I'm bullish on the housing market over the next decade. It's one of the reasons why I bought a new forever home in 2023 and have invested $954,000 in private real estate. I plan to keep on investing in housing, especially after Trump won the presidential election in 2024.

There is a structural undersupply of residential homes in America. Mortgage rates are also coming down after 11 rate hikes since 2022. There is pent-up demand for housing as people delayed their purchases since 2022. Finally, the economy is strong with a bull market in stocks.

In addition to my real estate fund investment, I'm buying San Francisco ocean-view rental properties as well. Real estate is one of the most attractive asset classes to build wealth in a low-interest rate environment.

For those thinking there will be a housing market crash any time soon, you will likely be disappointed. We're past the bottom of the real estate cycle with likely higher prices ahead. The economy is actually strengthening while the Fed has begun its multi-year interest rate cut cycle. Being long real estate is the right move in my opinion.

Reasons Why Real Estate Will Be A Solid Investment

In this article, you will read 16 reasons why the average homeowner will likely grow richer over the next decade. I have so much conviction in my housing market thesis that I've not only put my money where my mouth is. I've invested over $10 million in real estate so far.

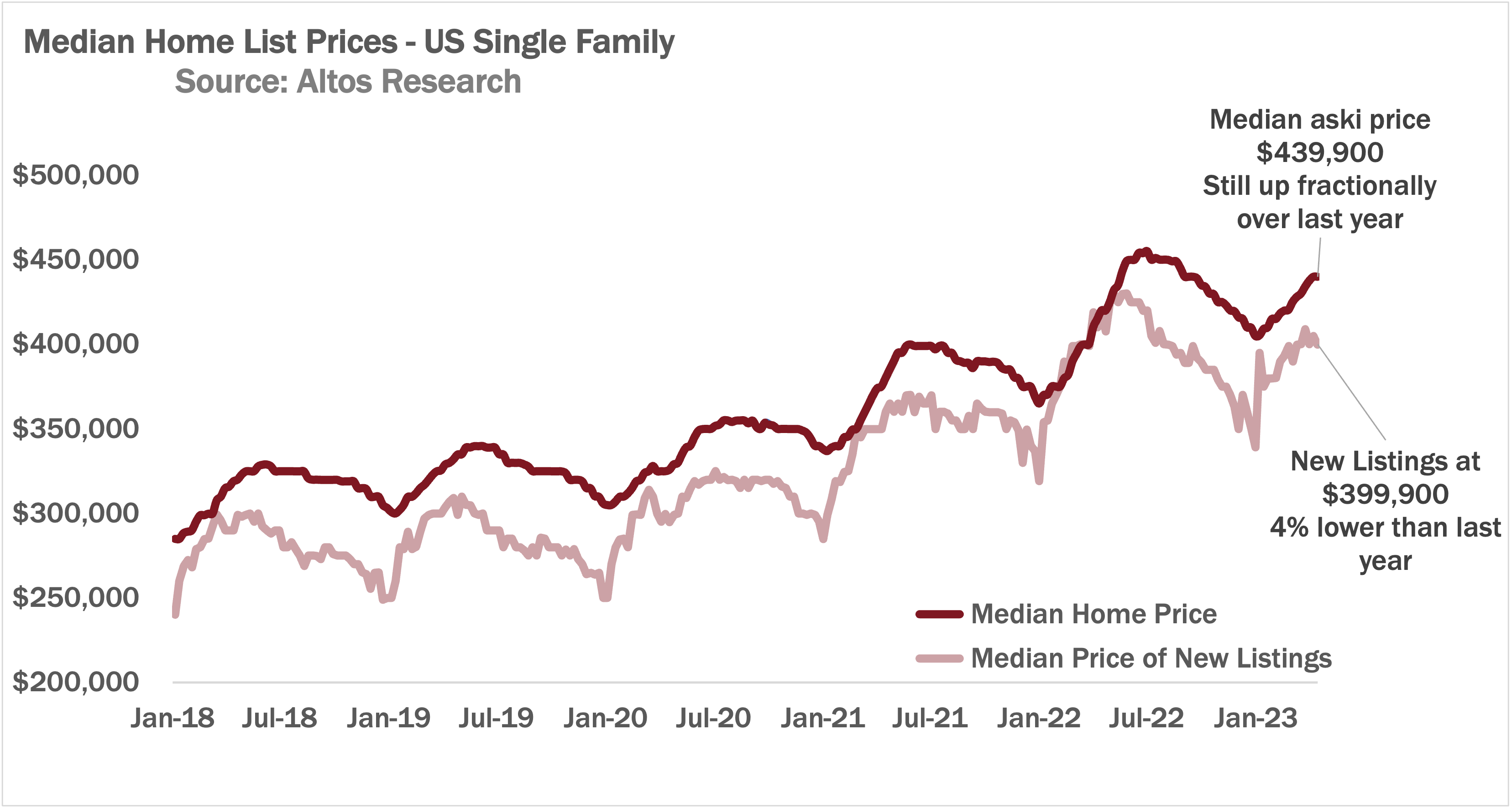

Yes, with higher mortgage rates, the demand for real estate slowed since October 2022. In areas where home prices went up 40%+ in two years, I can certainly see a 10% – 15% decline in prices. Austin, Texas is a prime example of a city that is correcting. However, this just gives savvy real estate buyers more opportunities.

Before I share all the reasons why the housing market won't crash any time soon, let me first share some more background so you know where I'm coming from. After all, we all have our biases, and I am positively biased towards housing.

Note: For those looking to leg into real estate, check out Fundrise. Fundrise offers private real estate funds that primarily investment in the heartland, where valuations are cheaper and net rental yields are higher. The minimum investment is only $10.

Brief Real Estate Background

Roughly 50% of my net worth is exposed to real estate. If I only owned stocks and real estate, real estate would account for a 60% weighting. My real estate portfolio consists of properties in San Francisco and Lake Tahoe, three publicly traded REITs, and a real estate crowdfunding fund focused on heartland real estate.

These assets generate roughly $150,000 a year in relatively passive income. If it wasn't for real estate, I'd probably still be working a traditional job.

I've been buying real estate since I first came to San Francisco in 2003 because I found valuations to be cheap compared to Manhattan real estate. I had worked in Manhattan from 1999-2001 and never imagined being able to find a 2/2 park-view condo for under $600,000.

I kept buying real estate because I also realized U.S. real estate was, and still is, cheap compared to international real estate. Working in international equities enabled me to explore various countries while working. And I always checked out the various local real estate markets while on business trips. Not only is U.S. real estate cheap on a global context, we also have jobs that make U.S. real estate affordable.

Take a look at the real estate statistics from one of our biggest foreign buyers, Canada. Cities like Vancouver and Toronto are equally as expensive as the most expensive cities in America. Yet, there are hardly any big Canadian companies that come close to paying as much as U.S. companies.

Go ahead. Try to name just three Canadian companies that pay new college graduates over $100,000 a year.

At the start of COVID in 2020, I encouraged readers to buy real estate through posts such as:

- How Are Real Estate Prices Impacted When Stocks Decline (March 16, 2020)

- Real Estate Buying Strategies During COVID-19 (April 19, 2020)

- The Best Near-Term Real Estate Buying Opportunity: Your Own City (June 2, 2020)

- It's Time To Focus On Big City Real Estate Again (Sept 8, 2020)

Finally, I followed my own advice and bought a forever home in 2020 and 2023. I put my money where my mouth is. Otherwise, there's no point talking so much about finances.

Reasons Why The Housing Market Won't Crash

For existing real estate investors, you should feel good about the risks you took to buy. It takes discipline to save up for a down payment. It also takes guts to buy a large asset with debt. My default recommendation for real estate is to hold on for as long as possible.

For new real estate investors, things are a little trickier. With elevated mortgage rates, a potential recession in 2024 or 2025, low inventory, and higher prices, you need to be careful running with the herd. Housing affordability is near an all-time low, which makes buying with a large mortgage more risky.

Getting into a bidding war where you're the only one out of 20 people willing to pay way over ask has its risks. The housing market won't crash any time soon. But, if you buy a property this way, it might not appreciate for years as the market takes time to catch up to your top bid.

Let's review some reasons why I believe the housing market will likely continue to stay strong for years. I assign a 80% probability the housing market will not crash (a 10% correction or greater) within the next three years.

I also believe with a 75% probability the housing market will average mid–single-digit YoY gains over the next 10 years. Single-digit YoY gains means that the pace of price growth should start moderating. If I'm wrong, then I will suffer the consequences as anybody with skin in the game does. And just to note, Goldman Sachs and Zillow believes home price will rise by low-single-digits in 2024.

1) Mortgage Rates Will Fall Back Down

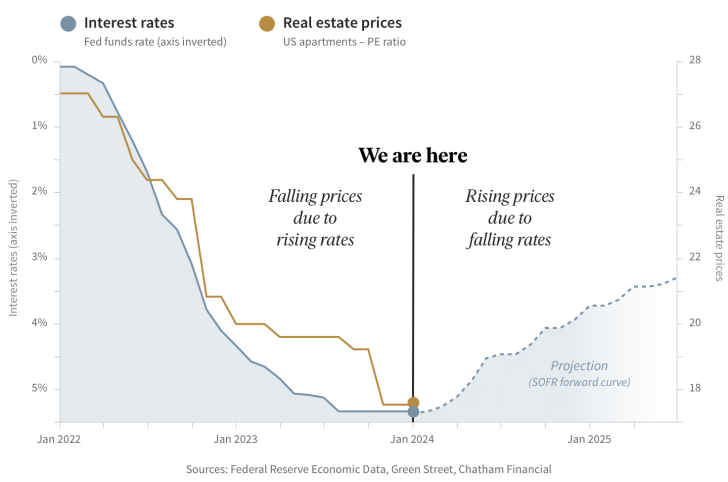

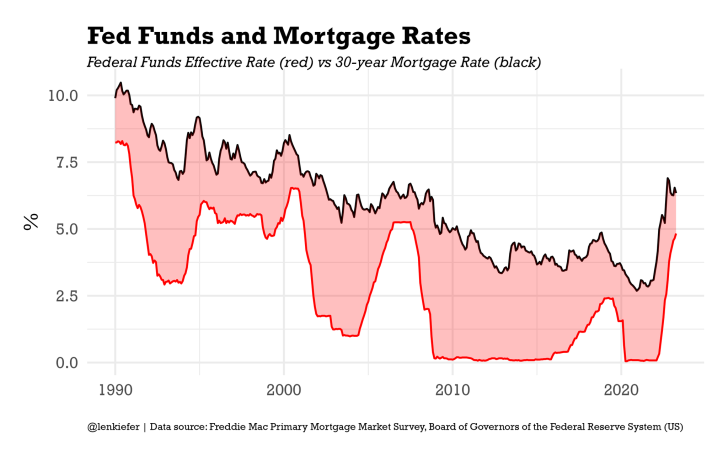

Although mortgage rates have come up from their 2020 bottoms, mortgage rates are now at 17-year highs. But looking at the 40+-year mortgage rate trend, rates should head lower by 2025.

Interest rates have been coming down since the 1980s thanks to information efficiency, technology, global coordination, and learnings from previous cycles. Productivity gains have also been massive over the years.

The average duration of homeownership is only about 11 years. There's no need to pay more interest than you need to. It's much better to take out an adjustable rate mortgage with a lower rate than a 30-year fixed rate. Matching the fixed rate duration with your ownership duration makes sense.

With negative real mortgage interest rates, homeowners are essentially borrowing free money. On an inflation-adjusted basis, homeowners are actually getting paid to borrow money. As a result, there will be continued strong demand to take out debt to buy real estate.

Now the the Fed is cutting the Fed Funds rate, there should be downward pressure on mortgage rates until around 2026.

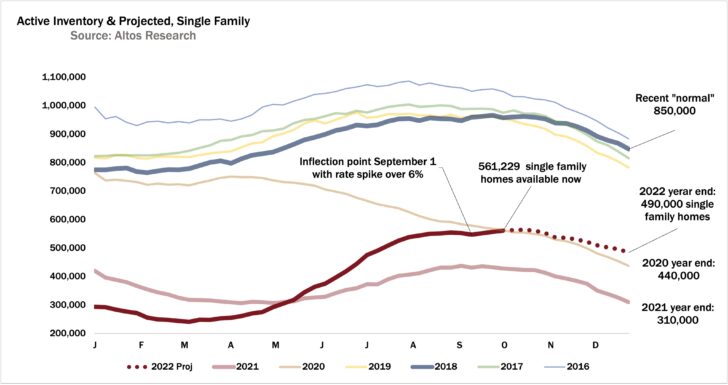

2) Inventory Will Remain Depressed For Longer

COVID has permanently increased the intrinsic value of real estate. When billions of people began spending more time at home starting in March 2020, the appreciation for a home's utility went up. Not only were homes protecting homeowners and their children from COVID, they provided a safe place for millions to play and work as well.

During perilous times, we hold onto what we treasure most. This is why real assets like homes held their value while stocks crashed 32% in March 2020. Unlike a home, you don't need stocks to survive.

Given how much homes have given homeowners since the pandemic began, the tendency is to hold onto our homes for longer. You don't get rid of things you love and use every day. You cherish them. Besides, what if there’s another pandemic or random disaster?

Homeowners also know that if they sell their home, they will have to compete against other homebuyers who want what they already have. Further, when 90% of mortgage holders have locked in a mortgage below 5%, they will want to hold on for longer.

With lower inventory for longer, rising long-term demand will continue to put upward pressure on home prices. With most homeowners locking in mortgage rates below 4%, selling and getting a higher mortgage rate doesn't make sense. As a result, both supply and demand are muted.

3) Potential Homebuyers Are Richer Post-Pandemic

The current potential homebuyer is likely much richer today due to a rise in stocks. The S&P 500 returned 16% in 2020. The NASDAQ returned 43% in 2020. Practically every single stock index went up in 2020. 2021 was another great year for stocks.

Too bad 2022 erased a lot of gains. But 2023 was another positive year followed by a strong 2024. There have been wild swings all over the place in 2025, but look at how much the markets rebounded as of May. Now, there is tremendous wealth creation in artificial intelligence. You want to be buying companies with AI exposure or AI companies as a hedge.

Further, the current potential homebuyer likely held onto their job during the pandemic. As a result, there was little-to-no income disruption as millions of people worked from home or found ways to make money from home.

Take a look at your own stock portfolio and net worth since January 2020. Chances are high you are up at least 20% since the start of the pandemic.

With more wealth from stocks and day job income, the buying power of homeowners has increased. With stocks continuing to go up and unemployment levels continuing to go down, homeowner demand will continue to increase.

4) Domestic And Foreign Institutional Demand Is Increasing

There is a clear increase in demand no from institutional real estate investors for rental properties. With a decline in interest rates, investors everywhere are looking for higher-yielding investments. We're not only seeing investors bid up real estate prices, but dividend stocks, and cash cow online businesses as well.

Technology has also made real estate syndication deals much easier to form. Capital raising is more efficient. Doing research online is easier. Signing documents and transferring funds is no longer a headache. As a result, institutional real estate funds are only going to get bigger, not smaller. More capital brings more competition.

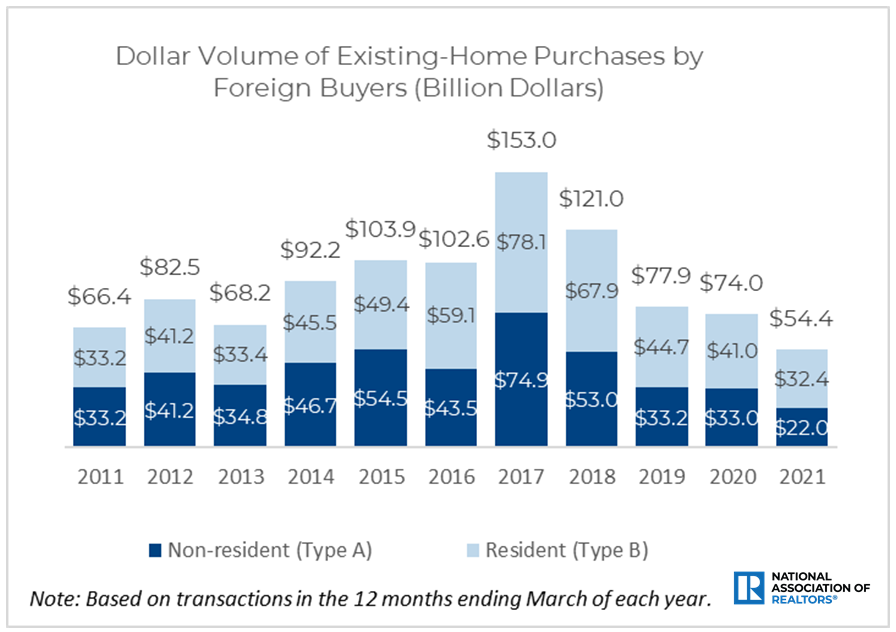

The next uptick in demand will come from foreign institutional investors who buy up cheap American property. COVID helped serve as a throttle in 2020 and 2021. However, that throttle will soon be released. Foreigners are also hungry for yield. They have also experienced record-high stock prices while also amassing pent-up savings.

If Americans don't buy our own homes, foreigner real estate investors will buy our property for decades to come. Be forewarned. Foreigners will once again start buying up properties in international cities like San Francisco, NYC, Los Angeles, Seattle, and Boston.

But they are also getting smarter about heartland real estate as well. Americans have the head start. Be that as it may, foreigners aren't far behind.

The U.S. housing market is cheap on a global context. The main reason why Canadians are consistently the number one buyer of U.S. real estate is because they recognize this fact. If the U.S. housing market were to turn into the Canadian housing market, prices could go up by another 30% – 70%!

5) The Federal Reserve And Federal Government Are Pro-Homeownership

Never fight the Fed or the Federal Government. If you fight the Fed, you will end up losing a lot of money. If you fight the Federal Government, you will likely get fined or get thrown in jail.

Given the Fed and the Government are pro-homeownership, it is only logical to invest in real estate. President Biden and Congress have clearly signaled their willingness to spend an endless amount of money on stimulus spending.

Besides the implicit support from the Fed and the Government, we have favorable real estate laws in place:

- Mortgage interest deduction

- $250K/$500K tax-free profits

- Programs for first-time home buyers

- Mortgage moratoriums

- 1031 Exchange

- Historical bailouts of homeowners and big lenders

- Raising interest rates and creating more renters to boost rents

If you want to make money in real estate, you must put any negative beliefs aside about the Fed and the Government. Be politically agnostic and face reality.

Most of the time, the people who are most vocal against real estate are the ones who cannot afford to buy property, sold property at the wrong time, or didn't buy property when they could have.

For some reason, some people against real estate aren't able to accept that people who buy real estate also buy stocks and other assets as well.

6) Demographic Tailwind, Undersupply of Housing

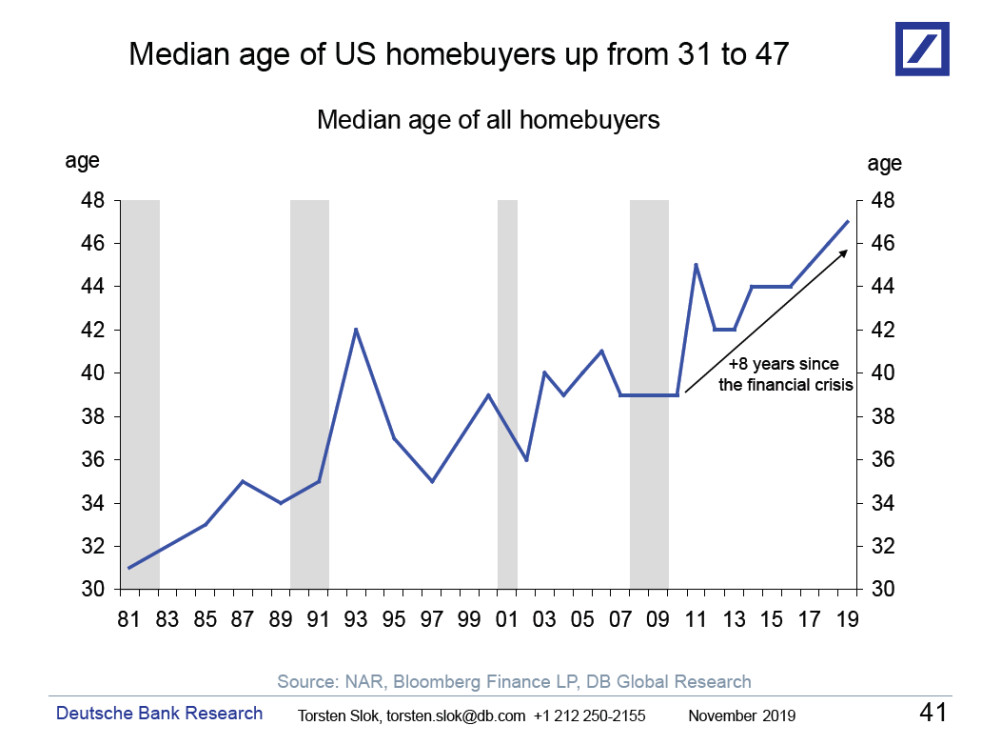

Fannie Mae estimates there are 88 million people in the millennial generation. This is the highest number I've ever heard reported of people born between 1980 – 1999. The millennial generation definition seems to be getting larger. But, the point is there is a huge population of 22 to 41-year-olds who are in their prime home-buying years. All the previous talk of the millennial generation renting for life is turning out to be BS.

A good life tends to be the same as it ever was for most people – find a partner, own a home, start a family, work hard to provide for your kids, retire with a paid-off home, etc.

Millennials have been late to the home buying trend due to more education, more student debt, delayed unions, and more competition. But for the past 5+ years, millennials have been the largest percentage of buyers. This trend will likely continue for another 10+ years.

As an investor, it's generally a good idea to invest in long-term trends. Positive demographics are a long-term trend worth riding. Once you invest in a positive trend, you don't have to worry as much about the minutiae. You just need proper exposure.

Check out how the median age of US homebuyers continues to increase over the past decade. Thankfully, the median life expectancy is also increasing.

7) Multi-Generational Wealth Transfer

The Boomer generation (born 1944 – 1964) is one of the wealthiest generations in history because Boomers have been able to invest in the longest bull market in history. As a result, Boomers have an estimated $30 trillion in wealth they will be transferring to their children when they die.

However, given how rich the Boomer generation is, they will likely transfer more of their wealth while still living in order to enjoy the benefits of their giving. The revocable living trust business is booming with the Boomers! My estate planning lawyer can't keep up with the demand and now takes forever to respond to my e-mails.

We are seeing an increasing percentage of parents buying homes for their adult children. Now we are seeing parents and grandparents buy homes for their little children or grandchildren decades before they need independent housing.

With the estate tax threshold likely to decline from a record-high $12.99 million per person in 2025, more rich parents will spend down their estates to avoid a 40% death tax. Further, more Boomers will start regularly giving $19,000 a year in gift-tax exclusion per person. More GRATs will be set up to avoid estate taxes as well.

The tsunami of inheritance money will inject more capital into real estate, stocks, and other asset classes. Younger people are more motivated to invest. Younger people also want to see what type of wealth they can build on their own. In contrast, older people are more set in their ways, especially when they already have everything they need.

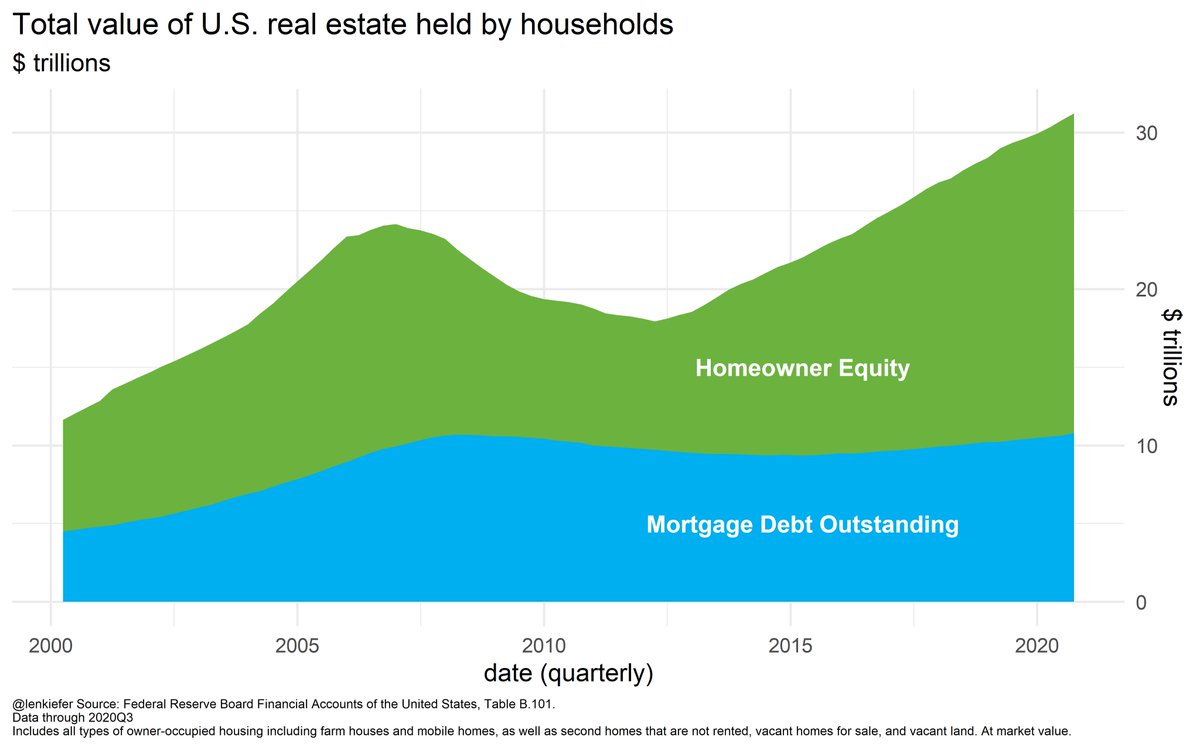

8) Homeowner Equity Cushion Is Massive

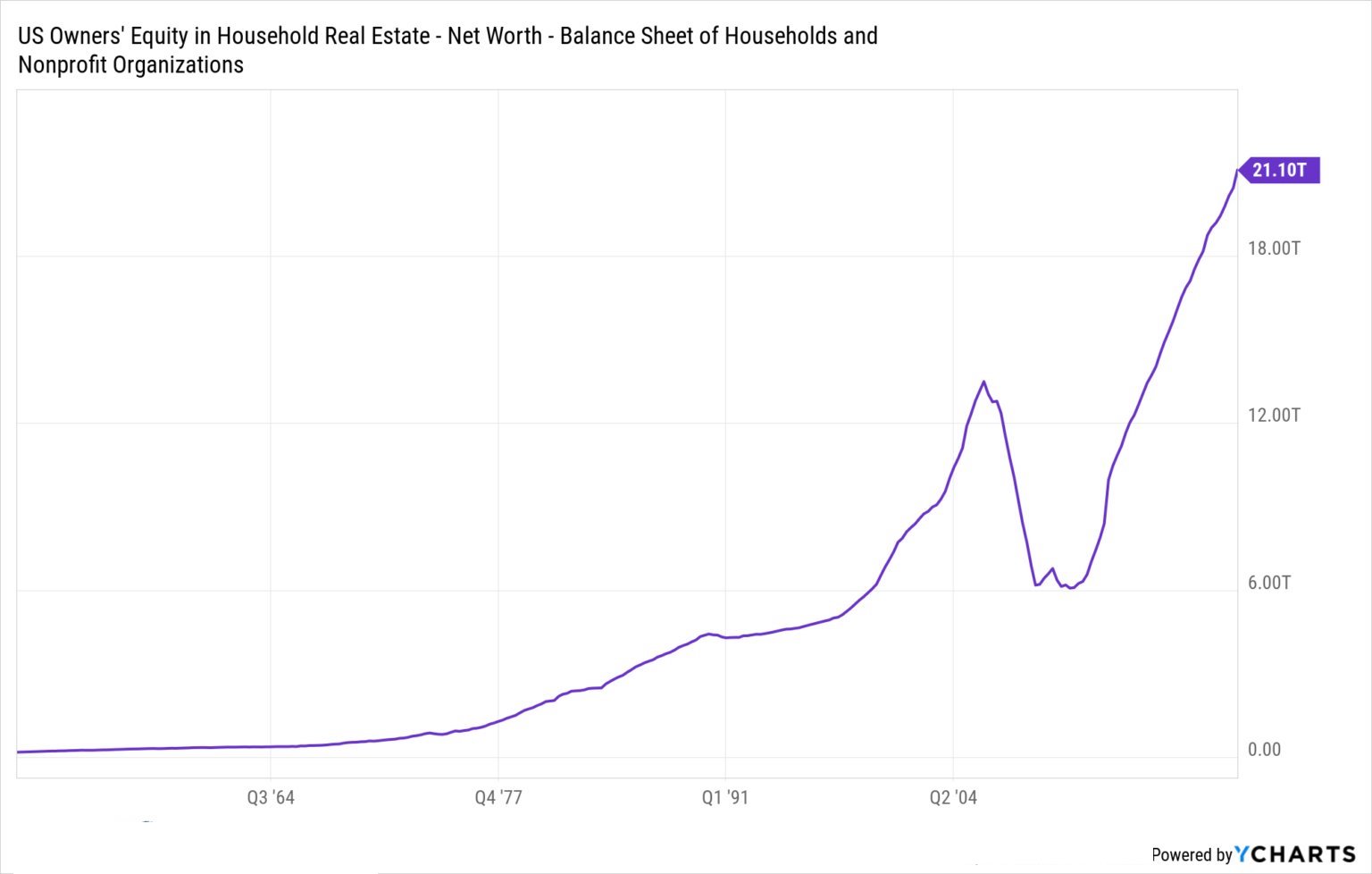

Take a look at the homeowner equity and mortgage debt outstanding chart below by the Federal Reserve Board. The data is as of Q32020 and homeowner equity has continued to grow since then.

Homeowner equity was roughly $21 trillion versus $11 trillion in mortgage debt outstanding. With so much homeowner's equity, there won't be a housing market crash any time soon.

$21 trillion in homeowner equity with $11 trillion in debt is like having 65% equity in your home and a loan-to-value ratio of only 35%. Most first-time homebuyers put down 10% – 20% for a loan-to-value ratio of 80% – 90%.

If you have 65% equity in your home, your equity buffer is so large that you will likely never have to fire-sale your home through a foreclosure or short sale. You will do everything in your power to find ways to keep paying the mortgage to keep all your home equity from going to the bank.

In fact, with so much home equity, it is more likely the typical homeowner will take out a home equity line of credit (HELOC) to buy more property or consume more goods. Many homeowners are investing in public REITs and private eREITs through Fundrise to take advantage of the real estate trend.

If you have been a homeowner for longer than one year, just ask yourself whether you'd ever sell your home at a discount as the economy opens up. Of course not. You are going to enjoy your property and hold on to it for as long as possible.

Below is a another chart that highlights US owner's equity in household real estate.

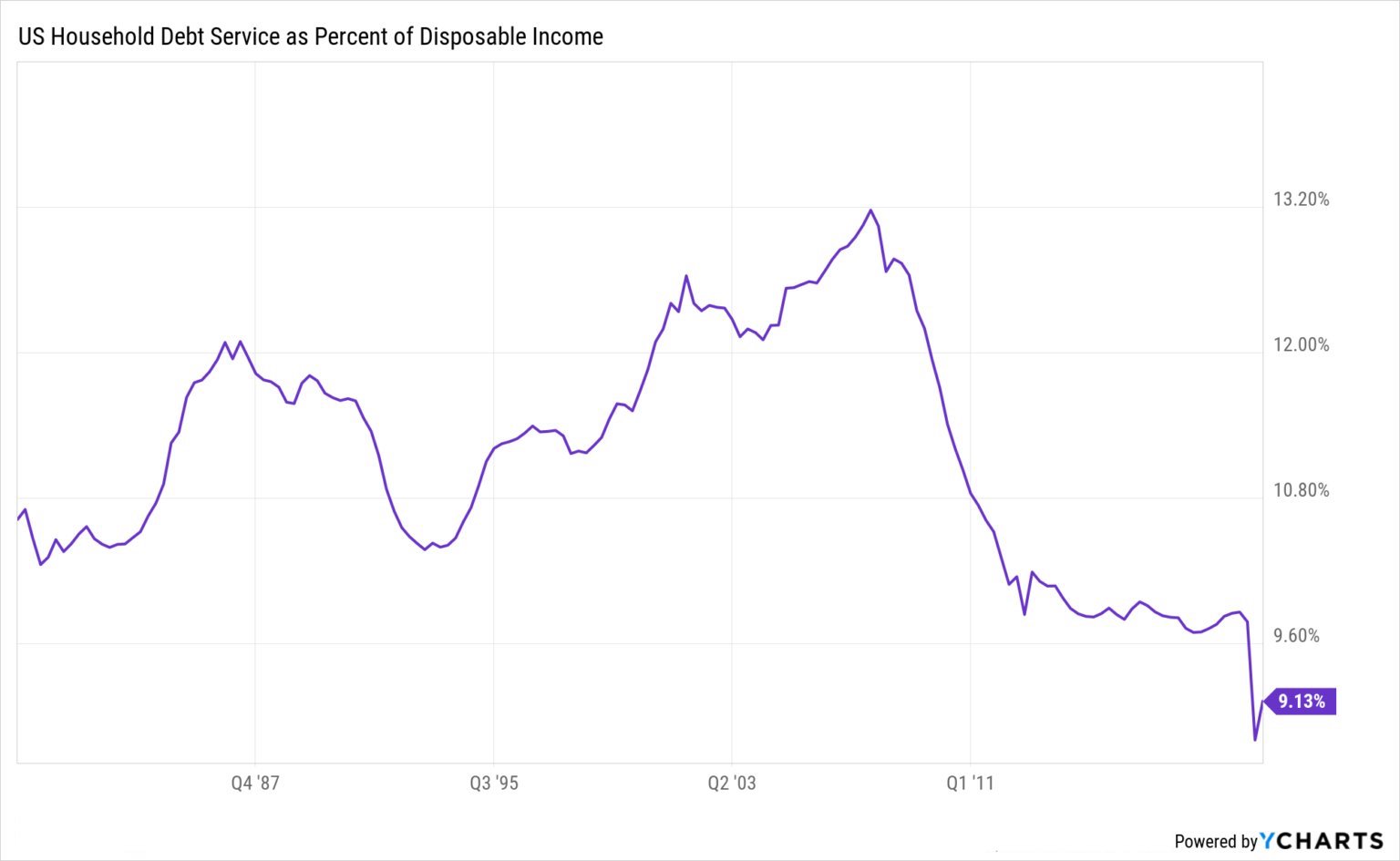

9) Household Debt As A Percentage Of Disposable Income Is Low

As long as a homeowner can service their debt and pay property taxes, the homeowner will never lose their home. Given it's been much harder to get a mortgage or refinance a mortgage since the Global Financial Crisis, homeowners have had to increase their down payments. As time went on, incomes increased, homeowner's equity increased, and mortgage debt decreased.

Today, we find ourselves in a scenario where U.S. household debt service as a percent of disposable income is at its lowest level for over 50 years. Part of the decline most certainly has to do with a continued drop in interest rates.

For example, when my wife and I refinanced our old primary residence in 2019, our mortgage payment dropped to about $2,850. Back in 2005, our mortgage payment was $6,500 for another house we owned.

If we adjust the mortgage amount to be the same as the mortgage we had in 2005, our mortgage would be about $4,300. Millions of homeowners are now much wealthier since 2009, yet are paying less to service their debt. The average tappable home equity is huge.

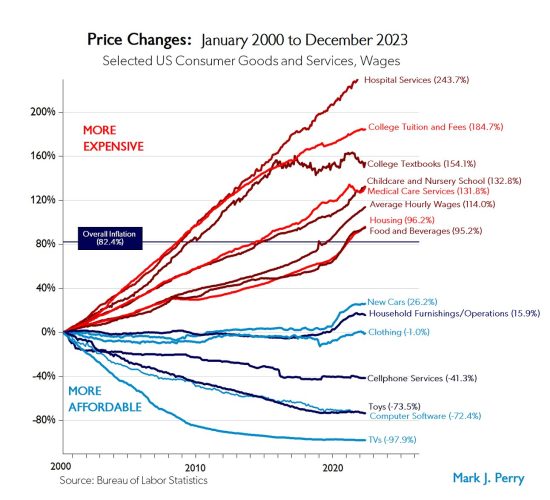

10) Moderate Inflation Is Good For Real Asset Prices

Real estate is one of the best inflation hedges given housing costs are a key part of inflation Inflation whittles down the real cost of debt. Further, inflation acts as a tailwind to boost rent and property prices.

With the latest inflation print and the current average 30-year fixed rate mortgage, borrowers are experiencing a negative real mortgage rate! When you have negative real mortgage rates, you want to responsibly borrow all you can to buy a real asset that will benefit from inflation due to rising rents.

If possible, an inflation investor should go long healthcare, higher education, and real estate. Too bad none of us can buy private colleges that raise tuition by 7% a year! But at least we can buy healthcare stocks that gouge us every month, a primary residence, rental properties, and stocks.

The main reason why most of us work so hard and invest is so that we can afford a comfortable home, provide for our children, and one day retire without financial worry. Housing is a core part of inflation.

If you can invest in real estate that not only provides shelter, but also appreciates in value over time, you're winning. The housing market is a beneficiary of inflation. Renters are going to continuously get squeezed by rental inflation. As a result, more renters will decide to buy homes.

11) The Amount Of Funny Money Is Exploding

Every 40+-year-old investor learned his or her lesson from the 2000 dot com bubble. When you've had a multi-bagger homerun in names like Tesla, Bitcoin, and more, you convert some of those funny money gains into real assets like real estate. You most certainly do not roundtrip your Pets.com and Webvan stocks to zero!

As the mania for crypto, NFTs, Reddit YOLO stocks, and growth stocks rages on, more money will smartly find its way into the housing market for diversification.

At the end of the day, these huge gains will be converted to buy things that improve the quality of an investor's life. In other words, real assets like real estate, art, wine, cars, and so forth. Otherwise, it's all kind of pointless.

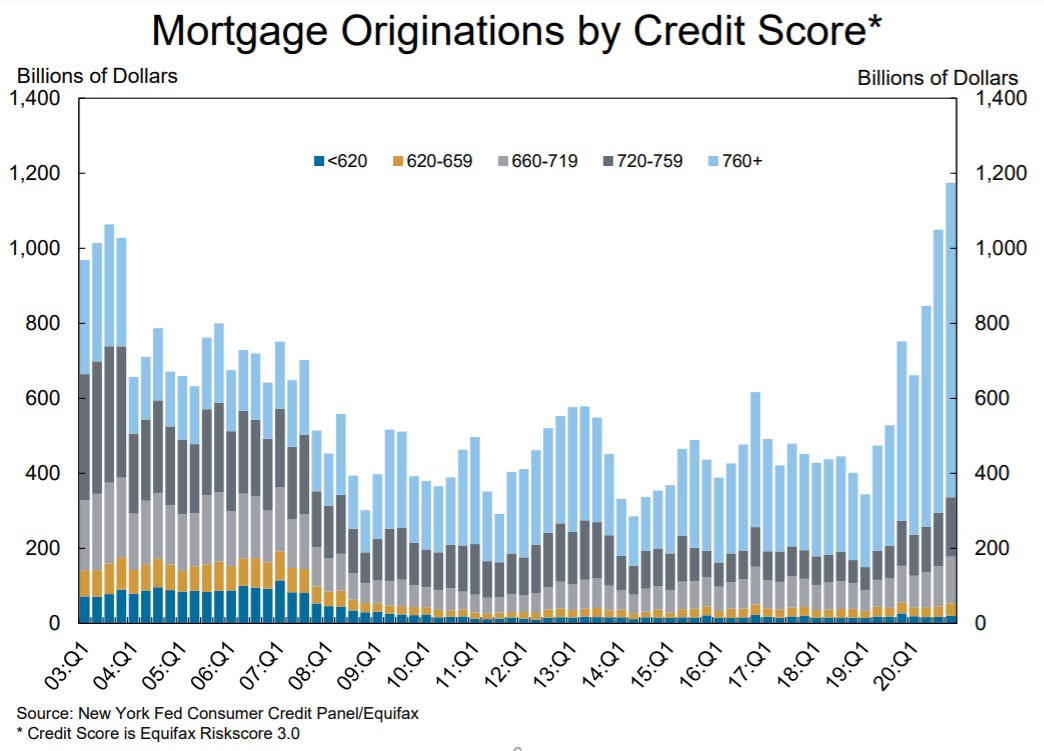

12) Credit Is Still Very Tight

When the dotcom bubble burst in 2000, real estate began to outperform until about 2H2006. That is when the euphoria hit its peak as banks lent to anybody with a pulse. Thankfully, lenders were forced to raise their tier 1 capital ratios and lend much more prudently since the 2008-2009 Global Financial Crisis.

Nowadays, only people with high credit scores and solid financials can get a mortgage. When I refinanced my mortgage in 2019, Citibank and Wells Fargo would only give me the best rate if my credit score was above 800. When I took out a new purchase mortgage in 2020, Wells Fargo required an 800+ credit score again.

During the 2020 crunch, the mortgage industry was very tight. There was a point where HELOCs and jumbo loan refinances were restricted, even to existing customers. Further, going through the underwriting process took a month longer than average.

Take a look at the mortgage originations by credit score chart below. Notice how anybody with under a 660 credit score has essentially been shut out from getting a mortgage or refinancing a mortgage since the GFC. Further, the percentage of borrowers with a 760+ credit score has increased.

It's hard to see the housing market crash when predominantly high credit score borrowers with huge homeowner's equity have been buying since 2008. Just look at the 1Q2009 blue bar compared to the latest blue bar. We're talking a 5-6X difference!

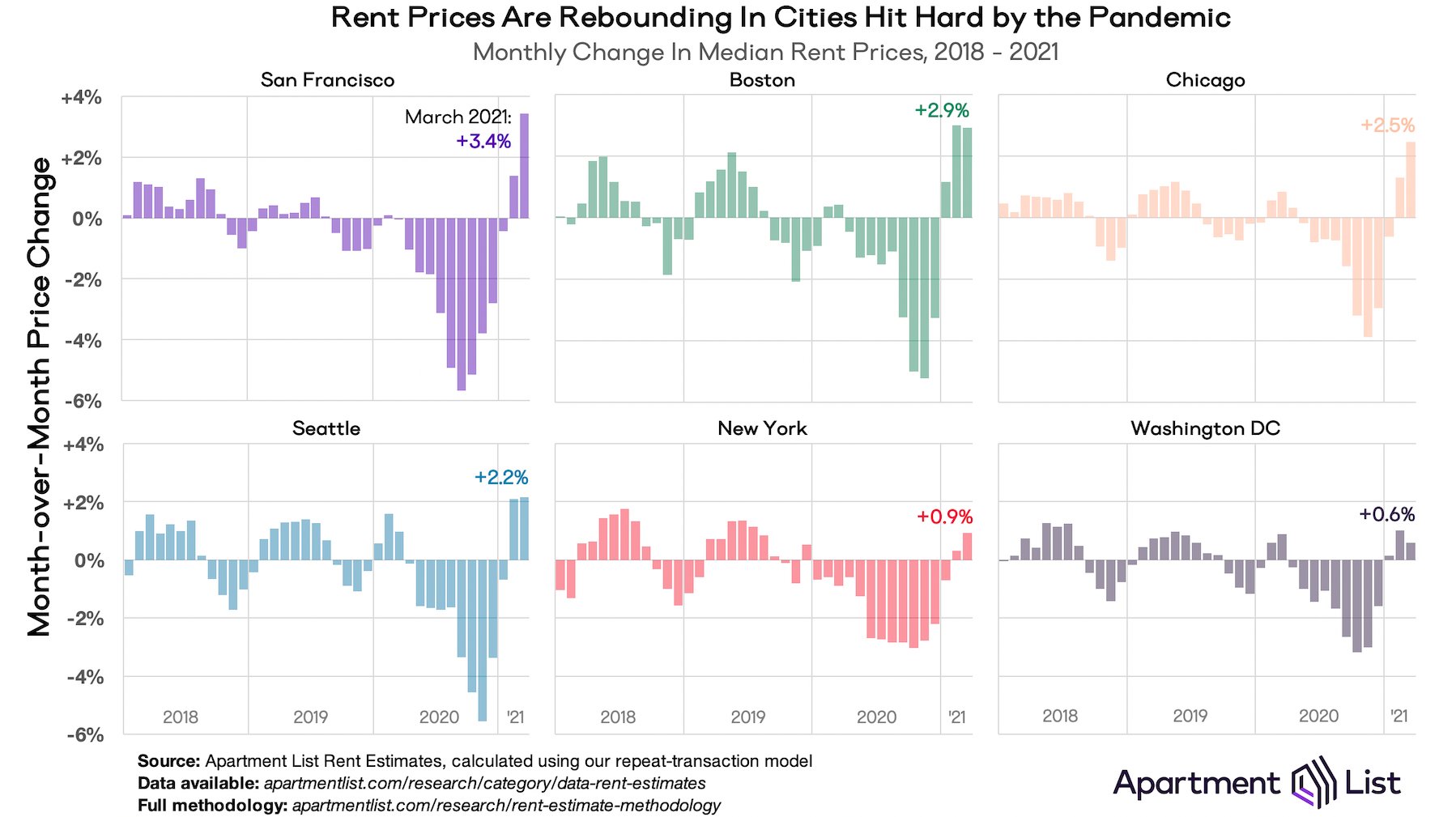

13) Rents Rebounded In Big Cities

One of the reasons for housing bubble concerns is that cap rates compressed to unattractive levels. As a result, a lot of capital flocked towards 18-hour cities where cap rates are higher. At the end of the day, a home price cannot keep going up indefinitely without rental price growth.

During the pandemic, we saw rental price compression in some of the most expensive cities in America. However, rent prices are now rebounding and will likely continue to rebound as people come flocking back. A continuous rebound in rent bodes well for home prices.

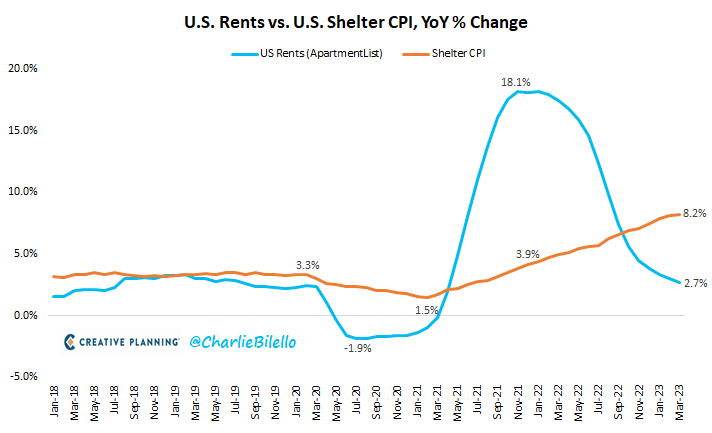

Besides big city rents going up, national rent growth had been accelerating. Ultimately, the value of a property is based on a multiple of its rental income. As a result, rising prices are supported by rising rents nationwide.

Here's another rent growth chart for good measure. Rent growth has slowed since 4Q 2022 and will help bring down inflation. More people are renting, ironically, because of higher mortgage rates.

Related: Rising Rents, Rising Fortunes For Landlords: But Is It Fair?

14) The Cost To Build Housing Is Rising

You may have heard that lumber prices are up 3X in one year as demand outstrips supply. Therefore, framing costs to build a house are up at least 2X as lumber accounts for 70% of framing costs. To build a new 2,000 sqft house, framing costs might be up $70,000 – $100,000. There are supply-chain shortages in many finished products as well. Expect delays.

Thankfully, lumber prices have cooled off as supply constraints normalize. That said, prices are still up double-digits from 2019 after the roundtrip in lumber prices in 2021. Remodeled home should sell for bigger premiums going forward due to the difficulty to remodel nowadays.

Then we have a construction labor shortage that is causing wages to rise. My contractor told me he is paying his subcontractors 50% – 100% more per hour than when he did a project for me in 2015. I don't doubt his word because I've been using one of his workers to do some side work for me over the years.

Finally, it is now tougher than ever to get a building permit in some cities due to the rise in home remodeling activity. Planning and Building departments are backed up. I've been waiting to get my within-the-envelope permit approved for close to four months now. What a waste of time.

The increase in cost and time to build or remodel a home makes a home more valuable. At the margin, new or newly remodeled homes will likely command a larger premium than fixers.

Note: You should re-shop your homeowner's insurance policy. With the cost of building a home going up quickly in the past couple of years, your homeowner's insurance policy is likely not enough. Check and compare the latest rates with Policygenius for free. Not only might you save money on your policy, you'll rest easier knowing you are properly covered.

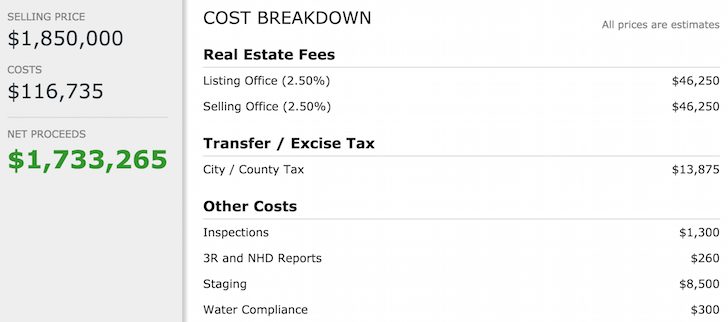

15) Selling Costs To Sell A Home Are Still Too High

If the cost to sell a home dropped to $0 like stock trading, I'm certain there would be a lot more supply of homes for sale. However, many realtors are still able to charge a 5% – 6% commission to sell a home despite the internet. Therefore, the real estate industry is self-throttling, which is actually beneficial for homeowners who never sell.

In addition to high real estate selling commissions, there is also the cost to prepare the home for sale. Potential costs include painting, refinishing floors, painting, changing fixtures, repair, and staging. Then there are transfer taxes, recording taxes, and potentially capital gains taxes to pay.

Here's a sample table of the cost to sell a home.

It took the previous owners of our home four months and ~$150,000 to get the home ready for sale. They put on a new roof, finished all the floors, painted the inside and outside of the house, changed many windows, replaced a couple decks, fixed a leak, re-did a ceiling and a wall, and landscaped.

As a buyer and experienced home remodeler, I loved knowing this and seeing the before and after pictures. It meant I didn't have to go through any of that.

Given all the costs and time required to sell a home, you have to be really motivated if you want to sell. Selling during a pandemic is just another hurdle. Therefore, perhaps pent-up supply is coming once there is herd immunity. However, unless selling costs go down, the vast majority of homeowners would rather hold on.

The cost and time required to sell a house makes panic-selling much harder. Therefore, the likelihood of a housing market crash is also lower.

At the same time, there was a blockbuster settlement on price fixing with the National Association of Realtors. As a result, real estate commissions should decline by 1% – 4% on average over the coming years.

Given the decline in real estate commissions, all residential property holders are now richer. Homeowners get to keep more of their home equity when they sell.

16) Potential Long-Term Capital Gains Tax Hike

President Biden wants to raise the long-term capital gains tax rate from 20% to 39.6% for households who make over $1 million. If you are a long-time homeowner sitting on more than $1 million in capital gains beyond the $250K/$500K tax-free profit exclusion, then you may end up holding onto your home for longer. As a result, home inventory should decline.

It’s already difficult enough to move out of a home you’ve lived in for 40+ years. Why would you then sell it to pay a 43.4% capital gains tax (includes the 3.8% Net Investment Income Tax)? Instead, it's best to hold onto your gold mine forever and pass it down to your children when you die.

With lower housing inventory due to a higher capital gains tax rate, housing prices should continue to stay elevated. Thankfully, Biden hasn't gotten his way yet for higher income tax rates and long-term capital gains tax rates. There will unlikely be any capital gains tax hike now that Trump will be president in 2025.

17) Higher Conforming Loan Limits Improve Affordability

The Federal Housing Finance Agency (FHFA) increased the conforming loan limit for 2022 by an astounding 18% to $647,200, up $98,950 from 2021’s limit of $548,250.

In higher-cost areas, the new loan limit increases to $970,800, or 150% of the baseline loan limit. This ceiling applies to residents of Alaska, Hawaii, Guam and the U.S. Virgin Islands, as well as areas in which 115% of the local median home value exceeds the baseline conforming loan limit.

These record-high increases are great for homebuyers because conforming loan rates are generally about 25 basis lower than nonconforming loan rates. As a result, housing demand, especially for homes priced up to 120% of the conforming loan limits should remain high.

18) War Is Making Real Estate More Attractive

Sadly, Russia's invasion of Ukraine has made people look towards owning more hard assets like real estate and gold. Gold prices in 2024 are at 5-year highs given more people are looking for protection.

Bond prices move up and mortgage rates go down as well. As a result, real estate becomes a highly coveted asset class during times of war. I really hate that I have to add this 18th bullet point about real estate. But war reminds us about the importance of owning hard assets instead of funny money.

Best Time To Get Into The Housing Market

With all the bullish reasons to get long the housing market, when is the best time to enter the housing market? I can think of four situations:

1) When You Can Afford To

I've made a case the best time to buy property is when you can afford it. In my opinion, you can only comfortably afford property if you follow my 30/30/3 rule. For those of you in more expensive metropolitan areas, you can stretch to buy a home equal to 5X your household income, but no more.

If you do stretch to 5X, you had better be bullish about your career. If not, you will likely have some sleepless nights for the first couple of years until your savings coffer gets refilled.

2) During The Winter

If you're looking for the best time to buy property during the year, the answer is during winter. Sellers who list their homes during bad weather and holidays months are usually more motivated. If they weren't motivated, they could simply hold off for several months and list in the spring.

I think the best time to upgrade your home is coming in the next 12-18 months.

3) When The Moratoriums End

The other potentially good time to buy property is when the mortgage and rent moratoriums end. The idea is many homeowners who are behind on their mortgages may have to foreclose or short-sale because they cannot afford all the back pay.

If banks are smart, they will simply tack on the back pay to the overall mortgage balance. This way, the homeowner gets to pay only a slightly higher mortgage amount each month. The lender also still gets paid with interest. Everybody wins. But, investors need to prepare for illogical legislation or moves by lenders by building up a cash hoard now.

However, institutional investors and retail investors are also waiting for such an opportunity. Hence, competition will likely continue to be fierce. Also, watch out for foreigns institutional investors flooding back in to the U.S. market.

For example, Fundrise, my favorite real estate crowdfunding platform, has been aggressively buying single-family properties. They run about $3 billion in assets under management and are vertically integrated for better efficiency and cost savings. Therefore, I'm happy to put my money with them so they can do the work and make the returns for me.

We also saw news in April 2024 that Blackstone is paying $10 billion for a new multifamily property in Miami, Florida. That is massive! The institutional real estate funds are putting their capital aggressively to work again.

4) As International Economies Open Fully

Perhaps the best opportunity to enter the housing market is when people start traveling in droves. With more people traveling, there should be less competition. Travel today is back to pre-pandemic levels. However, the rush of foreign buyers isn't as prominent yet with China's capital restrictions and the war still going on in Russia and Ukraine.

The reality is that there are always good real estate opportunities if you look hard enough. Some properties are mis-priced and go stale-fish. Some properties are listed by an out-of-town agent without the proper marketing skills and connections.

You might also be able to get a deal if you send a real estate love letter or knock on a home that's looking to be prepped for sale. That's what I did in 2019 and it worked like a charm.

Real Estate Will Always Be A Core Holding

To get over your real estate buying fears, think in generations. What will your kids and grandkids say about the property you buy today? Chances are high that in 20-40 years they will be amazed at what a good deal you got. Inflation is too powerful of a force to combat. It tends to sneak up on you.

A savvy investor rides the inflation wave. Just like how it's not a good idea to short the S&P 500 long-term, it's not a good idea to short the housing market by renting long-term.

I don't care what your favorite financial guru says about the negatives of owning real estate. There's a reason why the net worth of the average homeowner is more than 40X the net worth of the average renter. Just the forced savings each month alone keeps a homeowner disciplined.

I used 2023 as a good window of opportunity to buy a house. I think that same window of opportunity is still open in 2025. When mortgage rates do go down, we will see tremendous bidding wars again due to pent-up demand.

What If There Is A Housing Crash?

If the housing market does crash one day, you will probably make out just fine if you bought responsibly and keep paying your mortgage, if any. Real estate is not like stocks. With stocks, you may go through daily heart attacks as their value disintegrates during a bear market.

During the 2008-2009 crash, my primary residence likely went down from $1,700,000 to at worst $1,400,000 (- 17%). But I refinanced the mortgage when rates declined to boost cash flow. Then, I happily kept living in my home until I found a new place in 2014. I turned my old home into a rental.

When my son was born, I sold the rental property for a lot more. Then I rolled $550,000 of the proceeds into stocks, muni bonds, and commercial real estate. When new opportunities arose in 2019 and 2020, I bought more single family homes.

Relatively Easier To Forecast A Future Slowdown

Unlike stocks, it can take years for the housing market to turn. Therefore, I'll let you know when I start to get a sense that it does. After all, to be a successful investor, we must practice predicting the future.

Housing price growth rates must decelerate over the coming years due to the law of large numbers. However, I expect the housing market to be higher in ten years time.

I won't have the capital to buy another single family home for a while. However, I do have the capital to buy publicly-traded REITs, private eREITs, and individual private real estate investments for more tactical exposure.

Take a look at my favorite real estate crowdfunding platforms: Fundrise.

Fundrise is a way for all investors to diversify into real estate through private real estate funds. Fundrise has been around since 2012 and is one of the largest real estate crowdfunding platform today with around $3 billion in assets and over 350,000 investors.

It specializes in residential and industrial properties in the heartland of America where valuations are lower and yields tend to be higher. For most people, investing in a diversified eREIT is the easiest solution.

I've personally invested $954,000 in private real estate funds since 2016 and six-figures in Fundrise. Fundrise is also a long-time sponsor of Financial Samurai and Financial Samura is a six-figure investor in Fundrise funds.

Best of luck in your real estate hunt! Stay disciplined. Run the numbers. Forecast worst case scenarios and only buy if you can survive them. I truly believe the housing market will stay strong for years to come. The housing market won't crash. But it will likely soften after such a huge run since 2012.

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

Great article. Very thorough, and as someone who works in Real Estate, music to my ears, haha. I talk to more people than you could imagine who are refraining from anything to do with real estate due to scare tactics and inaccurate information they get from sources that don’t truly understand the housing market. They call the next 5 years “the next 2008,” when In fact, I believe right now is the best time you can buy in the next 5-10 years. No one can perfectly time the low point when prices stop declining and begin to increase- but if you buy now in many situations at a reduced price, then wait till interest falls & demand returns and refinance, you will have mortgage payments going DOWN with your home value going UP and you’ll be happy you didn’t listen to the scare tactics going around right now on Fox News

What do you think now of housing market for first time house buyers?

I have enough downpayment but still hesitating to buy with this rediculous prices..

Thanks

Well, sounds like you went all in right at the top of the housing super bubble. I’ll take the opposite side of your thesis and believe a multi-decade housing bear market has begun. Population demographics, cyclical forces, multi-year rising mortgage rates, income decline etc. are all aligning to put an end to the 70+ year housing bull market, IMO.

The recent top was around March 2022. I didn’t buy a house then. I bought in mid-2020, but also bought in 2003.

A multi-decade housing market is something I can definitely bet against. Real estate markets go in 7-10-year cycles. We’re now going to see a softening until probably the end of 2023 and I’ll be looking for deals. It was a great run until the beginning of 2022.

Inflation and rates will go down again by 2023 and then it’s back to normal trend. This is the beauty of the market. We can invest and do what we want and accept what comes next.

Whats your thoughts on investing in BREIT or SREIT and owning real estate through them rather than doing the grunt work personally.

Dear Sam,

I am now well invested in real estate(Thanks to your informative analysis and posts).

On the other hand to safe gaurd my interests, I would like to hedge my real estate investments just in case. Can you please advise of any real estate short stocks or alternative vehicles to hedge against a real estate fall scenario.

Thanks in advance.

Vasanth.

If you want to short the housing market, you can short Invitation Homes, American Homes 4 Rent, Home Depot, Vanguard Real Estate ETF VNQ, Redfin, and Zillow.

I wouldn’t short. But those are some options. Good luck!

The market is already in crashola mode, EVRYWHERE! Listen to the pro’s not not two bit real estate people, lol

Sounds good to me Robert! Feel free to short real estate if you wish.

You might enjoy this post: How Long Will Rent Increases Last? Advice For Renters

Try not to generalize. Many good agent, many bad ones, just like other industries and professionals. Most likely you either had an unpleasant real estate experience, or you are bitter because you failed the r.e. exam.

Hi,

As always great article. The 3 yr period that you mention at the start of this article, “I’m bullish on the housing market over the next three years” is this 3 year period from your original post date or updated/edited date i.e. 06/24/2021.

Thank you,

Vasanth.

Pretty similar as I just wrote the post and am updating it monthly.

Through 2024, and I’ll update if I change my views.

The pace of housing price appreciation will slow for sure, but will still appreciate.

Thank you.

I agree with what you are saying. Builders are much more conservative in building and supply is tight. This will drive prices up. Interest rates are low but I think the Fed will move more quickly than people think when they do.

Should I buy a condo apartment as first investment property if it is cash flow negative by about $300?

If rates don’t increase. I can probably refinance the mortgage to decrease mortgage payments in a few years to make it cash-flow positive.

If I keep it forever, I will eventually get passive income when it is fully paid.

“The average duration of homeownership is only about 10 years.” – is this still true in light of points 2) and 8) where you highlight the value of holding on to your home for as long as possible? Are we possibly seeing the beginning of a trend where people hold onto their homes for longer than 10 yrs on average ?

A 10-year holding period is the latest data. 10.5 years actually. Before the pandemic, the average was about 9 years. I think the average holding. Will only increase over time. Savy investors will simply accumulate more real estate and hold on for as long as possible.

I don’t think the market will go down. I’m 33, just bought a two acre parcel off I-80 45 minutes from Tahoe to build our dream home (I’m a contractor).

All of my early 30s friends bought their first homes this year, these are my “smartest friends”, they have 800+ credit scores, secure jobs at big companies, have fantastic taste/style, and aren’t idiots.

The landscape has changed, every person I know around my age is dead set on investing/buy and hold/passive income. This is basic information about how to be successful as a millennial. Work hard, buy the right assets. The boomers now understand it too, as this info is all over the internet. Why would my dad (tradesman) sell his house that he bought for $215k in the 90s and blow the cash when he can rent it out for 5k a month and still own the asset to pass down? People aren’t stupid anymore- it’s all about holding onto valuable assets that are in short supply, if the economy crashes and everyone looses their jobs who gives a shit? People will hold on for life- they will house hack their rooms/garages/living rooms as rentals to keep their asset. People need to live somewhere, as Sam has said multiple times.

The only people I see losing right now are my friends in service jobs without higher education- they stopped paying rent, their credit scores suck, it’s a recipe for being bounced around from rental to rental for the long term, financing someone’s retirement.

I’m probably wrong. I don’t know shit. But this is what I see at the moment.

-tay

In other words, it’s the same as it ever was. People get jobs, people find love, people want to start families and settle down. And the thing is, real estate is becoming more of a common investment for Passive income in retirement. So instead of just owning your own home, he start to accumulate a portfolio.

Did you ever write a post on the rationale behind your 2Q 2020 purchase? Would love to read your thought process on buying as I want to buy a home too.

It’s quite amazing how great real estate is doing and how much I expect real estate to not crash anytime too. It’s like these days, there’s no way to lose with investing. When people don’t expect to lose is when everything crashes but I just don’t see it.

Thanks for pointing out the typo. I didn’t write about my specific property purchase. But I did write a broader article highlighting why we should be looking to buy property in 2020: Real Estate Buying Strategies During The Pandemic

Getting into a bidding war right now is not a good idea. There are always deals to be had in any market.

This chart is my favorite pandemic chart: fred.stlouisfed.org/series/CDCABSHNO

Individuals are flush with cash, student loans are suspended (forever?), the FHA cohort is about to start receiving $300/mo per kid, and construction labor is super tight.

Looks like a pretty good setup.

Is it possible to have a live debate between you and Patrick(patrick.net) on real estate futures?

This will help us understand two sides of “real estate” as investment.

I think it will crash, I hope not. It seems like the housing has been propped up by the government printing, spending and giving away taxpayers money and secondly people with a lot of money are buying expensive property because they know that inflation is going to increase by an incredible amount.

So how does the housing market crash in such a scenario?

I don’t know how but, the way everything went up overnight and adding $4 trillion to the debt in a few month’s is not wise. I don’t keep running my credit card up and then get another credit card to pay it. I’m not claiming to know much about economics, but, this looks to me like tough times are coming. I hope not. I have 2 pensions coming when I retire and 1 of them was in trouble. Congress just passed a recovery plan (bailout) which is good news for me but I would truly rather see this nation in a healthy financial state for the future rather than individual benefit.

The government is encouraging people take welfare rather than learning a skill and getting a good paying job. They are going to run out of other peoples money. Time will tell.

I sold my house and signed one year lease. I put the cash at different banks to the 250k fdic limit. A year and a half into the pandemic and we still are losing 600k jobs per week. Still the eviction and mortgage moratoriums in effect. I say depression hasn’t started yet. Give it some time.

Thanks for sharing your view. The employment and forbearance data doesn’t point to this direction, but one never knows.

I have begun to de-risk a little in stocks. But my net worth is still majority exposed to the YOLO economy.

The only way the housing market will crash is only if there is a black swan event x 10. The Baby Boomer generation is not downsizing, their kids are moving in to assist parents and parents are leaving their kids the house and any rentals. The millennial generation is much larger than the baby boom generation.

Millennials are starting to buy, builders slowed way down. Also think about this aspect in the early 70’s Roe vs Wade. So Generation X was so much smaller. Builders are not building first time buyers type homes (profit margin is to small to build them).

Starting in the 1950’s up to 1999 each decade an average of 25-27 million new homes were built in America. The last 2 decades it has averaged 5-7 million new homes each decade, basically a fourth (1/4) less. So it’s back to the old faithful saying, supply and demand.

There is no real estate crash unless some serious black swan. The Feds are stuck and rates will remain low for next few years. I’m looking to add to real estate portfolio of 5 SFH’s!

Maybe not black swan event X 10 given a black swan event is already a 3 standard deviation outlier. But I get what you mean.

5 more SFHs is a lot! Please run your numbers over and over again before you buy! And if you buy with all cash, then enjoy!

Sam,

Yeah I know, I was exaggerating on the 10x. I currently own 5 SFH’s. Not looking to add 5 more anytime soon..if I had the $’s I would though.

As I recalled, there was a 7.0 earthquake in 1990 which caused housing crash in the Bay Area. People from Bay Area went and bought house in Sacramento after the quake. I hope there is no earthquake anytime soon.

What an echo chamber you have going here Sam! I think you’re getting a little worried about California real estate when you’re writing these lengthy posts trying to convince people how real estate is a good investment. Inflation is historically bad for housing prices. Look no further than the inflation adjusted home prices of the 1970s. Yes, it’s true that the absolute home prices may not fall much (the fed will make sure of that), but there will be a much better return on investment in other assets classes such as stocks, bonds, and commodities.

You could be right! And the great thing is, we can always revisit this post in 1-3 years and see who ended up being right. At the end of the day, everything is rational. We are either richer or poorer because of our investment decisions.

I wrote this post because I’ve been the least worried about housing in a long while. So I’m hoping more people will share with me WHY you think housing will decline or crash.

Are you a renter or a homeowner, and for how long? I’d love to get your background and know where you’re coming from. Why do you think real estate will not do well?

I hope you are right about stocks and bonds because I’ve got heavy investments in these asset classes as well.

I’ve always been a renter for the past 10 years since graduating college. I’m frustrated that no matter how much I try to save, I can’t keep up.

Therefore, I’m hoping real estate prices go down so I can buy.

Well, hoping things crash or people stumble is on way to get ahead. But it’s out of you control. Hence, a better way is to focus on new ways to earn income. I decided to start this website when I knew my days in banking were numbered. Use the energy of your youth to try something new!

You should likely try house hacking then. Perhaps you can get some others to go in on it with you? You are renting anyway, may as well rent from yourself and buy with some friends. Eventually your “rental” payments will shift along with the equity increase. Then you can borrow from the house and go get your own. You and the friends can keep the original house and keep renting it out.

I did similar back when I got out of college. I ended up buying it myself, but always had a roommate with me prior to moving on to my next one. I then kept that property for another 3-4 years before selling it off.

I would just look for something cheap in the area you want to live, rather than renting something that you want to live in. You’d be surprised at how efficient it can be. I used to get to downtown DC in about 8 minutes while paying 1/5 the housing prices and rentals other were.

We are in uncharted financial territory by a lot of metrics and I’m noticing that folks who want the housing market to crash are seeing a lot of reasons why it will crash (me as I am eager to buy but refuse to get in a bidding war over inflated prices in the Bay Area right now). And folks who do not want the housing market to crash are seeing a lot of reasons why it won’t (Sam who is a homeowner here).

Whatever happens you should be prepared is all anyone can do.

Yes, everybody wants a situation that’s best for them. Hence, I have been up front with my post on my position.

But I was also strongly recommending people look for real estate deals in 2020 as you can read from the posts I highlighted. That’s the positive of just writing consistently about what you believe. Right or wrong, we all will know!

See: Real Estate Buying Strategies During The Pandemic

Sam how will Biden’s doubling of cap gains tax to 43%, increase in corporate taxes, removal of the step up provision for inherited assets and subsequent increase in interest rates after this year affect the housing market?

Also do you subscribe to the view that we are currently in a cyclical inflationary period but really a secular deflationary period going forward. Thx for your reply

What do you mean by secular deflationary period?

See my thoughts on Biden’s capital gains tax hike proposal: https://www.financialsamurai.com/capital-gains-tax-hike/

Cap gains tax increase will discourage RE investment, just as any tax would.

Municipalities will look to additional taxes to rebuild finances and real estate is the easiest target.

Investors will look to crpyto where it is easier to evade tax.

I just think investors will simply end up holding onto their investments longer, resulting in more scarcity and higher prices.

Investors can simply borrow from their equity to do whatever.

Hi sam,

When you say your net worth is 40% in real estate, this means your EQUITY in all properties, crowdfunding and reits right? It doesnt count the debt portion yet? The reason i asked is like you, i really like real estate a lot and am contemplating of a comfortable percentage of networth tied to property. Thanks!

Kerwin

Correct. Estimated equity for net worth.

I also calculate exposure to equity, which includes debt.

Yes, estimated equity is what is used to calculate net worth. However, total property value is used to calculate total real estate exposure.

I don’t like having any one asset over 50% of net worth, including real estate. Although, I understand that is hard when one is first starting out and buying their first home with debt.

As soon as your buy a property, do your best to grow other parts of your net worth.

Related: Recommended Net Worth Allocation By Age And Work Experience

Great advice. I’m sitting at 60+% of networth in real estate. Now, this isn’t just primary home equity. It includes an office space and rentals producing positive cash flow, but I understand I need to bulk some other areas of my NW. It’s just been hard to do so, as properties are increasing in value faster than I can type!

Hi sam,

Thanks for this. Im finally going long real estate, i bought my house 2 yrs ago which got me to neutral. Ill be at 30% net worth exposed to real estate after my down payment for this second house. I checked with your 30/30/3 rule and i think i passed all parameters. One thing im a little worried about is prices of single detached homes in manila increased by 30-35% for the past couple of years. Keeping my fingers crossed that property wont collapse. Lol

Cheers,

Kerwyn

Sam,

You left out the most important reason real estate won’t crash soon. The cause of SFH prices increasing (and all other assets; stocks, other real estate, crypto; you name it) is the UNPRECEDENTED increase in the money supply. See below for link showing the M1, M2, M3 money supply skyrocketing over the last 12 months. The government(s) have used COVID as an excuse to increase money supply to levels that have never before been seen. All that money has to go somewhere. It’s going to income producing assets such as stocks and real estate. It’s also going to speculative assets like gold, cryptocurrency, fine art and more.

Jim

M1: forbes.com/sites/investor/2020/06/26/inflation-baked-in-as-us-money-supply-explodes/?sh=2b131aa87829

M2: tradingeconomics.com/united-states/money-supply-m2

M3: shadowstats.com/alternate_data/money-supply-charts

Go Federal Reserve and liquidity!

The jump in M1 is misleading. The Fed redefined the money in savings accounts when they removed the 6 times per month withdraw limit on savings accounts. The majority of M2 (savings and money market accounts) suddenly was considered M1, hence more dramatic vertical line jump.

There is even a disclaimer explaining this on the Fed’s website.

Wow! What a thorough post! I had to read it twice, and I probably still missed some nuggets!

Hi Sam. I’m in contract for a SFH in SF. Will lease out for a couple of years then sell. Is a fixer so there was only 5 offers and I didn’t have to pay way over asking. However, a friend was outbid recently on an average 3 bedroom home on the peninsula. Listed for 1.8M & sold for 2.4M. Crazy. I’m thinking at least 50% of the people who left SF will come back as the economy continues to reopen. Fingers crossed!

Good luck with your fixer! I used to love fixers in my 20s and 30s, but no more in my 40s as a dad of two young kids.

I think 50% – 70% of the people who left SF will come back too. And I think even more people who didn’t think they had a chance to compete in big cities will come back. Just look at college admissions at the Ivies, up 20% – 30%!

Great post Sam! Why haven’t you gotten your real estate agent license? It won’t be difficult for you and it would solve the barrier of high commissions for you.

I should if I want to sell. But then, what a PITA to try and save in 2-2.5% commission. Further; I may get to emotional selling and don’t have the Rolodex of buyers.

But when I buy, I buy directly from the listing agent and represent myself. I’ve done this for the past three homes I have purchased, and each time, I have saved at least 2%.

How do you know that you managed to save 2% by buying without an agent? My understanding is that listing contracts usually say that a seller’s agent receives some percentage as a commission (5-6%, which is remains stubbornly too high in my opinion). Seller’s agents usually share half that commission with a buyer’s agent. But if there is no buyer’s agent, won’t a seller’s agent just keep the full commission for herself? How do you make sure that you’re getting a discounted price instead of the seller’s agent just pocketing the extra?

It’s in the contract and reflects in the ultimate price. Pretty good deal if you know what you’re doing. You can check out the archives on my experiences.

Here’s one post from a home I bought in 2014: https://www.financialsamurai.com/in-real-estate-money-is-made-on-the-purchase-not-on-the-sale/

Hi Sam,

In addition to investing in Fundrise, would you recommend to buy VNQ at the moment given the price has already increased a lot in the past year?

I’m not selling, so I guess I’m still willing to buy. Just look at VNQ today as the stock market sells off. VNQ is up, partially due to asset rotation and partially because rates are coming back down.

The answer of whether to buy or sell depends on your risk tolerance and current asset allocation of real estate and stocks and bonds and so forth.

The one thing to realize from the March 2020 meltdown is that publicly traded REITs sold off even more than stocks. Therefore, in a big market correction scenario, if you are buying publicly traded REITs for lower volatility, it’s probably not gonna help.

Makes sense. However, VNQ is almost at all times high now, do you think there is still potential to go further up over the next few years? I’m considering holding this long term..

Hi Kate, definitely ask your financial advisor. You haven’t shared your net worth, asset allocation, goals, get etc, so it’s hard for me to give any advice. Let me know what she or he says!

I’m bullish for the next 3 years as I’ve stated in my article.

How are REITs looking in this environment? Vanguard VNQ is moving upwards.

Tony

Indeed. Doing well. For my kids custodial Roth IRA accounts I set up finally at the beginning of 2021, I bought them VNQ.

And collecting the dividends along the way!