If you invest in the stock market, you'll eventually experience emotions of euphoria, greed, fear, uncertainty, and self-loathing. The more emotionally weak you are, the less likely you'll enjoy investing in stocks and holding on for the long term. Losing money in the stock market stinks.

Given I spent my career working in equities from 1999 – 2012, I witnessed plenty of highs and lows. From people making millions to losing it all, I've seen enough. And given I left in 2012, I also missed out on many good years.

Therefore, I never got the courage to go all-in on stocks after the age of 35. The volatility bummed me out. Instead, I've diversified my net worth into real estate, venture debt, venture capital, and alternatives, while keeping my equity exposure to 35% of net worth at most.

How To Feel Better About Losing Lots Of Money In Stocks

If you invest long enough, you will lose money in the stock market. It is an inevitability. Either the single stock you bought will have a bad quarter or the fresh money you invested into an index ETF will inexplicably start to sell off soon after.

Recently, one of my top holdings, Netflix, reported terrible subscriber growth guidance. As a result, my $200,000 position lost over $50,000 in value in a single day! Ouch.

Not only was my Netflix stock down over $50,000 in a day, so were plenty of my other tech stocks and index funds during this latest market correction. Hundreds of thousands of dollars have evaporated into thin air.

Easy come, easy go, as is often the case with investing in stocks. But this time around, something felt different about losing lots of money in stocks. I don't feel the same amount of disappointment as I had in previous corrections. Instead, I feel somewhat apathetic.

If you're feeling bad about losing money in stocks, perhaps some of these tips can help you feel better. The reality is, you could be living with dead money for months or years. Therefore, you've got to figure out a way to move on and live your life.

1) Get busy doing hard things.

If you tackle something really difficult and succeed, losing money in the stock market will feel less painful in comparison. You're distracted and engaged. It's the juxtaposition between taking action and being a passive investor that really helps put your stock market losses into perspective.

As a passive investor who has no control over a business, there's nothing you could have done to prevent the losses except to control your asset allocation. Once you give into the mantra of control what you can control, you will experience a nice psychological release.

Further, taking action and succeeding is far more gratifying than making money from stocks. Even if you don't succeed, but cross the finish line with your life intact, that's often good enough to counteract any negative feelings about losing money as well.

If you're not a tennis or sports fan, feel free to skip this next section and go straight to point #2.

Example Of Doing A Hard Thing

On Wednesday night, I got back at 10:30 p.m. because I just played the most difficult league tennis match of my life. I had joined a new team with a new doubles partner. The match was indoors at our opponent's facility. Further, I had never won an indoor tennis match in my 12 years of league tennis. There's something about the lights and faster courts that hurt my ability to perform at my best.

At #1 doubles, my new partner and I were thrown to the wolves. It was the most important position in the lineup because it counted for two points versus one point. The odds of winning were less than 40%, especially against two crafty lefties who had played together for over a decade.

The match started at 7:30 p.m. and we quickly lost the first set 2-6. But we hung on in the second set and won 6-4. The turning point came at 4-4, 15-30, when our opponent was serving. I called his first serve out, which the server thought was in. They got pissed and began to mentally unravel. Anil, the partner who was not serving, decided to headhunt me twice while I was at the net. Headhunting is when you try to bash your opponent’s head with the ball. He missed both times as I ducked and both balls sailed long.

But our opponents regrouped and took the lead in the third set 5-3. The usually noisy indoor club was now quiet as it was 9:40 p.m. Everybody had gone home except for the 12 spectators spread across both teams. At this moment, I told myself that if we lose, it would be OK. I had fought my hardest against a tough opponent.

Miraculously, we were able to fight back to 6-6, which meant it was now time to play a 7-point tiebreaker to determine the victor. We were up 3-1, when once again, Anil decided to smash the ball at me while I was at the net. This time, it was fair play as the ball was going in. Only this time, I was able to get a racket on it. The ball hit the tape and dribbled over! We were up 4-1.

Anil got so pissed that he smashed the ball at the net while I was walking by for changeover at 4-2. It made me flinch, but I said nothing because I wanted to keep the good vibes alive. We had the momentum! Besides, as a father of two, my warring days are over.

I was serving and we were up 6-4 in the tiebreaker. All we needed was to win one more point to win the match! I ended up hitting a solid first serve out wide to Anil. He was forced to pop it up to my partner at the net who proceeded to dump the easy volley into the net! Nooo! Was my 12-year winless curse going to continue?

The score was now 5-6 and Anil’s partner was serving to me. Was I really going to mess up my return and blow our lead? Heck no! I ended up returning his first serve crosscourt and after a couple of rallies, my partner put an overhead away for a victory! We had just won a 2.5-hour match, the longest in my league-playing career.

Hard Things Put Stock Losses Into Perspective

I ended up going to bed at 2 a.m. that morning because I didn't want the thrill of victory to disappear. But when I woke up, the feeling of triumph was still there. Hopefully this feeling will never go away.

Although this match might sound trivial to you, to me, it was an uncomfortable activity that filled me with excitement. Most of my tennis friends aren't willing to play USTA league tennis because they don't want to be put in a stressful situation.

Had my partner and I lost our match, our team would have lost 2-3. Further, our wins and losses are all memorialized on the internet for all of the tennis community to see. So if you are a loser, everybody will know. As a result, most tennis players don't play league tennis. It's just too stressful.

Winning this match successfully negated the pain of me losing $50,000 in Netflix stock. Sure, I could have sold the stock earlier to avoided losses. However, I've held the stock for 10 years already. Netflix was our saving grace during the pandemic. I'm happy to hold on for a lot longer.

2) Have a diversified net worth.

If you have more than 50% of your net worth in one asset class that is tanking, you will likely feel a lot of pain and fear. As a result, by the time you reach a minimum level of financial independence, I recommended keeping any risk asset to less than 50% of your net worth.

Sure, you may miss out on some further gains if stocks outperform other asset classes. However, you'll also minimize the volatility in your net worth as well as any emotional damage. Of course, if you have diamond hands, feel free to concentrate your net worth all in stocks or whatever risk asset of choice.

However, most people who get wealthier over time get more risk-averse. They become more satisfied with what they have. Therefore, they're willing to accept lower returns for lower risk. As a result, wealthier people tend to diversify their net worth across many investments.

With a diversified net worth, even if your stocks are tanking, your real estate holdings or bond portfolio might be appreciating in value. You'll tally up your cash and give it a virtual hug. As a result, you won't feel the pain of stock market losses as acutely.

Depending on your percentage weighting in stocks, you might actually feel better when stocks are correcting because you will feel good your diversification is finally paying off. Further, your other investment might be providing returns that more than make up for your stock market losses.

A diversified net worth gives you HOPE that everything will turn out OK. Often, the biggest challenge to developing a diversified net worth is overcoming greed. Investing FOMO can be extremely hard to overcome. If you are more satisfied with what you have, it's easier to give up potentially higher returns by diversifying.

3) Zoom out. Focus on your little ones.

If you're feeling bad about losing money in stocks, simply zoom out 5-years, 10-years, and to the maximum time horizon. The more you zoom out, the better you should feel because the upward-sloping chart looks smoother, at least for the broader markets.

Your goal is to invest when times are good and bad. Over the long-term, the S&P 500 has performed very well. The problem some investors have is not being able to hold on during downturns. If you can keep on investing during downturns, chances are extremely high, 10 years from now, you'll make money.

Another trick to feeling better about your stock losses is to shift your time horizon from yourself to your children if you have any. By thinking about your children, you start viewing selloffs as opportunities, not setbacks.

20 years from now, when your children are adults, how do you think they will view today's stock market selloff? Looking back, I believe our children will view it as a wonderful time to buy. As a result, it becomes much easier to invest in your child's 529 plan, custodial investment accounts, and custodial Roth IRA.

4) Expect to lose 35% of your wealth.

The global financial crisis resulted in about a 38% correction in the S&P 500 in 2008. The March 2020 meltdown was a 32% correction from peak to trough. Therefore, to make yourself feel better, take a 35% haircut off the value of your stocks. This way, your realistic downside expectations are set.

Once you set low expectations, any losses less than 35% will feel better. Thinking about realistic worst-case scenarios is one of the best ways to extinguish fear. Below is a chart showing the historical returns of the S&P 500.

5) Think about all the money you spent that didn't get invested in the stock market.

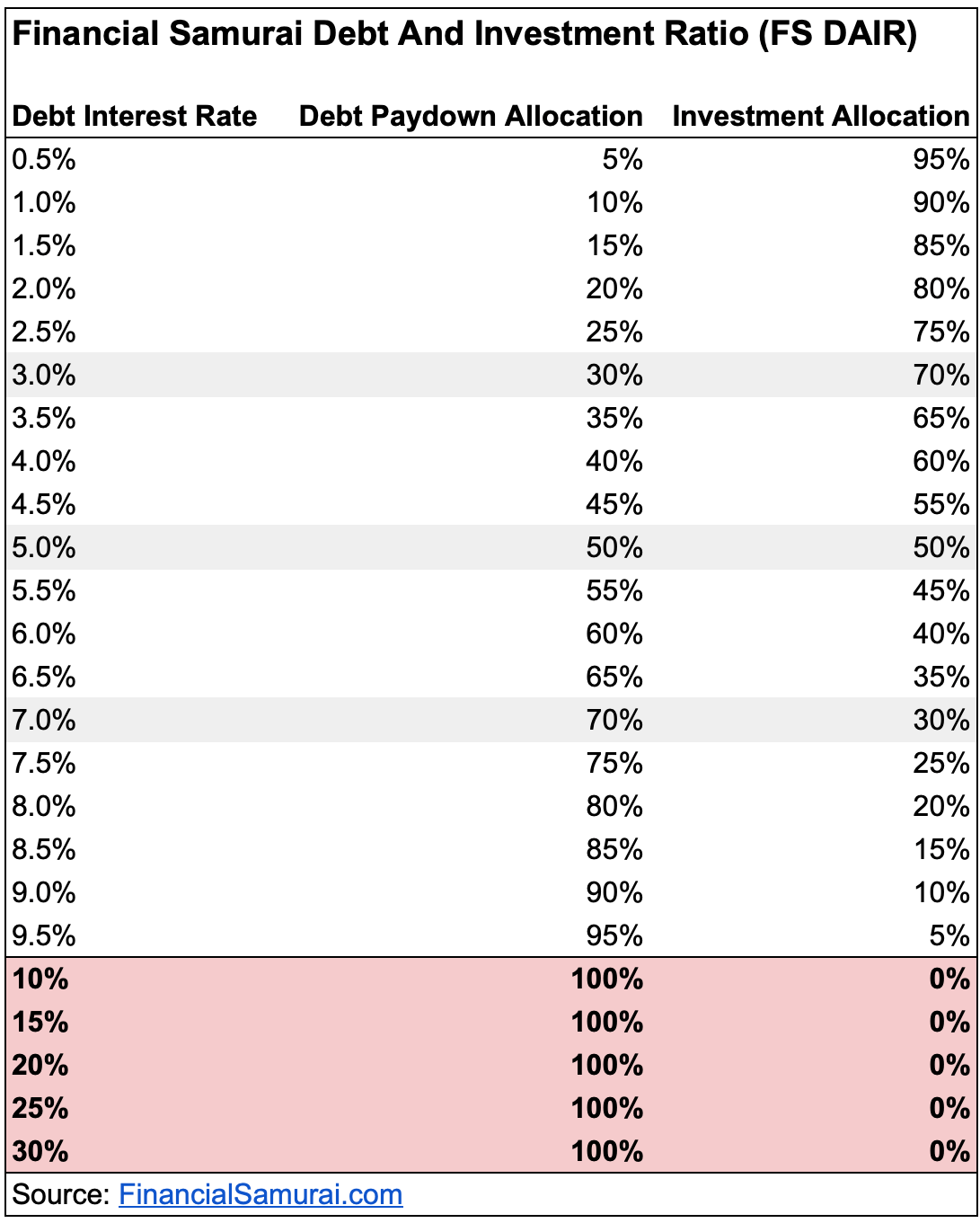

All the money you spent paying down debt instead of investing is a huge win during a stock market correction. If you have any type of debt and follow my FS-DAIR framework, then you're always using a percentage of your cash flow to pay down debt. The debt interest rate might have only been 2.5%, but that's still better than losing 10% in the stock market.

Further, any money you spent on great experiences, tuition, food, shelter, and other expenses should also make you feel better. This is why it's important to try and live the life that you want while on your journey to financial freedom. If you can concurrently spend enough money to live a comfortable life while also continuously investing, you're hedged against investment losses.

At the end of the day, the reason why you invest is to live a better life and take care of future generations. Don't forget to enjoy your stock market gains on occasion. Otherwise, all your hard work and risk-taking will be for nothing.

6) Know that things could always be worse.

When someone is making more money than you in a bull market, you may feel bad if you're not a self-confident individual. However, during stock market corrections, that person is also likely losing a lot more money than you.

Heck, during the global financial crisis, we were all tens of billions of dollars closer to Warren Buffett's net worth, not because we were outperforming, but because he was losing so much money! But even if Warren lost 99% of his net worth, he would still be 99% richer than all of us. So he's not a great example.

You might lose 35% of your stock portfolio's value in one year. But it could have been worse if you went on 50% margin before the crash. Your largest single-stock position might lose 25% of its value in one day after missing earnings exceptions. But it could have been worse if you decided to join the company right before the disappointing results.

By knowing that things could always be worse, you better appreciate what you have right now. In the grand scheme of things, losing money in the stock market isn't that big of a deal. Life usually goes on if you didn't over-leverage.

7) Stay off social media.

Social media mostly tries to curate the best versions of ourselves. You will seldom find people who will admit losing $50,000 in one day on a stock position.

During a stock market downturn, there will inevitably be people who brag about how they sold or shorted before the correction. Such information will piss you off. A guy who has been negative on stocks for 10 years in a bull market will shout how he was right all along.

Given investing can be emotional, the most emotionally unstable people will get on Twitter and Facebook to release their emotions. Therefore, you should avoid social media or rigorously scrub your feed.

8)Do some physical exercise.

If you're feeling stressed out, close your computer, shut off your phone, and go for a nice long walk. If you want to do something more fun, go play a sport with some friends.

Exercising with friends always puts me in a good mood. Further, exercise helps me sleep much better as well. A positive cycle!

9) Write out your thoughts.

Writing forces you to think more deliberately about issues. As a result, you will feel more calm during a difficult time. I highly suggest giving journaling a go if you don't want to start a blog like this one. There may be no better free therapy than writing.

Writing this post makes me feel better about my stock market losses. It is also satisfying to know this article might help a worried investor out there. Without losing so much money in Netflix, I probably wouldn’t have written this post. Always think about the positives!

Make Sure You Enjoy Your Gains Along The Way

Losing money in the stock market stinks. I get it. I lose money in the stock market all the time! However, over the long run, stock investors tend to win far more than we lose.

If we can continuously use some of our stock market gains to pay for a better life, it's hard to feel too bad. Since 2003, my strategy has been to take some gains and convert them into real estate. This way, I get to actually enjoy some of my stock market gains while potentially making money off my primary residence as well.

Over time, I've continued to convert some funny money into rental properties. This increases the chances my gains will continue given I've round-tripped plenty of stocks before. Further, the conversion also helps boost passive income given real estate tends to generate much higher income than dividend stocks.

Investing in the stock market will always be a core part of building wealth. Just make sure you've got the proper asset allocation. The money we lose is deserved because we invested appropriately based on our risk tolerance.

Investing in stocks can feel empty after a while because it provides no utility. And ironically, it is that empty and emotionless feeling you need to be able to hold on to when times are difficult.

Invest In Private Growth Companies

To avoid losing money in the stock market, invest in private growth companies instead. One of the most interesting funds I'm allocating new capital toward is the Innovation Fund. The Innovation fund invests in:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 35% of the Innovation Fund is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI! Of course, there are no investment guarantees, but it's nice to diversify into private growth companies with less visible volatility.

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum. In addition, you can see what the Innovation Fund is holding before deciding to invest and how much. Traditional venture capital funds require capital commitment first and then hopes the general partners will find great investments.

Stay On Top Of Your Finances

During volatile times, it's imperative to stay on top of your finances. To do so, I use Empower, the best free wealth management tool today.

Before Empower, I had to log into eight different systems to track 35 different accounts. Now I can just log into Empower to see how my stock accounts are doing. I can easily track my net worth and spending as well.

Empower's 401(k) Fee Analyzer tool is saving me over $1,700 a year in fees. It's important to analyze your net worth allocation to see if it's appropriate. Finally, there is a fantastic Retirement Planning Calculator to help you manage your financial future.

Once you link up over $100,000 in investable assets to track, you can then sign up for a free financial advisor session to get an analysis of your net worth and investments.

Related posts:

What If You Buy A Home At The Top Of The Market?

The Proper Asset Allocation During Your First Years Of Retirement

Preparing For A 50-Year Retirement Due To Lower Return Assumptions

Readers, how else do you feel better when you're losing money in the stock market? Anybody buying stocks here? Joint with 60,000+ other readers and sign up for my free weekly newsletter.

Hi. I think what a good number of people are trying to do is making quick money off the stock market. You hear about those few who became very wealthy “over-night” through, say crypto. You don’t hear about those who are at a loss. It doesn’t work that way. Since January up till now, my portfolio is down by about 20% (and I am certainly not the only one). So all I am doing is “cost-averaging”. On a rainy day I buy some stocks to bring down my average cost price. For most companies I have, there is really not much wrong with them, it’s just….everything is down. So by continuously bringing down cost price, at some point this has to pay off. I am not in the stock market for a quick win. I am in it for the long run. And in my view, that ought to be the correct mindset. If I want to take my chances for a “quick win” I might as well go to a casino. Hang in there folks, it is not going to go down forever, it’s only a paper loss if you don’t sell. Things will turn around.

Step 10: Go to Financial Samurai to feel better about yourself and put things into perspective!

Related to bubbles and possibly avoiding their allure, do you know, Sam, if there’s a way to access the sum of all prices paid for each individual share? i.e. If XYZ has issued 100 shares, 90% of shareholders bought it day 1 at $1 and still own it, and the other 10% of shares were last purchased for $10 ea, the market cap would be 10*100 = $1,000, right? But the total price paid would be 90*1 + 10*10 = $190. Or average share price of $1.90. I feel like something like this would be an interesting indicator. Does this make any sense?

I just lost 10% of my net worth overnight. It took me ten years to save that much money, and I’ve only been saving and investing for 20. I think it’s time in my investing life to de-risk, pivot to caution.. I have been so focused on capital appreciation, not realizing that this strategy could swiftly wipe out what I have spent so much time trying to reach. It’s not worth reaching out for the stars on the risk curve if you’ve already achieved financial independence. Gratitude.

Careful not to hit the eject button and miss the next bull though. Zoom out, it will recover.

In August of ‘20 I was short a triple leveraged natural gas ETN. CS took the note pink sheet. I figured, no big deal the product will trade down to intrinsic and eventually I’ll have a 40% return.

Except a squeeze pushed it up to 300 and then 3,000. Then as people were called out it went to 30,000. Needless to say I was down a lot. The broker said they would hold my margin because this didn’t make any sense on low vol pink sheet. I think what really happened is that many brokers had this balloon faster than their risk managers could keep up with.

If you owe the bank 1 million it’s your problem. If you owe the bank 1 billion it’s their problem. FINRA halted and CS said they would close the note at intrinsic (which was like 90).

I lost my taste for the stock market after that. I was very lucky on that one but other losses made me realize that there are basically zero tax benefits for loss in equities.

Oh man, that unlimited downside by shorting a position is scary. What did you end up reinvesting in? You can write off your losses to your short-term stock gains that year though.

Mineral/royalty buying has been a solid and safe bet. For risk investment, working interest in oil wells provide excellent tax benefits if the investment doesn’t pan out.

So much better than the stock market.

Sam, your tennis story is riveting! You may have a career in writing fiction novels… Anyways, congratulations on breaking your 12-year winless curse!

Regarding investments and losing money, I stick to the zoom out principle and look at my longterm gains and remind myself it is all short-term. Furthermore, the more the markets go down, the less I log into my brokerage firm. Patience is key, after all!

What I have done to make myself feel better about stock market losses is to read and save/bookmark articles about how wealthy it has made people. These could be articles from a blogger who consistently invested even as the market kept falling, historical returns, the fact that there are more bull years than bear years, and benefit of lump sum investing vs dollar cost averaging to keep me from trying to time the market or at least feeling better even if the market continues to go down after a purchase. Anytime I’m feeling nervous about these unrealized losses, I reread those saved articles and feel better.

For a beginning investor, the current stock market decline should be viewed as a great situation. Stocks are on sale and who doesn’t like a good sale?! Remember when the market dropped by ~30% in March 2020? Anyone kicking themselves for not buying more stocks at the time?

Now that I’ve read another FS article regarding the S&P 500 P/E ratio, I’m rethinking my stock investment plans.

Hi Sam – From one NFLX investor to another I feel your pain, it’s been a brutal month. Personally I didn’t think the earning report was THAT bad to warrant what has now amounted to an almost 50% correction from peak. Curious your thoughts on the company/stock moving forward. Has your perception/outlook changed? Are you going to say invested or look for an exit?

Hi Sam,

For diversifying into real estate, does VNQ count? It seems that when stocks drop, VNQ also drops. How does that work in terms of diversifying?

It doesn’t really count. Back in March 2020, I noted that public REITs often move inline or MORE (higher beta) with the S&P 500. As a result, I diversify away from stocks by owning physical property and private real estate syndication deals.

See: How Real Estate Prices Move With A Change In Stock Prices

I’ll revisit this topic again this week. It really is worth pointing out for those looking to diversify.

Thanks Sam, this helps. For Fundrise, is there any risk in terms of not able to pull the money out of there is downtown and properties go underwater?

Even after the recent “crash,” TSLA is still at an astonishing PE ratio of ~283. It remains the biggest bubble in world economic history.

I’m not sure I want to even touch that with a 1000-ft pole until it has come down to a much more reasonable level.

Congrats on the big win! Legging in with every ~2% drop (as per a great FS article of the past..). The process is never fun, but know my future self 5-10 years from now will give my current self a pat on the back :)

Congrats on the colorful tennis match! I lost over $200k in stocks but am thankful that my RE bets have paid off. Thanks for the article. It was good timing! Therapy :)

I’m looking to buy more, and thinking of adding Netflix. I bought Zoom and Zillow over a month ago and my paper losses are still mounting. I’m looking to put bigger chunks in tech focused and small cap index funds even though my paper losses are already multiple 6 figures and any gains on these new positions won’t come close to the paper losses already incurred.

I like getting “good deals”. So I try and trick my mind into thinking stocks are on sale, buy more now since I’m going to buy anyways and be giddy I’m getting them on the cheap (although I still feel stocks are somewhat expensive). It sort of works for me.

I love your article!

Been doing the same thing with real estate after making 100k in the stock market. I bought 1 house in 2012 and then a house and duplex in 2020 during the pandemic.

While I have about 40k on the sidelines right now for investing in my retirement account I don’t know what to buy. Any suggestions?

Sam. great job on tennis. I play doubles every Saturday and soccer on Sunday (at age 57) and such a good way to forget about a lousy market week.

Could you direct me to what you have written on bonds? I seem to have a blind eye there. I have 70% of net worth in stock and really would like to scale down to 45-50% as I get toward wealth preservation age.

However, all I hear is how bonds have been in a 30-year bull market and everybody scratching their head about why they aren’t tanking. Don’t we invest in bonds primarily for the yield (income), so what would it mean if they were to tank. I also remember during the 2008-2010 meltdown, bonds “crashed” also. Given, these concerns, what are the best places to put money in bonds other then treasuries, which I consider a fixed income asset. BND principal is down 5% in the last year and the yield says it is less than 2%? Thats a losing investment correct?

Great post Sam. Congrats on the tennis victory!

Definitely agree, the more you can put this small drop into perspective over time the easier it is to ignore all the horrifying doom and gloom headlines.

Also dabbling in crypto, seeing insane sell-offs has become just a regular day of the week!

One thing that helps me is to focus on how stocks are on sale! They have seemed so overvalued for so long it makes it much easier to buy in. While my purchases are smaller than current unrealized loses it still helps to think about that buying opportunity.

100%. Been though the dotcom crash and the housing crash as well. Kept plugging away adding regularly to ROTH and 401k all the way down and all the way back and wound up much further along than when the market turned. I always think of downturns as the market on sale.

Set an asset allocation you can sleep with and just keep adding, and likely one will be fine in the end. I’m risk averse and have done this using only a bond fund and funds that track the SP500 and the market. If the market wins, I win. If it loses, then I am down what the market takes and that’s it. Not as fun as a big score if one is in a Tesla or an Apple, but hey, I own the market weight in those without almost none of the risk :)

This start of the year 2022 has been pretty painful. My stock portfolio is holding up for now. But it seems like it could break down at any time.

One positive about losing money in the stock market is the learning experience I get with all the new information. It can be new information from a specific company, like Netflix realizing pulled-forward pandemic growth will mean less growth in the future. Or it can be new information from price adjustments, like Restauration Hardware (RH) – a company I was interested in buying – plunging 50% in a few weeks, reminding me even the best companies can get hit hard, no matter the quality of the company.

Everything seems so certain, until it doesn’t. So, reassessing my assumptions and beliefs with the new information I get from the stock market and trying to think how I can do better in the future is the probably the most positive thing I get from losing money in the stock market.

The second thing I do is trying to stay rational. It’s easy to get caught up by emotions. But good financial decisions are based on facts. This is true for stocks, but it is the same for real estate or any other investment. So I try to get as much information as I can by reading company’s financial reports, trying to understand the macroeconomic environment, etc.

For Netflix as an example, the good news is the pandemic is very close to an end (macroeconomics). This is bad for Netflix short term, but it doesn’t change anything for the company if we take a 10-15 years horizon. The pandemic was going to end anyway. Better sooner than later …

The company has great content. It is rising prices 10% again this year. And the propect of new clients internationally for the next 10 years is still incredible (company’s specific).

With a P/E ratio of 35, it is certainly not a “cheap” stock. But if the stock price get cut in half again, it’s the kind of company I would be glad to invest a large amount of money, ie. 5-10% of my portfolio.

Finally, I try to diversify my stock portfolio as much as I can. I would like to go “all-in” on Alibaba like Charlie Munger did recently. But I really can’t afford to do a mistake an lose 50% on a single stock position, even if it’s temporary. Diversification make it much easier to go through tough times, particularly if this is affecting a single company inside my portfolio. It also make it much more manageable, emotionally, and it’s easier to add to a losing position when it’s a smaller amount of money.

My position in Netflix was 0.1% of my portfolio. So, even if I’m mad for losing -25% in a day – I never like losing money even if it’s a small amount – I have to remind myself that it’s only 0.025% of my portfolio. Even if I ended up buying at a multi-year peak and the stock never goes up again, the information value I will get from this experience will be much more valuable than the amount of money i lost with this investment. That is the rational part of the situation.

Anyway, I hope we are near the end of the sell-off. It’s been pretty painful. But the other avantage is that there will be plenty of buying opportunities when this is all over. Better be patient, I don’t think this is over, yet…

What are some of your positions that have held up your portfolio in this selloff? Thanks

My best performers as of today are Energy (Suncor, TC Energy, Philips 66), Canadian banks (RBC, TD) and autos (Daimler, Toyota and Honda).

Large portions of my portfolio are not moving that much, like my recession stocks (Coca-Cola, Pepsi, Hershey, Procter & Gamble, WalMart), Telcos (Verizon, BCE, Rogers) and pharmaceuticals (Johnson & Johnson, GlaxoSmithKline and Novartis).

But it’s still pretty early in the year. Everything could change very fast.

Manuel it seems like you have a plentiful amount of single stock position are you worried about your lack of diversification? Have you considered index funds so that you can benefit from the entire market or do you prefer to research and buy based off metrics? Remember the stock market is irrational in the short term but very efficient and rational in the long run just be careful.

Hi Keith,

I have a diversified portfolio, almost like an index fund. I monitor my diversification through capital allocation. For a single stock, I generally don’t invest more than 5%, with a 10% maximum. For a sector, my cap is around 10%, with an maximum at 20%. The stocks named above are just a few examples inside my portfolio.

I prefer active investing over passive investing as it gives me more confidence in the investments I make (ie. I know what I own). It also allow me to take advantage of irrational movements in the market. Obviously, this is harder to do than it appears. But so far, it worked well. So, I’ll try to continue as long as I can.

Last year was the first time i invested in an index fund. It did well for a while, until it didnt. Luckily i pulled out on time, before i began to lose but my gains were wiped out at the begining of this year.

What i learned is that i dont enjoy passive investing one single bit. The concept that my money can grow or dissapear based on the performance of companies i only know in numbers but will probably never know anyone working there sounded appealing at first but then when you lose and you know you could have done something, it sucks big time.

Id rather lose by being involved in the desicions rather than winning a little because of someone else´s desicions.

of course, in order to do this i need to educate myself much more.

This week was a great opportunity to add more Tesla and Apple. Good quality tech is being lumped in with no earnings tech. I will continue to add more of my top 2/3 stocks while adding VOO thru $ cost averaging. I have 60% NW in RE with passive income from a rental property, am self employed and have a side hustle that is expanding

Listen to Warren Buffett- plus his largest holding is…… Apple.

Added more Tesla@ 808 today. Have enough Apple thru splits. Bought Mar18 64 QQQ puts yesterday.

Thank goodness for Apple reporting good results. Hopefully we are finding a base at around 4,200 – 4,300 in the S&P 500.

Did you sell or thinking of selling NFLX if it keeps tanking? (ZM, BABA were other good stocks, who got 60-70% losses, although revenues and profits were raising and good P/E)

Maybe. Hurdle seems low enough to beat this year now that lower guidance is set. How about you?

Something for everyone…can see how your years of being a tennis coach helps all your readers. Well done.

Bottom line, perspective, gratitude, and actions help ease the pain of these corrections. Glad you are celebrating your win on the court and savouring it by sharing it with us in writing.

I’ve held some capital back for months and thinking it’s time to start buying a little stock over the next two quarters even as prices might fall further. And let’s hope 2022 is the year for recovery in SF rents…even Manhattan rents have rebounded (despite WFH).

Such excellent advice!! Thank you for sharing.

-Joshua

I’m guilty of not following the markets that closely. It helps in me avoid feeling angry and stressed on the way down but it also causes me to lose out on putting cash to work when prices are low.

I like #1 and #3 a lot. If I’m hard at working doing something else it helps me worry less about how much I’m losing in the markets. And I also definitely look at the long term horizon to ride out the dips without getting too upset.

Exercise is also a good one as proved by your tennis battle. Congrats on such an exciting win! I also wash dishes as a way to zone out and feel less stressed about things like losing money sometimes. Simple to do and is always rewarding to have a clean sink afterwards. :) Thanks

One more Great article Sam, my saga is an average person earning $120k/year salary who Played with stock mkt, without realizing the potential, burned almost $300k and now hoping for a better tomorrow!! I did same mistakes again this week, not taking off some profits, betting wrong direction and lost big chunk Hope one day I will be victorious and at finish line!!

Oh no! I hope you are victorious in the long run too. Please follow an asset allocation model and stick with it long term.

GL!

Its not too late to sell. S&P only down 6-7% from high. Seems like investment community gets over-focused on high growth tech. I know stocks like SHOP, TSLA, SQ, and BABA are down a ton, and may not be smart to sell at this point, but they are only small part of market.

For instance, I bought F at 12 and sold some at 23 off recent high of 25. If market drops another 20% it is going back to 12. So not too late to sell at all. Costco, UHC, DVN example of sectors that all have had, and are still in, tremendous runs but if market tanks another 20% they will tank too.

Are you selling more stock here?

I’ve been a silent reader of FS. Very timely post Sam and comforting to know am not the only once loosing $ stock market in 2022 so far :). Hoping it to stabilize soon.

Due to appreciation in home prices over last couple of years, % of my real estate assets (5 residential rental properties and primary home) has gone well above 50%.

Below is how my net worth spread looks at end of 2021.

Stock 25%

Bond 13%

Equity (Inv Prop) 45%

Equity (Pr Home) 14%

Cash 3%

(I’ve NOT included my kids 529 into the net worth)

Now with 2022 stock market correction my real estate allocation has over 60%. What is the best way to handle this over allocation especially in real estate? Selling one of rentals and moving some of the equity to stocks maybe the way go, but selling rental takes months.

T

I wouldn’t sell a rental to get RE under 50%. You’re already close. I’d try to boost your overall wealth in other assets and build your cash balance as well.

If your rentals are closing no trouble, then continue to hold them. I think Bing property prices will continue to go up this year.

You could also remove the equity from your primary residence from the asset allocation breakdown.

I don’t include equity from our primary in our net worth. My assumption is that we need a place to live and that equity cannot be cashed out without also losing our shelter.

Otherwise my asset allocation looks eerily similar to yours but with (just) two rental properties.