A good net worth allocation is important to weather the consistent financial storms that tend to come every 5-10 years. The last thing you want is to have a net worth allocation mismatch with your risk tolerance and financial objectives. A savvy investor is congruent with thought and action.

The right net worth allocation by age and work experience will boost your chances of living a comfortable retirement life. The key is to stay on track by following a net worth allocation model. Life tends to get complicated as we age. Bear markets come around every so often. As a result, it's easy to get off track.

The recommended net worth allocation of stocks, bonds, real estate, alternatives investments, and your X factor are broken down into three net worth allocation models:

- Conventional Asset Allocation

- New Life Asset Allocation

- Financial Samurai Asset Allocation

The net worth allocation models will depend on your risk tolerance, financial objectives, and creativity.

For example, if you have normal risk tolerance and want to retire at a conventional age in your 60s, the Conventional Asset Allocation is most appropriate. If you are highly entrepreneurial and want to retire earlier from a day job, the Financial Samurai Asset Allocation model may be more appropriate.

Before we go through my recommended net worth allocation, it's important to understand the baseline of American finances. When it comes to growing your net worth and getting ahead, everything is relative.

The Typical American Hasn't Saved Much

The median 401(k) is hovering only around $110,000 in 2024. The average 401(k) balance at retirement age 60 is only around $230,000. Therefore, many Americans will have a difficult time retiring comfortably, even with Social Security benefits.

Just do the math yourself. Add the average Social Security payment per person of ~$15,800 a year to a 4% withdrawal rate on $230,000. You get $25,000 a year to live happily ever after until you die.

$25,000 a year is OK if you've got your house paid off and no major medical bills. However, you won't exactly be living it up in retirement. We need to do more to boost our wealth.

Can you imagine spending almost 40 years of your life working just to live off minimum wage in retirement? That doesn't sound too good, especially with inflation continuing to make things more expensive. At least, hopefully, you were able to live it up during your working years.

What Percentage Of Americans Invest In Stocks?

Stocks and real estate are two of the main asset classes that have historically built the most wealth for Americans. Unfortunately, not every American owns stocks and real estate.

According to the Federal Reserve's latest Survey Of Consumer Finances, only about 53% of all US families own publicly traded stock in some form. Although this percentage is up from 32% in 1989, it's still not enough. The median stock value held among households in the market was $40,000 in 2019. It's closer to $55,000 in 2024 after a 24% increase in the S&P 500 in 2023.

It is a shame that roughly 47% of American households haven't participated in the largest stock bull market in history. A low stock investing participation rate has ensured the wealth gap between the rich and poor has gotten larger. Please do your best to regularly invest in the S&P 500 over time through an ETF or index fund.

What Percentage Of Americans Invest In Real Estate?

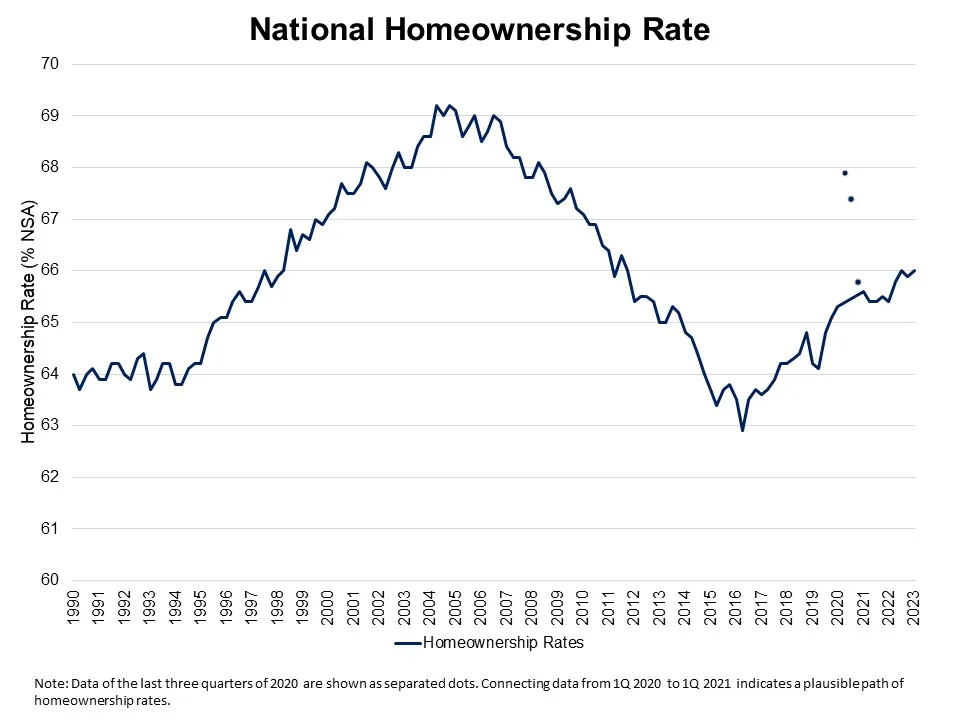

The Census Bureau’s Housing Vacancy Survey (CPS/HVS) reported the U.S. homeownership rate at 66% in 2023, amid persistently tight housing supply.

The homeownership rate remained statistically unchanged from the fourth quarter reading (65.9%). It is 0.6 percentage points higher than the rate in the first quarter of 2022. Compared to the peak of 69.2% in 2004, the homeownership rate is 3.2 percentage points lower and remains below the 25-year average rate of 66.4%.

Although a 66% homeownership rate is better than a 53% stock ownership rate, that still means roughly 34% of American households missed out on the housing boom since 2010. And real estate is my favorite asset class for the average person to build real wealth.

It was the housing bust from 2007 – 2010 that led to a decline in homeownership rates. Thousands of homeowners lost their homes through a foreclosure or shortfall.

As a result, there was a steady decline in homeownership rates until 2015, when credit reports for those who had lost their homes finally began to improve again. Note: A foreclosure usually stays on your credit report for seven years.

As a financial freedom seeker, your baseline goal is to own both stocks and real estate over the long run. If you do, you will likely outperform a large percentage of Americans who own neither. We are past the bottom of the real estate cycle and should see gains as the Fed cuts interest rates again.

Now the key question is how much should you own of each asset as part of your net worth. Let's discuss further the appropriate net worth asset allocation by age.

Recommended Net Worth Allocation By Age

We've talked in detail about the proper asset allocation of stocks and bonds by age. In the post, I discuss three asset allocation models for stocks and bonds to consider:

- Conventional Asset Allocation

- New Life Asset Allocation

- Financial Samurai Asset Allocation

Therefore, to stay consistent, I will also discuss three net worth asset allocation models based on the Conventional, New Life, and Financial Samurai models here as well. Each net worth allocation model will incorporate the corresponding stocks and bonds asset allocation.

Stocks and bonds (public investments) are usually only one portion of your overall net worth. In addition to public investments, the average person should also invest in real estate. After all, owning a home will always be a part of the American dream.

In addition to public investments and real estate, some people may also want to diversify into alternative investments. An alternative investment is a catch-all term for everything other than stocks, bonds, and real estate.

For example, investments in art, music royalties, farmland, commodities, cryptocurrencies, hedge funds, and collectibles are all considered alternative investments.

Finally, some people may want to start a business while working a day job or take a leap of faith altogether. I call this the X-Factor.

With so many black swan events since 2000, more people are trying to diversify their income sources with side hustles or entrepreneurial activities, especially online.

The Average American Is Not Diversified Enough

To come up with recommended net worth allocation models, we also need to first understand the typical net worth composition of the average American.

Although I love real estate and believe the housing market will stay strong for years, the average American is either too heavy into real estate or has a net worth that is poorly diversified. The lack of diversification is because most of the average American's net worth is tied up in their primary residence.

Let's take a look at what happened during the last financial crisis. By 2010, the median net worth plunged by 39% to $77,300 from a high of $126,400 in 2007. Meanwhile, the median home equity dropped from $110,000 to $75,000.

In other words, the median American's net worth consisted almost entirely of home equity ($77,300 median net worth vs. $75,000 median home equity).

Put differently, 97% of the median American household's net worth consisted of their primary residence! Thus, it's not hard to understand why Americans were in such great pain between 2008 – 2010. With a diversified net worth that included bonds and risk-free assets, the average American would have faired better.

Take a look at this chart below by Deutsche Bank. It highlights how a record high 30% of American households have no wealth outside their primary residence. That's not good enough. Building more wealth outside your primary residence is a must.

If you don't have any wealth outside of your primary residence, that means you don't have a taxable portfolio, rental properties, or tax-advantaged retirement accounts. If you want to retire early, you need wealth outside your primary residence to produce passive investment income.

Anybody who has lived through the 1997 Russian Ruble crisis, the 2000 internet bubble, and the 2006 – 2010 housing crisis probably has a good portion of their net worth in CDs, bonds, and money markets because they've been burned so many times before.

Investors who were heavy into stocks before the 32% correction in March 2020 have probably thought more about their stock and bond allocation and overall net worth allocation as well.

Thankfully, most asset classes have recovered and then some. However, that's not to say another big correction isn't right around the corner with valuations so high.

If you plan to retire right before a bear market hits, you might find yourself having to work for many more years instead.

Figuring Out The Proper Net Worth Allocation

The question we should ask ourselves is, “What is the right net worth allocation to allow for the most comfortable financial growth?” There is no easy answer to this question as everybody is of different ages, intelligence, work ethic, and risk tolerance. Further, luck also plays a huge part in building wealth.

I will attempt to address this question based on what has worked for me and feedback from some of the millions of readers who've come to Financial Samurai since the site began in 2009. I believe following one of these three net worth allocation frameworks can help the vast majority of people looking to achieve financial freedom.

I've also spent over 40 hours writing and revising this post over the years. The goal is for every Financial Samurai reader to grow their net worth in a risk-appropriate manner. Let us make more money in good times and lose less money in bad times.

Finally, before we look at the charts, let's go through the mental framework for investing and building wealth. When it comes to investing and growing your net worth, you must think rationally. You also should have a risk-appropriate asset allocation where you're not always thinking and feeling stressed about your investments.

Mental Framework For The Recommended Net Worth Allocation

1) You are not smarter than the market

I don't care by how much you've been able to outperform the stock market over the years with your stock trading account. Eventually, your performance will likely normalize over the medium-to-long run. Most professional money managers fail to outperform their respective indices. Don't be delusional and think you can over the long run.

As you grow your assets to the hundreds of thousands or millions of dollars, you won't be whipping around your capital as easily as before. Your risk tolerance will likely decline, especially if you have dependents and aging parents to consider.

The most dangerous person is one who has only experienced a bull market. They think they are invincible, confusing a bull market with their brains until the next inevitable downturn comes and wipes them out.

Get it in your head you will lose money at some point. There is no risk-less investment unless you are putting less than $250,000 in CDs, money markets, or buying US Treasuries.

Take a look at the active versus passive equity fund performance yourself. It is shocking how many professional money managers underperform their respective indices. The below chart shows that 81%+ of equity mutual funds underperformed over the past 10 years.

2) You are not a financial professional

Even if you were a financial professional, your investment returns will likely underperform. I've been investing since 1995, and still regularly blow myself up. As a result, I've followed a net worth asset allocation model to minimize potential damage.

Know your expertise. If you are a software engineer, your expertise is in creating online programs, not giving investment advice. If you are a doctor, your expertise may be in giving a patient a catheter, perhaps not so much on real estate syndication. Then again, everything is the wild Wild West nowadays.

It would be nice to know the future. If I did, I'd probably be on a mega-yacht in the South of France getting a massage right now! The only thing I can do is come up with rational expectations and invest accordingly. If you can't come up with a coherent 5-minute presentation to a loved one about why you are investing the way you are, you might as well be throwing darts.

For the typical investor, I recommend no more than 20% of public investment capital go towards buying individual securities. 80% of public investment capital should be invested in passive index funds and ETFs.

3) You only have at most 110 years to live

Statistics show the median life expectancy is around 82-85 years old. Less than 0.1% of the 7.7 billion people on earth will live past 110 years old. As a result, you should plan for roughly 80-90 years of life after secondary school.

The good thing is you have a time frame to plan for your financial wellbeing. The bad thing is you might die too early or live too long. Whatever happens, planning your finances around various life expectancies is smart.

It's better to plan for a longer retirement and have money left over to give to others than to come up short. This is why managing your finances consistently is so important. You need to predict the future, then spend, save, and earn accordingly.

4) Your risk tolerance will change over time.

When you've only got $20,000 to your name and you're 25 years old, your risk tolerance is likely going to be high. Even if you lose all $20,000, you can gain it back with relative ease. When you are 60 years old with $2 million and only five years away from retirement, your risk tolerance will likely be much lower.

When you're young, you naively think you can work at your same job for years. The feeling of invincibility is incredible. Your energy is what can help make your first million.

However, the longer you live, the more bad (and good) things tend to happen. Your energy tends to fade and your interests will certainly change. The key is to forecast these changes by preparing well in advance.

Do not be deluded into thinking you will always be a certain way. Review your finances twice a year and assess your goals. Accept that life doesn't go in a straight line.

5) Black swan events happen all the time

Hello, global pandemic! A black swan is supposed to be rare, but if you've been paying attention for the past couple of decades, incredible financial disruption happens all the time.

Nobody knows when the next panic-induced correction will incur. When Armageddon arrives, practically everything gets crushed that is not guaranteed by the government. It's important to always have a portion of your net worth in risk-free assets.

Further, you should consider investing your time and money in things that you can control. If you want evidence of people not knowing what they are talking about, just turn on the TV. Watch stations trot out bullish pundits when the markets are going up and bearish pundits when the markets are going down.

Not many people could have predicted a coronavirus pandemic would shut down the entire global economy for over a year and cause tens of millions of Americans to lose their jobs. Always be prepared for a black swan event, especially if you've already reached financial independence.

6) Take Advantage Of Bull Markets

Bull markets tend to last between 5-10 years. This is the time period when you can get incredibly rich. The goal is to know you are in a bull market and allocate your net worth accordingly. For example, I believe we will be in a housing bull market for years to come. As a result, I've invested 40% of my net worth in real estate.

The last thing you want to do is have most of your net worth allocated towards risk-free or low-risk investments in a bull market. Since 2009, I've come across many readers who saved diligently, but just let their savings pile up. As a result of not investing, they fell behind their peers.

The issue with getting rich is that you must take risks. Even if the NASDAQ closes up 43% again, as it did in 2020, you aren't richer if everybody else is up 43%. To get rich, you must outperform various financial benchmarks.

In addition to investing during a bull market, you should also be more aggressive in your career. Ask for those raises and promotions when times are good. Look for new job opportunities that can immediately boost your compensation and title. In a bull market, demand for labor is high.

7) The Right Net Worth Allocation Will Be Responsible For Most Of Your Wealth Gains

Spending many hours trying to identify promising individual investments will likely be a waste of your time. We already know most professional money managers don't outperform their target indices.

Therefore, instead of trying to pick the best individual security, focus on having the right net worth allocation first. Having the proper exposure to risk assets is the best way to build wealth over the long term.

Once you have the right net worth allocation, then you can slowly drill down to the types of funds, ETFs, individual stocks, and real estate investments you want to make.

Recommended Net Worth Allocation: Conventional

Let's start with the Conventional net worth allocation model. The Conventional model consists of investments in Stocks, Bonds, Real Estate, and Risk-Free assets. It is the most basic net worth asset allocation model and also one of the most proven models over the decades.

For those of you who like to keep things simple and who are also fine with working until the traditional retirement age of 60+, the Conventional model is for you. Let's go through some assumptions below.

Conventional Net Worth Allocation Model Assumptions

- The Stocks & Bonds allocations follow my stocks and bonds asset allocation by age. Please refer to the post and charts for details. The Conventional model suggests a 90%+ asset allocation into stocks in your 20s. Your 20s is a time to save aggressively and take maximum investment risk. Any losses can be easily made up by work income.

- At age 30, the Conventional model recommends buying a primary residence and having 5% of your net worth in risk-free assets. One of your main financial goals should be to get neutral real estate as soon as you know where you want to live and what you want to do. The return on rent is always -100%.

- By age 40, the Conventional model suggests having a larger weighting in Stocks & Bonds versus Real Estate. As your net worth grows, your primary residence becomes a smaller and smaller portion of your overall net worth. At the same time, you may also be interested in investing in rental properties, REITs, or private eREITs to get long real estate instead of just neutral real estate.

- By age 60, the Conventional model recommends having roughly an equal weighting in stocks, bonds, and real estate (30%-35% each) with a 5% risk-free allocation. By age 60, you should be financially secure and should no longer need to take as much risk in the stock market. Bonds and real estate will provide the lion's share of passive retirement income.

- All percentages are based on a positive net worth. If you have student loans right out of school, or a negative net worth due to negative equity, use these charts for the asset side of the balance sheet equation. Systematically look to reduce non-mortgage debt as you build your wealth-building assets.

- Stocks include individual stocks, index funds, mutual funds, ETFs, and structured notes. Bonds include government Treasuries, corporate bonds, municipal bonds, high yield bonds, and TIPs.

- If you just don't want to own physical property, then you should consider gaining real estate exposure through REITs, real estate stocks, and real estate crowdfunding. As you grow older, you may not want to own as much physical real estate due to tenant and maintenance issues. Real estate is one of the proven ways Americans have built wealth over the century.

- Alternative investments and your X factor stay at 0%. It's already hard enough to get people to save more than 20% of their income and buy a house. To then ask to invest in stocks and buy alternative investments may be too much.

Recommended Net Worth Allocation: New Life

The New Life net worth model changes things up around age 40. After living the Conventional way of life for years, you may want to experience a “new life” in the second half of your existence.

Since starting Financial Samurai in 2009, I've discovered many of us start wanting to do something new around age 40. Given you've had almost 20 years of learning, building wealth, and honing new skills, you may have a growing itch to try a new career, invest in different assets, or start your own side business.

Some call this a mid-life crisis. I like to think of this time as a period of discovery and excitement because you have a solid financial foundation. Therefore, you decide to take slightly more risk. At the same time, you can't fully let go of the conventional way of life.

The New Life Framework essentially includes investments in more alternative assets like venture capital, private equity, building your own business, and consulting on the side.

New Life Net Worth Allocation Assumptions

- By age 30, you purchase your first property and allocate 5% of your net worth to risk-free assets like CDs now that you have a mortgage. If you own the property you live in, you are neutral real estate. The only way you can make money in real estate is if you buy more than one property. If you are a renter, you are short real estate.

- By age 40, your net worth has increased handsomely. Your real estate now accounts for a more manageable 40% of net worth compared to 90%+ for the typical American. You finally decide to diversify some of your risk assets into alternative investments like private equity, angel investing, art, farmland, and venture debt.

- Around age 40, you also start a side hustle while you still have a steady job. You've always wanted to consult on the side, start a blog, launch an e-commerce store, or teach music lessons online. Whatever your X factor is, you're finally pursuing it under the safety of a regular paycheck. You've begun your new life!

- Also around age 40, you are beginning to wonder what else is there to life. You're getting burned out after doing the same old thing for almost 20 years. Maybe you negotiate a severance before working in a different industry. Maybe you just take a long sabbatical and transfer departments. Or maybe you decide to join a competitor for a pay raise and a promotion.

- By the time you're 60, you have roughly an equal balance between Stocks, Bonds, and Real Estate (20%-25%). Meanwhile, your Alternatives percentage rises to roughly 10% of your net worth. If all goes well, your X-Factor rises to about 20% of net worth because you've created a valuable asset.

- In your golden years, a diversified net worth provides stability and security as you plan to live until 110 years old. If you die before 110 years old, your estate will get passed down to your heirs and charitable organizations. You adopt more of the Legacy Retirement Philosophy.

Recommended Net Worth Allocation: Financial Samurai

The Financial Samurai net worth allocation model is one where you aggressively bet on yourself (X-Factor). You believe the traditional way of building wealth is outdated. You have no desire to work for someone else until your 60s. Instead, you want to build your own business and have more freedom at a younger age.

Despite your desire for more autonomy, you still diligently build your financial foundation in your 20s and early 30s. The 20s is when you're learning so that you can start earning in your 30s and beyond. During this time period, you are also actively building your passive investment income streams.

Once your side hustle starts generating enough to cover your basic living expenses, you take a leap of faith and go all-in on your business or your desire for freedom.

Your financial goal is to build a new asset that makes up half or more of your net worth. Your lifestyle goal is to live life completely on your terms.

Let's review some assumptions.

Financial Samurai Net Worth Allocation Assumptions

- The Financial Samurai model assumes you will have better control of your own financial future than other investments. When you invest in stocks, bonds, and real estate, you are a passive investor. You depend on someone else and favorable macro conditions to make you money. When you invest in You, you believe you have a superior ability to build wealth.

- One way to ascertain whether the Financial Samurai net worth allocation model is for you is to ask whether you can make a greater than 10% annual return from something you build. 10% is the average return of the S&P 500.

- By your late 20s, you get neutral real estate by owning your primary residence. You understand that it's not good to fight inflation over the long term by renting. Your real estate and bond investments provide more stability as you seek to take more investment risks and work on your X factor.

- By your early 30s, you start aggressively going to work building your side hustle. After 10 years, you already know you don't want to do the same job forever. You also know what you want to do after a decade of working. Your initial goal is to earn enough money from your side business to cover your basic living expenses. Once that is achieved, you will take a leap of faith.

- Before leaving your day job, you will negotiate a severance. There is no way you will leave money on the table after devoting years of excellence to your employer. With your negotiating skills and ability to create a win-win situation, you walk away from your day job with a nice financial buffer.

- Despite building your business, you are also focused on building as many passive income streams as possible through your Stocks, Bonds, and Alternative investments. Your goal is to build a large enough passive investment portfolio to cover your desired living expenses. In addition, you want a diversified enough portfolio to keep spitting out income no matter the economic condition.

- At the same time, you are also trying to generate profits from your entrepreneurial endeavor to either cover your desired living expenses, reinvest it into the business for potentially more profits, or reinvest it into more passive income investments. Your business income is essentially another income stream, albeit an active one.

- If you are wildly successful in building your own business, the X Factor column can easily dwarf all other columns. See the below chart from my post, Net Worth Composition By Levels Of Wealth. Notice how the X-Factor, the dark blue portion, grows as one gets wealthier.

The Proper Net Worth Allocation Is Well-Diversified

So there you have it financial independence seekers. Following one of these three net worth allocation models during your lifetime should give you a great chance at eventually achieving financial freedom. At the very least, you should be able to achieve an above-average net worth.

Of course, we must recognize that financial returns are not guaranteed. Your financial journey will be full of twists and turns. As a result, it's best to keep a diversified net worth mix that can withstand economic downturns. At the same time, your diversified net worth will also benefit from multi-year bull runs.

When it comes to building wealth, I encourage everyone to plan for bad scenarios as well. Expect the occasional 30%+ decline in your risk assets. This way, you will increase your chances of staying more disciplined when it comes to investing.

Remember, the average American has 90%+ of their ~$110,000 net worth in their primary residence. Meanwhile, roughly 35% of Americans don't even own a home. This lack of net worth diversification is dangerous. It means the average American is not actively investing in other asset classes.

I do not recommend having more than 50% of your net worth in any one asset class after age 40. Once you've built a significant amount of wealth, your goal should start tilting towards capital preservation. The last thing you want to do is go back to the salt mines when you're old and tired to make up for lost wealth.

Perhaps my recommended net worth allocation guides are too conservative. Or maybe they are too aggressive. Whatever your beliefs, you must at least come up with your own net worth allocation framework to follow throughout your life. You can always adjust your net worth asset allocation over time.

Finally, remember to enjoy your journey towards financial independence. Even if you amass enough wealth to never have to work again, you won't magically feel happier. Make sure you always have a purpose to provide your life with constant meaning.

Suggestions For Building Wealth

1) Diversify Your Real Estate Investments

Take a look at Fundrise, my favorite real estate platform to help you gain exposure in a much less volatile way. Fundrise manages over $3.3 billion for over 500,000 investors. It predominantly invests in residential and industrial real estate in the Sunbelt, where valuations are cheaper and yields are higher. You can earn income 100% passively and diversify your exposure across America with Fundrise funds.

If you are looking to invest in real estate more surgically, check out CrowdStreet. CrowdStreet focuses on mostly individual real estate opportunities in 18-hour cities where valuations are lower and growth rates are higher. I've met them as well and they've got an excellent platform. If you are an accredit investor, you can build your own select real estate portfolio.

Both are free to sign up and explore. I've invested $954,000 in real estate crowdfunding so far to diversify my investments and earn more income passively. I'm bullish on real estate in 2024 and beyond as mortgage rates come down and the asset class plays catchup to stocks.

2) Stay On Top Of Your Finances

To grow your wealth, I recommend using Empower's free financial app. I've been using them since 2012 to track my net worth, analyze my investments, and plan for retirement. I even spent a couple years consulting with Empower (previously) Personal Capital in their San Francisco office from 2013-2015.

3) Invest In Private Growth Companies

Finally, consider diversifying into private growth companies through an open-ended venture capital fund. Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment.

Check out the Innovation Fund, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 35% of the Innovation Fund is invested in artificial intelligence, which I'm bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI! I allocate about 10% of my net worth to private growth companies.

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum. You can see what the Innovation Fund is holding before deciding to invest and how much. Traditional venture capital funds require capital commitment first and then hope the general partners will find great investments.

I've spent years updating my recommended net worth allocation models to help the majority of people try to achieve financial independence. I'd love to hear your feedback on how these net worth allocation models can improve. I'd also love to hear what your net worth allocation breakdown is. There is no one size fits all. However, I do believe these three models are relevant for 80%+ of the population.

For more nuanced personal finance content, join 60,000+ and sign up for my free newsletter. Financial Samurai started in 2009 and is one of the top independently-run personal finance sites today.

When calculating current net worth allocations for Stocks/Bonds vs. Real Estate is it advisable to use the total value of your home in the total net work number or only the equity total built up? This of course changes the current % allocation in each bucket but does not necessarily mean you want to pay down that mortgage faster to be closer to a 50%/45% allocation. Assuming total value of the home but curious? Thanks!

equity is an asset, mortgage balance is a liability

Always a big discussion on whether a primary residence is part of one’s ‘Net Worth’ calculation. Sure, it is an asset — but it’s also one of the three basic needs (food/shelter/clothing) so it isn’t something one can liquidate to move into another asset/investment opportunity as you would have to replace it with another shelter. Maybe why some folks will leave it off the table (assuming the roof over your head is fully paid for). Don’t own it yet? There’s that debt obligation in the negative column.

Sam,

In the new life model, do you strongly feel a 35 year old should have 15% of their stock/bond portion in bonds? I know it’s situational but this on top of 5% risk free when focusing on growth feels conservative for a 34-35 year old. Just curious!

Hi Sam, did your models for allocation recently change? I noticed they are different in this post than previous articles. Thanks,

Hi Michael, the post with the latest date should have the latest changes.

Hi Sam,

First, thanks for the amazing book! I bought a physical copy through Amazon and an audiobook through Audible. Much of it is a bit over my head, but if I take more time to break things down (when I have more time), I’m sure it will all make sense. You do a great job of helping keep things simple and giving lots of great ideas/options for all kinds of investors.

I’m working on writing a smaller, more focused book on investing for the average Joe. Would you mind if I sourced you and used one of your charts from this article? Of course, I’ll refer to this article and provide credit to Financial Samurai as a reference.

I love hearing your podcasts and reading your articles! Keep up the great work. And happy holidays to you and your family.

All the best,

Christopher

Hi Christopher,

Thanks for purchasing Buy This, Not That. Sure, you are welcome to reference Financial Samurai, Buy This, Not That, or my podcast in your book. Thanks for reading and listening!

Best,

Sam

Thank you, Sam!

It’s shocking how that your “new life” description above is almost dead on where I am in life. Like SCARY close. Thank you for all your info sharing.. Question for you, in your 40% real estate calculation above. Do you include your investments in Fundrise and Crowdstreet here or in alternative?

Hi Dave, yes I do. I include all types of real estate in my RE allocation percentage. Although, some might classify private real estate investments in alternatives. But I don’t think that’s correct.

Are REITS are counted in the RE total as well vs. Stock/Bonds? Assumption is yes.

Thanks!

It can be. But public REITs are often MORE volatile than the S&P 500, as we discovered during the 2020 downturn. Public REITs declined more than the S&P 500.

Can you redo the asset allocation with Crypto as % of the overall total.

I like to invest 10% of my investable assets in speculative investments. So crypto would be a part of the 10%. But I wouldn’t put more than 3-5% of my investments in crypto, meme stocks, NFTs, etc.

What asset allocation do you recommend for someone who is 45 years old and just getting started in investing? I only have 20 years to a conventional retirement, so I have less time to grow my nest egg, but don’t want to take foolish risks.

Depends if you have a pension, and how long more you want to work and can work.

Perhaps follow an asset allocation closer to a 50-55 year old, again depending on your future income and desire to work.

Hi, im 39. i have around 85% of my net worth on six properties. 3 of them completely paid off, the other pay for themselves and then some. I live in one, the other generate rents. the six of them have doubled in value in the last 5 years and one of them have tripled. The rest is half stocks and half cash. I dont live in the US, but from what i read here, i have the lifestyle of someone earning around 150k AFTER taxes.

What risks do you see in this scenario?

also, after hearing so much noise about a possible stock market crash this year, im thinking in cashing out all stock and buy another property or payoff one of the mortgages while leaving about 1.5 year cushion in cash. what would be your take on this?

The frustrating games I find myself playing are the “What If” or “Why didn’t I?” scenarios.

For example, why on earth did I NOT invest in Amazon stock early on? Shouldn’t that have been a no-brainer? I kick myself every time I look back on “what-if” scenarios like that. What if I had purchased 5000 shares of Amazon stock in 2005 when it was $35 a share? Would I be fully retired, own three homes and be traveling the world full-time?

It’s frustrating seeing now what I should have clearly seen in the past. How do others feel about this phenomenon and how do you handle it? Is there something out there now that we all would agree is a stock or an investment our future selves would kick us for not going “all in” on today?

Tina, I cannot tell you how much this “what-if” scenario mindset resonates with me! I am constantly kicking myself for either 1) selling too early or 2) not cashing in early enough. Like they say, hindsight is 20/20… As a baby investor myself, it’s something I struggle a lot with especially given how volatile recent market activity has been with the pandemic and supply chain crisis. I keep asking myself what the right balance is between being bullish in a company’s growth potential and taking gains where you can.

I am 57 and now slowing down in my career, working part-time. My wife is also 57 and we have about $4M in IRA/401k assets, and $3.6M in taxable investment accounts. Our house is worth $1.2M. We have no debt. (We have a 16-year-old son and a 529 for his education that has grown bigger than expected due to investments, $467K today. I know that’s too big. We’ll end up paying a penalty to liquidate the excess some day. Oh well.)

So with a liquid net worth of about $8M, and total over $9M, the question is how much should I consider paying for our retirement house. I think we’ll head to Montana, and I don’t think $1.2M (just swapping our city house for country house even-steven) is enough for a nice mountain home in Bozeman or Big Sky.

Is there any reason, with assets like this, that we cannot pay $3M for a house? If we pay $3M cash for a house, we still have $6M liquid generating enough for living expenses. ($6M means if we just take out 3%, that’s $15K/month in income.) My wife thinks paying that much for a house is crazy; but I tell her it is an investment in a different class than equities, so it counts as diversification.

Just watching financial investments grow forever so we die with more equities doesn’t seem fun. I’d prefer to have a better house with more land, privacy, and views, which we can enjoy by using it to host family. And use to lure our grown son back to visit us to ski etc. I’d like to know whether I’m crazy, given our asset level, to be willing to put 30% or more into our sole residence.

I actually just finished writing a post regarding your Primary Residence Value as a percentage of your net worth. I’ve concluded that you can spend up to 30% of net worth. Therefore, buying a $3 million house on a $9 million net worth is very close! I think you can do it.

Subscribe to my new post distribution list and you’ll eventually get my post on what I just mentioned. I’m scheduling it for next week.

You may have to mortgage the $1.8M to avoid the capital gains taxes. Married filing jointly only allows for $80,800 of long term capital gains tax free.

With a $3 million home, I suspect one would be looking at thousands of dollars in property taxes, which aren’t as much of a tax write-off as they used to be.

About $32,000-$65,000 in annual property taxes actually!

Check out my post on the minimum income necessary to afford a $3 million home.

I”m curious what you think I should do in my situation. I live in Vancouver, BC and plan on staying here. I’m 40 and my net worth is 75% in real estate, 20% stocks and 5% cash due to high housing costs here. Should there be a different target net worth allocation by age if you happen to live in a city where real estate ownership is so high?

Ive looked over some of your articles and was wondering what you might do in this situation.

My wife and I (early 30s) made 3.5mil in a Roth IRA on a certain video game retail stock. I’ve since removed our assets from risk into a stock/bond portfolio of 60-40.

I’ve crunched numbers and it seems like we could retire if we were willing to pull out what we need, in addition to tax and penalty costs. I know the smart thing would be to leave it in the Roth until 59.5 to avoid taxes and penalty, but that’s such a long way away to keep chugging along.

Do you think it’d be okay withdrawing 3-4% and still expect growth? What’s your view in a situation like this.. it’s hard to find others in a similar boat.

Nice win! I’d keep the money in the Roth IRA and let it compound.

What is your overall net worth and annual expenses? Lots of variables to consider.

If you have at least $3.5 million at sub 35, you might as well shoot for $10 million, the ideal net worth amount for retirement IMO.

Build that passive income portfolio too!

Thanks.

Net worth is just under 3.7mil, it’s pretty much all the Roth IRA and our home/cars. Most of our savings was in the Roth when it exploded.

My hope is to withdraw only what’s needed on our budget, which based on annual budget for 2022 is ~$63k. (not counting taxes, penalty).

I’d love to shoot for $10 mil or beyond, but I don’t want to sacrifice time for that. I want to spend my time for me or my family if able.

When you say passive income, do you mean focusing on dividend stocks? I had looked at this for awhile but felt if we are still quite young, it’s not necessary.

Hi Sam-

Fear of not having enough for retirement was imprinted on me at a young age. I watched my grandfather return to the workforce in his 70s after a few years of retiring because they realized they didn’t have enough in pension, ssn, and savings to make ends meet for the long haul (and they lived the simple live). It broke my heart to watch him slag-away when he should have been enjoying life doing the things he loved most. Which leads me to my quandary:

How should, and which allocation, would be best utilized if one spouse is +8 years older than the other? I’m in my 40’s and my spouse is in the early 50s. While we are working towards a common goal of making an ostrich-sized nest egg, we are in totally different net allocation mixes given what is presented.

There is a 5% delta for the nw allocation and a 10% delta of the proper allocation of stocks/bonds between our age groups. If we allocate based on the older spouse, we run the risk of losing out opportunity and having a smaller egg as a result. If we allocate based on the younger spouse, we run the risk of being too aggressive and suffering the consequences; broken egg. Five and ten percent deltas are reasonably small differences- in retirement though, those deltas can really add up. Or am i being too pedantic and literal on the numbers?

I am petrified about retiring and running out of money- despite being on/a bit above target for accumulation of retirement assets at my age group.

While we all may YOLO, my goal in life it to YORO…comfortably.

Great read. This is a bit unrelated, but any recommendations on how to adjust your net worth allocation in advance of a period where your income will drastically reduce (i.e. MBA program)?

I am in the process of applying to MBA programs and will be pursuing a career in investment banking. At 29 years old, currently have a NW of ~$300k ($165k in stocks/etfs – ~$65k of which is unrealized gains, $100k in 401k, $30k in cash, $3k btc/eth).

I am hoping to attend Columbia Business School or NYU Stern, where total cost of attendance is upwards of $230k assuming no scholarship. I am debating whether to take loans to cover the full cost of attendance verses using a combination of loans and proceeds from liquidating some of my stocks/etfs.

I’m leaning towards covering the costs with 80% loans and 20% savings (would require selling some stocks/etfs). Taking on this much debt while forgoing income is definitely not an easy decision – however post-MBA I hope to increase my total comp from $140k currently to $250-300k post-MBA. I’m also not loving my current career path (middle office at a bank) and am seeking a change.

Would love to hear your thoughts on the matter!

A big move! Good luck on the application process. I got my MBA part-time at Berkeley. Took 3 years and long hours due to work. However, my employer paid 80% of it and I deducted the rest if I remember correctly.

Perhaps consider the PT MBA program at NYU instead?

That said, to answer your question, I would follow the Years Worked column. But in the long run, things tend to work out as you’re only taking a 2-year hiatus from work + more debt.

The media makes student debt sounds scarier than it is b/c they don’t focus enough on the higher income students will likely generate.

And if you go to Columbia or NYU, you will likely land those income figures. Demand for investment bankers is currently VERY HIGH!

Note: I worked in banking from 1999-2012 (GS/CS). Here are some posts to read.

Related posts:

Should I Work On Wall Street? Pros And Cons Of Working In Finance

Don’t Make Over $400,000 A Year: Look At How GS Analysts Suffer

You can’t borrow for retirement but you can always defer loans and refinance and play all kinds of balance transfer games etc. plus your new income will allow for a rapid payback should you choose. Also lots of companies give tuition reimbursement as well. I would just take the loan and pay it back later. Besides current administration might continue the effort to cancel loans anyway. Take a shot at the free money and get your advanced degree.

I was a little horrified until I got to the end. Having 40% of your net worth in bonds at 40 is an appalling idea, glad this idea is getting eliminated. I like the financial Samurai X-factor allocation. I would tweak to perhaps putting a little more in earlier; because the x-factor can grow exponentially. For me (32) this has been crypto (over last 5 years), some tech stocks (last 8 years or so), and a couple side investments. People should note the model is % of net worth (ie assets value as appreciated), not % contribution.

An X-factor growing exponentially can start as 5% of savings by contribution $s and grow to be 40% of net worth in new value with appreciation / income and reinvestment. And hopefully everyone remembers the power of leverage. Homes may only appreciate at say 4% after re-investment (Repairs, maint, carrying cost etc) on a total asset value basis, but if you started with 95% leverage (FHA loan), you are 10-20x that 4% in the first few years ie 80% cash on cash returns.

I’m still in my early 20s, but it looks like I’ll hit some of those benchmarks a few years ahead of schedule!

Right now I’m living in a property that I bought for the sole purpose of turning into a rental in a few more years. So far, so good. It’s seen an insane amount of appreciation in the current market, and I’m hoping it will be a good source of income to start investing in additional rental properties.

Do you have any thoughts on REITs in the current market, or single-family vs multi-family housing (in terms of their value for investors)?

I’m glad that article ended up in the read list today. It is extremely well broken down and I love the talk about x factor. That’s what I am shooting for with the addition of real estate.

It’s worth keeping in mind that not all millionaires are created equal.

A thirty year-old with a million dollars is a hell of a lot richer than a 65 year-old with a million dollars. The thirty year-old can work another 35 years and can also let that million dollars work for them another 35 years. The 65 year old is on the cusp of giving up work and having to live on that million dollars and its earnings. Totally different situation.

Also different, of course, if the younger one is unable to work for medical reasons or if either requires permanent assisted care, as well as the earnings potential of the 30 year old. It also matters where they live. An argument could also be made that it matters whether the money was inherited or earned, and even if it is being used as capital in the owner’s business.

A good point about the relative levels of wealth by age. Yes, being rich at younger age and for a longer percentage of your life is nice.

Hence why we all need to try and eat right and stay as fit as possible to live as long as possible!

Hi Sam, i am a big fan. What are your thoughts about investing in the same asset class but in different countries/ continents, in this case rental property, with total made up to 80% of the net worth? (I am aware about the FX risk )

Fundamentally, it makes sense due to inflation, rising rents, limited land, rising population, etc.

If you know the market and understand the rules and regulations and have someone to manage the property, it should work. You just have to assess whether the hassle and complications of owning foreign property is worth it for the returns.

Obviously, investing in Shanghai/Beijing/Shenzhen property since the late 1990s would have been a home run!

Omg, my mom sold her Shanghai property for 30k then. Now it’s prob 1.5m and rental 2k monthly. Mistake of a lifetime!

Doh, but did she reinvest the money or buy another Shanghai property with the proceeds?

Sam,

Any thoughts on Gold? Especially with inflation heating up

If inflation is really heating up, I’d rather buy an income producing asset like rental properties instead. Gold simply doesn’t produce any passive income, and I want passive income to take care of my family and not have to work.

It’s a pretty good chart and I like the rationale behind it. I’m not sure if I would ever move away from 100% equities but that could change as the years pass.

I really don’t think I know where to go to buy bonds in the first place anyway. Ignorance is bliss!

Different strokes.

How old are you and how did your investments fare in 2008 and 2009?

A part of asset allocation may depend on whether you have invested during a bear market before, how many dependents you have, and whether you need to take more risk or not.

Let’s say you have $5 million, you may not feel the need to be in 100% equity anymore. But if you have $500,000, it’s easier to take more risk because even if you lose 30%, you can make it back in a relatively easy time period. Further, you likely still want to build a larger financial nut.

I think you’ll be surprised that many some bond funds have done better than equities over the past 20 years.

The problem with the conventional model is that interest rates are at my lifetime low. I am 65 years old. When interest rates rise significantly people are going to get killed with 60% in bonds. This blows the conventional model (that I first saw when I was in college, and tried to live by for a long time) out of the water. With government spending and inflation going up, interest rates will eventually have to go up. Losses in bonds will be bad. As a result I have too much in Stocks, because I don’t believe in bonds right now. Then I have a lot in CDs and money markets but they are loosing value to inflation. I have asked many financial advisers why I should have 69% in bonds right now, and express my concerns. So far no one can logically support why I should be using the conventional model right now and be 60% in bonds. I would love others opinions here!

Sure. People have been afraid of bonds for the past 40+ years. Yet, bonds have continued to perform well ad we have become a more efficient and technologically savvy society with coordinated central banks.

Have you compared what bonds have done compared to stocks over the past 20 years? I think you might be surprised to learn how well bonds have done.

Here are some thoughts on why I think interest rates will stay low: https://www.financialsamurai.com/why-low-interest-rates-are-probably-here-forever/

At the end of the day, you’ve got to invest based on your beliefs and your risk tolerance. Don’t let anybody tell you otherwise.

I’m hoping that at age 65, you have enough to live comfortably for the rest of your life.

I agree with you Dayle. You buy a 10 year treasury at 1.3 percent, then give 40 percent away in taxes your left with .8 percent return and inflation is at 5%. If you buy bonds now you are guarantying a loss. I understand Sam’s point that bonds have done well over the last 20 years but at todays prices they simply do not make sense.

People keep saying how overvalued stocks are now but if the S@P earns $200 a share this year then stocks are trading at about 30 percent above historical averages. Bonds historically trade at the rate of Inflation. Even if you use a conservative 5% percent inflation rate right now that puts bonds trading at nearly 400% above their historical average. It is simply nuts to be buying bonds at these prices.

All that being said Sam’s “X factor” is more important than ever if you want to generate income.

I pulled out from all my bond holdings several months back. I’m about 15 years younger. It was about 20% of my asset allocation. My thinkin is the same as yours. I figure the yield I get just by having my money in an S&P 500 index fund is not far off from what bonds are paying right now. I’d rather wait until rates go further up in a couple of years before considering them again.

Very good article. I would say my current portfolio allocation is closest to the New Life allocation, although slightly more aggressive as I don’t have much in bonds. I’ve also begun my X-Factor work earlier than outlined, although I haven’t made a 5% financial commitment to it.

Side note – In the home ownership chart it shows that home ownership decreased from 2005 all the way to ~2015, well into the recovery from the Great Financial Crisis. I would’ve expected to see home ownership at least flatten in the early 2010s. A lot of wealth was created between 2010 to 2015, yet home ownership continued to decline. It makes me wonder if there are more individuals that have the financial capacity to purchase homes, yet make a lifestyle choice and don’t. We’ve seen an increase in home ownership since ~2015 as you point out due to credit scores recovering from the GFC, and presumably cheaper debt. But I wonder how big that contingent is of folks that have built wealth over the past five years and choose not to purchase, even though they can.

I have a friend with a net worth of roughly $100M, and he doesn’t own any properties – directly anyway. He currently is renting an East coast, West Coast and Tahoe house. And he just floats between them for business need and leisure. He said no reason to buy a house if he doesn’t need just one home base.

In addition to that I know several people in the DC area with incomes in the $250-500k range, and they all choose to rent as well.

So perhaps your thought process is correct.

Hello Sam,

Thank you for the great posts. In this one, I would suggest that you break out stocks and Bonds into Stocks and seperately bonds. This will be one of the largest determinates of success for your readers. This article highlight x-factor which can make millionaires and billionaires of some of your readers, but division between stocks and bonds will play as much real estate. Just a suggestion.

Thanks for the feedback. Although I have a section that explains the Stocks & Bonds column incorporates my stocks and bonds asset allocation by age recommendations from a previous post, I can see how you and other readers may have missed it in this very long post.

Therefore, I have added the three respective Stocks and Bonds allocation models to each net worth allocation section. Hope that is more clear for everyone.

Wow thanks so much for such a thorough article. This is so helpful! I’ve been overly weighted in stocks for a long time. And although I’ve benefited from the ride up, it’s time for me to diversify my allocation more especially now that I’m getting older and I don’t want all my eggs in one basket.

Being able to see your three different frameworks is really helpful too because I’m a visual person. I am going to try something close to your new life framework. Great name btw!

50YO, NW~$3M but about 2/3 is in a paid for home. Kids start college soon, planning to pay/cashflow 80%. Down to one income due to COVID. I could return to a regular job or I could tackle an X factor project (preferred) Any advice on does and don’ts? My take is, Bootstrap, don’t put assets at risk, target to replace previous income over 3-5 years, potential larger upside (blue bar on the color graph!) Alternatively, If striking out on my own I could buy an existing business and put at risk some of my current net worth (not ever going into debt again), or go 100% personal digital company where costs are minimal and it’s mostly my time investment, or somewhere in between, with the caveat that it doesn’t count to my net worth unless I can sell it. For our risk/lifestyle the Newco could never make money and we could probably retire comfortably with a rebalance into a cheaper primary residence. At age 50, would be interested in what you would do if you woke up in my shoes?

This is one of the best financial articles I’ve read in a long time. Thank you. One question though. When determining percentages of your net worth, how do you factor in retirement accounts? If someone’s net worth is heavily weighted towards retirement in 401k/IRAs that are built primarily out of mutual funds, does that mean you suggest diversifying those accounts so they’re more equally balanced across bonds, money market funds, etc? We’re heavily weighted in the stock category because of this, but unsure on how to reallocate into more real estate and risk-free areas.

Hi Sam, I’d really like to hear your thoughts on folks like me that have an unbalanced portfolio allocation. Currently, my wife and I have 90+% of our 401k in equities, 3x more than you! How does one go about a more balanced allocation when in this type of scenario when not having much flexibility with the type of assets in the 401k?

Without knowing what options you have within the 401k, it’s kinda hard to see your options wrt decisions inclusive of that program’s offerings. E.g., if the 401k has target date fund accounts and your are in a 2060, you’re probably at 90% equities. If the 401k offers other target date funds (one would assume so), you could shift or contribute to another offering that has a larger % bonds, such as a 2030 plan that is likely 65% equities/35% bonds. Either through future contributions or shifting your current holdings, that would begin to balance your allocation.

Alternatively, if you have no real controls or options within the 401k, ETFs such as AGG, BND, BNDX all offer excellent diversification within the bond segment. Buying those outside of your 401k in tax-advantaged accounts such as HSA or Roth or in non-advantaged accounts can help you diversify. Personally I’d say ‘no’ on the Roth — use it for potential high-reward plays, but that’s up to you.

Hello Everyone! I’m 22 years old, and I’m trying to figure out how to allocate my assets moving forward. Does anyone know if an emergency fund in a high yield savings account, counts towards the “Risk Free” column? Or since it is strictly for emergencies, should it be ignored when looking at asset allocation?

Yes high yield savings is risk-free category.

I wonder with interest rates low rising and the NAV able to fall on a bond fund, do you view bond funds as deserving the same allocation % as an actual bond one can hold to maturity?

Love your posts, and have read this specific one several times in the past. I realize your answer will need to have tons of asterisks associated with it, but am just curious – in the current US market, and pursuant to your note in this article on Bull Markets…would you generally recommend that people move money from stocks into bonds to ride out potential dips coming as there is a leveling from historic highs? Or would you leave money in current stock-based allocations? Total timeline/horizon before tapping into funds is 20+ years.. just trying to figure out how to juggle investments in this odd time.

Great articles Sam and thought provoking information, thank you. Curious about a statement above seemed to indicate equity in a primary residence was excluded in the model. While I agree that’s good conservative planning, home equity tax free profits have been an important, perhaps lucky, part of my growth. Bought home in San Jose in ‘09 for $560k, sold in ‘17 for $975k. This created a meaningful tax free profit to use for my next home purchase in Walnut Creek for $1.39 now valued $1.75. We have children raising in this home so *unfortunately* will likely exceed the $500k profit but are considering this when looking at primary residence planning. What are your thoughts on primary residence equity planning?

Feel free to count your home equity as part of your net worth. Just be conservative with the calculation.

Ive used Personal Capital for a couple years, as a suggestion from this site. I cannot express the value it brings as it really shows you what you have and your direction. The ability to link all of your assets and liabilities along with you spending has helped me cut unnecessary costs and dial in my direction.

I love all your posts Sam, they have truly helped me get closer to retirement.

Hi Gary, great to hear you’ve made so much progress! Let’s all pray that the coronavirus pandemic gets under control and that everything will get better over time. It’s more important than ever to stay on top of our finances!

Thanks for this article, I like breakdowns like this. I’m not sure if I agree for myself personally, particularly in this environment. I’m self-employed, I have only been investing since last summer since I learned about it. Povertyish (1-2x/fed limit- this year I’m at least 4x!!) until this past year, no regrets tho and a great lifestyle. I’ve gone from $0 net worth to $29k since 10/19 (it’s 7/20 now) so I’m pretty stoked.

I started late and feel ok to take more risk having a higher % of allocation in stocks, at least while I’m working on growth. My CoL is very low.

I don’t feel super confident in bonds in this current market. I also feel like keeping liquidity is good. I have my IRA from last year fully in ETF’s, about half foreign half US (small, large, emerging, REITs etc). I found out it wasn’t too late to open a SEP IRA for last year so I’ve got that 20% invested in gold and silver instead of bonds right now (in total, it’s about 10% of my total retirement accounts rn). Considering Mix of physical (mostly) and miners stocks/ETFs.

Also there’s a part of me that feels like I can get a higher RoR outside the market- my current plan is to keep cash on hand until I fund the retirement accounts each year. I have been doing bank bonuses for some years, and I’ve recently accumulated enough cash to start with Kickfurther, hoping to do some other opportunities like Groundfloor (I’ve only tiny money there, it’s been good so far), CrowdStreet, or even the Vinovest. The crowdfunding opportunities look good to me, more ability to choose? My REIT ETF has done terrible this year (still down 23%, yikes) so I’m hesitant on only it as a percentage of my RE. I live in my bf’s place and we are trending towards the M word, and he doesn’t want me to be responsible for paying off his mortgage (yes, I do contribute equally to household expenses and tiny amt rent. He’s close to paying it off anyway). So I don’t expect to have any of my net worth in any physical RE that I live in. I’d also like to have a small amount invested in crypto (<5%).

Also wondering if it's worth it or not to pay the extra $ to set up something with mysolo401k etc to include alternative investments, or to just keep with Schwab doing their version, and keep the alternatives in taxable accounts. We're not talking massive moneys but I guess every bit counts?

Solo401k is a terrific idea if your income is not of W2 kind

I was a 1099 contractor for defence industry.

Its fairly easy to setup

Open non-conforming account with Fidelity or other brokerage firms.

You pay no management fees.

You appoint yourself as a Administrator and a Treasurer.

You can invest in whatever you want, but the only limitation is no self dealing.

Another great benefit that you can contribute to your Solo401k much more than with the regular 401 k

Years ago when I contributed, I I coukd put away up to 54k

There is such a thing as a deffered compensation that makes this possible

I’ve always wondered about this statement (seen similar in other sites regarding 401k balances). “To start, the median 401(k) is hovering only around $100,000. The average 401(k) balance at retirement age 60 is only around $230,000. ”

Is this the combined 401k of a person across all accounts or just each account? A person changes jobs during his career and usually has multiple 401k accounts (or may have converted to an IRA). So wouldn’t his 401k savings (including those converted to IRA) actually be more than what this suggests? Thank you.

That is a good point. The average and median balances are based on Fidelity and Vanguard median and average balances per account.

So yes, the likely combined 401(k) balance per person is probably a little bit higher. However, I think most people will transfer the 401(k) to the new employer. For those who do not, they will roll it over to a IRA.

Since I started this site in 2009, I’ve received a lot of pushback from my 401(k) by age balance post, saying the numbers are too aggressive. But many of the same people 5 to 10 years later have said actually, they are just right.

What’s your situation?

The assumption that “most people rollover their 401(k) to their new employer” is a bit presumptuous.

I think there’s more likely three way even mix of (a) people who roll it over to the new employer, (b) people who roll it over to an self-directed IRA and (c) the people who have no clue and just leave it at the old employer because they can’t be bothered with a little paperwork.

To me the most adventitious is to do the self-directed IRA at a discount broker – so many more investment options available to insure your well-balanced portfolio.

It just makes more sense in the long run.

I’m glad you mentioned REITs. They’re especially useful for busy parents who want to get into real estate but don’t have the bandwidth to manage rental properties with a full-time job.

I’m not sure about the allocations. The stock allocation seem to be a bit conservative especially since people are living longer.

Also, historically downturns last only a couple of years then the market recovers (i.e., there are more good years than bad by far). So as long as people can stomach a couple of years of major losses, it seems like their portfolio should be fine.

REITs are a good alternative, however, REITs proved to be MORe volatile than stocks during the 1Q2020 downturn, so folks need to beware.

Do you consider the home equity the RE portion of your net worth or the full value of the home regardless of mortgage?

Yes. Although it’s good to value the equity conservatively.

Hi Sam,

I’m 51 and am very real estate heavy with just over $1.2 million in equity from 4 rentals and my primary home and have 200K in cash. I retired from the Army 5 years ago and receive two pensions (Army and VA disability, which is tax free) the two total 7K each month. I just started a Roth which I really will never have to touch with the pensions I receive each month. The rentals are all single families and always rent easily and total cash flow is $1500 a month in total. I live just outside Seattle. I am comfortable with them but I have been thinking of selling 1 or 2 in order to pay off 2. Any suggestions/advice is greatly appreciated.

Thank you

Big Sarge,

If you end up selling, let me know. I live outside Seattle as well.

MI,

Lol, you sound like a younger version of me!

I know if I sell, I will most likely regret it 3-5 years from now. As you know everybody around here is pushing south for affordability and the homes are in Yelm, perfect location for the military.

Thank you for your service Big Sarge. I’ve been hearing that the “rent to own” contracts allow for the owner to take a much larger deposit upfront and then rent it out for high prices. Typically, 90% of the time the renter doesn’t end up buying.

Hey Robert,

Thank you, it’s much appreciated. I have no idea about the rent to own subject. I have never looked into it and more than likely never will. I have property management. As I was promoted up through the senior levels I learned a very important aspect of leadership and business. “Keep one person between you and the task”. Property management is the way to go, especially when dealing w/multiple properties.

What’s your overall net worth?

If I had $1.2 million in real estate equity, my goal would be to have a total net worth of between $3 to 4 million.

Then again, you’ve got to do what’s most comfortable for you. As you pay off your real estate, the leverage decreases, and so does the risk.

Sam,

My overall net worth is 1.5 million. I know it’s more because of my life time pension, but it’s hard to factor in and put a value on it as the pension is for life. Like you I love real estate. I know I’m over leveraged on it, but I have a big cash reserve and made it through the real estate bust of 2007-2009 w/no issues of vacant rentals. I just started a Roth for both myself and wife that we will max out each month and won’t ever have o tap in to but will begin at mandatory age 70.

This is an excellent article for people to pay attention to regardless of their financial goals. Finding your net worth, keeping track of it, thats one thing. The underlying asset allocation and it’s actual risk tolerance is another. Warren Buffet once said, never lose money. This is very true the more you age where it becomes increasingly difficult to make that money back.

Really great insights in this post thanks! I’ve gone into savings mode for the rest of the year. My goal is to save up some cash to slowly deploy over the next 6-12 months, declutter my house, reuse as many things as I can, and only buy things that I need or that my kids will benefit from. The one minor snag is most of the donation places are still shut down so I’ve got boxes piling up. But it’s gonna be a great feeling when I can finally get them all out.

It always feels great to save up cash during times of uncertainty!

It also feels great to pay down mortgage debt and any type of debt there is.

We can almost treat this time. Like a game. Let’s make it fun and at the very least!

I just turned 50 years old expat living and working outside of USA, $2M in US real-estate investments fetching me cashflow of $5K per month. Saved $450K thru 401k+IRA mostly in 2030 vanguard retirement mutual funds. Zero debt. One kid starting college another two in middle school.

Should I be investing in alternative, stock and bonds? or stick to real-estate? I can save upto $5 to $10K per month depending on my work. I plan to work another 5 to 8 years. I spend over 20K per year on international vacations with family before kids go to college which I would like to continue.

It’s really what you’re most comfortable with. Stocks and bonds provide more passive income. However, stocks are much more volatile.

I think you’d enjoy these posts:

Ranking The Best Passive Income Investments

Why Real Estate Will Always Be More Attractive Than Stocks

The Proper Asset Allocation Of Stocks And Bonds By Age

I will share my situation. Nearly 30 years old with net worth of 110k.

I have 30k in stocks and 80k in cash. I intend to keep at least 50k as an emergency buffer.

I want to double exposure in stocks but seems not ideal in the current market. It may take a while, I thought of adding 1k every month, and more if market drops.

Maybe I will start to think about owning a house/appartment but right now, renting is the way to go for my situation. I also considered buying reverse mortgages as a “cheaper” way to have ownsership but I´m not an expert.

One aspiration would be, as others wrote as well, is to own several income-producing properties to retire early.

Newkid,

Did you take advantage of the stock market dip in Feb/March 2020? If so, that would have been an opportunity.

I retired 20 years ago at age 42. I own triple net commercial real estate and it’s paid the bills and allowed me to save other funds. In addition to giving me a good income, it’s gone up in value more than I expected which has caused my portfolio to be a bit lopsided:

Real Estate 80%

Stock 7%

Bonds 1%

Cash 12%

The stocks, bonds and cash are $600K.

I’ve been thinking of selling some of the real estate and doing a 1031 into DSTs to avoid tax and add diversification, but with the great cash flow, it’s just easier to do nothing.

i retired at the same age as you, but followed a different path to financial security… your approach appears to work well for you (especially if your real estate generates income through housing rentals – there will always be a need for housing no matter what market conditions exist [it’s local government that can make being a landlord unprofitable])…

we all have comfort levels… some folks need to spend $50,000 a month, while others are quite happy with $50,000 per year…

we’re happy to have no debt, enough money for any financial hardship, a roof over our heads, food on the table, but most important – good health… we swim 1200 meters in the morning, walk several miles each day, cook healthy and nutritious meals, don’t smoke, and tipple moderately… life is good!

it’s heartening to read here of folks doing well for themselves and exhibiting financial common sense

That is a very sensible approach to live off rental income. But I imagine the beginning might have been difficult.

My plan would be: pay rent and, (pay mortgage+rent property). That way, the mortgage would be paid with the rent and I may be able to go after the next property.

Worst case scenario: I would pay rent and mortgage. That´s why I would need spare cash.

Enjoy life!

Sam, I am 64 and retired. I will be selling the family house next Spring and will buy a house in a lower property tax location. After selling the house, my net worth will be $1.7 million.

How much house would you say I can afford?

I’m assuming my new house will be my last. I’m just looking for some directional input…

From experience, other advisers would just use maths on this one.

How much do you need to live the rest of your life till say 100?

Make sure you have access to that figure.

Balance goes on the house as a maximum.

Enjoy retirement :)

Chuck- I’m always interested in that question too!

From articles/comments that I’ve read before on Sam’s blog from past readers…I think 15-20% of your total net worth should be on your final housing. If you want to sleep at night….no mortgage obviously. So if your net worth is $1.7M- I’d only buy a $250-340K home. I’m curious to see what others think…

Sam- your advice?

Hello!

I am a young 28 year old attorney, and I have been working only for 2 years. Can you explain on what bases you would recommend following the base allocation or the new life allocation?

My net worth is currently about 71k (I payed my small student loan right away after I started working as first priority, and saved as a result more than $5,000).

This is my current allocation, and I would like to know if I should follow the base or the new life guidelines:

36k low risk (cd/yis, etc.) this is high as I want to save cash as a safety net and in wait for a market downturn.

7,5k real estate crowfunding

16,2k in Stocks

2k P2P lending

1,5k alternative investments

8k in 401k and ROTH IRA (I know this is low, my first job offered 401k and I was making contributions, but then I changed jobs and I could not make contributions anymore, then I got married and was not eligible anymore for Roth IRA contributions).

Thank you! I am from Europe, not from the US, but I learned much about this system and importance of savings through your website!

VS,

FinSam’s allocations are conservative for my taste, but they provide more stability and security in a volatile market. I would say invest based on your risk tolerance and invest what you can afford to lose. Here in the U.S. stocks, bonds, and real estate are three of the biggest investment vehicle investor rely on to achieve millionaire status and/or FI.

$27k per year isn’t enough? Where the hell do you plan to retire? Unless you are still renting or paying a mortgage at retirement age, that’s plenty to live comfortably, not in luxury, but you won’t be suffering either.

So, 27K per year? This is a VERY personal thing, this number.