. Now only have ~$250K in cash after tax but I rebalanced / de-risked most of my retirement accounts at the end of the last year so now it’s a question of when I rebalance back into equities.

I’m considering a similar move as Bogey – buying airlines/hotels (e.g. Jets/MGM) on the cheap… in addition to buying high(er)-quality names at a discount (e.g. Goog/AMZN). Just need to decide whether to buy in/out of my retirement accounts.

Do you think about asset allocation in/out of retirement accounts differently? I’m 47 and hoping to retire in the next 10 years.

Thanks!

Been a long-time reader. Thanks so much for all the great info over the years, Sam! I really appreciate it. Thoughts on the impact of the Fed Rates going to 0 and its impact on mortgage rates? Do you think ARMs are still better than conventional fixed rates when mortgage rates are so low? My significant other and I are finally in the place of our lives to buy our primary residence in the next couple of months so we really appreciate your thoughts on buying real estate when the markets are on a downward trend. Question is how fast do things move – do we look in a few weeks or a few months when things could potentially be more stable or worse? I guess no one knows…

Not Sam, but I will share my thoughts. Congratulations on being in a place to buy your first residence! That takes some financial diligence.

The Fed rates going to near 0 won’t have an impact on the mortgage rates for 2 reasons:

1. This was widely expected so the market already priced it in

2. Lenders are at capacity for new loans. Due to the backlog, lenders are locking for 60 days ( whereas in more normal times they would lock for 30 days ) There is no pressure to lower costs to get new customers when your restaurant is already full.

If you are looking at a 30 year timeline to pay off your loan I recommend following Sam’s preference for the ARM over the fixed rate. You pay a big premium to have the lender take the risk on interest rates fluctuations over the next 30 years.

Hi Sam,

Really agree with you about the leverage, tax, inflation-resistant and living benefits of real estate. Seeing how stocks can meltdown in such a short time, OMG, I’m def convinced by you!

I’ve been looking to upgrade to SFH in NoVa, and saw exactly the price surge between Jan-Feb due to the rotation from stocks to RE. BUT, starting last weekend, sellers became a bit more desperate. There were 10 times more open houses than usual last weekend, but 5 times less people. Some agent said there probably would be no open house from now on due to the coronavirus.

I saw a SFH with a listing price more than 10% higher than its sold price just a couple of months ago (insane, isn’t it?). I want to bargain it down, and put 10% down payment. I wonder if 10X leverage is too much leverage? Or is it better to wait until my savings reach 20% down? The SFH is in the range of 1.1-1.2Mn. I’m planning to rent out my current residence (a townhouse of 750k) to make up the payment.

Thank you for your insights!